Professional Documents

Culture Documents

HW 5 Investments PDF

Uploaded by

b bOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HW 5 Investments PDF

Uploaded by

b bCopyright:

Available Formats

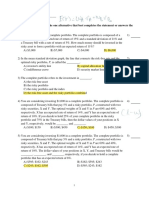

1.

Rank the following from highest average historical return to lowest average historical return

from 1926 to 2013.

I. Small stocks

II. Long-term bonds

III. Large stocks

IV. T-bills

a. I, III, II, IV

b. III, I, II, IV

c. I, II, III, IV

d. III, IV, II, I

2. Suppose you pay $9,400 for a $10,000 par Treasury bill maturing in 6 months. What is the

e ective annual rate of return for this investment?

13.17%

6.38%

12.77%

14.25%

3. The CAL provided by combinations of 1-month T-bills and a broad index of common stocks

is called the ________.

CAPM

SML

CML

total return line

4. The Manhawkin Fund has an expected return of 16% and a standard deviation of 20%. The

risk-free rate is 4%. What is the reward-to-volatility ratio for the Manhawkin Fund?

.8

.6

5. The buyer of a new home is quoted a mortgage rate of .5% per month. What is the APR on

the loan?

6.5%

6%

5%

.50%

APR = .5% x 12 = 6.0%

6. The complete portfolio refers to the investment in ________.

the risk-free asset

the risky portfolio

the risk-free asset and the risky portfolio combined

the risky portfolio and the index

7. The excess return is the ________.

rate of return to risk aversion

rate of return in excess of the Treasury-bill rate

ff

rate of return that can be earned with certainty

index return

8. The geometric average of -12%, 20%, and 25% is ________.

9.7%

18.88%

8.42%

11%

9. The normal distribution is completely described by its ________.

mode and standard deviation

median and variance

mean and variance

mean and standard deviation

10. The return on the risky portfolio is 15%. The risk-free rate, as well as the investor's

borrowing rate, is 10%. The standard deviation of return on the risky portfolio is 20%. If the

standard deviation on the complete portfolio is 25%, the expected return on the complete

portfolio is ________.

16.25%

6%

10%

8.75 %

11. You are considering investing $1,000 in a complete portfolio. The complete portfolio is

composed of Treasury bills that pay 5% and a risky portfolio, P, constructed with two risky

securities, X and Y. The optimal weights of X and Y in P are 60% and 40%, respectively. X has

an expected rate of return of 14%, and Y has an expected rate of return of 10%. If you decide

to hold 25% of your complete portfolio in the risky portfolio and 75% in the Treasury bills, then

the dollar values of your positions in X and Y, respectively, would be ________ and ________.

$450; $300

$300; $450

$150; $100

$100; $150

12. You have the following rates of return for a risky portfolio for several recent years: 2011

35.23% 2012 18.67% 2013 −9.87% 2014 23.45% If you invested $1,000 at the beginning of

2011, your investment at the end of 2014 would be worth ________.

$1,247.87

$1,645.53

$2,176.60

$1,785.56

13. You invest $1,000 in a complete portfolio. The complete portfolio is composed of a risky

asset with an expected rate of return of 16% and a standard deviation of 20% and a Treasury

bill with a rate of return of 6%. A portfolio that has an expected value in 1 year of $1,100 could

be formed if you _________.

place 40% of your money in the risky portfolio and the rest in the risk-free asset

place 75% of your money in the risky portfolio and the rest in the risk-free asset

place 60% of your money in the risky portfolio and the rest in the risk-free asset

place 55% of your money in the risky portfolio and the rest in the risk-free asset

14. You invest $10,000 in a complete portfolio. The complete portfolio is composed of a risky

asset with an expected rate of return of 15% and a standard deviation of 21% and a Treasury

bill with a rate of return of 5%. How much money should be invested in the risky asset to form

a portfolio with an expected return of 11%?

$3,000

$7,000

$4,000

$6,000

15. You put up $50 at the beginning of the year for an investment. The value of the investment

grows 4% and you earn a dividend of $3.50. Your HPR was ________.

7%

11%

3.5%

4%

16. Your investment has a 20% chance of earning a 30% rate of return, a 50% chance of

earning a 10% rate of return, and a 30% chance of losing 6%. What is your expected return on

this investment?

9.2%

8.9%

12.8%

11%

17. Your investment has a 40% chance of earning a 15% rate of return, a 50% chance of

earning a 10% rate of return, and a 10% chance of losing 3%. What is the standard deviation

of this investment?

7.59%

9.29%

5.14%

8.43%

You might also like

- 615 Risk, Return Problems and QuestionsDocument7 pages615 Risk, Return Problems and Questionslittle_lady26100% (3)

- 300 AssignmentDocument4 pages300 AssignmentFgvvNo ratings yet

- Test Bank - Mgt. Acctg 2 - CparDocument16 pagesTest Bank - Mgt. Acctg 2 - CparChris LlevaNo ratings yet

- 435 Solution 3Document7 pages435 Solution 3Shahin Oing0% (1)

- Chapter 05 MCQsDocument7 pagesChapter 05 MCQsElena WangNo ratings yet

- Summary of Stephen Spicer CFP®'s Stop Investing Like They Tell You (Expanded Edition)From EverandSummary of Stephen Spicer CFP®'s Stop Investing Like They Tell You (Expanded Edition)No ratings yet

- Tutorial QuestionsDocument15 pagesTutorial QuestionsWowKid50% (2)

- Bao2001 Group AssignmentS22018SunwayDocument4 pagesBao2001 Group AssignmentS22018SunwayDessiree ChenNo ratings yet

- Review For Exam 3: 11:30 AM - 2:30 PMDocument14 pagesReview For Exam 3: 11:30 AM - 2:30 PMCindy MaNo ratings yet

- 3.3.6 Mod EvaluationDocument6 pages3.3.6 Mod EvaluationWelshfyn ConstantinoNo ratings yet

- Homework 1Document3 pagesHomework 1wrt.ojtNo ratings yet

- Chapter 5Document5 pagesChapter 5Khue NgoNo ratings yet

- Pproblems Chapter 4 5 6Document6 pagesPproblems Chapter 4 5 6Sanghoon JeongNo ratings yet

- FIN604 MID - Farhan Zubair - 18164052Document7 pagesFIN604 MID - Farhan Zubair - 18164052ZNo ratings yet

- Practice Question - 2 Portfolio ManagementDocument5 pagesPractice Question - 2 Portfolio Managementzoyaatique72No ratings yet

- Questões Cap6Document5 pagesQuestões Cap6João EspositoNo ratings yet

- Seminar 5 Mini CaseDocument5 pagesSeminar 5 Mini Casebbaker2014100% (1)

- CourseDocument147 pagesCourseOumema AL AZHARNo ratings yet

- Past Exam Questions - InvestmentDocument14 pagesPast Exam Questions - InvestmentTalia simonNo ratings yet

- Practice 1Document3 pagesPractice 1Shahida Akter 1520691631No ratings yet

- 308 Final Mock B F23Document18 pages308 Final Mock B F23juliarust7No ratings yet

- Agile Portfolio 2Document9 pagesAgile Portfolio 2quantextNo ratings yet

- HuDocument13 pagesHujt626No ratings yet

- Introduction To Risk, Return, and The Historical Record: A. B. C. EDocument24 pagesIntroduction To Risk, Return, and The Historical Record: A. B. C. EAreej AlGhamdiNo ratings yet

- Utility 1Document24 pagesUtility 1ananthalaxmiNo ratings yet

- 9501期中黃瑞靜財務管理 (一)Document6 pages9501期中黃瑞靜財務管理 (一)অচেনা একজনNo ratings yet

- Mt2 PracticeDocument8 pagesMt2 PracticemehdiNo ratings yet

- 2009-03-11 142055 TholmesDocument14 pages2009-03-11 142055 TholmesSirVicNYNo ratings yet

- Homework 1 Due Thursday 04/11 (By 6pm London Time) One Copy Per GroupDocument5 pagesHomework 1 Due Thursday 04/11 (By 6pm London Time) One Copy Per GroupJosh GirnunNo ratings yet

- Estimating Risk and Return On AssetsDocument9 pagesEstimating Risk and Return On AssetsLianne EscoNo ratings yet

- Equal To One Because It Has Only Systematic RiskDocument15 pagesEqual To One Because It Has Only Systematic Risk13-Đình T.QNo ratings yet

- 2023 Tute 6 ValuationDocument6 pages2023 Tute 6 ValuationThảo TrươngNo ratings yet

- Tutorial 4Document3 pagesTutorial 4sera porotakiNo ratings yet

- IACFMAS-ASSIGN MarjDocument4 pagesIACFMAS-ASSIGN MarjMarjorie PagsinuhinNo ratings yet

- Topic 4 Tutorial QuestionsDocument2 pagesTopic 4 Tutorial QuestionsThirusha balamuraliNo ratings yet

- 74 - Quiz Equity and Options PDFDocument3 pages74 - Quiz Equity and Options PDFAdri Aswin AzhariNo ratings yet

- Financial Management - Practice WorkbookDocument39 pagesFinancial Management - Practice WorkbookFAIQ KHALIDNo ratings yet

- Chapter 6 Risk and Return, and The Capital Asset Pricing Model ANSWERS TO END-OF-CHAPTER QUESTIONSDocument10 pagesChapter 6 Risk and Return, and The Capital Asset Pricing Model ANSWERS TO END-OF-CHAPTER QUESTIONSSolutionz Manual50% (2)

- LFPP5800 Quiz 1 Investment Planning 2020 MEMO FinalDocument10 pagesLFPP5800 Quiz 1 Investment Planning 2020 MEMO FinalKekeletso MoshoeshoeNo ratings yet

- Test 092403Document10 pagesTest 092403Janice ChanNo ratings yet

- Practice Worksheet - IBFDocument3 pagesPractice Worksheet - IBFsusheel kumarNo ratings yet

- Fourth QuestionDocument1 pageFourth QuestionPwNo ratings yet

- Compounding and Annuity Tables Use in Equity ValuationDocument8 pagesCompounding and Annuity Tables Use in Equity ValuationKarya BangunanNo ratings yet

- Midterm3 AnswerDocument4 pagesMidterm3 AnswerHà LêNo ratings yet

- SOlution To AnsDocument12 pagesSOlution To Anssome_one372No ratings yet

- Soal Asis 4 IPMDocument2 pagesSoal Asis 4 IPMPutri Dianasri ButarbutarNo ratings yet

- Extension ExercisesDocument10 pagesExtension Exercisesjackie.chanNo ratings yet

- Assignment 5 - CH 10 - The Cost of Capital PDFDocument6 pagesAssignment 5 - CH 10 - The Cost of Capital PDFAhmedFawzy0% (1)

- 2009-04-03 181856 ReviewDocument18 pages2009-04-03 181856 ReviewAnbang XiaoNo ratings yet

- Exercicios - Chapter5e6 - IPM - BKM - Cópia - CópiaDocument12 pagesExercicios - Chapter5e6 - IPM - BKM - Cópia - CópiaLuis CarneiroNo ratings yet

- Is Equal To The Total Market Value of The FirmDocument33 pagesIs Equal To The Total Market Value of The FirmHUYỀN BÙI THỊNo ratings yet

- Risk Tolerance QuestionaireDocument4 pagesRisk Tolerance QuestionaireATL3809100% (1)

- AC513 Midterm Review.Document14 pagesAC513 Midterm Review.Lauren ObrienNo ratings yet

- CH8,9,11,12Document13 pagesCH8,9,11,12Noehmi CarvalosNo ratings yet

- C6 C7 C8 Answers SolutionsDocument16 pagesC6 C7 C8 Answers Solutionsjhela18No ratings yet

- Tutorial 6 Valuation - SVDocument6 pagesTutorial 6 Valuation - SVHiền NguyễnNo ratings yet

- Rebalancing Your Portfolio On TimeDocument3 pagesRebalancing Your Portfolio On Timehiteshmakhijani23No ratings yet

- Week 4 Tutorial QuestionsDocument2 pagesWeek 4 Tutorial QuestionsThomas Kong Ying LiNo ratings yet

- 1.3.2.1 Elaborate Problem Solving AssignmentDocument17 pages1.3.2.1 Elaborate Problem Solving AssignmentYess poooNo ratings yet

- Sample PaperDocument29 pagesSample PaperhulvaNo ratings yet

- Summary of William J. Bernstein's The Intelligent Asset AllocatorFrom EverandSummary of William J. Bernstein's The Intelligent Asset AllocatorNo ratings yet

- Can Hoover Dam’s Design Principles Help Us Solve the Retirement Income Problem?From EverandCan Hoover Dam’s Design Principles Help Us Solve the Retirement Income Problem?No ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Mou NikaDocument50 pagesMou NikaAshis Kumar MohapatraNo ratings yet

- CHAPTER IV - Bond and Sock Valuations and Cost of CapitalDocument73 pagesCHAPTER IV - Bond and Sock Valuations and Cost of CapitalMan TKNo ratings yet

- Introduction To Investing and ValuationDocument44 pagesIntroduction To Investing and ValuationSupreet GuptaNo ratings yet

- 4874-Article Text-16268-1-10-20210429Document10 pages4874-Article Text-16268-1-10-20210429alim shaikhNo ratings yet

- Research Paper On Security Analysis and Portfolio ManagementDocument6 pagesResearch Paper On Security Analysis and Portfolio Managementvvgnzdbkf100% (1)

- Beta Capm AptDocument30 pagesBeta Capm AptERICKA MAE BALDEMORNo ratings yet

- Diversification Strategies, Bus1 N Ess Cycles and Economic PerformanceDocument12 pagesDiversification Strategies, Bus1 N Ess Cycles and Economic PerformanceCẩm Anh ĐỗNo ratings yet

- S11 Introdion Taluatioost Ofital EstimationDocument42 pagesS11 Introdion Taluatioost Ofital Estimationsuhasshinde88No ratings yet

- Topic 4 Risk ReturnDocument48 pagesTopic 4 Risk ReturnBulan Bintang MatahariNo ratings yet

- Comparison of CAPM & APTDocument31 pagesComparison of CAPM & APTRikesh Daliya100% (3)

- FM14e PPT Ch06Document77 pagesFM14e PPT Ch06Aayat R. AL KhlafNo ratings yet

- IPOMDocument23 pagesIPOMmuskan200875No ratings yet

- Principles of Managerial Finance: Fifteenth Edition, Global EditionDocument56 pagesPrinciples of Managerial Finance: Fifteenth Edition, Global EditionKahtiNo ratings yet

- Nama: Redi Perdiansyah NIM: 55120110139 Quiz Ke: 9: Stock X Stock y Stock ZDocument5 pagesNama: Redi Perdiansyah NIM: 55120110139 Quiz Ke: 9: Stock X Stock y Stock ZFikky Chandra SilabanNo ratings yet

- Problem Set 4 SolutionDocument8 pagesProblem Set 4 SolutionMỹ HạnhNo ratings yet

- Capital Asset Pricing ModelDocument2 pagesCapital Asset Pricing ModelThomasaquinos Gerald Msigala Jr.No ratings yet

- Chapter 08-Risk and Rates of Return: Cengage Learning Testing, Powered by CogneroDocument7 pagesChapter 08-Risk and Rates of Return: Cengage Learning Testing, Powered by CogneroqueenbeeastNo ratings yet

- FRM Learning Objectives 2023Document58 pagesFRM Learning Objectives 2023Tejas JoshiNo ratings yet

- Mva CapmDocument27 pagesMva Capmjc820809No ratings yet

- FNCE30001 Investments Subject Guide 2011 - 2Document13 pagesFNCE30001 Investments Subject Guide 2011 - 2ellie_newnhamNo ratings yet

- Finance Management Notes MbaDocument12 pagesFinance Management Notes MbaSandeep Kumar SahaNo ratings yet

- Table of Contents - Valuation and Common Sense (8th Edition)Document13 pagesTable of Contents - Valuation and Common Sense (8th Edition)meditationinstitute.netNo ratings yet

- Sapm Notes (Problems)Document11 pagesSapm Notes (Problems)anilkc9No ratings yet

- Valuation & Macroeco Finance Session - 131016Document59 pagesValuation & Macroeco Finance Session - 131016Vivek AnandanNo ratings yet

- Ross FCF 9ce Chapter 13Document58 pagesRoss FCF 9ce Chapter 13Khalil Ben JemiaNo ratings yet

- Bangalore University MBA FinanceDocument31 pagesBangalore University MBA FinanceRakeshChowdaryKNo ratings yet