Professional Documents

Culture Documents

Limitation Period For Running Account

Uploaded by

Nishi Yaduvanshi0 ratings0% found this document useful (0 votes)

13 views1 pageThe document discusses the limitation period for running accounts and mutual/reciprocal accounts under Indian law.

For running accounts as prescribed in Article 14, the limitation period is extended each time the last payment is made, not just from the date of last supply.

For mutual/reciprocal accounts under Article 1, the limitation period of 3 years begins from the close of the year in which the last item is entered in the account.

Original Description:

research

Original Title

limitation period for running account

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the limitation period for running accounts and mutual/reciprocal accounts under Indian law.

For running accounts as prescribed in Article 14, the limitation period is extended each time the last payment is made, not just from the date of last supply.

For mutual/reciprocal accounts under Article 1, the limitation period of 3 years begins from the close of the year in which the last item is entered in the account.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageLimitation Period For Running Account

Uploaded by

Nishi YaduvanshiThe document discusses the limitation period for running accounts and mutual/reciprocal accounts under Indian law.

For running accounts as prescribed in Article 14, the limitation period is extended each time the last payment is made, not just from the date of last supply.

For mutual/reciprocal accounts under Article 1, the limitation period of 3 years begins from the close of the year in which the last item is entered in the account.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

LIMITATION PERIOD WHEN THERE IS A RUNNING ACCOUNT

JUDGEMENT RELEVANT PARAGRAPHS

15. In this view of the matter, it comes to be

Ashok Parshad vs M/S Mahalaxmi that if it is not a Mutual or Reciprocal Account

as is contemplated in Article 1 of the

Sugar Mills Co. Ltd 2013 SCC OnLine Limitation Act, but, is a Running Account as

Del 3629 prescribed in Article 14, in that event, the

Before M.L. MEHTA J. limitation would not end with the supply, but it

would keep on being extended when the last

payment is made. Though, where the goods

were delivered to the defendant from time to

time on account, the starting point of

limitation in respect of each item of account

as per Article 14 is to be the date of delivery

of goods under that item of account, and the

last date of delivery cannot be taken to be the

date of delivery on earlier occasions, but the

cause of action for all the items delivered is

single down to the date of last delivery

LIMITATION PERIOD WHEN THERE IS A MUTUAL, REPCIPROCAL

AND CURRENT ACCOUNT

JUDGEMENT RELEVANT PARAGRAPHS

Ashok Parshad vs M/S Mahalaxmi 10. A bare reading of the aforesaid Articles

set out in the Schedule to the Limitation Act

Sugar Mills Co. Ltd 2013 SCC OnLine shows that Article 1 relates to suits in respect

Del 3629 of balance due on a Mutual, Open and

Before M.L. MEHTA J. Current Account where there have been

reciprocal demands between the parties. The

period of limitation prescribed by this Article

is three years from the close of the year in

which the last item admitted or proved is

entered in the account and such year is to be

computed as in the account. In other words, if

the statement of account between the parties

is to be regarded as a Mutual, Open and

Current Account, then the period of limitation

of three years would begin from the close of

the year in which the last item admitted or

proved is entered in the account

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Pre-Week Pointers in Commercial Law by Prof. Maria Zarah Villanueva-CastroDocument7 pagesPre-Week Pointers in Commercial Law by Prof. Maria Zarah Villanueva-CastroJaneNo ratings yet

- Updated FMT05 MOM Safety Committee Jan-22Document3 pagesUpdated FMT05 MOM Safety Committee Jan-22anil kumarNo ratings yet

- Chap 3 Obligations and ContractDocument34 pagesChap 3 Obligations and ContractgRascia OnaNo ratings yet

- Palmares VS CaDocument1 pagePalmares VS CaJulioNo ratings yet

- Ho 8 - Provisional Remedies and Special Civil ActionsDocument12 pagesHo 8 - Provisional Remedies and Special Civil ActionsDe Jesus MitchshengNo ratings yet

- Secretary of DPWH V Tecson (2015) DigestDocument4 pagesSecretary of DPWH V Tecson (2015) DigestJustin ParasNo ratings yet

- Nego Cases 1st ExamDocument6 pagesNego Cases 1st ExamAmanda ButtkissNo ratings yet

- Ethics Prefinal ExaminationDocument4 pagesEthics Prefinal ExaminationKwenzie FortalezaNo ratings yet

- Ku Vs RCBC Securities DigestDocument3 pagesKu Vs RCBC Securities DigestjieNo ratings yet

- Brondial Case DoctrinesDocument26 pagesBrondial Case DoctrinesM VillarNo ratings yet

- Cases On Preliminary AttachementDocument24 pagesCases On Preliminary AttachementJohn Edward Marinas GarciaNo ratings yet

- Petitioners: Special Second DivisionDocument3 pagesPetitioners: Special Second DivisionJakie Cruz100% (1)

- Republic v. FNCBDocument2 pagesRepublic v. FNCBBibi JumpolNo ratings yet

- Doctrines CasesDocument16 pagesDoctrines CasesIndira PrabhakerNo ratings yet

- Jmcruz Reviewer in Civ Rev 2 Atty. TLC - Midterms Case DoctrinesDocument14 pagesJmcruz Reviewer in Civ Rev 2 Atty. TLC - Midterms Case DoctrinesJm CruzNo ratings yet

- Serrano v. Gallant Maritime Services, LNC., G.R. No. 167614, March 24,2009Document2 pagesSerrano v. Gallant Maritime Services, LNC., G.R. No. 167614, March 24,2009Pamela Camille BarredoNo ratings yet

- 1st Exam Credit Transactions Past Exam CompilationDocument8 pages1st Exam Credit Transactions Past Exam CompilationCassy VeranaNo ratings yet

- The Impairment ClauseDocument3 pagesThe Impairment ClauseJean Monique Oabel-Tolentino100% (1)

- Appointed Date Vs Effective Date Under Ind AS RegimeDocument6 pagesAppointed Date Vs Effective Date Under Ind AS RegimeBiren PachalNo ratings yet

- Limits of The Limitation Law and IBCDocument11 pagesLimits of The Limitation Law and IBCMeghaNo ratings yet

- G.R. No. 126490 March 31, 1998 ESTRELLAPALMARES, Petitioner, Court of Appeals and M.B. Lending Corporation, RespondentsDocument6 pagesG.R. No. 126490 March 31, 1998 ESTRELLAPALMARES, Petitioner, Court of Appeals and M.B. Lending Corporation, RespondentsBeltran KathNo ratings yet

- OBLICON Chapter 3 Pure ObligationsDocument4 pagesOBLICON Chapter 3 Pure ObligationsMark Ebenezer BernardoNo ratings yet

- Ce Laws - Kind of Obligations Art. 1179-1192Document9 pagesCe Laws - Kind of Obligations Art. 1179-1192marlon_bantilan100% (1)

- ObliCon CH 3 Pt1 Full CasesDocument111 pagesObliCon CH 3 Pt1 Full CasesLiaa AquinoNo ratings yet

- Limitation Period W/R To IBCDocument16 pagesLimitation Period W/R To IBCRagesh KarimbilNo ratings yet

- G.R. No. 126490 March 31, 1998 ESTRELLA PALMARES, Petitioner, Court of Appeals and M.B. Lending Corporation, Respondents. Regalado, J.Document8 pagesG.R. No. 126490 March 31, 1998 ESTRELLA PALMARES, Petitioner, Court of Appeals and M.B. Lending Corporation, Respondents. Regalado, J.Jasielle Leigh UlangkayaNo ratings yet

- Summary of Maceda Law IssuesDocument1 pageSummary of Maceda Law IssuesNielson PanganNo ratings yet

- G.R. No. 123793. June 29, 1998. Associated Bank, Petitioner, vs. Court of APPEALS and LORENZO SARMIENTO, JR., RespondentsDocument21 pagesG.R. No. 123793. June 29, 1998. Associated Bank, Petitioner, vs. Court of APPEALS and LORENZO SARMIENTO, JR., RespondentsCJ CasedaNo ratings yet

- Civil Law Review - 2018: Atty. Genevieve Marie D.B. PaulinoDocument12 pagesCivil Law Review - 2018: Atty. Genevieve Marie D.B. PaulinoNLainie OmarNo ratings yet

- G.R. No. L-7859 February 12, 1913 VICTORIA SEOANE, Administratrix of The Intestate Estate of Eduardo Fargas, PlaintiffDocument4 pagesG.R. No. L-7859 February 12, 1913 VICTORIA SEOANE, Administratrix of The Intestate Estate of Eduardo Fargas, PlaintiffOmie Jehan Hadji-AzisNo ratings yet

- Land Titles and DeedsDocument29 pagesLand Titles and DeedsShan Jerome Lapuz SamoyNo ratings yet

- Aparna CPCDocument5 pagesAparna CPCNarendra BhadoriaNo ratings yet

- DigestDocument26 pagesDigestgraceNo ratings yet

- Goldenway Merchandising v. Equitable PCI BankDocument16 pagesGoldenway Merchandising v. Equitable PCI BankMelissa AdajarNo ratings yet

- Cred Trans DigestsDocument5 pagesCred Trans DigestsaudreyracelaNo ratings yet

- Procedure and Challenges For Insolvency Under Part IIIDocument5 pagesProcedure and Challenges For Insolvency Under Part IIIVimal AgarwalNo ratings yet

- Ku-vs-RCBC-Securities-DigestDocument3 pagesKu-vs-RCBC-Securities-DigestRobby DelgadoNo ratings yet

- Actionable Claims: CknowledgementDocument16 pagesActionable Claims: CknowledgementPee KachuNo ratings yet

- LARCODocument12 pagesLARCOErvin TanNo ratings yet

- 6pal Employees V NLRCDocument26 pages6pal Employees V NLRCdwight.sahidNo ratings yet

- CIPS Model Terms&ConditionDocument23 pagesCIPS Model Terms&Condition9313913iNo ratings yet

- BLAWDocument2 pagesBLAWcjmarie.cadenasNo ratings yet

- Adjudication of Tax DraftDocument5 pagesAdjudication of Tax Draftnicky.anurag1008No ratings yet

- Statcon Cases - MidtermsDocument7 pagesStatcon Cases - MidtermsCzyra F. CamayaNo ratings yet

- OBLICON Cases and RulingsDocument10 pagesOBLICON Cases and RulingsShekinah CruzNo ratings yet

- Dela Cruz v. PlantersDocument29 pagesDela Cruz v. Plantersjleo1No ratings yet

- Proper Application of Interest Rate - Estores vs. SupanganDocument3 pagesProper Application of Interest Rate - Estores vs. SupanganRommel P. AbasNo ratings yet

- 17 PALMARES V G.R. No. 126490Document8 pages17 PALMARES V G.R. No. 126490Quinnie PiolNo ratings yet

- CONTRATOS Unit LLDocument38 pagesCONTRATOS Unit LLPaola Ximena Duran RossellNo ratings yet

- Cases Rules of Procedure: Appeal Corporate Inn Hotel vs. LizoDocument52 pagesCases Rules of Procedure: Appeal Corporate Inn Hotel vs. LizoAnonymous b7mapUNo ratings yet

- Palmares V Court of AppealsDocument10 pagesPalmares V Court of Appealsarianna0624No ratings yet

- General Provisions - Concept of DamagesDocument19 pagesGeneral Provisions - Concept of DamagesElica DiazNo ratings yet

- Art 1179 To 1192Document18 pagesArt 1179 To 1192DanicaNo ratings yet

- Limitation Period For Recovery of DebtsDocument4 pagesLimitation Period For Recovery of DebtsKamran Siddiqui100% (3)

- Recent Cases On Arbitration Law in IndiaDocument9 pagesRecent Cases On Arbitration Law in IndiaRayadurgam Bharat Kashyap100% (1)

- Republic of The Philippines vs. Philippine National Bank G.R. No. L-16106 December 30, 1961Document2 pagesRepublic of The Philippines vs. Philippine National Bank G.R. No. L-16106 December 30, 1961Joanne besoyNo ratings yet

- KTRL CIVIL LAW I LegaspiDocument24 pagesKTRL CIVIL LAW I LegaspiKevin G. PerezNo ratings yet

- CPC Assignment 69Document4 pagesCPC Assignment 69Pratyush GuptaNo ratings yet

- Lim Vs Lazaro G.R. No. 185734 HeldDocument14 pagesLim Vs Lazaro G.R. No. 185734 Heldrosario orda-caiseNo ratings yet

- CaterdillaDocument1 pageCaterdillaManuel DancelNo ratings yet

- Dfeert BTDocument24 pagesDfeert BTJustin De JesusNo ratings yet

- J 2018 SCC OnLine NCLT 25414Document14 pagesJ 2018 SCC OnLine NCLT 25414Nishi YaduvanshiNo ratings yet

- J 2016 SCC OnLine Bom 8750Document6 pagesJ 2016 SCC OnLine Bom 8750Nishi YaduvanshiNo ratings yet

- TP 2021 10 SCC 401 479Document79 pagesTP 2021 10 SCC 401 479Nishi YaduvanshiNo ratings yet

- J 2013 SCC OnLine Del 3629Document7 pagesJ 2013 SCC OnLine Del 3629Nishi YaduvanshiNo ratings yet

- Aim Online Review 4Document5 pagesAim Online Review 4Jojames GaddiNo ratings yet

- Reflection PaperDocument2 pagesReflection PaperLeinard AgcaoiliNo ratings yet

- Introduction To The Philosophy of The Human Person: Quarter 1 - Module 2: Methods of PhilosophizingDocument18 pagesIntroduction To The Philosophy of The Human Person: Quarter 1 - Module 2: Methods of PhilosophizingWilma DamoNo ratings yet

- Aesthetic Theory: EssentialDocument3 pagesAesthetic Theory: EssentialHakim HemadiNo ratings yet

- Ethics - PPTsDocument30 pagesEthics - PPTsMaey RoledaNo ratings yet

- Agree - Disagree Essay : Structures For This Essay TypeDocument5 pagesAgree - Disagree Essay : Structures For This Essay TypeKhánh An VũNo ratings yet

- Module 4bDocument17 pagesModule 4bJay BaliarNo ratings yet

- RAJAT Hnlu TPADocument14 pagesRAJAT Hnlu TPARahul sawadiaNo ratings yet

- Primary Source Analysis - The Paralyzing Influence of ImperialismDocument2 pagesPrimary Source Analysis - The Paralyzing Influence of ImperialismDaniel PoncianoNo ratings yet

- Contract Order GemDocument4 pagesContract Order GemKal YanNo ratings yet

- Supreme Court: Jose B. Echaves For Petitioner. Jose A. Binghay and Paul G. Gorres For RespondentsDocument13 pagesSupreme Court: Jose B. Echaves For Petitioner. Jose A. Binghay and Paul G. Gorres For RespondentsAmanda HernandezNo ratings yet

- Lecture Guide Introduction To Total Quality Management Defining QualityDocument29 pagesLecture Guide Introduction To Total Quality Management Defining QualityYeye GatdulaNo ratings yet

- LL275 P II: RopertyDocument7 pagesLL275 P II: RopertyJoshNo ratings yet

- NSTP 2 ReviewerDocument26 pagesNSTP 2 ReviewerJoferlyn Mai Marabillo VillarNo ratings yet

- Subject-Moot Court Exercise And: Internship (Practical)Document15 pagesSubject-Moot Court Exercise And: Internship (Practical)venkataramana teppalaNo ratings yet

- Stealth-Bomber-Case StudyDocument7 pagesStealth-Bomber-Case StudyAnooshaNo ratings yet

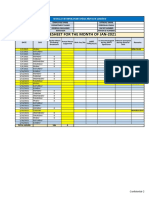

- Timesheet For The Month of Jan-2021: Segula Technologies India Private LimitedDocument33 pagesTimesheet For The Month of Jan-2021: Segula Technologies India Private LimitedSureshNo ratings yet

- Fluxactive CompleteDocument2 pagesFluxactive CompleteFluxactive CompleteNo ratings yet

- A May 20 2002 Business Week Story by Stanley HolmesDocument1 pageA May 20 2002 Business Week Story by Stanley HolmesM Bilal SaleemNo ratings yet

- HIRA - WiringDocument1 pageHIRA - WiringPrithika AnbuNo ratings yet

- 304044204-Philosophy-of-Man-Syllabus - Obe FormatDocument6 pages304044204-Philosophy-of-Man-Syllabus - Obe FormatVilma SottoNo ratings yet

- Business Ethics Book-4Document26 pagesBusiness Ethics Book-4nasiddikNo ratings yet

- Current NY Exam Subjects 2016Document1 pageCurrent NY Exam Subjects 2016SemsudNo ratings yet

- WV6 QuestionnaireDocument21 pagesWV6 QuestionnaireBea MarquezNo ratings yet

- Principles and Practices of Management: Instruction To CandidatesDocument2 pagesPrinciples and Practices of Management: Instruction To CandidatesAnshika JainNo ratings yet

- Drawing and Specification Duly Signed8Document4 pagesDrawing and Specification Duly Signed8Engineer LeeNo ratings yet

- Summary Session 2 - What Is EthicDocument4 pagesSummary Session 2 - What Is Ethicrifqi salmanNo ratings yet

- Chapter 4 (Notes)Document8 pagesChapter 4 (Notes)Abanes, Cherry ShaneNo ratings yet