Professional Documents

Culture Documents

Dream Chaser

Uploaded by

Hiền NguyễnCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dream Chaser

Uploaded by

Hiền NguyễnCopyright:

Available Formats

DREAM CHASER

Mr. Tung Chan is a young teacher at HALU University. He has a dream to own a Rolls-Royce

Ghost, which costs 16 billion VND. He decided to take a loan from the bank to chase his fantasy.

Currently in Vietnam, the maximum loan-to-value ratio is 80%

He planned to use his house, which located on km9, Nguyen Trai Road as collateral for his loan.

The house is currently priced on the market at 12 billion VND. The loan to collateral ratio is 80%

He asked some of his friends, who currently working in several banks, in particular: Oceanbank, SCB,

Vietcombank, VPBank.

We know that different bank has different interest rate for car loan (you have to look up the I/R

by yourself). Assume that the interest rate for car loan is a fixed rate, which equal to deposit rate of each

bank for 12 months + adjustable rate (A/R is the same for all banks at fixed 3.5%)

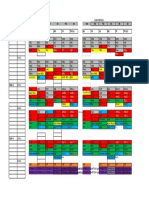

Create a loan repayment schedule for Mr. Tung Chan as his loan will be approved on October

15th 2022 and he will make his 1st repayment on November 15th 2022. The maximum duration for a

car loan in Vietnam is 7 years (after 7 years, a car will be fully amortized)

Note: Using Vietnamese loan repayment schedule, you can use Edate function to add 1 month

into a date

In case you don’t know how Rolls-Royce Ghost looks like. I mean the car, not the man, ofc!

You might also like

- Mod9top1 App CreditfileDocument1 pageMod9top1 App CreditfileRidhi PapineniNo ratings yet

- There Are 3 Types of Car Loans Available in IndiaDocument11 pagesThere Are 3 Types of Car Loans Available in IndiaAshis Kumar MuduliNo ratings yet

- SME LoanDocument17 pagesSME LoanrajNo ratings yet

- Canara Bank Is AnDocument25 pagesCanara Bank Is AnvaishnaviNo ratings yet

- Bank of India Loan Against Property Through LoanmoneyDocument10 pagesBank of India Loan Against Property Through LoanmoneyMAYUURESH RAVALENo ratings yet

- Education Loan Overview - Updated 2022Document19 pagesEducation Loan Overview - Updated 2022Priya BhojaniNo ratings yet

- Bank of Baroda (BOB) Car Loan Interest Rates 2019: Sona Copy HereDocument81 pagesBank of Baroda (BOB) Car Loan Interest Rates 2019: Sona Copy Heresavita kailas kadamNo ratings yet

- Axis Bank-Vehicle LoanDocument45 pagesAxis Bank-Vehicle LoansonamNo ratings yet

- Meta Title: EMI For Personal Loan of Rs 10 Lakh Meta Description: A Personal Loan Obtained From A Bank or NBFC Can BeDocument4 pagesMeta Title: EMI For Personal Loan of Rs 10 Lakh Meta Description: A Personal Loan Obtained From A Bank or NBFC Can BeParag ShrivastavaNo ratings yet

- Why Reverse Mortgage Failed in IndiaDocument3 pagesWhy Reverse Mortgage Failed in IndiaravitejaNo ratings yet

- Comparative Study of Home Loans of Abhyudaya Co-Operative Bank and NKGSB Co-Operative Bank .Document85 pagesComparative Study of Home Loans of Abhyudaya Co-Operative Bank and NKGSB Co-Operative Bank .meenakshi dange100% (1)

- What Is A MortgageDocument6 pagesWhat Is A MortgagekrishnaNo ratings yet

- Comparative Analysis of SBI & HDFC Bank Regarding Personal LoanDocument6 pagesComparative Analysis of SBI & HDFC Bank Regarding Personal LoanAkhil MohantyNo ratings yet

- Comparative Study of Home Loans of PNB and Sbi Bank Final ProjectDocument11 pagesComparative Study of Home Loans of PNB and Sbi Bank Final ProjectManish KumarNo ratings yet

- Bamboo Prahok: Case 1Document2 pagesBamboo Prahok: Case 1sochealaoNo ratings yet

- Chapter 1 BhavanDocument60 pagesChapter 1 BhavanPrashant ShindeNo ratings yet

- Bhavesh ProjectDocument81 pagesBhavesh Projectattalr54No ratings yet

- 3.BANKING SECTOR - Nishtha ChhabraDocument83 pages3.BANKING SECTOR - Nishtha ChhabraHarshal FuseNo ratings yet

- Car Loan FinalDocument21 pagesCar Loan Finalislamkilaniya66100% (1)

- Srinath 123Document69 pagesSrinath 123hullur_srinath62633No ratings yet

- My FRP REPORTDocument61 pagesMy FRP REPORTsetiaricky100% (1)

- Auto Loan From Bangladeshi BanksDocument4 pagesAuto Loan From Bangladeshi Bankstipu1sultan_1No ratings yet

- Ritesh HDFCDocument51 pagesRitesh HDFCRitesh VarmaNo ratings yet

- HOME LOAN HDFC AND SBiDocument48 pagesHOME LOAN HDFC AND SBiLucky XeroxNo ratings yet

- Loan Systen in IndiaDocument19 pagesLoan Systen in IndiaPrashant singhNo ratings yet

- My FRP REPORTDocument61 pagesMy FRP REPORTsetiarickyNo ratings yet

- ENG - Ebook Kurangkan Hutang Kita!-1Document21 pagesENG - Ebook Kurangkan Hutang Kita!-1Mr DummyNo ratings yet

- Loans WebquestDocument3 pagesLoans Webquestapi-288392955No ratings yet

- Assignment: Submitted By:-Submitted ToDocument5 pagesAssignment: Submitted By:-Submitted ToVasudev KashyapNo ratings yet

- Features New Car Loan Used Car LoanDocument2 pagesFeatures New Car Loan Used Car LoanRahul JOshiNo ratings yet

- Assignment-I FMDocument2 pagesAssignment-I FMArnav ShresthaNo ratings yet

- Pit Stop LoansDocument5 pagesPit Stop Loansjose teixeiraNo ratings yet

- Dubai Islamic Bank Car IjarahDocument18 pagesDubai Islamic Bank Car IjarahBaniya KhanNo ratings yet

- What Do Banks Look at WhenDocument7 pagesWhat Do Banks Look at WhenlykaNo ratings yet

- Money and Banking CrosswordDocument2 pagesMoney and Banking Crosswordapi-314630514No ratings yet

- Add Maths FolioDocument17 pagesAdd Maths FolioSeven Hearts100% (1)

- Krish Mahtre Maths ProjectDocument21 pagesKrish Mahtre Maths ProjectKrish MhatreNo ratings yet

- Edu Loan For Foreign StudyDocument17 pagesEdu Loan For Foreign StudyGurbani Kaur SuriNo ratings yet

- Group 7 F2Document37 pagesGroup 7 F2Payal SarafNo ratings yet

- Personal FinanceDocument7 pagesPersonal FinanceSri Dhanya S MNo ratings yet

- 8 MortgageDocument9 pages8 Mortgagefitnumanarshadna7No ratings yet

- Mortgage and Amortization: Lesson 11Document14 pagesMortgage and Amortization: Lesson 11귀여워gwiyowoNo ratings yet

- Business LoansDocument25 pagesBusiness LoansMai TiếnNo ratings yet

- Personal Loan in India at Lowest Interest Rates - Compare & Apply OnlineDocument3 pagesPersonal Loan in India at Lowest Interest Rates - Compare & Apply OnlineDILLIP KUMAR MAHAPATRANo ratings yet

- Introduction:-: Establishment For Custody of Money, Which It Pays Out On Customer's Order."Document12 pagesIntroduction:-: Establishment For Custody of Money, Which It Pays Out On Customer's Order."varunNo ratings yet

- FM3 Lesson 1 Banking and Financial InstitutionDocument8 pagesFM3 Lesson 1 Banking and Financial InstitutionBeatriz Caladiao MatituNo ratings yet

- Amortization and MortgageDocument20 pagesAmortization and MortgageprincemarvinvueltaNo ratings yet

- bài ôn tập cho vayDocument6 pagesbài ôn tập cho vayQuynh NguyenNo ratings yet

- Car Finance Islamic BankingDocument14 pagesCar Finance Islamic BankingNouman SarwarNo ratings yet

- Banking ProductsDocument21 pagesBanking ProductsAkhil RawatNo ratings yet

- Payday Loans With No Credit Check in 5 Minutes - Direct MoneyDocument20 pagesPayday Loans With No Credit Check in 5 Minutes - Direct MoneyDirect Money (South Africa)No ratings yet

- Bank LoansDocument20 pagesBank LoansMihir ShahNo ratings yet

- Subject: Credit Analysis and Advances Vehicles Loan Auto Loans An Overview in Nepal: Auto Loans/hire Purchase Loans, One of The ConsumerDocument17 pagesSubject: Credit Analysis and Advances Vehicles Loan Auto Loans An Overview in Nepal: Auto Loans/hire Purchase Loans, One of The ConsumerAnkit NeupaneNo ratings yet

- Vehicle Loan Procedure in IndiaDocument12 pagesVehicle Loan Procedure in Indiatripti480% (1)

- Education Loan FAQs 1Document2 pagesEducation Loan FAQs 1mvtarunNo ratings yet

- Customer Satisfaction Bank LoanDocument84 pagesCustomer Satisfaction Bank LoanAshish Khandelwal33% (3)

- Folio Add Math )Document6 pagesFolio Add Math )Farah Umaira JamalludinNo ratings yet

- Course Outline - FIP - 2023Document5 pagesCourse Outline - FIP - 2023Hiền NguyễnNo ratings yet

- Lecture 6 - Managing Your CreditDocument47 pagesLecture 6 - Managing Your CreditHiền NguyễnNo ratings yet

- Lecture 10 - Retirement PlanningDocument33 pagesLecture 10 - Retirement PlanningHiền NguyễnNo ratings yet

- Lecture 11 - Estate PlanningDocument15 pagesLecture 11 - Estate PlanningHiền NguyễnNo ratings yet

- Lecture 3 - Preparing Your Taxes PDFDocument46 pagesLecture 3 - Preparing Your Taxes PDFHiền NguyễnNo ratings yet

- Lecture 7 - Life Insurance PDFDocument29 pagesLecture 7 - Life Insurance PDFHiền NguyễnNo ratings yet

- FMT Program StructureDocument1 pageFMT Program StructureHiền NguyễnNo ratings yet

- Syllabus Financial Modeling 22.08.2022 FINALDocument7 pagesSyllabus Financial Modeling 22.08.2022 FINALHiền Nguyễn0% (1)

- Tute-9 FMTDocument6 pagesTute-9 FMTHiền NguyễnNo ratings yet

- Tutorial 2 QuestionsDocument5 pagesTutorial 2 QuestionsHiền NguyễnNo ratings yet

- For Each of The Following Transactions: Portfolio. CopenhagenDocument18 pagesFor Each of The Following Transactions: Portfolio. CopenhagenHiền NguyễnNo ratings yet

- Tute 1 QuestionsDocument5 pagesTute 1 QuestionsHiền NguyễnNo ratings yet

- Courseoutline-BM 2022 FullDocument97 pagesCourseoutline-BM 2022 FullHiền NguyễnNo ratings yet

- International Finance Spring 2023 SyllabusDocument9 pagesInternational Finance Spring 2023 SyllabusHiền NguyễnNo ratings yet

- Syllabus - CorporateFinance - Autumn 2022Document7 pagesSyllabus - CorporateFinance - Autumn 2022Hiền NguyễnNo ratings yet