Professional Documents

Culture Documents

Motorbike Insurance Policy Provided by AGL

Uploaded by

Michelle EnkhmendOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Motorbike Insurance Policy Provided by AGL

Uploaded by

Michelle EnkhmendCopyright:

Available Formats

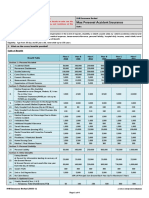

Third Party Liability

MOTOR INSURANCE

Tel: 1457 Version 01/2022

Third Party Liability Motor Insurance (TPL)

When accident happened, there is a price to pay

Accident may result in bodly injury and materials damage to the victims. The consequences could be

minor injuries up to the loss of life in the worst cases. Therefore:

- Victims need to have an immediately medical treatment in case of injury.

- Victims need to be indemnified in case of permanent disability.

- Materials damages need to be reimbursed.

Protect yourself against financial consequence of damages you can cause to others in case of accident

by subscribing to Allianz Insurance Laos Co.,Ltd Third Party Liability Motor insurance.

1. Third Party Liability in case of bodily injury and materials damages of third party.

2. Bodily injury of driver and passengers.

3. Legal support in case of legal procedure is needed.

Details of coverage.

Sum insured (LAK) maximum per accident

Coverage

Compulsory (AB0) Option 1 (AB1) Option 2 (AB2) Option 3 (AB3)

1. Third Party liability cover

1.1. ** Bodily injury.

1.1.1. Death or total permanent disability, max./person 12,000,000 25,000,000 35,000,000 50,000,000

1.1.2. Medical expenses, max./person 1,800,000 2,500,000 3,500,000 5,000,000

(in witch Baci fee in case of hospitalization) 100,000 160,000 200,000 500,000

** Bodily injury, max./accident 101,400,000 250,000,000 500,000,000 750,000,000

1.2. Material damage, max./accident 5,200,000 17,500,000 50,000,000 50,000,000

2. Accident cover for driver ( 01 seat) Option (I0) Option (I1) Option (I2) Option (I3)

Motorcycle - Death or total permanent disability 6,000,000 12,500,000 17,500,000 17,500,000

Or Tuk Tuk - Medical expenses 900,000 1,250,000 1,750,000 2,500,000

4 wheels & more - Death or total permanent disability 12,000,000 25,000,000 35,000,000 35,000,000

- Medical expenses 1,800,000 2,500,000 3,500,000 5,000,000

3. Legal defense and recourse, cover H 150,000 150,000 150,000 150,000

Annual premium (in LAK)

Vehicle type Option (AB0/I0) Option (AB1/I1) Option (AB2/I2) Option (AB3/I3)

Motorbike, less than 50 cc (Private use) 105,000 200,000 341,000 373,000

Motorbike, 50 cc to 124 cc (Private use) 149,000 242,000 430,000 470,000

Motorbike, 125 cc and more (Private use) 178,000 281,000 512,000 561,000

3 wheels or TUK TUK (Public use) 266,000 473,000 934,000 1,025,000

car, less than 2000 cc (Private use) 259,000 537,000 1,065,000 1,170,000

car, 2000 cc and more (Private use) 277,000 603,000 1,209,000 1,328,000

car, less than 2000 cc (Public use) 463,000 764,000 1,543,000 1,695,000

car, 2000 cc and more (Public use) 521,000 861,000 1,757,000 1,931,000

What TPL Motor insurance could give benefit to you?

✓ Road assistance on site in case of accident.

24 hrs./7 helpline : 1456, (021) 222 222, (020) 5524 4222

✓ Allianz Insurance Laos Co., Ltd will pay for damaged resulting from accident you

may be responsible for.

✓ Convenient to subscribe now at any Allianz agent’s office near you.

This brochure use only for sale illustration.

Further more information, please contact Allianz Insurance Laos Co., Ltd agent near you

Allianz Insurance Laos Co., Ltd

33, Lane Xang Avenue, Allianz building

P. O. Box : 4223, Vientiane Capital, Lao PDR

Call : 1457, (021) 21 5903

24 hrs./7 Accident helpline: 1456, 021 222 222 , 020 5524 4222

E-mail: agl@agl-allianz.com

www. azlaos.com

fb: allianzinsurancelaos

Now you can download

My Insurance App.

© Allianz Insurance Laos Co., Ltd

You might also like

- Mercedes - Benz Vito & V-Class Petrol & Diesel Models: Workshop Manual - 2000 - 2003From EverandMercedes - Benz Vito & V-Class Petrol & Diesel Models: Workshop Manual - 2000 - 2003Rating: 5 out of 5 stars5/5 (1)

- Standard Insurance: Philippine British Assurance Co. IncDocument4 pagesStandard Insurance: Philippine British Assurance Co. IncVince Felipe OlivarNo ratings yet

- Abic888 Poc 240109922Document3 pagesAbic888 Poc 240109922Joemar LagartoNo ratings yet

- Product Disclosure Sheet, 0Document2 pagesProduct Disclosure Sheet, 0Yusuf Md HusainNo ratings yet

- Product Disclosure Sheet OTO360 TakafulDocument2 pagesProduct Disclosure Sheet OTO360 TakafulsiranepNo ratings yet

- Week #10 ACCT 3039 Decision MakingDocument3 pagesWeek #10 ACCT 3039 Decision MakingPriscella LlewellynNo ratings yet

- Product Disclosure Sheet TRIPCARE 360 TakafulDocument5 pagesProduct Disclosure Sheet TRIPCARE 360 TakafulCikgu AnnNo ratings yet

- 2020 Toyota Innova - Noel LasDocument1 page2020 Toyota Innova - Noel LasjuanNo ratings yet

- PDS (OTO360) FormDocument2 pagesPDS (OTO360) FormSara AriffNo ratings yet

- PDS (OTO360) FormDocument2 pagesPDS (OTO360) Formawang naziroolNo ratings yet

- Z-Travel Insurance (International) BrochureDocument28 pagesZ-Travel Insurance (International) BrochureNoraihan RahmatNo ratings yet

- Private PolicyDocument22 pagesPrivate PolicyRoger RubiatoNo ratings yet

- 2016 Ford Everest - Christopher N. AriasDocument4 pages2016 Ford Everest - Christopher N. Ariasalmagpelino1322No ratings yet

- Mapfre Insular Policy JacketDocument5 pagesMapfre Insular Policy JacketDee MartyNo ratings yet

- PDS (OTO360) Form PDFDocument2 pagesPDS (OTO360) Form PDFcikgutiNo ratings yet

- PolicyDoc - 614733440 232 1 - 03 13 24Document8 pagesPolicyDoc - 614733440 232 1 - 03 13 24Casa Mais PrintNo ratings yet

- Your Text Here 1: Welcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Document3 pagesYour Text Here 1: Welcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Randy OrtonNo ratings yet

- Standard Fire & Special Perils Policy Schedule: Page 1 of 3Document4 pagesStandard Fire & Special Perils Policy Schedule: Page 1 of 3asdfNo ratings yet

- ATEDomesticPolicyWording enDocument12 pagesATEDomesticPolicyWording enngNo ratings yet

- Welcome To The ICICI Lombard Family!: Dear Mrs Rashmi Choudhury, We Hope This Communication Finds You in Good HealthDocument4 pagesWelcome To The ICICI Lombard Family!: Dear Mrs Rashmi Choudhury, We Hope This Communication Finds You in Good HealthSanjay SharmaNo ratings yet

- Dec PageDocument2 pagesDec PageKerry Henry100% (1)

- AFIA - QIC - Policy WordingDocument100 pagesAFIA - QIC - Policy WordingSama88823No ratings yet

- Captura de Pantalla 2023-09-15 A La(s) 7.30.14 A.M.Document4 pagesCaptura de Pantalla 2023-09-15 A La(s) 7.30.14 A.M.Odessa FigueroaNo ratings yet

- Chubb Travel Insurance: Kemalangan & KesihatanDocument12 pagesChubb Travel Insurance: Kemalangan & KesihatanmiazainuddinNo ratings yet

- TISBmpaRev1 3Document6 pagesTISBmpaRev1 3azizul mat aripNo ratings yet

- Compulsory Vehicle LiabilityDocument5 pagesCompulsory Vehicle LiabilityKim Laurente-AlibNo ratings yet

- Two Wheeler Insurance Renewal: Insured DetailsDocument5 pagesTwo Wheeler Insurance Renewal: Insured DetailsanirudhNo ratings yet

- Airen B. Ramirez PDFDocument5 pagesAiren B. Ramirez PDFBenjonit CapulongNo ratings yet

- Liberty Insurance Berhad (16688-K) Customer Service Tollfree: 1-300-888-990Document5 pagesLiberty Insurance Berhad (16688-K) Customer Service Tollfree: 1-300-888-990Abdul Hady Abu BakarNo ratings yet

- Your Cycle Insurance at A Glance: What's Covered?Document1 pageYour Cycle Insurance at A Glance: What's Covered?Narasimha SNo ratings yet

- Two Wheeler Standalone OD Only: Certificate of Insurance Cum Policy ScheduleDocument3 pagesTwo Wheeler Standalone OD Only: Certificate of Insurance Cum Policy Scheduleprasanth adabalaNo ratings yet

- Full Policy Schedule DocumentDocument6 pagesFull Policy Schedule DocumentKiran JoshiNo ratings yet

- AckoPolicy DCTR10111598313 00 - 2Document8 pagesAckoPolicy DCTR10111598313 00 - 2UmangtarangNo ratings yet

- 2022-11-01 - NW Travel Prime - PADocument24 pages2022-11-01 - NW Travel Prime - PAJean. PNo ratings yet

- Certificate of Insurance - B2CHKA800000898Document2 pagesCertificate of Insurance - B2CHKA800000898billyleemaxwayNo ratings yet

- Welcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Document4 pagesWelcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!kanishkrivith.sNo ratings yet

- PDF DocumentDocument3 pagesPDF DocumentdrjasonellisNo ratings yet

- Declaration PageDocument2 pagesDeclaration Pageluisalcantara12345678No ratings yet

- NCL Standard Generic COI 7 21Document62 pagesNCL Standard Generic COI 7 21Charles BasNo ratings yet

- PruPersonal AccidentDocument17 pagesPruPersonal AccidentYeok hong WangNo ratings yet

- Motor Two Wheelers Policy Bundled Schedule Cum Certificate of InsuranceDocument3 pagesMotor Two Wheelers Policy Bundled Schedule Cum Certificate of InsuranceRaja nayaKNo ratings yet

- C89HPuR9tezSwW2ZTxZ-XbH3 qCRIKFu6MprtUdN9iI 180341 20240210063429 29Document2 pagesC89HPuR9tezSwW2ZTxZ-XbH3 qCRIKFu6MprtUdN9iI 180341 20240210063429 29joegesang07No ratings yet

- Acko Bike Policy - DBTR01240319516 - 00Document7 pagesAcko Bike Policy - DBTR01240319516 - 00Deepak DeloNo ratings yet

- PLCYMANLDocument3 pagesPLCYMANLThusitha WeerathungaNo ratings yet

- Enhanced Max PA PDS Annual PremiumDocument8 pagesEnhanced Max PA PDS Annual Premiumboy zamaniNo ratings yet

- Travel Insurance BrochureDocument7 pagesTravel Insurance BrochureArunava SahaNo ratings yet

- DBCR10146298380 00Document6 pagesDBCR10146298380 00Vishnu VNo ratings yet

- Flex PA Brochure FADocument18 pagesFlex PA Brochure FAAIA Sunnie YapNo ratings yet

- Trans-Phil Land Corp.: Journal VoucherDocument4 pagesTrans-Phil Land Corp.: Journal VoucherLaicka AquinoNo ratings yet

- Epolicy Private CarDocument10 pagesEpolicy Private CarThomas Daniel CuarteroNo ratings yet

- PC - Policy Wordings, Program, Forms, and NoticeDocument17 pagesPC - Policy Wordings, Program, Forms, and NoticeAyne BetarmosNo ratings yet

- AckoPolicy-DBCR00977659657 00Document7 pagesAckoPolicy-DBCR00977659657 00Kanthraju T CNo ratings yet

- KD145685Document4 pagesKD145685Abhishek Kumar SinghNo ratings yet

- InsuranceDocument4 pagesInsurancebasit.000No ratings yet

- Welcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Document3 pagesWelcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!abcdNo ratings yet

- PolicySchedule GTDocument4 pagesPolicySchedule GTwiliso2806No ratings yet

- Etiqa ProductDocument5 pagesEtiqa ProductOrkid MerahNo ratings yet

- A-Plus AccidentalShield A-Plus Total AccidentalShield Brochure 201306 v2Document14 pagesA-Plus AccidentalShield A-Plus Total AccidentalShield Brochure 201306 v2nusthe2745No ratings yet

- BikeWarriorBrochure November2021Document20 pagesBikeWarriorBrochure November2021razsyaNo ratings yet

- Takaful Financial ProductDocument19 pagesTakaful Financial Producttae tae is teaNo ratings yet

- Nominee Shareholder AgreementDocument9 pagesNominee Shareholder AgreementNurul Huda Lim80% (5)

- Purchase Order: For Festiva Global Management L.L.C Authorized Signatory SupplierDocument1 pagePurchase Order: For Festiva Global Management L.L.C Authorized Signatory Supplierahmed ANo ratings yet

- Life Insurance NotesDocument38 pagesLife Insurance Notesshahidjappa67% (3)

- Lesson 2 Types of CompensationDocument21 pagesLesson 2 Types of Compensationag clothingNo ratings yet

- Policy MacalisangDocument3 pagesPolicy MacalisangCrush RockNo ratings yet

- Solutions To Problems: Pe On Estate TaxDocument11 pagesSolutions To Problems: Pe On Estate TaxErica NicolasuraNo ratings yet

- Designing Universal Family Care Digital Version FINALDocument310 pagesDesigning Universal Family Care Digital Version FINALPyaePhyoAungNo ratings yet

- Risk Retention and Risk Reduction DecisionsDocument4 pagesRisk Retention and Risk Reduction DecisionsNicole BrownNo ratings yet

- Cpa Review School of The PhilippinesDocument12 pagesCpa Review School of The PhilippinesPJ PoliranNo ratings yet

- Heidrun Ihechiloru Egbuta: 7 Alhaja Adetola Street, Apapa, LagosDocument75 pagesHeidrun Ihechiloru Egbuta: 7 Alhaja Adetola Street, Apapa, LagosheidyegbutaNo ratings yet

- Asamani Et Al. - 2020 - The Imperative of Evidence-Based Health Workforce Planning and Implementation Lessons From Nurses and MidwiveDocument6 pagesAsamani Et Al. - 2020 - The Imperative of Evidence-Based Health Workforce Planning and Implementation Lessons From Nurses and MidwiveJAMES AVOKA AsamaniNo ratings yet

- Part F: 1. Incontestability ClauseDocument17 pagesPart F: 1. Incontestability ClauseVim MalicayNo ratings yet

- IA 1 Valix 2020 Ver. Problem 26-1 - Problem 26-5Document5 pagesIA 1 Valix 2020 Ver. Problem 26-1 - Problem 26-5Ariean Joy DequiñaNo ratings yet

- Applied English 9 10 Solutions 1 - HarbourpressDocument72 pagesApplied English 9 10 Solutions 1 - HarbourpressAniruddha MondalNo ratings yet

- Annexure IV Future Investment DeclarationDocument2 pagesAnnexure IV Future Investment DeclarationBhooma Shayan100% (1)

- Class 36: NICE CLASSIFICATION - 11 Edition, Version 2021Document4 pagesClass 36: NICE CLASSIFICATION - 11 Edition, Version 2021Michelle SuryaNo ratings yet

- If Warren Buffett Started Today, Could He Still Reach His Current Level of Wealth? (ANALYSIS)Document10 pagesIf Warren Buffett Started Today, Could He Still Reach His Current Level of Wealth? (ANALYSIS)Matt EbrahimiNo ratings yet

- Troo Insurance Company: Vision: What We Strive ForDocument6 pagesTroo Insurance Company: Vision: What We Strive ForEfren ChanNo ratings yet

- Professional Indemnity InsuranceDocument3 pagesProfessional Indemnity InsuranceHarshilNo ratings yet

- M A-Transactions CliffordDocument28 pagesM A-Transactions CliffordAndrew LeeNo ratings yet

- CN WTN6443Document1 pageCN WTN6443Fadli ZainalNo ratings yet

- NCL Standard Generic COI 7 21Document62 pagesNCL Standard Generic COI 7 21Charles BasNo ratings yet

- Week 2 - FIP 507 Government Benefit Plans In-Class Spring-Summer 2022Document20 pagesWeek 2 - FIP 507 Government Benefit Plans In-Class Spring-Summer 2022Arshi GhachiNo ratings yet

- Lesson 3Document34 pagesLesson 3sathes6No ratings yet

- Motor Claim FormDocument2 pagesMotor Claim FormmuhammadmoazmaalikNo ratings yet

- Comprehensive Case Study - 2021Document7 pagesComprehensive Case Study - 2021Ledger PointNo ratings yet

- Underwriters and Brokers (Submitted)Document17 pagesUnderwriters and Brokers (Submitted)dollu mehtaNo ratings yet

- HPS 2303 Public Procurement 1Document37 pagesHPS 2303 Public Procurement 1Amos Makori MaengweNo ratings yet

- Insurance Sector PPTDocument19 pagesInsurance Sector PPTpdabhaadeNo ratings yet

- FPG Insurance QuoteDocument5 pagesFPG Insurance QuoteRichard TanNo ratings yet