Professional Documents

Culture Documents

Cfa - R1

Uploaded by

Thanh TuyềnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cfa - R1

Uploaded by

Thanh TuyềnCopyright:

Available Formats

Today’s value of a cash flow that is to be received at some point in the future PV

Present value vs Future value Discount rate used to discount cashflows in future to PV

The amount to which a current deposit will grow over time FV

Opportunity cost forgo by choosing a course of action

nominal r.f = real

Annual compounding

Required rate of return minimum rate must receive to accept the investment

r.f + inflation p

Periodically compounding Lump-sum (single cashflow)

Nominal risk-free rate

Real risk-free rate

required ror =

Inflation premium

nominal r.f + RP

Components Default risk premium -> Required rate of return = Real risk-free rate

+ Inflation premium + Default risk premium +

Continuously compounding Interest rate Liquidity premium + Maturity premium

Types of cashflow Premiums (compensate for bearing risk) Liquidity premium

R1: Time value of money

Maturity premium

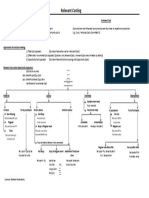

Types of cashflow

first cash flow (PMT) that occurs one period Ordinary annuity

from now (t1)

no reinvestment of interest

Simple interest

based on principal amount

first cash flow (PMT) that occurs immediately (t0) Annuity due

Annuity (Series of equal cashflow)

reinvestment of interest

first cash flow (PMT) that occurs one period from Compound interest

now (t1) Perpetuity based on principal amount + accumulate interest

never-ending sequential cash flows

Effective annual rate (EAR) the rate investors actually realize as a result of compounding

m: the frequency compound/year

Periodically compounding Type something

Type something Series of unequal cashflow

m→∞

Continuously compounding

Type something

Usage: The cash flow additivity principle can be used to solve problems Cashflow additivity rule

with uneven cash flows by combining single payments and annuities.

You might also like

- Mindmap QUANT - M1Document1 pageMindmap QUANT - M1Quyên ĐặngNo ratings yet

- Fin PrepDocument40 pagesFin PrepArijit GoraiNo ratings yet

- AUDIT OF INVESTMENT - Debt SecuritiesDocument2 pagesAUDIT OF INVESTMENT - Debt SecuritiesJoshua LisingNo ratings yet

- FMP Interest Rates SSEIDocument1 pageFMP Interest Rates SSEIDIVYANSHU GUPTANo ratings yet

- Ia Notes-PayableDocument2 pagesIa Notes-PayableJhunnie LoriaNo ratings yet

- BKM 9e Commonly Used NotationDocument1 pageBKM 9e Commonly Used Notationfossils1001No ratings yet

- IND AS 116 - P2-DraftDocument2 pagesIND AS 116 - P2-DraftSarun ChhetriNo ratings yet

- The Time Value of MoneyDocument2 pagesThe Time Value of Moneypier AcostaNo ratings yet

- Global Engineering Economics 4th Edition (Fraser, Jewkes, Barnhadt, Tajima)Document608 pagesGlobal Engineering Economics 4th Edition (Fraser, Jewkes, Barnhadt, Tajima)obamist97% (39)

- MapDocument1 pageMapddi40275No ratings yet

- Measuring and Evaluate Bank PerformanceDocument1 pageMeasuring and Evaluate Bank PerformanceNguyen Hoai HuongNo ratings yet

- MM L1 Formula SheetDocument20 pagesMM L1 Formula SheetMlungisi MalazaNo ratings yet

- Financial Mathematics FormulasDocument5 pagesFinancial Mathematics FormulasKhoaNamNguyenNo ratings yet

- Wacc Calculation SimplifiedDocument2 pagesWacc Calculation SimplifiedPranjalNo ratings yet

- BF2201 Cheatsheet BF2201 CheatsheetDocument4 pagesBF2201 Cheatsheet BF2201 CheatsheetRahman Md SaifurNo ratings yet

- CA Final AMA Summary Chart On Relevant Costing PDFDocument1 pageCA Final AMA Summary Chart On Relevant Costing PDFNksNo ratings yet

- Huaneng Shandong Ruyi (Pakistan) Energy PVTDocument13 pagesHuaneng Shandong Ruyi (Pakistan) Energy PVTHumaira AtharNo ratings yet

- Lec 2 - 2004010060Document1 pageLec 2 - 2004010060mai linhNo ratings yet

- FormulaDocument2 pagesFormulaChu Thị Thanh ThảoNo ratings yet

- Long Term Financing: After TaxDocument1 pageLong Term Financing: After TaxMa. Cristy BroncateNo ratings yet

- Capitalization: Capital Vs Operating LeaseDocument2 pagesCapitalization: Capital Vs Operating Leasejohnsmith12312312312No ratings yet

- CIMA P1 Cheat SheetDocument2 pagesCIMA P1 Cheat Sheetasamy3010100% (1)

- Maths NotesDocument43 pagesMaths NotesBurnt llamaNo ratings yet

- CostingDocument3 pagesCostingThuraNo ratings yet

- Economics: Summary of Assessing Performance of Different Market StructuresDocument1 pageEconomics: Summary of Assessing Performance of Different Market StructuresWeimingNo ratings yet

- Financial Product Prototype: Asset ClassDocument1 pageFinancial Product Prototype: Asset ClassRuwan WijemanneNo ratings yet

- RSM230Document2 pagesRSM230alankn2004No ratings yet

- Inputs: (Tools Add-Ins... ) Installed To Use The CUMIPMT FormulaDocument9 pagesInputs: (Tools Add-Ins... ) Installed To Use The CUMIPMT FormulaRavi ShankarNo ratings yet

- Corporate Finance and ValueDocument1 pageCorporate Finance and Valueapi-3721037No ratings yet

- Break Even AnalysisDocument20 pagesBreak Even AnalysisSachi DhanandamNo ratings yet

- FMar Financial Markets Formulas Rob NotesDocument8 pagesFMar Financial Markets Formulas Rob NotesEvelyn LabhananNo ratings yet

- Formula SheetDocument31 pagesFormula Sheetkarthik Ravichandiran100% (1)

- For Local Sales Only: The Peak Antipolo City, Rizal February 04, 2022 12:38 AMDocument1 pageFor Local Sales Only: The Peak Antipolo City, Rizal February 04, 2022 12:38 AMGEN888 IGNo ratings yet

- UEU Penilaian Asset Bisnis Pertemuan 14Document67 pagesUEU Penilaian Asset Bisnis Pertemuan 14Saputra SanjayaNo ratings yet

- Om FinanceDocument26 pagesOm Financeshahrachit91No ratings yet

- Time Value of Money Cheat Sheet: by ViaDocument3 pagesTime Value of Money Cheat Sheet: by ViaTechbotix AppsNo ratings yet

- Financial Statement Analysis FIN658Document1 pageFinancial Statement Analysis FIN658azwan ayop50% (2)

- Ind As 23 - Mind MapDocument2 pagesInd As 23 - Mind MapSarun ChhetriNo ratings yet

- Bond DrawioDocument1 pageBond DrawioVishesh ManglaNo ratings yet

- CORP Finance II Exam NotesDocument12 pagesCORP Finance II Exam NotesTeddie MowerNo ratings yet

- For Local Sales Only: Fortune Hill San Juan September 23, 2019 01:19 AMDocument2 pagesFor Local Sales Only: Fortune Hill San Juan September 23, 2019 01:19 AMRey R SonicoNo ratings yet

- FM Formula Sheet - Not GivenDocument4 pagesFM Formula Sheet - Not GivenSophie ChopraNo ratings yet

- Oxford IB Diploma Programme IB Economics Course Book (JOCELYN. DORTON BLINK (IAN.), Ian Dorton)Document601 pagesOxford IB Diploma Programme IB Economics Course Book (JOCELYN. DORTON BLINK (IAN.), Ian Dorton)sophieperervinNo ratings yet

- HW#14 Ch9Document18 pagesHW#14 Ch9Young-Hun KimNo ratings yet

- Corporate Finance 5E 2020-1-2Document2 pagesCorporate Finance 5E 2020-1-2Emanuele GennarelliNo ratings yet

- I I R R: Unit 4: Risk and ReturnDocument2 pagesI I R R: Unit 4: Risk and ReturnBuhle HlongwaneNo ratings yet

- Group Report: Executive SummaryDocument4 pagesGroup Report: Executive SummaryTường HuyNo ratings yet

- Coaching QuantitativeDocument6 pagesCoaching QuantitativeThanh TuyềnNo ratings yet

- Coaching Quantitative (Reading 3)Document6 pagesCoaching Quantitative (Reading 3)Thanh TuyềnNo ratings yet

- Coaching Quantitative (Reading 2)Document7 pagesCoaching Quantitative (Reading 2)Thanh TuyềnNo ratings yet

- Coaching - Quant (Buoi 2) - R4,5,6,7 - AnswerDocument45 pagesCoaching - Quant (Buoi 2) - R4,5,6,7 - AnswerThanh TuyềnNo ratings yet

- Coaching - Quant (Buoi 1) - R1,2,3 - AnswerDocument31 pagesCoaching - Quant (Buoi 1) - R1,2,3 - AnswerThanh TuyềnNo ratings yet

- Cfa - R4Document1 pageCfa - R4Thanh TuyềnNo ratings yet

- Cfa - R3Document1 pageCfa - R3Thanh TuyềnNo ratings yet

- Cfa - R2Document1 pageCfa - R2Thanh TuyềnNo ratings yet

- List of FormulaDocument2 pagesList of FormulaMidas Troy VictorNo ratings yet

- BSN R&R Request FormDocument2 pagesBSN R&R Request FormROS AMIRA IZAYU ISMAILNo ratings yet

- Poa T - 8Document3 pagesPoa T - 8SHEVENA A/P VIJIANNo ratings yet

- Intacc 1 Cash and Cash Equivalents-1Document10 pagesIntacc 1 Cash and Cash Equivalents-1randel10caneteNo ratings yet

- Reits Report by Hkis 2006Document70 pagesReits Report by Hkis 2006morrislamthNo ratings yet

- The Problem and Its Background I. Background of The StudyDocument31 pagesThe Problem and Its Background I. Background of The StudyEzra CalayagNo ratings yet

- Project Senior PDFDocument89 pagesProject Senior PDFPavani SimhadriNo ratings yet

- Mankind Pharma Limited RHPDocument588 pagesMankind Pharma Limited RHPArmeet ChhatwalNo ratings yet

- Advertising and Promotion An Integrated Marketing Communications Perspective 11Th Edition Belch Test Bank Full Chapter PDFDocument36 pagesAdvertising and Promotion An Integrated Marketing Communications Perspective 11Th Edition Belch Test Bank Full Chapter PDFjames.graven613100% (15)

- Know Your Client (Kyc) - Application Form (For Individuals Only)Document51 pagesKnow Your Client (Kyc) - Application Form (For Individuals Only)dhruvinpatel5434No ratings yet

- Revised-application-for-CoR For HFCDocument28 pagesRevised-application-for-CoR For HFCmuskanNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalSwati KunwarNo ratings yet

- Khajuria Final TranscriptDocument22 pagesKhajuria Final Transcriptmlieb737No ratings yet

- MGT590 Research TopicsDocument4 pagesMGT590 Research TopicsAhmed El-SebaiiNo ratings yet

- Ethiopia Financial Sector Development The Path To An Efficient Stable and Inclusive Financial SectorDocument112 pagesEthiopia Financial Sector Development The Path To An Efficient Stable and Inclusive Financial SectorAli HassenNo ratings yet

- FAC1502 - Study Unit 12 - 2021Document9 pagesFAC1502 - Study Unit 12 - 2021Ndila mangalisoNo ratings yet

- Ems p1 8 Question Paper Final 2023Document6 pagesEms p1 8 Question Paper Final 2023Abdul AhadNo ratings yet

- Marketing 3rd Quarter ReviewerDocument10 pagesMarketing 3rd Quarter ReviewerJohn Cris BuanNo ratings yet

- Entrep Quiz 3 - Potential MarketDocument2 pagesEntrep Quiz 3 - Potential MarketAlona GallegoNo ratings yet

- 2024 Crypto Investment OutlookDocument4 pages2024 Crypto Investment OutlookIvan DoriNo ratings yet

- Transaction Statement 6523cd38 1d29 A757 A256 1050ec5d7e03 en Ie F2ccceDocument1 pageTransaction Statement 6523cd38 1d29 A757 A256 1050ec5d7e03 en Ie F2ccceragduarte25No ratings yet

- 2023 Investment Stewardship Voting SpotlightDocument61 pages2023 Investment Stewardship Voting SpotlightComunicarSe-ArchivoNo ratings yet

- Chapter 5Document8 pagesChapter 5Jimmy LojaNo ratings yet

- Ministry of Corporate AffairsDocument2 pagesMinistry of Corporate Affairscarbtwork0% (1)

- CHAP 3&4: Balance of Payment Corporate Governance Around The WorldDocument30 pagesCHAP 3&4: Balance of Payment Corporate Governance Around The WorldKim Anh TruongNo ratings yet

- Comparative Study Nse Bse 2Document99 pagesComparative Study Nse Bse 2idealNo ratings yet

- Wicaksana Overseas International Tbk-Dec 31 2022Document88 pagesWicaksana Overseas International Tbk-Dec 31 2022Jefri Formen PangaribuanNo ratings yet

- Abay Bank's IFB Brand-صادقDocument41 pagesAbay Bank's IFB Brand-صادقEz N100% (1)

- Muthoot Microfin LTD - IPO Note - Dec'2023Document11 pagesMuthoot Microfin LTD - IPO Note - Dec'2023Rahul KirkNo ratings yet

- Assignment 1Document4 pagesAssignment 1Ahmad Ullah KhanNo ratings yet