Professional Documents

Culture Documents

Financial Reporting & Analysis exam questions

Uploaded by

John SadulaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Reporting & Analysis exam questions

Uploaded by

John SadulaCopyright:

Available Formats

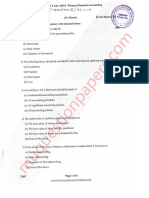

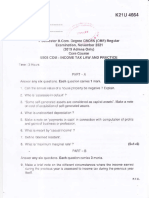

Paper / Subject Code: 44303 / Financial Reporting & Analysis

-fQtsBr

I"*n _yItq*u*t 1

Time: 2:30 horlr's Marks: 75

N"B. 1.Q. 1 is compulsory.

2. Q.2 to Q.5 are courpulsory with intemal choice.

3. Figures to the right indicate fu1l rrarks.

4. Workings should fonn a pafi of your answer.

#*s

.{./ uenqnY |h

'+ \ t,OWnt-76.1S

5. Use of sirnple calculator is allowed. r6r.t ,/ Sl

R),>"4/

Q"1 a. State Whether True or False. (any 8) (08)

1. Baldhies'with RBI are shou,n in the fina1 accounts of Bank in Schedule 4.

2. SutpJls on revaluation rn banking Companl should be treated as other Income.

3. A ioss asset would be one, u,hich has renrarned NPA for a period less ttran or equal to 12

m

Months.

4. Clairr outstanding is shown under balance sireet of an iasurance colnpany under current

5.

as s ets.

.co

Preminm received in advance is shown :nder balance sheet of an insurance company

under current liabilities.

6.

ra

CARO i.; rrol applicable to Banking Conr:'=nr'

7, Good'ui,i11 is nr:t depreciated.

S. r:ru loan is a loar Cue for more than 5 vears.

nd

Si,,-.rl

9. Casir deposited into bank inclease cash inflorv.

I0. V/liistle blou,er can be an emp1o1,'ee

ke

QI b. Ivlatcli the column. (Any 7) (07)

:, Column A Colurnn B

QP

' ,1.,, Ethics (a) First tune adoption

2. Ind AS 101 (b) Operating activities

;3:..tufl 45 192 (c) Financing activitres

4.' Dearease in stock (d) lnvesting activities

5..,.8uy back of share (e) Opened by Businessmen

6. Purchase of Fixed Assets (f) Greek word I

,.7. .Frevious year account (g) Share Based Pal,rnent

8. Live sto:ii (h) General Lrsurance

9. Fire Insurance (i) Not for the fir"st year.

1-0. Current account fi) Fixed Assets

74931. Page 1 of 5

Visit www.qpkendra.com for more question paper

2FC8B 8 1 F0F26 A1 4F5 t 320 l 7808A89E2E

-/-

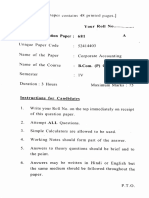

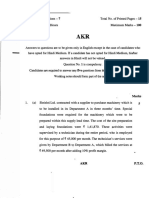

Paper / Subject Code: 44303 / Financial Reporting & Analysis

Q.2 a. From the following infomation, find out the amount of provision recluired to be made in the (07)

profit and loss account fot the ABC Bank year ended 31-3-18"

Advances Rs.Thodsan'd.i

Standard Asset 1600

. 700 ._:_.. --' -. .

Sub- standard Asset

Doubtful Assets for:

For one year tt2

,'...

For two and Three years ,56

For More than 3 years

m

Loss Asset 18

Q.2 b.=''.Billdiscounted (Rs)

Retateon bill discounted (Rs) (01.04.2016)

Discount Received (Rs)

.co 1,85,06,000

I ?r 500

I 1.56.300

. (08)

ra

Fronr the Following data calculate rebate on Bilis Discount as on 31 .3.2017 and give

necessary j ournal entries.

nd

..':J-'.n -

Amount Rs Period (inclusive of 3 days of grace)

1q6s000 01.06.20t7 10%

26,10,000 1s.06.20t7

ke

2i,60,000 '28.06.20t7 L1%

33,90,000 08 07.2017 l0% ' -''.,.=:'.-:,-:

QP

OR

,Q.2: - ,Iromflre following balances, prepare Profit and Loss Account of Shyarn Bank Ltd- fot,the (15)

year ended 3 1 st March, 20 i 8.

,Particulars ,.' Amount Particulars '.: ,-.,.. .r{mount

,,Trlterest on Loans 12,95.000 Rent and Taxes .90,000

',

13,75.000 Interest bn Overdraft .7,,70,.000 .. ,. : ! ''-, :: .; j.,ii

'

'Rebate on Bil1s Discounted 2,45.000 Directors Fees ,, {,5;000

Conrniission 41,00c Auditors Fees 5,000

,'Establishment charses 2,70.000 Interest on Saving Bank 3,40,000

Accounts

74931 Page 2 of 6

Visit www.qpkendra.com for more question paper

2FC8B 8 1 F0F26 A7 1E5 13201 7E08A 8gE:lE

:

Paper I Subject Code: 44303 / Financial Reporting & Analysis

Discount on Bill Diseounted 7,30,000 Postage and Telegrarns 7,000

(net)

Interest.olr Cash Credit 11,i5,000 Printing and Stationery 14,500

,lnterest on Current account 2,10,000 Sundry Charges 8,500

Bad debts.lo.be writren off amounted to Rs. 2,00,000. Provision for taxation may be made at

50% of net profits. Transfer to statutory reserye tobe @25%.

Krishna General hisurance Cornpany sui:mits tL; lbilowing infonlatiLtn fbr the year ended (15)

31't March,20l8.

::

m

',..: .

"-i.i r ': ParticularS Direct Business Re insurance

Premiutn Received 32,87,500 4,75,000

.co

Preruium Paid ? 17 s00

€laims paid during the year 21,25,000 2,50,0cr0

,Claiini Payable - opening 3,12,500 43,500

ra

Closing 3,59,000 30.000

Claims Received 7

"62,500

nd

Cla-lms Receir.able - opening -?2.500

' ' Closins 55.000

Expenses of Management 1 . i 5,000

ke

Comrnission

On.insurance Accepted 75 00() 5,500

QP

On insurance Ceded 7,000

-,. -. .. .. The Following additional information is also available:

::: a.:. ,,t-

", 1. ,-Experrsiis of N4anagement include Rs. 17.500 Surveyor's fees and Rs. 22,500 legal

r, expenses for settlement of claims"

-'':

- ' ,, 2. Resove.for unexpired risk is to be rlarntained @ 40%. The balance of reserve for

".: r'-r: unexpired risk as on 01.4.17 ri'as Rs 12,25.000

-r':':.i :. :'' . ' Youare requiiedto preparethe Rer.enue Acr:ount for the year ended 31'tMareh,2018.

OR

7493L Page 3 of 6

Visit www.qpkendra.com for more question paper

2FC8B 81F0F26A7 4E5 tl2ti I 7E0EA89E2E

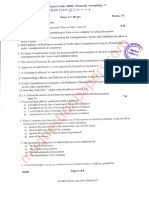

Paper / Subject Code: 44303/ Financial Reporting & Analysis

Q.3 From the following infonnation as on 31't March 2018, prepare the Revenue Accoun! of the (15)

Shiv Insurance Co. Ltd in respect of fire and marine insurance business.

Particulars Fire (Rs.) Marine (Rs)

Outstanding Claims ( opening Balance) 84,000 :21,000

Ciaim Paid 3,00,000 2;40,000

Reserve for Unexpired Risk ( opening Balance) 6,00,000 4,20,000

Premium Received 13,50,000 9,90,000

Agent Commission 1,20,000 60,000

Expenses Management 1,80,000 1,i 5.,QQ0_

1l::- i

- -

.:1

Re insurance Premiurl ( debit) 75,000 145,Q0Q

m

The ic;llowing points are to be consider:

for fire and N{arine lnsurance.

fire and N,farine Insurance.

.co

ra

respectively for fire and Nlarine lnsurance.

nd

-, :- I :. d. Clairn outsianding as on 31't March, 2018 u,ere Rs. 10.000 and Rs. 45.000

respectlvely for f,re and Marile Insurance.

ke

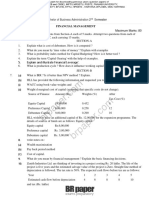

Q.4 Foilowing are the balances sheet of N4/s Kesav Ltd. as on 31.3.17 and3l.-".16 werq: . (15)

2017 20r6 Assets 2017 2.qrc

QP

Equity Share capital 3,00,000 2,80,000 Land and 5,40,000

-7oToo

-__-_J Building ;,

i

8% Preference Share 2,00,000 1,70,000 Plant and 2,55,000' ". -!,180,-0-00

Capital Machinery

General Reserve 1,20,000 95,000 Furniture and

-

1,08,000

. .36,000

Fixtures

. Profit & Loss 1,48,000 i,39,000 Motor Car 85,000 .=I,,0q;000

account

'12%Dehenfiire' 3,50,000 3,00,000 Inventory 2,20,000 2,83,000

74931 Page 4 of 6

Visit www.qpkendra.com for more question paper

2FC8B 8 1 F0F26 A7 485 1 32A1 7E08A89E2E

i

.t....,:_.

Papef/ Subject Code: 443A3/ Finanpial. Reporting & Arialysis

) .::

Creditors 1,43,000 1,20,000 Accounts' :2r45,0AA 3,44,000

'.1'":

Receivables .".,..

Expenses Payable '84,000 77,400 Cash and Bank "64,000

ri

92,000 67,000

i

Pro.posed Dividend 80,000 73,000

Total 15,17,000 13,21,000 Total '.15117r000 13,21,000

;".'t'.I

Additional Inforriiation:

a. Issue of shares, debentures and additions to assets were'made on lst Apnt,2017.

b. Depreciation qr l0% p.a. was charged on land building and furnirure.

m

c. Plant & Machinery and motor vehicles, both were depreciated by llYo,p.a.

d. Income tax paid and proposed clividend cluring the year were Rs.69,000 and

.co

Prepare Cash f'low slatement as per AS- 3 (Use Indirecr Method).

,oR

ra

Q.4 The lollowing is the Trial Balance of Neelam Lrd as on 3 I .03.2017. You are required to (1s)

prepare Balance sheet as on 3 I .03.201 70.

nd

Particulars Debit Credit

Cash in Itrand 1,17,000

Cash at Bank 2,05,800

ke

Share Capital 55,20,000

9% Debenture 18,00.000

QP

Bank Over Draft 12,00,000

Investment ( long Term) 60,000

Bills Receivable - Trade 8,40,000

Sundry Debtors 33,00,000

Sundry- Creditors 14,40,000

Security Deposit ( long terrn) 24,000

Piofit and Loss.account 17,40,000

Security Premium 5,40,000

Intbrest on Debenture accrued and due 40,500

Goodwill 3,90,000

Plarit'and'Machinery ( cost Rs. 30,00,000) 18,00,000

74931 Page 5 of 6

Visit www.qpkendra.com for more question paper

2FC8B8 1F0F26 A1 485 I 3201 7E08A89E2E

Paper / Subject Code: 44303 / Financial Reporting & Analysis

Land and Building ( cost Rs. 15,00,000) I 1,40,000

Furniture ( cost Rs. 4,80,000) 2,70,000

Provision for Taxation :7,23,0A0

Advance Tax 6,00,000

Bills Payable 1,80,000

General Reserve 6,00,000

Stock in Trade 50,96,700

Capital Reserve 60,000

Total 1,38,43,500 1,38,43,500

m

Additional In lormation:

l. Sundry Debtors which are all unseculed and considered good. include Rs. 5.40.000

2.

due lor rnore than six month.

.co

Investrnent replesent 15,000 equity Share in ZEN Ltd of Rs. i0 each , Rs. 4 per share

called and paid up.

ra

3. Bills Receivable discounted with the bank, not matured till the Balance Sheet date.

amounred to Rs. 45.000

nd

Q.5 a. Whar are the benefits of Code ol- Ethics? (08)

b. What is Share Based Payment? What is the scope of Ind AS i02? (07)

ke

Q.5 Short note (any 3) ' ' , ' (1s)

QP

1. Scope of Ind AS 101

4. Money at call and short notice

5. Exceptional and Extra ordinary items.

74931. Page 6 of 5

Visit www.qpkendra.com for more question paper

2FC8B8 I F0F26 A1 4E5 I 320 I 7E08A89E2E

You might also like

- Fa6 Sem5 Cbcgs Baf Commerce Nov19Document6 pagesFa6 Sem5 Cbcgs Baf Commerce Nov19sacos16074No ratings yet

- 2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Document4 pages2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill0% (1)

- Iii - Proforma Statement of Financial Position (20 PoDocument6 pagesIii - Proforma Statement of Financial Position (20 PoRaymond RocoNo ratings yet

- Tybaf Sem6 Fa-Vii Apr19Document5 pagesTybaf Sem6 Fa-Vii Apr19h9833151519No ratings yet

- Financial Accounting - Balance Sheet of Prateeth Bank LtdDocument6 pagesFinancial Accounting - Balance Sheet of Prateeth Bank LtdHasan ShahNo ratings yet

- Ch-2 Accounting SolutionsDocument22 pagesCh-2 Accounting SolutionsDarienDBKearneyNo ratings yet

- AFS 93th JAIBBDocument4 pagesAFS 93th JAIBBAtabur RahmanNo ratings yet

- Caf-5 Far-1 Pac BookDocument312 pagesCaf-5 Far-1 Pac BookMuhammad NaeemNo ratings yet

- Nirma: UniversityDocument3 pagesNirma: UniversityBHENSDADIYA KEVIN PRABHULALNo ratings yet

- Total No. of Printedpages-11 Maximummarks - 100 ..: PC! Group I-Paper Advanced AccountingDocument11 pagesTotal No. of Printedpages-11 Maximummarks - 100 ..: PC! Group I-Paper Advanced AccountingNyonikaNo ratings yet

- Advanced Accounting Adc Bcom Part 2 Solved Past Paper 2020Document2 pagesAdvanced Accounting Adc Bcom Part 2 Solved Past Paper 2020usman haiderNo ratings yet

- Csec Poa January 2022 p1Document13 pagesCsec Poa January 2022 p1INSHAN IMRAN RAMSAROOPNo ratings yet

- Tybms Sem5 Fa Nov19Document6 pagesTybms Sem5 Fa Nov19Hola GamerNo ratings yet

- Adobe Scan 5 May 2023Document5 pagesAdobe Scan 5 May 2023NarayanNo ratings yet

- Paper Finance IVDocument3 pagesPaper Finance IVAbhijeetNo ratings yet

- Review School of Accountancy First Pre-Board Examination Theory of Accounts QuestionsDocument12 pagesReview School of Accountancy First Pre-Board Examination Theory of Accounts QuestionsPhilip CastroNo ratings yet

- ROP SS ProblemsDocument4 pagesROP SS ProblemsSauban AhmedNo ratings yet

- Corporate Accounting Exam with Bonus Share CalculationDocument25 pagesCorporate Accounting Exam with Bonus Share Calculationyash nawariyaNo ratings yet

- rtsr$f1#'"":',: Paselof4 / - 'A, Cr,'liiDocument4 pagesrtsr$f1#'"":',: Paselof4 / - 'A, Cr,'liiShahin AlamNo ratings yet

- Tybaf Sem5 Fa-V Nov19Document8 pagesTybaf Sem5 Fa-V Nov19katejagruti3No ratings yet

- CSEC Principles of Accounts June 2015 Paper 1Document14 pagesCSEC Principles of Accounts June 2015 Paper 1Aria PersaudNo ratings yet

- Aravali International SchoolDocument6 pagesAravali International SchoolArsh GuptaNo ratings yet

- CBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Document4 pagesCBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill75% (4)

- Income Tax 21Document4 pagesIncome Tax 21aromalsolteroNo ratings yet

- Fabv 2018 Board Question Paper Sem 5Document11 pagesFabv 2018 Board Question Paper Sem 5ASHISH NYAUPANENo ratings yet

- Engineering Economy Jan 2014Document2 pagesEngineering Economy Jan 2014Prasad C MNo ratings yet

- Statement. Cash.: M.B.A. Semester-Ill Exadinatioh Working Capital Management Paper-Mba/3103/FDocument2 pagesStatement. Cash.: M.B.A. Semester-Ill Exadinatioh Working Capital Management Paper-Mba/3103/FPavan BasundeNo ratings yet

- Ta-250: Cash & Cash Equivalents: Resa 7K KT'R%, Scle (O (:aczaout A 74U, Q (AuaarctoDocument3 pagesTa-250: Cash & Cash Equivalents: Resa 7K KT'R%, Scle (O (:aczaout A 74U, Q (AuaarctoJessa HerreraNo ratings yet

- Final Preboard Examinations Advisory ServicesDocument1 pageFinal Preboard Examinations Advisory ServicessunshineNo ratings yet

- Corporate Finance I763 UmyMzqnN1hDocument2 pagesCorporate Finance I763 UmyMzqnN1hABHINAV AGRAWALNo ratings yet

- FAR.2855 Accounting Process. 1 PDFDocument3 pagesFAR.2855 Accounting Process. 1 PDFVhia Rashelle GalzoteNo ratings yet

- FAR.2855 Accounting Process. 1 PDFDocument3 pagesFAR.2855 Accounting Process. 1 PDFVhia Rashelle GalzoteNo ratings yet

- Tybbi Sem5 FSM Nov19Document2 pagesTybbi Sem5 FSM Nov19parchavinit35No ratings yet

- Project Appraisal FinanceDocument20 pagesProject Appraisal Financecpsandeepgowda6828No ratings yet

- Steps in The Accounting Process (Cycle) : Lecture NotesDocument12 pagesSteps in The Accounting Process (Cycle) : Lecture NotesGlen JavellanaNo ratings yet

- The Umversity of The West IndiesDocument7 pagesThe Umversity of The West IndiesIsmadth2918388No ratings yet

- Question Chapter2 Final 1Document18 pagesQuestion Chapter2 Final 1nguyen longNo ratings yet

- Paper2 SolutionDocument10 pagesPaper2 Solutionadityatiwari122006No ratings yet

- CA IPCC Old Accounts Question Paper Nov 2018 StudycafeDocument15 pagesCA IPCC Old Accounts Question Paper Nov 2018 Studycafeadityatiwari122006No ratings yet

- Tybaf Sem5 Fa-Vi Nov18Document5 pagesTybaf Sem5 Fa-Vi Nov18rohitgadkari5959No ratings yet

- Various Topics in MANAGEMENT ACCOUNTING (RESA)Document2 pagesVarious Topics in MANAGEMENT ACCOUNTING (RESA)Denise ChristinaNo ratings yet

- #, FFRN:-: RRRFTF (ODocument1 page#, FFRN:-: RRRFTF (OJohn Francis Raspado AnchetaNo ratings yet

- Questions: Indicate Debit and Credit Eff Ects and Normal BalanceDocument11 pagesQuestions: Indicate Debit and Credit Eff Ects and Normal BalanceThiện Vũ100% (1)

- Abdul Vahid LoharDocument2 pagesAbdul Vahid LoharpulkitjanguNo ratings yet

- Advanced Financial Management Exam QuestionsDocument3 pagesAdvanced Financial Management Exam QuestionsRamakrishna NagarajaNo ratings yet

- Exam June 2009Document8 pagesExam June 2009kalowekamoNo ratings yet

- FM (2nd) May2016Document2 pagesFM (2nd) May2016JohnNo ratings yet

- 2A FS Analysis Exercises 2022Document5 pages2A FS Analysis Exercises 2022Alyssa Tolcidas0% (1)

- Accounting AndFinancial Management 2015-16Document4 pagesAccounting AndFinancial Management 2015-16Ashish AgarwalNo ratings yet

- Needles Finman Irm Ch09Document17 pagesNeedles Finman Irm Ch09Dr. M. SamyNo ratings yet

- Loursl: - (L) : (Semester-II)Document4 pagesLoursl: - (L) : (Semester-II)Riya AgrawalNo ratings yet

- CA IPCC Nov 2014 Group I AccountsDocument16 pagesCA IPCC Nov 2014 Group I AccountsSmriti IyerNo ratings yet

- Steps in The Accounting Process (Cycle) : Lecture NotesDocument2 pagesSteps in The Accounting Process (Cycle) : Lecture NotesGlen JavellanaNo ratings yet

- Toa 09.15.12Document16 pagesToa 09.15.12Philip CastroNo ratings yet

- 12th BK Question Paper 2023Document11 pages12th BK Question Paper 2023yashashreebhurke333100% (1)

- Analyzing Cash AccountsDocument1 pageAnalyzing Cash AccountsRyan PelitoNo ratings yet

- Financial Reporting May 22 Mock Test Ques PPRDocument7 pagesFinancial Reporting May 22 Mock Test Ques PPRVrinda GuptaNo ratings yet

- Financial Accounting (4-6)_Fall 2022Document90 pagesFinancial Accounting (4-6)_Fall 2022Saahil KarnikNo ratings yet

- Modern Portfolio Management: Moving Beyond Modern Portfolio TheoryFrom EverandModern Portfolio Management: Moving Beyond Modern Portfolio TheoryNo ratings yet

- International Business 14th Edition Daniels Test Bank DownloadDocument27 pagesInternational Business 14th Edition Daniels Test Bank DownloadChristina Walker100% (24)

- CH 06Document79 pagesCH 06arif nugraha67% (3)

- Finman Activity1 SantosDocument9 pagesFinman Activity1 SantosJken OrtizNo ratings yet

- SAP Business Blue Print (Materials Management) : Import ProcurementDocument18 pagesSAP Business Blue Print (Materials Management) : Import ProcurementAshish GuptaNo ratings yet

- Financial Management Notes PDFDocument68 pagesFinancial Management Notes PDFtirumala ReddyNo ratings yet

- SCM-310-Final Project (MHC) PDFDocument22 pagesSCM-310-Final Project (MHC) PDFMahmudul HasanNo ratings yet

- Intra African Trade Full ReportDocument32 pagesIntra African Trade Full ReportSantiago Marquez CabreroNo ratings yet

- Prelim (Answer Key)Document6 pagesPrelim (Answer Key)Justine PaulinoNo ratings yet

- Chapter 1: Introduction 1.1 Meaning and Definition of BankDocument6 pagesChapter 1: Introduction 1.1 Meaning and Definition of BankdineshNo ratings yet

- Blouet The Imperial Vision of Halford MackinderDocument9 pagesBlouet The Imperial Vision of Halford MackinderGustavo 69No ratings yet

- Topic 3. P1 - Ch4 - Exchange Rate DeterminationDocument10 pagesTopic 3. P1 - Ch4 - Exchange Rate DeterminationBui Tra MyNo ratings yet

- AftaDocument6 pagesAftanurnoliNo ratings yet

- Revised Delegation of Powers AnnexureDocument42 pagesRevised Delegation of Powers AnnexureVijayKumar BiradarNo ratings yet

- Commodity Grading CriteriaDocument12 pagesCommodity Grading CriteriaHamid RazaNo ratings yet

- BA21420230004153Document1 pageBA21420230004153onyenuwe humphreyNo ratings yet

- DIB 02 - 202 International Trade and Finance - 03Document13 pagesDIB 02 - 202 International Trade and Finance - 03farhadcse30No ratings yet

- Best Currency Pairs To Trade at What Time or Session - FXSSI - Forex Sentiment BoardDocument10 pagesBest Currency Pairs To Trade at What Time or Session - FXSSI - Forex Sentiment Boardgiberamu790No ratings yet

- State TradingDocument27 pagesState TradingGagan Bhalla0% (1)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancegaurav kumarNo ratings yet

- International Business EnvironmentDocument3 pagesInternational Business EnvironmentNeelabh KumarNo ratings yet

- Financial DerivativeDocument16 pagesFinancial Derivativerahula22No ratings yet

- COMESADocument3 pagesCOMESAadrymanoNo ratings yet

- Tankers: Mcquilling Partners, IncDocument13 pagesTankers: Mcquilling Partners, IncSumitNo ratings yet

- Agents Charged With Fraud PDFDocument12 pagesAgents Charged With Fraud PDFDebbie HilderNo ratings yet

- IsoDocument19 pagesIsoNadiLNo ratings yet

- Accounting For Managers Assignment IDocument3 pagesAccounting For Managers Assignment ITsgereda Mekasha86% (7)

- CS Executive Tax Laws Amendments by Vipul ShahDocument41 pagesCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNo ratings yet

- Islamic Retail Banking: Sources of FundsDocument106 pagesIslamic Retail Banking: Sources of FundsThineshNo ratings yet

- Accounting Special Transaction - PartnershipDocument12 pagesAccounting Special Transaction - PartnershipMikee LajatoNo ratings yet

- Cartage Advice With Receipt - TB00606076Document2 pagesCartage Advice With Receipt - TB00606076CP KrunalNo ratings yet