Professional Documents

Culture Documents

Short Term Credit Line Example

Uploaded by

Như Hoài Thương0 ratings0% found this document useful (0 votes)

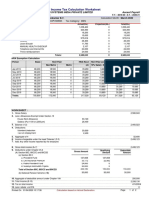

6 views1 pageThe document contains income statements, balance sheets, and cash flow statements for years 2018A through 2020F for a company. It shows that revenue increased from $5.5M in 2018 to $15M in 2019 and is projected to be $20M in 2020. Net profit increased from $180k in 2018 to $4.39M in 2019 and is projected to be $4.68M in 2020. The balance sheet indicates that total assets will increase from $14.48M in 2018 to $29.55M in 2020, driven largely by growth in cash from $8.98M to $20.55M over that period. The cash flow statement projects a $10.68M increase in cash

Original Description:

Original Title

Short term credit line example

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains income statements, balance sheets, and cash flow statements for years 2018A through 2020F for a company. It shows that revenue increased from $5.5M in 2018 to $15M in 2019 and is projected to be $20M in 2020. Net profit increased from $180k in 2018 to $4.39M in 2019 and is projected to be $4.68M in 2020. The balance sheet indicates that total assets will increase from $14.48M in 2018 to $29.55M in 2020, driven largely by growth in cash from $8.98M to $20.55M over that period. The cash flow statement projects a $10.68M increase in cash

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageShort Term Credit Line Example

Uploaded by

Như Hoài ThươngThe document contains income statements, balance sheets, and cash flow statements for years 2018A through 2020F for a company. It shows that revenue increased from $5.5M in 2018 to $15M in 2019 and is projected to be $20M in 2020. Net profit increased from $180k in 2018 to $4.39M in 2019 and is projected to be $4.68M in 2020. The balance sheet indicates that total assets will increase from $14.48M in 2018 to $29.55M in 2020, driven largely by growth in cash from $8.98M to $20.55M over that period. The cash flow statement projects a $10.68M increase in cash

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

INCOME STATEMENT 2018A 2019A 2020F

Revenue 5,500.0 15,000.0 20,000.0

COGS 3,000.0 6,000.0 9,000.0

Gross Profit 2,500.0 9,000.0 11,000.0

SG&A 1,200.0 1,200.0 1,500.0

EBITDA 1,300.0 7,800.0 9,500.0

Depn & Amort 1,000.0 2,000.0 3,000.0

EBIT 300.0 5,800.0 6,500.0

Interest 60.0 10.0 262.5

EBT 240.0 5,790.0 6,237.5

Tax rate 25% 60.0 1,400.0 1,559.4

Net Profit 180.0 4,390.0 4,678.1

BALANCE SHEET 2018A 2019A 2020F

ASSET 14,480.0 16,870.0 29,548.1

1. Short-term Asset 10,480.0 12,870.0 22,548.1

1.1 Cash 8,980.0 9,870.0 20,548.1

1.2 Inventory 1,000.0 1,500.0 1,000.0

1.3 A/R 500.0 1,500.0 1,000.0

2. Fixed Assets, net 4,000.0 4,000.0 7,000.0

LIABILITY & EQUITY 14,480.0 16,870.0 29,548.1

3.1 A/P 300.0 1,300.0 1,800.0

3.2 Notes payable 2,000.0 1,000.0 2,500.0

3.3 Long term Debt 2,000.0 0.0 7,000.0

3.3 Equity 10,180.0 14,570.0 18,248.1

3.3.1 Common stock 10,000.0 10,000.0 10,000.0

3.3.2 Retained Earnings 180.0 4,570.0 8,248.1

CASH FLOW 2018A 2019A 2020F

Operating 9,178.1

Net Income 4,678.1

∆D&A 3,000.0

∆ A/R 500.0

∆ Inventory 500.0

∆ A/P 500.0

Investing (6,000.0)

CAPEX (6,000.0)

Financing 7,500.0

ST. Debt 1,500.0

LT. Debt 7,000.0

Issue Share 0.0

Dividends (1,000.0)

Net Cash Change 10,678.1

Cash Begin 9,870.0

Cash End 20,548.1

You might also like

- Solutions - Formation-LumpSum LiquidationDocument14 pagesSolutions - Formation-LumpSum LiquidationLuna SanNo ratings yet

- UE MC 2023-2024 Exercíse 9 B2 Solution1Document1 pageUE MC 2023-2024 Exercíse 9 B2 Solution1Sami El YadiniNo ratings yet

- Adesoye, Adeniji-Scena - CorrectDocument11 pagesAdesoye, Adeniji-Scena - CorrectAdesoye AdenijiNo ratings yet

- Case File 2.0Document4 pagesCase File 2.0abeer alamNo ratings yet

- Case FileDocument4 pagesCase Fileabeer alamNo ratings yet

- Capital Budgeting - 2021Document7 pagesCapital Budgeting - 2021Mohamed ZaitoonNo ratings yet

- Financial Analysis - Mini Case-Norbrook-Group BDocument2 pagesFinancial Analysis - Mini Case-Norbrook-Group BErrol ThompsonNo ratings yet

- Lab9 FahmiGilangMadani 120110170024 Jumat10.30 KakAlissa Kamis07.30 BuPrimaDocument3 pagesLab9 FahmiGilangMadani 120110170024 Jumat10.30 KakAlissa Kamis07.30 BuPrimaFahmi GilangNo ratings yet

- 1st-Case-Study - Financial-Statement-Analysis - Group 5Document18 pages1st-Case-Study - Financial-Statement-Analysis - Group 5gellie villarinNo ratings yet

- Er Cla 2Document2 pagesEr Cla 2Sakshi ManotNo ratings yet

- 1st Case Study - Financial Statement AnalysisDocument6 pages1st Case Study - Financial Statement AnalysisKimberly SoqueNo ratings yet

- Rudita Cahya - B - 24604 - QuizBesar1Document6 pagesRudita Cahya - B - 24604 - QuizBesar1Giovanni HebertNo ratings yet

- Activity 2Document1 pageActivity 2soleilNo ratings yet

- Jawaban UTS Manajemen KeuanganDocument16 pagesJawaban UTS Manajemen KeuanganMikhail BarenovNo ratings yet

- Bab III Buku Bu IinDocument14 pagesBab III Buku Bu IinAditya Agung SatrioNo ratings yet

- Financial Statement Analysis: Income Statement Balance Sheet Statement of Cash Flows Free Cash Flow Performance MeasuresDocument44 pagesFinancial Statement Analysis: Income Statement Balance Sheet Statement of Cash Flows Free Cash Flow Performance Measuressincere sincereNo ratings yet

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Document2 pagesFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCONo ratings yet

- Activity 1Document4 pagesActivity 1Lezi WooNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument8 pagesFinancial Statements, Cash Flow, and TaxesAdwa Al-NaimNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Appendix Projected Profit & LossDocument3 pagesAppendix Projected Profit & LossDwirainita RamadhaniaNo ratings yet

- Integ Case 1 FsDocument7 pagesInteg Case 1 FsIra BenitoNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument8 pagesFinancial Statements, Cash Flow, and TaxesRaihan Eibna RezaNo ratings yet

- FinMan DLSUD Mid-Term Exam April 11 2019Document4 pagesFinMan DLSUD Mid-Term Exam April 11 2019Raquel ManarpiisNo ratings yet

- 2014a 2015a 2016e 2017e 2018e 2019e 2020e 2021eDocument1 page2014a 2015a 2016e 2017e 2018e 2019e 2020e 2021evivianclementNo ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- Solution ExercisesDocument7 pagesSolution Exercises280alexNo ratings yet

- Mini CaseDocument7 pagesMini CaseHarrisha Arumugam0% (1)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision QuestionskelvinmunashenyamutumbaNo ratings yet

- Group Assignment 2Document2 pagesGroup Assignment 2sebsibeboki01No ratings yet

- Afar-Chapter 3 AssignmentDocument38 pagesAfar-Chapter 3 AssignmentJeane Mae BooNo ratings yet

- Template 2 Task 3 Calculation Worksheet - BSBFIM601Document17 pagesTemplate 2 Task 3 Calculation Worksheet - BSBFIM601Writing Experts0% (1)

- SLEEP WELL HOTELS - Financial Statements Forecast: Income Statement Year 1 Year 2 Balance SheetDocument3 pagesSLEEP WELL HOTELS - Financial Statements Forecast: Income Statement Year 1 Year 2 Balance SheetDIPESH KUNWARNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- Analysis of Financial Statements - VICO Foods CorporationDocument19 pagesAnalysis of Financial Statements - VICO Foods CorporationHannah Bea LindoNo ratings yet

- CH4 MinicaseDocument4 pagesCH4 Minicasemervin coquillaNo ratings yet

- The Institute of Finance Management: AnswersDocument6 pagesThe Institute of Finance Management: AnswersAli SalehNo ratings yet

- Test 3 FinaccDocument8 pagesTest 3 FinaccPaul ChavundukaNo ratings yet

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- Statements Projected Profit & LossDocument6 pagesStatements Projected Profit & LossApril Joy ObedozaNo ratings yet

- Cortez Exam in Business FinanceDocument4 pagesCortez Exam in Business FinanceFranchesca CortezNo ratings yet

- BU51009 (5BA) - Assessed Coursework - EBT 2019-20Document2 pagesBU51009 (5BA) - Assessed Coursework - EBT 2019-20Sravya MagantiNo ratings yet

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- Final PB FAR Batch 7 Sept 2023Document38 pagesFinal PB FAR Batch 7 Sept 2023Leo M. SalibioNo ratings yet

- Activity 2 MIlca BSA 3 3Document6 pagesActivity 2 MIlca BSA 3 3kyrie IrvingNo ratings yet

- GYM Financial ModelingDocument12 pagesGYM Financial ModelingDivyanshu SharmaNo ratings yet

- Manual Solution 6-14Document5 pagesManual Solution 6-14Sohmono HendraiosNo ratings yet

- Illustrative Full Set of IFRS For SME Financial StatementsDocument16 pagesIllustrative Full Set of IFRS For SME Financial StatementsGirma NegashNo ratings yet

- Quiz No 3Document5 pagesQuiz No 3KristiNo ratings yet

- Course Folder Fall 2022Document26 pagesCourse Folder Fall 2022Areeba QureshiNo ratings yet

- Borrowing Cost Problems IIDocument15 pagesBorrowing Cost Problems IICHRISTIAN DAVE SAYSONNo ratings yet

- 02 - Partnership Operation Handout SolutionDocument14 pages02 - Partnership Operation Handout SolutionJanysse CalderonNo ratings yet

- Problem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowDocument2 pagesProblem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowChristy YouNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- Mini Case Chapter 3 Final VersionDocument14 pagesMini Case Chapter 3 Final VersionAlberto MariñoNo ratings yet

- 3 Months PlanDocument8 pages3 Months PlanWaleed ZakariaNo ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- Assignment Financial Ratio Fin420Document8 pagesAssignment Financial Ratio Fin420FATIMAH ZAHRA BINTI ABDUL HADI KAMELNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Lecture 13 PDFDocument6 pagesLecture 13 PDFNhư Hoài ThươngNo ratings yet

- ReillyBrown IAPM 11e PPT Ch11Document58 pagesReillyBrown IAPM 11e PPT Ch11rocky wongNo ratings yet

- Targeted Cash Flow AnalysisDocument1 pageTargeted Cash Flow AnalysisNhư Hoài ThươngNo ratings yet

- Typical Loan CovenantsDocument3 pagesTypical Loan CovenantsNhư Hoài ThươngNo ratings yet

- Loan StructuringDocument10 pagesLoan StructuringNhư Hoài ThươngNo ratings yet