Professional Documents

Culture Documents

Module 3 Lesson 2 History

Uploaded by

Jovi Floresca AberinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 3 Lesson 2 History

Uploaded by

Jovi Floresca AberinCopyright:

Available Formats

Do you think VAT is a valid exercise of power by the government? Give factual basis.

Yes it is a valid exercise of power since tax can help develop a nation. It is the Filipinos who will

benefit from it. As long as they are not corrupting it and they make sure that they are spending it

well then it’s not a problem. Taxation provides revenue to the government for the maintenance

of public services and infrastructure. Also VAT helps to generate tax revenues to the government

similar to the corporate income tax or the personal income tax. It has the potential for raising

large amounts of revenue at a low tax rate. Through the help of VAT we will have stable revenue

that will provide citizens good service. Just like for example on our highways and transportation.

Transportation infrastructure, the government relies on revenue generated and allocated for

transportation purposes. The revenue dedicated to transportation is referred to as

transportation revenue. Transportation revenue includes taxes and charges (i.e., fees) collected

by the government from transportation and non-transportation-related activities and allocated

to fund transportation programs. However, the value-added tax (VAT) they are imposing on

goods and services should not be excessive in order for the unfortunate to continue to be able to

purchase.

Do you think that the taxes that the citizens are paying be lowered? Take note that when taxes are low,

the government cannot deliver its services to the people well.

I think no, because taxes help promote economic stability and growth. It plays a big part to our

economy. If for example the government will lower the taxes, it is the citizens that will likely who

will suffer and the country itself because taxes are the primary source of revenue for the

Philippine government. Taxes are spent on infrastructure projects, public services, welfare

programs, services, and as budget of different departments of government. If it will be lowered,

the government will not be able to provide its services to the populace effectively. With that, as

long as the government makes sure that they are spending the taxes well then I think its okay

that it should not be lowered. And without the help of the taxes, the government would have to

borrow a lot more money, and the spending would have to go way down. I know, a lot of people

are complaining why taxes are getting higher, but that’s how it is. When inflation rises, the

nominal amount of such income rises, as does the tax owed on that income, even though the

real value of the income is unchanged.

You might also like

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaFrom EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaNo ratings yet

- What Is TaxationDocument3 pagesWhat Is TaxationJhade Danes BalanlayNo ratings yet

- Essay of Conjectures Part 2Document3 pagesEssay of Conjectures Part 2mustafa27No ratings yet

- Putu Diah Meilani Puspita DewiDocument10 pagesPutu Diah Meilani Puspita DewiArdian AndriawanNo ratings yet

- Eco HW Danyal TahirDocument2 pagesEco HW Danyal TahirDanyal TahirNo ratings yet

- Fiscal Policy of The Government of IndiaDocument5 pagesFiscal Policy of The Government of Indianipun26No ratings yet

- VAT On TollDocument3 pagesVAT On TollChariss GarciaNo ratings yet

- Income of All FilipinosDocument1 pageIncome of All FilipinosEmer MartinNo ratings yet

- Taxation NotesDocument22 pagesTaxation NotesIniesta DenohNo ratings yet

- Essay DraftDocument2 pagesEssay DraftWidodo MohammadNo ratings yet

- 18bec62c U3Document9 pages18bec62c U3Chandru VeluNo ratings yet

- Relevance of Taxation1Document10 pagesRelevance of Taxation1einol padalNo ratings yet

- Tax AssignmentDocument11 pagesTax AssignmentmanalNo ratings yet

- Buque - Prelim Exam-Income TaxationDocument3 pagesBuque - Prelim Exam-Income TaxationVillanueva, Jane G.No ratings yet

- 05 Essay 1: Jeremeh C. Pande BSIT 301ADocument2 pages05 Essay 1: Jeremeh C. Pande BSIT 301AJeremeh PandeNo ratings yet

- Related: BBA From Amity University, Ranchi (Graduated 2022)Document4 pagesRelated: BBA From Amity University, Ranchi (Graduated 2022)Shy DyNo ratings yet

- Train Law Bane or BoonDocument1 pageTrain Law Bane or BoonJunel PlanosNo ratings yet

- People Should Pay Tax (Arg. Essay)Document3 pagesPeople Should Pay Tax (Arg. Essay)Adam AliNo ratings yet

- Advanced Taxation CH - 1Document9 pagesAdvanced Taxation CH - 1Mekuriaw MezgebuNo ratings yet

- Ranie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Document2 pagesRanie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Ranie MonteclaroNo ratings yet

- Ranie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Document2 pagesRanie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Ranie MonteclaroNo ratings yet

- Importance and Role of TaxationDocument7 pagesImportance and Role of TaxationZale Crud100% (2)

- Ace O.Adiova Bsba HRM 1BDocument1 pageAce O.Adiova Bsba HRM 1Baceadiova564No ratings yet

- Basic Principles of A Sound Tax SystemDocument6 pagesBasic Principles of A Sound Tax SystemMelvin Franco San Gabriel60% (5)

- Take-Home Salary To Take A Hit Thanks To New Income Tax BracketsDocument1 pageTake-Home Salary To Take A Hit Thanks To New Income Tax BracketsIjaz AliNo ratings yet

- The Importance of Taxes: What Is A "Tax"Document6 pagesThe Importance of Taxes: What Is A "Tax"Hami KhaNNo ratings yet

- CHP 3 Pad370 MDM SarehanDocument8 pagesCHP 3 Pad370 MDM SarehanPaikuna sumoNo ratings yet

- Role of Taxation in Equal Distribution of The Economic Resources in A CountryDocument5 pagesRole of Taxation in Equal Distribution of The Economic Resources in A CountryAlextro MaxonNo ratings yet

- 1.characteristics of Taxes 2.classification of Taxes 3.roles of Taxation 4.principles of TaxationDocument10 pages1.characteristics of Taxes 2.classification of Taxes 3.roles of Taxation 4.principles of TaxationMugwanya AsadNo ratings yet

- The Importance of TaxesDocument2 pagesThe Importance of Taxeslorena arrieta100% (1)

- 2nd Gov 2nd MotionDocument3 pages2nd Gov 2nd MotionAinnaNo ratings yet

- Government Budget and The Economy-STDocument14 pagesGovernment Budget and The Economy-STSafwa KhasimNo ratings yet

- Taxation Course Code-ACT 311: Md. Ziaul Haque Department of Business Administration East West UniversityDocument35 pagesTaxation Course Code-ACT 311: Md. Ziaul Haque Department of Business Administration East West Universitymgupta60No ratings yet

- The Essence of Taxation Fueling Society's ProgressDocument2 pagesThe Essence of Taxation Fueling Society's ProgressKaren Faith MallariNo ratings yet

- The Problem With Our Tax System and How It Affects Us: Name: Chokde B. Hudierez, Bspharm IiDocument1 pageThe Problem With Our Tax System and How It Affects Us: Name: Chokde B. Hudierez, Bspharm IiCHOKDE HUDIEREZNo ratings yet

- The Compliance of Paying Taxes in Tiyingtali VillageDocument10 pagesThe Compliance of Paying Taxes in Tiyingtali VillageArdian AndriawanNo ratings yet

- Part A: Taxation 1. Concept of TaxationDocument49 pagesPart A: Taxation 1. Concept of TaxationAbhishekShresthaNo ratings yet

- Reflection 1Document2 pagesReflection 1Lalaine BalmesNo ratings yet

- Educ 612 Reaction Paper Unit 3Document2 pagesEduc 612 Reaction Paper Unit 3Cristobal RabuyaNo ratings yet

- Direct Tax Vs Indirect TaxDocument22 pagesDirect Tax Vs Indirect TaxDr. Swati Gupta100% (1)

- WWWWWWWWWWWWWW OdtDocument1 pageWWWWWWWWWWWWWW Odtmulugeta teferyNo ratings yet

- WWW WWW WWWW WWWWDocument1 pageWWW WWW WWWW WWWWmulugeta teferyNo ratings yet

- 11 - Government and TaxesDocument11 pages11 - Government and TaxesPadmajaNo ratings yet

- POS301.R - Topic7Worksheet-8-29-16 CompleteDocument3 pagesPOS301.R - Topic7Worksheet-8-29-16 Completetama00018No ratings yet

- Finance Compiled FinalDocument21 pagesFinance Compiled Finaljadyn nicholasNo ratings yet

- MainBullseyeBulletin 176Document2 pagesMainBullseyeBulletin 176rockstar104No ratings yet

- Insight EconomicsDocument50 pagesInsight EconomicsMohit GautamNo ratings yet

- IMC Report - Pay TaxDocument10 pagesIMC Report - Pay TaxAdityaGroverNo ratings yet

- Taxation FinalDocument10 pagesTaxation FinalMaelyn GelilangNo ratings yet

- Paying Tax Is A Good Thing in GeneralDocument1 pagePaying Tax Is A Good Thing in GeneralRia Evita RevitaNo ratings yet

- Train Law RecommendationDocument10 pagesTrain Law RecommendationMaria Angelica PanongNo ratings yet

- Taxation Laws Module 1: Introduction To Taxation in India: CS Sangeeta BaggaDocument16 pagesTaxation Laws Module 1: Introduction To Taxation in India: CS Sangeeta BaggaBhanu Pratap SinghNo ratings yet

- Taxation EssayDocument1 pageTaxation EssayHITNo ratings yet

- EY Young Tax Professional of The Year 2014 MalaysiaDocument5 pagesEY Young Tax Professional of The Year 2014 MalaysiaXiaxun OngNo ratings yet

- Are Taxes EvilDocument5 pagesAre Taxes Evilpokeball0010% (1)

- Taxation AgorDocument1 pageTaxation AgorFOOD MASTERSNo ratings yet

- Public Revenue 17396Document54 pagesPublic Revenue 17396sneha9988gargNo ratings yet

- The Importance of Taxes To The Government and The EconomyDocument3 pagesThe Importance of Taxes To The Government and The EconomyClarice Kee100% (5)

- How to Handle Goods and Service Tax (GST)From EverandHow to Handle Goods and Service Tax (GST)Rating: 4.5 out of 5 stars4.5/5 (4)

- Feel Ko Teh 1Document1 pageFeel Ko Teh 1Jovi Floresca AberinNo ratings yet

- Comparative ParadigmDocument4 pagesComparative ParadigmJovi Floresca AberinNo ratings yet

- ABERIN4Document1 pageABERIN4Jovi Floresca AberinNo ratings yet

- Skeletal SystemDocument7 pagesSkeletal SystemJovi Floresca AberinNo ratings yet

- Lab Act 5Document6 pagesLab Act 5Jovi Floresca AberinNo ratings yet

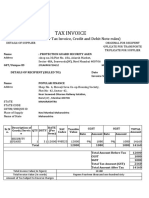

- Tax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Document5 pagesTax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Bharat DafalNo ratings yet

- Kapil Raj Mandavi 23-24Document1 pageKapil Raj Mandavi 23-24khan khanNo ratings yet

- 14 Commissioner of Internal Revenue vs. St. Lukes Medical Center Inc. 682 SCRA 66 September 26 2012Document28 pages14 Commissioner of Internal Revenue vs. St. Lukes Medical Center Inc. 682 SCRA 66 September 26 2012DannethGianLatNo ratings yet

- Chapter 1 - Introduction: Code - 1 (A) - (F), (I) A. Orientation The Tax Practitioner's Tools (P. 1-11, 24-30, 42-46)Document40 pagesChapter 1 - Introduction: Code - 1 (A) - (F), (I) A. Orientation The Tax Practitioner's Tools (P. 1-11, 24-30, 42-46)Lauren PoelingNo ratings yet

- Buyer MR - Harish Karimnagar Ph:9989088769 Gstin/Uin: 36AAWCS2706E2Z5 State Name: Telangana, Code: 36 Terms of DeliveryDocument1 pageBuyer MR - Harish Karimnagar Ph:9989088769 Gstin/Uin: 36AAWCS2706E2Z5 State Name: Telangana, Code: 36 Terms of DeliveryPAPPU RANJITH KUMARNo ratings yet

- Full Download South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions ManualDocument36 pagesFull Download South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manualblindoralia100% (38)

- Indiana University of Pennsylvania Affidavit of Financial SupportDocument1 pageIndiana University of Pennsylvania Affidavit of Financial Supportadani9No ratings yet

- 16 Account Showing CNCDocument2 pages16 Account Showing CNCAngel RamírezNo ratings yet

- Feasibility Study - Financial AssumptionsDocument3 pagesFeasibility Study - Financial Assumptionshgciso33% (3)

- Microsoft Word - AP Lab Exercise10Document5 pagesMicrosoft Word - AP Lab Exercise10I'm RangaNo ratings yet

- Form 8453 EMPDocument1 pageForm 8453 EMPKatakuriNo ratings yet

- Primary LienDocument11 pagesPrimary LienNeeron KatieNo ratings yet

- (INCOME TAX-BUSINESS TAX) AnswersDocument37 pages(INCOME TAX-BUSINESS TAX) AnswersAeyjay Manangaran100% (1)

- Goods and Service Tax (GST) and Its Impact: Jaspreet KaurDocument3 pagesGoods and Service Tax (GST) and Its Impact: Jaspreet KaurSreekutty KNo ratings yet

- Colon JuniorDocument36 pagesColon JuniorVicmali Papeleria Ciber50% (2)

- EU Tax Observatory No 2 1631100371Document60 pagesEU Tax Observatory No 2 1631100371hervianNo ratings yet

- E-Way Bill SystemDocument1 pageE-Way Bill SystemManoj RacerNo ratings yet

- Maceda Vs MacaraigDocument4 pagesMaceda Vs MacaraigJovy Balangue MacadaegNo ratings yet

- Posada Corporation S Balance Sheet at December 31 2009 Is PresDocument1 pagePosada Corporation S Balance Sheet at December 31 2009 Is PresM Bilal SaleemNo ratings yet

- Comp4 1Document3 pagesComp4 1Kavya GopakumarNo ratings yet

- What Are The Incomes Specified For TDSDocument6 pagesWhat Are The Incomes Specified For TDSaniket thakurNo ratings yet

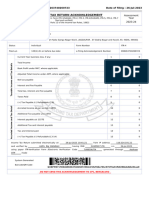

- Annual Income Tax Return: - TAN Lance Adrian GUT IerrezDocument4 pagesAnnual Income Tax Return: - TAN Lance Adrian GUT IerrezReina EvangelistaNo ratings yet

- Certificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document2 pagesCertificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)RapRalph GalagalaNo ratings yet

- FM09-CH 30Document4 pagesFM09-CH 30Mukul KadyanNo ratings yet

- NS Setelah BB 2021 Pt. SGDocument2 pagesNS Setelah BB 2021 Pt. SGAL FilmsNo ratings yet

- Invoice 00002Document1 pageInvoice 00002Asad AhmedNo ratings yet

- Invoice Baby Cart LLP: GST No:27ADXFS4779C1ZBDocument8 pagesInvoice Baby Cart LLP: GST No:27ADXFS4779C1ZBSuryapratap Singh SikarwarNo ratings yet

- Budgeting and Financial Management-2Document17 pagesBudgeting and Financial Management-2Engr AhmadNo ratings yet

- Li Yao vs. CIRDocument4 pagesLi Yao vs. CIRVan John MagallanesNo ratings yet

- Tax Teaching Student ManualDocument28 pagesTax Teaching Student ManualDayarayan CanadaNo ratings yet