Professional Documents

Culture Documents

GST 4

Uploaded by

Crick Compact0 ratings0% found this document useful (0 votes)

24 views19 pagesOriginal Title

gst4

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views19 pagesGST 4

Uploaded by

Crick CompactCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 19

CHAPTER V

INPUT TAX CREDIT

SECTION 16 - Eligibility and conditions for taking

input tax credit

• 16. (1) Every registered person shall, subject

to such conditions and restrictions as may be

prescribed and in the manner specified in

section 49, be entitled to take credit of input

tax charged on any supply of goods or services

or both to him which are used or intended to

be used in the course or furtherance of his

business and the said amount shall be

credited to the electronic credit ledger of such

person.

Section 16 contd….

• (2) Notwithstanding anything contained in this section, no

registered person shall be entitled to the credit of any input

tax in respect of any supply of goods or services or both to

him unless,––

• (a) he is in possession of a tax invoice or debit note issued

by a supplier registered under this Act, or such other tax

paying documents as may be prescribed;

• (b) he has received the goods or services or both

• (c) subject to the provisions of section 41, the tax charged

in respect of such supply has been actually paid to the

Government, either in cash or through utilization of input

tax credit admissible in respect of the said supply; and

• (d) he has furnished the return under section 39:

Section 16 contd….

• (3) Where the registered person has claimed

depreciation on the tax component of the cost

of capital goods and plant and machinery

under the provisions of the Income-tax Act,

1961, the input tax credit on the said tax

component shall not be allowed.

Section 16 contd….

• (4) A registered person shall not be entitled to

take input tax credit in respect of any invoice

or debit note for supply of goods or services

or both after the due date of furnishing of the

return under section 39 for the month of

September following the end of financial year

to which such invoice or invoice relating to

such debit note pertains or furnishing of the

relevant annual return, whichever is earlier.

Section 17 - Apportionment of credit

and blocked credits

17. (1) Where the goods or services or both are

used by the registered person partly for the

purpose of any business and partly for other

purposes, the amount of credit shall be

restricted to so much of the input tax as is

attributable to the purposes of his business.

Section 17 contd….

• (2) Where the goods or services or both are

used by the registered person partly for

effecting taxable supplies including zero-rated

supplies under this Act or under the

Integrated Goods and Services Tax Act and

partly for effecting exempt supplies under the

said Acts, the amount of credit shall be

restricted to so much of the input tax as is

attributable to the said taxable supplies

including zero-rated supplies.

• (3) The value of exempt supply under sub-

section (2) shall be such as may be prescribed,

and shall include supplies on which the

recipient is liable to pay tax on reverse charge

basis, transactions in securities, sale of land

and, subject to clause (b) of paragraph 5 of

Schedule II, sale of building.

Section 17 contd…

• (4) A banking company or a financial

institution including a non-banking financial

company, engaged in supplying services by

way of accepting deposits, extending loans or

advances shall have the option to either

comply with the provisions of sub-section (2),

or avail of, every month, an amount equal to

fifty per cent. of the eligible input tax credit on

inputs, capital goods and input services in that

month and the rest shall lapse:

Section 17 contd….

• (5) Notwithstanding anything contained in sub-section (1) of section 16 and sub-

section (1) of section 18, input tax credit shall not be available in respect of the

following, namely:— (a) motor vehicles and other conveyances except when they

are used–– (i) for making the following taxable supplies, namely:—

• (A) further supply of such vehicles or conveyances ; or (B) transportation of

passengers; or

• (C) imparting training on driving, flying, navigating such vehicles or conveyances;

• (aa) Vessels and aircraft expect when they are used—

(i) for making the following taxable supplies, namely :--

(A) Further supply of such vessels or aircraft; or

(B) transportation of passengers; or

( c) Imparting training on navigating such vessels; or

(D) Imparting training on flying such aircraft;

• (ii) for transportation of goods;

• (ab) Services of general insurance, servicing, repair and maintenance in so far as

they relate to motor vehicles, vessels or aircraft referred to in clause (a) or clause

(aa):

Section 18 - Availability of credit in special

circumstances

• 18. (1) Subject to such conditions and restrictions as may be

prescribed—

• (a) a person who has applied for registration under this Act within

thirty days from the date on which he becomes liable to registration

and has been granted such registration shall be entitled to take credit

of input tax in respect of inputs held in stock and inputs contained in

semi-finished or finished goods held in stock on the day immediately

preceding the date from which he becomes liable to pay tax under

the provisions of this Act;

• (b) a person who takes registration under sub-section (3) of section

25 shall be entitled to take credit of input tax in respect of inputs held

in stock and inputs contained in semi-finished or finished goods held

in stock on the day immediately preceding the date of grant of

registration;

Section 18 contd….

• (c) where any registered person ceases to pay tax under

section 10, he shall be entitled to take credit of input tax in

respect of inputs held in stock, inputs contained in semi-

finished or finished goods held in stock and on capital

goods on the day immediately preceding the date from

which he becomes liable to pay tax under section 9

• (d) where an exempt supply of goods or services or both by

a registered person becomes a taxable supply, such person

shall be entitled to take credit of input tax in respect of

inputs held in stock and inputs contained in semi-finished

or finished goods held in stock relatable to such exempt

supply and on capital goods exclusively used for such

exempt supply on the day immediately preceding the date

from which such supply becomes taxable:

Section 19

Taking input tax credit in respect of inputs

and capital goods sent for job work

Section 19 contd….

• 19. (1) The principal shall, subject to such conditions and

restrictions as may be prescribed, be allowed input tax credit on

inputs sent to a job worker for job work.

• (2) Notwithstanding anything contained in clause (b) of sub-section

(2) of section 16, the principal shall be entitled to take credit of

input tax on inputs even if the inputs are directly sent to a job

worker for job work without being first brought to his place of

business.

• (3) Where the inputs sent for job work are not received back by the

principal after completion of job work or otherwise or are not

supplied from the place of business of the job worker in accordance

with clause (a) or clause (b) of sub-section (1) of section 143 within

one year of being sent out, it shall be deemed that such inputs had

been supplied by the principal to the job worker on the day when

the said inputs were sent out:

• (4) The principal shall, subject to such conditions and restrictions as may

be prescribed, be allowed input tax credit on capital goods sent to a job

worker for job work.

• (5) Notwithstanding anything contained in clause (b) of sub-section (2) of

section 16, the principal shall be entitled to take credit of input tax on

capital goods even if the capital goods are directly sent to a job worker for

job work without being first brought to his place of business.

• (6) Where the capital goods sent for job work are not received back by

the principal within a period of three years of being sent out, it shall be

deemed that such capital goods had been supplied by the principal to the

job worker on the day when the said capital goods were sent out:

• (7) Nothing contained in sub-section (3) or sub-section (6) shall apply to

moulds and dies, jigs and fixtures, or tools sent out to a job worker for job

work.

Section 20

Manner of Distribution of credit

by Input Service Distributor

• 20. (1) The Input Service Distributor shall distribute the credit of central tax as central tax or

integrated tax and integrated tax as integrated tax or central tax, by way of issue of a document

containing the amount of input tax credit being distributed in such manner as may be prescribed.

• (2) The Input Service Distributor may distribute the credit subject to the following conditions,

namely:––

• (a) the credit can be distributed to the recipients of credit against a document containing such

details as may be prescribed;

• (b) the amount of the credit distributed shall not exceed the amount of credit available for

distribution;

• (c) the credit of tax paid on input services attributable to a recipient of credit shall be distributed

only to that recipient;

• (d) the credit of tax paid on input services attributable to more than one recipient of credit shall be

distributed amongst such recipients to whom the input service is attributable and such distribution

shall be pro rata on the basis of the turnover in a State or turnover in a Union territory of such

recipient, during the relevant period, to the aggregate of the turnover of all such recipients to

whom such input service is attributable and which are operational in the current year, during the

said relevant period;

• (e) the credit of tax paid on input services attributable to all recipients of credit shall be distributed

amongst such recipients and such distribution shall be pro rata on the basis of the turnover in a

State or turnover in a Union territory of such recipient, during the relevant period, to the aggregate

of the turnover of all recipients and which are operational in the current year, during the said

relevant period.

Section 21

Manner of recovery of credit

distributed in excess

• 21. Where the Input Service Distributor

distributes the credit in contravention of the

provisions contained in section 20 resulting in

excess distribution of credit to one or more

recipients of credit, the excess credit so

distributed shall be recovered from such

recipients along with interest, and the

provisions of section 73 or section 74, as the

case may be, shall, mutatis mutandis, apply

for determination of amount to be recovered.

You might also like

- Input Tax Credit (TC)Document128 pagesInput Tax Credit (TC)Sidhant GoyalNo ratings yet

- Voyage CharterDocument22 pagesVoyage CharterAnkit MauryaNo ratings yet

- Negotiable InstrumentsDocument20 pagesNegotiable InstrumentsDan Dan Dan DanNo ratings yet

- Income Tax Rules, 2002 PDFDocument244 pagesIncome Tax Rules, 2002 PDFAli Minhas100% (1)

- RR 9-99Document2 pagesRR 9-99matinikkiNo ratings yet

- Government Leave Rules QuizDocument12 pagesGovernment Leave Rules QuizCrick Compact100% (3)

- Republic of The Philippines Province of Cebu: CityofnagaDocument10 pagesRepublic of The Philippines Province of Cebu: CityofnagaLGU San FranciscoNo ratings yet

- ITC Provisions and Rules in GSTDocument8 pagesITC Provisions and Rules in GSTAnonymous ikQZphNo ratings yet

- Input Tax CreditDocument45 pagesInput Tax CreditGourav PareekNo ratings yet

- BGSTAct, 2017 (EN) 20 25Document6 pagesBGSTAct, 2017 (EN) 20 25Ahsan ZakariyyaNo ratings yet

- Input Tax Credit (Itc) (Section 16) : Sem 5: Procedure and Levy Under Gstgoods and Service TaxDocument3 pagesInput Tax Credit (Itc) (Section 16) : Sem 5: Procedure and Levy Under Gstgoods and Service TaxmanjulaNo ratings yet

- CGST Act 16-21Document37 pagesCGST Act 16-21Dasari NareshNo ratings yet

- Input Tax Credit System (Chapter-V) (Sections: 16, 17, 18, 19, 20, 21. (Other Related Sections Linked 39, 41, and 49)Document3 pagesInput Tax Credit System (Chapter-V) (Sections: 16, 17, 18, 19, 20, 21. (Other Related Sections Linked 39, 41, and 49)dinesh kasnNo ratings yet

- Input Tax CreditDocument10 pagesInput Tax CreditSme 2023No ratings yet

- GST Session 43Document20 pagesGST Session 43manjulaNo ratings yet

- GST & Customs II Unit 1Document11 pagesGST & Customs II Unit 1GagandeepNo ratings yet

- Vat Regulation The Value Added Tax (General) Regulation 1998 CitationDocument9 pagesVat Regulation The Value Added Tax (General) Regulation 1998 CitationERICK MLINGWANo ratings yet

- Input Tax Credit 36. Documentary Requirements and Conditions For Claiming Input Tax Credit.Document22 pagesInput Tax Credit 36. Documentary Requirements and Conditions For Claiming Input Tax Credit.KaranNo ratings yet

- Draft Refund RulesDocument7 pagesDraft Refund RulessridharanNo ratings yet

- Input Tax Credit (Itc) SystemDocument17 pagesInput Tax Credit (Itc) SystemJasmin BidNo ratings yet

- Chapter12 - VII - PDF Zero Rated SupplyDocument3 pagesChapter12 - VII - PDF Zero Rated Supplyravi.pansuriya07No ratings yet

- Section 16 of CGST Act 2017 - Eligibility & Conditions For Taking Input Tax Credit - Taxguru - inDocument3 pagesSection 16 of CGST Act 2017 - Eligibility & Conditions For Taking Input Tax Credit - Taxguru - inDHANNNo ratings yet

- SGST Act and Ugst Act) : Ridhi GoelDocument22 pagesSGST Act and Ugst Act) : Ridhi GoelVaibhav GoyalNo ratings yet

- Agenda Item 2 (2) - ITC RulesDocument9 pagesAgenda Item 2 (2) - ITC Rulesfintech ConsultancyNo ratings yet

- Refund of Tax-Section 54Document4 pagesRefund of Tax-Section 54RajgopalNo ratings yet

- 003 ITC Mismatch in GSTR 2A Vs 2BDocument7 pages003 ITC Mismatch in GSTR 2A Vs 2BAman GargNo ratings yet

- TRANSITIONAL PROVISIONS UNDER CGST ACTDocument29 pagesTRANSITIONAL PROVISIONS UNDER CGST ACTSATYANARAYANA MOTAMARRINo ratings yet

- GST 31.03.17 Itc Rules PDFDocument9 pagesGST 31.03.17 Itc Rules PDFParthibanNo ratings yet

- The New Income Tax Chapter 13: COLLECTION of Tax: PrintDocument4 pagesThe New Income Tax Chapter 13: COLLECTION of Tax: PrintzeeshanshahbazNo ratings yet

- GST - Input Tax Credit - Edition 5Document17 pagesGST - Input Tax Credit - Edition 5Vineet PandeyNo ratings yet

- Section 194Document10 pagesSection 194Hitesh NarwaniNo ratings yet

- Refund of TaxDocument4 pagesRefund of Taxdhaval bhalodiaNo ratings yet

- Registration: 22. Persons Liable For RegistrationDocument7 pagesRegistration: 22. Persons Liable For RegistrationSAMICDPNo ratings yet

- © Skill Short Edulife Pvt. Ltd. (2020)Document3 pages© Skill Short Edulife Pvt. Ltd. (2020)Animesh Kumar TilakNo ratings yet

- Form GST RFD-01: 1. Application For Refund of Tax, Interest, Penalty, Fees or Any Other AmountDocument7 pagesForm GST RFD-01: 1. Application For Refund of Tax, Interest, Penalty, Fees or Any Other Amountpuran1234567890No ratings yet

- Explanation.-For The Purposes of This SectionDocument2 pagesExplanation.-For The Purposes of This SectionJeremy RemlalfakaNo ratings yet

- csnt07 2022Document12 pagescsnt07 2022dharmaNo ratings yet

- RETURNS Under GST - Types, Applicability, Annual Returns, Matching, Final Returns With Rules CA. V.Vijay AnandDocument8 pagesRETURNS Under GST - Types, Applicability, Annual Returns, Matching, Final Returns With Rules CA. V.Vijay Anandshahista786No ratings yet

- Form GST RFD-01: 1. Application For Refund of Tax, Interest, Penalty, Fees or Any Other AmountDocument7 pagesForm GST RFD-01: 1. Application For Refund of Tax, Interest, Penalty, Fees or Any Other AmountSarinNo ratings yet

- 06 A Idt Ammentments 2 in 1Document33 pages06 A Idt Ammentments 2 in 1Venkat RamanaNo ratings yet

- Chapter - Composition Rules 1. Intimation For Composition LevyDocument4 pagesChapter - Composition Rules 1. Intimation For Composition LevyGuru SankarNo ratings yet

- Income Tax DepartmentDocument2 pagesIncome Tax DepartmentP DNo ratings yet

- NEW TDS RULESDocument14 pagesNEW TDS RULESsugasenthilNo ratings yet

- Application For Refund of Tax, Interest, Penalty, Fees or Any Other AmountDocument15 pagesApplication For Refund of Tax, Interest, Penalty, Fees or Any Other Amountdhaval bhalodiaNo ratings yet

- Bill of Entry - Its Journey and OtherDocument17 pagesBill of Entry - Its Journey and OtherAnonymous SQh10rGNo ratings yet

- Taxguru - In-Refund of ITC On Capital Goods A Possible PerspectiveDocument6 pagesTaxguru - In-Refund of ITC On Capital Goods A Possible PerspectiveVamshi Krishna Reddy PathiNo ratings yet

- Input - Ax - Credit PDFDocument124 pagesInput - Ax - Credit PDFRupasinghNo ratings yet

- Input Tax Credit: Cma Bibhudatta SarangiDocument3 pagesInput Tax Credit: Cma Bibhudatta SarangihanumanthaiahgowdaNo ratings yet

- Itc 2022-23Document24 pagesItc 2022-23Chutmaarika GoteNo ratings yet

- Notfctn 40 Central Tax English 2021Document12 pagesNotfctn 40 Central Tax English 2021sridharanNo ratings yet

- Conditions For Purposes of Appearance. - (1) No Person Shall Be Eligible To AttendDocument7 pagesConditions For Purposes of Appearance. - (1) No Person Shall Be Eligible To AttendLITTO GEORGENo ratings yet

- Chapter V: Customs Duty Exemptions and RefundsDocument24 pagesChapter V: Customs Duty Exemptions and RefundsVikash KumarNo ratings yet

- @GSTMCQ Chapter 5 Input Tax CreditDocument15 pages@GSTMCQ Chapter 5 Input Tax CreditIndhuja MNo ratings yet

- Tax Ordinance Sub Section 114 and 115Document4 pagesTax Ordinance Sub Section 114 and 115faiz kamranNo ratings yet

- Some Issues On Practice of TDS Law Seminar by NIRCDocument29 pagesSome Issues On Practice of TDS Law Seminar by NIRCHarish KalidasNo ratings yet

- Advanced Tax Laws and Practice: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate ToDocument18 pagesAdvanced Tax Laws and Practice: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate ToMurugesh Kasivel EnjoyNo ratings yet

- TDS Not DeductDocument6 pagesTDS Not DeductAnil WayanadNo ratings yet

- GST Supplement - Dec 2022Document10 pagesGST Supplement - Dec 2022SAMAR SINGH CHAUHANNo ratings yet

- WHT on Goods and Services 2013Document13 pagesWHT on Goods and Services 2013touseefahmadNo ratings yet

- Chapter-REFUND Application GuideDocument7 pagesChapter-REFUND Application GuideRavi Kiran KandimallaNo ratings yet

- Asifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-08 PDFDocument18 pagesAsifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-08 PDFaemanNo ratings yet

- Tax Collection at Source ProjectDocument15 pagesTax Collection at Source ProjectShivamPandeyNo ratings yet

- MCQs in Regulation of Audit AccountsDocument17 pagesMCQs in Regulation of Audit AccountsDeepankarNo ratings yet

- Staff Selection Commission, Southern Region, ChennaiDocument4 pagesStaff Selection Commission, Southern Region, ChennaiCrick CompactNo ratings yet

- MCQs GSTDocument1 pageMCQs GSTCrick CompactNo ratings yet

- Cal 2023 2 CaaDocument2 pagesCal 2023 2 CaaCrick CompactNo ratings yet

- TA Rules-1Document54 pagesTA Rules-1Crick CompactNo ratings yet

- Sample MCQs Income Tax - DEADocument15 pagesSample MCQs Income Tax - DEACrick CompactNo ratings yet

- Class On Pay Fixation in 8th April.Document118 pagesClass On Pay Fixation in 8th April.Crick CompactNo ratings yet

- GST NotesDocument39 pagesGST NotesCrick CompactNo ratings yet

- Income Tax Act for AuditorsDocument83 pagesIncome Tax Act for AuditorsCrick CompactNo ratings yet

- Bes Chartering Shipping TermsDocument47 pagesBes Chartering Shipping TermsbosereeNo ratings yet

- Tender Schedule Interior Works Union Bank of India Collectorate Branch Jagtial Ro KarimnagarDocument54 pagesTender Schedule Interior Works Union Bank of India Collectorate Branch Jagtial Ro KarimnagarashokNo ratings yet

- Case Digest: Ayala Corporation V. Rosa-Diana Realty and Development CorporationDocument2 pagesCase Digest: Ayala Corporation V. Rosa-Diana Realty and Development CorporationAshNo ratings yet

- Scaffolding InspectorDocument2 pagesScaffolding InspectorMunaku TafadzwaNo ratings yet

- General-Warranty-Deed-Form 2023 09 19Document3 pagesGeneral-Warranty-Deed-Form 2023 09 19youtrends27No ratings yet

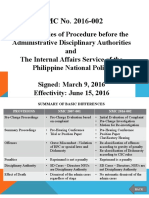

- Revised Rules of Procedure Re NMC 2016 002Document20 pagesRevised Rules of Procedure Re NMC 2016 002eli laropNo ratings yet

- Elar's LechonDocument20 pagesElar's LechonGodfrey ReverenteNo ratings yet

- RFP Vacant Lot Property List 6.17.2021 (19172)Document29 pagesRFP Vacant Lot Property List 6.17.2021 (19172)NewsTeam20No ratings yet

- Chapter 09 Negotiable Instruments (Law & Practice of Banking)Document8 pagesChapter 09 Negotiable Instruments (Law & Practice of Banking)Rayyah AminNo ratings yet

- SECTION A Medan NCC SF1442Document2 pagesSECTION A Medan NCC SF1442Afit WidyantokoNo ratings yet

- Charity Registration Renewal FormDocument3 pagesCharity Registration Renewal FormNadia ByfieldNo ratings yet

- Instant Download Practical Financial Management 8th Edition Lasher Solutions Manual PDF Full ChapterDocument17 pagesInstant Download Practical Financial Management 8th Edition Lasher Solutions Manual PDF Full ChapterWayneShermanibkya100% (3)

- Legaspi vs. CSCDocument6 pagesLegaspi vs. CSCShally Lao-unNo ratings yet

- Drafting and Negotiating Commercial Contracts College of LawDocument15 pagesDrafting and Negotiating Commercial Contracts College of LawKeil LucredoNo ratings yet

- Unit 1: Introduction To Partnership AccountsDocument29 pagesUnit 1: Introduction To Partnership AccountsTisha ShahNo ratings yet

- The Contract 1Document204 pagesThe Contract 1kashif.it2010No ratings yet

- EFTA Philippines FTA Factsheet 2021 - 230413 - 015527Document3 pagesEFTA Philippines FTA Factsheet 2021 - 230413 - 015527Evardone CirylNo ratings yet

- Workplace Safety Reporting RegulationsDocument7 pagesWorkplace Safety Reporting RegulationsSafe HavenNo ratings yet

- Buy Local Ordinance of Surigao CityDocument12 pagesBuy Local Ordinance of Surigao CityMark HenryNo ratings yet

- BidForm MGLDocument2 pagesBidForm MGLanu radhaNo ratings yet

- Fundamentals Class 12 Accountancy MCQs PDFDocument6 pagesFundamentals Class 12 Accountancy MCQs PDFAryan RawatNo ratings yet

- Supreme Court Lowers Excessive P5.5M Bail Amount in Yap Jr vs CADocument2 pagesSupreme Court Lowers Excessive P5.5M Bail Amount in Yap Jr vs CAChristian Adrian CepilloNo ratings yet

- Comres 9984 2015Document22 pagesComres 9984 2015Florienne MelendrezNo ratings yet

- Land Registration Case Over 33k Hectares AnnulledDocument3 pagesLand Registration Case Over 33k Hectares AnnulledMarian's PreloveNo ratings yet

- APPOINMENT AND REMOVAL OF DIRECTORSDocument15 pagesAPPOINMENT AND REMOVAL OF DIRECTORSSamiksha PawarNo ratings yet

- Img - 01/09/2023 - Notice of Allodial Cost ScheduleDocument6 pagesImg - 01/09/2023 - Notice of Allodial Cost Scheduleal malik ben beyNo ratings yet

- Carlill v Carbolic Smoke Ball Co: Advertisement as OfferDocument6 pagesCarlill v Carbolic Smoke Ball Co: Advertisement as OfferShashank Shekhar SinghNo ratings yet