Professional Documents

Culture Documents

Botm Tutorial 2

Uploaded by

Zhiyu KamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Botm Tutorial 2

Uploaded by

Zhiyu KamCopyright:

Available Formats

UBFB3013 Banking Operations and Treasury Management

UNIVERSITI TUNKU ABDUL RAHMAN

FACULTY OF BUSINESS AND FINANCE

ACADEMIC YEAR 2022/2023

BACHELOR OF BUSINESS ADMINISTRATION (HONS) BANKING AND FINANCE

BACHELOR OF ECONOMICS (HONS) FINANCIAL ECONOMICS

TUTORIAL 2: An Introduction to Treasury Management & the Management

of Balance Sheet Exposures

1. Descript the key decision areas of a Treasurer?

2. Follows are information obtained on the interest rate sensitivity of your bank:

Amount Rate

90 day interest rate sensitive asset $80,000 8.0%

90 day interest rate sensitive liabilities $120,000 6.0%

The consensus of forecasting is for interest rates to increase by 50 basis points during

the ninety days. But a significant minority of forecasters expects interest rate to fall by

50 basis points.

a) How could the bank eliminate its interest rate risk?

b) What could happen to net interest income if the minority forecast turned out to

be the correct one?

3. Assume that the ABC National Bank has the following structure of assets

and liabilities:

Assets RM Liabilities & Equity RM

Floating rate 250 Market deposit accounts 200

business loans

Federal funds sold 50 Federal funds purchased 200

Fixed rate loans and 700 Fixed rate liabilities 500

investments

Equity 100

Total assets 1000 Total liabilities & 1000

equity

Compute the dollar gap of the bank.

UBFB3013 Banking Operations and Treasury Management

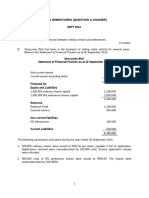

4.

Assets RM Rate Duration Liabilities & RM Rate Duration

(%) (Years) Equity (%) (Years)

Cash 1000 Deposits 3000 6 0.5

Govt. 2000 4 5 Certificate of 9000 5 4

Securities Deposit

Loans 10000 8 4 Equity 1000

Total 13000 Total 13000

Assets Liability &

Equity

a) Based on the balance sheet above, calculate the duration gap of the bank.

b) Calculate the percentage and dollar change in the value of equity if all interest

rates increase by 100 basis points.

5. Indicate what will happen to the Economic Value Equity (EVE) under following

situations:

(a) Rising of interest rates when a bank have a negative duration gap

(b) Falling of interest rates when a bank have a positive duration gap

(c) Falling of interest rates when a bank have a zero duration gap

6. Differentiate Dollar Gap Analysis and Duration Gap Analysis.

You might also like

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet

- Seminar Questions Set II-1Document4 pagesSeminar Questions Set II-1fanuel kijojiNo ratings yet

- QuestionsDocument5 pagesQuestionsdhitalkhushiNo ratings yet

- Assets Liabilities and EquityDocument2 pagesAssets Liabilities and Equityusama siddiquiNo ratings yet

- Bank Financial Statements 2020 SDocument54 pagesBank Financial Statements 2020 SSuvajitLaikNo ratings yet

- Non Performing Assets of BankDocument7 pagesNon Performing Assets of BankDivyaNo ratings yet

- 73535bos59345 Final p2qDocument6 pages73535bos59345 Final p2qSakshi vermaNo ratings yet

- FMC 2019Document3 pagesFMC 2019Shweta ShrivastavaNo ratings yet

- PR 5Document7 pagesPR 5vanessagreco17No ratings yet

- Managenet AC - Question Bank SSDocument18 pagesManagenet AC - Question Bank SSDharshanNo ratings yet

- Tutorial 3 QsDocument5 pagesTutorial 3 QsYauweiNo ratings yet

- Corporate Strategic Financial Decisions 120675525Document17 pagesCorporate Strategic Financial Decisions 120675525Anushka GuptaNo ratings yet

- Accounts ProblemsDocument30 pagesAccounts ProblemsBalasaranyasiddhuNo ratings yet

- Profit MaximizationDocument42 pagesProfit MaximizationSwarnima SinghNo ratings yet

- Management Accounting Problem Unit 2Document7 pagesManagement Accounting Problem Unit 2princeNo ratings yet

- Short TermDocument4 pagesShort Termjeanniemae100% (2)

- Mid-Term-Exam 2021 2022Document3 pagesMid-Term-Exam 2021 2022dangNo ratings yet

- Practice-Assignment - Afs - 31-Augsut-2019Document10 pagesPractice-Assignment - Afs - 31-Augsut-2019Waqar AhmadNo ratings yet

- Mar./Apr. 2017: Instructions For Assignment SubmissionDocument11 pagesMar./Apr. 2017: Instructions For Assignment SubmissionShubham DhokNo ratings yet

- Final Exam FM Summer 2021Document2 pagesFinal Exam FM Summer 2021AAYAN FARAZNo ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- Financial Analysis TestsDocument25 pagesFinancial Analysis Teststheodor_munteanuNo ratings yet

- CA Bcom PH 3rd Sem 2016Document7 pagesCA Bcom PH 3rd Sem 2016Gursirat KaurNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- Redemption of Debentures (Inter CA) PDFDocument4 pagesRedemption of Debentures (Inter CA) PDFvenkata srikanth topalliNo ratings yet

- Sept 2014 - 230716 - 233727Document22 pagesSept 2014 - 230716 - 233727mohddanialhanaffimustaffiNo ratings yet

- Cost of DebtDocument2 pagesCost of Debtbekalgagan29No ratings yet

- Management of Interest Rate Risk in BanksDocument6 pagesManagement of Interest Rate Risk in BanksPratik NayakNo ratings yet

- Bank NII and NIM Scenarios Case StudyDocument8 pagesBank NII and NIM Scenarios Case Studynedhul50No ratings yet

- Internal Reconstruction NotesDocument16 pagesInternal Reconstruction NotesAkash Mehta100% (1)

- TM Tut 13 Credit Derivatives Revision PDFDocument5 pagesTM Tut 13 Credit Derivatives Revision PDFQuynh Ngoc DangNo ratings yet

- ExportDocument21 pagesExportBükre PNo ratings yet

- Questions For Unit 4 RevisionDocument3 pagesQuestions For Unit 4 RevisionDimple PatelNo ratings yet

- Fin464 AsDocument13 pagesFin464 AsMohammed Jubaer Alom Shuvo 1812809630No ratings yet

- Worked Example - Ratio IiDocument1 pageWorked Example - Ratio IiABDULSWAMADU KARIMUNo ratings yet

- Section A: Sixty (60) Independent Multiple-Choice Questions Answer All Questions in This SectionDocument27 pagesSection A: Sixty (60) Independent Multiple-Choice Questions Answer All Questions in This SectionGabriel ArthurNo ratings yet

- Ratio Analysis QuestionDocument3 pagesRatio Analysis QuestionPraween BimsaraNo ratings yet

- 3.BACC III 2016 End - Docx ModeratedDocument7 pages3.BACC III 2016 End - Docx ModeratedsmlingwaNo ratings yet

- KRDTop100SFM PDFDocument215 pagesKRDTop100SFM PDFNag Sai NarahariNo ratings yet

- Fra Suresh Rao TybbiDocument2 pagesFra Suresh Rao TybbiRasKumarNo ratings yet

- Financial Analysis and InterpretationDocument2 pagesFinancial Analysis and InterpretationRasKumarNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- ABC Apparel MFGDocument5 pagesABC Apparel MFGShyam C VNo ratings yet

- ABC Apparel MFGDocument5 pagesABC Apparel MFGShyam C VNo ratings yet

- Ratio AnalysisDocument7 pagesRatio AnalysisDEEPA KUMARINo ratings yet

- r7 Mba Financial Accounting and Analysis Set1Document3 pagesr7 Mba Financial Accounting and Analysis Set1Sunil RaparthiNo ratings yet

- Homework of Quantitative Courses Home Work No.: 3Document3 pagesHomework of Quantitative Courses Home Work No.: 3Jasjeet SinghNo ratings yet

- Solvency RatioDocument3 pagesSolvency RatioRaghavendra JeevaNo ratings yet

- Part 4 ExercisesDocument6 pagesPart 4 Exercisesrbaalsdy530No ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- FM Handout 5Document32 pagesFM Handout 5Rofiq VedcNo ratings yet

- Mid Term FIN 514Document4 pagesMid Term FIN 514Showkatul IslamNo ratings yet

- SA Syl12 Jun2015 P20Document21 pagesSA Syl12 Jun2015 P20Atiq ur RehmanNo ratings yet

- MA A-3 Ratio AnalysisDocument3 pagesMA A-3 Ratio AnalysisShilpa AroraNo ratings yet

- Botm Tutorial 4Document2 pagesBotm Tutorial 4Zhiyu KamNo ratings yet

- MBA AFM Probs On FS Analysis, Ratio Analysis and Com SizeDocument6 pagesMBA AFM Probs On FS Analysis, Ratio Analysis and Com SizeAngelsony AmmuNo ratings yet

- Section - 1Document7 pagesSection - 1ravichandrasterNo ratings yet

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyNo ratings yet

- L3 Capital ManagementDocument35 pagesL3 Capital ManagementZhiyu KamNo ratings yet

- L4 Money Market & Instrument TradingDocument32 pagesL4 Money Market & Instrument TradingZhiyu KamNo ratings yet

- L5 Eurocurrency MarketDocument24 pagesL5 Eurocurrency MarketZhiyu KamNo ratings yet

- L2 Source of FinanceDocument26 pagesL2 Source of FinanceZhiyu KamNo ratings yet

- L1 Intro To Treasury MGM & The MGM of Balance Sheet ExposuresDocument35 pagesL1 Intro To Treasury MGM & The MGM of Balance Sheet ExposuresZhiyu KamNo ratings yet

- Botm Tutorial 4Document2 pagesBotm Tutorial 4Zhiyu KamNo ratings yet

- Botm Tutorial 7Document1 pageBotm Tutorial 7Zhiyu KamNo ratings yet

- Botm Tutorial 6Document1 pageBotm Tutorial 6Zhiyu KamNo ratings yet

- Botm Tutorial 3Document1 pageBotm Tutorial 3Zhiyu KamNo ratings yet

- 3.4 Supporting Doc Risk Register Template With InstructionsDocument8 pages3.4 Supporting Doc Risk Register Template With InstructionsSwadhin PalaiNo ratings yet

- Assessment Task-2Document7 pagesAssessment Task-2Parash RijalNo ratings yet

- Verka Project ReportDocument69 pagesVerka Project Reportkaushal244250% (2)

- Country in A Box ProjectDocument6 pagesCountry in A Box Projectapi-301892404No ratings yet

- ATI PN Maternal Newborn Proctored Exam Test Bank (38 Versions) (New-2022)Document7 pagesATI PN Maternal Newborn Proctored Exam Test Bank (38 Versions) (New-2022)kapedispursNo ratings yet

- 8299 PDF EngDocument45 pages8299 PDF Engandrea carolina suarez munevarNo ratings yet

- Reaserch ProstitutionDocument221 pagesReaserch ProstitutionAron ChuaNo ratings yet

- Greek Mythology ReviewerDocument12 pagesGreek Mythology ReviewerSyra JasmineNo ratings yet

- Leander Geisinger DissertationDocument7 pagesLeander Geisinger DissertationOrderPapersOnlineUK100% (1)

- Lecture 1Document12 pagesLecture 1asiaNo ratings yet

- Shes Gotta Have It EssayDocument4 pagesShes Gotta Have It EssayTimothy LeeNo ratings yet

- Warnord 041600zmar19Document4 pagesWarnord 041600zmar19rjaranilloNo ratings yet

- Superstore PROJECT 1Document3 pagesSuperstore PROJECT 1Tosin GeorgeNo ratings yet

- Term Paper Air PollutionDocument4 pagesTerm Paper Air Pollutionaflsnggww100% (1)

- Airport Planning and Engineering PDFDocument3 pagesAirport Planning and Engineering PDFAnil MarsaniNo ratings yet

- 304 1 ET V1 S1 - File1Document10 pages304 1 ET V1 S1 - File1Frances Gallano Guzman AplanNo ratings yet

- Noah Horwitz - Reality in The Name of God, or Divine Insistence - An Essay On Creation, Infinity, and The Ontological Implications of Kabbalah-Punctum Books (2012) PDFDocument358 pagesNoah Horwitz - Reality in The Name of God, or Divine Insistence - An Essay On Creation, Infinity, and The Ontological Implications of Kabbalah-Punctum Books (2012) PDFGabriel Reis100% (1)

- Cebu BRT Feasibility StudyDocument35 pagesCebu BRT Feasibility StudyCebuDailyNews100% (3)

- Proposal Teen Age PregnancyDocument2 pagesProposal Teen Age Pregnancymountain girlNo ratings yet

- PS2082 VleDocument82 pagesPS2082 Vlebillymambo0% (1)

- Hack Tata Docomo For Free G..Document3 pagesHack Tata Docomo For Free G..Bala Rama Krishna BellamNo ratings yet

- Mt-Requirement-01 - Feu CalendarDocument18 pagesMt-Requirement-01 - Feu CalendarGreen ArcNo ratings yet

- Modules 1-8 Answer To Guides QuestionsDocument15 pagesModules 1-8 Answer To Guides QuestionsBlackblight •No ratings yet

- Updated 2 Campo Santo de La LomaDocument64 pagesUpdated 2 Campo Santo de La LomaRania Mae BalmesNo ratings yet

- Ikea ReportDocument48 pagesIkea ReportPulkit Puri100% (3)

- Declarations On Higher Education and Sustainable DevelopmentDocument2 pagesDeclarations On Higher Education and Sustainable DevelopmentNidia CaetanoNo ratings yet

- Read The Following Case Study Carefully and Answer The Questions Given at The End: Case # 3. ElectroluxDocument3 pagesRead The Following Case Study Carefully and Answer The Questions Given at The End: Case # 3. ElectroluxDarkest DarkNo ratings yet

- Theological Seminary of Evengelical Kalimantan ChurchDocument15 pagesTheological Seminary of Evengelical Kalimantan ChurchPetra Aria Pendung Wu'iNo ratings yet

- CEAT PresentationDocument41 pagesCEAT PresentationRAJNTU7aNo ratings yet

- Projections GuideDocument28 pagesProjections GuidemkmattaNo ratings yet