Professional Documents

Culture Documents

10 Manish PDF

10 Manish PDF

Uploaded by

Shashwat mishra0 ratings0% found this document useful (0 votes)

23 views2 pagesOriginal Title

10 MANISH.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views2 pages10 Manish PDF

10 Manish PDF

Uploaded by

Shashwat mishraCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

Form for furnishing particulars of income under secti

March, 2023

FORM NO. 10E

[See rule 214A]

192(2A) for the year ending 31st

for claiming relief under section 89(1) by a Government servant or an

employee in a company, co-operative society, local authority, university, institution, association

1 Name and address of the employee

2 Permanent account number

3 Residential status

or body

MANISH KUMAR PANDEY

DMZPPRTSR

RESIDENT

Pariculars of come referred ton ale 214 ofthe Income tax Rules, 1962, during the previous year relevant fo assessment

year 2023-24

1 (@) Salary received in arrears or in advance in accordance with the Rs. 148963

provisions of sub-rule (2) of rule 214, —_—s§$_———

(©) Payment inthe nature of gratuity i

spect of past services, extending 0

over a petiod of not less than S years in accordance with the

provisions of sub-rule (3) of rule 214,

(©) Payment in the nature of compensation from the employer or former 0

employer at or in connection with termination of employment after

continuous service of not less than 3 years or where the unexpired

portion of term of

employment is also not less than 3. years in

accordance with the provisions of sub-rule (4) of rule 21

2. Detailed particulars of payments referred to above may be given in Annexure 1

Annexure I I, IIA, II or TV, a8 the case may be

|, MANISH KUMAR PAN

Signature ofthe employee

Verification

do hereby declare that wha is stated above is true othe best

of my knowledge andbelieh

Verified oday,the 08/02/2023

Place MUSAF

KIIANA,

Date TROBE

‘ay of Wednesday

Signature ofthe employee

‘Source: www taxguru.in

ANNEXURE 1

[See item 2 of Form No, 108}

ARREARS OR ADVANCE SALARY

1. Total income (excluding salary received in arrears or advance) 635922

2 Salary received in areas or advance 148963

3 Total income (as increased by selary received in arrears or Teas

advance) [Ada item 1 and item 2] —_—_

4 Tax on total income (as per item 3) 41488

Tax om total income (as per item 1) Oo

Tax on salary received in arrears or advance [Difference of item 4 oo

and item 5] TTT

7 ‘Tax computed in accordance with Table “A” (Brought from column 7 of °

Table"

8 Relief under section 89(1) [Indicate the diference between the amounts 41488

mentioned aginst items 6 nd 7]

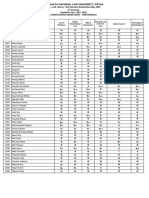

TABLE "A"

[See item 7 of Annexure T]

Fava Taal | Salayrecined | Tor come rar Taxon Taran Difereee ar

year) | tmcomeoy | smareasor | tread hysaiay | saat icome | att imcome | (Amountunder

the relevent dvonce received i rears or aspen tasrer | column (5) minus

previous — | relating tthe trance) ofthe cotonnra | comnts) | amount under

year | relevantprevious | relevant previous ear colin (3)

esoned cola) (Ald

scott) — | columns 2) and ())

Rs) (he) (Re (Re ae a

T 2 3 4 5 @ 7

[a020-21 Wise THR965| pia 7 7

Note: In this Table, deals of salary received in arrears or advance rel

tng to different previous years

smay be furnished.

‘Source: www taxguru.in

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Evaluating The Impact of The UN Convention On The Use of ElectronDocument19 pagesEvaluating The Impact of The UN Convention On The Use of ElectronShashwat mishraNo ratings yet

- ContentDocument16 pagesContentShashwat mishraNo ratings yet

- 4th Semester Final Result May 2022Document31 pages4th Semester Final Result May 2022Shashwat mishraNo ratings yet

- Economic and Political Weekly Economic and Political WeeklyDocument5 pagesEconomic and Political Weekly Economic and Political WeeklyShashwat mishraNo ratings yet

- State Quota.: Optional Fee Hostel & Mess FeeDocument33 pagesState Quota.: Optional Fee Hostel & Mess FeeShashwat mishraNo ratings yet

- Transfer Funds Transaction DetailsDocument1 pageTransfer Funds Transaction DetailsShashwat mishraNo ratings yet

- Supreme Court of India Page 1 of 3Document3 pagesSupreme Court of India Page 1 of 3Shashwat mishraNo ratings yet

- Evidence Rough DraftDocument4 pagesEvidence Rough DraftShashwat mishraNo ratings yet

- INDIAN DRUGS AND PHARMACEUTICALS LTD vs. AMBIKA ENDocument6 pagesINDIAN DRUGS AND PHARMACEUTICALS LTD vs. AMBIKA ENShashwat mishraNo ratings yet

- KONDA ASHOK vs. STATE OF A.P.Document4 pagesKONDA ASHOK vs. STATE OF A.P.Shashwat mishraNo ratings yet

- GLR2P12Document11 pagesGLR2P12Shashwat mishraNo ratings yet

- 4fa9 PDFDocument12 pages4fa9 PDFShashwat mishraNo ratings yet