Professional Documents

Culture Documents

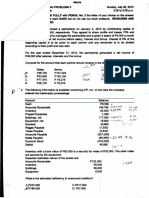

FAR 2nd Monthly Assessment

Uploaded by

Ciena Mae AsasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAR 2nd Monthly Assessment

Uploaded by

Ciena Mae AsasCopyright:

Available Formats

REAL EXCELLENCE ONLINE REVIEW

SECOND MONTHLY ASSESSMENT EXAMINATIONS

NOVEMBER 2022

1. Which of the following is false statement regarding Property, Plant and Equipment?

A. Land improvements are items of PPE that are non-depreciable and usually includes as its cost,

the cost of paving parkways and sidewalks.

B. When items of PPE are subject to testing procedures, the net proceeds from samples arising

from such testing procedures are NOT deducted from the testing cost but presented directly

within profit or loss.

C. The acquisition cost of land and building acquired on a lump-sum price is allocated to both land

and building based on their relative fair values at purchase date if the is only a construction of a

new building on such land.

D. Not all assets held for rentals are classified as Property, Plant and Equipment.

2. Which of the following is not classified as PPE and accounted for using PAS 16?

A. Land used in agricultural activity

B. Bearer plants related to agriculture

C. Equipment leased out under operating lease

D. Building leased out under operating lease

w

E. None from the choices

3. GEORGIA CORP., a non VAT registered company, has recently purchased a new office equipment. The

ie

following information was gathered in relation to the acquisition of the unit:

List price P152,000

Trade discount and rebates taken 56,000

Installation and assembly cost

Initial delivery and handling cost

Purchase discount

Value added taxes

Cost of water device surrounding the machine

ev 3,200

6,400

2%

15,000

12,000

R

Estimated dismantling cost to be incurred as required by contract (at present value) 8,000

Insurance cost 24,000

Cost of training for personnel who will use the machine 4,000

What is the acquisition cost of the new equipment

PA

A. 148,680 C. P138,680

B. 111,680 D. P162,680

Use the following information in answering the next item(s):

On January 1, 2023, GERMANY acquired a parcel of land with an intention to use it as the company’s

future factory site. At that time, an old building was situated and management decided to demolished

C

such old building and construct a new one as the old one is not suited to be a factory. GERMANY paid

for the acquisition of the land and old building at a lump-sum price of P900,000. On that date, the

land and the old building have a fair value of P800,000 and P200,000, respectively.

EO

In addition, the following costs were incurred:

Payment of delinquent property taxes P50,000

Survey before construction of new building 30,000

Option fee for properties acquired 10,000

Option fee for properties not acquired 8,000

Payments to tenants to vacate the building 20,000

R

Cost of razing old building, net of P5,000 proceeds from salvaged materials 85,000

Contract cost of new building 700,000

Landfill for building site 25,000

Excavation cost 40,000

Cost of open house party to celebrate opening of new building 25,000

Savings on construction 4,000

Sidewalk and parking lot (included on the blueprint) 35,000

4. What is the cost of land?

A. P833,000 C. P798,000

B. P864,000 D. P823,000

5. What is the cost of new building?

A. P910,000 C. P850,000

B. P905,000 D. P885,000

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 1

6. What is the net amount to be presented in profit or loss in relation to the above items?

A. P225,000 C. P216,000

B. P220,000 D. P221,000

7. Which of the following is an incorrect statement regarding depreciation?

S1: Depreciation ceases when the item of PPE is derecognized or becomes held for sale whichever is

later.

S2: Management should choose the depreciation method that best reflects the expected pattern of

consumption of the future economic benefits embodied on the asset.

A. S1 only C. Both statements

B. S2 only D. None from the statements

8. Regarding revaluation, determine the incorrect statement.

A. The revalued amount of property plant and equipment is fair value or depreciated replacement

cost whichever is higher.

B. If a revalued asset is non-depreciable, no portion of revaluation surplus is periodically

transferred to retained earnings.

C. If a depreciable property is revalued at the middle of the current year, depreciation for the first

half of the year is based on cost and for the second half on revalued amount.

D. A revaluation decrease shall be charged directly against any revaluation surplus to the extent

that the decrease is a reversal of a previous revaluation; the remaining amount is recognized as

w

impairment loss.

9. On January 1, 2022, DENMARK COMPANY acquired equipment for P2,000,000 with a 10-year useful

ie

life and P200,000 residual value. The straight line method of depreciation is used. During 2026, after

the 2025 financial statements had been issued, the entity determined that this equipments remaining

useful life was only four more years and shall be depreciated using the SYD method of depreciation.

What is the carrying amount of the equipment on December 31, 2027?

A.

B.

P768,000

P384,000

C.

D.

Use the following information for the next two questions:

ev

P848,000

P524,000

R

As of January 1, 2023, GABRIEL COMPANY has the following information regarding its land and

building accounts.

Land P400,000

Building 9,000,000

PA

Accumulated depreciation 1,500,000

There were no movements on the above assets during the year, meaning there are no additions or

disposals during 2023. Depreciation policy indicates that the building shall be depreciated using

straight line method over its 15 years of useful life. On June 30, 2023, GABRIEL conducted a

revaluation of the land and building and the results of the revaluation were as follows:

C

Replacement cost

Land P700,000

Building 12,000,000

EO

10. The depreciation expense for the year 2023 is

A. P700,000 C. P600,000

B. P800,000 D. P640,000

11. The revaluation surplus as of December 31, 2023 is

A. P2.70 million C. P2.60 million

R

B. P2.50 million D. P2.54 million

12. SPAIN CORP. disclosed that the depreciation policy on machinery is as follows:

• A full year depreciation is taken in the year of acquisition.

• No depreciation is taken in the year of disposition.

• The estimated useful life is five years.

• The straight line method is used.

On June 30, 2015, the entity sold for P2,300,000 a machine acquired in 2012 for P4,200,000. The

residual value was P600,000. What amount of gain on the disposal should be recorded in 2015?

A. 140,000 C. 620,000

B. 260,000 D. 980,000

13. In accounting for government grants under PAS 20, determine whether the following statements are

true or false:

S1: The gross method of presentation, as compared to the net method of presentation, will result to

a higher amount presented within profit or loss.

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 2

S2: Whether gross or net method was employed, the same amount of deferred income from

government grants account will be presented for grant related to asset.

S3: Receipt of a grant does not of itself provide conclusive evidence that the conditions attaching to

the grant have been or will be fulfilled.

A. False, true, false D. True, false, true

B. False, false, true E. False, true, true

C. True, false, false

14. If a company uses the net method in accounting for government grants related to assets, which of

the following statements is correct?

A. The book value of the asset is overstated

B. Net income is unaffected

C. Net income is overstated

D. Depreciation expense is overstated

Use the following information for the next two questions:

ECUADOR COMPANY received two government grants during 2023, the information for which are as

follows:

The company purchased a machine for P660,000 on January 1, 2023 and received a local government

grant of P60,000 towards the capital cost. The policy is to treat the grant as a reduction in the cost of

w

the asset. The machine is to be depreciated on a straight line basis over 10 years with a residual

value of P50,000. On January 1, 2025, the grant became fully repayable because of noncompliance

with conditions.

ie

On January 1, 2023, ECUADOR COMPANY received land from a national government agency, the

condition of which is for ECUADOR to construct a factory on it. The fair value of the land at that time

is P300,000. The construction of the factory started immediately and finished on July 1, 2023 with a

ev

total cost of P1,000,000. The factory has a useful life of 10 years with a salvage value of P100,000

and to be depreciated using the double declining balance method. The grant is accounted for using

the net method of presentation.

R

15. What is the amount reported as depreciation expense for 2023?

A. P195,000 C. P175,000

B. P125,000 D. P115,000

PA

16. What is the amount reported as depreciation expense for 2025?

A. P60,000 C. P73,000

B. P61,000 D. P78,000

17. On January 1, 2021, the local government of Laguna agreed to provide PERU CORP. with a

P10,000,000, three-year, zero-interest bearing loan evidenced by promissory note. On that date, the

C

prevailing rate of interest for a loan of this type is 10%. (Round off the present value factors in four

decimal places.)

Which of the following is not included in the journal entry made on January 1, 2021?

A. Credit to note payable P7,513,000

EO

B. Debit to discount on note payable P2,487,000

C. Credit to deferred income from government grants P2,487,000

D. Debit to cash P10,000,000

18. Determine which of the following statements is correct in relation to borrowing costs, in accordance

with PAS 23.

R

A. PAS 23 does not require the segregation of qualifying assets from other assets as part of the

entity’s note disclosures.

B. Borrowing costs related to non-qualifying assets are not capitalized but charged directly to

retained earnings.

C. Investment properties under long-term construction and to be accounted for using the fair value

model are classified as qualifying assets in accordance with PAS 23.

D. None from the choices.

Use the following information in answering the next item(s):

On January 1, 2022, BEAST CORP. began constructing a building on a land that it had previously

acquired. The building is to be used by the company as its main office. The building was completed on

September 30, 2022. The following payments were made to the sub-contractor:

Date of Payment Amount

January 1, 2022 2,000,000

April 1, 2022 3,000,000

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 3

June 1, 2022 1,800,000

August 31, 2022 900,000

The following amounts represent the borrowings of BEAST CORP. as of December 31, 2022.

• 10%, P 3,000,000, 4-year note dated January 1, 2022 with simple interest payable annually,

specifically borrowed to finance the construction project. Income earned until date of

construction completion from temporary investments amounted to P15,000.

• 14%, P 4,000,000, 5-year note dated January 1, 2022 with interest payable annually.

• 12%, P 36,000,000, 5-year note dated December 31, 2021 with interest payable annually.

19. How much is the capitalizable borrowing cost in 2022 using the traditional approach?

A. P441,800 C. P398,850

B. P414,350 D. P383,850

20. How much is the capitalizable borrowing cost in 2022 using the contemporary approach

A. P441,800 C. P398,850

B. P414,350 D. P383,850

21. Which of the following statements is correct?

A. There is no depreciation during the period(s) of shutdown.

B. Depletion is computed using the double declining balance method.

w

C. PFR6 does not provide any clear-cut guidelines for recognition of exploration and evaluation

assets.

D. Both tangible and intangible development costs are capitalized as cost of wasting assets.

ie

Use the following information in answering the next item(s):

On July 1, 2022, HAWK-EYE CORP. a calendar year corporation, purchased the rights to a mine. The

total purchase price was P11,500,000, of which P800,000 was allocable to the land. As of that date,

ev

the total estimated reserves were 3,600,000 tons. HAWK-EYE was expecting an extraction of 30,000

tons per month. Exploration costs on the property amounted to P501,000, one-fourths of which

resulted to dry holes. HAWK-EYE’s accounting policy is to use full cost method in accounting for its

exploration costs. Intangible development costs incurred amounted to P2,000,000

R

The entity is legally required to restore the land to a condition appropriate for resale at an

undiscounted amount of P650,000. The market rate of interest is 8% at the date of transaction.

(Round-off the present value factors to two decimal places if necessary).

PA

The entity constructed buildings on the site and was completed on September 30, 2022 at a total cost

of P1,800,000. The useful life of the building is 15 years with a residual value of P300,000. The

depreciation of the building are 60% attributable to mining operations and the remainder was

attributable to operating expenses. Labor cost of miners totaled P150,000 while mining overhead

totalled P180,000 for 2022.

C

The mining operations started when the building was completed and three-fourths of the total mineral

mined was sold during 2022?

22. What is the carrying amount of the wasting as of the end of 2022?

A. P14,628,500 C. 13,942,500

EO

B. P12,678,500 D. 13,962,500

23. What is the total amount of expense in the statement of profit or loss for the year ended 2022?

A. P626,960 C. P725,960

B. P544,460 D. P532,500

R

24. LOKI CORP. has the following information pertaining to its mining operations:

Estimated cost of restoring property after mining is completed P400,000

Number of tons mined during the current year 50,000 tons

Cost of land P6.0M

Estimated number of tons of ore to be mined 400,000 tons

Sales value of land after mining P300,000

Development costs incurred P500,000

Number of tons sold during the current year 35,000 tons

Cost of production (excluding depletion) P7.00

The company already recognized the estimated restoration cost immediately after the resource

property was acquired. How much would be the companys cost of goods sold?

A. P525,000 C. P787,500

B. P603,700 D. P822,500

25. In period/(s) of no extraction, (choose the incorrect statement)

A. Depreciation of movable tangible development costs continues and are unaffected.

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 4

B. Depletion of wasting assets is suspended.

C. Depreciation of immovable tangible development costs continues and will result to a change in

the depreciation method if its life is longer than the life of the wasting assets.

D. None from the choices.

26. Regarding intangible assets, which of the following statements is false?

A. If the payment for an intangible asset is deferred beyond normal credit terms, the cost is the

cash price equivalent. The difference between the cash price and the total payments is

recognized as interest expense over the life of the intangible asset.

B. When an intangible asset is acquired through exchange and such exchange lacks commercial

substance, no gain or loss on exchange is to be recognized.

C. The revaluation model for intangible assets can only be used if there is an active market for the

intangible asset.

D. Generally, the residual value of an intangible asset shall be presumed to be zero.

E. Not all intangible assets are subject to amortization.

Use the following information in answering the next item(s):

CAITLYN CORP. acquired the following intangible assets during the year with the following

information:

(a) On January 1, 2023, CAITLYN signed an agreement to operate as a franchise of BRAUM CORP.

for an initial franchise fee of P300,000. Of this amount, P100,000 was paid when the agreement

w

was signed and the balance is payable in equal annual payment of P50,000 beginning December

31, 2023. The agreement provides that the down payment is not refundable and no future

services are required of the franchisor. CAITLYN’s credit rating indicates that it can borrow

ie

money at 12% for a loan of this type. The agreement also provides that 5% of the revenue from

the franchise must be paid to the franchisor annually. CAITLYNs revenue from the franchise for

2021 was P120,000. CHINA estimates the useful life of the franchise to be five years. (Round-off

present value factors in four decimal places)

ev

(b) On July 1, 2023, CAITLYN purchased an item of intangible asset on a deferred settlement basis

with a price of P100,000. The cash price equivalent of the asset is P92,000. Legal fees and other

professional fees paid amounted to P8,000 while administration and overhead costs amounted

to P10,000. The liability was settled before year-end. In addition, costs of introducing a new

R

product or service amounted to P3,000 and costs of staff training P2,000. The intangible asset

has a remaining useful life of 10 years and has a remaining legal life of 8 years. Management

estimates that the asset has a residual value of P5,000. On December 31, 2023, the company

successfully defended the intangible asset incurring P5,000 in legal costs.

PA

27. What is the total initial cost of the above intangible assets?

A. P400,000 C. P405,000

B. P351,865 D. P370,865

28. What is the total amortization expense in 2023?

C

A. P56,623 C. P62,873

B. P66,250 D. P56,310

29. What is the total amount of expense reported in 2023 statement of profit or loss?

EO

A. P96,873 C. P115,097

B. P90,623 D. P108,847

30. BANGLADESH CORP. incurred the following costs during the year ended December 31, 2023:

Routine, on-going efforts to refine, enrich, & improve

upon the qualities of an existing product P100,000

Design, construction, and testing of pre-production prototypes and models 125,000

R

R and D equipment with useful life of four years in various R & D projects 500,000

Cost of marketing research 50,000

Advertising expense to introduce a new product 70,000

Testing in search for new products or process alternatives 140,000

Quality control during commercial production including routine testing of products 25,000

What is the total research and development expense?

A. P790,000 C. P765,000

B. P415,000 D. P390,000

- END OF EXAMINATION -

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 5

w

ie

ev

R

PA

C

EO

R

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 6

You might also like

- Property Plant and Equipment AuditDocument7 pagesProperty Plant and Equipment AuditKristine Jewel MirandaNo ratings yet

- Auditing Problems PPE Self-Construction CostsDocument17 pagesAuditing Problems PPE Self-Construction CostsMakiri Sajili II50% (2)

- Midterm INTACC 2 examDocument6 pagesMidterm INTACC 2 examMac b IBANEZNo ratings yet

- 06 - PpeDocument4 pages06 - PpeLloydNo ratings yet

- Intermediate Accounting 2Document12 pagesIntermediate Accounting 2polxrixNo ratings yet

- Quiz - Module 2Document5 pagesQuiz - Module 2Alyanna Alcantara67% (3)

- Cost of Land, Buildings, Equipment for Aliaga CorporationDocument4 pagesCost of Land, Buildings, Equipment for Aliaga CorporationLeisleiRagoNo ratings yet

- Ac20 Quiz 4 - DGCDocument8 pagesAc20 Quiz 4 - DGCMaricar PinedaNo ratings yet

- Intermediate AccountingDocument12 pagesIntermediate AccountingpolxrixNo ratings yet

- PPEDocument16 pagesPPENiño Mendoza MabatoNo ratings yet

- SEATWORK-LBM 1st2324 STUDENTSDocument3 pagesSEATWORK-LBM 1st2324 STUDENTSpadayonmhieNo ratings yet

- PPEDocument1 pagePPEExcelsia Grace A. Parreño0% (1)

- Financial Accounting and Reporting - QUIZ 6Document4 pagesFinancial Accounting and Reporting - QUIZ 6JINGLE FULGENCIONo ratings yet

- AP DLSA 05 PPE For DistributionDocument10 pagesAP DLSA 05 PPE For DistributionStela Marie CarandangNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- Calculating borrowing costs for construction projectsDocument15 pagesCalculating borrowing costs for construction projectsKervin Rey JacksonNo ratings yet

- Diagnostic Exam 1 23 AKDocument11 pagesDiagnostic Exam 1 23 AKAbegail Kaye BiadoNo ratings yet

- Seatwork 1 IAC2Document8 pagesSeatwork 1 IAC2Jerickho JNo ratings yet

- FAR1Document4 pagesFAR1hanselNo ratings yet

- ACC 211 Intermediate Accounting 1 Practice TestDocument3 pagesACC 211 Intermediate Accounting 1 Practice TestArlene Garcia100% (1)

- Property Plant Tutorials Number OneDocument46 pagesProperty Plant Tutorials Number OneNatalie SerranoNo ratings yet

- Internal Control Measures: Page 1 of 7Document7 pagesInternal Control Measures: Page 1 of 7Lucy HeartfiliaNo ratings yet

- Answer KeysDocument35 pagesAnswer Keyspayos manuelNo ratings yet

- PROBLEMS AND EXERCISES ON ACCOUNTING FOR PROPERTY, PLANT AND EQUIPMENTDocument10 pagesPROBLEMS AND EXERCISES ON ACCOUNTING FOR PROPERTY, PLANT AND EQUIPMENTJess SiazonNo ratings yet

- Act1205 Midterm Exam For Posting PDFDocument9 pagesAct1205 Midterm Exam For Posting PDFteam SAMNo ratings yet

- Ap Ppe Quizzer Q Accounting ReviewerDocument19 pagesAp Ppe Quizzer Q Accounting Reviewercynthia reyesNo ratings yet

- Audit of PPE AssignmentDocument1 pageAudit of PPE AssignmentAlexis BagongonNo ratings yet

- PpeDocument7 pagesPpeJer Rama100% (1)

- Intermediate Accounting 1Document8 pagesIntermediate Accounting 1Margielyn SuniNo ratings yet

- Accounting for Property ExchangeDocument10 pagesAccounting for Property ExchangeJerome BaluseroNo ratings yet

- Acctg 2 quiz covers depreciation, depletionDocument3 pagesAcctg 2 quiz covers depreciation, depletionArjay CarolinoNo ratings yet

- Land and Building Cost CalculationsDocument12 pagesLand and Building Cost CalculationsKervin Rey Jackson100% (1)

- Q3 - PPE and Government Grant Problem Solving: SolutionDocument8 pagesQ3 - PPE and Government Grant Problem Solving: SolutionLyka Nicole DoradoNo ratings yet

- QUIZ - CHAPTER 15 - PPE PART 1 - 2020edDocument3 pagesQUIZ - CHAPTER 15 - PPE PART 1 - 2020edjanna napili100% (1)

- Cpar Practical Accounting Ii Problems Oct 2010 Final Pre Board W SolutionsDocument14 pagesCpar Practical Accounting Ii Problems Oct 2010 Final Pre Board W SolutionsKyla MilanNo ratings yet

- Intermediate Accounting 2Document5 pagesIntermediate Accounting 2Kristine Lara100% (3)

- Auditing and Assurance - Concepts and Applications 2Document11 pagesAuditing and Assurance - Concepts and Applications 2hazel alvarez100% (1)

- Audit of PpeDocument8 pagesAudit of PpeCPANo ratings yet

- AP Ppe Quizzer QDocument28 pagesAP Ppe Quizzer Qkimberly bumanlagNo ratings yet

- Acco 30053 - Audit of Ppe - MarpDocument10 pagesAcco 30053 - Audit of Ppe - MarpBanna SplitNo ratings yet

- Adamson University Intermediate Accounting 1 Property, Plant, & Equipment Quiz - Answer KeyDocument4 pagesAdamson University Intermediate Accounting 1 Property, Plant, & Equipment Quiz - Answer KeyKhai Supleo PabelicoNo ratings yet

- Problems Audit of Property Plant and Equipmentdocx PresentDocument10 pagesProblems Audit of Property Plant and Equipmentdocx PresentDominic RomeroNo ratings yet

- Acquisition and Self-Construction Equipment Cost CalculationsDocument35 pagesAcquisition and Self-Construction Equipment Cost Calculationslordaiztrand50% (2)

- Property, Plant and Equipment Sample Problems: Problem 1Document10 pagesProperty, Plant and Equipment Sample Problems: Problem 1Mark Gelo Winchester0% (1)

- Audit of Ppe (2) : P300,000 P450,000 P150,000 P200,000 None of The AboveDocument6 pagesAudit of Ppe (2) : P300,000 P450,000 P150,000 P200,000 None of The AboveellaNo ratings yet

- Chapter 5 Audit of Property, Plant and EquipmentDocument26 pagesChapter 5 Audit of Property, Plant and EquipmentDominique Anne BenozaNo ratings yet

- Final Exam Intermediate Accounting 2Document2 pagesFinal Exam Intermediate Accounting 2William TabuenaNo ratings yet

- Property Plant and Equipment: Problem 1Document13 pagesProperty Plant and Equipment: Problem 1A.B AmpuanNo ratings yet

- Audit of Ppe, Int. AssetsDocument5 pagesAudit of Ppe, Int. AssetsJon SagabayNo ratings yet

- Ppe - ModuleDocument7 pagesPpe - ModuleYejin ChoiNo ratings yet

- Carbon Capture, Utilization, and Storage Game Changers in Asia and the Pacific: 2022 Compendium of Technologies and EnablersFrom EverandCarbon Capture, Utilization, and Storage Game Changers in Asia and the Pacific: 2022 Compendium of Technologies and EnablersNo ratings yet

- California Infrastructure Projects: Legal Aspects of Building in the Golden StateFrom EverandCalifornia Infrastructure Projects: Legal Aspects of Building in the Golden StateNo ratings yet

- Improving Energy Efficiency and Reducing Emissions through Intelligent Railway Station BuildingsFrom EverandImproving Energy Efficiency and Reducing Emissions through Intelligent Railway Station BuildingsNo ratings yet

- Forest Products: Advanced Technologies and Economic AnalysesFrom EverandForest Products: Advanced Technologies and Economic AnalysesNo ratings yet

- A Contractor's Guide to the FIDIC Conditions of ContractFrom EverandA Contractor's Guide to the FIDIC Conditions of ContractNo ratings yet

- RFBT 2nd Monthly AssessmentDocument11 pagesRFBT 2nd Monthly AssessmentCiena Mae AsasNo ratings yet

- MAS 2nd Monthly AssessmentDocument11 pagesMAS 2nd Monthly AssessmentCiena Mae AsasNo ratings yet

- AFAR Second Monthly Assessment ResultsDocument7 pagesAFAR Second Monthly Assessment ResultsCiena Mae AsasNo ratings yet

- AT 2nd Monthly AssessmentDocument8 pagesAT 2nd Monthly AssessmentCiena Mae AsasNo ratings yet

- AP 2nd Monthly AssessmentDocument6 pagesAP 2nd Monthly AssessmentCiena Mae AsasNo ratings yet

- Monthly Assessment - Management Accounting FundamentalsDocument7 pagesMonthly Assessment - Management Accounting FundamentalsCiena Mae AsasNo ratings yet

- RFBT 1st Monthly AssessmentDocument7 pagesRFBT 1st Monthly AssessmentCiena Mae AsasNo ratings yet

- AT 1st Monthly AssessmentDocument3 pagesAT 1st Monthly AssessmentCiena Mae AsasNo ratings yet

- AP 1st Monthly AssessmentDocument6 pagesAP 1st Monthly AssessmentCiena Mae Asas100% (1)

- FAR 1st Monthly AssessmentDocument5 pagesFAR 1st Monthly AssessmentCiena Mae AsasNo ratings yet

- CHAPTER 18 - AnswerDocument8 pagesCHAPTER 18 - AnswerNico evansNo ratings yet

- Cover Page of Business PlanDocument9 pagesCover Page of Business PlanCiena Mae AsasNo ratings yet

- AFAR 1st Monthly AssessmentDocument6 pagesAFAR 1st Monthly AssessmentCiena Mae AsasNo ratings yet

- Solution Manual For Financial ACCT 2010 1st Edition by GodwinDocument12 pagesSolution Manual For Financial ACCT 2010 1st Edition by Godwina527996566No ratings yet

- CH 14Document105 pagesCH 14Bhavin purohitNo ratings yet

- Tugas 2 Akuntansi ManajemenDocument3 pagesTugas 2 Akuntansi ManajemenSherlin KhuNo ratings yet

- ANALYSIS OF FINANCIAL STATEMENTSDocument33 pagesANALYSIS OF FINANCIAL STATEMENTSAsim Mahato100% (3)

- UD. BUANA Trial Balance and Journal Entries for December 2020Document46 pagesUD. BUANA Trial Balance and Journal Entries for December 2020ayesha maharaniNo ratings yet

- Six SigmaDocument98 pagesSix SigmaGokulRamThangamaniNo ratings yet

- Acc106 - Test 1 - May 2018 - SSDocument5 pagesAcc106 - Test 1 - May 2018 - SSsyahiir syauqiiNo ratings yet

- Test Bank Advanced Accounting Part 2 Millan PDFDocument433 pagesTest Bank Advanced Accounting Part 2 Millan PDFAmie Jane MirandaNo ratings yet

- The PPSAS and The Revised Chart of Accounts: Tools To Enhance Accountability and Transparency in Financial ReportingDocument98 pagesThe PPSAS and The Revised Chart of Accounts: Tools To Enhance Accountability and Transparency in Financial ReportingJhopel Casagnap EmanNo ratings yet

- MAF603-QUESTION TEST 2 - May 2019Document3 pagesMAF603-QUESTION TEST 2 - May 2019fareen faridNo ratings yet

- Cost Concept and Behavior RaibornDocument40 pagesCost Concept and Behavior RaibornRJ MonsaludNo ratings yet

- Solution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th EditionDocument24 pagesSolution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th EditionJenniferLeonyowc100% (29)

- Polytechnic University of The PhilippinesDocument16 pagesPolytechnic University of The PhilippinesMakoy BixenmanNo ratings yet

- Forum s5Document6 pagesForum s5Aruni PribadiNo ratings yet

- Cash FlowDocument6 pagesCash Flowsilvia indahsariNo ratings yet

- Accounts ReceivableDocument3 pagesAccounts Receivablelea atienza100% (1)

- Free Cash FlowDocument47 pagesFree Cash FlowpagalinsanNo ratings yet

- Bueno Salud Care Audit Report 21-22Document31 pagesBueno Salud Care Audit Report 21-22Sameer ParwaniNo ratings yet

- Zoca Courtyard DPRDocument24 pagesZoca Courtyard DPRbrijeshbabu1019No ratings yet

- Corporate Reporting Past Question Papers (ICAB)Document55 pagesCorporate Reporting Past Question Papers (ICAB)Md. Zahidul Amin100% (1)

- Survey of Accounting 4Th Edition Edmonds Solutions Manual Full Chapter PDFDocument51 pagesSurvey of Accounting 4Th Edition Edmonds Solutions Manual Full Chapter PDFzanewilliamhzkbr100% (5)

- ACFrOgAqiiJXkh6qPT06Dyr92wNqM 7FUlP7UX0J4bfQdyRnaPEgZzNDquQKGbpgOqe8gQtLHnzilftiJfPGb ph6jXhCfSJ - bTZ9eIoIXcm9JypVLjHwd0K7fOWt0nJlptBa Yas8vHz03v1z2Document14 pagesACFrOgAqiiJXkh6qPT06Dyr92wNqM 7FUlP7UX0J4bfQdyRnaPEgZzNDquQKGbpgOqe8gQtLHnzilftiJfPGb ph6jXhCfSJ - bTZ9eIoIXcm9JypVLjHwd0K7fOWt0nJlptBa Yas8vHz03v1z2727822TPMB005 ARAVINTHAN.SNo ratings yet

- Sol. Man. Chapter 14 Bvps 2021Document6 pagesSol. Man. Chapter 14 Bvps 2021Nikky Bless LeonarNo ratings yet

- ECF1100 Individual Assignment 2 Sem 1 2022Document4 pagesECF1100 Individual Assignment 2 Sem 1 2022wesley hudsonNo ratings yet

- ACCA SBR Course NotesDocument412 pagesACCA SBR Course NotesAhsanMughalAcca100% (11)

- A. Journal Entries Accounts Debit CreditDocument3 pagesA. Journal Entries Accounts Debit CreditAnne AlagNo ratings yet

- 2019 Analysis SAC Version 2 SolutionDocument6 pages2019 Analysis SAC Version 2 SolutionLachlan McFarlandNo ratings yet

- MiaDocument298 pagesMiaMujahidahFaqihahNo ratings yet

- Financial Performance of Hatsun Agro Product LimitedDocument51 pagesFinancial Performance of Hatsun Agro Product LimitedMukesh GuptaNo ratings yet

- Chap 2 Financial AnalysisDocument43 pagesChap 2 Financial AnalysisGizachew AlazarNo ratings yet