Professional Documents

Culture Documents

Acct II Chapter 4

Uploaded by

Gizaw BelayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acct II Chapter 4

Uploaded by

Gizaw BelayCopyright:

Available Formats

Principles of accounting II

CHAPTER FOUR

4 THE PAYROLL ACCOUNTING SYSTEM

IN ETHIOPIAN CONTEXT

4.1The importance of payroll accounting

The concept of payroll is often referred to the total amount paid to employees of a firm as a

compensation for the service rendered to a firm in a given period of time. The payroll accounting

of a firm has to be given emphasis of significance for the following reasons (as stated on the book

entitled “Accounting principles” by Fees and Warren, page 297)

1. Employees are sensitive to payroll errors and irregularities, and maintaining good

employees moral requires that the payroll be paid on a timely and accurate basis.

2. Payroll expenditures are subject to varies government regulations.

3. The payment for payroll and related taxes has significance on the net income of most

business enterprise.

For the aforesaid reasons the need for accurate system of handling the payroll of a business

enterprise is unquestionable.

4.2 Definition of payroll related terms

Salary or wages:

Salary and wages are usually used interchangeably. However, the term wage is more correctly

used to refer to payments for manual labor that are paid based on the number of hours worked or

the number of units produced. So, they are usually paid when a particular piece of work is

completed or weekly. On the other hand, compensations to employees on monthly basis are

termed as salary.

It must be clear that when we say an employee, we refer to an individual who works primarily to

an organization and whose activities are under the direction and supervision of the employer.

Hence, an employee is different from an independent contractor, a self-employed individual who

works on a fee basis to a firm.

The pay period:

The pay period refers to the length of time covered by each payroll payment. Payment period for

wage workers are usually made on weekly basis. On the other hand, salaried employees’ pay

periods are monthly or semimonthly.

Compiled by Habtamu T. MU, CBE, DCS 1

Principles of accounting II

The pap day:

The day on which wages or salaries are paid to employees, usually the last day of the pay period,

is known as the PAY DAY.

Basic records of a payroll accounting system include:

1. A payroll register (sheet)

2. Individual employees earning records, and

3. Usually, pay checks

These records are generated from a payroll system that is operated manually or using computers.

A payroll register (sheet): The entire list of employees of a business along with each

employee’s gross earning, deductions and net pay for a particular payroll period. The basic

for the preparation of the payroll register can be the attendance sheets, punched (clock)

cards or time cards.

Employee earning record: It is a summary of each employee’s earnings, deductions, and

net pay for each payroll period and of cumulative gross earnings during the year. It is a

separate record kept for each employee. The individual employee’s earning record helps

the employer organization to properly summarize and file tax returns.

Pay check: An instrument for paying salary if the firm makes payment via writing a check

in the name of employee for the net pay or a check for the total net pay.

Gross earnings: It is the total pay of an employee before deductions for the pay periods.

Payroll taxes: Are taxes levied against the employer on the payroll of a firm. It is an

additional payroll related expenses to an employer.

Withholding taxes: these are taxes levied against the earnings of employees of an

organization and withhold by the employer per the regulations of the concerned

government.

Payroll deductions: All the reductions from the gross earnings of employees of an

organizations such as withholding taxes, union dues, fines, credit association pays, .

….etc.

Net pay: The gross earnings after subtracting all the deductions. Sometimes it is known as

the take home pay.

Compiled by Habtamu T. MU, CBE, DCS 2

Principles of accounting II

4.3 Possible components of payroll register

1) Employee number: Numbers assigned to employees for identification purpose when a

relatively large number of employees are included in the payroll register.

2) Name of employees: list of the name of employees.

3) Gross Earnings: the money earned by an employee(s) from various sources. It may

include:

The basic salary or regular earning.

A flat monthly salary of an employee is that paid for carrying out the normal work of

employment and subject to change when the employee is promoted.

Allowance: Money paid monthly to an employee for special reason, which may include:

I) Position allowance: A monthly sum paid to an employee for being a particular

office responsibility, e.g. head of a particular or division.

II) House allowance: A monthly allowance given to cover housing costs of the

individual employee when the employment contact requires the employer to provide

housing but fails to do so.

III) Hard ship allowance: A sum of money given to an employee to compensate for an

inconvenient circumstance caused by the employer. E.g. unexpected transfer to a

different and distant work area or location. It is sometimes known as disturbance

allowance.

IV) Desert allowance: A monthly allowance given to an employee because of assignment

to a relatively hot area.

V) Transportation (fuel) allowance: A monthly allowance to an employee to

cover the cost of transportation up to the work place. If the employer has committed

itself to provide transportation service.

Overtime earning: Overtime work is the work performed by an employee beyond the

regular working hour or day.

Overtime earning is the amount payable to an employee for overtime work done.

In Ethiopia, in this respect, according to Article 33 of proclamation No. 64/1975 the following

matters are discussed about the payment of overtime work.

1. A worker shall be entitled to be paid at a rate of one and one quarter(11/4) times his

ordinary hour rate for overtime work performed before 10 o’clock in the evening(10 p.m.).

Compiled by Habtamu T. MU, CBE, DCS 3

Principles of accounting II

2. A work shall be paid at the rate of one and one half (11/2 ) times his ordinary hour rate for

overtime work performed between 10 o’clock in the evening(10 p.m.) and six o’clock in

the morning(6 a. m.).

3. Overtime work performed on the weekly rest day shall be paid at a rate of two (2) times the

ordinary hour rate of payment.

4. A worker shall be paid at a rate of two and half (21/2) times the ordinary hour rate for

overtime work performed on a public holiday.

Hence, the gross earnings of an employee include the basic salary, allowance and overtime

earnings.

You may sometimes find other of earnings such as Bonus that is paid to employees for

achieving results better than usual.

4) Deductions

These are subtractions made from the earnings of employees that is because it is required by

government or permitted by the employee himself.

In our country, Ethiopia, some of the deductions against the earnings of employees are:

A) Employee income tax

In Ethiopia every citizen is required to pay something in the form of income tax from

his/her earnings of employment. In this case a progressive income tax system that charges

higher rates for higher earnings is applied on the gross earnings of each employee save the

first 150 birr. According to proclamation No. 268/2002 that future amended the income tax

proclamation N o. 107/1994 given below exempts the first 150 birr of the earnings of an

employee from the income tax. The money on which a person does not pay income tax is

an EXEMPTION.

The amended income tax proclamation copied from 4th July 2002 Negarit Gazeta No. 34

states the following about employment income tax and its computation:

Amendment proclamation No.286/2002

A proclamation to amend the income tax proclamation:

WHERE AS, it has become necessary to further amend the Income tax proclamation No.

107/1994, as amended;

NOW THEREFORE, in accordance with Article 9(d) of the Transitional period charter, it is here

by proclaimed as follows;

Compiled by Habtamu T. MU, CBE, DCS 4

Principles of accounting II

1) Short Title

This proclamation may be cited as the “Income Tax Proclamation amendment

No.286/2002.”

2) Amendment

The Income Tax proclamation No. 107/1994 as amended is hereby further amended as

follows:

1) Sub –article of Article 7 is hereby deleted and replaced by the following new sub-

article (b). (1) The first one hundred fifty birr (Birr 150) income from employment

shall be exempt from payment of income tax in all cases.

2) The tax on income from employment over one hundred fifty birr (> birr 150) shall be

charged, levied and collected monthly according to the following schedule.

Rates of Tax(%)

Taxable Monthly Income (In Birr) on Every additional

Income

1 The First 150 birr 0%

2 Over Br.150, but not exceeding Br.650 on the next 500 birr 10%

3 Over Br.650, but not exceeding Br.1400 on the next 750 birr 15%

4 Over Br.1400, but not exceeding Br.2,350 on the next 950 birr 20%

5 Over Br.2,350, but not exceeding Br.3,550on the next 1200 birr 25%

6 Over Br.3,550, but not exceeding Br.5000 on the next 1450 birr 30%

7 Over Br.5000 35%

Generally, taxable income from employment includes salaries, wages, allowances, directors’ fee

and other personal employment, all payments in cash and benefits in kind.

However, according to income tax amendment proclamation No. 30/1992 issued on October 12,

1992 stated that the following categories of payments in cash or benefits on kind are exempted

from tax.

1) Medical costs incurred by employer for treatment of employees.

Compiled by Habtamu T. MU, CBE, DCS 5

Principles of accounting II

2) Transportation allowances paid by employer to its employee.

3) Reimbursement by employer of travelling expenses incurred on duty by employees.

4) Traveling expenses paid to transport employees from elsewhere to place of employment

and to return them upon completion of employment.

B) Pension Contributions

Permanent employees of an organization the employees of which are governed by the existing

regulations of the Ethiopian public servants are expected to pay or contribute 4% of their basic

(monthly) salary to the Government Pension Trust Fund. This amount should be withheld

by the employer from the basic salary of each employee on every payroll and later be paid to

the respective government body.

On the other hand, the employer is also expected to contribute towards the same fund 6% of

the basic salary of every permanent employee of it. It is total amount is that we called earlier

as payroll tax expense to the employer organization. i.e. 6% of the total basic salary of all

permanent employee.

Consequently, the total contribution to the pension Trust Fund of the Ethiopian government is

equal to 10% of the total basic salary of all permanent employees of an organization(4%

comes from the employees and the 6% comes from the employer).

This enables a permanent employee of an organization to be entitled to the pension pay given

that the employee has satisfied the minimum requirements to enjoy this benefits when retired.

Non government organizations are also using this kind of scheme to benefit their employees

with some modifications. This is made in some NGO’s by keeping a fund known as

Provident Fund. Both the employees and the employer contribute towards this fund

monthly. Ultimately, when an employee is retired or drawn out of work a lump sum amount is

given at once.

C) Other deductions

A part from the above two kind of deductions from employees earnings, employee may

individually authorize additional deductions such as deduction to pay health or life insurance

premium, to repay loans from the employer or credit associations, to pay for donations to

charitable organization,…etc

Each of the major other deductions may be put in special column in the payroll register.

Ultimately, the sum of the employees’ income tax, pension contributions, and other deductions

gives the total deductions from the gross earnings of an employee.

Compiled by Habtamu T. MU, CBE, DCS 6

Principles of accounting II

5) The Net Pay

This amount is held in one column of the payroll register representing the excess of gross

earnings over the total deductions of an employee. The column ‘Net pay’ totally tells the

employee home take amount.

6) Signature

Unless some other document is used, the payroll sheet may be designed to allow a column for

signature of the employees after collection of the net pay.

In general, a payroll register should at least show the earnings, deductions and the net payment

with the names of the employees.

4.4 Major Procedures or Activities Involved in Accounting for payroll

1) Gathering the necessary data: All the relevant information about every employee should be

gathered. This activity requires reviewing various documents and to do some arithmetic

work.

2) Including the names of employees along with the gathered data such as earnings,

deductions and net pays in the appropriate column of the payroll register.

3) Totaling and proving the payroll register. It must be proved that the grand total earning

equals the sum of the grand totals of deductions and the net pay in the payroll register.

4) The accuracy and authenticity of the information summarized in the payroll should be

verified by a different person from the one who compiles it.

5) The payroll should be approved by the authorized personnel.

6) Paying the payroll either in cash (this may be after cashing a check issued for the total net

pay of the payroll) or issuing a check of every individual of employee for the net amount

payable to each employee.

7) Recording the payment of the payroll and recognition of the withholding tax liabilities.

8) Recording the payroll tax expenses of the employer.

9) Paying and recording withholding and payroll tax liabilities to the concerned authority, in

our case to the Inland Revenue Administration.

Compiled by Habtamu T. MU, CBE, DCS 7

Principles of accounting II

Demonstration problem

Messebo cement factory pays the salary of its employees according to the Ethiopian calendar

month.

The forth coming data related to the month of Ginbot, 2002.

Ser. Name of Basic Monthly OT hours Duration of OT work Basic salary

No. employee Salary Allowance worked per hour

1 Sara T. 2080 200 10 Up to 10 p. m. 13

2 Petros C. 640 ----- 8 10 p.m. to 5a.m. 4

3 Abdu M. 1280 ----- 6 Weekly rest days 8

4 Leila J. 960 150 ------ ------ 6

5 Kiros W. 520 100 10 Public holiday 3

N.B

Note that the management of the factory usually expects a worker to work 40 hours in a week and

during the month Ginbot all workers have done as they have been expected. Besides, all workers

of this factory are a permanent employees except Petros, the monthly allowance of kiros is not

taxable, and Abdu agreed to have a monthly Br.200 be deducted and paid to the credit association

of the factory as a monthly saving.

INSTRUCTIONS:

Based on the above information,

1) Prepare a payroll register (sheet) for the factory for the month of Ginbot, 2002?

2) Record the payment of salary as of Ginbot, 30 using Ck No. 21 as a source document?

3) Record the payroll tax expenses for the month of Ginbot?

4) Record the payment of the claims of the credit association of the factory that arose from

the Ginbot payroll assuming that the payment was made on Sene1, 2002?

5) Assuming that the withholding taxes and payroll taxes of the month of Ginbot, 2002 have

been paid on Sene3, 2002 via CK No.29, record the required journal entry?

Compiled by Habtamu T. MU, CBE, DCS 8

Principles of accounting II

Computation of earnings, deductions, and net pay:

Overtime earnings=OT Hours worked x (Ordinary hour rate X OT rate)

1) Sara, OT earnings 10 hrs x (13 x 1.25) =Br. 162.5

2) Petros, OT earnings 8hrs x (4 x 1.5) = Br. 48

3) Abdu, OT earnings 6hrs x (8 x 2) = Br.96

4) Kiros, OT earnings 10hrs x (3 x 2.5) = Br.75

Gross earnings = Basic salary + Allowance + OT earnings

1) Sara, (2080+200+162.5) = Br. 2342.5

2) Petros, (640 + 48) = Br. 688

3) Abdu, (1280 + 96) = Br. 1376

4) Leila, (960 + 150) = Br.1110

5) Kiros, (520 + 100 + 75) = Br.695

N.B ITR = Income tax rate

IT = Income tax

OT = Over time

Computation of deductions and net pays:

1) Sara Gross taxable income = Br.2342.5

Employee income tax: Earnings x ITR = IT

150 x 0% = 0.00

500 x 10% = 50.00

750 x 15% = 112.5

942.5 x 20% = 188.5

Total: Br. 2342.5 351.00

Pension contribution: Basic salary x 4%

2080 x 4% = 83.20

Total deductions: ------------------------------------------- -------Br. 434.20

Net pay--------------------------------------------------------------- Br. 1908.30

Compiled by Habtamu T. MU, CBE, DCS 9

Principles of accounting II

2) Petros

Gross taxable income = Br. 688.00

Employee income tax: Earnings x ITR = IT

150 x 0% = 0.00

500 x 10% = 50.00

38 x 15% = 5.70

Total: Br. 688.00 55.70

Pension contribution: Basic salary x 4% = 0.00

(Since he is temporary employee)

Total deductions: ------------------------------------------------Br. 55.70

Net pay ---------------------------------------------------------- Br. 632.30

3) Abdu

Gross taxable income = Br. 1376.00

Employee income tax: Earnings x ITR = IT

150 x 0% = 0.00

500 x 10% = 50.00

726 x 15% = 108.90

Total: Br. 1376 158.90

Pension Contribution: Basic Salary x 4%

1280 x 4% = 51.20

Credit association payment ------------------------------ 200.00

Total deductions: ------------------------------------------ Br.410.10

Net pay --------------------------------------------------- Br. 965.90

4) Leila

Gross taxable income = Br. 1010.00

Employee income tax: Earnings x ITR = IT

150 x 0% = 0.00

500 x 10% = 50.00

Compiled by Habtamu T. MU, CBE, DCS 10

Principles of accounting II

360 x 15% = 54.00

Total: Br. 1010.00 104.00

Pension Contribution: Basic salary x 4%

960 x 4% = 38.40

Total deductions ----------------------------------------- Br. 142.40

Net pay ---------------------------------------------------- Br. 867.60

5) Kiros

Gross taxable income = Br. 595 (Since his monthly allowance is not taxable)

(695-100 = 595)

Gross earnings = Br. 695

Employee income tax: Earnings x ITR = IT

150 x 0% = 0.00

445 x 10% = 44.50

Total: Br.595 44.50

Pension Contribution: Basis Salary x 4%

520 x 4% = 20.80

Total deductions ------------------------------------------- Br. 65.30

Net pay ------------------------------------------------------ Br. 629.70

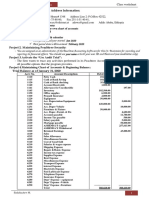

1) Preparation of payroll register

PAYROLL REGISTER

Messebo cement factory

For the month ended Ginbot 30, 2002

Earnings Deductions Net

Ser. Name B.Sa M.Al Ov.T Gross IT Pe.Con. Ot.ded T.ded Pay

No lowa. Earn.

Sign

1 Sara 2080 200 162.5 2342.5 351 83.20 ---- 434.2 1908.30

2 Petros 640 ----- 48 688 55.70 ----- ------ 55.7 632.30

3 Abdu 1280 ----- 96 1376 158.9 51.20 200 410.1 965.90

Compiled by Habtamu T. MU, CBE, DCS 11

Principles of accounting II

4 Leila 960 150 --- 1010 104 38.40 ----- 142.4 867.80

5 Kiros 520 100 75 695 44.5 20.80 ----- 65.3 629.70

Total 5480 450 383.5 6111.5

Compiled by Habtamu T. MU, CBE, DCS 12

You might also like

- Citizens Rule BookDocument44 pagesCitizens Rule BookSam Gregory100% (1)

- Finding Buyers Leather Footwear - Italy2Document5 pagesFinding Buyers Leather Footwear - Italy2Rohit KhareNo ratings yet

- Affidavit and Affidavit of Loss - Andres (Cessation and Bir Documents)Document2 pagesAffidavit and Affidavit of Loss - Andres (Cessation and Bir Documents)Antonio J. David II80% (5)

- ISO Audit Findings ExplainedDocument4 pagesISO Audit Findings ExplainedJohn RajeshNo ratings yet

- Case 1 - Ermita-Malate Hotel and Motel Operators Association Inc Vs City Mayor of ManilaDocument3 pagesCase 1 - Ermita-Malate Hotel and Motel Operators Association Inc Vs City Mayor of ManilaArlen RojasNo ratings yet

- Zsuzsanna Budapest - The Holy Book of Women's Mysteries (PP 104-305)Document109 pagesZsuzsanna Budapest - The Holy Book of Women's Mysteries (PP 104-305)readingsbyautumn100% (1)

- Agency Trust & Partnership ReviewerDocument8 pagesAgency Trust & Partnership ReviewerKfMaeAseronNo ratings yet

- Impact of Transformational Leadership on Employee Engagement in Engineering CompaniesDocument3 pagesImpact of Transformational Leadership on Employee Engagement in Engineering CompaniesSafi SheikhNo ratings yet

- Innovation Management & EnterpreneurshipDocument48 pagesInnovation Management & EnterpreneurshipGizaw Belay100% (2)

- Evolution of CommunicationDocument20 pagesEvolution of CommunicationKRISTINE MARIE SOMALONo ratings yet

- Hul ProjectDocument69 pagesHul ProjectgauravNo ratings yet

- PPE, Intangibles, Natural ResourcesDocument43 pagesPPE, Intangibles, Natural ResourcesBrylle TamañoNo ratings yet

- Innovation Management & EnterpreneurshipDocument128 pagesInnovation Management & EnterpreneurshipGizaw Belay100% (2)

- Fundamentals of Acc II CH 3 & 4Document13 pagesFundamentals of Acc II CH 3 & 4Sisay Belong To Jesus100% (2)

- Fundamental CH 4Document8 pagesFundamental CH 4Tasfa ZarihunNo ratings yet

- Payroll accounting essentialsDocument14 pagesPayroll accounting essentialsMahlet AemiroNo ratings yet

- Chapter 3 PayrollDocument16 pagesChapter 3 PayrollAbdi Mucee TubeNo ratings yet

- Ethiopia Employment Income Tax GuideDocument10 pagesEthiopia Employment Income Tax GuideHarsh Nahar100% (1)

- CH 3 PeyrollDocument9 pagesCH 3 PeyrollChalachew Eyob100% (1)

- 4 6048443301533583445Document3 pages4 6048443301533583445Beka AsraNo ratings yet

- Assignment Bank Reconciliation and Payroll New 1Document5 pagesAssignment Bank Reconciliation and Payroll New 1Dagnachew WeldegebrielNo ratings yet

- Individual Assignment Financial Accounting and Report 1Document7 pagesIndividual Assignment Financial Accounting and Report 1Sahal Cabdi AxmedNo ratings yet

- Payroll, pension, and tax calculationsDocument4 pagesPayroll, pension, and tax calculationsAliyi BenuraNo ratings yet

- Project Two. Process Financial Transactions and Prepare Financial The Accounts in The Ledger ofDocument11 pagesProject Two. Process Financial Transactions and Prepare Financial The Accounts in The Ledger ofGetahunNo ratings yet

- COC at LEVEL-4Document53 pagesCOC at LEVEL-4RoNo ratings yet

- Accounting and BudgetDocument82 pagesAccounting and BudgetGemeda TuntunaNo ratings yet

- COC LEVEL-3 PracticalDocument81 pagesCOC LEVEL-3 PracticalMohammed AbduramanNo ratings yet

- Level Four Code 5-1Document5 pagesLevel Four Code 5-1EdomNo ratings yet

- 4 5845855793034823826Document36 pages4 5845855793034823826Gena HamdaNo ratings yet

- Accounting Level IV Project Post-Closing Trial BalanceDocument5 pagesAccounting Level IV Project Post-Closing Trial BalanceTewodros BekeleNo ratings yet

- Exam 3 Coc Level 3Document4 pagesExam 3 Coc Level 3tamene wolde100% (1)

- Learning Guide: Basic Account Works Level IIDocument29 pagesLearning Guide: Basic Account Works Level IIBeka AsraNo ratings yet

- Ategory: Details of Possible Complaints Relating To TheaccountDocument45 pagesAtegory: Details of Possible Complaints Relating To TheaccountKen Lati100% (1)

- Peachtree Class Practice QuestionDocument4 pagesPeachtree Class Practice QuestionNazar MuhammadNo ratings yet

- Rift Valley University Assignment On Fundamental of Accounting II Submission Date January 10/2022Document2 pagesRift Valley University Assignment On Fundamental of Accounting II Submission Date January 10/2022Kat SullvianNo ratings yet

- PCT 2Document57 pagesPCT 2nigusNo ratings yet

- Accounting Level II - Third Term Assignement IDocument3 pagesAccounting Level II - Third Term Assignement IEdomNo ratings yet

- Assume XYZ Company Is A Merchandising Business and Registered For VAT WhichDocument6 pagesAssume XYZ Company Is A Merchandising Business and Registered For VAT WhichKen LatiNo ratings yet

- Saving Account Advantage: Project 1 Work Effectively in The Financial Sector and Customer Account Task1.1Document3 pagesSaving Account Advantage: Project 1 Work Effectively in The Financial Sector and Customer Account Task1.1yoniakia2124No ratings yet

- Baw - IDocument5 pagesBaw - Iyoniakia2124No ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- Advanced Taxation Chapter 4Document123 pagesAdvanced Taxation Chapter 4amogneNo ratings yet

- BAW2 Assignment 4Document3 pagesBAW2 Assignment 4eferemNo ratings yet

- CHAPTER 4 Partiner ShipDocument22 pagesCHAPTER 4 Partiner ShipTolesa Mogos100% (1)

- Peachtree Exercise Part 2Document10 pagesPeachtree Exercise Part 2Juan KermaNo ratings yet

- CH 04-ACCOUNTING SYSTEMS FOR PAYROLL AND PAYROLL TAXESDocument39 pagesCH 04-ACCOUNTING SYSTEMS FOR PAYROLL AND PAYROLL TAXESSitra AbduNo ratings yet

- Accounting Department Basic Accounting Works Level Ii: Global College Ambo CampusDocument21 pagesAccounting Department Basic Accounting Works Level Ii: Global College Ambo Campusembiale ayaluNo ratings yet

- Prepare Financial Report 3rdDocument12 pagesPrepare Financial Report 3rdTegene Tesfaye100% (1)

- Cost accounting projects breakeven analysis profitDocument3 pagesCost accounting projects breakeven analysis profitbiniamNo ratings yet

- Introduction To Accounting (Etagenehu)Document113 pagesIntroduction To Accounting (Etagenehu)YonasNo ratings yet

- Rift Valley University: Learning GuideDocument28 pagesRift Valley University: Learning GuideBlack Lion boxNo ratings yet

- Practice Questions Inventories # 2 With AnswersDocument9 pagesPractice Questions Inventories # 2 With AnswersIzzahIkramIllahiNo ratings yet

- 01 Full CH Cost and Management Accounting Chapter 1 Copy 1Document200 pages01 Full CH Cost and Management Accounting Chapter 1 Copy 1sabit hussenNo ratings yet

- 2021-06 Icmab FL 001 Pac Year Question June 2021Document3 pages2021-06 Icmab FL 001 Pac Year Question June 2021Mohammad ShahidNo ratings yet

- Chapter-II Risk Management ProcessDocument44 pagesChapter-II Risk Management ProcessCanaanNo ratings yet

- Computerized Accounting ExerciseDocument4 pagesComputerized Accounting ExerciseAbel Hailu100% (1)

- Develop Understanding of TaxationDocument14 pagesDevelop Understanding of Taxationnatanme794No ratings yet

- Project Information Project 1Document8 pagesProject Information Project 1biniamNo ratings yet

- XYZ Company tax and employee salary calculationsDocument4 pagesXYZ Company tax and employee salary calculationsbiniamNo ratings yet

- 11 Processing PayrollDocument22 pages11 Processing PayrollYohannes AdmasuNo ratings yet

- Leadstar College Fund Accounting Individual AssignmentDocument3 pagesLeadstar College Fund Accounting Individual AssignmentFantayNo ratings yet

- COC Training ExcercisesDocument8 pagesCOC Training ExcercisesGuddataa DheekkamaaNo ratings yet

- PFT Chapter 3Document16 pagesPFT Chapter 3Nati TesfayeNo ratings yet

- Chapter 1Document15 pagesChapter 1Fethi ADUSSNo ratings yet

- Plant AssetsDocument17 pagesPlant AssetsGizaw Belay100% (1)

- Accounting Level IIIDocument95 pagesAccounting Level IIIteshome neguseNo ratings yet

- Preparing Financial ReportDocument88 pagesPreparing Financial ReportSurafel HNo ratings yet

- 2.1 The Recording Phase: Sheet and Income Statement AccountsDocument12 pages2.1 The Recording Phase: Sheet and Income Statement Accountsayitenew temesgenNo ratings yet

- Training, Teaching and Learning Materials (TTLM) : EIS ABS4160812 EIS ABS4 M 16 0812Document10 pagesTraining, Teaching and Learning Materials (TTLM) : EIS ABS4160812 EIS ABS4 M 16 0812NabuteNo ratings yet

- Develop and Understand TaxationDocument26 pagesDevelop and Understand TaxationNigussie BerhanuNo ratings yet

- Learning Guide: Accounts and Budget Support Level IiiDocument75 pagesLearning Guide: Accounts and Budget Support Level IiiNigussie BerhanuNo ratings yet

- Calculate Taxes Fees & Charges ASSIGNMENT NewDocument2 pagesCalculate Taxes Fees & Charges ASSIGNMENT NewJarra AbdurahmanNo ratings yet

- Acct II Chapter 3edDocument11 pagesAcct II Chapter 3edmubarek oumer100% (2)

- Payroll AccoutingDocument7 pagesPayroll AccoutingGizaw BelayNo ratings yet

- Chapter 4Document26 pagesChapter 4Gizaw BelayNo ratings yet

- Chapter 4Document18 pagesChapter 4Gizaw BelayNo ratings yet

- Chapter 3Document37 pagesChapter 3Gizaw BelayNo ratings yet

- Chapter 1Document21 pagesChapter 1Gizaw BelayNo ratings yet

- CashDocument15 pagesCashGizaw BelayNo ratings yet

- Chapter 3Document29 pagesChapter 3Gizaw BelayNo ratings yet

- Chapter 5Document22 pagesChapter 5Gizaw BelayNo ratings yet

- Chapter Three - Plant AssetDocument23 pagesChapter Three - Plant AssetGizaw BelayNo ratings yet

- Statistics Class Discussion Questions on Sampling DistributionsDocument2 pagesStatistics Class Discussion Questions on Sampling DistributionsGizaw Belay100% (1)

- Account Receivables GuideDocument15 pagesAccount Receivables GuideGizaw BelayNo ratings yet

- ch-5 CashDocument12 pagesch-5 CashGizaw BelayNo ratings yet

- RecivablesDocument12 pagesRecivablesGizaw BelayNo ratings yet

- Plant AssetsDocument17 pagesPlant AssetsGizaw Belay100% (1)

- Exercise On Probability TheoryDocument7 pagesExercise On Probability TheoryGizaw BelayNo ratings yet

- Managerial EconomicsDocument28 pagesManagerial EconomicsGizaw BelayNo ratings yet

- Probability Disribution2Document2 pagesProbability Disribution2Gizaw BelayNo ratings yet

- Stat I CH - 1Document9 pagesStat I CH - 1Gizaw BelayNo ratings yet

- B.C CHAPTER ONEDocument2 pagesB.C CHAPTER ONEGizaw BelayNo ratings yet

- Arbaminch Distance Chapter 3Document16 pagesArbaminch Distance Chapter 3Gizaw BelayNo ratings yet

- Business Communication Module (Distance)Document187 pagesBusiness Communication Module (Distance)Gizaw BelayNo ratings yet

- Economics G 11Document468 pagesEconomics G 11Gizaw Belay100% (1)

- Stat I CH - 4Document15 pagesStat I CH - 4Gizaw BelayNo ratings yet

- Ch-1 Innovation and EntrepreneurshipDocument19 pagesCh-1 Innovation and EntrepreneurshipGizaw BelayNo ratings yet

- Stat I CH - 2Document13 pagesStat I CH - 2Gizaw BelayNo ratings yet

- Chapter-Five: Capital Budgeting DecisionDocument50 pagesChapter-Five: Capital Budgeting DecisionGizaw BelayNo ratings yet

- Understanding Capital Structure and LeverageDocument34 pagesUnderstanding Capital Structure and LeverageGizaw BelayNo ratings yet

- PSCD Corp Vs CaDocument3 pagesPSCD Corp Vs CaDel Rosario MarianNo ratings yet

- AFS 100 Lecture 1 Introduction To African StudiesDocument28 pagesAFS 100 Lecture 1 Introduction To African StudiesJohn PhilbertNo ratings yet

- Benjamin Dent Arrest Press ReleaseDocument2 pagesBenjamin Dent Arrest Press ReleaseRyan GraffiusNo ratings yet

- Enabling Business of Agriculture - 2016Document262 pagesEnabling Business of Agriculture - 2016Ahmet Rasim DemirtasNo ratings yet

- High Performance School Ancash Offers World of OpportunitiesDocument2 pagesHigh Performance School Ancash Offers World of OpportunitieswilliamNo ratings yet

- Hilltop Technology v. TPK Holding Et. Al.Document6 pagesHilltop Technology v. TPK Holding Et. Al.Patent LitigationNo ratings yet

- Essay USP B. Inggris 21-22 PDFDocument3 pagesEssay USP B. Inggris 21-22 PDFMelindaNo ratings yet

- CH 1 - TemplatesDocument7 pagesCH 1 - TemplatesadibbahNo ratings yet

- Solved Table 2 5 Shows Bushels of Wheat and Yards of ClothDocument1 pageSolved Table 2 5 Shows Bushels of Wheat and Yards of ClothM Bilal SaleemNo ratings yet

- KFCDocument1 pageKFCJitaru Liviu MihaitaNo ratings yet

- Laxmibai v. Anasuya Case AnalysisDocument15 pagesLaxmibai v. Anasuya Case AnalysisAnkit KumarNo ratings yet

- Soal Pas Xii SastraDocument9 pagesSoal Pas Xii SastraMaya SholihahNo ratings yet

- A Short Guide To Environmental Protection and Sustainable DevelopmentDocument24 pagesA Short Guide To Environmental Protection and Sustainable DevelopmentSweet tripathiNo ratings yet

- DOJ Payne-Elliott - Statement of Interest in Indiana Lawsuit Brought by Former Teacher Against Illinois ArchdioceseDocument18 pagesDOJ Payne-Elliott - Statement of Interest in Indiana Lawsuit Brought by Former Teacher Against Illinois ArchdioceseBeverly TranNo ratings yet

- Affidavit of Loss (Official Receipt)Document5 pagesAffidavit of Loss (Official Receipt)Christian GonzalesNo ratings yet

- ECHR Rules on Time-Barred Paternity Claim in Phinikaridou v CyprusDocument24 pagesECHR Rules on Time-Barred Paternity Claim in Phinikaridou v CyprusGerasimos ManentisNo ratings yet

- What Factors Affect Chinese Consumers Online Grocery Shopping Zhang 2020Document21 pagesWhat Factors Affect Chinese Consumers Online Grocery Shopping Zhang 2020Gus Mohammad AkbarNo ratings yet

- Ann Joo Steel BHD V Pengarah Tanah Dan Galian Negeri Pulau Pinang Anor and Another Appeal (2019) 9 CLJ 153Document24 pagesAnn Joo Steel BHD V Pengarah Tanah Dan Galian Negeri Pulau Pinang Anor and Another Appeal (2019) 9 CLJ 153attyczarNo ratings yet

- Bustos vs. Lucero, G.R. No. L-2068, October 20, 1948Document19 pagesBustos vs. Lucero, G.R. No. L-2068, October 20, 1948jam taumatorgoNo ratings yet