Professional Documents

Culture Documents

Tax Unit 1-2 - 24

Uploaded by

joy BoseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Unit 1-2 - 24

Uploaded by

joy BoseCopyright:

Available Formats

Anual value

How detemined

Pars

eofthe club house as contemplaledin

C1 section 22will

taN-Chelnsford Clubv.

varueofthee beoutside

CIT|20001 109 ti purs

annal

income-tax- .One

should also

keep in view

Taxman 215(5C)

poins

hok entries - It a tirm the

following

Othersby.

l hries

by book ransers its

entrics, annual value of the

house propositiens

property to its pat ners

amfer merely arain Har Narain v. property is taxable in beire

CIT|198013Taxman 365 thehandsf 1}e

hssolution, th affixed- Sincethe words (Delhi).

pemanenr lue of

of stalls pern "building" and "house

annualvalue not defined

Salls eAct, permanently affixed to the property" arena

1201T allixed tothe groundis

d Kanaivalal Ninmani[19791 taxable under*xVI

of- In order attract taxability, the onus

to

of

mus the owner of building in question-CITv.

is on the

revenue to pryve

that an

Fuzalbhoy Investment

Co.(P) L1d.|)IJ

aNseSICE

fromttax

incomeexem

is exempt trom tax in

i

property income the

operty following

farm house [sec. 2(1A)()read with

from far sec.

a income value of any one palace of an

|

10()--see also para 278;

ex-ruler [sec.

10(19A)]:

annua income of a local authority [sec.

erty

propincome of an authority 10(20-see para 38.37];

the for

dproperty of cities, towns andconstituted

of villages [sec.

purpose of

planning, developmentor

rovement 10(20A)] :

e of approved scientific research

an

rtyincomee association [sec. 10(2/)];

pro income ofa gamesassociation [sec. 10(23)-see

income of

proper

a university or other educational

para 3843];

institutions

[sec. 10(23C)-see

38.53-2]:

orty income of a hospital or other medical institution

h pro [sec.10(23C)-see para

roperty

income of atradeunion[sec. 10(24)]; 38.53-3

nerty income in the case of a person resident of Ladakh [sec.

10(26A)-see para 38.62]:

income derived from letting of godowns or warehouses

for storage,

aitating themarketing commodities by an authority constituted under processing or

of

law forthe any

heing in force for the marketing of commodities

time [sec. 10(29)]:

held for charitable purposes

house property [sec.

L 11-see para 343]:

income of a political party [sec.

13A-see para 42];

property

forown business or profession [sec.

rODerty used

pro 22-see para 86.3];and

a oneself-occupied property [sec.23(2)-seepara 91],

the of a

co-operative society included in gross

Besides aforesaid exemptions,rental income

totalincomeis subject to the following deductions:

income derived by a co-operative society from the letting of godowns or warehousesfor

storage, processing

or facilitating the marketing of commodities, is wholly deductible under

section 80P(2Xe).

lf the gross total income of co-operative society (not being a housing society or an urban

consumers' society or a society carrying on transport business or a society engagedin the

performance of any manufacturing operations with the aid of power) does not exceed

Rs. 20,000, any income from house property is fully deductible under section 80P(2X).

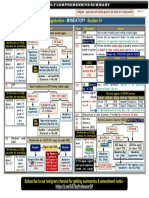

Annual value -How determined [Sec. 23]

89. Though tax under the head "Incomefrom house property" is a tax on income, yet it is not

atax uponrent but upon inherent capacity of a buildingtoyieldincome. Thestandard selected

asa

measureof the income to be taxed is annual value which is deemed to be the sum forwhich

theproperty might reasonably be expected to be let out fromyear year. fact

to In tax is

charged

on an artificial or notional income,even if the owner does not receive any incomeor even it

there is no of receiving any incomefrom the property.

possibility

The income is termed as "annual value" and defined as "the sum for which the

artificial

might reasonably be expected to let from year

to

property vear".In determining reasonable

rent, severalfactors have to be taken into consideration. These factors play a vital role in

You might also like

- Capital GainDocument10 pagesCapital GainMakki BakhshNo ratings yet

- SI Heads Ref RateDocument19 pagesSI Heads Ref RateSrikrishna DharNo ratings yet

- PDF 3 Income TaxDocument1 pagePDF 3 Income Taxmanishchd81No ratings yet

- JEHT Foundation - 2001 Tax ReturnDocument17 pagesJEHT Foundation - 2001 Tax ReturnMain JusticeNo ratings yet

- Sets Off and Carry Forward of LossesDocument12 pagesSets Off and Carry Forward of LossesRaghav BhardwajNo ratings yet

- Adobe Scan 26 Apr 2022Document5 pagesAdobe Scan 26 Apr 2022Sus MitaNo ratings yet

- TDS Rates With Section References in Income Tax of Bangladesh For Financial Year 2018-19Document15 pagesTDS Rates With Section References in Income Tax of Bangladesh For Financial Year 2018-19LASKAR REAZNo ratings yet

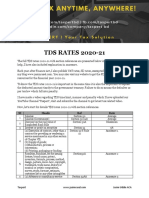

- TDS and TCS-rate-chart-2023 RemovedDocument4 pagesTDS and TCS-rate-chart-2023 Removeddurgeshsonawane65No ratings yet

- TDS and TCS Rate Chart 2023Document5 pagesTDS and TCS Rate Chart 2023DEEPAK SHARMANo ratings yet

- Bos 25158Document12 pagesBos 25158naman jainNo ratings yet

- Tax 2 Final Cheat Sheet 1.2Document2 pagesTax 2 Final Cheat Sheet 1.2HelloWorldNowNo ratings yet

- Form No. 12B: 2022 Name and Address of The Employee: Permanent Account No.: Residential Status: Date of JoiningDocument3 pagesForm No. 12B: 2022 Name and Address of The Employee: Permanent Account No.: Residential Status: Date of JoiningSantosh Kumar JaiswalNo ratings yet

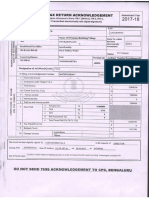

- Indian TAX: Ingome Return AgknowledgementDocument3 pagesIndian TAX: Ingome Return AgknowledgementnikhilbhorNo ratings yet

- Clinton Family Foundation 2016 Form 990Document30 pagesClinton Family Foundation 2016 Form 990Joe Schoffstall0% (1)

- 2020-21 TDS Rates 2020 21 TaxpertDocument12 pages2020-21 TDS Rates 2020 21 TaxpertHarun AccountantNo ratings yet

- From Deposit: Currency Deposit Funds B.)Document4 pagesFrom Deposit: Currency Deposit Funds B.)thea balinasNo ratings yet

- TDS - and - TCS Rate Chart 2024Document5 pagesTDS - and - TCS Rate Chart 2024Taxation KTPL (Kalyani Techpark Taxation)No ratings yet

- TDS Rate With Section FY 2019-2020Document22 pagesTDS Rate With Section FY 2019-2020Iftekhar SaikatNo ratings yet

- IT Assessment of Individuals IllustrationDocument5 pagesIT Assessment of Individuals Illustrationsyedfareed596No ratings yet

- 2016 Jun Ans-5-6Document2 pages2016 Jun Ans-5-6何健珩No ratings yet

- 2008 Mark and Stephanie Madoff Foundation 990Document60 pages2008 Mark and Stephanie Madoff Foundation 990jpeppardNo ratings yet

- TDS Rates On The Income Tax of Bangladesh For 2019-20Document19 pagesTDS Rates On The Income Tax of Bangladesh For 2019-20Muhammad Asaduzzaman MonaNo ratings yet

- INCOME TAX Imp - SectionsDocument7 pagesINCOME TAX Imp - SectionsDeepak Singh100% (1)

- Lillian Kaplan 2006-300127083-0373d0e6-F-1Document25 pagesLillian Kaplan 2006-300127083-0373d0e6-F-1yadmosheNo ratings yet

- Prime Company Lane Company: RequiredDocument8 pagesPrime Company Lane Company: RequiredSinta AnnisaNo ratings yet

- Section - 24 GST REGDocument1 pageSection - 24 GST REGraj pandeyNo ratings yet

- TDS and TCS Rate Chart 2023Document3 pagesTDS and TCS Rate Chart 2023praveenNo ratings yet

- IFRIC 14 - Class Practice (Solutions)Document4 pagesIFRIC 14 - Class Practice (Solutions)Muhammed NaqiNo ratings yet

- Advance Class Exerciseriver Sept 15Document2 pagesAdvance Class Exerciseriver Sept 15SANDY MARILOU RAMIREZNo ratings yet

- Module - Exemptions 2024Document2 pagesModule - Exemptions 2024mthandazomathNo ratings yet

- Revised Chitty Fees in KeralaDocument6 pagesRevised Chitty Fees in KeralaAnson Chits Registration & InsuranceNo ratings yet

- TDS - and - TCS Rate Chart 2025Document5 pagesTDS - and - TCS Rate Chart 2025jsparakhNo ratings yet

- Bangaluru ZoneDocument16 pagesBangaluru ZoneASHIN SHAJI GEORGE 1960119No ratings yet

- Statement of Cash FlowsDocument15 pagesStatement of Cash FlowsSanyam NarangNo ratings yet

- @CACell Inter Income Tax Important Sections List Nov22Document8 pages@CACell Inter Income Tax Important Sections List Nov22Srushti AgarwalNo ratings yet

- US Internal Revenue Service: f2438 - 2000Document3 pagesUS Internal Revenue Service: f2438 - 2000IRSNo ratings yet

- P6MYS 2012 Dec ADocument15 pagesP6MYS 2012 Dec AFakhrul Azman NawiNo ratings yet

- Return of Net WealthDocument4 pagesReturn of Net WealthbharatNo ratings yet

- CA Final DT A MTP 1 May 23Document14 pagesCA Final DT A MTP 1 May 23Mayur JoshiNo ratings yet

- TDS Rates Chart Fy 2020 21 Ay 2021 22Document6 pagesTDS Rates Chart Fy 2020 21 Ay 2021 22Brijendra SinghNo ratings yet

- Income From Property 1Document18 pagesIncome From Property 1aisha jabeenNo ratings yet

- Page 1 of 12Document12 pagesPage 1 of 12Pajarillo Kathy AnnNo ratings yet

- Picower Foundation - 2001 Tax ReturnDocument48 pagesPicower Foundation - 2001 Tax ReturnMain JusticeNo ratings yet

- 2006 Lax Charity Foundation 990 - Moshe Lax, DirectorDocument24 pages2006 Lax Charity Foundation 990 - Moshe Lax, Directorjpeppard100% (1)

- Standalone Financial Results For December 31, 2016 (Result)Document4 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- P17Document21 pagesP17anandhan61No ratings yet

- TDS Rate Chart - FY 2021-22Document3 pagesTDS Rate Chart - FY 2021-22Ram YadavNo ratings yet

- CA Final DT A MTP 2 Nov23 Castudynotes ComDocument14 pagesCA Final DT A MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- The Third Schedule Computation of Depreciation Allowance (And Amortization) (See Section 27 and 29)Document16 pagesThe Third Schedule Computation of Depreciation Allowance (And Amortization) (See Section 27 and 29)Jasmin AkterNo ratings yet

- Format Variation StatementDocument8 pagesFormat Variation StatementabhishekNo ratings yet

- Intangible Sec.24Document1 pageIntangible Sec.24Rabia SohailNo ratings yet

- 工管111704031宋昊恩Document1 page工管111704031宋昊恩宋昊恩No ratings yet

- Capital Budgeting AnswerDocument18 pagesCapital Budgeting AnswerPiyush ChughNo ratings yet

- Tax Unit 1-2 - 25Document1 pageTax Unit 1-2 - 25joy BoseNo ratings yet

- Actual Investment Declaration For FY 2017-18: Section Nature of Deduction Maximum Amt Documents RequiredDocument6 pagesActual Investment Declaration For FY 2017-18: Section Nature of Deduction Maximum Amt Documents Requiredsandeepreddys091537No ratings yet

- PPR For Risers - 0776 - 20200716 - DAR - Comments - For - Final - 1st - 2nd - and - 220928 - 112552Document25 pagesPPR For Risers - 0776 - 20200716 - DAR - Comments - For - Final - 1st - 2nd - and - 220928 - 112552Fady SherifNo ratings yet

- Tax Unit 1-2 - 9-10Document2 pagesTax Unit 1-2 - 9-10joy BoseNo ratings yet

- Derived From Sources Within The Philippines by All Banks and Non-Bank Financial Intermediaries in Accordance With The Following ScheduleDocument9 pagesDerived From Sources Within The Philippines by All Banks and Non-Bank Financial Intermediaries in Accordance With The Following ScheduleShane JardinicoNo ratings yet

- NIET No. 05 of 2022-23 WBSIDC LTDDocument52 pagesNIET No. 05 of 2022-23 WBSIDC LTDRohan DeyNo ratings yet

- ( )Document65 pages( )joy BoseNo ratings yet

- Tax Unit 1-2 - 22Document1 pageTax Unit 1-2 - 22joy BoseNo ratings yet

- Tax Unit 1-2 - 18Document1 pageTax Unit 1-2 - 18joy BoseNo ratings yet

- Tax Unit 1-2 - 21Document1 pageTax Unit 1-2 - 21joy BoseNo ratings yet

- Tax Unit 1-2 - 23Document1 pageTax Unit 1-2 - 23joy BoseNo ratings yet

- Tax Unit 1-2 - 25Document1 pageTax Unit 1-2 - 25joy BoseNo ratings yet

- Tax Unit 1-2 - 20Document1 pageTax Unit 1-2 - 20joy BoseNo ratings yet

- Tax Unit 1-2 - 16Document1 pageTax Unit 1-2 - 16joy BoseNo ratings yet

- Tax Unit 1-2 - 19Document1 pageTax Unit 1-2 - 19joy BoseNo ratings yet

- Tax Unit 1-2 - 14Document1 pageTax Unit 1-2 - 14joy BoseNo ratings yet

- Tax Unit 1-2 - 15Document1 pageTax Unit 1-2 - 15joy BoseNo ratings yet

- Tax Unit 1-2 - 5-6Document2 pagesTax Unit 1-2 - 5-6joy BoseNo ratings yet

- Tax Unit 1-2 - 11Document1 pageTax Unit 1-2 - 11joy BoseNo ratings yet

- Tax Unit 1-2 - 12Document1 pageTax Unit 1-2 - 12joy BoseNo ratings yet

- Tax Unit 1-2 - 7-8Document2 pagesTax Unit 1-2 - 7-8joy BoseNo ratings yet

- Tax Unit 1-2 - 3-4Document2 pagesTax Unit 1-2 - 3-4joy BoseNo ratings yet

- Tax Unit 1-2 - 1-2Document2 pagesTax Unit 1-2 - 1-2joy BoseNo ratings yet

- Tax Unit 1-2 - 9-10Document2 pagesTax Unit 1-2 - 9-10joy BoseNo ratings yet

- Nov 2019 Paper 2A Questions EngDocument10 pagesNov 2019 Paper 2A Questions EngTerry MaNo ratings yet

- Language Department Business English Worksheet Name: Date:: Cash Flow StakeDocument2 pagesLanguage Department Business English Worksheet Name: Date:: Cash Flow StakeMaria Camila Sanchez Herrera67% (3)

- Chapter 9 Excel Budget AssignmentDocument4 pagesChapter 9 Excel Budget Assignmentapi-261038165No ratings yet

- Arif Sir FinalDocument25 pagesArif Sir FinalMd. Sakawat HossainNo ratings yet

- Understanding Mutual FundsDocument6 pagesUnderstanding Mutual FundspareshhadkarNo ratings yet

- S20 TX SGP Sample AnswersDocument7 pagesS20 TX SGP Sample AnswersKAH MENG KAMNo ratings yet

- You Are Accouter in HotelDocument1 pageYou Are Accouter in HotelRoberto FiorilloNo ratings yet

- Perpetual Inventory SystemDocument8 pagesPerpetual Inventory SystemChristianne Joyse MerreraNo ratings yet

- Exercise 7 To 9Document4 pagesExercise 7 To 9No NotreallyNo ratings yet

- Chapter - 14-Working Capital and Current Assets ManagementDocument8 pagesChapter - 14-Working Capital and Current Assets ManagementShota TsakashviliNo ratings yet

- Sure IpadalaDocument1 pageSure IpadalaChristine LogdatNo ratings yet

- Project Finance Solar PV ModelDocument81 pagesProject Finance Solar PV ModelSaurabh SharmaNo ratings yet

- NPO Financial Policies TemplateDocument13 pagesNPO Financial Policies TemplateNyril Tamayo0% (1)

- Bank Negara Malaysia & AMLADocument34 pagesBank Negara Malaysia & AMLASitiSarahNo ratings yet

- Know Yor Customer - Addendum: (For Third Party Payment)Document2 pagesKnow Yor Customer - Addendum: (For Third Party Payment)Shrikant GawhaneNo ratings yet

- 574-Article Text-2257-1-10-20220317 PDFDocument13 pages574-Article Text-2257-1-10-20220317 PDFNadia NagaraNo ratings yet

- Salary Pay SlipDocument3 pagesSalary Pay SlipSendhilNo ratings yet

- 01 Company Final Accounts QuestionsDocument10 pages01 Company Final Accounts QuestionsMd. Iqbal Hasan0% (1)

- PSB Education LoanDocument71 pagesPSB Education LoanGanesh JoshiNo ratings yet

- AralPan9 q3 Mod16-17 PatakarangPananalapi v5-1Document23 pagesAralPan9 q3 Mod16-17 PatakarangPananalapi v5-1Ronald Montecillo AresNo ratings yet

- Sample Work PlanDocument5 pagesSample Work PlanVJ GeoNo ratings yet

- Lecture17 PDFDocument27 pagesLecture17 PDFkate ngNo ratings yet

- Same Borrowers, Same Lenders, Same Problems - But India's Two Public Credit Platforms Won't Join HandDocument2 pagesSame Borrowers, Same Lenders, Same Problems - But India's Two Public Credit Platforms Won't Join HandVignesh RaghunathanNo ratings yet

- Daftar Pustaka: Arifin, S., Winantyo, R., Dan Kurniati, Y. (2007) - Integrasi Moneter Dan Media KomputindoDocument4 pagesDaftar Pustaka: Arifin, S., Winantyo, R., Dan Kurniati, Y. (2007) - Integrasi Moneter Dan Media Komputindoal ghaisaniNo ratings yet

- ECON 2508 - Tutorial 6Document2 pagesECON 2508 - Tutorial 6Manh Ha NguyenNo ratings yet

- Business Finance Lesson-Exemplar - Module 3Document7 pagesBusiness Finance Lesson-Exemplar - Module 3Divina Grace Rodriguez - LibreaNo ratings yet

- New Oltc Enrolment Form: TitleDocument14 pagesNew Oltc Enrolment Form: TitleHari PrasadNo ratings yet

- Elecon Eng Bba ReportDocument47 pagesElecon Eng Bba Reportarjunj_4No ratings yet

- 03a Time Value of Money Part 2 Test Bank Problems Solutions 2018 0129 12Document57 pages03a Time Value of Money Part 2 Test Bank Problems Solutions 2018 0129 12Jessica AlbaracinNo ratings yet

- Your Current Business Card Greatly Under-Estimates You.: Master of Business Administration Segal Graduate SchoolDocument12 pagesYour Current Business Card Greatly Under-Estimates You.: Master of Business Administration Segal Graduate SchoolSyed Farjad AliNo ratings yet