Professional Documents

Culture Documents

04-Chap2-Chart of Accounts-2022-2023-S1

Uploaded by

Lilly ChanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

04-Chap2-Chart of Accounts-2022-2023-S1

Uploaded by

Lilly ChanCopyright:

Available Formats

Chart of accounts 會計科目表 (reference only)

A list of all account names available in the accounting system to record transactions of a

company. The chart of accounts consists of statement of financial position accounts (assets,

liabilities, and shareholders’ equity) and income statement accounts (revenues, expenses,

gains, losses). The chart of accounts can be expanded and tailored to reflect the operations of

the company.

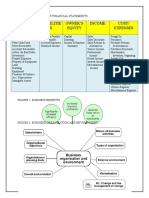

STATEMENT OF FINANCIAL POSITION INCOME STATEMENT

ASSETS LIABILITIES REVENUES

Cash Accounts Payable Service Revenue

Petty Cash Notes Payable Sales Revenue

Accounts Receivable Unearned Revenue Interest Revenue

Less: Allowance for Impairment Salaries Payable Gain

iii

Notes Receivable Wages Payable

Interest Receivable Interest Payable

Shave

Supplies Income Tax Payable

Inventory Dividends Payable

Prepaid / Unexpired Advertising

Prepaid / Unexpired Insurance

Bonds Payable EXPENSES

Advertising Expense

歮

Investments Impairment Loss of Receivable

Land and Buildings Cost of Goods Sold

Equipment Delivery Expense

Less: Accumulated Depreciation Depreciation Expense

Equipment SHAREHOLDERS' EQUITY Insurance Expense

Patents Ordinary Share Interest Expense

Copyrights Preference Share Income Taxes Expense

Goodwill Share Premium Rent Expense

Retained Earnings Supplies Expense

Less: Treasury Share Utilities Expense

Gasoline Expense

Loss

DIVIDENDS**

Dividends (Cash)

** Reported in the statement

of retained earnings.

Note: You will see these account titles used in your textbook and in your homework.

In practice, companies often use variations of these account titles, many of which are specific to

industries or business e.g. banks and insurance companies.

You might also like

- Business Ratios and Formulas: A Comprehensive GuideFrom EverandBusiness Ratios and Formulas: A Comprehensive GuideRating: 3 out of 5 stars3/5 (1)

- Chart of AccountsDocument1 pageChart of AccountsChips AhoyNo ratings yet

- Asset Liabilities Equity Revenue Expense: Depreciation Expense Maintenance and Repair ExpensDocument3 pagesAsset Liabilities Equity Revenue Expense: Depreciation Expense Maintenance and Repair ExpensediwowNo ratings yet

- Acctg Terms and Debit CreditDocument3 pagesAcctg Terms and Debit CreditHel LoNo ratings yet

- Financial Statement OverviewDocument3 pagesFinancial Statement OverviewHel LoNo ratings yet

- Acctg Terms and Debit CreditDocument3 pagesAcctg Terms and Debit CreditHel LoNo ratings yet

- Accounting Basic TermsDocument3 pagesAccounting Basic TermsHel LoNo ratings yet

- Assets Liabilitie S Owner'S Equity Income Cost/ Expenses: Figure 1: Elements of Financial StatementsDocument6 pagesAssets Liabilitie S Owner'S Equity Income Cost/ Expenses: Figure 1: Elements of Financial StatementsalexisNo ratings yet

- Accounting Equation - Part 1Document11 pagesAccounting Equation - Part 1Krrish Bosamia100% (1)

- Problems On Profit Prior To IncorporationDocument18 pagesProblems On Profit Prior To Incorporationcsneha0803No ratings yet

- 1 Accounts-Debit or CreditDocument1 page1 Accounts-Debit or CreditPeter GeorgesNo ratings yet

- Accounting For ManagerDocument202 pagesAccounting For ManagerKHAWAJA MUHAMMAD HUZAIFA100% (1)

- Pearl Angelica S. Cagunot BSBA-Marketing Management 1 Year: Accounting 101 Quiz - Arranging The AssetsDocument4 pagesPearl Angelica S. Cagunot BSBA-Marketing Management 1 Year: Accounting 101 Quiz - Arranging The Assetspearl angelicaNo ratings yet

- Unit: IV Final Accounts of Sole TradersDocument16 pagesUnit: IV Final Accounts of Sole TradersAnbe SivamNo ratings yet

- Accounting Equation - Part 2Document48 pagesAccounting Equation - Part 2Krrish BosamiaNo ratings yet

- Finance NotesDocument23 pagesFinance NoteschamilasNo ratings yet

- Charts of AccountsDocument2 pagesCharts of AccountsNur ika PratiwiNo ratings yet

- Accounting Work Sheet No.01-1 PDFDocument3 pagesAccounting Work Sheet No.01-1 PDFTaskeen AliNo ratings yet

- Account ClassificationDocument22 pagesAccount ClassificationBenicel Lane De VeraNo ratings yet

- Review Session - NUS ACC1002 2020 SpringDocument50 pagesReview Session - NUS ACC1002 2020 SpringZenyuiNo ratings yet

- Final Accounts Guide for Business OwnersDocument7 pagesFinal Accounts Guide for Business OwnersSushank Kumar 7278No ratings yet

- CHAPTER 4 Types of Major AccountsDocument4 pagesCHAPTER 4 Types of Major AccountsUnah Ysabelle ValdonNo ratings yet

- Adobe Scan 20-Apr-2023Document6 pagesAdobe Scan 20-Apr-2023Notes GlobeNo ratings yet

- Financial StatementDocument2 pagesFinancial StatementJeftonNo ratings yet

- Accounting Measures & Firm Performance: Ratio CalculationDocument7 pagesAccounting Measures & Firm Performance: Ratio CalculationVítor Gularte de OliveiraNo ratings yet

- Accounting 101Document6 pagesAccounting 101angel luxxNo ratings yet

- Tally Ledger List in PDF Format TeachooDocument10 pagesTally Ledger List in PDF Format Teachoothakur731011No ratings yet

- CH 3 Classpack With SolutionsDocument29 pagesCH 3 Classpack With SolutionsjimenaNo ratings yet

- Chapter 2 Fundamentals of Accounting Module PDFDocument12 pagesChapter 2 Fundamentals of Accounting Module PDFCyrille Kaye TorrecampoNo ratings yet

- AssetsDocument1 pageAssetsbaljitkpanesar11No ratings yet

- Basic Financial Accounting Notes Very Helpfull Must SeeDocument5 pagesBasic Financial Accounting Notes Very Helpfull Must SeeBabar AbbasNo ratings yet

- List of Account Titles With Normal BalanceDocument3 pagesList of Account Titles With Normal BalanceGwendel Shine Villarmino FagalasNo ratings yet

- Profit and loss account and balance sheet analysisDocument3 pagesProfit and loss account and balance sheet analysisjulekhabegumNo ratings yet

- Basic Financial Accounting Notes.Document6 pagesBasic Financial Accounting Notes.Babar AbbasNo ratings yet

- 008 EBIT-and-EBITDADocument7 pages008 EBIT-and-EBITDAcaparvez25No ratings yet

- Accountingfornonaccountants 150701025139 Lva1 App6891Document187 pagesAccountingfornonaccountants 150701025139 Lva1 App6891Ferdinand Macol100% (1)

- AFAR - Sir BradDocument36 pagesAFAR - Sir BradOliveros JaymarkNo ratings yet

- Actividad Semana 5Document4 pagesActividad Semana 5Esteban CobosNo ratings yet

- Study of Financial Statement Repaired)Document4 pagesStudy of Financial Statement Repaired)sureshprojectsNo ratings yet

- Career Certificate In Business & HR ModulesDocument81 pagesCareer Certificate In Business & HR ModulesMuhamad Fadli HarunNo ratings yet

- Chapter 3 (AIS)Document16 pagesChapter 3 (AIS)John Paolo JosonNo ratings yet

- Chapter 03 Solutions ManualDocument75 pagesChapter 03 Solutions ManualElio AseroNo ratings yet

- Lecture 1 - Fundamentals and Accounting CycleDocument3 pagesLecture 1 - Fundamentals and Accounting CyclecoyNo ratings yet

- LLH9e Ch03 SolutionsManual FINALDocument68 pagesLLH9e Ch03 SolutionsManual FINALIgnjat100% (1)

- Unit 3Document29 pagesUnit 3Urja DhabardeNo ratings yet

- Accounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmDocument2 pagesAccounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmGurinder Pal SinghNo ratings yet

- List of Ledgers and It's Under Group in TallyDocument5 pagesList of Ledgers and It's Under Group in Tallyrachel KujurNo ratings yet

- Chapter # 4 Final AccountDocument39 pagesChapter # 4 Final AccountRooh Ullah KhanNo ratings yet

- Page 1 - 13 PDFDocument81 pagesPage 1 - 13 PDFCikgu kannaNo ratings yet

- Alfa Week 1Document13 pagesAlfa Week 1Cikgu kannaNo ratings yet

- Capital and Revenue IndifferencesDocument4 pagesCapital and Revenue IndifferencesMegan DhanavanthanNo ratings yet

- Contractor Chart of AccountsDocument2 pagesContractor Chart of AccountsDaves VestNo ratings yet

- MMS-2 Semester Batch 2010 - 2011 VesimsrDocument11 pagesMMS-2 Semester Batch 2010 - 2011 VesimsrVishal ShanbhagNo ratings yet

- Chapter 2-Overview of Financial StatementsDocument26 pagesChapter 2-Overview of Financial StatementsTESDA Regional Training Center- TaclobanNo ratings yet

- Chapter 1 Class NotesDocument6 pagesChapter 1 Class NotesCaroline RiosNo ratings yet

- Creation of Different Type of GL AccountDocument6 pagesCreation of Different Type of GL AccountMohammed Nawaz ShariffNo ratings yet

- Account Titles: Accounting (Cagayan State University)Document6 pagesAccount Titles: Accounting (Cagayan State University)Keith Anthony AmorNo ratings yet

- Istilah Ekonomi Dalam Bahasa InggrisDocument3 pagesIstilah Ekonomi Dalam Bahasa InggrisJuharNo ratings yet

- Account ClassificationDocument3 pagesAccount ClassificationUsama MukhtarNo ratings yet

- 04 - COA SamplesDocument4 pages04 - COA SamplesJonalyn MalicdanNo ratings yet

- Lesson 8Document69 pagesLesson 8Lilly ChanNo ratings yet

- Lesson 7Document68 pagesLesson 7Lilly ChanNo ratings yet

- Kantian ethics and the concept of treating people as ends in themselvesDocument68 pagesKantian ethics and the concept of treating people as ends in themselvesLilly ChanNo ratings yet

- Lesson 1Document43 pagesLesson 1Lilly ChanNo ratings yet

- Quiz PaperDocument5 pagesQuiz PaperLilly ChanNo ratings yet

- Afar 10Document8 pagesAfar 10RENZEL MAGBITANGNo ratings yet

- Management Information System: Bba LLB by The - Lawgical - WorldDocument18 pagesManagement Information System: Bba LLB by The - Lawgical - WorldK venkataiahNo ratings yet

- IRR = 15Document35 pagesIRR = 15FebriannNo ratings yet

- Green Field TownshipsDocument8 pagesGreen Field Townshipssharad yadavNo ratings yet

- Signal Cable Company: Cash Flow AnalysisDocument4 pagesSignal Cable Company: Cash Flow AnalysisRauf JaferiNo ratings yet

- Cash Flow in Production CycleDocument3 pagesCash Flow in Production CycleShishir BogatiNo ratings yet

- Asset and Liability ManagementDocument8 pagesAsset and Liability ManagementPriyanka YadavNo ratings yet

- Testbank - Chapter 15Document4 pagesTestbank - Chapter 15naztig_0170% (1)

- 8 Japan Structured Products Forum 2007Document10 pages8 Japan Structured Products Forum 2007Marius AngaraNo ratings yet

- Significance of Payback Analysis in Decision-MakingDocument9 pagesSignificance of Payback Analysis in Decision-MakingdutrafaissalNo ratings yet

- The Green House AgriBondDocument13 pagesThe Green House AgriBondMussa MlawaNo ratings yet

- Fundamental AnalysisDocument8 pagesFundamental AnalysisNiño Rey LopezNo ratings yet

- ITAT Hearing on Transfer Pricing AdjustmentDocument29 pagesITAT Hearing on Transfer Pricing Adjustmentbharath289No ratings yet

- Don Miller L BR SlidesDocument27 pagesDon Miller L BR Slidesartus14No ratings yet

- Chapter 5Document16 pagesChapter 5desi permataNo ratings yet

- Charting A Company'S Direction: Its Vision, Mission, Objectives, and StrategyDocument35 pagesCharting A Company'S Direction: Its Vision, Mission, Objectives, and StrategyNewaz SamiNo ratings yet

- CF WACC, WC NewDocument5 pagesCF WACC, WC NewSanjana PottipallyNo ratings yet

- PT Sawit Sumbermas Sarana TBK.: (Million Rupia ### ### ### Total AssetsDocument2 pagesPT Sawit Sumbermas Sarana TBK.: (Million Rupia ### ### ### Total AssetsAgil MahendraNo ratings yet

- Coca-Cola Amatil's Interest Rate Risk Hedging StrategiesDocument5 pagesCoca-Cola Amatil's Interest Rate Risk Hedging StrategiesLucas TingNo ratings yet

- CFA Programs Certificates and Courses Brochure Nov 2023Document7 pagesCFA Programs Certificates and Courses Brochure Nov 2023civicdoNo ratings yet

- Shares and DividendsDocument28 pagesShares and Dividendsrajaboina yakaiahNo ratings yet

- Evolution of FDI in India: Subject: Trade FinanceDocument32 pagesEvolution of FDI in India: Subject: Trade Financeashwin_nakmanNo ratings yet

- Tech Mahindra Financial Statement AnalysisDocument172 pagesTech Mahindra Financial Statement AnalysisManish JaiswalNo ratings yet

- Avoid Bases That Make Too Deep A DropDocument2 pagesAvoid Bases That Make Too Deep A DropAndraReiNo ratings yet

- Homework Chapter 11Document8 pagesHomework Chapter 11Trung Kiên NguyễnNo ratings yet

- Agricultural Bank of ChinaDocument7 pagesAgricultural Bank of ChinaJack YuanNo ratings yet

- Three Simple Ideas Ifrs17 IdDocument12 pagesThree Simple Ideas Ifrs17 IdNOCINPLUSNo ratings yet

- Financial Statements AnalysisDocument8 pagesFinancial Statements AnalysisyukiNo ratings yet

- Q: What Do You Think Is Wrong With The First Question I Asked in The Application Questions? How Does This Impact Your Answer, If at All?Document1 pageQ: What Do You Think Is Wrong With The First Question I Asked in The Application Questions? How Does This Impact Your Answer, If at All?PratikNo ratings yet