Professional Documents

Culture Documents

Car Insurance

Car Insurance

Uploaded by

Vaibhav is live0 ratings0% found this document useful (0 votes)

14 views8 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views8 pagesCar Insurance

Car Insurance

Uploaded by

Vaibhav is liveCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

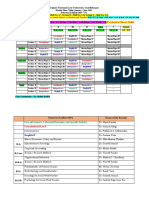

Bharti Axa General Insurance Company Limited

‘B® 1a00-103.2292

B customer. servica@bhartiaxa.com

@ swsto 5667700

CERTIFICATE OF INSURANCE CUNT! Seances

‘Smart rive Private Car Policy : 7

sured Name | Poly No Fvisos45z2004 20006046

= Pot racioa | Docanbar21, 2120000 o Manga Docembor 70 2007

TURURAT TRAVELS 70

INOUSTRIAC AREA KATAY GHAT fncereceateat eat

IRATN 483501 coe eee

MADHYA PRADESH

IRS -| roy nsed on | cart 70200,

ITRAVES D1OAYAIICO. COM ae reea | ee ~

UNESIMIORYANOO COM. RtOLeesten [ear

Nog eopene eet Hypothecated To | ICICI BANK LTO

ponies Pai

3s

‘SPOUSE Age,

Relationship

Agent Name & No HDFC BANK LIMITED (M4000987)

Agent contact No (Office) 022 6160 6161

‘Registration No. | MakelModel Type of Body [eGMW] Mtg ¥ | Seating Gapaciy ‘Chassis No. Engine No

wezicasaos ~ | — WaRUT WAGONR VHT) os [216 2008, TASEWOE soesdies | —i0eN TERA

Venicov | Waor | Non Eetieat Tacnca Econ eHGTUPG Unk Tein Ov

f Accmeoren ‘nceesore @ m

Tro 200 rm 00 27000,

t Premium Details 1

‘OWN DAMAGE (A @ Lapis)

‘Premium on Voice and non Elect Acsassory 870193 ne Pa a ae

Elec Accesso [aso

NSLS o fenane

Ani Tot 0 [Beanies TBD

Handicap 9 fakes ft

1.409 27 a api Pid Deer

— 1.0)

NCB 2500)

USeaiecourt $\824 7 [Unnamed PA Cover tar 5 PSone aad

(wn premises 0 Peato cai Eeoeeeernee| a

\olumary Excess 0 [itiensiase FF

Fiore Gigs Tank rr aa

‘ur25 ° i ar

(Geoararhcal Area © Gaara e

Total Own Damage Premium (A) 1308.00 SST a

Talal Penn a

apalcabie iT aus mas |

ara

ce tiny Sor en ln ee ei yh mc

oF ET nn a cn TAN Ee a

a ts Se IR ye Oat cas anes re ook PL Ney we ay

mnt mead nae ene ateny ere a one Magee a

Bey tate cach i a, i A eg his an ty

aa 9 te ina tg Me fee oe

{eezxerle tom Ie ee es she Camm rus INGD| cv he oedema secon of Be py 9 cm made of Fendng dg the racerg years a hows The preceding yor

SSR a a ARLE renova ins ees ohn Ny

Sorensen en oan tanron ay nnn

erasure soe inc sect rannon oy va egal copnd modes I ase cf show of emu Pete the compan sal net Be

Tas noah Seth a he SOE oot SCOT TINGS Se wal i ET ‘ART ANA GENERAL INSURARIOE COMPANY LT,

Antnased Satey

‘Stamp ty pid othe cout of The Dstt Raptr of Stas (ACE He 40962408040 Bangalore Kanak

28

-v800-103-2202

cuntomerserdcembrati com

SMBt0 5667700

era hartexagi 20.n

STL eS S

ress han w wend nh tl. Ay para’ made by campy Oy eon oer en peer

rr Se rains hats AVOONNCE Gr CERFAM FRG ANO RIOMT OF RECOVERY

Senn a mee nc et gt el tT a ni

Ps rp yan res as nn am ey ne nt Cay eo tin

Sense 1 ra a oy ere mans 2 es 2 ae ob ad, oh we ea ma oy me

ee On attcimeonsar! mano nan zh sn anaes be a Conny

rape Mme nth than Vries cl recov HON

‘Stamp ty plat th account of The Ole Rega of Stampa (ACC Hoa 03

Frese Nane Sat Ove Pete Cran Priel UN ROR BRP DN0V0'200809

ct a vee sre de ah Peto ner Grr PC) Cast ed of arnt oF ey

010), Banglore Karna

a8

PRA Lae

redefining /

general insurance

Bharti AXA General Insurance

Company Limited

8 1800-108-2292 (ot Fre No)

(080-43573450 (Charges app

B customer servicesahartiaragi.co.in

4 SMS to 5667700

wwwibhartaxagica.in

SmartDrive - Private Car Insurance Policy

- Policy Wordings

\Wnereas the insured by a proposal and declaration dated as stated in the

‘Schedule which shall be the basis of this contract and is deemed to be

incorporated herein has applied to Bharti AXA General Insurance Co. Ltd.

(hereinafter referred to as “the Company’) for the insurance hereinafter

Contained and has paid the premium mentioned in the Schedule as

Consideration for such insurance in respect of accidental loss or damage

‘occurring during the period of insurance.

NOW THIS POLICY WITNESSETH:

That subject to the Terms Exceptions and Conditions contained herein or

endorsed or expressed nereon:

Section -Loss of or Damage To The Vehicle Insured

AGE OF THE VEHICLE DEPRECIATION

Not exceeding 6 months Nit

Exceeding 6 months but not exceeding 4 year a

Exceeding 1 year but not exceeding 2 years 10%

Exceeding 2 years but not exceeding 3 years 15%

Exceeding 3 years but not exceeding 4 years 28%

Exceeding 4 years but not exceeding 5 years 38%

Exceeding 5 years but not exceeding 10 years 40%

Exceeding 10 years, 50%

The Company willindemnify the insured against loss or damage to the vehicle

insured hereunderand / orits accessories whilst

1) byte explosion setfignition or ight

ng

ll) byburglary housebreaking orthett

li) byriot and stke,

iv) byearthauake (fire and shock damage

W) by flood typhoon hurricane storm tempes

hailstorm fost;

Inundation cyclone

vi) by accidental externalmeans;

vil) by malicious act

“il by terorst activity

x) whilstin transit by toadralinlandwaterwayIftelevatr ora

x). bylandslide rockslie.

Subject toa deduetion for depreciation atthe rates mentioned below In respect

of parts replaced:

4) Forallrubber/njlon/plasticparts,tyres and - 50%

tubes, batteries and air bags

2) For fibre glass components 30%

3) Forall parts made of glass Nit

44)Rate of depreciation for all other parts including wooden parts

willbe as per the following schedule,

aarti AXA General Insurance Co, Le

Fist Foot, Ferns loon, Survey No. 28, Doddanekunci, Bangalore. 560 037.

ST Registation No: AADCE20080ST0O1 Co. Reg/sraton Ne.: US6030KA2007P1.c043362

‘The Company shall note lable to make any payment in respect of

2) Consequential loss, depreciation, wear and tear, mechanical or

electrical breakdown, failures orbreakages:

') Damage to tyres and tubes unless the vehicle is damaged at the

same time in which case the liability of the compary shall be

limited 10 50% ofthe cost of replacement.

and

©) Any accidental loss or damage suffered whilst the insured or any

person diving the vehicle with the knowledge and consent of the

Insured is under the influence of intoxicating liquor or crugs.

Inthe event ofthe vehicle being disabled by reason of loss or damage

‘covered! under this Policy the Compary will bear the reasonable cost of

protection and removal to the nearest repairer and redelivery to the

Insured but not exceeding in all Rs. 1500/- in respect of ary one

accident.

The insured may authorize the repair of the vehicle necessitated by

damage for which the Company may be liable under this Policy provided

chat:

1) the estimated cost of such repair including replacements, if

any, does notexceea Rs. 500/-;

|i) the Compary is furnished forthwith with a detailed estimate of

the cost of repairs; and

li the insured shall give the Company every assistance to see

that such repairis necessary and the charges are reasonable.

Lore

‘Sum Insured - Insured's Dectared Value (IDV)

The Insured's Declared Value (IDV) of the vehicle will be deemed to be the

‘SUM INSURED’ for the purpose of this policy which is fixed at the

‘commencement of each policy period for the insured vehicle.

‘The IDV of the vehicle (and accessories if any fitted tothe vehicle) isto be fixed

fon the bas's of the manufacturer’ listed selling price ofthe brand and model

a the vehicle insured at the commencement of insurance/renewal and

adjusted for depreciation (as per schedule below).

The schedule of age-wise depreciation as shown below is applicable for the

purpose of Total Loss/ Constructive Total Loss (TL/CTL) claims only.

THE SCHEDULE OF DEPRECIATION FOR

Tixina Ibv OF THE VEMCLE

AGE OFTHE VEWCLE or DerReEATON

No nceedng@ mons om

Eiceedng months ba not eceeding year | _18H

Eeeecng 1 year bi not exceeding 2 ears 20%

Erceedng 2 years bit ot exceeding 8 years 20%

Exaeecng 3 years bit ot exoeding 4 years 40%

ieeeng 8 years bi ot exceeding 5 years sox

IDV of vehicles beyond 5 years of age and of obsolete models of the vehicles

(e, models which the manufacturers have discontinued to manufacture) sto

bee determined on the basis of an understanding between the Company and

the insured,

IDV shallte treated as the ‘Market Value" throughout the poley period without

{any further depreciation for the purpose of Total Loss (TL) / Constructive Total

Loss (CTL) claims.

The insured vehicle shall be teeated as a CTL ifthe aggregate cost of retrieval

and / or repair ofthe vehicle, subject to terms and conditions of the policy,

exceeds 75% of the IDV ofthe vehicle.

Section Il-Liabiltyto Third Parties

41) Subject to the limits of liability as laid down in the Schedule hereto the

Compary will indemnity the insured in the event of an accident caused by

orarising out ofthe use of the vehicle against all sums which the insured

shall become legally liable to pay inrespect of

«death of or bodly injury to any person including occupants carriedin the

Vehicle (provided such occupants are not carried for hie or reward) but

except so far as it is necessary to meet the requirements of Motor

Vehicles Act, the Company shall not be lable where such death or injury

arises out of and in the course ofthe employment of such person by the

insured,

ii) damage to property other than property belonging tothe insured or held

inttustorin the custody or control ofthe insures.

2) The Company wil pay all costs and expenses incurred with its written

consent

3) Interms of and subject to the limitations ofthe indemnity granted by this

section to the insured, the Company will indemnify any driver who is

criving the vehicle on the insured's order of with insured's permission

provided that such driver shall as though he/she was the insured observe

fulfil and be subject tothe terms exceptions and conditions ofthis Policy

insofaras they apply.

4) In the event of the death of ary person entitled to indemnity under

this policy the Company will in respect of the liability incurred by

such person indemnity his/her personal representative in terms

ff and subject to the limitations of this Policy provided that such

personal represertative shall as though such representative was

‘the insured observe fulfll and be subject to the terms exceptions

and conditions ofthis Policy in so faras they apply.

DREN.

redefining /

general insurance

5) The Company mayatits own option

2) arrange for representation at ary Inquest or Fatal Inquiry in respect of

any death which may be the subject of indemnity under this Policy

and

»} undertake the defence of proceedings in any Court of Law in respect of

any act or alleged offence causing of relating to ary event which may be

‘he subject of indemnity under this Policy

Avoidance of Certain Terms And Right of Recovery

Nothing in this Patcy or any endorsement hereon shall affect the right of any

person indemnified by this Policy or any other person to recover an amount

under orby virtue ofthe provisions of the Motor Vehicles Act

But the insured shall repay to the Compaty all sums paid by the Company

which the Company would not have been liable to pay but for the said

provisions,

Application of Limits of indemnity

In the event of any accident involving indemnity to more than one person any

limitation by the terms of this Policy andor of any Endorsement thereon of the

{amount of ary indemnity shall apply to the aggregate amount of indemnity to

all persons indemnified and such indemnity shall apply in priority to the

insured.

‘Section Il Personal Accident Cover tor Owner-Driver

‘The Company undertakes to pay compensation as per the following scale for

bodily injuny/ death sustained by the ownerdriver of the vehicle, in direct,

‘connection with the vehicle insured or whilst rving or mounting

into/¢ismounting from the vehicle insured or whilst traveling initas a co-driver,

‘caused by Violent accidental external and visible means which independent of

anyother cause shall within sixealendar months of such injury result in

Nature of injury Seale of compensation

1 | Death 100%

1) | 188 of two Tinbs or sight of wo eyes

| or one limb and sight of one eye. 100%

lip] Loss of one limb or sight of one eye 50%

Permanent total isablement from

"1 injuries other than named above, 100%

Provided always that

8) Compensation shall be payable under only one ofthe tems () to (hv) above

in respect of the owner-crver ar'sing out of ary one occurrence and the

{ota liability of the Company shall not in the aggregate exceed the sum of

Rs. 2 lakhs curing any one period of insurance.

No compensation shall be payable in respect of death of bocily injury

directly or indirectly wholly orn part arising or resulting from or traceable

10 (2) intentional seinjury suicide or attempted suicide physical defect or

infiemity of (2) an accident happening whilst such person is under the

influence of intoxicating liquor or crugs.

6), Such compensation shall be payable directly to the insured or to his/her

legal representatives whose receipt shall be the fll discharge in respect

‘of the injury to the insured

This coveris subjectto

2) the ownerriveris the registered owner ofthe vehicle insured herein;

») the owner-diveris the insured named in this Policy.

©) the ownerdriver holds an effective driving license, in accordance

with the provisions of Rule 3 of the Central Motor Vehicles Rules,

1989, atthe time of the accident,

2 of 6

Gener

Exceptions

(Applicable to all Sections ofthe Policy)

‘The Company shall notbe liable under this Policy in respect of

41) Any accidental loss or damage and/or lability caused sustained or

Incurted outside the geographical area;

2) Any claim arising outof any contractual ibility

2) Any accidental loss damage and/or lability caused sustained or

Incurted whilst the vehicle insured herein is

a) being used otherwise than in accordance with the ‘Limitations:

astoUse’

b} being driven by or is for the purpose of being driven by him/her in the

charge of ary person other than a Driver as stated in the Drver's

Clause.

4) a) Any accidental loss or damage to any property whatsoever or ary loss or

expense whatsoever resulting or arising there from or ary

consequential loss

by Any labilly of whatsoever nature directly or indirectly caused by oF

contributed toby or asing from ionising radiations or contamination by

radioactivity rom ary nuclear fuel or from ary nuclear waste from the

combustion of nuclear fuel, For the purpose of this exceotion

combustion shallinclude ary self-sustaining process of nuclear fission,

'5)_ Any accidental loss or damage or liability directly or indirectly caused by oF

contributed to by or arising from nuclear weapons material

6) Any accidental loss damage and/or liability ditectly or indirectly or

proximately or remotely occasioned by contributed to by or

traceable to or ar'sing out of or in connection with war, invasion,

the act of foreign enemies, hostilities or warlike operations

(whether before or after declaration of war) civil war, mutiny

Febellion, military or usurped power or by any ditect or indirect

consequence of any of the said occurrences and in the event of

ary claim hereunder the insured shall prove that the accidental

loss damage and/or liability arose independently of and was in

no way connected with or occasioned by or contributed to by or

traceable to any of the sald occurrences or ary consequences

‘thereof and in default of such proof, the Compary shall not be

liable tomake ary payment in respect of sucha claim.

Deductible

The Compary shall not be liable for each and every claim under

Section- I{loss of or damage to the vehicle insured) ofthis Paley in respect of

the deductible stated in the Schedule

Conditions,

This Policy and the Schedule shall be read together and any word or

expression to which a specific meaning has been attached in any part ofthis,

Policy or ofthe Schedule shall bear the same meaning wherever i may appear.

1) Notice shall be given in writing to the Company immediately upon

the occurrence of any accidental loss or damage in the event of

any claim and thereafter the insured shall give all such

Information ad assistance as the Company shall requive. Every

letter claim writ summons and/or process or copy thereot shall

be forwarded to the Company immediately on receipt by the

insured. Notice shall also be given in writing to the Company

Immediately the insured shall have knowledge of any impending

prosecution, inquest or fatal inquiry in respect of ary occurrence

‘hich may give rise to a claim under this Policy. In case of theft or

DENG

redefining /

general insurance

2)

3)

4

5)

8

n

criminal act wihich may be the subject of a claim under this Polley

the insured shall give immediate notice to the police and co-

‘operate with the Company in securing the conviction of the

offender.

No admission offer promise payment or indemnity shall be made or given

by or on behalf of the insured without the written consent af the Company

Which shall be entitled if it so desires to take over and conduct in the

name of the insured the defence or settlement of any claim or to

prosecute in the name of the insured for its own benefit any claim for

indemnity or otherwise and shall have full discretion in the conduct of

any proceedings of in the settlement of any clalm and the insured shall

ive all such information and assistance as the company may require.

The Company may atts own option repair reinstate or replace the vehicle

‘or part thereof and/or its accessories or may pay in eash the amount of

the loss ordamage and the liability of the Company shall not exceed:

a) for total loss / constructive total loss of the vehicle - the Insured's

Declared Value (IDV) of the vehicle (including accessories thereon) as

specified in the Schedule ess the value ofthe wreck,

») for partial losses, Le. losses other than Total Loss/Constructve Total

Loss of the vehicle - actual and reasonable costs of repair and/or

replacement of parts ost/damaged subject to depreciation 3s per

limits specif.

‘The insured shall take all reasonable steps to safeguard the vehicle from

loss or damage and to maintain it inefficient condition and the Company

shall have at all times free and full access to examine the vehicle or any

part thereof or ary driver or employee of the insured. In the event of any

‘accident or breakdown, the vehicle shall not be left unattended without

proper precautions being taken to prevent further damage of loss

land If the vehicle be driven before the necessary repairs are

‘effected any extension of the damage or ary further damage to

the vehicle shall be entrelyat the insured's own sk.

The Compary may cancel the Policy by sending seven days notice

by recorded delivery to the insured at insured’s last known

address and in such event will return to the insured the premium

pald less the pro rata portion thereof for the period the Policy has

been in force or the Policy may be cancelled at ary time by the

insured on seven days’ notice by recorded delivery and provided

no claim has arisen during the currency of the Policy, the insured

shall be entitled to a return of premium less premium at the

Compary's Short Period tates for the period the Policy has been in

force. Retum of the premium by the Company will be subject to

Fetention of the minimum premium of Rs.100/- (or Rs.25/- In

respect of vehicles specifically designed/modified for use by

blind/handicapped/mentally challenged persons). Where the

‘ownership of the vehicle is transferred, the Policy cannot be cancelled

Unless evidence thatthe venicle is insured elsewhere is produced.

If atthe time of occurrence of an event that gives rise to any claim under

this Policy there Is in existence any other insurance covering the same

labiliy, the Company shall not be liable to pay or contribute more than its

ratable proportion of any compensation, cost or expense,

IW any dispute or eifference shal arise as to the quantum to be

ald under this Policy (liability being otherwise admitted), such

difference shall independent of all other questions be refered to

the decision of a sole arbitrator to be appointed in waiting by the

parties to the dispute or if they cannot agree upon a single

arbitrator within 30 days of ary party invoking Arbitration, the

same shall be referred to a panel of three arbitrators comprising

‘wo arbitrators one to be appointed by each of the parties to the

dispute / cifference, and a third arbitrator to be appointed by

such two arbitrators who shall act as the presiding arbitrator and

‘Aitration shall be conducted under and in accordance with the

provisions of the Arbitration ans Conetiation Act, 2996.

3 of 6

Itis clearly agreed and understood that no difference or dispute shall be

Feferable to Arbitration as hereinbefore provided, if the Company has

disputed ornot accepted lability under arin respect of this Policy

It is hereby expressly stipulated and declared that it shall be condition

precedent to any rignt of action or sult upon this Policy that the award by

such arbitrator/ arbitrators of the amount ofthe loss or damage shall be

firstobtained.

Itis also hereby further expressly agreed and declared that ifthe Company

shall disclaim lability to the Insured for any claim nereunder and such

claim shall not, within twelve ealendar months from the date of such

disclaimer have been made the subject matter ofa sult in a court of law,

then the claim shall for all purposes be deemed to have been abandoned

and shall not thereafter be recoverable hereunder.

8) The due observance and fulfllment of the terms, conditions and

endorsements of this Policy in so far as they relate to anything to

be done or complied with by the insured and the truth of the

statements and answers in the sald proposal shall be concitions

precedent to any liability of the Company to make any payment

Under ths Policy

9) In the event of the death of the sole insured, this Policy will not

immediately lapse but will remain valid for a period of three

months from the date of the death of insured or until the expiry of

this Policy (whichever is earlier), During the said period, legal

heir{s) of the insured to whom the custody and use of the Motor

Vehicle passes may apply to have this Policy transferred to the

hhame(s) of the hei{s) or obtain a new insurance policy for the

Motor Venicle

Where such legal heirs) desire(s) to apply for transfer of this

Policy or obtain a new policy for the vehicle such hei(s) should

make an application to the Company accordingly within the

aforesaid period. All such applications should be accompanied by:-

2) Death Certificate inrespect of the insured

») Proof of ite tothe vehicle

6) Original Policy

Invoice Price Cover(1066)

Scope of Cover

In consideration of the payment of an adtltional premium as stated in the

‘Schedule, itis understood and agreed that the Compary agrees to pay the

“shortfall amount” between the amaunt received under Section | ofthe policy

‘and the price as per the purchase invoice OR the eurent replacement value of

vehicle ifthe same make modelis available, which everis essin the event of a

Total loss/ Constructive Total Loss (CTL oF Total Theft of the vehicle. The said

“shortfall amount” also stands to cover the Road tax and first time

registration charges incurred on the insured vehicle. Maximum liability to the

‘company is limited the sum insured stated inthe policy schedule,

‘Special Conditions applicable to this benefft-

4) The vehicle is not more than __years old* on the date of commencement

ofthe polcy period

'b) The Total loss/ Constructive Total Loss (CTL) or Total Theft ofthe vehicle

should be admssible under Section lof the policy

©). Insured should be the frst registered owner ofthe vehicle

4) Vehicle insured should be indigenous.

@) The bank/finance compary whose interest is endorsed inthe policy shal

agree inviting.

4) First Information Report issued by police authorities needs to be

submitted with the company incase of theft of insured vehicle.

DENG

redefining /

general insurance

‘Special Exetus

2} Any electrcal/non electrical and electronic/non electronic accessory(s)

including ary bi fuel kit forming part of the invoice but not insured under

Section lof the policy.

) Ifthe vehicle is recoveredwithin 90 days of the thet.

* Vehicle should not be more than __year od from the date of invoice/ date of

registration whichever is earlier on the commencement date ofthe policy

Depreciation Cover-(1067)

Scope of Cover

In consideration of the payment of an additional premium mentioned in the

policy schedule itis hereby understood and agreed that the Company shall pay

the Depreciation amount deducted on the value of the parts replaced for upto

2 admissible claims* under Section! ofthe policy, provided that the vehicle

insuredis =

2), Repaired at ary of Compary's authorized Garage

Vehicle is not more than __ years old from the date of registration or date

of purchase whichever s earlier at the commencement of the policy period.

* For the purpose of this Cover the expression ‘admissible claim’ shall mean

an event or series of events arising out of one cause In connection with the

vehicle nsuredin respect of which indemnity provided under this policy

Hospital Cash cover(l068)

‘Scope of Cover

In consideration ofthe payment of an addtional premium as mentioned in the

poliey schedule itis hereby understood and agreed that the Compary agrees.

to pay the amount mentioned in the policy schectle per insured{s) for per day

of hospital'sation caused due to bodily inury caused by accidental, external

violent and visible means while traveling in, embarking or disembarking from

the insured vehicle during the policy period as mentioned in the schedule for

hich a valid claim under tre Policy admissible.

Medical Expens

Reimbursement Cover(1069)

‘Scope of Cover:

In consideration ofthe payment of an addtional premium as specified in the

policy schedule it is hereby understood and agreed that the Company

undertakes to reimburse Medical Expenses per Insured person's upto the

‘Sum Insured as specified in the Schedule, but not exceeding the maximum

licensed capacity ofthe vehicle following treatment of bodily injury caused by

accidental, external, violent and vsiale means while traveling in, embarking oF

disembarking from the insuredvehicle.

‘Special Conditions:

The Compary stands to cover medical expenses for treatment taken from only

registered MedicalPractitioners under respective medicalcouncils

Ambulance Charges Cover(1070)

‘Scope of Cover

In consideration of the payment of an additional premium mentioned in the

poliey schedule itis hereby understood and agreed that the Company agrees.

‘to pay reimbursement amount as mentioned in the policy schedule incurred by

the insured{s) towards transportation of the insured/ insured person(s) in

[Ambulance to the Hospital post suffering bodily injury caused by accidental

extemal, violent and visible means while traveling in, embarking of

isembarking from the insured vehicle during the policy period as mentioned

In the schedule for which a valid claim under the Policy Is admissible.

Maximum lability to the compary is limited to the sum insuted stated in the

policy schedule.

4of6

Roadside Assistance cover-(1100)

Scope of Cover

Ih consideration of the payment of any additional premium mentioned in the

policy schedule it is hereby understood and agreed that the company agrees

to provide Roadside assistance though an authorised vendor in case of

breakdown of the insuted vehicle. The services provided under the Roadside

Assistance are as under:

4) Repair Services for Minor Breakdowns:

If your vehicle is immobilized whether at home or on the road for a minor

breakdown (definition of “minor” being a breakdown that can likely be fixed

within a period of maximum 30 minutes with no need fora specific spare part

to’be replaced unless immediately available at our mechanic's workshop), we

will dispatch a mechanic that will attempt to fix it on the spot/side of

the road

'b) Vehicle relocation tothe nearest garage incase of Major breakdown:

IF the attempt to remobilize the vehicle fails following a mechanical or

electrical breaktiown, arecovery vehicle can be sent to you, wllcollect the laid-

off vehicle and take It to the nearest dealer or garage in measure to proceed to

the repair at the workshos,

©) Changing of Fattyee:

If the tre(s) has(have) a puncture which immobilizes the vehicle, we can send

youa mechanic that can help you replace the punctured tyre, provided that the

river does have a spare tyre in a shape of order. If more than one tyre is,

punctured, while there is only one spare tyre per venice, the immobilization

may be necessary by the time the tires are being repaired or replaced at the

drivers’ expenses atthe workshop.

DREN.

redefining /

general insurance

4) Assistance in ease of Lockout/ lost keys:

Ityou have lost your vehicle key o locked it inside the vehicle, we can dispatch

‘a mechanic at the location of the incident and help you either unlock the

Vehicle witout damaging the vehicle or whenever and wherever possible, help

you make a copy of the key or arrange delivery of key set from his/her place of

Fesidence, The cost of replacement ofthe key wille borne by the customer.

{©} Arrangement of emergency fuel in ease the vehele runs outof fuel:

If the veticle has run short of fuel, we can dispatch a mechanic with an

‘emergency tank of fuel, The cost of fuel willbe borne by the custome.

1) Alternative Transport assistance to the nearest safe lecation for the

passengers ofthe vehicle:

Ifthe vehicle is being laicoff, we can dispatch an alternative transport to the

passengers of the vehicle and take them to the nearest safe location. This,

arrangement wil be taken forward on a referral basis, and all costs are to be

approved and bome by the customer.

‘Special Conditions (for all coverage)

2) All adcitional expenses regarding replacement of a part, aditional fuel and

any other service which does not forma part ofthe standard services provided

‘would be on chargeable basis tothe insured

) The territorial scope of the Roadside Assistance Services provided will be

'50 Kms radius of any office of Bharti AXA or city under coverage netwark of AXA,

Assistance, inthe Republic of India, excluding'slands.

5 of 6

PW/PC/GREY/05-14

general insurance

For details on risk factors and terms & conditions, please rad the brochure

carefully before concluding a sale. Insurance is the subject matter of the

solicitation

6 of 6

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Registration FormDocument2 pagesRegistration FormVaibhav is liveNo ratings yet

- Wealth Mitra LTD v. Dileep Kr. Gupta - Complaint Case 92 of 2018 - 09.02.2018 Order TranslationDocument11 pagesWealth Mitra LTD v. Dileep Kr. Gupta - Complaint Case 92 of 2018 - 09.02.2018 Order TranslationVaibhav is liveNo ratings yet

- 10 - SmartDrive - Private Car Insurance Policy Wordings - 0Document6 pages10 - SmartDrive - Private Car Insurance Policy Wordings - 0Vaibhav is liveNo ratings yet

- Final Time Table January - June 2023 For StudentsDocument10 pagesFinal Time Table January - June 2023 For StudentsVaibhav is liveNo ratings yet

- Termination of Insolvency Process by NCLT – Landmark Judgement - Taxguru - inDocument9 pagesTermination of Insolvency Process by NCLT – Landmark Judgement - Taxguru - inVaibhav is liveNo ratings yet

- Information InstructionsDocument7 pagesInformation InstructionsVaibhav is liveNo ratings yet

- Moot ProblemDocument11 pagesMoot ProblemVaibhav is liveNo ratings yet