Professional Documents

Culture Documents

2010 P T D (Trib.) 1470

Uploaded by

haseeb Ahsan0 ratings0% found this document useful (0 votes)

4 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pages2010 P T D (Trib.) 1470

Uploaded by

haseeb AhsanCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

2010 P T D (Trib.) 1470

[Income-tax Appellate Tribunal Pakistan]

Before Munsif Khan Minhas; Judicial Member

I.T.A. No.567/IB of 2010, decided on 1st June, 2010.

(a) Income Tax Ordinance (XLIX of 2001)---

----Ss.182(1) & 114---Penalty for failure to furnish a return or statement---Tax payable---Imposition of

penalty for late filing of annual income tax return---Validity---Provisions of S.182(1) of the Income Tax

Ordinance, 2001 clearly established the imposition of penalty linked with the tax payable---Absence of

tax payable was fatal for imposition of penalty---Penalty for default of S.114 of the Income Tax

Ordinance, 2001 would only become leviable when there was a "tax payable" but when there was no tax

payable by the taxpayer, levy of penalty was not justified---No error or infirmity in the order of First

Appellate Authority was found which was upheld and maintained by the Appellate Tribunal ---Appeal

of the department was dismissed being devoid of any merit.

(b) Income Tax Ordinance (XLIX of 2001)---

----Ss.182 (1) & 144---Penalty for failure to furnish a return or statement---Tax payable ---Penalty had

been prescribed in Sub-Cl. (i) of S.182 of the Income Tax Ordinance, 2001---Said clause had specified

that penalty should be imposed on the basis of tax payable, whereas in the present case, no tax had

become payable even on assessment--Restriction imposed on calculation of penalty was one tenth of one

per cent of tax payable and maximum limit was 25% of the tax payable---Base point was the tax

payable, resultantly second part of clause (i) came into operation only when initial calculation of penalty

had been made on the basis of tax payable---For imposing penalty for default under S.114 of the Income

Tax Ordinance, 2001, the pre-requisite was the tax payable by such assessee---Fulfilment of basic

ingredient of "tax payable" thus was a condition precedent for levying the penalty.

(c) Interpretation of statutes---

----Tax statute is to be interpreted strictly and to be followed as per its language without stretching the

meanings of the same.

(d) Interpretation of statutes---

----In the matter of taxation, literal approach had to be followed provided it did not lead to manifest

absurdity.

Sardar Zafar Mehmood, D.R. for Appellant.

Zahid Hussain, A.C.M.A. for Respondent.

ORDER

MUNSIF KHAN MINHAS, JUDICIAL MEMBER.---This appeal has been filed by the department

against the order, dated 15-3-2010 passed by C.I.R. (Appeals) on the following ground:

"That the learned CIR (A) was not justified to annul the order with the remarks that penalty was

imposed in the presence of extension allowed whereas the application for extension was rejected

by the department".

2. Brief facts leading to this appeal are that Taxpayer is a Private Limited Company. Return for the year

under consideration was E-Filed on 23-1-2009 which was late by 23 days as the due date of filing of

return was 31-12-2008. The Taxation Officer imposed a penalty under section 182(1) for late tiling of

annual income tax return for 23 days. In first appeal relief was allowed.

3. Before us the Department has contested the relief allowed at the first appeal stage but when asked to

explain as to how bringing anything plausible that penalty could be imposed and secondly without

following the procedure as laid down in section 182 that its imposition could be possible. Nothing

material in reply to it was submitted before us. The learned AR has supported the order by substantiating

the stance with earlier orders passed by the Tribunal, wherein it has been held that penalty shall be

imposed on the basis of the tax payable.

4. I have heard both the parties and have also perused the available record. It is imperative that the

original text of the section 182(1) be properly gone through for dilating upon the issue which has been

placed before us. For convenience, provision of section 182(1) is being reproduced as under:

"Any person who, without reasonable excuse, fails to furnish, within the time allowed under this

Ordinance, [return of income [or a statement as required under subsection (4) of section 115 or

wealth statement] for any tax year] as required under this Ordinance shall be liable for a penalty

to one-tenth of one per cent of the tax payable for each day of default subject to a maximum

penalty of five hundred rupees and a maximum penalty of twenty-five per cent of the tax payable

in respect of [that tax year]"

Undisputedly, it is as a result of non-compliance to provisions of section 114 i.e. not filing of return

within the prescribed span of time, that the penalty has been imposed so it is a default in compliance to

the provisions of section 114, which situation is covered under the section 182(1) ibid. For it the penalty

has been prescribed in sub-clause (i) ibid. This clause has specified that penalty shall be imposed on the

basis of the tax payable, whereas in the instant case before us no tax has become payable even on

assessment. Restriction imposed on calculation of penalty is one tenth of one, per cent of tat payable and

maximum limit is 25% of the tax payable, thus inevitability the base point is the tax payable, resultantly

second part of clause (i) comes into operation only when initial calculation of penalty has been made on

the basis of tax payable. For imposing the penalty for default under section 114 ibid, the pre-requisite is

the tax payable by such assessee. Fulfilment of basic ingredient of "tax payable" is a condition precedent

for levying the penalty. There cannot be two opinions that tax statutes are to be interpreted strictly and

are to be followed as per its language without stretching the meanings of the same. Had the intent of

statute was to impose the penalty in a situation like instant case then its linkage with tax payable would

not have been expressed. Such interpretation is further strengthened from the provisions of section

182(1) ibid where for imposition of penalty, linkage has been expressed with the tax payable. In the

matter of taxation, literal approach has to be followed provided it does not lead to manifest absurdity.

Here importantly the penalty provisions are to be interpreted strictly, where relevant provisions of

section 182 (1) are clearly establishing the imposition of penalty is linked with the tax payable, then it

has to be followed. The absence of tax payable is fatal for it. So keeping in view the provisions of

section 182(1) I do not have any hesitation in holding that penalty for default of section 114 only

becomes leviable when there is a "tax 'payable" but in the instant case when no tax has been imposed on

the Taxpayer, levy of penalty is not justified. Hence I find no error or infirmity in the order of the

learned CIR(A) which is upheld and maintained. The departmental appeal being devoid of any merit is

dismissed.

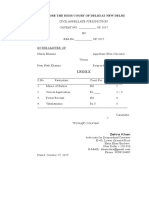

C.M.A./94/Tax(Trib.) Appeal dismissed.

You might also like

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Reply On PANDocument6 pagesReply On PANPaul Casaje89% (18)

- Accenture V Commission G.R. 190102 (Digest)Document3 pagesAccenture V Commission G.R. 190102 (Digest)mercy rodriguezNo ratings yet

- Adlawan v. Adlawan (G.R. No. 161916, January 20, 2006)Document3 pagesAdlawan v. Adlawan (G.R. No. 161916, January 20, 2006)Lorie Jean Udarbe100% (1)

- David Vs CADocument1 pageDavid Vs CAcharmdelmo100% (3)

- 8.cir V Roh Auto ProductsDocument2 pages8.cir V Roh Auto ProductsQuengilyn QuintosNo ratings yet

- Accenture vs. CIRDocument3 pagesAccenture vs. CIRJOHN SPARKS100% (1)

- Remedial Law 1 Case DoctrinesDocument299 pagesRemedial Law 1 Case DoctrinesAlexisNo ratings yet

- 226 CIR v. Sony Philippines, IncDocument4 pages226 CIR v. Sony Philippines, IncclarkorjaloNo ratings yet

- 2020 P T D 1908Document2 pages2020 P T D 1908haseeb AhsanNo ratings yet

- 2010 P T D (Trib.) 1394Document2 pages2010 P T D (Trib.) 1394haseeb AhsanNo ratings yet

- 2023 PTD 541 161BDocument8 pages2023 PTD 541 161BYour AdvocateNo ratings yet

- 2013 P T D 1420Document6 pages2013 P T D 1420haseeb AhsanNo ratings yet

- 2019 P T D 2072Document3 pages2019 P T D 2072Yahia MustafaNo ratings yet

- Latest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Document0 pagesLatest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Ketan ThakkarNo ratings yet

- Income Tax ProjectDocument22 pagesIncome Tax ProjectGargi UpadhyayaNo ratings yet

- Section 276B: by CA Puja Borar and Vivek SethiaDocument4 pagesSection 276B: by CA Puja Borar and Vivek SethiastudentsNo ratings yet

- Digestdocx 3 PDF FreeDocument2 pagesDigestdocx 3 PDF FreeAshleyKeikoDYuNo ratings yet

- 2019 P T D 2072Document5 pages2019 P T D 2072Ishratfatima wazirNo ratings yet

- (Chennai - Trib.) (30-11-2016)Document24 pages(Chennai - Trib.) (30-11-2016)harsh hgNo ratings yet

- UntitledDocument5 pagesUntitledharsh hgNo ratings yet

- Common TopicsDocument51 pagesCommon Topicsjonnajon92No ratings yet

- Adjudication - Case (1) .Docx 1Document14 pagesAdjudication - Case (1) .Docx 1aliciag4342No ratings yet

- Penalties PDFDocument19 pagesPenalties PDFpavankumarNo ratings yet

- 2017LHC1658 - Advance TaxDocument13 pages2017LHC1658 - Advance TaxMuhammad ZameerNo ratings yet

- Digests 2Document17 pagesDigests 2Henry LNo ratings yet

- TLP Supplement DT June 2020-OSDocument105 pagesTLP Supplement DT June 2020-OSZamr GNo ratings yet

- QUESTION: I Own A Commercial Building Giving Me A Rent of Rs. 4 Lakhs A Month. TheDocument3 pagesQUESTION: I Own A Commercial Building Giving Me A Rent of Rs. 4 Lakhs A Month. TheCma Saurabh AroraNo ratings yet

- PenaltiesDocument21 pagesPenaltiesSivaji MotorsNo ratings yet

- TLP Supplement DT June 2019 Old SyllabusDocument60 pagesTLP Supplement DT June 2019 Old Syllabusjanardhan CA,CSNo ratings yet

- Revenue Bulletin No. 1-2003 No Ruling AreasDocument3 pagesRevenue Bulletin No. 1-2003 No Ruling AreasArianne CyrilNo ratings yet

- 2017 P T D 1372Document17 pages2017 P T D 1372Saveeza Kabsha Abbasi100% (1)

- PenaltiesDocument21 pagesPenaltiesJyoti VidhaniNo ratings yet

- High Court Reduces GST Penalty From Rs. 56,00,952 To Rs. 10000 - Taxguru - inDocument5 pagesHigh Court Reduces GST Penalty From Rs. 56,00,952 To Rs. 10000 - Taxguru - inVineet AgrawalNo ratings yet

- Circular No 984-08-2014 - 16-09-2014-Appeal-Stay-predeposit PDFDocument4 pagesCircular No 984-08-2014 - 16-09-2014-Appeal-Stay-predeposit PDFHimanshu SawNo ratings yet

- TLP Supplement DT Dec, 2019 - Old SyllabusDocument94 pagesTLP Supplement DT Dec, 2019 - Old Syllabusjanardhan CA,CSNo ratings yet

- Cir Vs CaDocument5 pagesCir Vs CaArthur John GarratonNo ratings yet

- Determination of Tax & Adjudication of Demand by Proper Officer – Section 74 of CGST Act, 2017 - Taxguru - inDocument11 pagesDetermination of Tax & Adjudication of Demand by Proper Officer – Section 74 of CGST Act, 2017 - Taxguru - inAdarsh TripathiNo ratings yet

- VAT - Qualification For Zero-Rated Sale Accenture, Inc. vs. Commissioner of Internal Revenue G.R. No. 190102 July 11, 2012Document12 pagesVAT - Qualification For Zero-Rated Sale Accenture, Inc. vs. Commissioner of Internal Revenue G.R. No. 190102 July 11, 2012Shawn JimenoNo ratings yet

- Accenture, Inc. vs. Commissioner of Internal Revenue G.R. No. 190102 July 11, 2012 VAT - Qualification For Zero-Rated SaleDocument3 pagesAccenture, Inc. vs. Commissioner of Internal Revenue G.R. No. 190102 July 11, 2012 VAT - Qualification For Zero-Rated SaleewnesssNo ratings yet

- 2023 SLD 78 (Selection of A Company For The Purpose of Audit Section 148)Document5 pages2023 SLD 78 (Selection of A Company For The Purpose of Audit Section 148)Zayn ShaukatNo ratings yet

- Income Tax 2 j2019Document50 pagesIncome Tax 2 j2019Avinash ShettyNo ratings yet

- Rmo No. 14 2021Document13 pagesRmo No. 14 2021Christine Fe BuencaminoNo ratings yet

- Submitted To Submitted by MR Mayank Shrivastava RachitaDocument6 pagesSubmitted To Submitted by MR Mayank Shrivastava RachitaRachita WaghadeNo ratings yet

- Philippine Guaranty Co Vs CIRDocument4 pagesPhilippine Guaranty Co Vs CIRJarvin David ResusNo ratings yet

- ( (2020) 122 TAX 10 (Trib.) ) - Section 111 Not Applicable To Non-ResidentDocument31 pages( (2020) 122 TAX 10 (Trib.) ) - Section 111 Not Applicable To Non-ResidentManan WarraichNo ratings yet

- PART IV Income TaxDocument9 pagesPART IV Income TaxRahil SattarNo ratings yet

- CIR v. Aichi ForgingDocument5 pagesCIR v. Aichi Forgingamareia yapNo ratings yet

- Revenue Bulletin No. 01-03Document4 pagesRevenue Bulletin No. 01-03MMNo ratings yet

- Tax CasesDocument43 pagesTax CasesArlando G. ArlandoNo ratings yet

- Adv. Mallya Oscar, F.k.... Tax LawDocument7 pagesAdv. Mallya Oscar, F.k.... Tax LawOscar MallyaNo ratings yet

- Tax AssignmentDocument6 pagesTax AssignmentRoha AyazNo ratings yet

- TDS On Salaries - Income Tax Department, INDIADocument112 pagesTDS On Salaries - Income Tax Department, INDIAArnav MendirattaNo ratings yet

- Ing V Cir FinalDocument6 pagesIng V Cir FinalTrem GallenteNo ratings yet

- Income Tax J2019Document50 pagesIncome Tax J2019Avinash ShettyNo ratings yet

- DST-CTA-gr 221655 2021Document5 pagesDST-CTA-gr 221655 2021Teresita TibayanNo ratings yet

- Income Tax AsgmentDocument9 pagesIncome Tax AsgmentPARVATHA VARTHININo ratings yet

- Reply For Hashim KhanDocument2 pagesReply For Hashim Khanhamza awan0% (1)

- Unit 18Document20 pagesUnit 18Raja SahilNo ratings yet

- Case Detail 182 Atir No Resoruce MobilizationDocument3 pagesCase Detail 182 Atir No Resoruce MobilizationFarhan JanNo ratings yet

- Merely Signing The Statement During Investigation Under Coercion and Admitting Tax Liability Not Amounts To Self-Assessment or SelfDocument5 pagesMerely Signing The Statement During Investigation Under Coercion and Admitting Tax Liability Not Amounts To Self-Assessment or SelfShrey SharmaNo ratings yet

- 2022 S C M R 1082Document2 pages2022 S C M R 1082haseeb AhsanNo ratings yet

- 2020 P T D Trib 614Document8 pages2020 P T D Trib 614haseeb AhsanNo ratings yet

- 2016 P T D 648Document4 pages2016 P T D 648haseeb AhsanNo ratings yet

- 2019 P T D 1780Document4 pages2019 P T D 1780haseeb AhsanNo ratings yet

- 2015 P T D 2287Document3 pages2015 P T D 2287haseeb AhsanNo ratings yet

- 2016 P T D (Trib.) 2675Document3 pages2016 P T D (Trib.) 2675haseeb AhsanNo ratings yet

- 2014 S C M R 907Document4 pages2014 S C M R 907haseeb AhsanNo ratings yet

- CaveatDocument4 pagesCaveatZahid HashmiNo ratings yet

- G.R. No. 80294-95Document8 pagesG.R. No. 80294-95Rose Mary G. EnanoNo ratings yet

- Caneda vs. Court of AppealDocument24 pagesCaneda vs. Court of AppealylourahNo ratings yet

- Lindain vs. CaDocument2 pagesLindain vs. CaaudreyNo ratings yet

- Nocum V TanDocument3 pagesNocum V TanLoren SeñeresNo ratings yet

- GOBINATH SINNAYA v. PP & OTHER APPEALSDocument9 pagesGOBINATH SINNAYA v. PP & OTHER APPEALSWestNo ratings yet

- LBP Vs Estate of Amado AranetaDocument39 pagesLBP Vs Estate of Amado AranetaSandy Marie DavidNo ratings yet

- Leslie Okol Vs Slimmers World PDFDocument40 pagesLeslie Okol Vs Slimmers World PDFVeronica RamosNo ratings yet

- Weingartner v. Arganosa-ManiegoDocument10 pagesWeingartner v. Arganosa-ManiegokristinevillanuevaNo ratings yet

- Vinuya V Executive Secretary RomuloDocument9 pagesVinuya V Executive Secretary RomuloJin AghamNo ratings yet

- Legal Alert - Stanbic Bank Vs Saphinah Nassanga - 3Document2 pagesLegal Alert - Stanbic Bank Vs Saphinah Nassanga - 3Isaac Christopher LubogoNo ratings yet

- Memorial For Respondent 1Document17 pagesMemorial For Respondent 1Jyoti PandeyNo ratings yet

- TORRES vs. PAGCORDocument2 pagesTORRES vs. PAGCORHarvey Leo RomanoNo ratings yet

- Nesia Vs Fermin (Scope of Consent) - Case DIgestDocument2 pagesNesia Vs Fermin (Scope of Consent) - Case DIgestAngelita Tohol MalanNo ratings yet

- System Factors Corporation Vs National Labor Relations CommissionDocument3 pagesSystem Factors Corporation Vs National Labor Relations CommissionAname BarredoNo ratings yet

- WORKMEN OF M/s FIRESTONE TYRE & RUBBER COMPANY OF INDIA (P.) LTD. v. Management & OTHERSDocument37 pagesWORKMEN OF M/s FIRESTONE TYRE & RUBBER COMPANY OF INDIA (P.) LTD. v. Management & OTHERSRanendraprataproutNo ratings yet

- Rules 45-56: SLIDES 49-96: Rule 47 Annulment of Judgments or Final Orders and ResolutionsDocument9 pagesRules 45-56: SLIDES 49-96: Rule 47 Annulment of Judgments or Final Orders and ResolutionsButternut23No ratings yet

- Heirs of Severina San Miguel vs. Court of AppealsDocument6 pagesHeirs of Severina San Miguel vs. Court of Appealsmark anthony mansuetoNo ratings yet

- Omico vs. VallejosDocument10 pagesOmico vs. VallejosAdrianne BenignoNo ratings yet

- Statutes 2022 Athelstan A4 v2.3Document38 pagesStatutes 2022 Athelstan A4 v2.3robert guiraoNo ratings yet

- Car and General Insurance Corp., Ltd. v. Jack Goldstein, and Myra Goldstein, An Infant, by Her Guardian Ad Litem, Frances Goldstein, 277 F.2d 162, 2d Cir. (1960)Document1 pageCar and General Insurance Corp., Ltd. v. Jack Goldstein, and Myra Goldstein, An Infant, by Her Guardian Ad Litem, Frances Goldstein, 277 F.2d 162, 2d Cir. (1960)Scribd Government DocsNo ratings yet

- United States Court of Appeals For The Tenth CircuitDocument7 pagesUnited States Court of Appeals For The Tenth Circuitdillon-richardsNo ratings yet

- Valley Golf v. Caram G.R. No. 158805 PDFDocument7 pagesValley Golf v. Caram G.R. No. 158805 PDFLiam LacayangaNo ratings yet

- Atuguba, The Rep. v. Dr. Kwame DuffourDocument7 pagesAtuguba, The Rep. v. Dr. Kwame DuffourBaaba enchillNo ratings yet

- Caoibes Vs CaoibesDocument5 pagesCaoibes Vs CaoibesCistron ExonNo ratings yet

- Barton V Armstrong - DuressDocument16 pagesBarton V Armstrong - DuresssoumyaNo ratings yet

- Balbir Singh Vs State of Punjab and Anr On 16 November 2015Document4 pagesBalbir Singh Vs State of Punjab and Anr On 16 November 2015Sundaram ojhaNo ratings yet