Professional Documents

Culture Documents

Blaylock (2002)

Uploaded by

Bambang HarsonoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blaylock (2002)

Uploaded by

Bambang HarsonoCopyright:

Available Formats

Tax Avoidance, Large Positive Temporary Book-Tax Differences, and Earnings

Persistence

Author(s): Bradley Blaylock, Terry Shevlin and Ryan J. Wilson

Source: The Accounting Review , JANUARY 2012, Vol. 87, No. 1 (JANUARY 2012), pp.

91-120

Published by: American Accounting Association

Stable URL: https://www.jstor.org/stable/41408062

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide

range of content in a trusted digital archive. We use information technology and tools to increase productivity and

facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at

https://about.jstor.org/terms

American Accounting Association is collaborating with JSTOR to digitize, preserve and extend

access to The Accounting Review

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

THE ACCOUNTING REVIEW American Accounting Association

Vol. 87, No. 1 DOI: 10.2308/accr-10158

2012

pp. 91-120

Tax Avoidance, Large Positive Temporary

Book-Tax Differences, and Earnings

Persistence

Bradley Blaylock

Oklahoma State University

Terry Shevlin

University of Washington

Ryan J. Wilson

The University of Iowa

ABSTRACT: We investigate why temporary book-tax differences appear to serve as a

useful signal of earnings persistence (Hanlon 2005). We first test and show that

temporary book-tax differences provide incremental information over the magnitude of

accruals for the persistence of earnings and accruals. We then opine that there are

multiple potential sources of large positive book-tax differences. We predict and find

that firms with large positive book-tax differences likely arising from upward earnings

management (tax avoidance) exhibit lower (higher) earnings and accruals persistence

than do other firms with large positive book-tax differences. Finally, we find significant

variation in current-period earnings and accruals response coefficients and insignif-

icant hedge returns in period ř+1 , consistent with investors being able to look through to

the source of large positive book-tax differences (earnings management and tax

avoidance), allowing them to correctly price the persistence of accruals for these

subsamples.

Keywords: book-tax differences; earnings persistence; tax avoidance ; earnings

management; earnings expectations.

Data Availability: Data are available from public sources identified in this study.

We acknowledge the helpful comments of Alex Edward, Michelle Hanlon, Stacie Laplante, Rick Mergenthaler, Tom

Omer, Sonja Rego, and two anonymous referees. Professor Shevlin acknowledges financial support from his Paul Pigott/

Paccar Professorship at the Foster School.

Editor's note: Accepted by Tom Omer.

Submitted: March 2010

Accepted: July 201 1

Published Online: August 2011

91

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

92 В lay lock, Shevlin, and Wilson

I. INTRODUCTION

information about earnings persistence (e.g., Lev and Nissim 2004; Hanlon 2005). Despite

Prior the informationtheimportant

importantresearch aboutof suggests

implications implications

these studies, earningsaboutthatwhatof causes

little is known the persistence

the observedthese tax information studies, (e.g., little Lev contained is and known Nissim in about financial 2004; what Hanlon causes statements 2005). the observed provides Despite

link between tax information and earnings persistence. This study begins to develop an

understanding of this link by first documenting that the information in temporary book-tax

differences, documented by Hanlon (2005), about earnings and accruals persistence is incremental

to the magnitude of accruals (i.e., larger accruals are less persistent). We next investigate whether

the implications of temporary differences between book and taxable income for the persistence of

earnings vary depending on the likely source of those differences. We develop two distinct

approaches for partitioning large positive temporary book-tax differences that provide meaningful

information about future earnings and accruals persistence. Our analysis thus extends Hanlon

(2005), who shows that for firm-years with large temporary book-tax differences, pretax income is

less persistent for future earnings than it is for firm-years with small book-tax differences.1

The purpose of accrual accounting is to better recognize firm performance, which often results

in accruals smoothing out transitory shocks in cash flows (Dechow 1994; Dechow and Ge 2006). If

accruals are recorded for book purposes but not for tax purposes, then the differences show up in

deferred tax expense such that a larger deferred tax expense (hereafter, larger book-tax differences)

could just be reflecting larger book accruals. Thus, the Hanlon (2005) result could just be reflecting

the fact that larger accruals are less persistent, as argued by Sloan (1996) and shown by Dechow

and Ge (2006). However, we argue that, when firms exhibit both large positive book-tax differences

and large positive accruals, those accruals are more likely to have resulted from managerial

discretion than a firm that exhibits large positive accruals and small book-tax differences. For this

reason, we expect the accruals of firms with large positive book-tax differences to be less persistent

than those of firms with small book-tax differences. Consistent with this expectation, we find that

large book-tax differences provide incremental useful information about earnings persistence

beyond the information provided by accruals.

Having established that book-tax differences provide incrementally useful information about

earnings and accruals persistence, we posit three primary sources of large positive book-tax

differences.2 First, book-tax differences can arise due to earnings management. Phillips et al. (2003)

conjecture that, because tax law allows less discretion in accounting choices than GAAP, large

positive differences between book and taxable income are informative about earnings management.

Consistent with their assertion, they find that deferred tax expense is incrementally useful to the

Jones' discretionary accruals model in detecting earnings management. In cases where book-tax

differences are generated by earnings management, we expect that accruals are more likely to

reverse in the next period, thus exhibiting low persistence.

Second, a basic tax-planning strategy is to defer taxes as long as possible to decrease the net

present value of the taxes paid. Such behavior leads to a large deferred tax expense, but does not

necessarily result in accruals that reverse in the following year. We predict that, in cases where large

positive book-tax differences arise primarily from extensive tax planning, these differences do not

signal managerial discretion over the accruals process and, as a result, will not be associated with

lower future earnings and accruals persistence. Therefore, we predict that firms with large positive

1 The temporary book-tax differences examined in our study are equal to the deferred tax expense grossed-up by

the applicable statutory tax rate. Consistent with Hanlon (2005), we do not include permanent differences

because, as she notes, permanent differences are affected by tax rate differences, tax credits, and statutory tax

breaks (e.g., tax-exempt interest) that are not indicative of earnings persistence related to the accrual process.

2 Our analysis focuses on firms with large positive book-tax differences because these differences could be a signal

of either earnings management or tax avoidance.

О Accounting The Accounting Review

Association ,

Ja

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

Tax Avoidance , Large Positive Temporary Book-Tax Differences, and Earnings Persistence 93

book-tax differences resulting primarily from tax planning will exhibit higher future earnings and

accruals persistence than other large positive book-tax difference firms.3

Third, deferred tax expense can arise in the absence of tax planning and earnings management

because of the normal differences in the treatment of revenue and expenses for book and tax purposes

(Scholes et al. 2008, 39). Examples of normal temporary differences are depreciation and allowance

for doubtful accounts, although both items can also be used for earnings management purposes.

We use two alternative techniques to partition firms with large positive book-tax differences

into three subsamples corresponding to the three conjectured sources of differences. Consistent with

expectations, under both partitioning approaches we find that firms with large positive book-tax

differences that arise predominantly from upward earnings management have less persistent

earnings and accruals than do firms in the BASE subsample. Also consistent with expectations, we

find that firms with large positive book-tax differences arising predominantly from tax avoidance

exhibit significantly more persistent earnings and accruals relative to the BASE subsample under

partitioning approach 2, but not under partitioning approach 1 .

We next investigate whether investors are able to identify the likely source of book-tax

differences to help interpret price accruals. Hanlon (2005) notes that several accounting textbooks

indicate large book-tax differences can provide information about earnings quality.4 Consistent with

investors heeding this lesson, Hanlon (2005) finds that investors reduce their expectations of the

persistence of earnings and accruals in the presence of large positive book-tax differences and are

able to efficiently price earnings and accruals for these firms; she finds insignificant hedge portfolio

returns in year t+ 1. Despite these results, it is not clear whether investors are able to efficiently price

earnings for sub-groups of large positive book-tax difference firms partitioned on the basis of the

predominant source of their book-tax differences. This question is important because we predict

that the implications of large positive book-tax differences for earnings persistence vary depending

on the likely source of the book-tax differences. Our analysis of different subsets of large positive

book-tax difference firms is similar in spirit to Sloan's (1996) finding that, on average, investors

correctly price the persistence of earnings for all firms. However, Sloan (1996) also shows that

there is differential persistence in the accrual and cash flow components of earnings and that the

market fails to identify and correctly price this differential persistence, resulting in positive hedge

portfolio returns to portfolios formed on accruals.

The ability of investors to identify differences in earnings persistence is critical in valuation.

Frankel and Litov (2009) point out that investors seek to identify the determinants of earnings

persistence in order to better understand the relation between current earnings and permanent

earnings. Ohlson (2009) discusses various theoretical models of firm valuation that all rely, to

varying degrees, on earnings persistence.

We conduct two market-based tests. First, we find in regressions of current-period returns on

earnings and accruals that the response coefficients vary for the subsamples, consistent with the

3 We define tax planning as non-conforming tax positions that lower taxable income relative to book income in the

current period. We acknowledge that firms could also engage in conforming tax planning that lowers reported

income for both book and tax purposes. However, conforming tax planning transactions would not give rise to

book-tax differences. Further, consistent with Hanlon and Heitzman (2010), we view tax avoidance as existing

on a continuum. This continuum of avoidance includes clearly legal transactions, such as investments in

municipal bonds that lower explicit taxes, on one end, to more aggressive forms of tax avoidance, such as tax

sheltering where the legality of the transaction is less certain, on the other end.

4 Recent accounting textbooks continue to suggest that book-tax differences are an indicator of earnings quality.

For example, Revsine et al. (2012, 780) point out that "deferred tax footnotes can be used to assess earnings

quality. " While their suggestion points to analysis of individual firms, the comment is applicable to hedge funds

and other investors using large sample screens to identify securities for investment. Earnings quality is difficult

to define (see Dechow et al. [2010] for a discussion of this concept); consistent with Hanlon (2005), we sidestep

the issue and simply focus on earnings and accruals persistence.

The Accounting Review O ÂSSlnung

January 2012 V A"°c'a,l°n

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

94 Blaylock, Shevlin, and Wilson

documented variation in earnings and a

portfolio returns in year f+l, suggestin

avoidance and high earnings manageme

We contribute to the literature in thre

large book-tax differences are assoc

incremental to the effect of accruals o

alternative means of partitioning firm

provide meaningful information about

differential earnings and accruals persis

difference firms validate our approache

useful to researchers who want to identi

samples of firms, as opposed to using a

in the tax footnotes as in Raedy et al. (2

for the most part, investors appear to u

provided by firms that exhibit large pos

Section II reviews the related literatur

sample. Section IV presents the earning

pricing test results, and Section VI con

II. RELATED LITERATURE AND HYPOTHESES

Earnings Persistence

Hanlon (2005) examines the implications of large book-tax differences fo

accruals persistence. Hanlon (2005) posits that, because discretionary accruals are

than nondiscretionary accruals (Xie 2001), if large book-tax differences are a sig

discretion in the accruals process, then firms with large book-tax differences sho

earnings and accruals persistence. Consistent with this argument, Hanlon (2005)

with large book-tax differences exhibit lower earnings and accruals persistence

small book-tax differences. However, if accruals for book purposes are not also

purposes, then the differences show up in deferred tax expense, and larger def

(equivalently larger book-tax differences) could just be reflecting larger book ac

first test whether large book-tax differences provide incremental useful informati

persistence beyond the information provided by accruals.

This analysis is similar in spirit to the approach of Weber (2009), who exami

analyst forecast errors are associated with the ratio of taxable income to net bo

controlling for accruals. He finds that analysts' forecasts of future earning

optimistic bias in firm-years where book income is high relative to taxable inco

controlling for accruals. We also note that Phillips et al. (2003) find temporary boo

have incremental explanatory power over discretionary accruals, estimated using

to detect earnings management around key earnings benchmarks. Thus, we predic

differences will have incremental explanatory power for the persistence of earni

Hla: Temporary book-tax differences provide incremental information over th

accruals for the persistence of earnings.

Hlb: Temporary book-tax differences provide incremental information over th

accruals for the persistence of the accruals component of earnings.

Assuming book-tax differences have incremental explanatory power, we next ex

tax differences might indicate differences in the persistence of earnings and accr

XQ Accounting The Accounting Review

Association r m n

" January r 2012 m n

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

Tax Avoidance, Large Positive Temporary Book-Tax Differences, and Earnings Persistence 95

Hanlon (2005) by making separate predictions about the earnings and accruals persistence for

different subsamples of firms with large positive book-tax differences (LPBTDs) based on the likely

predominant source of those differences. We expect that the ability of LPBTDs to serve as a red-flag

for low earnings quality (less persistent earnings and accruals) will be most pronounced for firms

where upward earnings management is the predominant source of the large positive book-tax

differences. Phillips et al. (2003, 492) argue that deferred tax expense can be used as a measure of

"managers' discretionary choices under GAAP because the tax law, in general, allows less discretion

in accounting choice relative to the discretion that exists under GAAP." As an example of this

flexibility, Phillips et al. (2003) note that GAAP allows discretion in accounting for bad debts, but tax

reporting requires the receivable to actually be written off. Consistent with this argument, Phillips et

al. (2003) find evidence of a positive association between deferred tax expense and firms just avoiding

a loss or a decline in earnings. They conclude that the deferred tax expense is a useful indicator of

earnings management incremental to a proxy for discretionary accruals. Also consistent with this

reasoning, Mills and Newberry (2001) find that the magnitude of book-tax differences is positively

associated with financial reporting incentives such as financial distress and bonus thresholds.

We compare the earnings and accruals persistence of firms likely to have managed earnings

with large positive discretionary accruals to the LPBTD BASE subsample firms. The above

discussion leads to our second set of hypotheses:

H2a: For firm-years with large positive book-tax differences, the persistence of earnings is

lower for the earnings management subsample than for the BASE subsample.

H2b: For firm-years with large positive book-tax differences, the persistence of the accruals

component of earnings is lower for the earnings management subsample than for the

BASE subsample.

In November 2006, the Wall Street Journal noted that public companies reported 40 percent

higher pretax profits to Wall Street (GAAP earnings) than to tax authorities during 2004 (Drucker

2006). 5 The article went on to report that one of the biggest drivers of this gap is reportable

transactions. These are transactions sold by tax advisers to companies, including some listed

transactions expressly forbidden by the 1RS. In addition, Mills (1998) reports that proposed 1RS

adjustments are positively associated with large book-tax differences.6 Wilson (2009) and

Lisowsky (2010) find that book-tax differences are positively associated with identified cases of tax

sheltering.7 Together, these findings suggest that tax avoidance is an important determinant of

book-tax differences. We conjecture that many firms report LPBTDs largely as a result of tax-

planning strategies associated with deferring income or accelerating deductions.

5 Drucker (2006) notes that these figures were based on 1RS data for 4,195 U.S. public companies with fiscal years

ending between June and December.

6 Mills (1998) uses three alternative measures of book-tax differences. Her full sample analysis utilizes 1RS data

and measures book-tax differences as the difference between pretax book income and taxable income. She also

uses the difference between the federal tax expense for book less the declared tax on the tax return as an

alternative measure of book-tax differences and finally the deferred tax expense as a third measure. Her third

measure is consistent with the measure of book-tax differences used in our study because it does not include

permanent book-tax differences.

7 Specifically, Wilson (2009) finds that both the permanent and temporary components of book-tax differences are

significantly associated with identified cases of tax sheltering. While the ideal tax shelter might generate only

permanent book-tax differences, Wilson's (2009) analysis shows that, in practice, corporate tax shelters often

generate temporary book-tax differences. In addition, Lisowsky et al. (2010) examine 101 tax shelters reported

to the 1RS as listed transactions and find that more of these transactions (38) report a related temporary book-tax

difference than those (12) that report a related permanent book-tax difference.

The Accounting Review ^ íSõínttae

January 2012 "V Assocla,lon

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

96 Blaylock, Shevlin, and Wilson

Ayers et al. (2010) examine the associ

book-tax differences. They conjecture

for credit ratings as a signal to analysts

However, to the extent that changes in

less useful in assessing credit worthine

that tax planning attenuates the relat

ratings. Similarly, we predict that in ca

from tax avoidance strategies, they wi

The above discussion leads to our thi

H3a: For firm-years with large posit

higher for the tax avoider subsam

H3b: For firm-years with large positi

component of earnings is higher f

subsample.

In summary, our hypotheses imply a ra

LPBTDs. Specifically, we expect that

avoidance, earnings and accruals persist

persistence will be exhibited by firms w

function of upward earnings manageme

as resulting from either upward earni

exhibit earnings and accruals persisten

subsample firms, LPBTDs likely arise

accruals as well as innate firm-specific

have large book-tax differences simply b

for GAAP versus the recognition requ

differences in the economics or business

information about subjectivity in the acc

they do for firms for which the predo

Market Pricing

Our next set of hypotheses examine w

about the future of earnings for firms

Sloan (1996) provides evidence that

persistence of accruals and cash flow

investors reduce their expectations ab

correctly price the accruals componen

8 Seidman (2010) finds that a small subset of

book-tax gap between 1993 and 2004. Further

the book-tax gap increases the association b

9 Specifically, Hanlon (2005) finds that inv

earnings for future earnings, but actually un

for future earnings. As a result, investors un

book-tax differences. There is a subtle dist

(2005). Sloan (1996) argues that investors m

and accruals and, thus, might misprice accru

differ across subsamples; investors might

subsamples.

Accounting The Accounting Review

Association T ~ ~

" January T 2012 ~ ~

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

Tax Avoidance, Large Positive Temporary Book-Tax Differences, and Earnings Persistence 97

whether investors recognize the difference in earnings and accruals persistence between various

subsamples of firms that we predict will exhibit meaningful differences in persistence.

Following the above discussion, we expect the persistence of earnings and accruals to be

lowest for firms with LPBTDs arising from upward earnings management. In contrast, we expect

the persistence of earnings and accruals to be highest for firms with LPBTDs generated by tax

avoidance activity. That is, we develop our pricing predictions assuming differential accruals

persistence across subsamples. If investors focus only on aggregate book-tax differences as a signal

of earnings persistence and do not examine the source of those book-tax differences, then we expect

that investors will not correctly understand differences in the persistence of accruals between

subsamples of LPBTD firms separated according to the source of those differences. We develop

two sets of hypotheses to test whether the pricing of equities is consistent with investors looking

through book-tax differences to their source.

We first examine whether the earnings response coefficient varies across subsamples in a

manner consistent with the predicted (in H2 and H3) variation in persistence across the subsamples.

These tests are motivated by prior literature that shows the earnings response coefficient is

positively associated with persistence (Kormendi and Lipe 1986; Collins and Kothari 1989). Thus,

we examine the association between current-period stock returns and earnings and accruals with the

following set of hypotheses:

H4a: The earnings response coefficient is lower (higher) for firms classified as earnings

managers (tax avoiders) than for firms in the BASE subsample.

H4b: The accruals response coefficient is lower (higher) for firms classified as earnings

managers (tax avoiders) than for firms in the BASE subsample.

Evidence consistent with H4a and H4b does not conclusively provide evidence that investors

are correctly or fully recognizing the differential persistence. If investors only partially recognize

the differential persistence of accruals across subsamples, then, as earnings and accruals are

reported in the subsequent year, investors will correct their estimates and portfolios formed on the

sign and magnitude of accruals should generate hedge portfolio abnormal returns. This reasoning

leads to the following hypotheses:

H5a: For firms classified as earnings managers, investors overestimate the persistence of the

accruals component of pretax earnings, resulting in negative abnormal returns to a hedge

portfolio formed on the sign and magnitude of pretax accruals.

H5b: For firms classified as tax avoiders, investors underestimate the persistence of the

accruals component of pretax earnings, resulting in positive abnormal returns to a hedge

portfolio formed on the sign and magnitude of pretax accruals.

III. SAMPLE SELECTION

We begin with a sample of all firms on the Compustat and CRSP tapes with n

and stock return data for the years 1993-2005. We start our sample in 1993 to

implementation of SFAS 109, thereby ensuring consistent accounting for incom

sample period.10 We eliminate observations with missing regression variables, p

losses, positive net operating losses (NOL carryforward), and negative current t

noted by Hanlon (2005), the presence of accounting losses, net operating los

10 We use five years of data to estimate the cash effective tax rate. Because cash taxes paid are

109, we are able to collect data for the calculation of the cash effective tax rate prior to 199

The

г

Accounting

ллП Vf

Review O îïïSÂg

Association

January г 2012 ллП

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

98 Blaylock, Shevlin, and Wilson

current tax expense can obfuscate the

differences.11 After all exclusions, our

We first estimate the book-tax differe

Deferred Taxes)/0.35] scaled by average

differences and partition them into the

4,195 observations), the quintile of larg

other observations (12,585 observatio

(SBTD).

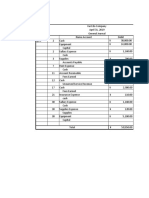

Table 1 presents descriptive statistics for firms categorized into the SBTD, LNBTD, and

LPBTD groups, respectively. Similar to Hanlon (2005), we find that the LNBTD firms are smaller

in terms of median assets. This finding is consistent with smaller growth firms being more likely to

be categorized in the LNBTD group. We also find that the LPBTD firms exhibit the lowest median

five-year cash ETR, which we calculate as the ratio of the sum of cash taxes paid over a five-year

period to the sum of pretax book income over the same five-year period ( Cash5ETR ). This result is

consistent with the LPBTD firms being more likely to be engaged in tax avoidance that results in

positive BTDs. Consistent with LPBTDs being, in part, a function of upward earnings management,

we also find that the LPBTD firms exhibit the largest median discretionary accruals of any of the

three groups. We estimate discretionary accruals using the Jones model with lagged return-on-assets

(Kothari et al. 2005).

IV. TESTS OF EARNINGS PERSISTENCE

The Basic Persistence Regression Model

The following regression model forms the basis of all our earnings persistence t

PTBIt+ 1 =}'() + yxPTBIt + £t+' i (1)

where PTBI is pretax accounting income scaled

comparability, and the coefficient yx is an estimate of

into future (one-period) earnings, referred to as th

expanded as in Hanlon (2005) to allow persistence to

and magnitude of book-tax differences:

PTBIt+] = y0 + yxLPBTDt + y2LNBTDt + y3PTBIt

+ y5PTBIt X LNBTDt + e/+1 , (2)

with the BTD groups as defined above. We next decom

flow and pretax accruals:

PTBIt+ 1 = }'() + yxPTCFt -f y2PTACCt + 8t+ 1, (3)

where PTCF is pretax cash flow and PTACC is pretax accruals, both scaled

for cross-sectional comparability. The coefficients y x and y2 are estimates of

period cash flows and accruals into future (one-period) pretax earnings. Thi

in the literature (Sloan 1996; Xie 2001; Hanlon 2005) as the persistence of

into future earnings. We again allow the persistence parameters to vary as a

magnitude of BTDs:

11 In addition, Hayn (1995) argues that because shareholders have a liquidation option, l

earnings persistence than profitable firm-years. The lower persistence of loss-ye

obscure our ability to detect differences in persistence signaled by large book-tax dif

Accounting The Accounting Review

Association ЛЛ7-)

^ January 20 ЛЛ7-) J 2

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

Tax Avoidance, Large Positive Temporary Book-Tax Differences, and Earnings Persistence 99

TABLE 1

Descriptive Statistics for Selected Variables

Panel A: Small Positive Book-Tax Difference Group (n = 12,585)

Variable Mean Median Std. Dev. Minimum Maximum

BTDt 0.004 0.002 0.010 -0.016 0.037

PTBI,+ l 0.082 0.072 0.104 -0.291 0.431

PTBIt 0.105 0.083 0.084 0.004 0.467

PTCFt 0.123 0.111 0.102 -0.146 0.498

PTACCt -0.017 -0.026 0.075 -0.213 0.305

SARt+l -0.002 -0.045 0.540 -1.583 9.587

Avg. Assets, 4,611 444.5 20,765 1.680 409,417

Disc. Acc, 0.002 0.000 0.060 -0.259 0.345

Cash5ETRt 0.324 0.321 0.167 0.000 1.000

Panel B: Large Negative Book-Tax Differ

Variable Mean Median Std. Dev. Minimum Maximum

BTDt -0.039 -0.028 0.037 -0.763 -0.005

PTBIt+l 0.120 0.113 0.129 -0.291 0.431

PTBIt 0.149 0.125 0.108 0.004 0.467

PTCFt 0.174 0.161 0.125 -0.146 0.498

PTACCt -0.024 -0.038 0.097 -0.213 0.306

SAR,+ i 0.038 -0.043 0.695 -1.545 15.74

Avg. Assets, 2,163 232.3 11,430 4.822 409,644

Disc. Acc, -0.015 -0.016 0.076 -0.362 0.306

Cash5ETR, 0.349 0.350 0.131 0.000 1.000

Panel C: Large Positive Book-Tax Differe

Variable Mean Median Std. Dev. Minimum Maximum

BTD, 0.059 0.045 0.049 0.021 0.742

PTBI,+ l 0.089 0.086 0.114 -0.291 0.433

PTBI, 0.130 0.108 0.087 0.004 0.465

PTCF, 0.140 0.138 0.114 -0.146 0.497

PTACC, -0.010 -0.028 0.088 -0.213 0.305

SAR,+ l -0.010 -0.077 0.618 -1.522 13.26

Avg. Assets, 2,514 376 13,787 4.640 684,794

Disc. Acc, 0.011 0.007 0.069 -0.283 0.344

Cash5ETR, 0.303 0.277 0.199 0.000 1.0000

PTBI,+U PTBI„ PTCF,, and PTACC, are winsorized at t

Variable Definitions:

LNBTD = large negative book-tax differences (bottom quintile);

SBTD = small book-tax differences (middle three quintiles);

LPBTD = large positive book-tax differences (top quintile);

BTD, = book-tax differences estimated as [(U.S. Deferred Tax + Foreign Deferred Tax)/0.35]/Average Total Assets;

PTBI,+l = pretax book income (Compustat item 170) one-year ahead divided by Avg. Assets,;

PTBI, = pretax book income for the current year divided by Avg. Assets,.

PTCF, = pretax cash from operations for the current year calculated as Compustat items 308 + 317- 1 24 divided by Avg. Assets,',

PTACC, = pretax accruals for the current year calculated as PTBI, - PTCF,-,

(continued on next page )

The Accounting Review NQ iSnZg

January 2012 V A"°c,i"on

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

100 В lay lock, Shevlin , and Wilson

TABLE 1 (continued)

SAR,+ 1 = size-adjusted return calculated as the buy-and-hold return on the security (including dividends) beginning at the

start of the fourth month after fiscal year-end (e.g., April 1 for a December 3 1 fiscal year-end firm) and ending at the

end of the third month the following year (e.g., March 31) less the buy-and-hold return on a size-matched portfolio

over the same period;

Avg. Assets, - Assets ,_j (Compustat item 6) plus Assets, divided by 2;

Disc. Acc, = modified Jones Model discretionary accruals by two-digit SIC industry; and

Cash5ETR, = sum of cash taxes paid over the previous five years divided by the sum of PTBI over the previous five years

(or three years if five years of data are unavailable); Cash5ETRs greater than 1 are reset to 1 .

PTBIt+] = 70 + yxLPBTDt + y2LNBTDt + y3PTCFt + y4PTACCt + y5PTCFt X LPBTDt

+ y6PTACCt X LPBTDt + у -j PTC F t X LNBTDt + y%PTACCt X LNBTDt

+ ČM-1- (4)

Equations (2) and (4

replicating Hanlon (20

available upon request

and 4) for our exten

exhibit significantly

To test whether Han

the persistence of ac

also vary as a functio

test Hla and Hlb:

PTBIt+' = y0 + yxLPBTDt + y2LNBTDt + y3ABSACCt + y4PTBIt + y5PTBIt X LPBTD ,

+ y6PTBIf X LNBTDt + У 7 PTBI, X ABS ACC t + et+] , (5)

PTBIt+{ = 7o + yxLPBTDt + y2LNBTDt + y3ABSACCt + y4PTCFt + y5PTACCt

+ y6PTCFt X LPBTDt + y1PTACCt X LPBTD t + ysPTCFt X LNBTDt

+ y9PTACCt X LNBTDt + 7 к }PTCFt X ABS ACC t + yuPTACCt X ABS ACC t

+ fy+b (6)

where ABSACC is

(1996) hypothesi

accruals is decrea

accruals persisten

the absolute value of accruals.

Table 2 reports the results of estimating these two models. In Panel A, the estimated coefficients

on the PTBI interaction terms are all significant in their predicted directions. The significance of the

absolute value of the accruals interaction term is the highest of the three interaction terms. However,

the results in Panel A show that both LPBTDs and LNBTDs provide incrementally useful information

about earnings persistence. In Panel B, we report the results for the persistence of pretax cash flows

and pretax accruals. After controlling for accruals, the persistence of pretax accruals is lower for both

the LNBTD and LPBTD firms, indicating that BTDs contain incremental information about accruals

persistence. Again the significance of the accruals interaction term is higher than for the BTD terms,

but the BTD terms clearly provide incremental information. Also note that, consistent with the results

in Dechow and Ge (2006), cash flows are less persistent as the magnitude of absolute accruals

increases. We believe this result arises through the normal process of accrual accounting smoothing

out transitory shocks in cash flows (Dechow 1994).

Accounting The Accounting Review

V Assocla,ion January 2012

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

Tax Avoidance, Large Positive Temporary Book-Tax Differences, and Earnings Persistence 101

Partitioning BTDs

Having established that book-tax differences have incremental ability to explain cross-sectional

variation in the persistence of earnings and accruals, we now proceed to test H2a, H2b, H3a, and

H3b. As previously noted, our hypotheses relate to why firms might appear in the LPBTD group

and why we might expect differences in persistence of earnings and accruals within this group. H2a

and H3a predict differences in yx in Equation (1) across the subsamples of firms in the LPBTD

group. To conduct tests of differences across the subsamples, we expand Equation (1) to examine

whether the earnings persistence of LPBTD firms varies as a function of whether those book-tax

differences are likely largely a result of upward earnings management (labeled EM observations) or

tax avoidance (labeled TAXAVOIDER observations).

PTBIt+i = 70 + yxEMt + y2TAXAVOIDERt + y3PTBIt

+ y4PTBIt X EMt + y5PTBIt X TAXAVOIDER t + e,+i . (7)

The coefficient on PTBIt , y3, represents the earnings persistence of firm-years with LPBT

that are in the BASE subsample - that is, firm-years that are not categorized as upward earn

management or tax avoidance firms. For these firms, LPBTDs are likely a result of som

combination of tax avoidance, earnings management, and innate firm characteristics.

Consequently, we expect the earnings persistence for this subset of LPBTD firms to fall between

the other two subsets of firms. We expect that if LPBTDs resulting from earnings management are

a signal of discretion in accruals, then the coefficient on the interaction term ( PTBI X EM ), y4, will

be negative. In contrast, if the positive book-tax differences are primarily a result of tax planning,

then we expect that earnings persistence will be higher for this subset of firms than for the BASE

subsample, and that the coefficient on the interaction term ( PTBI X TAXAVOIDER ), y5, will be

positive.

H2b and H3b predict differences in the persistence of accruals across the subsamples of firms

in the LPBTD group (EM, BASE, and TAXAVOIDER). To test accruals persistence across

subsamples, we expand Equation (3) as follows:

PTBIt+x = 7o + yxEMt + у 2 TAXA V О I DER t + y3PTCFt + y4PTCFt X EMt + y5PTCFt

X TAXAVOIDERf + y6PTACCt + y^TACCt X EMt + y^PTACCt

X TAXAVOIDERf + £,+ ,. (8)

H2b predicts that y7 will be negative and H3

hypotheses, we must partition firms into subsam

(EM and TAXAVOIDER)}2 We use the two ap

12 Partitioning large book-tax difference firms into sub

tax differences raises the question of why we do not

differences. After all, we are not predicting that defe

underlying event that caused the deferred tax. Our m

deferred tax expense (or book-tax differences) prov

accounting choices. For hedge funds or other investor

summary measure that provides useful information ab

individual transactions at numerous firms. In contra

and examine individual line-items from the tax foot

methods of partitioning LPBTDs to provide addition

persistence that are relatively easy to implement

transactions that give rise to book-tax differences.

The Accounting Review A™"nt"ng

January 2012 V Аиос,*,,оп

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

102 Blaylock, Shevlin, and Wilson

"i

2 +

?

2 ¿

+ .¿(N

со

* w o *

o w .ОSО

-

с ^ . 00 0) 'Z2

Ь + i-

3 + i- 3

3 с

с ^о553<< .ь

0 «

<

X Xи

Р 0>и * -

^

~ 5 s 2 = i 3 z ^

22 OQ * "© CQ ^ 9 "Т -g

^ ^ Os * Ä <4 ?

O I ЧО (N ^ w -x- Q

Oí ^ oc Oí *

2 g li 5 С + s i £ Ь i

^ г- o rf i O VO сл

<u £ г- «S o S rf + i il s сл

s + a> °p. a j

"® ¿Г r- * Я ^ О S U

"R j§ ¿Г У ^ I "o

Ä£ r-

g ^.*

СЛ

"3

и

5

CJ

< "R

d - ££Г

§<u К" < ^ lOt-;

^.^OniOnOO

Il

cç

om

^ 1 оIrj Ä

g 8ö^

£

■fi

■fi~ ~^ X

r9 U

U cS * V

* I-S

I o. t

и

<

S V S3

0

o<r 2 ^ О о £ ^

cq fi v U S3 -n ?°

"л

с

a>

S îS^o

îS^o cq s * § v S3 II 1 -n t ?°

* X

Г*- iTj 1 I h- (N Ä r CL 71, - !

r CL II tn о1

E

QJ £

£g' Г*-

О м' iо^ 0^

iTj *

1 I-£

q h-

u (N ^ g

- 'S -Ок 71, - - u

U

и СQ /-С"

0 /-С" Г II

^ )^

^ ^Г4-) r-

^ ,

4-2£ чо * .S2

22 eö <u<u

£-г;

-г;

•-

С

ÇJ CQ

^ ^ +

Ö£cT+^ ' r-

cT, >->

I Я 0(N

P - eö

- ^žfe°^t

£

С

а й .s 11 -s Io --о

•5X* £ * <o % °QS* 0

.5 °

0 °ss I •-

§

#о

л С * * л ^ % у г-

E

U

С Я

Я ^ -fe

I X - -I Q

r-^ r-^

л *

X *

li И л ^ й ^ °Q S * So

ri с2 . ы

Св '' л ^' =ië

^ .-H +s

*C

и S Й iT)

2 . О ^iT)

2+u^ ,, k,

'Я II

s >TD ^ О

^ X ^ ¿2 SО?c

S *

*

®- t S ^ 2 ~* 2 §. Š§!C Ь

M т>

< V

н 2 g ^ " a./- s +"ř Já O

Cu

сл Ё S-i ^

S-i &; O

^ s r'

с»ь' O^ s<ич

'+ °2 .>'&

C3<ич_. n_ .c

a _; U r' +r^ ' ^ - Я ХЗОТЗВ-ХЗ _ n_

0J

CJ

jTT a С- О (N _; Q ■!-> С Я ^ (UcAťufc

С

о; fi

fi S3

S3+ ^

О f

PS' f►LÍ/j

►LÍ/j *Um

3t¡>^СС ^SO^'CUÜ

-v L,,^^

и

° O ^ SPr оиНхз ^ .т: 13 ^ ^

6

te «>

«> m u u

e drfO - 3 e Sř £SPr

fe ü-|S^^i 'S -o i - о

S

X

•S S Ï g ^ - 40 s E^ ««3

£ Э й o- 2 à й -o - - s I 'g. i a ^ J fc

S a ^ P ^ И i^ì ^ Î

1 И от ^ чо in fjO^ o'Sfl'i"0^^

О

PQ

о

1

o5o5 t I QQ

Q ¿* 11 11

S-S i UIUÌ

ccg--c=>

•• §ä Is

i s2 ^g§

iß ^ Is

„ řS»

3 têS^-i

^ „i řS»

i g sÖ-

I ^&«i

СУ

ex

í-

I ä i - Il ¿ t§ Ö- s^

Л

O Q ^^ "" О

О Ьч w w

pj q^)

О --<U

^ gоОс-0

оОс-0ooc

ooc- -^^-1

Q

CQX gu

fa + Q Ьч O О pj <U > Й

fi fi

QQ Q V

сЗ^цГ 9?'S

d тз a"°¿

=s ^ 'S ^ g j~

3^

1 fi S QQ V •§

И -JS^-O-: Им .ř1 „ SS^ uuEug-jOO

И 2 г- °7 2 11+°^ ® ï „ |".-2 ггЗЕс:»

ад + juS^+£^'c!'n .а»53! Sš^.lágl

02 ° ^«ll ®7 ^1**ё^ё§о»У-

СЛ nJ II сл§+ NÍ a.g|.giatás><l

nJ __ С NÍ ^ н^" с •- ^ С 'Р •- •- i2 V- Й -О

°1 __ -Š? С °J ^ S н^" ^ с •- 2^,1 ^ С 1

^ ^ й M 'S в -а « * ^ £ *8 в • a t I § ® I I 11 ft lü-

13 7 ^ ^ .3 § I ^2 * я .а § -1 *. i'S iSSJ^tCçj^

s" S « "S "g -д л *ü;5 ■CDQCQCQûîOtS

PLhs5 >cutì^ OhPLh >СиШЛ * < ft >g^Q,^Q,Q,t

Accounting The Accounting Review

V Assocla,lon January 2012

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

Tax Avoidance, Large Positive Temporary Book-Tax Differences, and Earnings Persistence 103

First Partitioning Approach of LPBTD Firms

We identify upward earnings management using discretionary accruals calculated from a cross-

sectional modified Jones model with lagged return-on-assets (Jones 1991; Kothari et al. 2005). We

classify firm-year observations as earnings management firm-years {EM) if the observation's

discretionary accruals are in the top quintile of all firms.13

We use the cash effective tax rate ( Cash5ETR ) developed by Dyreng et al. (2008) to identify tax

avoidance firms. The Cash5ETR is the ratio of the five-year sum of cash taxes paid to the five-year

sum of pretax financial accounting income. As discussed by Dyreng et al. (2008), this measure of tax

avoidance has several advantages over the traditional effective tax rate measures. First, the Cash5ETR

measure is not affected by the recording of contingencies for uncertain tax benefits. Regardless of

whether a firm recognizes the benefit associated with a tax-planning position in earnings, the reduced

cash tax payments that result from that position will be reflected in a lower Cash5ETR.]4 In addition,

if firms accelerate expenses or defer income for tax purposes, then this will be reflected in a lower

Cash5ETR , provided that those timing differences do not reverse within the five-year period over

which Cash5ETR is measured.15 We classify firms as tax avoiders (TAXAVOIDER) if they have a

five-year Cash5ETR in the lowest quintile within the pooled sample of all firms.16

There are 349 firm-year observations in our LPBTD group classified into both the

TAXAVOIDER and EM subsamples. These observations exhibit both high levels of discretionary

accruals and low Cash5ETRs .17 To maintain consistency with partitioning approach 2 below, we

13 We use a broad measure of earnings management because we are trying to determine the most likely source of a

firm's large positive book-tax difference regardless of the legality of the earnings manipulation. Both within

GAAP upward earnings management and fraudulent upward earnings management could lead to a large positive

temporary book-tax difference, so we attempt to capture both with our measure. We do not use measures that

capture the most aggressive earnings management, such as restatements or AAERs, because the sample would

likely be too small to conduct a meaningful analysis of persistence or equity pricing and because we are not

trying to capture management's intent in reporting large positive accruals. Furthermore, just meeting or beating

earnings benchmarks does not necessarily result in large positive book-tax differences.

14 Cash taxes paid represents the actual taxes paid by the firm during a given year, and as a result could include

estimated tax payments associated with the prior year's income or settlement payments to the 1RS associated

with past tax years. We expect that the effect of the timing of estimated tax payments will add only limited noise

to our measure of Cash5ETR , since we use a five-year measure. However, we acknowledge that the

appropriateness of the five-year Cash5ETR measure depends on the consistency of these timing issues from year

to year and that a five-year Cash5ETR is not an exact measure of a firm's tax avoidance activities in the current

year. When we use a three-year measure of Cash5ETR instead of a five-year measure, the results are unchanged.

1 5 We use a five-year Cash5ETR for this analysis because we believe it is the broadest measure in the literature of tax avoidance.

We are indifferent to the legality of the tax avoidance; we are simply trying to partition firms based on the most likely source of

the temporary book-tax difference. Measures designed to capture only the most aggressive forms of tax avoidance, such as

models of tax sheltering, are too narrow for this purpose. Additionally, tax avoidance measures based only on permanent

differences, such as the traditional ETR, by definition should not cause large positive temporary book-tax differences.

Finally, there is insufficient time-series data to perform meaningful persistence tests using uncertain tax benefits as defined

under FIN 48 as an alternative tax avoidance measure. These data are available for only two years, and the economic upheaval

in 2007 and 2008 likely makes any inferences based on uncertain tax benefits over this sample period less generalizable.

16 In supplemental tests (not tabulated) we categorize firms as TAXAVOIDER within the LPBTD group by year. The

results are consistent with those reported in Table 3 using this alternative classification.

17 The 349 firm-year observations categorized in both the TAXAVOIDER subsample and the EM subsample

represent 26.9 percent (349/1299) of firms in the TAXAVOIDER subsample (before we exclude the 349 EM

firm-year observations), or 32.2 percent (349/1084) of firms in the EM subsample. We would expect that, by

chance, 25.8 percent of the TAXAVOIDER subsample and 31.0 percent of the EM subsample would be

categorized in both subsamples. Neither of these differences is statistically significant at conventional levels.

Thus, it is notable that we do not observe a high correlation between tax avoidance and financial reporting

aggressiveness (as measured by the level of discretionary accruals). This result contrasts with that of Frank et al.

(2009), who find that aggressive financial reporting firms are more likely to also pursue aggressive tax reporting

strategies. However, our measure, Cash5ETR, is a broad measure of tax avoidance, whereas their measure,

adjusted permanent book-tax differences, tends more toward the tax aggressiveness end of the spectrum. Thus,

the results are not directly comparable.

The Accounting Review A«S¡nt"n9

January 2012 V Assoda,lon

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

104 Blaylock, Shevlin, and Wilson

exclude the 349 firm-years classified

subsample and treat them as EM observ

Our tests are joint tests of our pred

(discretionary accruals and CashSETR) to

the observation is in the LPBTD group.

income, which is affected by earning

Cash5ETR arises because of a higher (ma

firm did not pay cash taxes on these

Cash5ETR. Further, if Cash5ETR is really

persistence results should not differ bet

supplemental tests, we find that the TAX

component of earnings than the BASE g

cash flow as a scalar instead of preta

TAXAVOIDER using the partitioning va

only for tax avoidance, but also for other

accruals are more persistent than in othe

is aimed at identifying useful/available

exhibit different earnings persistence. T

Panel A of Table 3 presents statistic

TAXAVOIDER within the SBTD, LNBTD,

EM and TAXAVOIDER firms based on th

observations. Firms in the bottom 20

provided that they are also not in the E

accruals are classified as upward EM (+) f

accruals are classified as downward EM (-

the EM variable used in our analysis of L

of EM and TAXAVOIDER firms were random between each group (SBTD, LPBTD, and

LNBTD), then we would observe that 20 percent of the firms in each group would be categorized as

EM (+) firms, 20 percent as EM (- ) firms, and 16 percent as TAXAVOIDER firms (we would

expect 20 percent in the TAXAVOIDER subsample if we did not reclassify the overlapping

observations in EM and TAXAVOIDER subsamples into the EM subsample only). However, it is

notable that the results in Panel A indicate a significant difference in the number of EM and

TAXAVOIDER firms within each group. Specifically, we observe significantly more EM (+) firms

and TAXAVOIDER firms in the LPBTD group. This result is consistent with prior studies

suggesting that LPBTDs serve as a useful signal of upward earnings management and as a signal of

tax avoidance activities (Phillips et al. 2003; Badertscher et al. 2009; Wilson 2009; Lisowsky

2010). This result is also consistent with our maintained assumption that both earnings management

and tax avoidance activities can lead firms to end up in the LPBTD group.

Table 3 also provides descriptive statistics for the three subsamples of LPBTD firms. Median

BTDs (0.041, 0.048, and 0.051) are similar for the BASE, EM, and TAXAVOIDER groups,

respectively. The TAXAVOIDER subsample has lower median current-period pretax earnings and

18 Omitting these 349 firm-year observations altogether yields almost exactly the same results reported in Table 3.

Including these observations in both groups and adding an interaction EM X TAXAVOIDER (to separately

identify these observations) results in the same inferences for the EM and TAXAVOIDER subsamples as

reported in Table 3. The coefficient on the interaction term for both earnings and cash flows persistence is

positive and significant. The estimate for the interaction term for accruals persistence is positive but insignificant.

Including these observations in both groups with no interaction term results in the TAXAVOIDER accruals being

more persistent than the BASE group, with no change in the results for EM earnings and accruals persistence.

О îSôïnîTng

^7

The Accounting

Association T <-»

Review

/w>

V January T 2012 <-» /w>

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

Tax Avoidance, Large Positive Temporary Book-Tax Differences, and Earnings Persistence 105

TABLE 3

Descriptive Statistics for Selected Variables and Persistence of Earnings and Ear

Components within LPBTD Group

Partitioning Approach 1

Panel A: Proportions of Groups Classified as EM and TAXAVOIDER

SBTD LNBTD LPBTD

n 12,585 4,263 4,195

EM (+) 18.5%*** 18.6%** 26.0%***

EM (-) 17.0%*** 32.9%*** 15.9%***

TAXAVOIDER 14.2%*** 12.7%*** 22.6%***

A Chi-squared test rejects the equivalence of t

the LNBTD and SBTD groups at a less than 0

Panel B: BASE Subsample in Large P

Variable Mean Median Std. Dev. Minimum Maximum

BTDt 0.053 0.041 0.040 0.021 0.566

PTBIt+x 0.096 0.089 0.104 -0.290 0.431

PTBIt 0.127 0.108 0.083 0.004 0.467

PTCFt 0.175 0.105 0.098 -0.146 0.498

PTACCf -0.048 -0.042 0.057 -0.213 0.306

SAR,+ i -0.004 -0.060 0.609 -1.149 13.257

Avg. Assets, 2,732 391.4 10,198 4.640 207,861

Disc. Accf -0.018 0.008 0.044 -0.277 0.038

С ash5ETRt 0.379 0.350 0.143 0.232 1.000

Panel C: EM in Large Positive Book-Tax D

Variable Mean Median Std. Dev. Minimum Maximum

BTDt 0.067 0.048 0.063 0.021 0.742

PTBIt+i 0.073 0.078 0.128 -0.290 0.431

PTBlt 0.140 0.116 0.095 0.004 0.467

PTCFt 0.069 0.066 0.102 -0.146 0.498

/ТАСС, 0.071 0.047 0.094 -0.131 0.306

SAR,+ X -0.074 -0.127 0.619 -1.479 7.146

Avg. Assets, 1,743 283.8 6,218 7.215 151,790

Disc. Acc, 0.090 0.070 0.054 0.039 0.345

Cash5ETR, 0.312 0.334 0.184 0.001 1.000

Panel D: Tax Avoiders in Large Positive

Variable Mean Median Std. Dev. Minimum Maximum

BTD, 0.065 0.051 0.045 0.021 0.348

PTBI,+ l 0.091 0.083 0.103 -0.290 0.431

PTBI, 0.121 0.102 0.078 0.004 0.467

PTC F , 0.173 0.157 0.095 -0.066 0.498

PT ACC, -0.052 -0.047 0.060 -0.213 0.305

SAR,+ l 0.013 -0.048 0.556 -1.522 5.722

( continued on ne

The Accounting Review iSSÍntFng

January 2012 V A"~ta,,on

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

106 Blaylock, Shevlin, and Wilson

TABLE 3 (continued)

Variable Mean Median Std. Dev. Minimum Maximum

Avg. Assets, 2,583 524.0 9,194 5.260 167,813

Disc. Accf -0.015 -0.005 0.042 -0.271 0.039

Ccish5ETRt 0.126 0.132 0.070 0.000 0.232

Panel E: OLS Regressions of Future Pretax

Large Positive Book-Tax Difference Grou

PTBIf+l = 7o + Vi EMt + У 2 TAXA VOIDE

+ y5PTBlt X TAXAVOIDERf +

Pretax Earning

Persistence by G

Variables y0 7i У 2 Уз У 4 У 5 Adj. R2 BASE EM Tax Avoider

Predicted sign ? ? ? + - +

Estimate -0.001 0.008 0.004 0.759 -0.291 -0.035 0.275 0.759 0.468 0.724

t-statistic -0.12 0.69 0.48 21.39*** -2.91*** -0.55

Panel F: OLS Regressions of Future Pretax Earnings on Current

Components within the Large Positive Book-Tax Difference Gro

PTBI[+i = y0 + yxEMt + у 2 TAXA VOlDERt + y3PTCFt + y4PTCFt X

X TAXAVOIDERt + y6PTACCt + y7 PTACCt X EMt + y^PTACC

+ 1 •

Variables y» Vi У2 Уз У4 Ys Уб У7 У8 Adj. R2

Predicted sign ? ? ? + ? ? + - +

Estimate -0.006 0.010 0.009 0.759 -0.062 -0.026 0.659 -0.366 0.095 0.312

t-statistic -1.09 1.16 1.53 23.57*** -0.96 -0.55 14.62*** -3.90*** 1.04

Panel G: Persistence of Earnings Components by Group

BASE EM TAX AVOIDER

PTCF PTACC PTCF PTACC PTCF PTACC

0.759 0.659 0.697 0.293 0.733 0.754

*, **, *** Indicates significance at th

All variables except for indicator var

PTBIf, PTCF „ and PTACC, are winsori

is made, two-sided otherwise. Standar

Variable Definitions:

Partitioning Approach 1:

EM, - indicator variable equal to 1 for firm-year observations within the LPBTD group and with modified Jones Model

discretionary accruals in the top quintile of all firm-years in the sample;

TAX AVOIDER, = indicator variable equal to 1 for firm-year observations within the LPBTD group and with a five-year

cash effective tax rate (see Dyreng et al. 2008) in the lowest quintile of all firm-years in the sample and not part of

the EM subsample;

PTBI,+ 1 = pretax book income (Compustat item 170) one-year ahead divided by Avg. Assets,;

PTB I, = pretax book income for the current year divided by Avg. Assets,;

PTCF, = pretax cash from operations for the current year calculated as Compustat items 308 + 317- 1 24 divided by A vg.

Assets,;

(continued on next page)

Accounting The Accounting Review

V Ass°d"ten January 2012

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

Tax Avoidance, Large Positive Temporary Book-Tax Differences, and Earnings Persistence 107

TABLE 3 (continued)

PTACCf = pretax accruals for the current year calculated as PTBI - PTCF divided by Avg. Assets

BTDt = book-tax differences estimated as [(U.S. Deferred Tax -I- Foreign Deferred Tax)/0.35]/Average Total Assets;

SA/?,+i = size-adjusted return calculated as the buy-and-hold return on the security (including dividends) beginning at the

start of the fourth month after fiscal year-end (e.g., April 1 for a December 31 fiscal year-end firm) and ending at the

end of the third month the following year (e.g., March 31) less the buy-and-hold return on a size-matched portfolio

over the same period;

Avg. Assets t = Assets t_ ' (Compustat item 6) plus Assets t divided by 2;

Disc. Acct - modified Jones Model discretionary accruals by two-digit SIC industry; and

Cash5ETRt = sum of cash taxes paid over the previous five years divided by the sum of PTBI over the previous five years

(or three years if five years of data are unavailable); Cash5ETRs greater than 1 are reset to 1 .

lower median pretax accruals, but higher median pretax cash flows, than the EM firms. The

TAX A VOIDER firms also have higher median average total assets and higher median size-adjusted

returns in period t- hi than the EM firms. Not surprisingly, the EM firms exhibit higher median

discretionary accruals and higher Cash5ETRs than the TAXAVOIDER firms.

We also note that pretax cash from operations scaled by average assets is less than half as large

for the EM subsample as for the other two subsamples (0.069 versus 0.173 and 0.175). This result is

consistent with prior studies that document a strong negative correlation between cash flows and

accruals (e.g., Dechow 1994; Sloan 1996; Xie 2001). Dechow (1994) notes that accruals are

intended to reduce timing and matching problems and could be used to smooth temporary

fluctuations in cash flows. The result is a strong negative correlation between accruals and cash

flows. We further note that the mean and median discretionary accruals are close to zero for both the

BASE and TAXAVOIDER subsamples, suggesting that there is no more earnings management in

the BASE subsample than in the TAXAVOIDER subsample, which might lead to no difference in

the persistence of accruals between these two subsamples (H2b). Significance tests of differences in

the descriptive statistics in Table 3 are not provided because these data are intended as purely

descriptive.

Table 3 also presents the regression results under partition approach 1. Panel E of Table 3

reports the results of estimating Equation (7). The results indicate that firm-years designated as

upward earnings managers (EM) exhibit significantly lower earnings persistence than the BASE

subsample of the LPBTD firms: y4 is significantly negative at the (p < 0.01) level. This finding is

consistent with H2a and suggests that, when large book-tax differences result primarily from

upward earnings management, they are a particularly useful signal of low earnings persistence. For

firm-years in the TAXAVOIDER subsample, inconsistent with H3a, y5 is negative but is not

significant at conventional levels.

Panels F and G of Table 3 reports the results of estimating Equation (8). Consistent with H2b,

the results indicate that the pretax accruals component of earnings exhibits significantly lower

persistence for future earnings for the firm-years designated as EM than for the BASE subsample of

LPBTD firms. This finding suggests that, in the cases for which LPBTDs are largely a function of

upward earnings management, they serve as a useful signal of subjectivity in the accruals process

and therefore of lower quality earnings. While the results in Panel E also show that the accruals

component of earnings for the TAXAVOIDER subsample is more persistent than for the BASE

subsample, the difference is not significant. We do not make a prediction about the persistence of

cash flows between subsamples of LPBTD firms. The results in Panels F and G indicate that the

persistence of cash flows is not significantly different for the EM and TAXAVOIDER firms than for

the BASE subsample firms. Panel G of Table 3 sums the coefficients reported in Panel F to provide

a direct estimate of the persistence of cash flows and accruals for each subsample within the

LPBTD group. As expected, the persistence of accruals is highest for the TAXAVOIDER firms

The Accounting Review ^£5 а^п«Гп9

January 2012 V Assoc,a,,on

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

108 Blaylock , Shevlin, and Wilson

(although as noted, the difference is not

while the EM firms exhibit the lowest pe

find the differences in the persistenc

TAXAVOIDER subsamples are significan

that concerns that the Cash5ETR mea

largely picking up the effects of earnings

Second Partitioning of LPBTD Firms

In our second partitioning of LPBTD firm

the LPBTD group in both the current an

LPBTD group in the current but not prev

we need to eliminate the first year of s

sample. We next exclude and separately c

managers (from approach 1) from both

to label these earnings managers as EM fi

forms the BASE subsample in this partiti

MULTIPLE subsample, we argue that the r

exhibiting large positive BTDs due to eithe

We make this prediction because tax avoid

because firm characteristics are unlikely

Panels A through С of Table 4 present d

second partitioning approach. We find t

MULTIPLE subsample and 25.9 percent

descriptive statistics subs across the three

flows and higher discretionary accruals t

these firms managing earnings when pre

have lower Cash5ETRs than firms in the

a more likely source of large positive BT

difference in the level of discretionary

difference in Cash5ETRs between the BA

Table 4 also presents the regression res

TAXAVOIDER label with the MULTIPLE l

partitioning approaches 1 and 2). The resu

of upward earnings managers (EM) exhibi

years of the LPBTD firms in the BASE s

that firm-years designated as MULTIP

subsample of firms, significant at p < 0.

the results of estimating Equation (8) test

subsamples. Consistent with H2b, the EM

the BASE firms. Consistent with H3b, th

accruals persistence than the BASE firm

persistence of cash flows across the th

partitioning are consistent with those repo

19 We pool all observations in the MULTIPLE su

exhibit the same persistence of earnings and ac

years. We validate this assumption by testing

subsample for two years compared to firms in t

accruals is not significantly different between

VHl Accounting The Accounting Review

V January 2012

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

Tax Avoidance, Large Positive Temporary Book-Tax Differences, and Earnings Persistence 109

TABLE 4

Descriptive Statistics for Selected Variables and Persistence of Earnings and Ear

Components within LPBTD Group

Partitioning Approach 2

Panel A: BASE Subsample (n = 1,799)

Variable Mean Median Std. Dev. Minimum Maximum

BTDt 0.055 0.043 0.044 0.021 0.566

PTBIt+x 0.097 0.088 0.110 -0.290 0.431

PTBIt 0.128 0.107 0.086 0.004 0.467

PTCFt 0.175 0.158 0.102 -0.128 0.498

PTACCf -0.047 -0.042 0.086 -0.213 0.306

SARt+] 0.007 -0.042 0.584 -1.489 5.946

Avg. Assets t 2,572 379.0 9,560 4.640 207,861

Disc. Acct -0.019 -0.009 0.045 -0.273 0.039

Cash5ETRt 0.327 0.350 0.172 0.000 1.000

Panel B: EM Subsample (n = 987)

Variable Mean Median Std. Dev. Minimum Maximum

BTDt 0.068 0.049 0.065 0.021 0.742

PTBIt+l 0.072 0.079 0.129 -0.290 0.431

PTBIf 0.140 0.117 0.095 0.004 0.467

PTCFf 0.070 0.069 0.102 -0.146 0.498

PTACCt 0.070 0.047 0.092 -0.131 0.306

SARt+i -0.073 -0.130 0.638 -1.479 7.146

Avg. Assets, 1,853 296.4 6,493 8.698 151,791

Disc. Acct 0.089 0.070 0.054 0.039 0.344

Cash5ETRt 0.310 0.331 0.184 0.000 1.000

Panel C: MULTIPLE Subsample (n = 1,027)

Variable Mean Median Std. Dev. Minimum Maximum

BTDt 0.059 0.047 0.039 0.021 0.430

PTBIt+i 0.089 0.086 0.196 -0.290 0.431

PTBIt 0.122 0.106 0.073 0.004 0.467

PTCFt 0.176 0.161 0.091 -0.066 0.498

PTACCt -0.053 -0.048 0.055 -0.213 0.215

SARt+l -0.008 -0.067 0.658 -1.522 13.25

Avg. Assets, 3,231 591.5 11,391 10.51 167,813

Disc. Acc, -0.013 -0.005 0.039 -0.240 0.039

Cash5ETRt 0.252 0.250 0.165 0.000 1.000

( continued on ne

The Accounting Review Amounting

January 2012 V А"~1а,,оп

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

1 10 Blaylock, Shevlin, and Wilson

TABLE 4 (continued)

Panel D: OLS Regressions of Future Pretax Earnings on Current Pretax Earnings;

Partitions Based on Discretionary Accruals and Number of Consecutive Years in LPBTD

Group (n = 3,813)

PTBIt+ 1 = y0 + yxEMt + y2MULTIPLEt + y^PTBIt + y4PTBIt X EMt + y5PTBI, X MULTIPLEt

I

't+ Pretax Earnings

Persistence by

Variables y0 7i У 2 Уз У 4 У 5 Adj. R2 BASE EM MULTIPLE

Predicted sign ? ? ? + - +

Estimate 0.004 0.004 -0.016 0.727 -0.271 0.099 0.273 0.727 0.456 0.826

t-statistic 0.94 0.38 -2.10* 18.83*** -2.61** 1.72*

Panel E: OLS Regressions of Future Pretax Earnings on Current

Components; Partitions Based on Number of Consecutive Years

PTBIt+ 1 = y0 + y , EMt + y2 MULTIPLEt + y3PTCFt + yAPTCFt*EM

+ y6PTACCt + ynPTACCt X EMt + y%PTACCt X MULTIPLEt

Variables

Predicted sign ? ? ? + ? ? + - +

Estimate -0.004 0.009 -0.003 0.735 -0.053 0.088 0.590 -0.305 0.327 0.309

t-statistic -1.08 0.97 -0.34 21.10*** -0.92 1.58 10.25*** -2.82*** 3.88***

Panel F : Persistence of Earnings Components by Group

BASE EM MULTIPLE

PTCF PTACC PTCF PTACC PTCF PTACC

0.735 0.590 0.682 0.285 0.823 0.917

*, **, *** Indicates significance at th

All variables except for indicator var

PTBI,, PTCF „ and PTACC, are winsori

is made, two-sided otherwise. Standa

Variable Definitions:

Partitioning Approach 2:

Base , = firms in the LPBTD group in year t that were not in the LPBTD group in the prior year t- 1 and are not part of the

EM subsample;

EM, - indicator variable equal to 1 for firm-year observations with modified Jones Model discretionary accruals in the

top quintile of all firm-years in the sample;

Multiplet = indicator variable equal to 1 for firm-year observations within the LPBTD group in year t that were in the

LPBTD sample in the prior year t- 1 and are not part of the EM subsample;

PTBIt+i = pretax book income (Compustat item 170) one-year ahead divided by Avg. Assets,;

PTB I, = pretax book income for the current year divided by Avg. Assets,;

PTCF, = pretax cash from operations for the current year calculated as Compustat items 308 + 317- 124 divided by Avg.

Assets ,;

PTACC, = pretax accruals for the current year calculated as PTBI - PTCF divided by Avg. Assets,;

BTD, = book-tax differences estimated as [(U.S. Deferred Tax + Foreign Deferred Tax)/0.35]/Average Total Assets;

SAR,+ 1 = size-adjusted return calculated as the buy-and-hold return on the security (including dividends) beginning at the

start of the fourth month after fiscal year-end (e.g., April 1 for a December 3 1 fiscal year-end firm) and ending at the

end of the third month the following year (e.g., March 31) less the buy-and-hold return on a size-matched portfolio

over the same period;

Avg. Assets, = Assets i (Compustat item 6) plus Assets, divided by 2;

Disc. Act, = modified Jones Model discretionary accruals by two-digit SIC industry; and

Cash5ETR, = sum of cash taxes paid over the previous five years divided by the sum of PTBI over the previous five years

(or three years if five years of data are unavailable); Cash5ETRs greater than 1 are reset to 1 .

Accounting The Accounting Review

V A,socla,,on January 2012

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

Tax Avoidance, Large Positive Temporary Book-Tax Differences, and Earnings Persistence 1 1 1

MULTIPLE subsample exhibits significantly higher earnings and accruals persistence than the

BASE subsample in partitioning approach 2, but TAXAVOIDERs in approach 1 do not.

V. MARKET PRICING TESTS

Do Investors Use BTDs and Their Source in Pricing Current Earnings?

We first examine whether investors appear to recognize and utilize the dif

persistence in earnings and accruals (as documented in Tables 3 and 4) in the current

of earnings and accruals. To conduct this analysis, we allow the earnings response coe

Equation (9) below to vary across subsamples:

RETt = ô0 + ái Д PTBIt + e,+ i . (9)

Kormendi and Lipe (1986) and Collins and Kotha

response coefficient is positively associated with

(H4b) that the earnings (accruals) response coeffic

LPBTD group that are classified as earnings manag

estimate the following two equations:

RETt = ¿o + <5 1 APTBIt 4- Ô2A PTBIt X EMt

RET, = ôo + ô'APTCFt -h ö2APTACCt + ô3APT

+ ô5APTCFt X TAXAVOIDERt + ô6APT

The results of estimating Equation (10) are repo

expectations, we find a negative and significan

This result is consistent with the earnings respon

variation in earnings persistence for the EM

interaction term is not significant. Next, we e

estimating Equation (11) with results reported

find that the accruals response coefficient is sign

TAXAVOIDER firms, than for the BASE group. The insignificant results on the

TAXAVOIDER interaction term in both panels are consistent with the earlier persistence

results: these firms did not exhibit significantly different earnings and accruals persistence

relative to the BASE group in Table 3.

In Panel A of Table 6 we test whether the earnings response coefficient varies across

subsamples using our second partitioning approach. Recall from Table 4 that the EM firms

exhibit significantly lower earnings and accruals persistence than the BASE firms, and the

MULTIPLE firms exhibit significantly higher earnings and accruals persistence than the BASE

firms. Consistent with investors incorporating this variation in persistence between subgroups

into their pricing, the earnings response coefficient is significantly higher for the MULTIPLE

firms than for the BASE firms. Also consistent with expectations, we find that the earnings

response coefficient is significantly lower for the EM firms than for the BASE group firms.

Finally, in Panel В of Table 6 we examine the accruals response coefficients on the subgroups

using our second partitioning. The results in Panel В are also consistent with investors

recognizing the differences in the persistence of accruals between subgroups and pricing

accruals accordingly. Overall, the results in Tables 5 and 6 are consistent with investors

incorporating variation in persistence across the subsamples (as documented in Tables 3 and 4)

in the current pricing of earnings and accruals.

The Accounting Review ^ i¡E£SS*

January 2012 V Амос|а,|оп

This content downloaded from

151.50.30.85 on Sun, 03 Oct 2021 14:18:59 UTC

All use subject to https://about.jstor.org/terms

1 12 В lay lock, Shevlin, and Wilson

TABLE 5

Earnings Response Coefficient Tests

Partitioning Approach 1

Panel A: OLS Regressions of Current Size-Adjusted Returns on Current Pretax E

Changes within the Large Positive Book-Tax Difference Group (n = 3,243)

RETt = ô0 + ¿i A PTBIt + ¿2 A PTBIt X EMt + 0ЪА PTBIt X TAXAVOIDERt + et+i .

Variables A0 <5i ô2 ô3 Adj. R2

Predicted sign ? + - +

Estimate -0.015 0.884 -0.376 -0.203 0.043

t-statistic -0.54 732*** -4.08*** -0.81

Panel B: OLS Regressions of Current S

Components Changes within the Larg

RETt = ¿o + S'APTCFt + ö2A PTACCt

+ ô5APTCFt X TAXAVOIDERt + ô6A

Variables <50 <5i S2 S3 ô4 S5 S6 Adj. R2

Predicted sign ? -f + ? - ? +

Estimate -0.016 0.967 0.779 -0.331 -0.282 -0.268 -0.191 0.045

t-statistic -0.59 6.39*** 7.54*** -2.58** -2.36** -1.02 -0.63

* ** *** indicates significance at the 10 percent, 5 percent, and 1 percen

For the above test we restrict the sample to firms with greater than $10 mi

all firm-year observations in the top or bottom 1 percent of earnings, cas

Partitioning Approach 1 : EM, = indicator variable equal to 1 for firm-yea

with modified Jones Model discretionary accruals in the top quintile of a

= indicator variable equal to 1 for firm-year observations within the

effective tax rate (see Dyreng et al. 2008) in the lowest quintile of all fir

EM group.

t-tests are one-sided if a directional prediction is made, two-sided otherwise. Standard errors are clustered by year.

Variable Definitions:

RET, = size-adjusted buy and hold returns for the 12-month period beginning in the fourth month after the fiscal year-end

of year t-' and ending in the third month following the year-end of fiscal year /;

PTBIt - pretax book income for the current year divided by beginning of the year price;

PTCF, = pretax cash from operations for the current year calculated as Compustat items 308 + 317 - 124 divided by

beginning of the year price; and

PTACC, = pretax accruals for the current year calculated as PTBI - PTCF divided by beginning of the year price.

Hedge Portfolio Tests

Table 7 presents the results of our market pricing tests using hedge portfolio returns. These

tests allow us to examine whether investors correctly infer the persistence of accruals for each