Professional Documents

Culture Documents

Module B Dec 2018answer

Uploaded by

ConnieChoiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module B Dec 2018answer

Uploaded by

ConnieChoiCopyright:

Available Formats

SECTION A – CASE QUESTIONS (Total: 50 marks)

Answer 1(a)

Number of shares after acquisition

= HK$50,000 million / HK$25 + 590 million

= 2,590 million

Stock price of merged firm after acquisition

= HK$75,000 million / 2,590 million

= HK$28.96

Answer 1(b)

Proportion of ownership of target firm’s shareholders after merger

= HK$15 billion / HK$75 billion

= 20%

new shares issued

= 20%

new shares issued + 2 billion

New shares issued = 500 million

That is 500 million: HK$10,000 million / HK$50

= 500 : 200

= 2.5 : 1

As a result, the proper exchange ratio should be 2.5 to make the stock offer ’s value to the

target firm shareholder equivalent to the cash offer of HK$15 billion.

Answer 1(c)

The stock offer in Question 1(b) is more preferred by the shareholders of Kowloon Motors.

It is because fewer shares (500 million versus 590 million) are offered to the target firm’s

shareholders.

The dilution effect to existing bidding firm’s shareholders is thereby mitigated.

Answer 1(d)

It will be a violation of Insider Dealing under Securities and Futures Ordinance (“SFO”)

if any person who possess information related to a takeover offer for a corporation, deals in

the listed securities of that corporation or their derivatives, or counsels or procures another

person to deal in those listed securities or their derivatives.

Module B (December 2018 Session) 1 of 8

Executives informed have to sign confidentiality agreements to keep the related

information secret. Creating a firewall between the deal team and the operating business

team of the corporation is necessary. Regular communication, from the top management

to staff, of the severe consequences related to SFO is expected.

Answer 2

The agency theory suggests that takeovers are primarily motivated by the self-interest of

the acquirer’s management. The theories put forward by the two professors highlight the

evidence of a positive relation between a firm’s acquisition and its growth rate.

In the case of Kowloon Motors, which seems to support the neoclassical view of

acquisitions, firms use acquisitions to reallocate corporate assets to more productive uses.

It emphasizes the importance of an acquisition strategy for a firm in order to keep a

sustainable growth rate. To the extent that Kowloon Motors just went public in 2016 which

was a well performing firm. It is expected that this young and high growth firm will have

more valuable assets and hence pursue more acquisitions with easier access to external

capital given it has successfully switch from a private to a public listed corporation.

In this regard, the growth theory of mergers highlights investment can take place through

capital expenditures as well as through acquisitions. High growth firms like

Kowloon Motors make acquisition in this target because Kowloon Motors is perceived to

exhibit higher level of productivity that they can transfer to the acquired firm.

Younger firms like Kowloon Motors have substantially higher growth than mature firms, and

thus are expected to undertake more acquisitions than mature firms.

Answer 3

(a) When we consider acquisitions paid for with cash, abnormal returns are expected

to be positive for acquisition firms. This is largely explained by the confidence of

Kowloon Motors to create value in the deal. As a result, the market will cheer

positively for the transaction where Kowloon Motors is going for the target

aggressively, typically indicating high level of synergies may happen.

(b) On the other hand, it is well known that acquisitions paid for with stocks are

associated with not positive, or even negative abnormal returns for the possible

dilution of earnings. Besides, capital market will also doubt the Kowloon Motors

executives’ level of confidence in the merit of the acquisition by issuing new shares

instead of using cash.

Module B (December 2018 Session) 2 of 8

Answer 4(a)

The accounting breakeven is the after-tax sum of the fixed costs and depreciation charge

divided by the after-tax contribution margin.

QA = [(FC + Depreciation) x (1 - tC)] / [(P - VC) x (1 - tC)]

= [(HK$860 million + HK$460 million) x (1 - 0.165)] / [(HK$400,000 - HK$80,000) x

(1 - 0.165)]

= 4,125 units

Answer 4(b)

When calculating the financial breakeven point, we express the initial investment as an

equivalent annual cost (EAC).

EAC = Initial Investment / PVIFA15%,5

= HK$1,000,000,000 / 3.3522

= HK$298,311,560

QF = [EAC + FC x (1 - tC) - D x tC] / [(P - VC) x (1 - tC)]

= [HK$298,311,560 + HK$860,000,000 x (1 - 0.165) - HK$460,000,000 x 0.165] /

[(HK$400,000 - HK$80,000) x (1 - 0.165)]

= 3,520 units

Answer 4(c)

Both the accounting and financial breakeven number suggest that the project could survive

if the firm sells around 3,500 to 4,200 units annually. As long as the number is feasible to

deliver, the firm should seriously consider investing in the hybrid car project.

15% is only the minimum threshold in the hybrid project that is related to the perceived risk

level. Investment decisions at the firm should be about allocation of long term capital to

the most attractive risk adjusted return project, among other projects availability.

Other future cashflow needs, such as dividend payout requirement, if there has been

stipulated dividend policy in place, will also likely determine the availability of capital at the

firm.

* * * END OF SECTION A * * *

Module B (December 2018 Session) 3 of 8

SECTION B – ESSAY / SHORT QUESTIONS (Total: 50 marks)

Answer 5(a)

To: Dr Simon Chan, Chairman

From: Ms Jenny Lee, CFO

Date: xxxxxxxx

Subject: A Corporate Treasury Centre (“CTC”) for BigCash Inc

Regarding your queries on the subject, below is my review for your consideration:

Foreign currency risk management: CTC helps net off foreign currency exposure and only

has to hedge the net exposure. Instead of hedging the exposure at subsidiary level,

CTC can coordinate the netting off of the long and short positions of each currency and

only hedge the net exposure to the market. The benefit is to reduce cost paid to banks.

Intra-group financing: CTC helps save interest costs. To the extent possible and subject

to regulatory restriction of the respective jurisdiction, CTC can facilitate intra-group

financing by acting as the “internal bank” in providing lending and borrowing services

between all entities of the BC group. CTC can also levy and / or pay interest to the

borrowing / lending entity with the possibility of charging and paying interest to the parties

of the financing arrangement. In doing so, CTC must ensure fair and proper interest

expenses and income are arranged so as not to violate any transfer pricing regulations

among the different tax jurisdictions.

Collection and disbursement services: CTC can collect and make disbursements on behalf

of the operating units and headquarters in order to reduce the transactions costs currently

incurred by using different external banks to perform such services.

Module B (December 2018 Session) 4 of 8

Answer 5(b)

The three suggested relevant performance measures are:

payment and collection: Number of transactions processed / cost per transaction;

financing: Budgeted net borrowing / lending rate compared to actual; and

foreign exchange risk management: Budgeted foreign exchange rates compared

with actual.

Answer 5(c)

The three areas in which performance of treasury activities can be enhanced:

Centralise banking relationships in CTC at Hong Kong for more effective services

and costing, and establish a relationship with one more major bank to reduce

centralisation risks.

Written treasury policies need to be documented with explicit approval at board

level in order to formalise the treasury activities. Such a document and formal

approach will enhance accountability and transparency.

Arrange internal audit to conduct annual performance review of CTC operations to

ensure compliance with regulatory as well as operational policies.

Answer 6(a)

Inventory holding period (days), IHP 103.48 Average inventory / Cost of sales

x 365 days

Accounts receivable collection 67.07 Average accounts receivable / Credit

period (days), ARC sales x 365 days

Accounts payable payment period 42.60 Average accounts payable / Cost of

(days), APP sales x 365 days

Cash cycle (days) 127.95 IHP + ARC - APP

Cash cycle is 128 days.

Module B (December 2018 Session) 5 of 8

Answer 6(b)

Recommended actions to reduce length of the cash cycle:

(i) Reduce inventory:

Practice Just-in-time (“JIT”) procurement. To link up to suppliers

computerized system in order to take advantage of the enhanced inventory

management practice which are expected to reduce inventory level and

lead time. Practice of JIT is also particularly beneficial for high value

parts.

Should review to reduce holding inventory of older models that are not in

high demand any more. The reduction can be offset by carrying more

popular models instead. This will speed up the inventory turnover.

It should be noted that company’s performance of 103.48 days is better

than that of the industry norm of 110 days. As such, the company should

strike a balance between putting resources in further reducing this indicator

compared with the others.

(ii) Speed up collection and develop credit policy:

Establish a collection policy to speed up payment particularly to its large

customers such as sending out reminders promptly, phone calls, offer early

settlement discounts, factoring.

Establish a tighter credit policy to assess creditworthiness of new

customers in order to control the amount of accounts receivable to a higher

quality and reduced volume.

(iii) Delay payment to suppliers:

It is not recommended to further push payments to the long time suppliers

as they are reliable and supportive. Since the payment days is already

longer than the industry average, no further action is recommended to

existing suppliers.

It is possible to explore the possibility of delaying payment to new and

smaller suppliers, as they represent 35% of purchases and current

accounts payable days is only 30 days, which is at the industry norm.

Hence, it is possible to delay payment without affecting substantially the

relationship with such suppliers.

Module B (December 2018 Session) 6 of 8

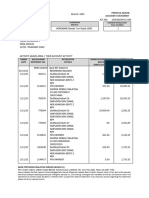

Answer 7(a)

Years 0 1 2 3 4 5

HK$ HK$ HK$ HK$ HK$ HK$

Initial investment (20,000,000)

Sales [w1] 15,500,000 17,050,000 18,755,000 18,755,000 18,755,000

Contribution margin 6,200,000 6,820,000 7,502,000 7,502,000 7,502,000

(sales x CM ratio)

Fixed cost (300,000) (300,000) (300,000) (300,000) (300,000)

excluding

depreciation

Operating cash 5,900,000 6,520,000 7,202,000 7,202,000 7,202,000

flow before tax

Tax (973,500) (1,075,800) (1,188,330) (1,188,330) (1,188,330)

Depreciation tax 660,000 660,000 660,000 660,000 660,000

shield [w2]

Operating cash 5,586,500 6,104,200 6,673,670 6,673,670 6,673,670

flow after tax

Working capital (120,000) (20,000) - - - 140,000

movement

After tax salvage 835,000

[w3]

Net Cash Flows (20,120,000) 5,566,500 6,104,200 6,673,670 6,673,670 7,648,670

Discount rate 15% 15% 15% 15% 15%

(post tax)

Discount factor 0.86957 0.75614 0.65752 0.57175 0.49718

(post tax)

Present values (20,120,000) 4,840,435 4,615,652 4,388,046 3,815,692 3,802,741

NPV 1,342,566

Working

[w1]

Year 1 15,500,000 Expected no. of units sold x unit selling price

= (0.6 x 50000 + 0.4 x 80000) x 250

Year 2 17,050,000 Year 1 sales x (1 + growth rate)

Year 3 18,755,000 Year 2 sales x (1 + growth rate)

Year 4-5 18,755,000 no growth

[w2]

depreciation 4,000,000 4,000,000 4,000,000 4,000,000 4,000,000

tax rate 16.5% 16.5% 16.5% 16.5% 16.5%

tax shield 660,000 660,000 660,000 660,000 660,000

[w3]

gain 1,000,000 Project fully depreciated at year 5, salvage = gain

tax on gain 165,000

after tax salvage 835,000

The project should be accepted.

Module B (December 2018 Session) 7 of 8

Answer 7(b)

The propose method is sensitivity analysis.

This tool evaluates the change in NPV from the change of variables used in calculation.

Only one variable, e.g. sales volume, is changed at the time with other variables, such as

fixed cost, margin, etc., remain fixed and the respective change in NPV is calculated. The

process is continued when all variables are examined.

Management should then pay special attention to the estimation of the variable(s) that

caused the most changes in NPV because a minor error in such an estimation will result in

an incorrect NPV, hence the final decision.

* * * END OF EXAMINATION PAPER * * *

Module B (December 2018 Session) 8 of 8

You might also like

- Clothing Line Business Plan Example PDFDocument27 pagesClothing Line Business Plan Example PDFSimran Singh67% (3)

- Event Management SystemDocument45 pagesEvent Management SystemJimmy Khan43% (23)

- Financial Management: Week 10Document10 pagesFinancial Management: Week 10sanjeev parajuliNo ratings yet

- MB0045 - Production and Operation ManagementDocument6 pagesMB0045 - Production and Operation ManagementJowin JacobNo ratings yet

- CS-Professional Paper-3 Financial, Treasury and Forex Management (Dec - 2010)Document11 pagesCS-Professional Paper-3 Financial, Treasury and Forex Management (Dec - 2010)manjinderjodhka8903No ratings yet

- Advanced Final Management Final ExamDocument9 pagesAdvanced Final Management Final Examgatete samNo ratings yet

- Evaluation of Change in Credit PolicyDocument5 pagesEvaluation of Change in Credit PolicyJhunorlando DisonoNo ratings yet

- Solutions Corporate FinanceDocument28 pagesSolutions Corporate FinanceUsman UddinNo ratings yet

- Name: Meenakshi MBA-II Semester MB0029 Financial ManagementDocument10 pagesName: Meenakshi MBA-II Semester MB0029 Financial Managementbaku85No ratings yet

- Feasibility StudyDocument8 pagesFeasibility StudymuhaNo ratings yet

- Fin622 McqsDocument25 pagesFin622 McqsIshtiaq JatoiNo ratings yet

- MB0045 Finacial Management Assignment 2Document8 pagesMB0045 Finacial Management Assignment 2Vishal TiwaraeNo ratings yet

- College WorkDocument10 pagesCollege Workmansuriadil2001No ratings yet

- Corporate Restructuring and InsolvencyDocument19 pagesCorporate Restructuring and InsolvencyJayachandra JcNo ratings yet

- Kingtim Co investment and debt financing impactDocument10 pagesKingtim Co investment and debt financing impactShaminiNo ratings yet

- Sample Questions From Chapter 15Document5 pagesSample Questions From Chapter 15FH100% (1)

- QPB - Dec - 20 Mock 1 Q FinalDocument9 pagesQPB - Dec - 20 Mock 1 Q FinalBernice Chan Wai WunNo ratings yet

- Seminar 10 WCMDocument8 pagesSeminar 10 WCMHeng CzNo ratings yet

- Egret Printing and Publishing CompanyDocument39 pagesEgret Printing and Publishing CompanySiddhartha Chhetri0% (1)

- The Term "Capital Structure" Refers To: Long-Term Debt, Preferred Stock, and Common Stock EquityDocument5 pagesThe Term "Capital Structure" Refers To: Long-Term Debt, Preferred Stock, and Common Stock EquityakhileshtiwariNo ratings yet

- Cash Flow Estimation Techniques and ConceptsDocument5 pagesCash Flow Estimation Techniques and Conceptskhaireyah hashimNo ratings yet

- IGNOU MBA MS - 04 Solved Assignment 2011Document16 pagesIGNOU MBA MS - 04 Solved Assignment 2011Kiran PattnaikNo ratings yet

- Business Analysis: (B) What Is An Operating Turnaround Strategy ? 4Document4 pagesBusiness Analysis: (B) What Is An Operating Turnaround Strategy ? 4Davies MumbaNo ratings yet

- Fin622 McqsDocument25 pagesFin622 McqsShrgeel HussainNo ratings yet

- Cost of Credit Formula ExplainedDocument3 pagesCost of Credit Formula ExplainedShin YaeNo ratings yet

- Reading 24 Private Company Valuation - AnswersDocument33 pagesReading 24 Private Company Valuation - Answerstristan.riolsNo ratings yet

- Problems Cash Flow AnalysisDocument18 pagesProblems Cash Flow Analysisleilo4kaNo ratings yet

- Capital BudgetingDocument44 pagesCapital Budgetingrisbd appliancesNo ratings yet

- MB0029 Set-2Document10 pagesMB0029 Set-2Shakeel ShahNo ratings yet

- MB0045Document6 pagesMB0045Shyam Pal Singh TomarNo ratings yet

- Af208 Fe s1 2018 Revision Package - SolutionsDocument20 pagesAf208 Fe s1 2018 Revision Package - SolutionsAryan KalyanNo ratings yet

- Term Project IDocument6 pagesTerm Project IAnthony SingogoNo ratings yet

- Comment Type QuestionsDocument38 pagesComment Type QuestionsgoforcsNo ratings yet

- Ch06 ProbsDocument7 pagesCh06 ProbsJingxian XueNo ratings yet

- Institute of Actuaries of India Subject CA1 - Paper I Core Applications ConceptsDocument23 pagesInstitute of Actuaries of India Subject CA1 - Paper I Core Applications ConceptsYogeshAgrawalNo ratings yet

- FM QuizzesDocument8 pagesFM QuizzesSoahNo ratings yet

- Business Finance Assgn.Document7 pagesBusiness Finance Assgn.Lesley DenisNo ratings yet

- AMF3872 Compensatory Assignment 1 and 2Document3 pagesAMF3872 Compensatory Assignment 1 and 2SoblessedNo ratings yet

- 3-7gbr 2006 Dec ADocument12 pages3-7gbr 2006 Dec AAqsa Waseem100% (2)

- Objectives of Financial Statements Analysis: Happened During A Particular Period of Time, Most Users Are Concerned AboutDocument20 pagesObjectives of Financial Statements Analysis: Happened During A Particular Period of Time, Most Users Are Concerned AboutKarla OñasNo ratings yet

- MS Quiz 3Document4 pagesMS Quiz 3Harold Dan AcebedoNo ratings yet

- Chapter 4 Evaluating A Single Project Payback and BC RatioDocument13 pagesChapter 4 Evaluating A Single Project Payback and BC RatioSarah Mae WenceslaoNo ratings yet

- Capital Budgeting RK 2019Document53 pagesCapital Budgeting RK 2019Ishaan TandonNo ratings yet

- Solution Financial Management Strategy May 2008Document7 pagesSolution Financial Management Strategy May 2008samuel_dwumfourNo ratings yet

- University of Tunis Tunis Business School: Corporate FinanceDocument3 pagesUniversity of Tunis Tunis Business School: Corporate FinanceArbi ChaimaNo ratings yet

- IGNOU MBA MS - 04 Solved Assignment 2011Document12 pagesIGNOU MBA MS - 04 Solved Assignment 2011Nazif LcNo ratings yet

- Session 7 Cost of CapitalDocument22 pagesSession 7 Cost of CapitalVishwa Deepak BauriNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- FM 11 8 Gbs For Week 10 To 17 1 PDFDocument11 pagesFM 11 8 Gbs For Week 10 To 17 1 PDFvlad vladNo ratings yet

- Cash ManagementDocument5 pagesCash ManagementVote btsNo ratings yet

- UntitledDocument25 pagesUntitledAditya ChavanNo ratings yet

- Mercury Athletics Footwear Case: B52.FIN.448 Advanced Financial Management Professor Roni KisinDocument7 pagesMercury Athletics Footwear Case: B52.FIN.448 Advanced Financial Management Professor Roni KisinFaith AllenNo ratings yet

- Gyaan Kosh Term 3 Corporate Finance SummaryDocument10 pagesGyaan Kosh Term 3 Corporate Finance SummaryAnuj AgarwalNo ratings yet

- Contemporary Financial Management Moyer 12th Edition Solutions ManualDocument16 pagesContemporary Financial Management Moyer 12th Edition Solutions ManualSteveJacobsafjg100% (36)

- FS ANALYSIS: ACCOUNTING INCOME & ASSETSDocument6 pagesFS ANALYSIS: ACCOUNTING INCOME & ASSETSKrishna PrasadNo ratings yet

- AFM NotesDocument110 pagesAFM NotesNguyen NhanNo ratings yet

- Capital Budgeting Lesson NewDocument44 pagesCapital Budgeting Lesson NewLea MachadoNo ratings yet

- 2-4 2005 Dec ADocument14 pages2-4 2005 Dec AnsarahnNo ratings yet

- The Mechanics of Law Firm Profitability: People, Process, and TechnologyFrom EverandThe Mechanics of Law Firm Profitability: People, Process, and TechnologyNo ratings yet

- Panelists Report Mod B Dec 16 FinalDocument5 pagesPanelists Report Mod B Dec 16 FinalConnieChoiNo ratings yet

- Panelists Report Mod B Dec 18 FinalDocument5 pagesPanelists Report Mod B Dec 18 FinalConnieChoiNo ratings yet

- Panelists Report Mod B Dec 19 FinalDocument6 pagesPanelists Report Mod B Dec 19 FinalConnieChoiNo ratings yet

- Panelists Report Mod B Dec 20 FinalDocument6 pagesPanelists Report Mod B Dec 20 FinalConnieChoiNo ratings yet

- Panelists Report Mod B Dec 17 FinalDocument5 pagesPanelists Report Mod B Dec 17 FinalConnieChoiNo ratings yet

- Module B Dec 2017answerDocument10 pagesModule B Dec 2017answerConnieChoiNo ratings yet

- Module B Dec 2017questionDocument8 pagesModule B Dec 2017questionConnieChoiNo ratings yet

- Module B Dec 2016answerDocument12 pagesModule B Dec 2016answerConnieChoiNo ratings yet

- Module B Dec 2016questionDocument9 pagesModule B Dec 2016questionConnieChoiNo ratings yet

- Wells 1975Document19 pagesWells 1975pedropauloNo ratings yet

- Location Analysis and Decision Support Model for Bank Branch LocationDocument29 pagesLocation Analysis and Decision Support Model for Bank Branch LocationRecep HaneciNo ratings yet

- Formulate But Do Not Solve The LP ProblemsDocument5 pagesFormulate But Do Not Solve The LP ProblemsNiccoRobDeCastro100% (1)

- Odisha HandicraftPolicy 2019Document20 pagesOdisha HandicraftPolicy 2019Sdrc IndiaNo ratings yet

- Declaration Under para 2 (B) of Finance Deptt Memo. No. 6038-F Dated 22.05.84 Read With Memo. Nos. 1925-F, Dated 21.10.1984 and 46-F, Dt. 9.1.75Document2 pagesDeclaration Under para 2 (B) of Finance Deptt Memo. No. 6038-F Dated 22.05.84 Read With Memo. Nos. 1925-F, Dated 21.10.1984 and 46-F, Dt. 9.1.75Sayani NandyNo ratings yet

- Business Finance Theory and PracticeDocument4 pagesBusiness Finance Theory and PracticechanchoNo ratings yet

- Pressure GroupDocument5 pagesPressure GroupasthaNo ratings yet

- PD Cen TR 13387-4-2015Document12 pagesPD Cen TR 13387-4-2015MaiDuyNo ratings yet

- Cultivation & planting equipment for saleDocument2 pagesCultivation & planting equipment for salekellyramosNo ratings yet

- Project Closure Checklist and ProcessDocument16 pagesProject Closure Checklist and ProcessHuynh Thuy VyNo ratings yet

- Karnataka Land Grant Rules, 1969Document20 pagesKarnataka Land Grant Rules, 1969Ramanan SelvamNo ratings yet

- Liabilities of Public CorporationsDocument17 pagesLiabilities of Public Corporationsrahul bhaskarNo ratings yet

- LUSH FinallDocument12 pagesLUSH Finallnashat doosNo ratings yet

- E-Marketing in Hospitality Industry Prospect'S and ChallengesDocument17 pagesE-Marketing in Hospitality Industry Prospect'S and Challengesprakash rajuNo ratings yet

- Business Analytics Course-1Document6 pagesBusiness Analytics Course-1Shreyas ShenoyNo ratings yet

- Nov 2023Document7 pagesNov 2023applybizzNo ratings yet

- Week 10 - Simple Future and Future Progressive Tense ActivityDocument2 pagesWeek 10 - Simple Future and Future Progressive Tense ActivityMohsin HaiderNo ratings yet

- GMCPTechnicalWeekly17 10 2023Document19 pagesGMCPTechnicalWeekly17 10 2023DineshM78No ratings yet

- Cse Dec 21 Free Mock Test Series Subject: Setting Up of Business Entities and ClosureDocument5 pagesCse Dec 21 Free Mock Test Series Subject: Setting Up of Business Entities and ClosureSimran TrehanNo ratings yet

- Basic Business PermitsDocument5 pagesBasic Business PermitsCarmie Lactaotao DasallaNo ratings yet

- Chapter Two: Literature ReviewDocument8 pagesChapter Two: Literature ReviewnganduNo ratings yet

- Summative Test 3rd QDocument3 pagesSummative Test 3rd QDah RylNo ratings yet

- Group Case Study Report for Fibre Fashion Marketing and Sales IS PlanDocument11 pagesGroup Case Study Report for Fibre Fashion Marketing and Sales IS PlanWarisha KhanNo ratings yet

- Ch16 Beams Advanced AccountingDocument49 pagesCh16 Beams Advanced AccountingMuhammad FahriNo ratings yet

- Simon Clark Toy Soldiers Building and Refining A Collection The Crowood Press 2023Document350 pagesSimon Clark Toy Soldiers Building and Refining A Collection The Crowood Press 2023Георгий ДементиюкNo ratings yet

- Model For IMC Planning PDFDocument6 pagesModel For IMC Planning PDFApurva SharmaNo ratings yet

- Industrial Visit Report - Ankur DubeyDocument32 pagesIndustrial Visit Report - Ankur DubeyAnkurNo ratings yet

- Bricks and Clicks vs. E-Tailing: Comparing Best Buy andDocument19 pagesBricks and Clicks vs. E-Tailing: Comparing Best Buy andapi-66679454No ratings yet