Professional Documents

Culture Documents

Assignment 2022

Uploaded by

Salma Sultana0 ratings0% found this document useful (0 votes)

9 views1 pageArnob chose the $600 today because he values money now more than money later. Badol chose $1200 in 3 years because he is willing to wait to receive a larger total amount. Tarek was indifferent because he values both options equally based on their present values.

The payback period for Able Plastics to purchase the $67,000 special removal equipment is 2.57 years (67,000/26,000). Since the payback period is less than the 2 years of the production contract, Able Plastics should buy the removal equipment.

Using the given depreciation methods: (a) Straight-line is $2,000 per year. (b) Sum

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentArnob chose the $600 today because he values money now more than money later. Badol chose $1200 in 3 years because he is willing to wait to receive a larger total amount. Tarek was indifferent because he values both options equally based on their present values.

The payback period for Able Plastics to purchase the $67,000 special removal equipment is 2.57 years (67,000/26,000). Since the payback period is less than the 2 years of the production contract, Able Plastics should buy the removal equipment.

Using the given depreciation methods: (a) Straight-line is $2,000 per year. (b) Sum

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageAssignment 2022

Uploaded by

Salma SultanaArnob chose the $600 today because he values money now more than money later. Badol chose $1200 in 3 years because he is willing to wait to receive a larger total amount. Tarek was indifferent because he values both options equally based on their present values.

The payback period for Able Plastics to purchase the $67,000 special removal equipment is 2.57 years (67,000/26,000). Since the payback period is less than the 2 years of the production contract, Able Plastics should buy the removal equipment.

Using the given depreciation methods: (a) Straight-line is $2,000 per year. (b) Sum

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

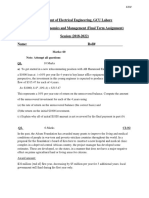

Q1.

Arnob, Badol, and Tarek were asked to consider two different cash flows: $

600 that they could receive today and $ 1200 that would be received 3 years from

today. Arnob wanted the $ 600 today, Badol chose to collect $ 1200 in 3 years, and

Tarek was indifferent between these two options. Can you explain the choice made

by each man?

Q2. Able Plastics, an injection-molding firm, has negotiated a contract with a

national chain of department stores. Plastic pencil boxes are to be produced for a 2-

year period. Able Plastics has never produced the item before and, therefore,

requires all new dies. If the firm invests $67,000 for special removal equipment to

unload the completed pencil boxes from' the molding machine, one machine

operator can be eliminated. This would save $26,000 per year. The removal

equipment has no salvage value and is not expected to be used after the 2-year

production contract is completed. The equipment, although useless, would be

serviceable for about 15 years. You have been asked to do a payback period

analysis on whether to purchase the special removal equipment. What is the

payback period? Should Able Plastics buy the removal equipment?

Q3. Some special handling devices can be obtained for $12,000. At the end of 4

years, they can be sold for $3,500. Compute the depreciation schedule for the

devices using the following methods: (a) Straight-line depreciation. (b) Sum-of-

years' -digits depreciation. (c) Double declining balance depreciation.

You might also like

- Engineered Products IncDocument2 pagesEngineered Products IncSalman Adri100% (3)

- The Cartridge DilemmaDocument2 pagesThe Cartridge DilemmashikharNo ratings yet

- Tugas 2Document7 pagesTugas 2Henny Zahrany100% (1)

- Finman4e Quiz Mod16 040615Document3 pagesFinman4e Quiz Mod16 040615Brian KangNo ratings yet

- Solved ExercisesDocument9 pagesSolved ExercisesKyle BroflovskiNo ratings yet

- Assigment 6 - Managerial Finance Capital BudgetingDocument5 pagesAssigment 6 - Managerial Finance Capital BudgetingNasir ShaheenNo ratings yet

- Half Years Exam (Probable Questions - Answers)Document15 pagesHalf Years Exam (Probable Questions - Answers)Taz UddinNo ratings yet

- The Georgia Ceramic Company Has An Automatic Glaze Sprayer ThatDocument1 pageThe Georgia Ceramic Company Has An Automatic Glaze Sprayer ThatHassan Jan100% (1)

- Assignment 2Document3 pagesAssignment 2RahulRandyNo ratings yet

- Capacity and Forecasting HomeworkDocument1 pageCapacity and Forecasting HomeworkReynaldo Dimas FachriNo ratings yet

- Assignment 2Document2 pagesAssignment 2JuandeLaNo ratings yet

- TVM QuizDocument18 pagesTVM Quizmonty6630No ratings yet

- Assignment 4Document4 pagesAssignment 4PrashanthRameshNo ratings yet

- Depreciation AssignmentDocument2 pagesDepreciation AssignmentAdil Khan LodhiNo ratings yet

- Workshop 2 AnsDocument4 pagesWorkshop 2 AnsAlia ShabbirNo ratings yet

- Review QuestionsDocument3 pagesReview QuestionsAriaNo ratings yet

- Assignment On DepreciationDocument4 pagesAssignment On DepreciationNouman MujahidNo ratings yet

- Chapter 2 - Examples - SolutionsDocument11 pagesChapter 2 - Examples - SolutionsAhmed walidNo ratings yet

- Capital Budgeting 2Document3 pagesCapital Budgeting 2mlexarNo ratings yet

- Capacity Problem1Document3 pagesCapacity Problem1Ahmed ZamanNo ratings yet

- 15705Document1 page15705Bharath s kashyapNo ratings yet

- Assignment1 2016Document3 pagesAssignment1 2016Youssef LebroNo ratings yet

- Eng'g Econ EXAMPLE PROBLEMS Week2Document2 pagesEng'g Econ EXAMPLE PROBLEMS Week2Raymond MoscosoNo ratings yet

- Business Plan Solar Trash CompactorDocument19 pagesBusiness Plan Solar Trash Compactorfms162No ratings yet

- Assignment Session 7Document9 pagesAssignment Session 7Custer CoNo ratings yet

- Mock - Econ - Exercise 4Document2 pagesMock - Econ - Exercise 4najib casanNo ratings yet

- Assignment 2Document3 pagesAssignment 2Sodhani AnkurNo ratings yet

- POM ExerciseDocument3 pagesPOM ExerciseYehualashet Feleke33% (3)

- EM Final Paper Assingment EE GCU S18Document4 pagesEM Final Paper Assingment EE GCU S18KhanNo ratings yet

- LPP - orDocument12 pagesLPP - orbharat_v79No ratings yet

- Finman Practice QuestionsDocument2 pagesFinman Practice QuestionsMaitet CarandangNo ratings yet

- Chapter 2 - ProblemsDocument13 pagesChapter 2 - ProblemsTSARNo ratings yet

- EEM - Assignment 2 During QuaramtineDocument2 pagesEEM - Assignment 2 During Quaramtineshreya mishraNo ratings yet

- Seatwork - Inventory Management - PomDocument1 pageSeatwork - Inventory Management - PomJuris ChristianNo ratings yet

- Cellop Tape ProjectDocument13 pagesCellop Tape ProjectHarpy happyNo ratings yet

- Practice Set 2Document6 pagesPractice Set 2Marielle CastañedaNo ratings yet

- Class-8 Maths Case Study Worksheet (Annual Exam 2023-2024) 2Document2 pagesClass-8 Maths Case Study Worksheet (Annual Exam 2023-2024) 2arjan.singh.sawhneyNo ratings yet

- Problem SetDocument3 pagesProblem SetTimothy Jones0% (1)

- Study Set 5Document8 pagesStudy Set 5slnyzclrNo ratings yet

- MilliChemDocument3 pagesMilliChemBilal ZahidNo ratings yet

- Productivity ProblemDocument2 pagesProductivity ProblemAhmed ZamanNo ratings yet

- Case Exercise: Financing An Audio Cassette Cover Manufacturing UnitDocument8 pagesCase Exercise: Financing An Audio Cassette Cover Manufacturing Unitvishi2219No ratings yet

- Thoma Cash FlowDocument2 pagesThoma Cash FlowflorentinaNo ratings yet

- Examples and ProblemsDocument4 pagesExamples and ProblemsPaul AounNo ratings yet

- Home Assignmant # 1Document2 pagesHome Assignmant # 1Talha Nasir50% (2)

- PADocument6 pagesPAashik rahmanNo ratings yet

- UECM2043, UECM2093 Operations Research Tutorial 1Document5 pagesUECM2043, UECM2093 Operations Research Tutorial 1kamun00% (2)

- MGAB03Document3 pagesMGAB03Daisy LauNo ratings yet

- CH9 11複習考題目Document8 pagesCH9 11複習考題目邱品榛No ratings yet

- Acct CH.7 H.W.Document8 pagesAcct CH.7 H.W.j8noelNo ratings yet

- That Help Reduce Recycling Costs.: 2. Answer The Following Questions According To The Text. (3 PTS)Document3 pagesThat Help Reduce Recycling Costs.: 2. Answer The Following Questions According To The Text. (3 PTS)maian saja100% (3)

- Business Plan (1) L (1) (2) 240821110903Document16 pagesBusiness Plan (1) L (1) (2) 240821110903johnegnNo ratings yet

- Chapter 10: Plant Assets, Natural Resources and Intangibles Important TermsDocument2 pagesChapter 10: Plant Assets, Natural Resources and Intangibles Important TermsMarwan DawoodNo ratings yet

- AC505 CourseProject2Document1 pageAC505 CourseProject2Cassandra NortonNo ratings yet

- Eefm ProblemsDocument4 pagesEefm ProblemsChitrala DhruvNo ratings yet

- Aracanut Plates 10 LakhsDocument19 pagesAracanut Plates 10 LakhsManju MysoreNo ratings yet

- Example of Asset ReplacementDocument1 pageExample of Asset ReplacementflorentinaNo ratings yet

- Engineering an Awesome Recycling Center with Max Axiom, Super ScientistFrom EverandEngineering an Awesome Recycling Center with Max Axiom, Super ScientistNo ratings yet

- Environmental Sustainability in Asian LogisticsDocument275 pagesEnvironmental Sustainability in Asian LogisticsSalma SultanaNo ratings yet

- Cardoso 2016Document7 pagesCardoso 2016Salma SultanaNo ratings yet

- SEO Ranking Factor Keyword Research, Analytics and Tracking Fixes, Technical Fixes, One Page Optimization, Off Page OptimizationDocument1 pageSEO Ranking Factor Keyword Research, Analytics and Tracking Fixes, Technical Fixes, One Page Optimization, Off Page OptimizationSalma SultanaNo ratings yet

- Materials CoverDocument1 pageMaterials CoverSalma SultanaNo ratings yet

- Have To Be ProductiveDocument3 pagesHave To Be ProductiveSalma SultanaNo ratings yet

- Cover DemoDocument2 pagesCover DemoSalma SultanaNo ratings yet

- 4th Year 2nd SemesterDocument27 pages4th Year 2nd SemesterSalma SultanaNo ratings yet

- 3rd Year 2nd SemesterDocument9 pages3rd Year 2nd SemesterSalma SultanaNo ratings yet

- 2nd Year 1st SemesterDocument12 pages2nd Year 1st SemesterSalma SultanaNo ratings yet

- 4th Year 1st SemesterDocument10 pages4th Year 1st SemesterSalma SultanaNo ratings yet

- 3rd Year 1st SemesterDocument11 pages3rd Year 1st SemesterSalma SultanaNo ratings yet

- Recruitment and Selection Process in Bangladesh Civil Service: A Critical OverviewDocument8 pagesRecruitment and Selection Process in Bangladesh Civil Service: A Critical OverviewSalma SultanaNo ratings yet