Professional Documents

Culture Documents

Incremental Analysis

Uploaded by

Riel BerdigayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Incremental Analysis

Uploaded by

Riel BerdigayCopyright:

Available Formats

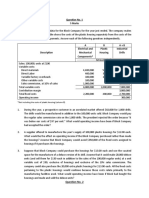

1.

Accept a special order: 168

Pederson Enterprises produces giant stuffed bears. Each bear consists of $12 of variable

costs and $9 of fixed costs and sells for $45. A wholesaler offers to buy 8,000 units at $14

each, of which Pederson has the capacity to produce. Pederson will incur extra shipping

costs of $1 per bear.

Instructions

Determine the incremental income or loss that Pederson Enterprises would realize by

accepting the special order.

2. Make or buy component parts or finished products. 169

Notson, Inc. produces several models of clocks. An outside supplier has offered to

produce the commercial clocks for Notson for $420 each. Notson needs 1,200 clocks

annually. Notson has provided the following unit costs for its commercial clocks:

Direct materials $100

Direct labor 140

Variable overhead 80

Fixed overhead (40% avoidable) 150

Instructions

Prepare an incremental analysis which shows the effect of the make-or-buy decision.

3. Sell or process further them further 174

Paola Farms, Inc. produces a crop of chickens at a total cost of $66,000. The production

generates 60,000 chickens which can be sold for $1 each to a slaughtering company, or

the chickens can be slaughtered in house and then sold for $2.75 each. It costs $65,000

more to turn the annual chicken crop into chicken meat.

Instructions

If Paola Farms slaughters the chickens, determine how much incremental profit or loss it

would report. What should Paola Farms do?

4. Repair, retain, or replace equipment 175

Elmdale Company has a machine that affixes labels to bottles. The machine has a book

value of $80,000 and a remaining useful life of 3 years and no salvage value. A new, more

efficient machine is available at a cost of $300,000 that will have a 5-year useful life with

no salvage value. The new machine will lower annual variable production costs from

$520,000 to $410,000.

Instructions

Prepare an analysis showing whether the old machine should be retained or replaced.

5. Eliminate an unprofitable business segment or product 176

Keith Inc. has 4 product lines: sour cream, ice cream, yogurt, and butter. Demand of

individual products is not affected by changes in other product lines. 30% of the fixed

costs are direct, and the other 70% are allocated. Results of June follow:

Sour Cream Ice Cream Yogurt Butter Total

Units sold 2,000 500 400 200 3,100

Revenue $10,000 $20,000 $10,000 $20,000 $60,000

Variable departmental costs 6,000 13,000 4,200 4,800 28,000

Fixed costs 5,000 2,000 3,000 7,000 17,000

Net income (loss) $ (1,000) $ 5,000 $ 2,800 $ 8,200 $15,000

Instructions

Prepare an incremental analysis of the effect of dropping the sour cream product line.

You might also like

- Exercises Easy Average Difficult 1Document9 pagesExercises Easy Average Difficult 1Denzel Pambago Cruz100% (1)

- Problem 1 ProblemDocument10 pagesProblem 1 ProblemLiyana Chua0% (1)

- CH 07 DOitDocument4 pagesCH 07 DOitHanna DizonNo ratings yet

- BA Problems 2Document6 pagesBA Problems 2rassaNo ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisAnne BacolodNo ratings yet

- Basic Sales Mix The General Manager of LoDocument7 pagesBasic Sales Mix The General Manager of LoAndres MontenegroNo ratings yet

- Problem MDocument3 pagesProblem Mheny2517100% (1)

- Quiz 2 Am c1 - 20 FebDocument8 pagesQuiz 2 Am c1 - 20 FebJonathan ChandraNo ratings yet

- Amercian FuelDocument8 pagesAmercian FuelAsh KaiNo ratings yet

- 4 5852725223857587726Document6 pages4 5852725223857587726survivalofthepolyNo ratings yet

- PROBLEM in RELEVANT COSTING 2 OCT 11 2019Document3 pagesPROBLEM in RELEVANT COSTING 2 OCT 11 2019Ellyza SerranoNo ratings yet

- Managerial Accounting Ch.20Document9 pagesManagerial Accounting Ch.20hyewon6parkNo ratings yet

- Quizzer For MasDocument3 pagesQuizzer For MasMa Teresa B. CerezoNo ratings yet

- Practice Problems For The Final - 2 - UpdatedDocument8 pagesPractice Problems For The Final - 2 - Updatedmaroo566100% (1)

- 55 - Chapter 6 Exercises With AnswersDocument4 pages55 - Chapter 6 Exercises With Answersgio gioNo ratings yet

- Incremental Analysis 2Document12 pagesIncremental Analysis 2enter_sas100% (2)

- Exam135 08Document3 pagesExam135 08Rabah ElmasriNo ratings yet

- Relevant Costing Sample ProblemsDocument29 pagesRelevant Costing Sample ProblemsAngela Padua100% (2)

- CH 26 Exercises ProblemsDocument5 pagesCH 26 Exercises ProblemsAhmed El KhateebNo ratings yet

- Question-Week 10-Latihan 1 Incremental AnalysisDocument2 pagesQuestion-Week 10-Latihan 1 Incremental AnalysisLulu LuthfiyahNo ratings yet

- Incremental Costing ProblemDocument8 pagesIncremental Costing ProblemJessica Faith Ignacio EstacioNo ratings yet

- Module 6 - Home Work SolutionDocument3 pagesModule 6 - Home Work Solutionntkt0408No ratings yet

- CH11Document32 pagesCH11devinaNo ratings yet

- 420C14Document38 pages420C14Suhail100% (1)

- Break Even AnalysisDocument4 pagesBreak Even AnalysisOwen Hudson0% (1)

- ACG2071 Managerial AccountingDocument31 pagesACG2071 Managerial Accountinganon_117931956No ratings yet

- Responsibility Accounting Practice ProblemDocument4 pagesResponsibility Accounting Practice ProblemBeomiNo ratings yet

- ACC209 Assignment 2 AlternateDocument14 pagesACC209 Assignment 2 Alternatehtet aungNo ratings yet

- Chapter 06-Sales Mix and ICPDocument11 pagesChapter 06-Sales Mix and ICPbbckk1No ratings yet

- Quiz 4 CADocument8 pagesQuiz 4 CAbasilnaeem7No ratings yet

- Relevant CostingDocument7 pagesRelevant CostingVassy EsperatNo ratings yet

- Discussion QuestionsDocument8 pagesDiscussion QuestionsSritel Boutique HotelNo ratings yet

- Chapter 1 - Sheet1Document6 pagesChapter 1 - Sheet1ywcqbtdgyqNo ratings yet

- Garrison 17e GEs PPT Chapter 6Document19 pagesGarrison 17e GEs PPT Chapter 6Jawad ahmadNo ratings yet

- Module 5 Supplemental Problems-SMALL BUSINESS MANAGEMENTDocument5 pagesModule 5 Supplemental Problems-SMALL BUSINESS MANAGEMENTPhát GamingNo ratings yet

- Chapter 7Document10 pagesChapter 7Eki OmallaoNo ratings yet

- Ca CH4Document12 pagesCa CH4Charlotte ChanNo ratings yet

- Long Test 2 Set BDocument2 pagesLong Test 2 Set BMonica ReyesNo ratings yet

- Case 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Document6 pagesCase 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Lalit SapkaleNo ratings yet

- Coma Quiz 6 KeyDocument20 pagesComa Quiz 6 KeyMD TARIQUE NOORNo ratings yet

- Aactg 15 Relevant CostingDocument7 pagesAactg 15 Relevant CostingRosevelCunananCabrera100% (1)

- ch7 CaseDocument3 pagesch7 CaseKayleen Allycia TanotoNo ratings yet

- Chapter 26Document15 pagesChapter 26Sanh NguyệtNo ratings yet

- ACC 561 Week 5 Homework AssignmentDocument6 pagesACC 561 Week 5 Homework AssignmentWrkingStudent75% (4)

- TIP Relevant Costing Ex TipDocument10 pagesTIP Relevant Costing Ex TipmaurNo ratings yet

- PB8MAT+Relevan Cost - ExerciseDocument4 pagesPB8MAT+Relevan Cost - Exercisemichael winartaNo ratings yet

- Soal Akuntansi KeuanganDocument4 pagesSoal Akuntansi Keuanganekaeva03No ratings yet

- Chapter 7 Examples 2Document2 pagesChapter 7 Examples 2AMNANo ratings yet

- Sales Mix PracticeDocument4 pagesSales Mix PracticeANo ratings yet

- Strat ReviewerDocument5 pagesStrat ReviewerChuckay SealedNo ratings yet

- CH 22 Exercises ProblemsDocument3 pagesCH 22 Exercises ProblemsAhmed El Khateeb100% (1)

- Chapter 6 QuestionsDocument8 pagesChapter 6 QuestionsJanelle Joyce Maranan DipasupilNo ratings yet

- Financial Decision MakingDocument4 pagesFinancial Decision MakingTaha JavaidNo ratings yet

- ExercisesDocument19 pagesExercisesbajujuNo ratings yet

- Variable Costs:: Exercise 5-13: B/E Analysis and CVP GraphingDocument21 pagesVariable Costs:: Exercise 5-13: B/E Analysis and CVP GraphingAshish BhallaNo ratings yet

- Toilet Preparations World Summary: Market Values & Financials by CountryFrom EverandToilet Preparations World Summary: Market Values & Financials by CountryNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Fats & Oils Refining & Blending World Summary: Market Values & Financials by CountryFrom EverandFats & Oils Refining & Blending World Summary: Market Values & Financials by CountryNo ratings yet

- From Kitchen to Consumer: The Entrepreneur's Guide to Commercial Food PreparationFrom EverandFrom Kitchen to Consumer: The Entrepreneur's Guide to Commercial Food PreparationRating: 3 out of 5 stars3/5 (1)

- TopicDocument59 pagesTopicRiel BerdigayNo ratings yet

- Elements of Donation: Group 2Document14 pagesElements of Donation: Group 2Riel BerdigayNo ratings yet

- Berdigay, Mariel E. Learning Insights Average and Fifo CostingDocument2 pagesBerdigay, Mariel E. Learning Insights Average and Fifo CostingRiel BerdigayNo ratings yet

- Berdigay, Mariel E. Acc222 Cost Accounting Learning Insight Just in Time and Backflush CostingDocument2 pagesBerdigay, Mariel E. Acc222 Cost Accounting Learning Insight Just in Time and Backflush CostingRiel BerdigayNo ratings yet

- STANDARD COSTING (Learning Insights)Document1 pageSTANDARD COSTING (Learning Insights)Riel BerdigayNo ratings yet

- The Probabilities That A Service Station Will Pump Gas Into 0Document1 pageThe Probabilities That A Service Station Will Pump Gas Into 0Riel BerdigayNo ratings yet

- Ganito Kami Noon, Paano Kayo NgayonDocument1 pageGanito Kami Noon, Paano Kayo NgayonRiel BerdigayNo ratings yet

- Ersweetcel C. Servano, Ph.D. Via ZoomDocument26 pagesErsweetcel C. Servano, Ph.D. Via ZoomRiel BerdigayNo ratings yet

- Film CritiqueDocument1 pageFilm CritiqueRiel BerdigayNo ratings yet

- Ganito Kami Noon, Paano Kayo NgayonDocument1 pageGanito Kami Noon, Paano Kayo NgayonRiel BerdigayNo ratings yet

- Dedication To GOMBURZADocument1 pageDedication To GOMBURZARiel BerdigayNo ratings yet

- The Marginal Income Report Prepared by Consultant Highlights Some of The Following Features of Moti and Heera (P) LimitedDocument5 pagesThe Marginal Income Report Prepared by Consultant Highlights Some of The Following Features of Moti and Heera (P) LimitedTushar VermaNo ratings yet

- The Sabat Corporation Manufactures and Sells Two ProductsDocument4 pagesThe Sabat Corporation Manufactures and Sells Two ProductsElliot RichardNo ratings yet

- If Department Q Uses 60 000 of Direct Materials and Department T Uses 15 000 ofDocument160 pagesIf Department Q Uses 60 000 of Direct Materials and Department T Uses 15 000 ofJames BarzoNo ratings yet

- Cost Accounting Quiz 12 Standard Cost Accounting: End of The Quiz. Good Luck! Reminder: Honesty Is The Best Policy!Document3 pagesCost Accounting Quiz 12 Standard Cost Accounting: End of The Quiz. Good Luck! Reminder: Honesty Is The Best Policy!lena cpaNo ratings yet

- Lecture 10 Relevant Costing PDFDocument49 pagesLecture 10 Relevant Costing PDFShweta Sridhar57% (7)

- MCQsDocument48 pagesMCQsSujeetDhakalNo ratings yet

- Design For ManuFacturingDocument46 pagesDesign For ManuFacturingxxxpressionNo ratings yet

- Costs Accounting CycleDocument2 pagesCosts Accounting CycleChris Aruh BorsalinaNo ratings yet

- Takehome - Quiz - Manac - Docx Filename - UTF-8''Takehome Quiz Manac-1Document3 pagesTakehome - Quiz - Manac - Docx Filename - UTF-8''Takehome Quiz Manac-1Sharmaine SurNo ratings yet

- Project Report On Inner Grooved Copper TubeDocument8 pagesProject Report On Inner Grooved Copper TubeEIRI Board of Consultants and Publishers0% (1)

- Case Study 2nd High StreetDocument0 pagesCase Study 2nd High StreetBobbie CraigNo ratings yet

- Accounting in ERP SystemDocument51 pagesAccounting in ERP SystemMohammad Azad KhanNo ratings yet

- Finals Exam Part 1 (Theories)Document7 pagesFinals Exam Part 1 (Theories)Zee De Vera LaderasNo ratings yet

- Cost AccountingDocument120 pagesCost AccountingjulianNo ratings yet

- Flexible Budgets, Standard Costs, and Variance AnalysisDocument90 pagesFlexible Budgets, Standard Costs, and Variance AnalysisNadia Kartika EkaNo ratings yet

- Contract CostingDocument18 pagesContract CostingAnant Jain100% (2)

- MAS-42F (Relevant Costing With Linear Programming)Document9 pagesMAS-42F (Relevant Costing With Linear Programming)Pearl Mae De VeasNo ratings yet

- Hyperion Essentianal VVBR PDFDocument31 pagesHyperion Essentianal VVBR PDFVijayabhaskarareddy VemireddyNo ratings yet

- Relevant Cost ReviewerDocument12 pagesRelevant Cost ReviewerRia Joy Cabantao AlimpuyoNo ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument23 pagesIntermediate Examination: Suggested Answers To QuestionsKUNAL KUMARNo ratings yet

- ACCT 219-Cost Accounting PDFDocument167 pagesACCT 219-Cost Accounting PDFaponojecy74% (27)

- Chapter 25 - Standard Costs and Balance ScoreCardsDocument55 pagesChapter 25 - Standard Costs and Balance ScoreCardsLe H KhangNo ratings yet

- Interim Payment ? Correct Name ?: Webinar: Preparation O F Interim Valuation Session Id: Ip&Es-Qs-T05Document9 pagesInterim Payment ? Correct Name ?: Webinar: Preparation O F Interim Valuation Session Id: Ip&Es-Qs-T05musthaqhassanNo ratings yet

- Survey of Accounting 6th Edition Warren Test BankDocument48 pagesSurvey of Accounting 6th Edition Warren Test Bankdariusarnoldvin100% (27)

- Unit II - Unit RateDocument48 pagesUnit II - Unit RateRenuka MagareNo ratings yet

- Chapter 3 Managerial Accounting PowerPointDocument38 pagesChapter 3 Managerial Accounting PowerPointOmar Bani-KhalafNo ratings yet

- Cost Accounting - ch06Document31 pagesCost Accounting - ch06IzmideNo ratings yet

- Semi Exam RecitDocument12 pagesSemi Exam RecitJess SiazonNo ratings yet

- LP3-Product Costing MethodsDocument12 pagesLP3-Product Costing MethodsCarla GarciaNo ratings yet

- WCM EstimationDocument3 pagesWCM Estimationtanya.p23No ratings yet