Professional Documents

Culture Documents

Sri Vidhyalakshmi Enterprise 2 PDF

Sri Vidhyalakshmi Enterprise 2 PDF

Uploaded by

Abhishek J T0 ratings0% found this document useful (0 votes)

23 views3 pagesOriginal Title

sri vidhyalakshmi enterprise 2.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views3 pagesSri Vidhyalakshmi Enterprise 2 PDF

Sri Vidhyalakshmi Enterprise 2 PDF

Uploaded by

Abhishek J TCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

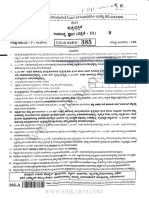

Bele Usetd :

7038, + Bos. &\ ew (| aeF | 0foa-a2,

139) wm xtseod sages @ IMO been AUS 0.008

poor don» epee 'SvEEP exgavor’ aR Uses)

Jux ge oom oge 00 5h) LAMY

ayely BAVA Looe 66%

- UrOR 2G apsoi2?

2:09 %

que

Ke ABS Movs.

sv) Yead ups wow pointing

ante 1 Head ays pith prinkry

GEFs qs

ay WAFz, he wae OPO aa Aa

satpaty Cele 20d

we ; o-lA2.

OY wut

ay) 4008 (2 2 Fd0H08 Ae nowetoe

Bovrae aos Head Capf be priwting Aca,

papi? #80] — BU ARODR sve

Aas LHP MILF Fog ZIT 90s]

bes Bip £65 AY aP

; ” bt ehh

LAL Bar Le ossancd Sverp gay

pig homcatue ag, one BB00/" AR

wpesias Of Sy Gig Eg

eifew) Behe (3) a

mrressr me Sco.

OP IBS3

9 svoseg6) On

®

Scanned with CawScanner

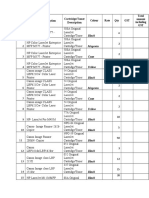

KMF No. 59

AILED BILL OF OTHER EXPENDITURE

Fund: Rs: Bill No./Date :...

Recount Wea | Gyyggee nea] Ament | avert nti} nate vate |g

Account Code

Pudge end Co

—_—

Awtborty Nember A Detefor Tray oice NoDate Description of charges

eer

west [prtioosh SER aac

Qa -pe Baek ak |ssmol— |

Ars

a3 aoe owe

Contractor / Suppliers / Beneficiary Nam

Certificate of officer / Section Head

invoice has not been paid earlier.

1 Certify that he expenditure charged inthis bill and attached

itto account on the

las and stores charged in the bill and attached invoice have been brough

of the Stores Register,on Date

‘for have been received in good order, that their quantities are correct and their

ro not in excess of those accepted and the market rates and that suitable notes

Vainst the Original indentand invoice concerned to prevent double payment

a

(2) 1 Certify that mat

respective Inventor

(3) 1 Certify thatthe purchases!

‘quality good, that the rates pald at

‘of payment have been recorded ag:

Officer-in-Charge Head of the Dep!

Date:

Total value of Bill :

3845-Income Tax

3845 - Works Contract Tax

3847- Others

3712 - Retention Money

‘Total Deductions

amount Payable Rs.

‘The bill amount and Deductions are verified and passed restricted to Rs

ith the above Deductions

in Words

Scanned with CamScanner

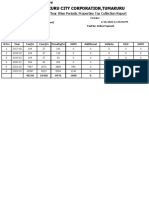

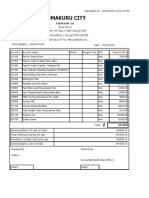

fuel DESCRIPTION -

| SWEEP Banoen Sega pe

ORS SBR F-N-2y22_

| PPodse Ave) SBA Ae nad

ol Head Caps .

ape eee | Iso | esl] as fy

Pacing, Nos P

_]{enano Total] F7So —

“oa

‘Account Name : SRI VIDYALAKSHMI ENTERPRISES

Account No. : 0522201001715, Bank : Canara Bank Authorised Signature

IFSC Code : CNRB0000522, Branch : H.0. Tumkur. A COMPOSITION TAX PAYER

Scanned with CawScanner

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Account DetalsDocument1 pageAccount DetalsAbhishek J TNo ratings yet

- Gururaj Advocate PDFDocument7 pagesGururaj Advocate PDFAbhishek J TNo ratings yet

- SBI Manager Four4 Bill PDFDocument3 pagesSBI Manager Four4 Bill PDFAbhishek J TNo ratings yet

- Trust Pan Card & 80G 12A Certificate PDFDocument3 pagesTrust Pan Card & 80G 12A Certificate PDFAbhishek J TNo ratings yet

- Program Doc Nag - Compressed PDFDocument5 pagesProgram Doc Nag - Compressed PDFAbhishek J TNo ratings yet

- Lokesh 1 PDFDocument1 pageLokesh 1 PDFAbhishek J TNo ratings yet

- SDA KRIDL 2023 Kannada Version PDFDocument19 pagesSDA KRIDL 2023 Kannada Version PDFAbhishek J TNo ratings yet

- Sri Vidyalakshi Enterprises 1 PDFDocument3 pagesSri Vidyalakshi Enterprises 1 PDFAbhishek J TNo ratings yet

- Gururaj Advocate Doc - Compressed PDFDocument7 pagesGururaj Advocate Doc - Compressed PDFAbhishek J TNo ratings yet

- E Aasthi Circular Issued On Apr 2016 PDFDocument4 pagesE Aasthi Circular Issued On Apr 2016 PDFAbhishek J TNo ratings yet

- LWF PDFDocument1 pageLWF PDFAbhishek J TNo ratings yet

- Fda GK Kannada Version Question Paper 28 02 2021 PDFDocument21 pagesFda GK Kannada Version Question Paper 28 02 2021 PDFAbhishek J TNo ratings yet

- Funds PDFDocument1 pageFunds PDFAbhishek J TNo ratings yet

- Rate Catridge PDFDocument2 pagesRate Catridge PDFAbhishek J TNo ratings yet

- Mgnvy Nikethan Consultancy PDFDocument7 pagesMgnvy Nikethan Consultancy PDFAbhishek J TNo ratings yet

- Legal Fees Payment 1 PDFDocument4 pagesLegal Fees Payment 1 PDFAbhishek J TNo ratings yet

- k2 Bill DocumentDocument2 pagesk2 Bill DocumentAbhishek J TNo ratings yet

- Income Tax PDFDocument1 pageIncome Tax PDFAbhishek J TNo ratings yet

- Manjula N February-2023 Attendance Report PDFDocument1 pageManjula N February-2023 Attendance Report PDFAbhishek J TNo ratings yet

- Aadhar Card PDFDocument1 pageAadhar Card PDFAbhishek J TNo ratings yet

- K R Mamatha Advocate - Compressed PDFDocument9 pagesK R Mamatha Advocate - Compressed PDFAbhishek J TNo ratings yet

- Cess PDFDocument1 pageCess PDFAbhishek J TNo ratings yet

- CBF PDFDocument1 pageCBF PDFAbhishek J TNo ratings yet

- SASBank Wise Collection ReportDocument2 pagesSASBank Wise Collection ReportAbhishek J TNo ratings yet

- GenReceiptCashwiseKMF 18 ReportDocument1 pageGenReceiptCashwiseKMF 18 ReportAbhishek J TNo ratings yet

- SASTax Collection ReportDocument2 pagesSASTax Collection ReportAbhishek J TNo ratings yet

- Covid 19 Bill Documents - Compressed PDFDocument8 pagesCovid 19 Bill Documents - Compressed PDFAbhishek J TNo ratings yet

- GenReceiptCashwiseKMF 18 ReportDocument1 pageGenReceiptCashwiseKMF 18 ReportAbhishek J TNo ratings yet

- GenReceiptCashwiseKMF 18 ReportDocument1 pageGenReceiptCashwiseKMF 18 ReportAbhishek J TNo ratings yet