Professional Documents

Culture Documents

67838bos54415 Ip

Uploaded by

akashOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

67838bos54415 Ip

Uploaded by

akashCopyright:

Available Formats

Final Course

(Revised Scheme of Education and Training)

Study Material

PAPER 2

Strategic Financial

Management

BOARD OF STUDIES

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA

© The Institute of Chartered Accountants of India

ii

This study material has been prepared by the faculty of the Board of Studies. The objective of the

study material is to provide teaching material to the students to enable them to obtain knowledge

in the subject. In case students need any clarifications or have any suggestions for further

improvement of the material contained herein, they may write to the Director of Studies.

All care has been taken to provide interpretations and discussions in a manner useful for the

students. However, the study material has not been specifically discussed by the Council of the

Institute or any of its Committees and the views expressed herein may not be taken to necessarily

represent the views of the Council or any of its Committees.

Permission of the Institute is essential for reproduction of any portion of this material.

© The Institute of Chartered Accountants of India

All rights reserved. No part of this book may be reproduced, stored in a retrieval system, or

transmitted, in any form, or by any means, electronic, mechanical, photocopying, recording, or

otherwise, without prior permission, in writing, from the publisher.

Edition : October, 2021

Website : www.icai.org

E-mail : bosnoida@icai.in

Committee/ : Board of Studies

Department

ISBN No. :

Price (All Modules) : `

Published by : The Publication Department on behalf of The Institute of Chartered

Accountants of India, ICAI Bhawan, Post Box No. 7100,

Indraprastha Marg, New Delhi 110 002, India.

Printed by :

© The Institute of Chartered Accountants of India

iii

BEFORE WE BEGIN…

Strategic Financial Management (SFM) is one of the core papers for students appearing in Final

Level of Chartered Accountancy Course.

As you all are aware that SFM is a blend of Strategic Management and Financial Management.

Recently, it has gained significance due to growing globalization and continuous cross border flow

of capital.

Some corrections have been carried in the Study Material of this edition vis-à-vis the previous

edition of October 2020. Though some additions/ deletions have also been carried out at some

places, the details of notable changes have been separately outlined in separate pages titled

“Significant Changes”. Accordingly, student who has referred October 2020 Edition for his/her

preparation can continue to refer the same by referring to these Significant Changes.

The other characteristics of this study material which are outlined as below:

(i) It comprehensively covers the course requirements of students preparing for SFM paper.

(ii) It is written in a very simple and lucid manner to make the subject understandable to the

students.

(iii) At the beginning of each chapter, learning outcomes have been given so that the students

know in advance as to what he will learn after going through the chapter.

(iv) At the end of each chapter, under the caption, “Test your Knowledge” is given. Basically,

the purpose of the same is to motivate the students to recapitulate what they have learnt in

the chapter.

(v) While preparing the study material, every effort has been made to keep the chapters

concise, giving appropriate headings, sub-headings and examples, at suitable places.

We are confident that this study material will prove to be extremely useful to the students.

Although, sincere efforts have been made to keep the study material error free, it is possible that

some error might have inadvertently crept in. In this respect, students are encouraged to highlight

any mistake they may notice while going through the study material by sending an e-mail at: sfm-

final@icai.in or write to the Director of Studies, The Institute of Chartered Accountants of India, A-

29, Sector-62, Noida-201309.

Happy Reading and Best Wishes!

© The Institute of Chartered Accountants of India

iv

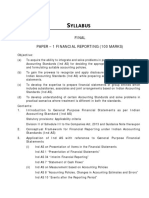

SYLLABUS

PAPER 2: STRATEGIC FINANCIAL MANAGEMENT

(One paper – Three hours – 100 marks)

Objective:

To acquire the ability to apply financial management theories and techniques in strategic decision making.

Contents:

(1) Financial Policy and Corporate Strategy

(i) Strategic decision making framework

(ii) Interface of Financial Policy and strategic management

(iii) Balancing financial goals vis-à-vis sustainable growth.

(2) Risk Management

(i) Identification of types of Risk faced by an organisation

(ii) Evaluation of Financial Risks

(iii) Value at Risk (VAR)

(iv) Evaluation of appropriate method for the identification and management of financial risk.

(3) Security Analysis

(i) Fundamental Analysis

(ii) Technical Analysis

a) Meaning

b) Assumptions

c) Theories and Principles

© The Institute of Chartered Accountants of India

v

d) Charting Techniques

e) Efficient Market Hypothesis (EMH) Analysis

(4) Security Valuation

(i) Theory of Valuation

(ii) Return Concepts

(iii) Equity Risk Premium

(iv) Required Return on Equity

(v) Discount Rate Selection in Relation to Cash Flows

(vi) Approaches to Valuation of Equity Shares

(vii) Valuation of Preference Shares

(viii) Valuation of Debentures/ Bonds

(5) Portfolio Management

(i) Portfolio Analysis

(ii) Portfolio Selection

(iii) Capital Market Theory

(iv) Portfolio Revision

(v) Portfolio Evaluation

(vi) Asset Allocation

(vii) Fixed Income Portfolio

(viii) Risk Analysis of Investment in Distressed Securities

(ix) Alternative Investment Strategies in context of Portfolio Management

© The Institute of Chartered Accountants of India

vi

(6) Securitization

(i) Introduction

(ii) Concept and Definition

(iii) Benefits of Securitization

(iv) Participants in Securitization

(v) Mechanism of Securitization

(vi) Problems in Securitization

(vii) Securitization Instruments

(viii) Pricing of Securitization Instruments

(ix) Securitization in India

(7) Mutual Fund

(i) Meaning

(ii) Evolution

(iii) Types

(iv) Advantages and Disadvantages of Mutual Funds

(8) Derivatives Analysis and Valuation

(i) Forward/ Future Contract

(ii) Options

(iii) Swaps

(iv) Commodity Derivatives

(9) Foreign Exchange Exposure and Risk Management

(i) Exchange rate determination

© The Institute of Chartered Accountants of India

vii

(ii) Foreign currency market

(iii) Management of transaction, translation and economic exposures

(iv) Hedging currency risk

(v) Foreign exchange derivatives – Forward, futures, options and swaps

(10) International Financial Management

(i) International Capital Budgeting

(ii) International Working Capital Management

a) Multinational Cash Management

- Objectives of Effective Cash Management

- Optimization of Cash Flows/ Needs

- Investment of Surplus Cash

b) Multinational Receivable Management

c) Multinational Inventory Management

(11) Interest Rate Risk Management

(i) Interest Rate Risk

(ii) Hedging Interest Rate Risk

a) Traditional Methods

b) Modern Methods including Interest Rate Derivatives

(12) Corporate Valuation

(i) Conceptual Framework of Valuation

(ii) Approaches/ Methods of Valuation

a) Assets Based Valuation Model

© The Institute of Chartered Accountants of India

viii

b) Earning Based Models

c) Cash Flow Based Models

d) Measuring Cost of Equity

- Capital Asset Pricing Model (CAPM)

- Arbitrage Pricing Theory

- Estimating Beta of an unlisted company

e) Relative Valuation

- Steps involved in Relative Valuation

- Equity Valuation Multiples

- Enterprise Valuation Multiple

f) Other Approaches to Value Measurement

- Economic Value Added (EVA)

- Market Value Added (MVA)

- Shareholder Value Analysis (SVA)

g) Arriving at Fair Value

(13) Mergers, Acquisitions and Corporate Restructuring

(i) Conceptual Framework

(ii) Rationale

(iii) Forms

(iv) Mergers and Acquisitions

a) Financial Framework

b) Takeover Defensive Tactics

© The Institute of Chartered Accountants of India

ix

c) Reverse Merger

(v) Divestitures

a) Partial Sell off

b) Demerger

c) Equity Carve outs

(vi) Ownership Restructuring

a) Going Private

b) Management/ Leveraged Buyouts

(vii) Cross Border Mergers

(14) Startup Finance

(i) Introduction including Pitch Presentation

(ii) Sources of Funding

(iii) Startup India Initiative

© The Institute of Chartered Accountants of India

x

SIGNIFICANT CHANGES

Significant changes in this Study Material vis-à-vis Study Material of

November 2020 edition of the Study Material

Chapter Chapter Name Details

1 Financial Policy and Corporate • Insertion of Sub-Heading ‘1.1 Meaning of

Strategy Strategic Financial Management’ including small

change in the language of the contents.

• Insertion of Sub-Heading ‘Sustainable Growth

Rate’ including small change in the language

and formatting of the contents.

4 Security Valuation • On Page No. 4.9 please read ‘H 1= Half-life of

high growth period’ as ‘H1 = Half of duration of

the transition period’.

• On Page No. 4.14 changed presentation of

formula for calculation of Theoretical Value of

Right.

• Insertion of new para 8.16 – Refunding of Bonds

• Corrections in the alternative solution of

Question No. 15.

• In the solution of Question No. 27 in last table

under Bond X please consider value 972.73 as

972.63 and also the answer as 51.80 instead of

51.79.

5 Portfolio Management • Insertion of some material in the end of para

10.3 – Jensen Alpha.

• Solution of Question No. 15 has been revised.

• Answer to part (i) of Question No. 17 as per

alternative approach has been included.

• Answer to part (iii) of Question No. 32 as per

alternative approach has been included.

• Answer to parts (ii) and (iii) of Question No. 36

as per alternative approach has been included.

• Solution of Question No. 39 has been revised.

7 Mutual Funds • Insertion of some material on Quant Fund under

the heading Special Funds.

• Minor changes in the language of first two lines

of para 4.9.

© The Institute of Chartered Accountants of India

xi

• In the Question No. 19 please read second last

sentence ‘At the end of the year equity shares

and 10% debentures are quoted at 175% and

90% respectively’ as ‘At the end of the year

equity shares and 10% debentures are quoted at

175% and 90% respectively of face value.’

• Insertion of alternative answer of Question No.

12.

• Insertion of a note in the end of the solution to

Question No. 7.36.

• Insertion of note in the solution of Question No.

17 under Plan B.

8 Derivatives Analysis and • Some values have been inserted in the end of

Valuation Illustration 3 and minor change in the solution of

sub-part (iii).

• Topic of Embedded Derivatives have been

removed and therefore question on the same in

Test Your Knowledge section been removed.

• Small change in the language of Question No. 4.

• In part (ii) of Question No. 12 please ignore the

Rupee symbol before 8125.

• In the end of Question No. 19 please read the

line ‘Assume the size option is 100 shares of

Delta Corporation.’ as ‘Assume the option size

is 100 shares of Delta Corporation.’

9 Foreign Exchange Exposure • In the Illustration No. 8, a note for sounding off

and Risk Management rates has been inserted and hence solution

stands modified. Further in solution in part (b)

please ignore the phrase ‘Net Amount payable

by customer per US$’

• On page No. 9.33 language of Swap Loss has

been modified.

• In Illustration 9 the answer of sub-part (ii) and

(vi) has been modified.

• In the Question No. 16 please insert 5 before

paisa.

• Solution of part (ii) of Question No. 1 has been

slightly changed.

• In the solution of Question no. 38 in second last

line 3 months has been replaced with 4 months.

© The Institute of Chartered Accountants of India

xii

• In the solution of Question No. 41 in part (b)

while calculating forward rate please add 0.0060

to €1.1770 instead of 0.0055 and accordingly the

answer will change to £ 3381234 instead of £

3382664.

10 International Financial • Illustration 1 and its solution has been slightly

Management revised.

11 Interest Rate Risk • In the second para of heading 1.3.1 please read

Management last line as ‘Conversely, a negative or liability

sensitive Gap implies that the banks’ NII could

increase as a result of decrease in market

interest rates.’

• In Question No. 3 for calculation of figures

please consider 3 decimal points instead of 4

and accordingly solution stands slightly revised.

• In the second last line of Question No. 7 please

ignore ‘9.0% and’.

• Minor changes in (ii) part of the solution of

Question No. 4.

12 Corporate Valuation • In the Illustration No. please read term

‘Reserves & Surplus’ as ‘Surplus Fund’. Further

in the answer in second table ignore term

‘Enterprise Value’ after Equity Value.

• On page No. 12.25 in the table of Step a(2)

please read ‘Forecasted Net Working Capital’ as

‘Forecasted Increase in Working Capital’.

• In Question No. 3 please read the line ‘From 4 th

year onward it will stabilize.’ as ‘From 4 th year

onward cash flow will be stabilized.’

13 Mergers, Acquisitions & • Under the sub-heading 4.2 please ignore the last

Corporate Restructuring para.

• Case Studies under the heading 11 have been

removed.

• In Question No. 19 in last line of para below the

table please consider ‘(EPS)’ after ‘earnings’.

• In Question No. 30 missing value of Equity

Capital i.e. ` 70,00,000 has been inserted.

14 Startup Finance • In Bootstrapping, please ignore the last para as

already covered earlier.

© The Institute of Chartered Accountants of India

xiii

CONTENTS

CHAPTER 1 – FINANCIAL POLICY AND CORPORATE STRATEGY

1. Strategic Financial Decision Making Framework ............................................................ 1.1

2. Strategy at Different Hierarchy Levels .......................................................................... 1.3

3. Financial Planning ....................................................................................................... 1.4

4. Interface of Financial Policy and Strategic Management ............................................... 1.5

5. Balancing Financial Goals vis-à-vis Sustainable Growth ............................................... 1.7

CHAPTER 2 – RISK MANAGEMENT

1. Identification of types of Risk faced by an organization ................................................. 2.1

2. Evaluation of Financial Risk ........................................................................................ 2.4

3. Value-at-Risk (VAR) ..................................................................................................... 2.4

4. Appropriate Methods for Identification and Management of Financial Risk ..................... 2.5

CHAPTER 3 – SECURITY ANALYSIS

1. Fundamental Analysis .................................................................................................. 3.2

2. Technical Analysis ..................................................................................................... 3.14

3. Difference between Fundamental Analysis and Technical Analysis .............................. 3.29

4. Efficient Market Theory .............................................................................................. 3.29

CHAPTER 4 – SECURITY VALUATION

1. Overview of Valuation .................................................................................................. 4.1

2. Return Concepts .......................................................................................................... 4.2

© The Institute of Chartered Accountants of India

xiv

3. Equity Risk Premium .................................................................................................... 4.4

4. Required Return on Equity ........................................................................................... 4.5

5. Discounts rates selection in relation to cash flows ........................................................ 4.5

6. Valuation of Equity Shares ........................................................................................... 4.6

7. Valuation of Preference Shares .................................................................................. 4.14

8. Valuation of Debentures and Bonds ........................................................................... 4.15

CHAPTER 5 – PORTFOLIO MANAGEMENT

1. Introduction ................................................................................................................. 5.2

2. Phases of Portfolio Management .................................................................................. 5.4

3. Portfolio Theories ........................................................................................................ 5.7

4. Risk Analysis ............................................................................................................... 5.9

5. Markowitz Model of Risk-Return Optimization ............................................................. 5.29

6. Capital Market Theory ................................................................................................ 5.32

7. Single Index Model .................................................................................................... 5.33

8. Capital Asset Pricing Model ....................................................................................... 5.37

9. Arbitrage Pricing Theory Model .................................................................................. 5.45

10. Portfolio Evaluation Methods ...................................................................................... 5.46

11. Sharpe’s Optimal Portfolio.......................................................................................... 5.50

12. Formulation of Portfolio Strategy ................................................................................ 5.51

13. Portfolio Revision and Rebalancing ............................................................................ 5.54

14. Asset Allocation Strategies......................................................................................... 5.58

15. Fixed Income Portfolio ............................................................................................... 5.58

16. Alternative Investment Strategies in context of Portfolio Management ......................... 5.61

© The Institute of Chartered Accountants of India

xv

CHAPTER 6 – SECURITIZATION

1. Introduction ................................................................................................................. 6.1

2. Concept and Definition ................................................................................................. 6.2

3. Benefits of Securitization.............................................................................................. 6.2

4. Participants in Securitization ........................................................................................ 6.3

5. Mechanism of Securitization......................................................................................... 6.5

6. Problems in Securitization ............................................................................................ 6.6

7. Securitization Instruments ............................................................................................ 6.7

8. Pricing of the Securitized Instruments .......................................................................... 6.8

9. Securitization in India ................................................................................................... 6.9

CHAPTER 7 – MUTUAL FUNDS

1. Introduction ................................................................................................................. 7.1

2. Evolution of the Indian Mutual Fund Industry ................................................................ 7.3

3. Classification of Mutual Funds ...................................................................................... 7.5

4. Types of Schemes ..................................................................................................... 7.10

5. Advantages of Mutual Fund ........................................................................................ 7.14

6. Drawbacks of Mutual Fund ......................................................................................... 7.15

7. Terms associated with Mutual Funds .......................................................................... 7.16

CHAPTER 8 – DERIVATIVES ANALYSIS AND VALUATION

1. Introduction ................................................................................................................. 8.1

2. Forward Contract ......................................................................................................... 8.2

3. Future Contract ............................................................................................................ 8.3

4. Pricing / Valuation of Forward / Future Contracts .......................................................... 8.5

© The Institute of Chartered Accountants of India

xvi

5. Types of Futures Contracts .......................................................................................... 8.8

6. Options ...................................................................................................................... 8.17

7. Option Valuation Techniques ..................................................................................... 8.21

8. Commodity Derivatives .............................................................................................. 8.32

CHAPTER 9 – FOREIGN EXCHANGE EXPOSURE AND RISK MANAGEMENT

1. Introduction ................................................................................................................. 9.1

2. Nostro, Vostro and Loro Accounts ................................................................................ 9.2

3. Exchange Rate Quotation ............................................................................................ 9.4

4. Exchange Rate Forecasting ....................................................................................... 9.10

5. Exchange Rate Determination .................................................................................... 9.11

6. Exchange Rate Theories ............................................................................................ 9.12

7. Foreign Exchange Market .......................................................................................... 9.17

8. Foreign Exchange Exposure ...................................................................................... 9.18

9. Hedging Currency Risk .............................................................................................. 9.21

10. Forward Contract ....................................................................................................... 9.24

11. Future Contracts ........................................................................................................ 9.36

12. Option Contracts ........................................................................................................ 9.37

13. Swap Contracts ......................................................................................................... 9.39

14. Strategies for Exposure Management ......................................................................... 9.40

15. Conclusion ................................................................................................................ 9.42

CHAPTER 10 – INTERNATIONAL FINANCIAL MANAGEMENT

1. International Capital Budgeting ..................................................... ……………………..10.1

2. International Sources of Finance .................................................................. ………..10.15

3. International Working Capital Management............................................................... 10.20

© The Institute of Chartered Accountants of India

xvii

CHAPTER 11 – INTEREST RATE RISK MANAGEMENT

1. Introduction ............................................................................................................... 11.1

2. Hedging Interest Rate Risk ........................................................................................ 11.5

CHAPTER 12 – CORPORATE VALUATION

1. Conceptual Framework of Valuation ........................................................................... 12.2

2. Important terms associated with Valuation .................................................................. 12.3

3. Approaches/ Methods of Valuation ............................................................................. 12.5

4. Measuring Cost of Equity ......................................................................................... 12.10

5. Relative Valuation .................................................................................................... 12.14

6. Other Approaches to Value Measurement ................................................................ 12.18

7. Arriving at Fair Value ............................................................................................... 12.26

CHAPTER 13 – MERGERS, ACQUISITIONS AND CORPORATE RESTRUCTURING

1. Conceptual Framework .............................................................................................. 13.2

2. Rationale for Mergers and Acquisitions....................................................................... 13.4

3. Forms (Types) of Mergers .......................................................................................... 13.6

4. Financial Framework .................................................................................................. 13.8

5. Takeover Defensive Tactics ..................................................................................... 13.11

6. Reverse Merger ....................................................................................................... 13.12

7. Divestiture ............................................................................................................... 13.13

8. Financial Restructuring ............................................................................................ 13.16

9. Ownership Restructuring .......................................................................................... 13.19

10. Premium and Discount ............................................................................................. 13.22

11. Mergers and Acquisitions Failures ............................................................................ 13.23

© The Institute of Chartered Accountants of India

xviii

12. Acquisition through Shares ...................................................................................... 13.24

13. Cross-Border M&A ................................................................................................... 13.28

14. Special Purpose Acquisition Companies ................................................................... 13.29

CHAPTER 14 – STARTUP FINANCE

1. The Basics of Startup Financing ................................................................................. 14.1

2. Some of the Innovative Ways to Finance a Startup ..................................................... 14.2

3. Pitch Presentation...................................................................................................... 14.3

4. Modes of Financing for Startups ................................................................................. 14.6

5. Startup India Initiative .............................................................................................. 14.14

© The Institute of Chartered Accountants of India

You might also like

- Paper 14 NewDocument655 pagesPaper 14 NewjesurajajosephNo ratings yet

- Basics of Finance, Investments, Institutions and International FinanceDocument12 pagesBasics of Finance, Investments, Institutions and International FinanceGama TamaNo ratings yet

- Course Syllabus Health Promotion 2017-2018Document4 pagesCourse Syllabus Health Promotion 2017-2018Sylvia Al-a'maNo ratings yet

- Financialmanagementpresentation 170131104519 PDFDocument29 pagesFinancialmanagementpresentation 170131104519 PDFwarda santiagoNo ratings yet

- Seventeenth Meeting of The WHO Vector Control Advisory GroupDocument38 pagesSeventeenth Meeting of The WHO Vector Control Advisory GroupnavenNo ratings yet

- Revised ISA SED Final Version April 17 2017-1-2Document150 pagesRevised ISA SED Final Version April 17 2017-1-2marlene100% (1)

- StudentAffairsAnnualReport 2016 FinalForWebDocument23 pagesStudentAffairsAnnualReport 2016 FinalForWebtdfield100% (1)

- Fostering The Principles of Natural Resources Management in Kenya Kariuki Muigua 9th January 2019Document36 pagesFostering The Principles of Natural Resources Management in Kenya Kariuki Muigua 9th January 2019Joy Nabi MboyaNo ratings yet

- Universityof Lucknow Faculty of LawDocument7 pagesUniversityof Lucknow Faculty of LawGoldi Singh100% (1)

- Financial Management: Unit - 1Document26 pagesFinancial Management: Unit - 1Sukumar SomasundaramNo ratings yet

- Pharmaceutical IndustryDocument241 pagesPharmaceutical IndustryRicky KumarNo ratings yet

- Financial ManagementDocument24 pagesFinancial Managementአረጋዊ ሐይለማርያምNo ratings yet

- QFS Filesystem Tuning and Best PracticeDocument7 pagesQFS Filesystem Tuning and Best PracticetechrskNo ratings yet

- Environmental Law: (Class Notes by Prof A Mumma © 2006) University of NairobiDocument31 pagesEnvironmental Law: (Class Notes by Prof A Mumma © 2006) University of NairobiGray CeeNo ratings yet

- Health Financing ModelsDocument7 pagesHealth Financing ModelsPrashant Nathani100% (1)

- Principles of Money & BankingDocument3 pagesPrinciples of Money & BankingMohsin KhanNo ratings yet

- 2009 Annual Discipline ReportDocument54 pages2009 Annual Discipline ReportMartin AndelmanNo ratings yet

- See Into The Future."Document67 pagesSee Into The Future."MatthewmanojNo ratings yet

- RPAC - 26 July 2019Document21 pagesRPAC - 26 July 2019lancekim21No ratings yet

- Copyright Research PaperDocument12 pagesCopyright Research PaperamyNo ratings yet

- Reduce Taxes Through Planning, AvoidanceDocument6 pagesReduce Taxes Through Planning, AvoidanceAryan SharmaNo ratings yet

- S F M - New Syllabus - Study MaterialDocument455 pagesS F M - New Syllabus - Study MaterialTummu SureshNo ratings yet

- SFM (New) ICAI SM For May 2021Document670 pagesSFM (New) ICAI SM For May 2021Sri PavanNo ratings yet

- Strategic Financial ManagementDocument526 pagesStrategic Financial ManagementPravin Mandora100% (3)

- Syllabus - NewDocument33 pagesSyllabus - NewanupNo ratings yet

- CA Final NewDocument18 pagesCA Final NewCharul ChhajerNo ratings yet

- 201 Paper 5Part ADocument316 pages201 Paper 5Part AIjaz MohammedNo ratings yet

- VSI017 CA Final Subjects (New Course) PDFDocument26 pagesVSI017 CA Final Subjects (New Course) PDFRanajit FouzdarNo ratings yet

- 67552bos54275 m1 IpDocument14 pages67552bos54275 m1 Ipmohammadtaha.yt21No ratings yet

- FMDocument499 pagesFMRajiv Kumar100% (1)

- 74844bos60515 FinalDocument14 pages74844bos60515 FinalShubhamNo ratings yet

- Initial PageDocument12 pagesInitial PageSneha ChembakasseryNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument278 pages© The Institute of Chartered Accountants of Indiakapiwex607No ratings yet

- Cost Accounting and Financial ManagementDocument921 pagesCost Accounting and Financial Managementmalikkamran06552989% (18)

- Strategic Financial Management: F C S MDocument13 pagesStrategic Financial Management: F C S MPrin PrinksNo ratings yet

- CS PP June 2014 Financial QuestionsDocument14 pagesCS PP June 2014 Financial QuestionsSureshArigelaNo ratings yet

- Cost Accounting & Financial Management VOL. IIDocument428 pagesCost Accounting & Financial Management VOL. IIseektheraj86% (7)

- Financial Services and Capital Markets: Final Course Study MaterialDocument16 pagesFinancial Services and Capital Markets: Final Course Study MaterialMANTHAN PALIWALNo ratings yet

- Paper 14 PDFDocument568 pagesPaper 14 PDFNithin JoseNo ratings yet

- Initial Professional Development - Technical Competence (Revised)Document15 pagesInitial Professional Development - Technical Competence (Revised)Zoraida RamirezNo ratings yet

- (1)Overview -Corp. valuation (14.9.2023)Document15 pages(1)Overview -Corp. valuation (14.9.2023)Sonali MoreNo ratings yet

- Fin Management - Lectures 1 - 30Document408 pagesFin Management - Lectures 1 - 30shubhu0794No ratings yet

- Financial Management: By. B.RavikumarDocument30 pagesFinancial Management: By. B.RavikumarRavikumar BalasubramanianNo ratings yet

- 169final New SyllabusDocument17 pages169final New SyllabusNeethu ThomasNo ratings yet

- FIN-1013 - Financial Analysis and Budgeti, Page 1/8 © 2020 Lambton CollegeDocument8 pagesFIN-1013 - Financial Analysis and Budgeti, Page 1/8 © 2020 Lambton Collegeharpreet kaurNo ratings yet

- Financial Reporting ICAI Study MaterialDocument1,821 pagesFinancial Reporting ICAI Study MaterialKrishna Kowshik100% (1)

- Corporate Finance 2marksDocument30 pagesCorporate Finance 2marksTaryn JacksonNo ratings yet

- Valuation For Mergers Buyouts and RestructuringDocument17 pagesValuation For Mergers Buyouts and RestructuringCAclubindiaNo ratings yet

- Final (Old) Course Paper 1: Financial Reporting (100 Marks)Document23 pagesFinal (Old) Course Paper 1: Financial Reporting (100 Marks)Abinash JNo ratings yet

- ADC 411 Financial Statement Analysis CourseDocument3 pagesADC 411 Financial Statement Analysis CourseAasir NaQvi100% (1)

- Project Report IDFC Mutual FundDocument64 pagesProject Report IDFC Mutual Fundjanaaab5068100% (6)

- Cost Accounting & Financial Management Vol. IDocument640 pagesCost Accounting & Financial Management Vol. Iseektheraj100% (6)

- 169final New Syllabus PDFDocument15 pages169final New Syllabus PDFNavin Man Singh ShresthaNo ratings yet

- Professional Competence For Engagement Partners Responsible For Audits of Financial Statements (Revised)Document17 pagesProfessional Competence For Engagement Partners Responsible For Audits of Financial Statements (Revised)Paula MilenaNo ratings yet

- Subjects Chapters DOC: I) Ethical and Professional Standards 1.ethics and Trust in The Investment ProfessionDocument2 pagesSubjects Chapters DOC: I) Ethical and Professional Standards 1.ethics and Trust in The Investment ProfessionHanako ChinatsuNo ratings yet

- Board of Studies The Institute of Chartered Accountants of IndiaDocument16 pagesBoard of Studies The Institute of Chartered Accountants of IndiaRakeshNo ratings yet

- Perspective of Indian Investors in Mutual FundsDocument84 pagesPerspective of Indian Investors in Mutual FundsShriya Vikram ShahNo ratings yet

- Shubhra johri cases-25Document19 pagesShubhra johri cases-25Manohar ReddyNo ratings yet

- 3.FINA211 Financial ManagementDocument5 pages3.FINA211 Financial ManagementIqtidar Khan0% (1)

- 4.31 T.Y.B.Com BM-IV PDFDocument7 pages4.31 T.Y.B.Com BM-IV PDFBhagyalaxmi Raviraj naiduNo ratings yet

- Indian Banker Jan 2023Document68 pagesIndian Banker Jan 2023akashNo ratings yet

- Yojana July 2022Document39 pagesYojana July 2022akashNo ratings yet

- Indian Banker Feb 2023Document68 pagesIndian Banker Feb 2023akashNo ratings yet

- Introductory MacroeconomicsDocument106 pagesIntroductory MacroeconomicsHardik Gupta50% (4)

- Simplification Techniques and TricksDocument45 pagesSimplification Techniques and TricksSheikh AaishanNo ratings yet

- Civil Services Mentor October 2016Document103 pagesCivil Services Mentor October 2016akashNo ratings yet

- Competition Booster English 2016Document31 pagesCompetition Booster English 2016akashNo ratings yet

- Analysis of The Indian Securities Industry: Market For DebtDocument20 pagesAnalysis of The Indian Securities Industry: Market For DebtSARVESH RNo ratings yet

- Crisil Sme Connect Feb13Document60 pagesCrisil Sme Connect Feb13tejasNo ratings yet

- GPAP Finance Policy Toolkit-2022Document26 pagesGPAP Finance Policy Toolkit-2022raharto polindoutamaNo ratings yet

- Meranti at Two Serendra Payment Term SummaryDocument1 pageMeranti at Two Serendra Payment Term SummaryJP ReyesNo ratings yet

- CMBS AB Note ModificationsDocument24 pagesCMBS AB Note ModificationsAbhijit MannaNo ratings yet

- 06 01 2022 Handwritten NotesDocument30 pages06 01 2022 Handwritten NotesPranav AryaNo ratings yet

- Priority Sector Lending in IndiaDocument40 pagesPriority Sector Lending in IndiaImdad Hazarika100% (1)

- Chapter 09 Risk Management: Asset-Backed Securities, Loan Sales, Credit Standbys, and Credit DerivativesDocument33 pagesChapter 09 Risk Management: Asset-Backed Securities, Loan Sales, Credit Standbys, and Credit DerivativesNway Moe Saung100% (2)

- Cash Flows Chap-13Document52 pagesCash Flows Chap-13nina0301100% (1)

- Advance AccountingDocument18 pagesAdvance AccountingMarvin AquinoNo ratings yet

- Citi FCS ComplaintDocument547 pagesCiti FCS ComplaintDinSFLANo ratings yet

- Print Preview - Final Application: Project Name and LocationDocument33 pagesPrint Preview - Final Application: Project Name and LocationRyan SloanNo ratings yet

- Real Estate MarketsDocument21 pagesReal Estate MarketsPriyanka DargadNo ratings yet

- PAS 7 Statement of Cash FlowsDocument23 pagesPAS 7 Statement of Cash FlowsAnne Marieline BuenaventuraNo ratings yet

- Bond journal entriesDocument3 pagesBond journal entriesAsuna SanNo ratings yet

- Mock CAT - 05 PDFDocument82 pagesMock CAT - 05 PDFDebNo ratings yet

- Functional Perspective of Financial Systems - An Introduction IFMR BlogDocument3 pagesFunctional Perspective of Financial Systems - An Introduction IFMR BlogmdmgovernanceNo ratings yet

- Green Bonds Getting The Harmony RightDocument82 pagesGreen Bonds Getting The Harmony RightLía Lizzette Ferreira MárquezNo ratings yet

- Bond MarketDocument29 pagesBond MarketShintia Ayu PermataNo ratings yet

- Assignment Subprime MortgageDocument6 pagesAssignment Subprime MortgagemypinkladyNo ratings yet

- English Paper - Hyderabad Edition: Sale Notice For Sale of Immovable PropertiesDocument1 pageEnglish Paper - Hyderabad Edition: Sale Notice For Sale of Immovable PropertiesSneha AdepuNo ratings yet

- Ibo 6Document12 pagesIbo 6vinodh kNo ratings yet

- Certificate of Sale PNBDocument4 pagesCertificate of Sale PNBGirish SharmaNo ratings yet

- Memory Aid (UP) Banking LawsDocument81 pagesMemory Aid (UP) Banking LawsVanessa SalvadorNo ratings yet

- REAL ESTATE SOURCES OF CAPITALDocument36 pagesREAL ESTATE SOURCES OF CAPITALABIAKAM & CO.No ratings yet

- Module 4 - Ia2 FinalDocument43 pagesModule 4 - Ia2 FinalErika EsguerraNo ratings yet

- AffidavitDocument6 pagesAffidavitGopalakrishna GorleNo ratings yet

- ACCA106 Reviewer TheoriesDocument5 pagesACCA106 Reviewer TheoriesFrankie AsidoNo ratings yet

- Securitisation and CDS CLNDocument29 pagesSecuritisation and CDS CLNVenkatsubramanian R IyerNo ratings yet

- NYS V Trump Exhibit July 30, 2012 Letter From Deutsche Bank To CushmanDocument4 pagesNYS V Trump Exhibit July 30, 2012 Letter From Deutsche Bank To CushmanFile 411No ratings yet