Professional Documents

Culture Documents

Philamcare vs. CA

Philamcare vs. CA

Uploaded by

John Mark RevillaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Philamcare vs. CA

Philamcare vs. CA

Uploaded by

John Mark RevillaCopyright:

Available Formats

Philamcare vs.

CA

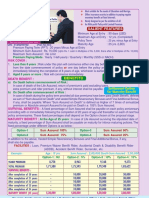

G.R. No. 125678

March 18, 2002

Facts

Ernani Trinos, deceased husband of respondent Julita Trinos, applied for a health

care coverage with petitioner. In the standard application form, he was asked if he

or any of his family members ever consulted or been treated for high blood pressure,

heart trouble, diabetes, cancer, liver disease, asthma or peptic ulcer, to which he

answered in the negative. The application was approved and a Health Care

Agreement was issued. Under such agreement, he was entitled to avail of

hospitalization benefits and also out-patient benefits such as annual physical

examinations and preventive health care services.

During the period of his coverage, Ernani suffered a heart attack and was confined

for one month. Respondent tried to claim the benefits under the agreement.

However, petitioner denied her claim saying that such Agreement was void.

According to petitioner, there was a concealment regarding Ernani’s medical history.

Thus, respondent paid the hospitalization expenses herself. The RTC rendered a

decision in favor of respondent and was later on affirmed by the CA on appeal.

Issue & Ruling

Whether or not the information that was not revealed by the insured constitutes

material information which should have been disclosed to the insurer

No. Under Section 27 of the Insurance Code, "a concealment entitles the injured

party to rescind a contract of insurance." The right to rescind should be exercised

previous to the commencement of an action on the contract. In this case, no

rescission was made. Under the title Claim procedures of expenses, the petitioner

had twelve months from the date of issuance of the Agreement within which to

contest the membership of the patient if he had previous ailment of asthma, and six

months from the issuance of the agreement if the patient was sick of diabetes or

hypertension. The periods having expired, the defense of concealment or

misrepresentation no longer lie.

Besides, the cancellation of health care agreements as in insurance policies require

the concurrence of the following conditions: (1) Prior notice of cancellation; (2)

Notice must be based on the occurrence after effective date of the policy; (3) Must

be in writing, mailed or delivered to the; (4) must state the grounds relied upon

provided in Section 64 of the Insurance Code and upon request of insured, to furnish

facts on which cancellation is based.

Being a contract of adhesion, the terms of an insurance contract are to be construed

strictly against the party which prepared the contract – the insurer. By reason of the

exclusive control of the insurance company over the terms and phraseology of the

insurance contract, ambiguity must be strictly interpreted against the insurer and

liberally in favor of the insured, especially to avoid forfeiture. This is equally

applicable to Health Care Agreements.

You might also like

- Philamcare Health Systems Vs CADocument2 pagesPhilamcare Health Systems Vs CAkamiruhyunNo ratings yet

- Philamcare v. CA-Health Care Agreement 379 SCRA 356 (2002) FactsDocument4 pagesPhilamcare v. CA-Health Care Agreement 379 SCRA 356 (2002) Factscarpediem0513No ratings yet

- Philamcare Health Systems V CADocument2 pagesPhilamcare Health Systems V CARebecca ChanNo ratings yet

- Philamcare Health Systems v. CADocument3 pagesPhilamcare Health Systems v. CADeyna MaiNo ratings yet

- Philam Vs CADocument1 pagePhilam Vs CAADNo ratings yet

- Philamcare V CADocument2 pagesPhilamcare V CAOscar E ValeroNo ratings yet

- PHILAMCARE HEALTH SYSTEMS, INC., Petitioner, vs. COURT OF APPEALS and JULITA TRINOSDocument3 pagesPHILAMCARE HEALTH SYSTEMS, INC., Petitioner, vs. COURT OF APPEALS and JULITA TRINOSjacq17No ratings yet

- Philamcare v. CA, 379 SCRA 356 (2002)Document6 pagesPhilamcare v. CA, 379 SCRA 356 (2002)Joena GeNo ratings yet

- Philamcare V CA G.R. No. 125678. March 18, 2002Document2 pagesPhilamcare V CA G.R. No. 125678. March 18, 2002cindy mateoNo ratings yet

- Philamcare vs. CADocument2 pagesPhilamcare vs. CAEarl LarroderNo ratings yet

- Insurance PHILAMCARE Vs CA DigestDocument6 pagesInsurance PHILAMCARE Vs CA DigestPao MillanNo ratings yet

- Philamcare v. CA (Case Digest)Document2 pagesPhilamcare v. CA (Case Digest)Everything LawNo ratings yet

- G.R. No. 125678 March 18, 2002 Philamcare Health Systems, Inc., Petitioner, COURT OF APPEALS and JULITA TRINOS, Respondents. Ynares-Santiago, J.Document5 pagesG.R. No. 125678 March 18, 2002 Philamcare Health Systems, Inc., Petitioner, COURT OF APPEALS and JULITA TRINOS, Respondents. Ynares-Santiago, J.Clarince Joyce Lao DoroyNo ratings yet

- Great Pacific Life Assurance CorpDocument3 pagesGreat Pacific Life Assurance CorpAnthonyNo ratings yet

- July 20 InsuranceDocument24 pagesJuly 20 InsuranceJoy Carmen CastilloNo ratings yet

- Lagmay Philamcare Health Systems Vs CADocument2 pagesLagmay Philamcare Health Systems Vs CAKacel CastroNo ratings yet

- Philamcare v. CADocument4 pagesPhilamcare v. CAWV Gamiz Jr.No ratings yet

- Insurance Cases 1Document94 pagesInsurance Cases 1Justine DagdagNo ratings yet

- G.R. No. 125678 Philamcare vs. CADocument5 pagesG.R. No. 125678 Philamcare vs. CAchristopher d. balubayanNo ratings yet

- G.R. No. 125678 March 18, 2002 Philamcare Health Systems, Inc., Petitioner, COURT OF APPEALS and JULITA TRINOS, Respondents. Ynares-Santiago, J.Document61 pagesG.R. No. 125678 March 18, 2002 Philamcare Health Systems, Inc., Petitioner, COURT OF APPEALS and JULITA TRINOS, Respondents. Ynares-Santiago, J.Jan Carlo Azada ChuaNo ratings yet

- 11 Philamcare Vs CADocument5 pages11 Philamcare Vs CARoger Pascual CuaresmaNo ratings yet

- Rika ReviewerDocument6 pagesRika ReviewerEKANGNo ratings yet

- Lesson 1 Cases Full TextDocument26 pagesLesson 1 Cases Full TextDanielle RoblesNo ratings yet

- Insurance CasesDocument36 pagesInsurance CasesPrincess PadronesNo ratings yet

- Philamcare Health Systems, Inc. vs. Ca (2002)Document4 pagesPhilamcare Health Systems, Inc. vs. Ca (2002)Genesis LealNo ratings yet

- Philamcare Health Systems, Inc., Petitioner, vs. Court of Appeals and Julita TrinosDocument4 pagesPhilamcare Health Systems, Inc., Petitioner, vs. Court of Appeals and Julita TrinosClaudine Christine A VicenteNo ratings yet

- Insurance CasesDocument81 pagesInsurance CasesBM MedilonoNo ratings yet

- G.R. No. 125678Document4 pagesG.R. No. 125678Tin LicoNo ratings yet

- Philamcare Health Systems V CA and Julita TrinosDocument7 pagesPhilamcare Health Systems V CA and Julita TrinosAbbot ReyesNo ratings yet

- Philamcare Health Vs CA GR No. 125678Document9 pagesPhilamcare Health Vs CA GR No. 125678judy andradeNo ratings yet

- (G.R. No. 125678. March 18, 2002) : Decision Ynares-Santiago, J.Document7 pages(G.R. No. 125678. March 18, 2002) : Decision Ynares-Santiago, J.Anonymous 91ILWUNo ratings yet

- Philamcare Health Systems Vs CA DigestDocument4 pagesPhilamcare Health Systems Vs CA DigestERNIL L BAWANo ratings yet

- Philamcare Health Systems, Inc. V. Ca, Trinos (2002) : Action On The Contract. in This Case, No Rescission Was MadeDocument2 pagesPhilamcare Health Systems, Inc. V. Ca, Trinos (2002) : Action On The Contract. in This Case, No Rescission Was MadeErrica Marie De GuzmanNo ratings yet

- 114106-2002-Philamcare Health Systems Inc. v. Court ofDocument9 pages114106-2002-Philamcare Health Systems Inc. v. Court ofMark Anthony Javellana SicadNo ratings yet

- Insurable Interest Case DigestDocument33 pagesInsurable Interest Case Digestmb_estanislaoNo ratings yet

- Philamcare Health Systems vs. CA G.R. No. 125678, March 18, 2002Document7 pagesPhilamcare Health Systems vs. CA G.R. No. 125678, March 18, 2002Maria Fiona Duran MerquitaNo ratings yet

- Philam Health System V CADocument4 pagesPhilam Health System V CAAlexandria ThiamNo ratings yet

- Petitioner Vs Vs Respondents Alvin B. Cunada Ronald O. LayawenDocument9 pagesPetitioner Vs Vs Respondents Alvin B. Cunada Ronald O. LayawenAggy AlbotraNo ratings yet

- 16&22-Philam Care Health Systems, Inc. vs. Court of Appeals, G.R. No. 125678, 18 March 2002Document5 pages16&22-Philam Care Health Systems, Inc. vs. Court of Appeals, G.R. No. 125678, 18 March 2002Jopan SJNo ratings yet

- Philamcare Health Systems Inc Vs CA and Julita TrinosDocument6 pagesPhilamcare Health Systems Inc Vs CA and Julita TrinosVincent OngNo ratings yet

- PHILAMCARE Health Systems Inc Vs Court of Appeals and Julita Trinos 379 SCRA 356 125678 PDFDocument6 pagesPHILAMCARE Health Systems Inc Vs Court of Appeals and Julita Trinos 379 SCRA 356 125678 PDFemmaniago08No ratings yet

- Philamcare Health System vs. Court of AppealsDocument1 pagePhilamcare Health System vs. Court of AppealsperlitainocencioNo ratings yet

- Philam Care Health Systems v. Court of AppealsDocument10 pagesPhilam Care Health Systems v. Court of AppealsNoel Cagigas FelongcoNo ratings yet

- Philam Care Health System Vs CADocument6 pagesPhilam Care Health System Vs CAAnonymous geq9k8oQyONo ratings yet

- No. 8Document14 pagesNo. 8Glenn PinedaNo ratings yet

- Philamcare Health Systems, Inc. vs. Court of Appeals and Julita Trinos G.R. No. 125678, March 18, 2002Document23 pagesPhilamcare Health Systems, Inc. vs. Court of Appeals and Julita Trinos G.R. No. 125678, March 18, 2002Jan NiñoNo ratings yet

- General ConceptsDocument60 pagesGeneral ConceptsCharlie PeinNo ratings yet

- 1 - Philamcare Vs CA G.R. No. 125678 March 18, 2002Document2 pages1 - Philamcare Vs CA G.R. No. 125678 March 18, 2002Emrico CabahugNo ratings yet

- Ins-Gen Provi CasesDocument18 pagesIns-Gen Provi CasesAnonymous B7PE7zNo ratings yet

- Facts: Plaintiff Is Estate Administrator For Late Joaquin Herrer. HerrerDocument6 pagesFacts: Plaintiff Is Estate Administrator For Late Joaquin Herrer. HerrerJa Mi LahNo ratings yet

- Insurance Cases Digest 2Document5 pagesInsurance Cases Digest 2Adriann Juanir CastañedaNo ratings yet

- and 48 Philamcare Health Systems, Inc. vs. Court of AppealsDocument8 pagesand 48 Philamcare Health Systems, Inc. vs. Court of AppealsJaja Ordinario Quiachon-AbarcaNo ratings yet

- Assignment 3 InsuranceDocument33 pagesAssignment 3 InsuranceKing AlduezaNo ratings yet

- Philamcare Health Systems, Inc. V. Court of AppealsDocument6 pagesPhilamcare Health Systems, Inc. V. Court of AppealsshelNo ratings yet

- Philam Health Systems Vs CA 379 SCRA 356Document2 pagesPhilam Health Systems Vs CA 379 SCRA 356Roi GatocNo ratings yet

- Insurance Law Case Digest August 21 2019Document19 pagesInsurance Law Case Digest August 21 2019Ma.Rebecca Fe MelendresNo ratings yet

- Insurance Case DigestDocument5 pagesInsurance Case DigestClarisse-joan GarmaNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- The Empowered Patient: Navigating the Healthcare System with ConfidenceFrom EverandThe Empowered Patient: Navigating the Healthcare System with ConfidenceNo ratings yet

- Great Pacific Life Assurance vs. CADocument1 pageGreat Pacific Life Assurance vs. CAJohn Mark RevillaNo ratings yet

- Artex Development Co. vs. Wellington Ins. CoDocument2 pagesArtex Development Co. vs. Wellington Ins. CoJohn Mark RevillaNo ratings yet

- Equitable Insurance vs. Transmodal InternationalDocument2 pagesEquitable Insurance vs. Transmodal InternationalJohn Mark RevillaNo ratings yet

- Magsaysay, Inc. vs. AganDocument2 pagesMagsaysay, Inc. vs. AganJohn Mark RevillaNo ratings yet

- PICP v. CADocument1 pagePICP v. CAJohn Mark RevillaNo ratings yet

- Phil. Home Assurance vs. CADocument1 pagePhil. Home Assurance vs. CAJohn Mark RevillaNo ratings yet

- Consuegra vs. GSISDocument2 pagesConsuegra vs. GSISJohn Mark RevillaNo ratings yet

- Cathay Insurance vs. CADocument1 pageCathay Insurance vs. CAJohn Mark RevillaNo ratings yet

- Harding vs. Commercial Union AssuranceDocument1 pageHarding vs. Commercial Union AssuranceJohn Mark RevillaNo ratings yet

- Jarque vs. Smith Bell & CoDocument2 pagesJarque vs. Smith Bell & CoJohn Mark RevillaNo ratings yet

- Equitable Insurance vs. Rural InsuranceDocument2 pagesEquitable Insurance vs. Rural InsuranceJohn Mark RevillaNo ratings yet

- Fieldman vs. Asian SuretyDocument2 pagesFieldman vs. Asian SuretyJohn Mark RevillaNo ratings yet

- Development Insurance vs. IACDocument2 pagesDevelopment Insurance vs. IACJohn Mark RevillaNo ratings yet

- Pacific Banking Corp. vs. CA G.R. No. L-41014 November 28, 1988 FactsDocument6 pagesPacific Banking Corp. vs. CA G.R. No. L-41014 November 28, 1988 FactsJohn Mark RevillaNo ratings yet

- Insular Life Assurance vs. Heirs of AlvarezDocument2 pagesInsular Life Assurance vs. Heirs of AlvarezJohn Mark RevillaNo ratings yet

- SSS V DavacDocument1 pageSSS V DavacJohn Mark RevillaNo ratings yet

- Lim V SunlifeDocument1 pageLim V SunlifeJohn Mark RevillaNo ratings yet

- Great Pacific Life Assurance vs. CADocument1 pageGreat Pacific Life Assurance vs. CAJohn Mark RevillaNo ratings yet

- Roque v. Intermediate Appellate CourtDocument2 pagesRoque v. Intermediate Appellate CourtJohn Mark RevillaNo ratings yet

- NG Gan Zee vs. Asian Crusader Life Assurance G.R. No. L-30685 May 30, 1983 FactsDocument4 pagesNG Gan Zee vs. Asian Crusader Life Assurance G.R. No. L-30685 May 30, 1983 FactsJohn Mark RevillaNo ratings yet

- Tan vs. CADocument1 pageTan vs. CAJohn Mark RevillaNo ratings yet

- Florendo vs. PHILAMDocument1 pageFlorendo vs. PHILAMJohn Mark RevillaNo ratings yet

- Young vs. Midland Textile InsuranceDocument1 pageYoung vs. Midland Textile InsuranceJohn Mark RevillaNo ratings yet

- NG Gan Zee vs. Asian Crusader Life AssuranceDocument1 pageNG Gan Zee vs. Asian Crusader Life AssuranceJohn Mark RevillaNo ratings yet

- Keihin-Everett vs. Tokio Marine Malayan InsuranceDocument4 pagesKeihin-Everett vs. Tokio Marine Malayan InsuranceJohn Mark RevillaNo ratings yet

- Qua Chee Gan vs. Law Union and Rock InsuranceDocument2 pagesQua Chee Gan vs. Law Union and Rock InsuranceJohn Mark RevillaNo ratings yet

- Insular vs. EbradoDocument1 pageInsular vs. EbradoJohn Mark RevillaNo ratings yet

- RCBC v. CADocument2 pagesRCBC v. CAJohn Mark RevillaNo ratings yet

- Eguaras vs. Great Eastern Life AssuranceDocument1 pageEguaras vs. Great Eastern Life AssuranceJohn Mark RevillaNo ratings yet

- Gercio vs. Sun Life AssuranceDocument1 pageGercio vs. Sun Life AssuranceJohn Mark RevillaNo ratings yet

- The Village Reporter - January 28th, 2015 PDFDocument20 pagesThe Village Reporter - January 28th, 2015 PDFthevillagereporterNo ratings yet

- Launch of New ProductsDocument6 pagesLaunch of New ProductsReezal KafalahNo ratings yet

- TAX Final Preboard SolutionDocument25 pagesTAX Final Preboard SolutionLaika Mae D. CariñoNo ratings yet

- Project Report On Insurance Management SystemDocument10 pagesProject Report On Insurance Management SystemishaanNo ratings yet

- 2 - Practice Assignment (ER - Diagram)Document3 pages2 - Practice Assignment (ER - Diagram)Zain Baig100% (1)

- The Free Rider Problem of Anarchism and National DefenseDocument17 pagesThe Free Rider Problem of Anarchism and National DefenseJohns EgoNo ratings yet

- Southdowns Travel Insurance: Insurance Product Information DocumentDocument2 pagesSouthdowns Travel Insurance: Insurance Product Information DocumentErdal AblachimNo ratings yet

- Report On MetLife BangladeshDocument35 pagesReport On MetLife BangladeshFariha TasnimNo ratings yet

- The Subtle Art of Not Giving A FuckDocument15 pagesThe Subtle Art of Not Giving A FuckArun Magha Rajha0% (1)

- Green Finance For Green GrowthDocument24 pagesGreen Finance For Green GrowthSreejith BhattathiriNo ratings yet

- Present Value Annuity Due TablesDocument1 pagePresent Value Annuity Due TablesDecereen Pineda Rodrigueza100% (2)

- Sia v. CADocument4 pagesSia v. CAChelsy EliosNo ratings yet

- IC 38 Short Notes Chapter 1: Introduction To InsuranceDocument6 pagesIC 38 Short Notes Chapter 1: Introduction To InsuranceTaher BalasinorwalaNo ratings yet

- Application For Admission: Azam MuhammadDocument7 pagesApplication For Admission: Azam MuhammadIshtiaq AzamNo ratings yet

- Loan On Bottomry and RespondentiaDocument14 pagesLoan On Bottomry and RespondentiaRio LorraineNo ratings yet

- ReportDocument34 pagesReportDarsh SoniNo ratings yet

- Nelson:Salmo Pennywise June 24, 2014Document56 pagesNelson:Salmo Pennywise June 24, 2014Pennywise PublishingNo ratings yet

- Developing A Process To Evaluate Construction Project Safety Hazard Index Using The Possibility Approach in IndiaDocument15 pagesDeveloping A Process To Evaluate Construction Project Safety Hazard Index Using The Possibility Approach in IndiaSetyo HardonoNo ratings yet

- SIC Code Industry DescriptionsDocument442 pagesSIC Code Industry Descriptionsfipeo100% (1)

- LIC - Jeevan TarunDocument1 pageLIC - Jeevan TarunPraveen Kumar KNo ratings yet

- Lectures 2 & 3Document10 pagesLectures 2 & 3Sheikh vlogsNo ratings yet

- Pioneer Insurance and Surety Corporation vs. APL Co. Pte.Document11 pagesPioneer Insurance and Surety Corporation vs. APL Co. Pte.EnzoNo ratings yet

- Grameen Bank: Voluntary Social Systems in ActionDocument48 pagesGrameen Bank: Voluntary Social Systems in ActionAvedhesh VyasNo ratings yet

- EPC Case Study Abstract Early CompletionDocument2 pagesEPC Case Study Abstract Early CompletionAjit LimayeNo ratings yet

- Institute Coal ClausesDocument2 pagesInstitute Coal ClausesBNNo ratings yet

- Newbury Homeowners Association DocumentsDocument71 pagesNewbury Homeowners Association DocumentsfiremancreativeNo ratings yet

- Gulf Resorts Inc Vs Philippine Charter Insurance CorpDocument2 pagesGulf Resorts Inc Vs Philippine Charter Insurance CorpJ. LapidNo ratings yet

- L.I.C. of India & Anr Vs Consumer Education & Research ... On 10 May, 1995Document22 pagesL.I.C. of India & Anr Vs Consumer Education & Research ... On 10 May, 1995Raj ChouhanNo ratings yet

- 2023 01 13 Ny Ui Fraud Letter To Ny Dol - FinalDocument3 pages2023 01 13 Ny Ui Fraud Letter To Ny Dol - FinalAdam PenaleNo ratings yet

- Request For Change in Policy Details Form English 120816Document1 pageRequest For Change in Policy Details Form English 120816Priya SelvarajNo ratings yet