Professional Documents

Culture Documents

FAQ Pension - 23 PDF

FAQ Pension - 23 PDF

Uploaded by

rahul ram0 ratings0% found this document useful (0 votes)

29 views9 pagesOriginal Title

FAQ Pension_23.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

29 views9 pagesFAQ Pension - 23 PDF

FAQ Pension - 23 PDF

Uploaded by

rahul ramCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 9

FAQ ON THE FCI - DEFINED CONTRIBUTION PENSION SCHE!

Query 1: Date of implementation of the scheme

Reply: The Pension Scheme shall be effective from 04-12-2008.

Query 2: Coverage & eligibility of the scheme,

Reply: The scheme covers all Category |, Il, Ill & IV Employees on regular rolls of the

Corporation as on the effective date ie. 01-12-2008 and those joining subsequent

thereto subject to their eligibility as follows:-

a. All Category |, II, Ill & IV Employees on regular rolls of the Corporation as

on the effective date i.e. on 01-12-2008, shall be admitted to the benefits

of the Scheme as per the provisions of the Pension Scheme, provided that

their continuous service in the regular scale of pay on the effective date

plus continuous service to be rendered thereafter till the normal date of

their superannuation is not less than 15 years,

b. All employees except trainees and adhoc / contractual employees, joining

the Corporation on regular rolls on or after the effective date i.e.

01-12-2008 shall become members of the Scheme from the date of joining

the Corporation, provided that their continuous service in the regular scale

of pay from the date of joining the Corporation till the date of their

superannuation is expected to be not less than 15 years.

¢. Trainees shall join the scheme on successful completion of training and

upon regularization in the regular scale of pay, on the regular rolls of the

Corporation provided their continuous service, in the regular scale of pay,

from the date of joining the regular scale till their normal date of

superannuation is expected to be not less than 15 years.

Query 3: Whether the employees / ex- employees governed under the CDA scales of

Pay are eligible to join in the scheme.

Reply: No. this scheme is applicable to those employees who are governed under the

IDA pay scales of the Corporation.

Query 4: Whether this scheme is also applicable to the employees of other

Organisations working in the Corporation on Deputation

Reply: The scheme shall not be applicable to Employees on deputation unless they are

absorbed in the Corporation after severing their connection with the previous employer.

Query 5: Whether this scheme is applicable to the employees of the Corporation

working in other organisation on Deputation

Reply: Yes. Employees of the Corporation on deputation to other Organisation / Service

would continue to be covered by the scheme provided the Corporation's and

Employee’s contribution for the period of deputation would be payable by the

Organisation / Service of deputation. In case the Organisation / Service of deputation

does not have provision for such payment, the same shall be payable by the employee

concemed

Query 6: Whether this scheme is applicable to the employees of the Corporation

working in other organisation by retaining lien of service with the Corporation.

Reply: Yes. Employee(s) of the Corporation, who joined /are joining other Organisation

by retaining lien of service, would continue to be covered by the scheme provided the

Corporation's and Employee's contribution for the period of lien would be payable either

by the employee or his employer.

Query 7: Whether the Ex- Employee / spouse/ beneficiary of the deceased employee

can opt-out from the said scheme.

Reply: Yes the Ex-Employee / spouse/ beneficiary, who retired / expired during the

period 01.12.2008 to 31.12.2016, can opt-out from the said scheme.

Query 8: Whether the Ex- Employee / spouse/ beneficiary of the deceased employee, if

they opt-out from the said scheme, will get interest on the amount of the contribution by

Employer since 01.12.2008

Reply: No. The Ex- Employee / spouse/ beneficiary of the deceased employee, if they

opt-out from the said scheme, will get the principal amount on account of Employer

contribution only, subject to deduction of Statutory Tax, if any

Query 9: The Ex- Employee / spouse/ beneficiary of the deceased employee, if they

opt-out from the said scheme, in how many installments they will get their share of

Employer's Contribution i.e. 10% of Basic Pay + DA.

Reply: The Ex- Employee / spouse! beneficiary of the deceased employee, if they opt-

out from the said scheme, will get their share of Employer's Contribution i.e. 10% of

Basic Pay + DA in lump sum subject to deduction of Statutory Tax, if any.

Query 10: Whether the Pension, once fixed by the Annuity Provider, can be revised in

case the interest rates are revised (increases / decreases).

Reply: No. The Pension, once fixed by the Annuity Provider shall remain unchanged,

subject to Annuity option exercised.

Query 14: Whether the PAN Number and Aadhaar Number are compulsory for opting

out from the Pension scheme

The same are required to the purpose of deduction and remittance of Tax, if

any, and for the purpose meeting official requirement.

Query 12: Whether it is mandatory to opt for the scheme by the legal heirs of the

deceased employee, in case, the death occurs at a later stage i.e.after 01.02.2017.

Reply: The Ex-Employee / spouse/ beneficiary, who retired / expired during the period

01.12.2008 to 31.12.2016, can opt-out from the said scheme.

Query 13: Whether an Employee / Ex- Employee once opted in for one of the Pension

Scheme of the Annuity provider can opt out in future with return of capital option

Reply: This will be governed by the schemes of the Annuity Providers as opted by the

beneficiary

Query 14: Who will make the payment to the Ex- Employee / spouse/ beneficiary of the

deceased employee, if they opt-out from the said scheme?

Reply: The payment will be made by the office of the Corporation where they served

the last.

Query 15: Percentage of Subscription / Contribution to the Pension fund by the

Employee and the Employer respectively.

Reply: Employer's Contribution: FCI shall contribute towards Pension Scheme

@10% of (Basic Pay + DA) of eligible employees or such other percentage as may be

notified by the Corporation with the approval of Central Government from time to time,

subject to the condition that the total post-retirement benefits comprising of Gratuity,

Provident fund, Post-Retirement Medical benefits and Contributory Pension shall not

exceed 30% of Basic Pay and DA or such other percentage as may be fixed by the

Government from time to time.

Member's Contribution: All eligible employees shall contribute at the rate of 2% of

(Basic Pay+ DA) or such other percentage of (Basic pay + DA) as may be fixed by the

Corporation as mandatory contribution towards pension with effect from 01-12-2008.

However, no past service contribution shall be collected from the spouse of an eligible

employees who expired while in service of FCI on or after 01-12-2008 and from the

spouse of an employee who superannuated on or after 01-12-2008 but is not alive as

on the date of issue of this Circular.

Query 16: Date of disbursement of Pension to the Ex- employees retired / expired

during the period 01.12.2008 to 31.12.2016, whether the same is from the date of

superannuation / date of death.

Reply: The Ex- employees retired / expired during the period 01.12.2008 to 31.12.2016

will get the pension, if they join the scheme, after completing the formalities as required

under the scheme circulated

Query 17: Management of Pension fund and Nomination of Fund Manager.

Reply: The custody, control and management of the Fund shall be vested in a Board of

Trustees constituted by the Corporation which shall only be responsible for and

accountable to the Members and/or the Corporation and any Statutory Authorities for

proper accounts of the fund including receipt and payment of money from the fund and

the money remaining in the custody and for proper investment and accounting of the

pension fund and payment of pension benefits as per the provisions of these rules to

the Members/Beneficiaries

LIC of India is nominated as Fund Manager of the Pension Scheme, initially for a period

of one year or till the appointment of a regular Fund Manager, whichever is earlier, on

nomination basis.

Query 18: Name of the Approved Companies (by IRDA) authorized to provide the

Annuity Schemes.

Reply: The Life Insurance Corporation of India, SBI Life Insurance Co. Ltd., HDFC Life

Insurance Co, Ltd., ICICI Prudential Life Insurance Co. Ltd., Bajaj Allianz Life Insurance

Co. Ltd., Birla Sun Life Insurance Co, Ltd. And other Insurance companies as approved

by the IRDA time to time.

Query 19: Annuity Schemes of various Annuity providers.

Reply: Annuity Schemes of various Annuity providers are enclosed herewith for ready

reference as Annexure ~A,

Query 20: Rate & Date from which the Interest is payable by the Fund Manager.

Reply: The rate of Interest will be decided by the Fund Manager time to time and the

same will be payable as and when the amount transferred in to their account.

Query 21: Why this One time Membership Fee is payable by the members.

Reply: Since the cost of administration of Pension Trust shall be borne by the Trust

itself, one-time non-refundable "Membership Fee" of Rs.100 (Rupees One Hundred

only) shall be collected from each eligible member. Membership-fee shall be recovered

from the arrear contribution of the initial members and from the 1* month contribution of

new members on their joining the Pension Scheme

Query 22: Whether the pre-audit is required before releasing the final payment to opt-

out ex-employees.

Reply: Yes. The pre-audit is required before releasing the final payment to opt-out ex-

employees.

Query 23: Whether the benefit of Pension would be available to the employee of the

Corporation, who leaves on account of resignation, termination, and dismissal / removal

ele.

Reply: Yes, in case of separation of an employee on account of resignation,

termination, dismissal’ removal etc., payment of pension benefit shall be computed

based on member's contribution only, if any, and interest accrued thereon,

Query 24: Whether the benefit of this scheme would be available to the employees

leaving services of the Corporation under VRS / Voluntary Separation scheme.

Reply: In the event of member leaving the services of the Corporation under Voluntary

Retirement Scheme / Voluntary Separation Scheme, the Pension shall be regulated in

terms of such schemes applicable to such employees as notified by the Corporation.

Query 25: Whether the Commutation of Pension is allowed under the scheme.

Reply: Commutation is not permissible under the Scheme/ Rules.

Query 26: Whether the employee can withdraw his / her membership once after the

joining the scheme.

Reply: No member shall be allowed to withdraw his/her membership of the Pension

Scheme during his/ her employment with the Corporation.

Query 27: Whether the Change of Nomination is allowed under the scheme.

Reply: Yes, a member may apply in the prescribed nomination form to change the

beneficiary (s) at any point of time during service.

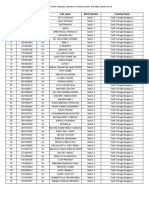

‘COMPARATIVE ANNUITY RATES STATEMENT FOR SUPERANNUATION FUND BY VARIOUS ANNUITY PROV!

Awswexuee Ww

Yu

ERS

{Subject to Revision)

GE GOYEARS

ANNUITY PURCTIASE PRICE TRE 100,000 (Rupees One Lal oniy)

‘MODE OF ANNUITY ‘MONTHLY

3 jal Alia Age

tac | sprite taeC Lite|B4S4" | pysterence Assumed is S

Years)

aa oo B93 EO

2 FOR LIFE WITH ROC 338537 S27, 28.953] 379.68.

3 "ANNUITY FOR § EARS Tat 7 era 8.1) 536.17

« ANNUITY FOR 10 EARS 708 712 662, 6.14 527.15

3 "ANNUITY FOR IS YEARS? a7 [000 6a E33) 513.25

66s [NA $9487

6 ANNUITY FOR 20 YEARS+ 630 489.25)

7 | ANNUITY FOR LIFE INCREASING @s% PA | s7_ | 593 ith ee

For Spouse Voungerto

Emp 47131

8 | ANNUITY FORLIFEWITHs0%TosPOUSE | 672 | 674 |Noy 635 bop respllowe wap

Available |Avaitae 49411

For Spouse Younger to

' 7 Emp 43320

9 | ANNUITY FORLIFE WITH 100% TOsPoUSE | «2s | oan | sis | oo mebaat anche

405.17) 469.23,

io | ANNUITY FOR LIFE WITH S0% TO SPOUSE [Not ms he ceo ‘Option Not Available

wir Roc Available | 57 _ | avaitabte lavaitae

For Spouse Younger to

ANNUITY FOR LIFE WITH 100% TO SPOUSE Emp 363.27

ee ‘WITH ROC se |e eu | ee For Spouse Older to Emp

38491) 372.81

cot INor Not

12 | ANNUITY FOR LIFE INCREASING @5% P.A |S diane [Nealable ae (tai Wuerdviii

ty | ANNUNTY FOR LIFE WITH ROC ON [Not INer [Nor

a DIAGNOSIS OF C1 Available [Available [Available | 526 [Available [Not Available

ot INor ot Nor

M4 |_ANNUITY FOR LIFE WITH ROCINPARTS |vaitapie [Available [Available | 427 _ |Avaitable_|Not Available

1p | ANNUMTY FOR LIFE WITH RETURN OF [Not Nor of [Not

BALANCE PURCHASE PRICE [avaitable [Available [Available | 648 |Avaitable [Not Available

4

Annexe?

a,

‘COMPARATIVE ANNUITY RATES STATEMENT FOR SUPERANNUATION FUND BY VARIOUS ANNUITY PROVIDERS

bet to Revs)

ra TERS

SNUTAV CHASE PRICE TE MOO Rapes One Lao

MODEOF ANNUITY OUTER

iin ge

aca olin egy ric |seatie| ‘CC fpr rie] So

7 ANNUITY FORTE [as | 9

[ANWR FOR IRE WITHTROC fas {se is | ss

5 ISNUITY TORS WEARS | a7 ‘on | a0

A ANNUITY TOR WVEARS= aaa a} ees

: ANSUITY FOR TSVEAIS® | a ise —| 18 issist

$ ANNUITY FORO YEARS zim [Nk ‘ane —| Tas Lae

[ANNOY FOR LIFE INCREASING ave PA | 170 —| “TS ik | 10699 yaaa Ror mtn

ir iaen Geo

8 | ANNUITY FOR LIFE WITHs0% TO SPousE | 2030 | 2040 sas ee

For Spouse Ober Emp

wou

Tarsjace tonne

coo srou Ty 1048

9 | axnurrvrortirewira 0% rospouse | sass | assy | rote | 19a fo eee

1221.04 1419.41

ARNUAY FOR LIFE WITH SV TO WROTE Ia) Op Ne aa

WITH ROC * ae 1698 | available

aaa

ANNUITY FOR LIE WITH 10% TO SPOUSE Tap 19830

- WITH ROC mat = -™ _ For Spouse Older to Emp

fea

ANNUITY FOR LIFE INCREASING @% PA 7

ANNUFTY FOR LIFE WITH ROC ON Rat

DIAGNOSIS OFC 1525 [Rea [por aatane

far

14 | ANNUITY FOR LIFE WITH ROC IN PARTS | suitable [Available 1324 _|Available_|Not Available

se) ARNT FOR TIRE W fr Nat

DALANCE PURCHL vata raat | eo a vata

Annexure’?

wy

‘COMPARATIVE ANNUITY RATES STATEMENT FOR SUFERANMUATION FUND BY VARIOUS ANNUITY PROVIDERS

(ube ess

aE ave

ARRUTTY PURCHASE FRICE TE TODO ages Ome Ta oT

MODEOPANRUITY TAL YEARLY

cI ‘ila Sun oe

‘Name of the Insurance Company tic }spauite] TC bape ritel Br ? Difference Assumed is 5

Prat ite ca

SRN FORE aaa ares] as

ANNUITY FORTAPEWITITROC——[~o0—| se | sigs —[ 55 | Bn ea

ANNUITY FOWS ARSE fas—[ ar [ snes —| a6 [tT Sia

ANNUITY FORO YEARS [ae ne [er [srr sna

ANNUITY FOR ISVEARS= top| anaes | ser] 297 a8

oe sa

‘ ANNUITY FoR YEARS rane | anes | sass [srs

ior pin Na ae

7) asneiry RoR LaeNcrcAemc eon, |! oem’ | 50M snes tau |. cia

Tarps Toes

: vp se

+ | axwurvrouirewmn ar rosrouse | sim | ans st ue lp tte aap

sus rm [702 Sape

Farias ome

o | aynurty ror irk wit iw ro spouse | ses sues | 260 ae

asa re

TRNUTTY FOR FE WITH aA TOSPOUSE Na wae

1g WITH ROC hd mr 3165 3430 | avaiable

Tarpon

ANNUITY FOR Lire Wirt 100% TO SPOUSE Timp

u tre wins sow | 0 | anes | ann eo

asssad ns

i lwaeimeomincmanaemr Ra ie foe || a fw

ste [vate [soe Seiabe [vot Avia

| wwervrorcirewrrinocox ue fase a is

DIAGNOSIS OF Cl JAvailable Available |Available 3219 _|Available [Not Available

ve | annuery ron ure wit noc Panes fae se

sate rants |_26rs_[avatote [ya vaste

| essen romuirewmaneronsor Ino ws

BALANCE PURCHASE PRICE [Available [Available 3970 [Not Available

=

Annexe

Ay

COMPARATIVE ANNUITY RATES STATEMENT FOR SUPERANNUATION FUND BY VARIOUS ANNUITY PROVIDERS

rife en)

50 TEARS

ARRUIT PURCHASE PRICE TAT epee One TaN oT

ODE OF ANNUITY Tey

; Time ae

Same ote surance Company vic [sere] ‘2 fiorcul ts | pitt tsanetios

‘cas

i ARSUTTY FORTE so a0

{aes Fortine winireoc—| prs] |e | ess aneu

5 ANNUITY FOWS YEARS oC ee

3 NUT FORT VER [a Sa

| —— ANNUITY FOR TS VERRS fet etter

tao] Wa

qf awwurry rons veanse Frnunne | rem | coms

a] ANNUITY FOR LIFEINCREASING @3%P.A | 720 | 7415 [A iaite | na a

For pone Voges

4] axwuiryroruirewirn sm roseouse | asso | 20s (yy, | 20 fer

vais [rami |e

Forpoue anger

of axserrvron tire wir iov-rosrouse | rm | res | rr | io

ASRUTY FOR CIE WITTE TOSPOISE hee a

10) WITH ROC 5 7190 [Available 7000 {Available

Tar Sy oer

{ANNUITY FOR LIFE WITH 00% TO SPOUSE Tn 4098

7 WITH ROC = —_ = _ for Spouse Older to Emp

ara nor

: : Ika — ot hor

| NUTT FoRuiPE Wir ROCON mei =

DIAGNOSIS OFC Frsabe avutaie | 570 _[artabie [pot vatni

z FOR LIFE WITH ROC WVPARTS Be aan eas

a RETURN OF —FRat

sumo_[artaie [nor Avae

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FinalAnswerkey CGLE2022 Tier1 27022023Document1 pageFinalAnswerkey CGLE2022 Tier1 27022023rahul ramNo ratings yet

- Allotment of Staff Training Centres To Probationary Officers Under CRP XiDocument14 pagesAllotment of Staff Training Centres To Probationary Officers Under CRP Xirahul ramNo ratings yet

- Training dt.11.12.20 (2 Files Merged) PDFDocument2 pagesTraining dt.11.12.20 (2 Files Merged) PDFrahul ramNo ratings yet

- List of Adm Offices As On 31.12.2016Document2 pagesList of Adm Offices As On 31.12.2016rahul ramNo ratings yet