Professional Documents

Culture Documents

Determinants of Profitability and Impact Towards The Firm Value in Food & Beverages Companies

Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Determinants of Profitability and Impact Towards The Firm Value in Food & Beverages Companies

Copyright:

Available Formats

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Determinants of Profitability and Impact Towards the

Firm Value in Food & Beverages Companies

M. Noor Salim Sudjono

Mercu Buana University, Postgraduate Faculty Mercu Buana University, Postgraduate Faculty

Master of Management Master of Management

Jakarta, Indonesia Jakarta, Indonesia

Marini Bekti Noviati

Mercu Buana University, Postgraduate Faculty

Master of Management

Jakarta, Indonesia

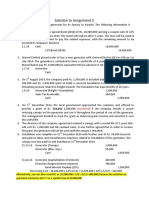

Abstract:- The objective of this study to analyze the impact The graph below shows the average PBV of consumer

of intellectual capital, institutional ownership, capital goods industry sectors from 2018 to 2021, experiencing

structure toward the firm value mediated by the increases and decreases respectively. However, among all

profitability. This study performed at food and beverages industrial subsectors, the food and beverages subsector showed

companies which registered on the IDX between 2018 to the largest decline in PBV.

2021. A total of 17 company samples were obtained

through a purposive sampling method. This study used

panel data regression analysis using Eviews 12 program.

The outcomes of this study found that intellectual capital,

capital structure and profitability effect toward the firm

value. However, institutional ownership doesn’t affect

toward the firm value. Furthermore, intellectual capital

and institutional ownership affect toward the firm value

mediated by profitability. Meanwhile, capital structure

doesn’t affect toward the firm value mediated by the

profitability.

Keywords:- Firm Value, Intellectual Capital, Institutional

Ownership, Capital Structure, Profitability.

I. INTRODUCTION

Fig 1. PBV of Consumer Goods Sector Companies for Period

Many companies in the industry are facing intense 2018-2021

competition among consumer goods companies in the current

economic climate, especially in the food and beverage Investors tend to prefer stable PBVs, so declining PBVs

subsector. Competition among industry subsectors forces all represent an unfavorable situation for investors. Also, the

companies to continuously improve their performance in order decline in PBV reflects the resulting poor performance, which

to meet their business objectives. has an impact on a decrease in firm for the food and beverage

companies. Changes in PBV values in the food and beverage

According to Wiyono & Kusuma (2017:81) a company companies indicate that there are factors that have influenced

has a primary objective to be achieved which is to maximize this condition.

the company's assets or value. Maximize the corporate value, it

means the company also maximize shareholder wealth. So, The first factor is intellectual capital that’s a combination

maximizing corporate value is very important for a company. of intangible assets that enable a company work (Ulum, 2009).

Companies own, manage, and utilize key strategic assets to

In this study, firm value is measured using financial ratio, gain competitive advantage and achieve good financial

namely Price to Book Value (PBV). According to Triyani et al. performance. As the company's performance increases, so does

(2018) PBV is commonly used by securities analysts to predict the value of the company. Previous studies have shown mixed

future stock prices. If the share prices rise, firm values will also results regarding the impact of intellectual capital on corporate

rise and vice versa (Salim & Aulia, 2021). value (Jay Barney, 1991). According to research performed by

Lukman & Tanuwijaya (2021), Salvi et al. (2020) and

Yustyarani & Yuliana (2020) shown that intellectual capital has

a significant positive effect toward firm value. On the other

hand, Lestari & Sapitri (2016) and Subaida et al. (2018) found

that intellectual capital doesn’t affect the firm value.

IJISRT23FEB157 www.ijisrt.com 366

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

A second factor is institutional ownership. Institutional II. LITERATURE REVIEW

shareholding percentage is the percentage of shares held by

institutional investors. Institutional investors are believed to be A. Signaling Theory

better able to monitor the behavior of management. Institutions According to Michael Spence (1973), the theory explains

as shareholders are believed to be better able to detect errors about involvement of 2 parties, insiders, such as management,

that occur (Alamsyah & Muchlas, 2018). The higher the who act as signal senders, and outsiders, such as investors,

institution's ownership, the more effective the surveillance. who act as signal recipients. Spence also said that management

Good internal oversight also affects shareholder wealth strives to provide relevant information that investors can use

(Sutrisno & Sari, 2020). In the research conducted by Zahro

through signals. Then, investor as signal receivers will adjust

(2018) and Soewarno & Ramadhan (2020), institutional

ownership has a significant positive effect toward the firm their decisions according to their understanding of the signals.

value. Unlike the research performed by Astuti et al. (2018),

Listiyowati & Indarti (2018), and Putra & Wirawati (2020) B. Stakeholder Theory

shown that institutional ownership doesn’t affect toward the According to Deegan (2004), the theory explains on how

firm value. organizational activities affect stakeholders. Indicates that all

interested parties have the right to receive information about.

A third factor is capital structure. Every business need The organizations voluntarily choose to disclose information

working capital to support sales. To obtain this working capital, about their environmental, social, and intellectual performance

it is typically required to be financed as a combination of equity beyond coercive demands to meet the expectations of their

and debt. The combination of a firm's debt and equity is called stakeholders.

its capital structure (Brigham and Ehrhardt, 2020:547).

Managers must make capital structure decisions designed to C. Agency Theory

maximize shareholder value. It is very important for companies According to Jensen & Meckling (1976), the theory

to enhance their financial stability, as changes in the capital explains about a relationship between on principal

structure are believed to lead to changes in firm value (Fahmi, (shareholders) and agent (manager). Shareholders trust and

2014). According to Ayuningrum (2017), Natalia et al. (2021) give managers responsibility to manage the company to

and Yurianda & Masdupi (2019) revealed that capital structure achieve desired goals. However, it’s not uncommon for

has a positive and significant effect toward the firm value. Putri managers to have other goals or interests that conflict with the

& Rahayuda (2020), Setiadharma & Machali (2017), and Rizki

company's main goals. This condition creates a conflict of

et al. (2018) revealed that capital structure doesn’t affect

interest (Putra and Budiasih, 2017).

toward the firm value.

Intervening variables used to inform the discrepancy of D. Resources-Based Theory

previous studies and to refine previous studies so that the According to Ulum (2009), companies can increase their

results are more accurate. The mediating variable used in this competitive advantage by developing resources to guide them

study is profitability. This is because the information from this to create value. In the long term, companies can increase their

variable is needed by many parties like shareholders, creditors, ability to invest in intellectual resources. In this case, human

and other external parties. According to Claudia et al. (2021) resources as a key factor in increasing the value of the

found that profitability can mediate the effect of intellectual company. According to Belkaoui (2007), a possible strategy

capital toward firm value. Putri et al. (2019) found that for improving company performance is to combine tangible

profitability doesn’t mediate the effect of intellectual capital and intangible assets.

toward the firm value. According to Nurkin et al. (2017)

revealed that profitability can mediate the effect of institutional E. Firm Value

ownership toward the firm value. Zahro (2019), on the other According to Wiyono and Kusuma (2017:69) states that

hand, found that profitability didn’t mediate the impact of firm value represents how well management manages its

institutional ownership toward the firm value. According to assets. This can be seen from the financial performance that

Ayuningrum (2017) revealed that profitability can mediate the has been obtained or often associated with the stock price in

impact of capital structure toward the firm value. On the other the capital market. The more investors who invest, the stock

hand, Riny et al. (2019) found that profitability doesn’t mediate

price will increase, and the value of the company will also

the impact of capital structure toward the firm value.

increase.

There are differences in the results of previous studies.

This difference indicates a research gap that leaves room for According to Brigham and Houston (2009:111), Price to

researchers to study firm value. This study uses the observation Book Value ratio is used to measure the firm value. The higher

period from 2018 to 2021 as a differentiator from previous the PBV achieved, the more confidence the market believes

studies. Furthermore, studies using intellectual capital as an the prospects in company. This ratio provides the information

independent variable are limited. The purpose of this study is a shareholder needs to assess how many times the price level

to analyze and determine the impact of intellectual capital, per share is above book value.

institutional ownership, and capital structure on firm value

through profitability as a mediating variable.

IJISRT23FEB157 www.ijisrt.com 367

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

F. Intellectual Capital In this study, profitability is measured by Return on

According to Klein and Prusak in Brooking (1997), Assets (ROA). Return on Assets shows the result (profit

intellectual capital is material gathered, collected, and used to margin) of the total assets used by the company. The smaller

create higher levels of wealth. According to Stewart (1997), this ratio, the worse, and vice versa (Kasmir, 2017:202).

intellectual capital refers to “packaged and useful knowledge”.

According to Brooking (1996), intellectual capital is a III. RESEARCH METHOD

combination of intangible assets that make a company work

(Ulum, 2009). Causal research methods used in this study to describes

certain causal and influence relationships based on a theoretical

The method developed by Pulic in 1997, namely the framework study. In causal research design there are

Value-Added Intellectual Coefficient (VAIC), provides influencing variables. This research was performed to examine

information about the efficiency of added value of a company's the causality between on intellectual capital, institutional

tangible and intangible assets. This method is relatively simple ownership, and capital structure on firm value with profitability

and very feasible, because it’s made from the accounts that’s as a mediating variable.

available on the financial statements (like balance sheet, profit

and loss).

G. Institutional Ownership

According to Alamsyah and Muchlas (2018) state that

institutional ownership is the percentage of equity ownership

held by institutional investors. Institutions as shareholders are

believed to be better able to detect errors when they occur. It’s

believed that institutional investors more capable of

monitoring the behavior of management than the individual

investors.

High institutional ownership leads to increased scrutiny

by institutional investors to curb management opportunistic

behavior. The higher the institution's ownership, the more

effective the surveillance. Good internal oversight also affects Fig 2. Research Framework

shareholder wealth (Sutrisno and Sari, 2020).

A. Research Variables

The variables used in this study are:

H. Capital Structure

1) Dependent variable: Firm Value (PBV).

According to Brigham and Erhardt (2020:547) all

2) Independent variable:

businesses need working capital to support their sales. To

a. Intellectual capital (VAIC).

obtain the working capital, it is typically required to be

b. Institutional ownership (INST).

financed as a combination of debt and equity. The combination

c. Capital structure (DER).

is called its capital structure. Managers need to make

3) Intervening variable: Profitability (ROA).

appropriate capital structure decisions designed to maximize

shareholder value. It is very important for companies to

B. Population

enhance their financial stability, as changes in the capital

The population in this study are all food and beverages

structure are believed to lead to changes in firm value (Fahmi, companies registered on the IDX for period 2018 to 2021 with

2014). the total are 22 companies.

This study uses the Debt-to-Equity Ratio (DER) to C. Sample

measure capital structure. This ratio is used to measure the This study uses a purposive sampling method based on

ratio of total debt to total equity (Febriani, 2020). the following criteria:

I. Profitability Criteria Number

According to Kasmir (2017:196) profitability is used to F&B companies registered on the IDX for period 22

assess a company's ability to generate profits. While the 2018-2021

metrics discussed so far provide useful indicators of a F&B companies release financial reports for (0)

company's operational efficiency, profitability metrics period 2018-2021

continue to demonstrate the combined effects of asset F&B companies that lost in the period 2018-2021 (5)

management, liquidity, and debt on performance (Brigham Total samples 17

and Erhardt, 2020:452) Table 1. Sample Criteria

IJISRT23FEB157 www.ijisrt.com 368

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

IV. RESULT AND DISCUSSION

A. Descriptive Statistical Analysis

Descriptive statistical analysis will describe the data values for each variable used in this study. The data includes min, max,

mean, and std. deviation.

X1_VAIC X2_INST X3_DER Z_ROA Y_PBV

Mean 3.106824 0.667257 0.657382 0.098887 3.301474

Median 2.672450 0.766500 0.513750 0.092350 2.154900

Maximum 7.268300 0.920100 1.766400 0.416300 25.86390

Minimum 1.500800 0.000000 0.076800 0.000500 0.296400

Std. Dev. 1.415524 0.245798 0.427469 0.076588 4.548700

Observations 68 68 68 68 68

Table 2. Descriptive Statistical result

The following is research data that has been analyzed

descriptively: Effects Test Statistic d.f. Prob.

Intellectual capital (VAIC) variable has a mean value

greater than its standard deviation (3.106824 > 1.415524). Cross-section F 5.799039 (16,48) 0.0000

This indicates that the data is less varied or relatively Cross-section Chi-square 73.170054 16 0.0000

homogeneous. The maximum and minimum values

obtained are 7.268300 and 1.500800 respectively. Table 4. Chow Test Result for 2nd Regression

Institutional ownership (INST) variable has a mean value

bigger than its standard deviation (0.667257 > 0.245798). The test results in Tables 3 and 4 show that probability

This indicates that the data is less varied or relatively values for the two regression models have a cross-section F

homogeneous. The maximum and minimum values value of 0.0000 and a cross-section Chi-square value of

obtained are 0.920100 and 0.000000 respectively. 0.0000. This indicates that the value is below the 0.05

Capital structure (DER) variable has a mean value bigger significance level. From this, we can conclude that the fixed

than its standard deviation (0.657382 > 0.427469). This effect model is better to use than the common effect model.

indicates that the data is less varied or relatively

homogeneous. The maximum and minimum values

obtained are 1.766400 and 0.076800 respectively. Test Summary Chi-Sq.Statistic Chi-Sq. d.f. Prob.

Profitability (ROA) variable has a mean value bigger than

its standard deviation (0.098887 > 0.076588). This Cross-section

indicates that the data is less varied or relatively random 8.906552 4 0.0635

homogeneous. The maximum and minimum values

obtained are 0.416300 and 0.005000 respectively. Table 5. Hausman Test Result for 1st Regression

Firm value (PBV) variable has a mean value lower than its

standard deviation (3.301474 < 4.548700). This indicates

that the data is quite varied relatively heterogeneous. The Test Summary Chi-Sq.Statistic Chi-Sq. d.f. Prob.

maximum and minimum values obtained are 25.86390 and

0.296400 respectively. Cross-section

random 4.201600 3 0.2405

B. Panel Data Regression Analysis Result

The regression equation for the panel data used in this Table 6. Hausman Test Result for 2nd Regression

study is:

PBV = α1 + b1VAIC + c1INST + d1DER + e1ROA + ε1 The test results in Tables 5 and 6 show that probability

ROA = α2 + b2VAIC + c2INST + d2DER + ε2 values for the two regression models have cross-section

random values of 0.2405 and 0.0635, respectively This

Several steps of tests, including Chow test, Hausman test, indicates that the value is greater than the 0.05 significance

and Lagrange Multiplier test, were performed to select an level. From this, we can conclude that the random effect model

appropriate model to use for panel data regression. is better to use than the fixed effect model.

Effects Test Statistic d.f. Prob. Cross-section Time Both

Cross-section F 16.352684 (16,47) 0.0000 Breusch-Pagan 41.87356 1.128133 43.00170

Cross-section Chi-square 127.978548 16 0.0000 (0.0000) (0.2882) (0.0000)

Table 3. Chow Test Result for 1st Regression Table 7. Lagrange Multiplier Test Result for 1st Regression

IJISRT23FEB157 www.ijisrt.com 369

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Cross-section Time Both Variable Coefficient Std. Error t-Statistic Prob.

Breusch-Pagan 24.17607 1.416840 25.59291 Regression 1

(0.0000) (0.2339) (0.0000) X1_VAIC -1.240922 0.324186 -3.827805 0.0003

X2_INST -2.328608 2.087719 -1.115384 0.2689

Table 8. Lagrange Multiplier Test Result for 2nd Regression X3_DER 2.746862 0.705446 3.893793 0.0002

Z_ROA 48.99985 5.464078 8.967634 0.0000

Test results in Tables 7 and 8 show that the cross-section Regression 2

values for the two regression models are 0.0000 and 0.0000, X1_VAIC 0.049253 0.004118 11.95969 0.0000

respectively. This indicates that the value is below the 0.05 X2_INST 0.111448 0.034765 3.205734 0.0021

significance level. From this, we can conclude that the random X3_DER -0.008525 0.014753 -0.577852 0.5654

effect model is better to use than the common effect model.

Table 11. T-Statistical Test Result

C. R-Square Test Result

For the first panel regression produces an adjusted R- Effect of Intellectual Capital (VAIC) on Firm Value (PBV)

squared value of 0.673507 (67.35%). This means that the Intellectual capital has a coefficient value of -1.240922

effect of the variables in this study is 67.35%, and the and a probability value of 0.0003, it means that H1 is rejected.

remaining 32.65% is affected by other variables outside of this From this we can conclude that intellectual capital has a

study. The panel regression model has a Prob (F-Statistic) negative and significant effect toward the firm value in food

value of 0.0000 < 0.05. This means that VAIC, INST and DER and beverages companies for period 2018-2021.

together have a significant effect on ROA.

The results of this study show that firm value decreases

as intellectual capital increases. The VAIC calculation consists

Weighted Statistics of three main components. There are Value Added Capital

Employed (VACA), Value Added Human Capital (VAHU)

Root MSE 1.132841 R-squared 0.652313 and Structural Capital Value Added (STVA).

Mean dependent var 0.791177 Adjusted R-squared 0.630238

S.D. dependent var 1.935495 S.E. of regression 1.176937 From three elements that provide high value come from

the VAHU component. VAHU shows how much value-added

Sum squared resid 87.26634 F-statistic 29.54941

is obtained from the fund spent by the company for employees.

Durbin-Watson stat 1.403286 Prob(F-statistic) 0.000000

Companies that budget high labor costs expect a high level of

added value from their employees. However, a high budget

Table 9. R-Square Test Result for 1st Regression

that is not compensated for by training reduces employee

productivity. Unproductive employees and high workloads

As for the second panel regression model produces an

devalue a company.

adjusted R-squared value of 0.630238 (63.02%). This means

that the effect of the variables in this study is 63.02%, and the

The component that gives the lowest value is the VACA.

remaining 36.98% is affected by other variables outside of this

The components of VACA consist of equity value and net

study. The panel regression model has a Prob (F-Statistic)

income. In fact, the market and investors prefer one of three

value of 0.0000 < 0.05. This means that VAIC, INST, DER

elements of intellectual capital, namely VACA, as their

and ROA together have a significant effect on PBV.

consideration in providing value to the company.

Theoretically, intellectual capital affects corporate value.

Weighted Statistics However, the results of the research that has been conducted

reveal that the market and investors don’t appreciate

Root MSE 0.027279 R-squared 0.688126 companies that have high intellectual capital values. Thus,

Adjusted R- with high intellectual capital companies cannot increase the

Mean dependent var 0.038569 squared 0.673507 value of their companies.

S.D. dependent var 0.049211 S.E. of regression 0.028119

Sum squared resid 0.050603 F-statistic 47.07043 The results of this study support research performed by

Durbin-Watson stat 1.307713 Prob(F-statistic) 0.000000 Marwa et al. (2017) and Anggraini et al. (2020) which shows

that intellectual capital has a negative and significant effect

Table 10. R-Square Test Result for 2nd Regression toward the firm value.

D. T-Statistical Test Result Effect of Institutional Ownership (INST) on Firm Value

A t-statistical test can show how the independent variable (PBV)

independently can explains the variation in the dependent Institutional ownership has a coefficient value of -

variable. If the Prob. value is less than 0.05, it means the 2.328608 and a probability value of 0.2689, it means that H2

independent variable partially affect the dependent variable is rejected. From this we can conclude that institutional

(Ghozali, 2018:98). Below are the results of the t-test in this ownership has no effect toward the firm value in food and

study. beverages companies for period 2018-2021.

IJISRT23FEB157 www.ijisrt.com 370

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

The results of this study show that increasing institutional significant effect toward the firm value in food and beverages

ownership doesn’t affect firm value. It doesn’t support agency companies for period 2018-2021.

theory. The results of this study show that institutional

investors tend to compromise management and often ignore The results of this study show that whenever profitability

the interests of minority shareholders as institutional increases, so does corporate value. The results of this study are

ownership increases. The assumption that management tends consistent with signaling theory. If profitability improves, firm

to take actions and strategies often leading to personal gain value will increase significantly. Profitability is a very

leads to alliance strategies between institutional investors and important metric for business owners. Good profitability

management. growth suggests that the outlook for the company is also good.

This is because it offers the potential to increase the company's

Institutional investors are temporary owners, so they only profits, increases investor confidence, and makes it easier for

look at ongoing profits. Changes in current income may affect management to attract capital in the form of equity. If there is

the decision-making of institutional investors. If this change is an increase in the stock price of a company, it will increase the

perceived to be unfavorable to investors, investors may value of the company.

withdraw their shares. Institutional investors hold large

amounts of shares, so share withdrawals affect the total The results of this study support research performed by

amount of shares. This means that institutional ownership Salim & Aulia (2021) and Salim & Susilowati (2019) which

cannot be a mechanism for increasing corporate value. show that profitability has a positive and significant effect

toward the firm value.

Stewardship theory is more suitable for explaining this

study results. Stewardship theory is based on psychology and Effect of Intellectual Capital (VAIC) on Profitability

sociology developed to motivate managers to act according to (ROA)

the wishes of their superiors. The level of institutional Intellectual capital has a coefficient value of 0.049253 and

ownership doesn't influence management behavior in a probability value of 0.0000, it means that H5 is accepted.

increasing shareholder value. From this we can conclude that intellectual capital has a

positive and significant effect toward the profitability in food

The results of this study support research performed by and beverages companies for period 2018-2021.

Astuti et al. (2018) and Nurkhin et al. (2017) which show that

institutional ownership has no effect toward the firm value. The results of this study show that profitability increases

as intellectual capital increases. The results of this study

Effect of Capital Structure (DER) on Firm Value (PBV) support the resource-based theory that firms must be able to

Capital structure has a coefficient value of 2.746862 and manage both tangible and intangible assets to achieve good

a probability value of 0.0002, it means that H3 is accepted. profitability. The results of this study show that value creation

From this we can conclude that capital structure has a positive has been thought of as a concept of profitability in terms of a

and significant effect toward the firm value in food and firm's ability to increase profits in its operations.

beverages companies for period 2018-2021.

The results of this study support research performed by

The results of this study show that whenever the capital Yustyarani & Yuliana (2020) which shows that intellectual

structure increases, so does the firm's value. The results of this capital has a positive and significant effect toward the

study support the pecking order theory that companies prefer profitability.

internal funding, from the company's operating income in the

form of retained earnings. When debt capital is required, the Effect of Institutional Ownership (INST) on Profitability

company first issues the safest securities. First issue bonds, (ROA)

then option securities, and finally new shares if insufficient. Institutional ownership has a coefficient value of

0.111448 and a probability value of 0.0021, it means that H6

Managers are valued for providing better initial is accepted. From this we can conclude that institutional

information. Therefore, the market studies the behavior of ownership has a positive and significant effect toward the

managers. The pecking order theory explains that companies profitability in food and beverages companies for period 2018-

that have more profits have less debt. It’s not because the 2021.

company has a low target leverage ratio, but because the

company doesn’t require external funding. The results of this study show that as institutional

ownership increases, so does profitability. Agency theory

The results of this study support research performed by views the behavior of institutional wealth variables as having

Ayuningrum (2017) and Suzulia et al. (2020) which show that an impact on profitability. This theory explains the gap

capital structure has a positive and significant effect toward between principals and agents because of conflicts of interest.

the firm value. This conflict-of-interest results in agency costs, which must be

borne by the company.

Effect of Profitability (ROA) on Firm Value (PBV)

Profitability has a coefficient value of 48.99985 and a Increasing institutional ownership ensures institutional

probability value of 0.0000, it means that H4 is accepted. From oversight of management activities. Performance can be

this we can conclude that profitability has a positive and measured by the amount of profit generated by the business

IJISRT23FEB157 www.ijisrt.com 371

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

over a period. Management seeks to generate high profits so This profitability plays an important role in the

that its position is not threatened because of the consequences development of the company, the better the company

that management will suffer if it takes any action that may performs, the higher the profit it will generate in the future.

harm its clients. Therefore, the higher the ownership ratio of Based on signal theory, profitability is used as a corporate

the organization, the higher the profitability. signal to attract investors to invest which positively affects the

firm value.

The results of this study support research performed by

Ali (2019) which shows that institutional ownership has a The results of this study support research performed by

positive and significant effect toward the profitability. Claudia et al. (2021) which shows that profitability is capable

to mediate the effect of intellectual capital toward the firm

Effect of Capital Structure (DER) on Profitability (ROA) value.

Capital structure has a coefficient value of -0.008525 and

a probability value of 0.5654, it means that H7 is rejected. Effect of Institutional Ownership on Firm Value Mediated

From this we can conclude that capital structure has no effect by Profitability

toward the profitability in food and beverages companies for The direct effect of institutional ownership on firm value

period 2018-2021. is -2.328608. Meanwhile, the indirect effect of institutional

ownership through profitability on firm value is 5.4609. The

The results of this study show that increasing capital results of this study show that the indirect effect is greater than

structure doesn’t affect profitability. The higher the capital the direct effect, it means that profitability as an intervening

structure a company deploys, the more funds it deploys to variable can mediate the effect of institutional ownership

support the company's performance. In other words, a toward the firm value.

company cannot become more profitable simply by changing

the debt-to-equity ratio used to finance the company. The role of institutional ownership in minimizing

institutional conflict. The existence of this agency competition

According to trade-off theory, the more a company is can result in agency fees for the company. One of his ways to

debt-financed, the higher the risk that it will default on its debts reduce agency costs is to increase agency ownership. The size

by paying fixed interest rates that are too high, and these of institutional ownership determines the company's

defaults will never be repaid. continuity, which influences the company's performance in

achieving its goals by maximizing the firm value. This can be

The results of this study support research performed by done through the control they have.

Sukmayanti & Triaryati (2019) and Nurlela & Dimyati (2021)

which show that capital structure has no effect toward the The value of a company can be considered good if it also

profitability. has good performance. The financial performance of a

company can be measured by profitability indicators that show

E. Sobel Test the efficiency of the business activities carried out by the

Below are the results of the Sobel test in this study. company.

t-Count t-Table Based on signal theory, high financial performance is

VAIC – ROA -PBV 7.155534 1.99834 associated with good company prospects, allowing investors

INST - ROA - PBV 3.001724 1.99834 to increase the number of shares requested. As the number of

DER – ROA - PBV -0.572653 1.99834 requests for shares increases, so does the value of the

Table 12. Sobel Test Result company. Strong financial performance signals from

managers to shareholders encourage investors to invest more

Effect of Intellectual Capital on Firm Value Mediated by in the company, increasing demand for the company's stock

Profitability and increasing the firm value.

The direct effect of intellectual capital on firm value is -

1.240922. Meanwhile, the indirect effect of intellectual capital The results of this study support research performed by

through profitability on firm value is 2.4134. The results of Nurkhin et al. (2017) which shows that profitability is capable

this study show that the indirect effect is greater than the direct to mediate the effect of institutional ownership toward the firm

effect, it means that profitability as an intervening variable can value.

mediate the effect of intellectual capital toward the firm value.

Effect of Capital Structure on Firm Value Mediated by

Maximizing the use of intellectual capital improves the Profitability

productivity and quality of a company. This increases the The direct effect of the capital structure variable on firm

effectiveness of the company's income. Investors choose to value is 2.746962. Meanwhile, the indirect effect of capital

allocate their funds to companies that offer guaranteed returns. structure through profitability on firm value is -0.4177. The

A steady increase in corporate profits can increase the results of this study show that the indirect effect is smaller than

corporate value reflected in the stock price. the direct effect, it means that profitability as an intervening

variable cannot mediate the effect of capital structure toward

the firm value.

IJISRT23FEB157 www.ijisrt.com 372

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Profitability affects capital structure as sufficient capital REFERENCES

generates high returns. On the other hand, the less capital a

company has, the harder it is to make a profit. Profitability also [1]. Alamsyah, A. R., & Muchlas, Z. (2018). Pengaruh

affects the value of the business. Signal theory suggests that Struktur Kepemilikan, Struktur Modal, dan Ios terhadap

high profitability is associated with good business prospects, Nilai Perusahaan dengan Kebijakan Dividen sebagai

prompting investors to increase demand for the stock. An Variabel Intervening pada Perusahaan Manufaktur

increase in demand for the stock increases the value of the Terdaftar di Bei. Jurnal Ilmiah Bisnis Dan Ekonomi Asia,

company. Profitability is one of the factors affecting the firm 12(1), 9-16. https://doi.org/10.32812/jibeka.v12i1.5.

value. [2]. Ali, M. (2019). Pengaruh Kepemilikan Institusional,

Kepemilikan Saham Publik, Umur Perusahaan, Dan

The results of this study support research performed by Ukuran Perusahaan Terhadap Profitabilitas Dengan

Erawati & Dewi (2019) and Amelia & Anhar (2019) which Jumlah Bencana Alam Sebagai Moderasi. Jurnal

show that profitability is unable to mediate the effect of capital Magister Akuntansi Trisakti, 6(1), 71-94.

structure toward the firm value. http://dx.doi.org/10.25105/jmat.v6i1.5068.

[3]. Amelia, F., & Anhar, M. (2019). Pengaruh Struktur

V. CONCLUSION AND SUGGESTION Modal dan Pertumbuhan Perusahaan terhadap Nilai

Perusahaan dengan Profitabilitas Sebagai Variabel

From the study performed regarding the effect of Intervening. Jurnal STEI Ekonomi, 28(01), 44-70.

intellectual capital, institutional ownership, capital structure https://doi.org/10.36406/jemi.v28i01.260.

toward the firm mediated by profitability, in the food and [4]. Anggraini, F., Seprijon, Y.P., & Rahmi, S. (2020).

beverages companies registered on the IDX in 2018 to 2021, Pengaruh Intellectual Capital Terhadap Nilai Perusahaan

the following conclusions are obtained: (1) intellectual capital Dengan Financial Distress Sebagai Variabel Intervening.

has a negative and significant effect toward the firm value; (2) Jurnal Informasi, Perpajakan, Akuntansi, Dan Keuangan

institutional ownership has no effect toward the firm value; (3) Publik, 15(2), 169-190.

capital structure has a positive and significant effect toward http://dx.doi.org/10.25105/jipak.v15i2.6263.

the firm value; (4) profitability has a positive and significant [5]. Astuti, F. Y., Wahyudi, S., & Mawardi, W. (2018).

effect toward the firm value; (5) intellectual capital has a Analysis of Effect of Firm Size, Institutional Ownership,

positive and significant effect toward the profitability; (6) Profitability and Leverage on Firm Value With

institutional ownership has a positive and significant toward Corporate Social Responsibility (CSR) Disclosure as

the firm value; (7) capital structure has no effect toward the Intervening Variable. Jurnal Bisnis Strategi, 27(2), 95-

profitability; (8) profitability is capable to mediate the effect 109. http://dx.doi.org/10.14710/jbs.27.2.95-109.

of intellectual capital toward the firm value; (9) profitability is [6]. Ayuningrum, N. (2017). Pengaruh Struktur Modal,

capable to mediate the effect of institutional ownership toward Pertumbuhan Perusahaan Terhadap Nilai Perusahaan

the firm value; (10) profitability is unable to mediate the effect Dengan Profitabilitas Sebagai Variabel Intervening Pada

of capital structure toward the firm value. Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek

Indonesia. Jurnal Riset Terapan Akuntansi, 1(1), 53-59.

Investors considering investing in food and beverage https://doi.org/10.5281/zenodo.3840869.

companies should pay attention to the management of [7]. Barney, Jay. (1991). Firm Resources and Sustained

intellectual capital within the company. An example of poor Competitive Advantage. Journal of Management, 17(1),

intellectual capital management is allocating excessive 99-120. https://doi.org/10.1177/014920639101700108.

budgets to employees and not being compensated for by [8]. Belkaoui, AR (2007). Accounting Theory. 5th Edition.

employee training. This leads to unproductive employees, Book 2. Translated Edition. Jakarta: Salemba Empat.

higher labor costs, and lower company value. Furthermore, [9]. Brigham, Eugene F dan Joel F Houston. (2009).

investors are not necessarily interested in investing in Fundamentals of Financial Management: Dasar-Dasar

companies with high institutional ownership, as institutional Manajemen Keuangan, Edisi 10. Salemba Empat.

ownership without a prudent stance can be detrimental to Jakarta.

investors. Investors should pay attention to the composition of [10]. Brigham, Eugene F., Ehrhardt, Michael C. (2020).

the company's capital structure. Companies need to be able to Financial Management : Theory & Practice. Cengage

find the right funding mix to achieve the optimal capital Learning. USA South Western.

structure that directly impacts enterprise value. Investors [11]. Brooking, A. 1996. Intellectual Capital: Core Assets for

should pay attention to the profitability on company. Profitable the Third Millennium. Enterprise Thomson Business

companies can offer large returns to their investors. Press London. United Kingdom.

[12]. Brooking, A. 1997. Intellectual Capital. International

On the other hand, the company's management should Thomson Business Press. London.

strengthen the supervision of intellectual capital, including the [13]. Claudia, V., Gustiawaty, F., & Joko, T. (2021). Pengaruh

development of science and education, improve the Intellectual Capital, Intellectual Capital Disclosure (ICD)

professional knowledge and skills of employees, and bring Terhadap Nilai Perusahaan Dengan Profitabilitas

high profit or profit to the company. And to gain investor Sebagai Variabel Intervening. Jurnal Pendidikan

interest and confidence in the capital markets, management of Akuntansi Indonesia, 19(2), 59-70.

companies with high institutional ownership will need to make http://dx.doi.org/10.21831/jpai.v19i2.43380.

more prudent decisions.

IJISRT23FEB157 www.ijisrt.com 373

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[14]. Deegan, C. (2004). Financial Accounting Theory. [28]. Olarewaju, O. M., & Msomi, T. S. (2021). Intellectual

McGraw-Hill Book Company. Sydney. capital and financial performance of South African

[15]. Dimyati, L. (2021). Pengaruh Struktur Modal Terhadap development community’s general insurance companies.

Profitabilitas Pada Perusahaan Yang Terdaftar di Jakarta Heliyon, 7(4).

Islamic Index 70. Jurnal Aktiva: Riset Akuntansi dan https://doi.org/10.1016/j.heliyon.2021.e06712.

Keuangan, 3(3), 119-128. [29]. Putra, G. M. P. D., & Wirawati, N. G. P. (2020).

https://doi.org/10.52005/aktiva.v3i3.121. Pengaruh Good Corporate Governance pada Nilai

[16]. Erawati, L., & Dewi, A. S. (2019). Peran Profitabilitas Perusahaan dengan Kinerja Keuangan sebagai Variabel

Sebagai Variabel Interverning Dan Pengaruh Struktur Mediasi. E-Jurnal Akuntansi, 30(2), 388-402.

Modal Terhadap Nilai Perusahaan. INA-Rxiv Papers. https://doi.org/10.24843/EJA.2020.v30.i02.p09.

https://doi.org/10.31227/osf.io/tnybp. [30]. Putra, I. P. D. P., & Budiasih, I. G. A. N. (2017).

[17]. Fahmi, Irham. (2014). Analisa Kinerja Keuangan. Pengaruh Karakteristik Perusahaan dan Kepemilikan

Alfabeta. Bandung. Institusional Pada Nilai Perusahaan dengan CSR sebagai

[18]. Febriani, R. (2020). Pengaruh Likuiditas Dan Leverage Variabel Intervening. E-Jurnal Akuntansi, 21(2), 1263-

Terhadap Nilai Perusahaan Dengan Profitabilitas 1289. https://doi.org/10.24843/EJA.2017.v21.i02.p15.

Sebagai Variabel Intervening. Progress: Jurnal [31]. Putri, A. J., Agustin, H., & Helmayunita, N. (2019).

Pendidikan, Akuntansi Dan Keuangan, 3(2), 216-245. Pengaruh intellectual capital terhadap nilai perusahaan

https://doi.org/10.47080/progress.v3i2.943. dengan profitabilitas sebagai variabel intervening. Jurnal

[19]. Ghozali, Imam. (2018). Aplikasi Analisis Multivariate Eksplorasi Akuntansi, 1(3), 1541-1555.

Dengan Program IBM SPSS 25, Edisi 9. Badan Penerbit https://doi.org/10.24036/jea.v1i3.161.

Universitas Diponegoro. Semarang. [32]. Riny, Natasha, S. E., & Firza, S. U. (2022). Peran

[20]. Jensen, M. C., & Meckling, W.H. (1976). Theory of The Profitabilitas dalam Memediasi Pengaruh Corporate

Firm: Managerial Behavior, Agency Costs and Governance dan Leverage Terhadap Nilai Perusahaan.

Ownership Structure. Journal Of Financial Economics 3, Jurnal Wira Ekonomi Mikroskil, 12(1), 37-44.

pages 305-360. https://doi.org/10.55601/jwem.v12i1.872.

[21]. Kasmir. (2017). Analisis Laporan Keuangan. Rajawali [33]. Rizki, A., Lubis, A. F., & Sadalia, I. (2018). The

Pers. Jakarta. influence of capital structure to the firm value with

[22]. Lestari, N., & Sapitri, R. C. (2016). Pengaruh intellectual profitability as intervening variables. KnE Social

capital terhadap nilai perusahaan. Jurnal Akuntansi, Sciences, 2018, 220-230.

Ekonomi dan Manajemen Bisnis, 4(1), 28-33. https://doi.org/10.18502/kss.v3i10.3375.

https://doi.org/10.30871/jaemb.v4i1.81. [34]. Salim, M. N., & Aulia, S. (2021). Analysis Determinant

[23]. Listiyowati, I. I., & Indarti, I. U. (2018). Analisis of Dividend Payout Ratio and Its Impact to the Firm

Pengaruh Good Corporate Governance Terhadap Nilai Value (Empirical Study on Food and Beverages Industry

Perusahaan dengan Profitabilitas Sebagai Variabel Issuer 2016-2019). International Journal of Engineering

Intervening (Studi Empiris Pada Perusahaan Kontruksi Technologies and Management Research, 8(9), 46-59.

Yang Terdaftar Di BEI Tahun 2014-2017). Jurnal Sosial https://doi.org/10.29121/ijetmr.v8.i9.2021.1017.

Ekonomi dan Humaniora (JSEH), 4(2), 1-16. [35]. Salim, M. N., & Susilowati, R. (2019). The Effect of

[24]. Lukman, H., & Tanuwijaya, H. (2021). The Effect of Internal Factors on Capital Structure and Its Impact on

Financial Performance and Intellectual Capital on Firm Firm Value: Empirical Evidence From The Food and

Value with CSR as a Mediating Variable in Banking Beverages Industry Listed on Indonesia Stock Exchange

Industry. Ninth International Conference on 2013-2017. International Journal of Engineering

Entrepreneurship and Business Management (ICEBM Technologies and Management Research, 6(7), 173-191.

2020), 353-359. https://doi.org/10.5281/zenodo.3359550.

https://dx.doi.org/10.2991/aebmr.k.210507.054. [36]. Salvi, A., Vitolla, F., Giakoumelou, A., Raimo, N., &

[25]. Marwa, A., Isynuwardhana, D., & Nurbaiti, A. (2017). Rubino, M. (2020). Intellectual capital disclosure in

Intangible asset, profitabilitas, dan sustainability report integrated reports: The effect on firm value.

terhadap nilai perusahaan. Jurnal Riset Akuntansi Technological Forecasting and Social Change, 160,

Kontemporer, 9(2), 79-87. 120228. https://doi.org/10.1016/j.techfore.2020.120228.

https://doi.org/10.23969/jrak.v9i2.582. [37]. Setiadharma, S., & Machali, M. (2017). The effect of

[26]. Natalia, C., Purnama, E. D., & Tampubolon, L. D. asset structure and firm size on firm value with capital

(2021). Mediation Effects Of Capital Structure And structure as intervening variable. Journal of Business &

Profitability On The Influence Of Sales Growth On Firm Financial Affairs, 6(4), 1-5.

Value In Consumer Goods Companies. Primanomics: https://doi.org/10.4172/2167-0234.1000298.

Jurnal Ekonomi & Bisnis, 19(3), 21-34. [38]. Soewarno, N., & Ramadhan, A. H. A. (2020). The effect

https://doi.org/10.31253/pe.v19i3.633. of ownership structure and intellectual capital on firm

[27]. Nurkhin, A., Wahyudin, A., & Fajriah, A. S. A. (2017). value with firm performance as an intervening variable.

Relevansi struktur kepemilikan terhadap profitabilitas International Journal of Innovation, Creativity and

dan nilai perusahaan barang konsumsi. Jurnal Akuntansi Change, 10(12), 215-236.

Multiparadigma, 8(1), 35-46.

http://dx.doi.org/10.18202/jamal.2017.04.7038.

IJISRT23FEB157 www.ijisrt.com 374

Volume 8, Issue 2, February – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[39]. Spence, Michael. (1973). Job Market Signaling. The

Quarterly Journal of Economics, 87(3), pp. 355-374.

[40]. Stewart, T.A. (1997). Intellectual Capital. Nicholas

Brealey Publishing. London.

[41]. Subaida, I., Nurkholis, N., & Mardiati, E. (2018). Effect

of intellectual capital and intellectual capital disclosure

on firm value. Jurnal Aplikasi Manajemen, 16(1), 125-

135. http://dx.doi.org/10.21776/ub.jam.2018.016.01.15.

[42]. Sukmayanti, N. W. P., & Triaryati, N. (2019). Pengaruh

Struktur Modal, Likuiditas Dan Ukuran Perusahaan

Terhadap Profitabilitas Pada Perusahaan Property Dan

Real Estate. E-Jurnal Manajemen, 8(1), 172-202.

https://doi.org/10.24843/EJMUNUD.2019.v8.i1.p7.

[43]. Sutrisno, & Sari, L. R. (2020). Pengaruh Struktur

Kepemilikan Terhadap Nilai Perusahaan Dengan

Profitabilitas Sebagai Variabel Intervening Studi Pada

Sektor Property dan Real Estate. EQUILIBRIUM: Jurnal

Ilmiah Ekonomi dan Pembelajarannya, 8(2), 115-126.

http://doi.org/10.25273/equilibrium.v8i2.7109.

[44]. Suzulia, M. T., & Saluy, A. B. (2020). The effect of

capital structure, company growth, and inflation on firm

value with profitability as intervening variable (study on

manufacturing companies listed on bei period 2014-

2018). Dinasti International Journal of Economics,

Finance & Accounting, 1(1), 95-109.

https://doi.org/10.38035/dijefa.v1i1.226.

[45]. Triyani, W., Mahmudi, B., & Rosyid, A. (2018).

Pengaruh Pertumbuhan Aset Terhadap Nilai Perusahaan

Dengan Profitabilitas Sebagai Variabel Intervening

(Studi Empiris Perusahaan Sektor Pertambangan Yang

Terdaftar Di Bursa Efek Indonesia Periode 2007-2016).

Tirtayasa Ekonomika, 13(1), 107-129.

http://dx.doi.org/10.35448/jte.v13i1.4213.

[46]. Ulum, Ihyaul. (2009). Intellectual Capital: Konsep dan

Kajian Empiris, Edisi 1. Graha Ilmu. Yogyakarta.

[47]. Wiyono, Gendro., & Kusuma, Hadri. (2017). Manajemen

Keuangan Lanjutan : Berbasis Corporate Value Creation.

STIM YKPN. Yogyakarta.

[48]. Yurianda, D., & Masdupi, E. (2020). The Effect of

Capital Structure and Intellectual Capital on Corporate

Value with Financial Performance as Intervening

Variable. In Proceedings of the 4th Padang International

Conference on Education, Economics, Business and

Accounting (PICEEBA-2 2019), 938-943.

https://dx.doi.org/10.2991/aebmr.k.200305.162.

[49]. Yustyarani, W., & Yuliana, I. (2020). Influence of

intellectual capital, income diversification on firm value

of companies with profitability mediation: Indonesian

banking. Jurnal Dinamika Akuntansi, 12(1), 77-89.

https://doi.org/10.15294/jda.v12i1.25466.

[50]. Zahro, H. (2018). Pengaruh Kepemilikan Institusional

Terhadap Nilai Perusahaan dan Kinerja Keuangan

Sebagai Variabel Intervening. Jurnal Akuntansi

AKUNESA, 6(3)

IJISRT23FEB157 www.ijisrt.com 375

You might also like

- The Influence of Intellectual Capital and Institutional Ownership Towards The Firm Value in Food & Beverages Industries Period 2018-2021Document9 pagesThe Influence of Intellectual Capital and Institutional Ownership Towards The Firm Value in Food & Beverages Industries Period 2018-2021International Journal of Innovative Science and Research TechnologyNo ratings yet

- The Influence of Intellectual Capital Disclosure and Capital Structure On Firm Value in Indonesian's State-Owned CompanyDocument4 pagesThe Influence of Intellectual Capital Disclosure and Capital Structure On Firm Value in Indonesian's State-Owned CompanyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Effect of Intellectual Capital and Profitability On Firm ValueDocument10 pagesThe Effect of Intellectual Capital and Profitability On Firm ValueAJHSSR JournalNo ratings yet

- The Financial Ratios and Institutional Ownership Impact On Healthcare Firm's ValueDocument8 pagesThe Financial Ratios and Institutional Ownership Impact On Healthcare Firm's ValueInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 1 SMDocument10 pages1 SMevander yedijaNo ratings yet

- Correlation Between Social Responsibility and Financial Performance Mediating Role of Real Earning ManagementDocument5 pagesCorrelation Between Social Responsibility and Financial Performance Mediating Role of Real Earning ManagementInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- FAMILY OWNERS JurnalterbitferdyputraDocument11 pagesFAMILY OWNERS JurnalterbitferdyputraEnny HaryantiNo ratings yet

- Enterprise Risk Management, Managerial Ownership and Institutional Ownership On Firm ValueDocument7 pagesEnterprise Risk Management, Managerial Ownership and Institutional Ownership On Firm ValueInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Influence of Financial Performance On Company Value With Capital Structure As A Mediation VariableDocument8 pagesThe Influence of Financial Performance On Company Value With Capital Structure As A Mediation VariableInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 50744-Article Text-156349-1-10-20220217Document8 pages50744-Article Text-156349-1-10-20220217Vira FernandaNo ratings yet

- Document 8Document15 pagesDocument 8Michael AngeloNo ratings yet

- Effect of Firm Size and Capital Structure On The Value of The Company With Profitability As An Intervening VariableDocument11 pagesEffect of Firm Size and Capital Structure On The Value of The Company With Profitability As An Intervening VariableAJHSSR JournalNo ratings yet

- 1195 4166 1 PBDocument11 pages1195 4166 1 PBB2MSudarman IfolalaNo ratings yet

- Intellectual Capital Effect On Financial Performance and Company Value (Empirical Study On Financial Sector Companies Listed On The Indonesia Stock Exchange in 2020)Document11 pagesIntellectual Capital Effect On Financial Performance and Company Value (Empirical Study On Financial Sector Companies Listed On The Indonesia Stock Exchange in 2020)International Journal of Business Marketing and ManagementNo ratings yet

- The Role of Corporate Social Responsibility in Mediating Intellectual Capital Relationships With Financial PerformanceDocument7 pagesThe Role of Corporate Social Responsibility in Mediating Intellectual Capital Relationships With Financial PerformanceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Effect of Business Intelligence and Intellectuals Capital of Company Value Moderated by Management of Profit RiilDocument15 pagesThe Effect of Business Intelligence and Intellectuals Capital of Company Value Moderated by Management of Profit RiilGracia Pulcheria ValentinaNo ratings yet

- Mini Research Report Formulatrix SemarangDocument15 pagesMini Research Report Formulatrix SemarangSari Bionic SevenNo ratings yet

- 26037-Article Text-80803-2-10-20230224Document18 pages26037-Article Text-80803-2-10-20230224Mira AprilianaNo ratings yet

- The Effect of Profitability, Firm Size, and Environmental Performance On Firm Value (Studies in Mining Companies Listed On The Indonesia Stock Exchange in 2017-2020)Document8 pagesThe Effect of Profitability, Firm Size, and Environmental Performance On Firm Value (Studies in Mining Companies Listed On The Indonesia Stock Exchange in 2017-2020)AJHSSR JournalNo ratings yet

- The Effect of Capital Structure and Agency Cost Towards ProfitabilityDocument19 pagesThe Effect of Capital Structure and Agency Cost Towards ProfitabilitySocialis Series in Social ScienceNo ratings yet

- Investment Decisions Funding Decisions and ActivitDocument16 pagesInvestment Decisions Funding Decisions and ActivitGONZALO ANDRE RIVERO MALATESTANo ratings yet

- The Effects of Earnings Management and Audit Quality On Cost of Equity Capital - Empirical Evidence From IndonesiaDocument8 pagesThe Effects of Earnings Management and Audit Quality On Cost of Equity Capital - Empirical Evidence From IndonesiaRISKA DAMAYANTI AkuntansiNo ratings yet

- Effect of Eco-Efficiency and Corporate Social Performance On Firm Value With Financial Performance As Intervening VariablesDocument13 pagesEffect of Eco-Efficiency and Corporate Social Performance On Firm Value With Financial Performance As Intervening VariablesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Capital Structure and InvestmentDocument9 pagesCapital Structure and InvestmentNurcahyonoNo ratings yet

- scipg,+Journal+manager,+JABFR 2020 9 (2) 50 56Document7 pagesscipg,+Journal+manager,+JABFR 2020 9 (2) 50 56Alamin Rahman JuwelNo ratings yet

- Al Hendrani 2021 ROA DER Company Size Comapny ValueDocument13 pagesAl Hendrani 2021 ROA DER Company Size Comapny ValueFitra Ramadhana AsfriantoNo ratings yet

- Jurnal Pendukung 13 (LN)Document16 pagesJurnal Pendukung 13 (LN)Natanael PranataNo ratings yet

- The Role of Ownership's Concentration Moderating Dividend Policy Effects On Firm ValueDocument10 pagesThe Role of Ownership's Concentration Moderating Dividend Policy Effects On Firm ValueZara ShoukatNo ratings yet

- Oktari Et Al 2016 Determinan Modal Intelektual Pada Perusahaan Publik Di Indonesia Dan Implikasinya Terhadap Nilai PerusahaanDocument29 pagesOktari Et Al 2016 Determinan Modal Intelektual Pada Perusahaan Publik Di Indonesia Dan Implikasinya Terhadap Nilai PerusahaanFarrel KunNo ratings yet

- 454-Article Text-1489-1-10-20220715Document10 pages454-Article Text-1489-1-10-20220715firdausman 01No ratings yet

- 133 137 1 PBDocument10 pages133 137 1 PBAyu RamayaniNo ratings yet

- 799 2141 1 SMDocument16 pages799 2141 1 SMDharmendra DclanaNo ratings yet

- Ownership and Management Structure CompanyDocument8 pagesOwnership and Management Structure CompanynamiNo ratings yet

- Value Relevance of Corporate Social Responsibility Disclosure On Public Companies in ASEAN CountriesDocument12 pagesValue Relevance of Corporate Social Responsibility Disclosure On Public Companies in ASEAN CountriesMuttiarni UnismuhNo ratings yet

- Good Corporate Governance Affects Company Value With Earnings Management As Intervening Variables in BUMNDocument9 pagesGood Corporate Governance Affects Company Value With Earnings Management As Intervening Variables in BUMNJunardi NgNo ratings yet

- Journal Ayu Wandari 2015Document14 pagesJournal Ayu Wandari 2015JuliusNo ratings yet

- 325 1171 1 PBDocument10 pages325 1171 1 PBPande R. Aprilyani DewiNo ratings yet

- Publikasi JAMEDocument11 pagesPublikasi JAMEMohamad FirdausNo ratings yet

- Investment Opportunity Set Persistensi Laba Dan FaDocument12 pagesInvestment Opportunity Set Persistensi Laba Dan FaStevenNo ratings yet

- The Effect of Financial Ratios On Capital Structure of Basic Material Firms in IndonesiaDocument10 pagesThe Effect of Financial Ratios On Capital Structure of Basic Material Firms in IndonesiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 3 Gianto Dan Alam 2020Document16 pages3 Gianto Dan Alam 2020Rifqi Nur FahmiNo ratings yet

- The Effect of Institutional Ownership, Capital Structure, Dividend Policy, and Company's Growth On Firm ValueDocument9 pagesThe Effect of Institutional Ownership, Capital Structure, Dividend Policy, and Company's Growth On Firm ValueRinanti DANo ratings yet

- Fixed Asset Revaluation Decision MakingDocument7 pagesFixed Asset Revaluation Decision MakingYosr TliliNo ratings yet

- The Influence of Good Corporate Governance Mechanisms, Liquidity, Firm Size, and Impact of Covid-19 On Firm Value: Financial Performance As Mediation VariableDocument9 pagesThe Influence of Good Corporate Governance Mechanisms, Liquidity, Firm Size, and Impact of Covid-19 On Firm Value: Financial Performance As Mediation VariableAJHSSR JournalNo ratings yet

- Pengaruh Economic Value Added, Market Value Added Dan Profitabilitas Terhadap Harga Saham Perusahaan Manufaktur Yang Terdaftar Di BeiDocument18 pagesPengaruh Economic Value Added, Market Value Added Dan Profitabilitas Terhadap Harga Saham Perusahaan Manufaktur Yang Terdaftar Di Beisiska wulandariNo ratings yet

- 1 PBDocument22 pages1 PBENUNGNo ratings yet

- How Intellectual Capital Effects Firm's Financial PerformanceDocument8 pagesHow Intellectual Capital Effects Firm's Financial PerformanceHendra GunawanNo ratings yet

- The Factors Affecting Financial Performance in Mining Sector Companies 2014-2019 PERIODDocument11 pagesThe Factors Affecting Financial Performance in Mining Sector Companies 2014-2019 PERIODvivipaufNo ratings yet

- The Effect of Political Connection, Intellectual Capital On Firm Value With Corporate Governance As Moderation PDFDocument8 pagesThe Effect of Political Connection, Intellectual Capital On Firm Value With Corporate Governance As Moderation PDFInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Effect of Intellectual Capital and Supply Chain Management On The Financial Performance by Using Cost Leadership Strategy As Moderating VariableDocument11 pagesThe Effect of Intellectual Capital and Supply Chain Management On The Financial Performance by Using Cost Leadership Strategy As Moderating VariableInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Ijerv 10 I 5 So 6 A CEOOverconfidenceDocument14 pagesIjerv 10 I 5 So 6 A CEOOverconfidenceMariam AlraeesiNo ratings yet

- Bunga Ekawati Devi, Khairunnisa, Eddy BudionoDocument12 pagesBunga Ekawati Devi, Khairunnisa, Eddy BudionoSherinudt RynaNo ratings yet

- Artikel JurnalDocument10 pagesArtikel Jurnalyesi anitaNo ratings yet

- KnowledgemanagementDocument18 pagesKnowledgemanagementIndah SariNo ratings yet

- 478-Article Text-1844-1836-10-20231230Document20 pages478-Article Text-1844-1836-10-20231230erikNo ratings yet

- Jurnal TugasDocument6 pagesJurnal TugasPutri Puspa AlkotdriyahNo ratings yet

- 01 Penelitian Bu Rina-Fithri (Inggris)Document17 pages01 Penelitian Bu Rina-Fithri (Inggris)kaka adikNo ratings yet

- Ac 2020 118Document8 pagesAc 2020 118Phạm Bảo DuyNo ratings yet

- Anida Amalia Luthfiah: How To CiteDocument10 pagesAnida Amalia Luthfiah: How To CiteMufti Khoirul Anam MuftiNo ratings yet

- Osho Dynamic Meditation; Improved Stress Reduction in Farmer Determine by using Serum Cortisol and EEG (A Qualitative Study Review)Document8 pagesOsho Dynamic Meditation; Improved Stress Reduction in Farmer Determine by using Serum Cortisol and EEG (A Qualitative Study Review)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Entrepreneurial Creative Thinking and Venture Performance: Reviewing the Influence of Psychomotor Education on the Profitability of Small and Medium Scale Firms in Port Harcourt MetropolisDocument10 pagesEntrepreneurial Creative Thinking and Venture Performance: Reviewing the Influence of Psychomotor Education on the Profitability of Small and Medium Scale Firms in Port Harcourt MetropolisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Impact of Stress and Emotional Reactions due to the Covid-19 Pandemic in IndiaDocument6 pagesImpact of Stress and Emotional Reactions due to the Covid-19 Pandemic in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Influence of Principals’ Promotion of Professional Development of Teachers on Learners’ Academic Performance in Kenya Certificate of Secondary Education in Kisii County, KenyaDocument13 pagesInfluence of Principals’ Promotion of Professional Development of Teachers on Learners’ Academic Performance in Kenya Certificate of Secondary Education in Kisii County, KenyaInternational Journal of Innovative Science and Research Technology100% (1)

- Sustainable Energy Consumption Analysis through Data Driven InsightsDocument16 pagesSustainable Energy Consumption Analysis through Data Driven InsightsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Detection and Counting of Fake Currency & Genuine Currency Using Image ProcessingDocument6 pagesDetection and Counting of Fake Currency & Genuine Currency Using Image ProcessingInternational Journal of Innovative Science and Research Technology100% (9)

- Utilization of Waste Heat Emitted by the KilnDocument2 pagesUtilization of Waste Heat Emitted by the KilnInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Effect of Solid Waste Management on Socio-Economic Development of Urban Area: A Case of Kicukiro DistrictDocument13 pagesEffect of Solid Waste Management on Socio-Economic Development of Urban Area: A Case of Kicukiro DistrictInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Auto Tix: Automated Bus Ticket SolutionDocument5 pagesAuto Tix: Automated Bus Ticket SolutionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Designing Cost-Effective SMS based Irrigation System using GSM ModuleDocument8 pagesDesigning Cost-Effective SMS based Irrigation System using GSM ModuleInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Smart Health Care SystemDocument8 pagesSmart Health Care SystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Overview of Lung CancerDocument6 pagesAn Overview of Lung CancerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Digital Finance-Fintech and it’s Impact on Financial Inclusion in IndiaDocument10 pagesDigital Finance-Fintech and it’s Impact on Financial Inclusion in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Computer Vision Gestures Recognition System Using Centralized Cloud ServerDocument9 pagesComputer Vision Gestures Recognition System Using Centralized Cloud ServerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Ambulance Booking SystemDocument7 pagesAmbulance Booking SystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Unmasking Phishing Threats Through Cutting-Edge Machine LearningDocument8 pagesUnmasking Phishing Threats Through Cutting-Edge Machine LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Cyber Security Awareness and Educational Outcomes of Grade 4 LearnersDocument33 pagesCyber Security Awareness and Educational Outcomes of Grade 4 LearnersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Predictive Analytics for Motorcycle Theft Detection and RecoveryDocument5 pagesPredictive Analytics for Motorcycle Theft Detection and RecoveryInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Forensic Advantages and Disadvantages of Raman Spectroscopy Methods in Various Banknotes Analysis and The Observed Discordant ResultsDocument12 pagesForensic Advantages and Disadvantages of Raman Spectroscopy Methods in Various Banknotes Analysis and The Observed Discordant ResultsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Blockchain Based Decentralized ApplicationDocument7 pagesBlockchain Based Decentralized ApplicationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Industry That Capitalizes Off of Women's Insecurities?Document8 pagesAn Industry That Capitalizes Off of Women's Insecurities?International Journal of Innovative Science and Research TechnologyNo ratings yet

- Study Assessing Viability of Installing 20kw Solar Power For The Electrical & Electronic Engineering Department Rufus Giwa Polytechnic OwoDocument6 pagesStudy Assessing Viability of Installing 20kw Solar Power For The Electrical & Electronic Engineering Department Rufus Giwa Polytechnic OwoInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Compact and Wearable Ventilator System For Enhanced Patient CareDocument4 pagesCompact and Wearable Ventilator System For Enhanced Patient CareInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Visual Water: An Integration of App and Web To Understand Chemical ElementsDocument5 pagesVisual Water: An Integration of App and Web To Understand Chemical ElementsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Factors Influencing The Use of Improved Maize Seed and Participation in The Seed Demonstration Program by Smallholder Farmers in Kwali Area Council Abuja, NigeriaDocument6 pagesFactors Influencing The Use of Improved Maize Seed and Participation in The Seed Demonstration Program by Smallholder Farmers in Kwali Area Council Abuja, NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Parastomal Hernia: A Case Report, Repaired by Modified Laparascopic Sugarbaker TechniqueDocument2 pagesParastomal Hernia: A Case Report, Repaired by Modified Laparascopic Sugarbaker TechniqueInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Insights Into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesDocument8 pagesInsights Into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Smart Cities: Boosting Economic Growth Through Innovation and EfficiencyDocument19 pagesSmart Cities: Boosting Economic Growth Through Innovation and EfficiencyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Impact of Silver Nanoparticles Infused in Blood in A Stenosed Artery Under The Effect of Magnetic Field Imp. of Silver Nano. Inf. in Blood in A Sten. Art. Under The Eff. of Mag. FieldDocument6 pagesImpact of Silver Nanoparticles Infused in Blood in A Stenosed Artery Under The Effect of Magnetic Field Imp. of Silver Nano. Inf. in Blood in A Sten. Art. Under The Eff. of Mag. FieldInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Predict The Heart Attack Possibilities Using Machine LearningDocument2 pagesPredict The Heart Attack Possibilities Using Machine LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Supertrend IndicatorDocument3 pagesThe Supertrend Indicatorpaolo50% (4)

- Investment Practice ProblemsDocument14 pagesInvestment Practice ProblemsmikeNo ratings yet

- CFA Level II Mock Exam 5 - Solutions (AM)Document60 pagesCFA Level II Mock Exam 5 - Solutions (AM)Sardonna FongNo ratings yet

- Assignment 2 SolutionDocument4 pagesAssignment 2 SolutionSobhia Kamal100% (1)

- National Mock Board Examination 2017 Financial Accounting and ReportingDocument9 pagesNational Mock Board Examination 2017 Financial Accounting and ReportingSam0% (1)

- Options Open Interest Analysis SimplifiedDocument17 pagesOptions Open Interest Analysis SimplifiedNaveenNo ratings yet

- List Down The Terminologies Which Were Mentioned in The Movie and Define Each Based On Your Own Research and UnderstandingDocument5 pagesList Down The Terminologies Which Were Mentioned in The Movie and Define Each Based On Your Own Research and UnderstandingvonnevaleNo ratings yet

- Tutorial 6Document4 pagesTutorial 6Jian Zhi TehNo ratings yet

- Cash Flow Statement - QuestionDocument27 pagesCash Flow Statement - Questionhamza khanNo ratings yet

- Chapter 10 Prospective Analysis - ForecastingDocument29 pagesChapter 10 Prospective Analysis - ForecastingHaidar Aulia RahmanNo ratings yet

- ROD of Keya CosmeticsDocument71 pagesROD of Keya Cosmeticsrash_sblNo ratings yet

- Bear Bull Power Indicator ExplainedDocument11 pagesBear Bull Power Indicator ExplainedMin Than Htut0% (1)

- Ultimate Options Strategies WorkbookDocument20 pagesUltimate Options Strategies WorkbookjitendrasutarNo ratings yet

- Accounting Principles 8th Edition - Exercises Chapter07Document9 pagesAccounting Principles 8th Edition - Exercises Chapter07kimkov119No ratings yet

- Financial Statements of HSYDocument16 pagesFinancial Statements of HSYAqsa Umer0% (2)

- Productive Output MethodDocument36 pagesProductive Output MethodEcha NoviandiniNo ratings yet

- Fin533 July 2021 Past YearDocument11 pagesFin533 July 2021 Past Yeardr4ppp72xcNo ratings yet

- Project A Project B Project C Project D Expected NPV (RS.) 60,000 80,000 70,000 90,000 Standard Deviation (RS.) 4,000 10,000 12,000 14,000Document11 pagesProject A Project B Project C Project D Expected NPV (RS.) 60,000 80,000 70,000 90,000 Standard Deviation (RS.) 4,000 10,000 12,000 14,000Hari BabuNo ratings yet

- Lesson 1 Introduction To Agricultural MarketingDocument3 pagesLesson 1 Introduction To Agricultural MarketingSittie Ainah MacapundagNo ratings yet

- Beta Company-Three ExamplesDocument15 pagesBeta Company-Three ExamplesDilip Monson83% (12)

- Project Work Report On NEPSE and SEBONDocument54 pagesProject Work Report On NEPSE and SEBONBibek Sh Khadgi79% (14)

- Problem 5Document3 pagesProblem 5Rudy LugasNo ratings yet

- Block 5: Dividend, Accounts, Audit and Winding UPDocument40 pagesBlock 5: Dividend, Accounts, Audit and Winding UPAsaadNo ratings yet

- Agency, Trust and Partnership - Course OutlineDocument9 pagesAgency, Trust and Partnership - Course OutlineKhay GonzalesNo ratings yet

- ACCT5001 2022 S2 - Module 2 - Lecture Slides StudentDocument33 pagesACCT5001 2022 S2 - Module 2 - Lecture Slides Studentwuzhen102110No ratings yet

- IAS 1 - Presentation of Financial StatementsDocument1 pageIAS 1 - Presentation of Financial Statementsm2mlckNo ratings yet

- Hills, Hutman, Et Miles, 2008, The Evolution and Development of Entrepreneurial MarketingDocument14 pagesHills, Hutman, Et Miles, 2008, The Evolution and Development of Entrepreneurial MarketingMaalejNo ratings yet

- Historical Financial Analysis - CA Rajiv SinghDocument78 pagesHistorical Financial Analysis - CA Rajiv Singhవిజయ్ పి100% (1)

- (Chapman & Hall - CRC Financial Mathematics Series) Gueant, Olivier-The Financial Mathematics of Market Liquidity - From Optimal Execution To Market Making-CRC Press (2016)Document302 pages(Chapman & Hall - CRC Financial Mathematics Series) Gueant, Olivier-The Financial Mathematics of Market Liquidity - From Optimal Execution To Market Making-CRC Press (2016)smalias100% (3)

- IGCSE Business Studies A - Notes C1 Understanding Business ActivityDocument38 pagesIGCSE Business Studies A - Notes C1 Understanding Business Activitymohamed100% (1)