Professional Documents

Culture Documents

Swarnarik Chatterjee 23405018005 CA1 Management Accounting

Uploaded by

Rik DragneelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Swarnarik Chatterjee 23405018005 CA1 Management Accounting

Uploaded by

Rik DragneelCopyright:

Available Formats

MANAGEMENT ACCOUNTING

CA 1

Name : Swarnarik Chatterjee

Roll No. : 23405018005

College Id : 18234030771

Subject : Management Accounting CA 1

1. Answer all questions:

i) Margin of safety is referred to as

Answer : (b) Excess of actual sales over break even sales

ii) Break even point arises, when

Answer : (d) All of the above

iii) A company sells a single product for Rs.28 per unit. If variable costs are 65% of sales

and fixed costs total Rs.9,800, the break-even point will be

Answer : (d) 1,000 units

iv) Sales Rs.1,80,000, profit Rs.20,000, variable cost 60%, P/V ratio will be

Answer : (b) 40%

v) Selling price and variable cost per unit are Rs.20 and Rs.12 respectively. Total fixed

cost is Rs.30,000. The BEP sales in unit will be

Answer : (d) 3750

2. Answer all questions:

a) Define Management Accounting. State the techniques used in management

accounting for decision making

Answer

Management accounting (also known as cost accounting or management accounting) is a

branch of accounting that is concerned with the identification, measurement, analysis, and

interpretation of accounting information so that it can be used to help managers make

informed operational decisions.

1. Margin analysis

Margin analysis is primarily concerned with the incremental benefits of optimizing production.

Margin analysis is one of the most fundamental and essential techniques in managerial

accounting. It includes the calculation of the breakeven point that determines the optimal

sales mix for the company’s products.

2. Constraint analysis

The analysis of the production lines of a business identifies principal bottlenecks, the

inefficiencies created by these bottlenecks, and their impact on the company’s ability to

generate revenues and profits.

3. Capital budgeting

Capital budgeting is concerned with the analysis of information required to make the

necessary decisions related to capital expenditures. In capital budgeting analysis,

managerial accountants calculate the net present value (NPV) and the internal rate of return

(IRR) to help managers to decide on new capital budgeting decisions.

4. Inventory valuation and product costing

Inventory valuation involves the identification and analysis of the actual costs associated

with the company’s products and inventory. The process generally implies the calculation

and allocation of overhead charges, as well as the assessment of the direct costs related to

the cost of goods sold (COGS).

5. Trend analysis and forecasting

Trend analysis and forecasting are primarily concerned with the identification of patterns and

trends of product costs, as well as with recognition of unusual variances from the forecasted

values and the reasons for such variances.

b) Discuss in brief BEP analysis

Answer

Break-even analysis entails calculating and examining the margin of safety for an entity

based on the revenues collected and associated costs. In other words, the analysis shows

how many sales it takes to pay for the cost of doing business. Analyzing different price levels

relating to various levels of demand, the break-even analysis determines what level of sales

are necessary to cover the company's total fixed costs. A demand-side analysis would give a

seller significant insight into selling capabilities.

3. ABC Ltd furnished the following information

Particular 2010-11 2011-12

Sales 2,00,000 2,50,000

Profit 30,000 50,000

You are required to find out:

i. P/V ratio

ii. BEP

iii. Total variable cost for 2010-11 and 2011-12

iv. Sales required to earn a profit of Rs.60,000

v. Profit/Loss when sales are Rs.1,00,000

vi. MOS when profit is Rs.80,000

Answer :

i) P/V ratio = (Difference in Profit ÷ Difference in Sales) × 100

Therefore,

(Rs 20,000 ÷ Rs 50,000) × 100 = 40%

As,

Contribution = Fixed Cost + Profit

Fixed Cost = Contribution – Profit

Therefore,

In Rs

Contribution in 2010-11(2,00,000 × 40%) 80,000

Less : Profit 30,000

Fixed Cost 50,000

ii) Break-even point = (Fixed Cost ÷ P/V Ratio) = Rs 50,000 ÷ 40% = Rs 1,25,000

iii) P/V Ratio = 40%

Variable cost ratio = 100% - 40% = 60%

For 2010-11,

Total Variable Cost = Total Sales × Variable cost ratio = 2,00,000 × 60%

= 1,20,000

For 2011-12,

Total Variable Cost = Total Sales × Variable cost ratio = 2,50,000 × 60%

= 1,50,000

So, the Total Variable Cost will be Rs 1,20,000 and Rs 1,50,000 for the years

2010-11 and 2011-12 respectively.

iv) Calculation of Sales to earn profit of Rs 60,000,

(Fixed Cost + Desired Profit) ÷ P/V Ratio = (50,000 + 60,000) ÷ 40%

= Rs 2,75,000

So, the Sales must be Rs 2,75,000 when desired profit is Rs 60,000.

v) Calculation of Profit/Loss when Sales are Rs 1,00,000,

Profit = Contribution – Fixed Cost

= (Sales × P/V Ratio) – Fixed Cost

= (Rs 1,00,000 × 40%) – Rs 50,000

= Rs 40,000 – Rs 50,000

= - Rs 10,000 (Loss)

So, there will be a Loss of Rs 10,000 if Sales are Rs 1,00,000.

vi) Calculation of Margin of Safety (MOS) when Profit is 80,000,

= Profit ÷ P/V Ratio = Rs 80,000 ÷ 40% = Rs 2,00,000

So, the Margin of Safety will be Rs 2,00,000 if the profit is Rs 80,000.

You might also like

- Construction On Soft GroundDocument9 pagesConstruction On Soft GroundyantieschumiNo ratings yet

- Amazon removes restricted supplement listing multiple timesDocument12 pagesAmazon removes restricted supplement listing multiple timesMasood Ur RehmanNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- EY - NASSCOM - M&A Trends and Outlook - Technology Services VF - 0Document35 pagesEY - NASSCOM - M&A Trends and Outlook - Technology Services VF - 0Tejas JosephNo ratings yet

- DocxDocument6 pagesDocxLeo Sandy Ambe CuisNo ratings yet

- Zodiac Working Boat MK6HDDocument4 pagesZodiac Working Boat MK6HDdan antonNo ratings yet

- Management Accounting: Breakeven AnalysisDocument27 pagesManagement Accounting: Breakeven Analysislakshmi aparna yelganamoniNo ratings yet

- Last Minute Reviewer for 2019 Bar ExamDocument19 pagesLast Minute Reviewer for 2019 Bar ExamFrances Ann Teves100% (1)

- Lewin's 3 Leadership StylesDocument2 pagesLewin's 3 Leadership Stylesmar_hisham8900No ratings yet

- Financial Performance Measures and Value Creation: the State of the ArtFrom EverandFinancial Performance Measures and Value Creation: the State of the ArtNo ratings yet

- CVP Analysis SolutionsDocument23 pagesCVP Analysis SolutionsAdebayo Yusuff AdesholaNo ratings yet

- Cost Volume Profit AnalysisDocument15 pagesCost Volume Profit AnalysisPrateek Arora100% (1)

- Calculate break-even sales, operating income for companiesDocument6 pagesCalculate break-even sales, operating income for companiesAsdfghjkl LkjhgfdsaNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- 2.1 Powerpoint - Slides - To - Chapter - 16Document40 pages2.1 Powerpoint - Slides - To - Chapter - 16Sarthak PatidarNo ratings yet

- Management AccountingDocument68 pagesManagement AccountingNekibur DeepNo ratings yet

- Solution AccountDocument12 pagesSolution Accountbikaspatra89No ratings yet

- S (RS.) 200 200 Rs. 40,00,000Document51 pagesS (RS.) 200 200 Rs. 40,00,000raandkadeewanaNo ratings yet

- Cost AnalysisDocument13 pagesCost AnalysistheNo ratings yet

- MANACC - NotesW - Answers - BEP - The Master BudgetDocument6 pagesMANACC - NotesW - Answers - BEP - The Master Budgetldeguzman210000000953No ratings yet

- Marginal Costing Technique: Break-Even AnalysisDocument9 pagesMarginal Costing Technique: Break-Even AnalysisAadarshNo ratings yet

- Institute of Certified General Accountants of Bangladesh (ICGAB) Performance Management (P13) LC-3: CVP AnalysisDocument5 pagesInstitute of Certified General Accountants of Bangladesh (ICGAB) Performance Management (P13) LC-3: CVP AnalysisMozid RahmanNo ratings yet

- Numericals On CVP AnalysisDocument2 pagesNumericals On CVP AnalysisAmil SaifiNo ratings yet

- Mangrial CostingDocument13 pagesMangrial CostinganishaNo ratings yet

- Break Even AnalysisDocument26 pagesBreak Even AnalysisDr. Avijit RoychoudhuryNo ratings yet

- CVP AnalysisDocument37 pagesCVP Analysis20B81A1235cvr.ac.in G RUSHI BHARGAVNo ratings yet

- Bac 300 Lesson ThreeDocument15 pagesBac 300 Lesson ThreejjjjNo ratings yet

- Module 4Document42 pagesModule 4Eshael FathimaNo ratings yet

- CVP ANALYSIS BREAK-EVEN POINT MULTI-PRODUCTDocument40 pagesCVP ANALYSIS BREAK-EVEN POINT MULTI-PRODUCTRajguru JavalagaddiNo ratings yet

- 1 - Strategic Thinking, Profit Planning and CVP Analysis KeyDocument4 pages1 - Strategic Thinking, Profit Planning and CVP Analysis KeyEdward Glenn BaguiNo ratings yet

- CVP AnalysisDocument11 pagesCVP AnalysisPratiksha GaikwadNo ratings yet

- Assignment Acct.Document9 pagesAssignment Acct.Dagmawit NegussieNo ratings yet

- Marginal CostingDocument13 pagesMarginal CostingKUNAL GOSAVINo ratings yet

- Cost Profit Volume AnalysisDocument28 pagesCost Profit Volume AnalysisClarice LangitNo ratings yet

- Lecture 4b Cost Volume Profit EditedDocument24 pagesLecture 4b Cost Volume Profit EditedJinnie QuebrarNo ratings yet

- 6.Mgmt AccountingDocument38 pages6.Mgmt AccountingJyoti Meghani MehrotraNo ratings yet

- Application of Marginal Costing TechniqueDocument7 pagesApplication of Marginal Costing TechniqueKumardeep SinghaNo ratings yet

- Break Even MCQ'sDocument19 pagesBreak Even MCQ'sMuhammad FaizanNo ratings yet

- Arginal Osting by Dinesh PhadtareDocument39 pagesArginal Osting by Dinesh PhadtareDinesh PhadtareNo ratings yet

- Breakeven Analysis 0Document35 pagesBreakeven Analysis 0Nistha Bisht100% (1)

- Cost-Volume-Profit AnalysisDocument24 pagesCost-Volume-Profit AnalysisIbrahim ElsayedNo ratings yet

- CostingDocument15 pagesCostingPavan ChitragarNo ratings yet

- Assignment No. 4 Managers of Accountants: Mrs. Manu KaliaDocument14 pagesAssignment No. 4 Managers of Accountants: Mrs. Manu KaliaBilal AhmadNo ratings yet

- CH 7Document9 pagesCH 7Karina AcostaNo ratings yet

- FMA Assg 1Document8 pagesFMA Assg 1Dagmawit NegussieNo ratings yet

- Chap1 Marginal Costing & Decision MakingDocument31 pagesChap1 Marginal Costing & Decision Makingrajsingh15No ratings yet

- Session 12 CVP AnalysisDocument52 pagesSession 12 CVP Analysismuskan mittalNo ratings yet

- CVP Analysis Target Net Profit and Sales MixDocument19 pagesCVP Analysis Target Net Profit and Sales MixWaleed J.No ratings yet

- Cost Volume Profit Analysis Lecture NotesDocument27 pagesCost Volume Profit Analysis Lecture NotesbiggykhairNo ratings yet

- Marginal CostingDocument39 pagesMarginal CostingMeet LalchetaNo ratings yet

- Cost - Chapter Two - FinalDocument50 pagesCost - Chapter Two - FinaltewodrosbayisaNo ratings yet

- Break Even AnalysisDocument6 pagesBreak Even AnalysisNafi AhmedNo ratings yet

- C_V_P AnalysisDocument19 pagesC_V_P AnalysisAman MahatoNo ratings yet

- Topic 11 - Cost Volume Profit Analysis - LectureDocument23 pagesTopic 11 - Cost Volume Profit Analysis - LectureshamimahNo ratings yet

- Cost II Chapter-OneDocument10 pagesCost II Chapter-OneSemiraNo ratings yet

- Null, 1Document67 pagesNull, 1siddharthsonar9604No ratings yet

- Cost Volume Profit AnalysisDocument6 pagesCost Volume Profit AnalysisSrabon BaruaNo ratings yet

- CVP AnalysisDocument41 pagesCVP AnalysisRahul Kumar Jain100% (1)

- Cost-Volume-Profit Relationships 2Document57 pagesCost-Volume-Profit Relationships 2Princess Jay NacorNo ratings yet

- Marginal Costing and CVP Analysis TechniquesDocument21 pagesMarginal Costing and CVP Analysis TechniquessugambordoloiNo ratings yet

- Cost 2 ch4Document7 pagesCost 2 ch4Eid AwilNo ratings yet

- CVP Analysis Guide for Cost Planning and Decision MakingDocument4 pagesCVP Analysis Guide for Cost Planning and Decision MakingEmma Mariz GarciaNo ratings yet

- Bep AccountsDocument10 pagesBep AccountskamsjaganNo ratings yet

- Chapter 3 CPV Latest For Non-FinMgrs - PPDocument61 pagesChapter 3 CPV Latest For Non-FinMgrs - PPWendimagen Meshesha FantaNo ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisAjay VatsavaiNo ratings yet

- Accounting 202 Chapter 7 NotesDocument15 pagesAccounting 202 Chapter 7 NotesnitinNo ratings yet

- Solucionario Capitulo 1 Gruber Porque Estudiamos Finanzas PublicasDocument5 pagesSolucionario Capitulo 1 Gruber Porque Estudiamos Finanzas PublicasDemetrio Pardo HerreraNo ratings yet

- Assignment 2Document21 pagesAssignment 2api-445531772No ratings yet

- Nitro - Quiz 3 Ged102-A13Document3 pagesNitro - Quiz 3 Ged102-A13Eliezer NitroNo ratings yet

- Chemestry CollageDocument85 pagesChemestry CollageET039 Sudhabrata SahooNo ratings yet

- Hedonomics: Bridging Decision Research With Happiness ResearchDocument20 pagesHedonomics: Bridging Decision Research With Happiness ResearchgumelarNo ratings yet

- Shangri La Hotels and Resorts SWOTDocument2 pagesShangri La Hotels and Resorts SWOTHadi Agustana100% (1)

- IT144052 Bauhn Wifi Extender Manual PDFDocument56 pagesIT144052 Bauhn Wifi Extender Manual PDFEdmark AldeaNo ratings yet

- Indian Pharmaceutical Industry: The Changing Dynamics: April 2016Document26 pagesIndian Pharmaceutical Industry: The Changing Dynamics: April 2016payal joshiNo ratings yet

- Impact On Cocoon Quality Improvement.1Document10 pagesImpact On Cocoon Quality Improvement.1Naveen NtrNo ratings yet

- Safety and Quality of Health Care System in IndiaDocument18 pagesSafety and Quality of Health Care System in IndiaKNOWLEDGE FeedNo ratings yet

- Nursing Grand Rounds Reviewer PDFDocument17 pagesNursing Grand Rounds Reviewer PDFAlyssa Jade GolezNo ratings yet

- Lecture 08Document27 pagesLecture 08simraNo ratings yet

- OriginalDocument4 pagesOriginalJob ValleNo ratings yet

- MSCL PipeDocument9 pagesMSCL PipeAhmad Zakwan Asmad100% (1)

- TriPAD Seminar Provides Guidance for TeachersDocument2 pagesTriPAD Seminar Provides Guidance for TeachersKingJames Lindo BarrogaNo ratings yet

- Seed FilesDocument1 pageSeed Filesارسلان علیNo ratings yet

- C-TECC Principles Guide TECC EducationDocument4 pagesC-TECC Principles Guide TECC EducationDavid Sepulveda MirandaNo ratings yet

- Company Law PPT on Types of CompaniesDocument8 pagesCompany Law PPT on Types of CompaniesAbid CoolNo ratings yet

- 2D IconsDocument8 pages2D IconsJacky ManNo ratings yet

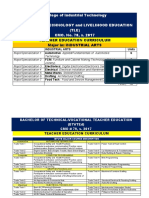

- College of Industrial Technology Bachelor of Technology and Livelihood Education (TLE) CMO. No. 78, S. 2017Document5 pagesCollege of Industrial Technology Bachelor of Technology and Livelihood Education (TLE) CMO. No. 78, S. 2017Industrial TechnologyNo ratings yet

- S Sss 001Document4 pagesS Sss 001andy175No ratings yet

- ED621826Document56 pagesED621826A. MagnoNo ratings yet

- Subhasis Patra CV V3Document5 pagesSubhasis Patra CV V3Shubh SahooNo ratings yet

- SE John Deere 6020 Series Filter Overview and Capacities 6120 6120L 6220 6220L 6320 6320L 6420 6420L 6520L NOV20Document2 pagesSE John Deere 6020 Series Filter Overview and Capacities 6120 6120L 6220 6220L 6320 6320L 6420 6420L 6520L NOV20marianNo ratings yet