Professional Documents

Culture Documents

Chapter 03 Question 1

Chapter 03 Question 1

Uploaded by

Daria Lang0 ratings0% found this document useful (0 votes)

6 views3 pagesYou invest $5,000 of your own money and borrow $5,000 at 8% interest to buy $10,000 worth of Telecom stock priced at $50 per share. If the stock price increases 10% to $55 per share, your return would be 12% after accounting for the $400 interest payment. The stock price would need to fall below $35.71 per share for you to face a margin call, as maintenance margin is 30%.

Original Description:

Original Title

Chapter 03 Question 1(1)

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentYou invest $5,000 of your own money and borrow $5,000 at 8% interest to buy $10,000 worth of Telecom stock priced at $50 per share. If the stock price increases 10% to $55 per share, your return would be 12% after accounting for the $400 interest payment. The stock price would need to fall below $35.71 per share for you to face a margin call, as maintenance margin is 30%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesChapter 03 Question 1

Chapter 03 Question 1

Uploaded by

Daria LangYou invest $5,000 of your own money and borrow $5,000 at 8% interest to buy $10,000 worth of Telecom stock priced at $50 per share. If the stock price increases 10% to $55 per share, your return would be 12% after accounting for the $400 interest payment. The stock price would need to fall below $35.71 per share for you to face a margin call, as maintenance margin is 30%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

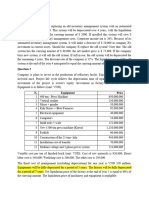

You are bullish on Telecom stock.

The current market price is $50

per share, and you have $5,000 of your own to invest. You borrow

an additional $5,000 from your broker at an interest rate of 8% per

year and invest $10,000 in the stock.

a. What will be your rate of return if the price of Telecom stock goes

up by 10% during the next year? (Ignore the expected dividend.)

b. How far does the price of Telecom stock have to fall for you to ge

a margin call if the maintenance margin is 30%? Assume the price

fall happens immediately.

Price per share $ 50

Equity invested $ 5,000

Borrowed funds $ 5,000

Interest rate 8.00%

Total investment $ 10,000

Price change 10.00%

Margin required 30.00%

Solution

a. Shares bought 200

Value change $ 1,000

Interest payment $ 400.00

Rate of return 12.00%

b. Margin call price $ 35.71

market price is $50

nvest. You borrow

rest rate of 8% per

Telecom stock goes

ected dividend.)

e to fall for you to get

Assume the price

You might also like

- 15 Real Estate Math QuestionsDocument8 pages15 Real Estate Math QuestionsAnonymous 7WS1xXNo ratings yet

- Ultimate First Time Home Buyer Guide: Step-By-Step Instructions On How to Buy Your First HomeFrom EverandUltimate First Time Home Buyer Guide: Step-By-Step Instructions On How to Buy Your First HomeNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Bitcoin, Ethereum and Co.: Emotionless Trading Earn money with Bot TradingFrom EverandBitcoin, Ethereum and Co.: Emotionless Trading Earn money with Bot TradingNo ratings yet

- Margin and Short SaleDocument3 pagesMargin and Short SaleSaafsourovNo ratings yet

- Midterm Review Winter 2019Document11 pagesMidterm Review Winter 2019Gurveen Kaur100% (1)

- Chapter 3 - Excel Spreadsheet SolutionsDocument6 pagesChapter 3 - Excel Spreadsheet SolutionsYounes HJNo ratings yet

- (Corporate Finance) SUMMARY OF EXERCISES PDFDocument9 pages(Corporate Finance) SUMMARY OF EXERCISES PDFneda ajaminNo ratings yet

- Chapter - 03 - Question 1 (Very Easy)Document2 pagesChapter - 03 - Question 1 (Very Easy)Daria LangNo ratings yet

- Seminar 2 Presentation QuestionsDocument17 pagesSeminar 2 Presentation QuestionsJennifer YoshuaraNo ratings yet

- Problems of The Equity MarketDocument5 pagesProblems of The Equity MarketTrần Phương AnhNo ratings yet

- FinanceDocument1 pageFinanceস্বপ্নবালকNo ratings yet

- Chapter 3 Solution Updated2 PDFDocument4 pagesChapter 3 Solution Updated2 PDFShakkhor ChowdhuryNo ratings yet

- FM2 EndtermDocument22 pagesFM2 EndtermSuraj RanaNo ratings yet

- Problem 9 - Buying On Margin Problem 11 - Buying On Margin Problem 10 - Short Sales Problem 12 - Short SalesDocument6 pagesProblem 9 - Buying On Margin Problem 11 - Buying On Margin Problem 10 - Short Sales Problem 12 - Short SalesBona Christanto SiahaanNo ratings yet

- CR Par Value PC $ 1,000 $ 40: 25 SharesDocument4 pagesCR Par Value PC $ 1,000 $ 40: 25 SharesBought By UsNo ratings yet

- Chapter 3: How Securities Are TradedDocument4 pagesChapter 3: How Securities Are TradedManik DograNo ratings yet

- What If ExercisesDocument21 pagesWhat If ExercisesMike Jim AchaNo ratings yet

- How Securities Are Traded PracticeDocument3 pagesHow Securities Are Traded PracticeRehabUddinNo ratings yet

- BF2201 W2 Chap003 005 PresentationDocument6 pagesBF2201 W2 Chap003 005 PresentationGabriel KuahNo ratings yet

- BKM - Tutorial - 1 - QuestionsDocument4 pagesBKM - Tutorial - 1 - Questions啵啵贊贊No ratings yet

- Cost Ofcapital NumericalsDocument6 pagesCost Ofcapital NumericalsKunal GargNo ratings yet

- Tien Te Review - AnswerDocument23 pagesTien Te Review - Answerdaovantien357No ratings yet

- 2023 (ASSIGNMENT) Mathematics in Practical SituationsDocument16 pages2023 (ASSIGNMENT) Mathematics in Practical Situationsalibabagoat1No ratings yet

- A. What Is The Margin in Rida's Account When She First Purchases The Stock? B. If TheDocument2 pagesA. What Is The Margin in Rida's Account When She First Purchases The Stock? B. If TheSadia Chowdhury Parisa 1711655630No ratings yet

- Quiz 2Document1 pageQuiz 2Kamal AkzNo ratings yet

- Test Paper InvestmentsDocument4 pagesTest Paper Investmentslagosjackie59No ratings yet

- Assignment #2Document2 pagesAssignment #2deemaaziz2016No ratings yet

- International Finance Assignment Apple CorporationDocument3 pagesInternational Finance Assignment Apple Corporationasim27911No ratings yet

- Bonds PayableDocument3 pagesBonds Payablegenesis roldanNo ratings yet

- The Last Trade in The Stock Occurred at A Price of $50.: Problem7Document3 pagesThe Last Trade in The Stock Occurred at A Price of $50.: Problem7Эрдэнэ-Очир НОМИНNo ratings yet

- Unit 3: Cost of Capital Cost of DebtDocument11 pagesUnit 3: Cost of Capital Cost of DebtTaransh A100% (1)

- File 000019Document2 pagesFile 000019Nicholas GunnellNo ratings yet

- Quiz Lecture 1Document3 pagesQuiz Lecture 1AnihaNo ratings yet

- Solutions To Problems: Coupon Interest Market Price Current YieldDocument4 pagesSolutions To Problems: Coupon Interest Market Price Current YieldAhmed El KhateebNo ratings yet

- Fin 650 Problem Set #1 SummerDocument3 pagesFin 650 Problem Set #1 SummerNII NARKU NORTEYNo ratings yet

- Securities Market Exercise HVNHDocument8 pagesSecurities Market Exercise HVNHBánh Bèo KangNo ratings yet

- RTP CA Final New Course Paper 2 Strategic Financial ManagemeDocument26 pagesRTP CA Final New Course Paper 2 Strategic Financial ManagemeTusharNo ratings yet

- Investment Assign 1 - QuestionsDocument4 pagesInvestment Assign 1 - QuestionsYuhan KENo ratings yet

- Problems On Cost of CapitalDocument3 pagesProblems On Cost of Capital766 Rutu KhadapkarNo ratings yet

- Turnbull Corp., Cost of Capital Based On Book ValueDocument9 pagesTurnbull Corp., Cost of Capital Based On Book ValueDhairya ShahNo ratings yet

- Cost of DebtDocument2 pagesCost of Debtbekalgagan29No ratings yet

- Tutorial 5Document2 pagesTutorial 5Yi QiNo ratings yet

- Econ FinalDocument4 pagesEcon FinalhalilozgurNo ratings yet

- Fi AssignmentDocument9 pagesFi Assignmentyohannes kindalem0% (1)

- Mock Exam Paper - 28 - April - 2022Document3 pagesMock Exam Paper - 28 - April - 2022dilinhtinh04No ratings yet

- Cost of Capital ProblemsDocument3 pagesCost of Capital ProblemsSragav RajNo ratings yet

- GS1129 SBS Tutorial 3 - Dividends and Shares 19 PDFDocument2 pagesGS1129 SBS Tutorial 3 - Dividends and Shares 19 PDFSetsuna TeruNo ratings yet

- Book Value Per Share: Name: Date: QuizDocument3 pagesBook Value Per Share: Name: Date: QuizRheu ReyesNo ratings yet

- Chapter 3 GoDocument8 pagesChapter 3 GoPiertotum LocomotorNo ratings yet

- Real Estate Finance & Investments Midterm I Solutions Name: ID#Document7 pagesReal Estate Finance & Investments Midterm I Solutions Name: ID#Jiayu JinNo ratings yet

- Little Oil CompanyDocument10 pagesLittle Oil CompanyJosann Welch100% (1)

- CH 18 ADocument14 pagesCH 18 AAhsan RazaNo ratings yet

- Midterm 1 - With Answers PDFDocument7 pagesMidterm 1 - With Answers PDFSamuel BrodriqueNo ratings yet

- FN202 Seminar Qns Set 4 Dividend Decision 2018Document3 pagesFN202 Seminar Qns Set 4 Dividend Decision 2018Tonie NascentNo ratings yet

- Chapter 11 BKMDocument7 pagesChapter 11 BKMNatalie OngNo ratings yet

- Tutorial 2 Market To Book, Annuities and Inflation and BondsDocument2 pagesTutorial 2 Market To Book, Annuities and Inflation and BondsmihsovyaNo ratings yet

- Midterm Examination 2Document5 pagesMidterm Examination 2Timbas TNo ratings yet