Professional Documents

Culture Documents

Mas7er - Concept DR/IDR Entry Type

Uploaded by

Anh NguyễnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mas7er - Concept DR/IDR Entry Type

Uploaded by

Anh NguyễnCopyright:

Available Formats

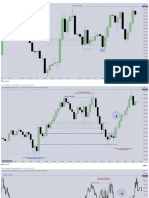

Mas7er Defining Range Concept

Defining Range (DR) Concept Trade Environment

▪ ODR (Overnight Defining Range) in LKZ is 03:00 - 04:00hrs

▪ RDR (Regular Defining Range) in NYKZ is 09:30 -1030hrs

▪ ADR (After Session Defining Range) in NY pm session 1930-2030hrs

Trade Environment

• If price in the 5m TF closes above the DRH after 10:30 or 0400 or 2030hrs (RDR, ODR, ADR)

then the DRL will be 80% probability the Low of the trading session.

• If price in the 5m TF closes below the DRL after 10:30 or 0400 or 2030hrs (RDR, DR, ADR)

then the DRH will be 80% probability the High of the trading session.

• If price close above the IDRH after 10:30 or 04:00 or 2030hrs (RDR, ODR, ADR) it is an early

indication that the low of the DR will be the Low of the day and vice versa.

Rules Of Execution

After the DR and IDR is formed;

1. If the price closes 10+ pips above/below DR, enter at breaker or IDR with SL at H/L around

50% of DR

2. If the price close 1-10 pips above/below DR, enter at 50% of the IDR range or appropriate PD

array around there with the stops at the opposite DRH/L

3. If the price fails to close below/ above IDR, wait 3-5candles. If price still hasn't closed below

IDR, enter a trade with appropriate PD array below 50% of DR with TP at the opposite DRH/L

{ for indices i use 100points }

You might also like

- Inside The Circle: Trade Model 1Document24 pagesInside The Circle: Trade Model 1YOUSSEF AIT TIZI67% (3)

- Balanced Price RangesDocument23 pagesBalanced Price RangesDavid Derri100% (1)

- Demystifying ICTDocument147 pagesDemystifying ICTFollow Wind100% (23)

- 2022 Content Ict Leaked CoursesDocument32 pages2022 Content Ict Leaked CoursesTikhon Kopylov100% (2)

- Month 1 Core Content - Elements of A Trade SetupDocument36 pagesMonth 1 Core Content - Elements of A Trade SetupAmi100% (1)

- Braveheart Walkthrough - MS Masterclass EP 3 PDFDocument48 pagesBraveheart Walkthrough - MS Masterclass EP 3 PDFAnto Richards100% (1)

- The - Ict - Mentorship - Core - Thread - by - Trader - Theory - Oct 17, 22 - From - RattibhaDocument16 pagesThe - Ict - Mentorship - Core - Thread - by - Trader - Theory - Oct 17, 22 - From - RattibhaSPICYASHISH15374100% (1)

- VSA High Probability TradesDocument3 pagesVSA High Probability TradesStacey BurkeNo ratings yet

- How Market Makers Condition The MarketDocument18 pagesHow Market Makers Condition The MarketGuy Surrey100% (2)

- Inner Circle Trader - High Probability Price PatternsDocument10 pagesInner Circle Trader - High Probability Price PatternsAleepha LelanaNo ratings yet

- ICT - Sniper Coarse - Basic InfantryDocument6 pagesICT - Sniper Coarse - Basic InfantryAzize MohammedNo ratings yet

- Inner Circle Trader - WENT 03Document6 pagesInner Circle Trader - WENT 03kinglove194100% (1)

- Welcome To Ipda PDFDocument24 pagesWelcome To Ipda PDFtodocoin100% (1)

- DR/IDR Playbook: Key TermsDocument21 pagesDR/IDR Playbook: Key TermsMayank100% (2)

- Inside Ict Intraday TemplatesDocument21 pagesInside Ict Intraday TemplatesPaul Osawa100% (7)

- Market Structure - LTH ITH STHDocument1 pageMarket Structure - LTH ITH STHS Wavesurfer100% (1)

- Telegram Cloud Document 4 5774082087745225801 PDFDocument75 pagesTelegram Cloud Document 4 5774082087745225801 PDFBen Willmott100% (2)

- InsideTheCircle Module2Document19 pagesInsideTheCircle Module2Thembokuhle100% (1)

- ICT 2022 Mentorship Notes TanjaTradesDocument43 pagesICT 2022 Mentorship Notes TanjaTradesTyR0 “Clash Royalty” -100% (2)

- MMXM PDF Part1Document20 pagesMMXM PDF Part1Derick Paulino100% (2)

- Braveheart Walkthrough - MS Masterclass EP 1Document52 pagesBraveheart Walkthrough - MS Masterclass EP 1Anto Richards100% (1)

- RektProof PA 2 - MSDocument8 pagesRektProof PA 2 - MStoto100% (1)

- Elements of A Trade SetupDocument22 pagesElements of A Trade SetupGuy Surrey100% (1)

- ICT Kill ZonesDocument9 pagesICT Kill ZonesArif Agustian100% (6)

- ICT Models Incluye KILLZONES INDEX y FOREX PDFDocument9 pagesICT Models Incluye KILLZONES INDEX y FOREX PDFferuz qazaqov100% (1)

- Inner Circle Trader - Sniper Course, Range FindingDocument5 pagesInner Circle Trader - Sniper Course, Range Findingtracie senjee100% (2)

- DR Idr IndicatorDocument1 pageDR Idr Indicatorvic beckhamNo ratings yet

- Market Maker Model PDFDocument9 pagesMarket Maker Model PDFTS100% (4)

- Flipping Markets: PDF Cheat SheetDocument59 pagesFlipping Markets: PDF Cheat SheetAsh Sam100% (8)

- Inner Circle Trader - WENT 05 PDFDocument6 pagesInner Circle Trader - WENT 05 PDFCr Ht100% (1)

- Episode 1 - Elements of A Trade SetupDocument3 pagesEpisode 1 - Elements of A Trade SetupAymane Ziani100% (1)

- #Ict - Market - Structure? - Introduction - Thread - by - Amtrades - Jun 21, 22 - From - RattibhaDocument29 pages#Ict - Market - Structure? - Introduction - Thread - by - Amtrades - Jun 21, 22 - From - RattibhaKevin Kang'auNo ratings yet

- ICT Mentorship EP6 SummaryDocument22 pagesICT Mentorship EP6 SummaryYassine Zer100% (2)

- Liquidity Hunting Algorithm On 15 MinDocument1 pageLiquidity Hunting Algorithm On 15 MinS WavesurferNo ratings yet

- ICT 2022 Mentorship Ep.41Document11 pagesICT 2022 Mentorship Ep.41macd_h100% (1)

- Understanding Asian Kill Zone, London Manipulation, Optimum TradingDocument35 pagesUnderstanding Asian Kill Zone, London Manipulation, Optimum TradingKevin Mwaura100% (1)

- ICT FX4Model Framework 2023 PDFDocument13 pagesICT FX4Model Framework 2023 PDFDevie Christian100% (1)

- Standard Deviation + Power of ThreeDocument14 pagesStandard Deviation + Power of Threezanoah.beazley100% (4)

- Inducement Cycle V2 @ict - Leaked - CoursesDocument48 pagesInducement Cycle V2 @ict - Leaked - CourseswomekedNo ratings yet

- Liquidity Price VoidDocument12 pagesLiquidity Price VoidSIDOW ADENNo ratings yet

- Inner Circle Trader - The Judas SwingDocument1 pageInner Circle Trader - The Judas SwingTalha darNo ratings yet

- Glossary of ICT TermsDocument15 pagesGlossary of ICT TermsRonelNo ratings yet

- MMXMDocument20 pagesMMXMsatori investmentsNo ratings yet

- Ict Content - NeokDocument14 pagesIct Content - Neokpareshpatel700qx100% (1)

- Market Structure ConfluenceDocument7 pagesMarket Structure ConfluenceSagar BhandariNo ratings yet

- Bold-Bolder-Boldest-V5 3 6 9 0 - 2Document171 pagesBold-Bolder-Boldest-V5 3 6 9 0 - 2Snow100% (2)

- Market Structure Masterclass - Inside Market StructureDocument44 pagesMarket Structure Masterclass - Inside Market Structuremunzerkhzy100% (3)

- IPDA Lookback FinalDocument9 pagesIPDA Lookback Finalmessaoudi05ff100% (1)

- External & Internal Range Liquidity - WatermarkDocument6 pagesExternal & Internal Range Liquidity - WatermarkMohammad Syaiful AmriNo ratings yet

- Vsip - Info Inner Circle Trader Inside The Range Webinar 5 PDF FreeDocument3 pagesVsip - Info Inner Circle Trader Inside The Range Webinar 5 PDF FreeСергей Максимов100% (1)

- Notes On - ICT Forex - Trading The Key SwingDocument8 pagesNotes On - ICT Forex - Trading The Key Swingsurendra Kumar100% (1)

- ICT London Kill ZoneDocument3 pagesICT London Kill Zoneazhar500100% (3)

- Lumitraders 2022 ICT - OCRDocument435 pagesLumitraders 2022 ICT - OCREderson Mendes100% (2)

- DR - Idr - Strategy - Time (Ny) - 4am - Thread - by - Jojishah - Mar 5, 23 - From - RattibhaDocument6 pagesDR - Idr - Strategy - Time (Ny) - 4am - Thread - by - Jojishah - Mar 5, 23 - From - RattibhaMr. Natee ParameeNo ratings yet

- Supply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.From EverandSupply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.No ratings yet

- ICT SauceDocument12 pagesICT SauceP E T A N100% (1)

- Ict Free Strategy FST PDF FreeDocument22 pagesIct Free Strategy FST PDF FreeAgnes Tembo100% (2)