Professional Documents

Culture Documents

6.01 Financial Statements Activity

Uploaded by

Nicholas FerroniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6.01 Financial Statements Activity

Uploaded by

Nicholas FerroniCopyright:

Available Formats

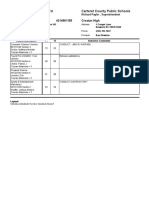

Name: Period:

6.01 Financial Statements Activity

Directions: Use the provided scenarios to complete a Balance Sheet and Income

Statement.

A Balance Sheet is the condensed statement of a person or entity's financial position.

An Income Statement is the total of income minus expenses, producing either a net

income or net loss.

Scenario: Marsha Jones is a recent college graduate. She worked during college and

managed to save $2,000 in her savings account. The balance of her checking account

(cash) is $440. During her freshman year, Marsha used a credit card and now owes

$1,250 to that credit card company. She has two school loans: one for $5,000 and the

other one for $3,000. She also has a car loan that started out at $12,500, of which she

owes $4,600.

Use this information to fill in Marsha’s Balance Sheet below for today’s date.

Marsha Jones

Balance Sheet

Date: December 10, 2020

Assets Amount Liabilities Amount

Total Assets Total Liabilities

Owner’s Equity

(or Net Worth)

Scenario: Marsha is working part-time at a restaurant. She makes an average of

$200 per week and her parents send her a monthly allowance of $100. She has the

following monthly expenses: Cell phone, $62.00; Gas, $100.00; Food, $200.00;

Entertainment, $100.00; Car payment, $200.00; and Insurance, $125.00.

Use this information to fill in Marsha’s Income Statement for the current month.

Marsha Jones

Income Statement

For the month of December 2020

Income (Revenue):

Total Income (Revenue)

Expenses:

Total Expenses

Net Income

You might also like

- Financial Statements ActivityDocument2 pagesFinancial Statements ActivityAaron FunderburkNo ratings yet

- 6.01 Financial Statements ActivityDocument2 pages6.01 Financial Statements ActivityAditya Nigam100% (1)

- Mid-Test Personal FinanceDocument5 pagesMid-Test Personal FinanceChristy Dwita MarianaNo ratings yet

- Personal Financial Planning Personal Financial PlanningDocument35 pagesPersonal Financial Planning Personal Financial Planningsabarais100% (3)

- Personal Financial Planning Personal Financial PlanningDocument35 pagesPersonal Financial Planning Personal Financial PlanningsabaraisNo ratings yet

- Personal Financial Planning Personal Financial PlanningDocument35 pagesPersonal Financial Planning Personal Financial PlanningsabaraisNo ratings yet

- 1 Using The Andersons Information Determine The Total Amount ofDocument2 pages1 Using The Andersons Information Determine The Total Amount oftrilocksp SinghNo ratings yet

- Chapter 3 QuestionDocument2 pagesChapter 3 QuestionSwee Yi LeeNo ratings yet

- Personal Financial Planning Statement and Investment Policy StatementDocument21 pagesPersonal Financial Planning Statement and Investment Policy Statementcollins KimaiyoNo ratings yet

- Continous Case p1Document15 pagesContinous Case p1api-314667643100% (2)

- Topic 2 Practice QuestionDocument4 pagesTopic 2 Practice Questionaarzu dangiNo ratings yet

- Dang Thuy Huong - 1704040049 - HW Tut 6Document19 pagesDang Thuy Huong - 1704040049 - HW Tut 6Đặng Thuỳ HươngNo ratings yet

- Dissolution and Liquidation of A Partnership q1Document3 pagesDissolution and Liquidation of A Partnership q1attiva jadeNo ratings yet

- Question and Answer - 13Document30 pagesQuestion and Answer - 13acc-expert0% (1)

- Shane SDocument2 pagesShane Sapi-207985362No ratings yet

- Tutorial Solution Chap 5Document4 pagesTutorial Solution Chap 5Nurul AriffahNo ratings yet

- Debt To Total Asset RatioDocument13 pagesDebt To Total Asset RatioMjNo ratings yet

- Instructions For Certificate of Finances For International StudentsDocument4 pagesInstructions For Certificate of Finances For International Studentsvaldo veillardNo ratings yet

- Uv7161 PDF EngDocument3 pagesUv7161 PDF EngdrashteeNo ratings yet

- Financial Affidavit With Ali FillableDocument2 pagesFinancial Affidavit With Ali FillableA M FaisalNo ratings yet

- Debt To AssetDocument4 pagesDebt To AssetMjNo ratings yet

- Personal Budgets: The Essential Question How Does Budgeting Help You Achieve Your Financial Goals?Document12 pagesPersonal Budgets: The Essential Question How Does Budgeting Help You Achieve Your Financial Goals?JamNo ratings yet

- Tim Hart Financial Plan FPLN 365 Spring 2017Document13 pagesTim Hart Financial Plan FPLN 365 Spring 2017api-377996169No ratings yet

- The Art of Personal Finance Budget Project Worksheet - IncomeDocument7 pagesThe Art of Personal Finance Budget Project Worksheet - Incomeecauthor5No ratings yet

- Client Name: Petra and Sean Alexander Financial Advisor: Ashish Rawat DATE: 29 Januray'21Document5 pagesClient Name: Petra and Sean Alexander Financial Advisor: Ashish Rawat DATE: 29 Januray'21Srushti RajNo ratings yet

- March 23 2021-Stocks QUESTION AND SOLUTION (Preffered Stock Notes & Dividends Notes)Document7 pagesMarch 23 2021-Stocks QUESTION AND SOLUTION (Preffered Stock Notes & Dividends Notes)Britania RanqueNo ratings yet

- Personal Finance CH 3 NotesDocument2 pagesPersonal Finance CH 3 NotesJohn RammNo ratings yet

- Parcor Quiz 2Document3 pagesParcor Quiz 2Pj ConcioNo ratings yet

- Chapter 2 SolutionsDocument8 pagesChapter 2 SolutionsSam ParkerNo ratings yet

- Math Skills PracticeDocument5 pagesMath Skills Practiceapi-436873837No ratings yet

- 2b Grant Proposal - EditedDocument4 pages2b Grant Proposal - EditedDaniel KibeNo ratings yet

- (I) One (1) Child: (Ii) Two (2) ChildrenDocument4 pages(I) One (1) Child: (Ii) Two (2) ChildrenballNo ratings yet

- Impact Report 2009Document16 pagesImpact Report 2009Stephen GrahamNo ratings yet

- Country Courier - 09/06/2013 - Page 01Document1 pageCountry Courier - 09/06/2013 - Page 01bladepublishingNo ratings yet

- On January 1 2012 Mona Inc Acquired 80 Percent ofDocument1 pageOn January 1 2012 Mona Inc Acquired 80 Percent ofMiroslav GegoskiNo ratings yet

- 2016 Annual ReportDocument24 pages2016 Annual ReportCentral High School FoundationNo ratings yet

- Ross, Patricia.2022 RPTDocument8 pagesRoss, Patricia.2022 RPTThomas JonesNo ratings yet

- Disclosure StatementDocument2 pagesDisclosure StatementAna CastroNo ratings yet

- Financial Literacy: Dr. Dennis E. MaligayaDocument65 pagesFinancial Literacy: Dr. Dennis E. MaligayaDennis Esik MaligayaNo ratings yet

- The Garden Spot Year OneDocument2 pagesThe Garden Spot Year OneJellyBeanNo ratings yet

- LJ SW 714 Annual Report AnalysisDocument4 pagesLJ SW 714 Annual Report AnalysisLynnette JenkinsNo ratings yet

- Maria Financial Case StudyDocument3 pagesMaria Financial Case Studyapi-252844849No ratings yet

- Personal Finance - Chapter 3 - Do The MathDocument2 pagesPersonal Finance - Chapter 3 - Do The Mathapi-526065196100% (1)

- Jaymeetsureshpatil 118Document2 pagesJaymeetsureshpatil 118Jaymeet PatilNo ratings yet

- Affording Amherst 2020Document7 pagesAffording Amherst 2020EDUARDO ADOLFO GONZALEZ HERRERANo ratings yet

- Budgeting WorksheetDocument1 pageBudgeting Worksheetjoseandres.ramirez27No ratings yet

- Donor Letters Made Easy for Your School: Strategic School FundraisingFrom EverandDonor Letters Made Easy for Your School: Strategic School FundraisingNo ratings yet

- 1112 Dependent Verification Worksheet-1Document2 pages1112 Dependent Verification Worksheet-1Mikey NguyenNo ratings yet

- Financial StatementDocument4 pagesFinancial Statementapi-204983594No ratings yet

- Financial StatementDocument5 pagesFinancial StatementDhairya ChandrojayNo ratings yet

- FA Lesson 1 Checking AccountDocument5 pagesFA Lesson 1 Checking Accountludy louisNo ratings yet

- DecfinDocument1 pageDecfinDeniAxis WinnerNo ratings yet

- PF - Chapter 2 - Personal Financial Statement - For STDocument14 pagesPF - Chapter 2 - Personal Financial Statement - For STTrung Lê BáNo ratings yet

- Funding Opportunities: Weeden FoundationDocument5 pagesFunding Opportunities: Weeden FoundationValerie F. LeonardNo ratings yet

- Impact - Hope. OpportunityDocument5 pagesImpact - Hope. OpportunityBrendaBrowningNo ratings yet

- 2014 Annual ReportDocument14 pages2014 Annual ReportKevin G. DavisNo ratings yet

- Continuing Case Part 1Document20 pagesContinuing Case Part 1api-309341411No ratings yet

- Cash BudgetDocument3 pagesCash Budgetmanoj kumarNo ratings yet

- State Magazine, November 2010Document52 pagesState Magazine, November 2010State Magazine100% (2)

- Day 19Document2 pagesDay 19Nicholas FerroniNo ratings yet

- AttachmentDocument1 pageAttachmentNicholas FerroniNo ratings yet

- 1.02 Medical Advances Form 16th To 19th CenturiesDocument21 pages1.02 Medical Advances Form 16th To 19th CenturiesNicholas FerroniNo ratings yet

- 2.01 Medical Term PrefixesDocument60 pages2.01 Medical Term PrefixesNicholas FerroniNo ratings yet

- 2.02 Medical Term RootsDocument55 pages2.02 Medical Term RootsNicholas FerroniNo ratings yet

- LAP MK 012 ScolorDocument18 pagesLAP MK 012 ScolorNicholas FerroniNo ratings yet