Professional Documents

Culture Documents

Lecture 05 Partnership Dissolution Admission

Lecture 05 Partnership Dissolution Admission

Uploaded by

Angel Cortez0 ratings0% found this document useful (0 votes)

34 views1 pageMiranda is being admitted as a new partner to Lavander Company. The document provides the capital balances of the original partners and lays out four scenarios for Miranda's admission, including purchasing a portion of an existing partner's interest or investing cash for a given percentage interest, with bonuses potentially being distributed to original partners. The reader is asked to prepare journal entries to record Miranda's admission under each of the given conditions.

Original Description:

Original Title

Lecture 05 Partnership Dissolution Admission.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMiranda is being admitted as a new partner to Lavander Company. The document provides the capital balances of the original partners and lays out four scenarios for Miranda's admission, including purchasing a portion of an existing partner's interest or investing cash for a given percentage interest, with bonuses potentially being distributed to original partners. The reader is asked to prepare journal entries to record Miranda's admission under each of the given conditions.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views1 pageLecture 05 Partnership Dissolution Admission

Lecture 05 Partnership Dissolution Admission

Uploaded by

Angel CortezMiranda is being admitted as a new partner to Lavander Company. The document provides the capital balances of the original partners and lays out four scenarios for Miranda's admission, including purchasing a portion of an existing partner's interest or investing cash for a given percentage interest, with bonuses potentially being distributed to original partners. The reader is asked to prepare journal entries to record Miranda's admission under each of the given conditions.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Sir Win – Accounting Lectures

Jokes Tagalog

Stories Legit Professor

Life Lessons

-----------------------------------------------------------------------------------------

---------------------

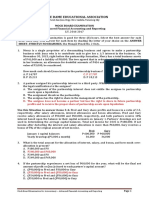

Lecture 05: Partnership Dissolution – Admission

-----------------------------------------------------------------------------------------

---------------------

Diala, Austria, and Tamayo are partners in Lavander Company. Their

capital balances as at July 31, 2021, are as follows:

Diala, Capital Austria, Capital Tamayo, Capital

450,000 150,000 300,000

Each partner has agreed to admit Miranda to the partnership.

Required:

Prepare the entries to record Miranda’s admission to the partnership under

each of the following conditions:

a. Miranda paid Diala P125,000 for 20% of Diala’s interest in the

partnership.

b. Miranda invested P200,000 cash in the partnership and received an

interest equal to her investment.

c. Miranda invested P300,000 cash in the partnership for 20% interest in

the business. A bonus is to be recorded for the original partners on the

basis of their capital balances.

d. Miranda invested P300,000 cash in the partnership for 40% interest in

the business. The original partners gave Miranda a bonus according to

the ratio of their capital balances on July 31, 2021.

You might also like

- Partnership Formation ActivityDocument8 pagesPartnership Formation ActivityShaira UntalanNo ratings yet

- Tax ReviewerDocument22 pagesTax ReviewercrestagNo ratings yet

- Question 1Document15 pagesQuestion 1Cale HenituseNo ratings yet

- BAC 522 Mid Term ExamDocument9 pagesBAC 522 Mid Term ExamJohn Carlo Cruz0% (1)

- Partnership Dissolution - Practice ExercisesDocument5 pagesPartnership Dissolution - Practice ExercisesVon Andrei Medina0% (2)

- 11 Lecture 05 Partnership Dissolution AdmissionDocument1 page11 Lecture 05 Partnership Dissolution AdmissionNathalie GetinoNo ratings yet

- Lecture 05 Partnership Dissolution Admission by Investment of AssetsDocument1 pageLecture 05 Partnership Dissolution Admission by Investment of AssetsAngel CortezNo ratings yet

- 12 Lec 05 Partnership Dissolution Admission by InvDocument1 page12 Lec 05 Partnership Dissolution Admission by InvNathalie GetinoNo ratings yet

- Lecture 05 Partnership Dissolution IncorporationDocument1 pageLecture 05 Partnership Dissolution IncorporationAngel CortezNo ratings yet

- Mid Term Exam Oct 2016 With SolDocument11 pagesMid Term Exam Oct 2016 With Solsunflower33% (3)

- Afar 1 Sw3 Mle01 PDF FreeDocument9 pagesAfar 1 Sw3 Mle01 PDF FreeBrian TorresNo ratings yet

- Quiz AccountingDocument11 pagesQuiz Accountingsino ako100% (1)

- MOCK BOARD May 222 Test Questions AFAR SCDocument16 pagesMOCK BOARD May 222 Test Questions AFAR SCKial PachecoNo ratings yet

- Lecture 05 Partnership Dissolution WithdrawalDocument1 pageLecture 05 Partnership Dissolution WithdrawalAngel CortezNo ratings yet

- Advacc Quiz On PartnershipDocument10 pagesAdvacc Quiz On PartnershipLenie Lyn Pasion TorresNo ratings yet

- ACTPACO - Lesson 3 (Revised)Document52 pagesACTPACO - Lesson 3 (Revised)Harry KingNo ratings yet

- BSA 23C-AFAR ReviewerDocument102 pagesBSA 23C-AFAR ReviewerKlint HandsellNo ratings yet

- P2 MaterialsDocument9 pagesP2 MaterialsmarygraceomacNo ratings yet

- Acctg 12 Final ExaminationDocument3 pagesAcctg 12 Final ExaminationMichael John DayondonNo ratings yet

- Chapter 2: Corporations: Introduction and Operating RulesDocument22 pagesChapter 2: Corporations: Introduction and Operating RulesAvneet KaurNo ratings yet

- Review Questions 4Document5 pagesReview Questions 4John Joseph Addo0% (1)

- The Partnership OperationDocument24 pagesThe Partnership OperationMarieCuNo ratings yet

- Lecture 05 Partnership Dissolution AdmissionDocument1 pageLecture 05 Partnership Dissolution AdmissionTanNo ratings yet

- Quiz On Partnership DissolutionDocument4 pagesQuiz On Partnership Dissolution이삐야No ratings yet

- AFAR Quiz 1 (B44)Document12 pagesAFAR Quiz 1 (B44)James RelletaNo ratings yet

- Reviewer 1 Fundamentals of Accounting 2 PDFDocument13 pagesReviewer 1 Fundamentals of Accounting 2 PDFelminvaldez80% (5)

- Module 2 - Partnership OperationsDocument33 pagesModule 2 - Partnership OperationsMaluDyNo ratings yet

- Quiz 2 KeyDocument5 pagesQuiz 2 KeyRosie PosieNo ratings yet

- Exercises - Partnership CombinepdfDocument8 pagesExercises - Partnership CombinepdfRiana CellsNo ratings yet

- Problem On AdmissionDocument2 pagesProblem On AdmissionSam Rae LimNo ratings yet

- 12 Accountancy Accounting For Partnership Firms FundamentalsDocument6 pages12 Accountancy Accounting For Partnership Firms FundamentalsIqra MughalNo ratings yet

- Partnership DissolutionDocument3 pagesPartnership DissolutionRoselyn Balik100% (1)

- Par CorDocument15 pagesPar CorKim Nayve57% (7)

- Partnership Operations (Additional Sample Problems)Document5 pagesPartnership Operations (Additional Sample Problems)Pauline Anne LopezNo ratings yet

- Drill 11272019Document1 pageDrill 11272019Mike MikeNo ratings yet

- ACCTBA2 ReviewerDocument49 pagesACCTBA2 ReviewerBiean Abao100% (2)

- 12 Accountancy Accounting For Partnership Firms Fundamentals Impq 3Document5 pages12 Accountancy Accounting For Partnership Firms Fundamentals Impq 3Adam ZakriNo ratings yet

- 139slides15 Jeter4eDocument56 pages139slides15 Jeter4enur kamiliaNo ratings yet

- PARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalDocument4 pagesPARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalErica AbegoniaNo ratings yet

- Accountancy Philippines Daily Review For Afar June 04 2020: Q1. AverageDocument7 pagesAccountancy Philippines Daily Review For Afar June 04 2020: Q1. Averagechris layNo ratings yet

- Assignment03 PDFDocument2 pagesAssignment03 PDFAilene MendozaNo ratings yet

- Chapter 18 TestbankDocument8 pagesChapter 18 TestbankBea GarciaNo ratings yet

- Partnership - ExercicesDocument7 pagesPartnership - ExercicesNurul SharizaNo ratings yet

- Notre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong CityDocument15 pagesNotre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong Cityirishjade100% (1)

- PUNZALANDocument16 pagesPUNZALANAngelique Kate Tanding DuguiangNo ratings yet

- ExamDocument3 pagesExamshaylieeeNo ratings yet

- Partnership Operations Lecture NotesDocument12 pagesPartnership Operations Lecture NotesRuby GoNo ratings yet

- SATURDAYDocument20 pagesSATURDAYkristine bandaviaNo ratings yet

- ParcOR ReveiwerDocument23 pagesParcOR ReveiwerMon Christian VasquezNo ratings yet

- Partnership Co Owenership Joint Venture and Fringe Benefits PDFDocument9 pagesPartnership Co Owenership Joint Venture and Fringe Benefits PDFangelo vasquezNo ratings yet

- Partnership Operation: By: Cymon P. Argawanon, CPADocument28 pagesPartnership Operation: By: Cymon P. Argawanon, CPALykaArcheNo ratings yet

- Partnership HCC CttoDocument7 pagesPartnership HCC CttoKenncy100% (1)

- PROBLEMS - Partnership DissolutionDocument4 pagesPROBLEMS - Partnership DissolutionA. MagnoNo ratings yet

- Advanced Financial Accounting and Reporting Accounting For PartnershipDocument6 pagesAdvanced Financial Accounting and Reporting Accounting For PartnershipMaria BeatriceNo ratings yet

- q2 Advacc1 PDF FreeDocument3 pagesq2 Advacc1 PDF FreeBea GarciaNo ratings yet

- Final Exam-Actg102 Summer 2019-2020Document11 pagesFinal Exam-Actg102 Summer 2019-2020Amor0% (1)

- Chapter 4 Graded Problems-1Document3 pagesChapter 4 Graded Problems-1almacen chrisNo ratings yet

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineFrom EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineNo ratings yet

- Lecture 05 Partnership Dissolution IncorporationDocument1 pageLecture 05 Partnership Dissolution IncorporationAngel CortezNo ratings yet

- Lecture 05 Partnership Dissolution Admission by Investment of AssetsDocument1 pageLecture 05 Partnership Dissolution Admission by Investment of AssetsAngel CortezNo ratings yet

- Lecture 05 Partnership Dissolution WithdrawalDocument1 pageLecture 05 Partnership Dissolution WithdrawalAngel CortezNo ratings yet

- Module 3 - Partnership Dissolution PDFDocument42 pagesModule 3 - Partnership Dissolution PDFAngel CortezNo ratings yet