Professional Documents

Culture Documents

Planview - 7 Stages To Lean Budgeting Success

Uploaded by

Oscar Diego Loaiza AguirreOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Planview - 7 Stages To Lean Budgeting Success

Uploaded by

Oscar Diego Loaiza AguirreCopyright:

Available Formats

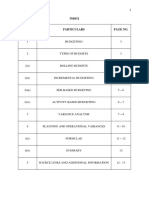

7 Stages to

Lean Budgeting Success

When implementing Lean-Agile practices at scale, organizations

quickly realize that their push for agility conflicts with traditional

budgeting and cost accounting practices. It’s not possible to truly

achieve organizational agility without evolving these practices.

That’s because funding practices – that is, the way budgets are

allocated throughout the organization – dictate nearly every

business outcome. They determine what work gets prioritized, how

teams are structured, and how impact is measured. Very little is

accomplished in an organization without the investment of time,

money, and people – so, it’s important to ensure the way funding

decisions are made aligns well with the business outcomes the

organization is trying to drive.

This is where Lean budgeting comes in. Adopting Lean-Agile

budgeting practices helps to decrease funding overhead and

friction, while maintaining financial governance, and aligning

budgeting practices with Lean-Agile goals.

In this guide, we’ll provide context for why Lean budgeting is

essential to Lean Portfolio Management, and then offer step-by-

step guidance you can use to successfully adopt Lean budgeting

practices in your own organization.

7 S TAGES TO LEAN BU DGE TIN G SUCCE SS | 2 |

The Limitations of Annual, Project-Based Budgets

In order to truly understand how Lean budgeting can help your organization, it’s helpful to first identify the limitations of traditional budgeting systems.

Funding by Project

In annual budgeting systems, funding decisions are project-based, meaning budget is allocated on

a per-project basis. Business units present their ideas to the PMO in a 6-9 month cycle to plan the

next annual year. IT provides cost and time estimates and executives prioritize funding based on

perceived value delivery. Then, teams are formed and eventually start working. With governance

tied to an approved plan, teams are incentivized to stay on track towards delivering the agreed

upon plan and are measured according to project completion and how well they are able to stay

on budget and on time.

This structure results in deep inefficiencies across the organization:

• Project-based funding requires creating detailed plans based on difficult to make projections,

which takes time and people away from actually delivering value

• Planning on an annual basis creates a state of perpetual administrative overload, which

decreases productivity, morale, and throughput

• Organizing temporary teams around projects (moving people to the work) results in less

predictable working groups and work delivery

• Because governance is tied to an approved plan, teams are incentivized to stay on budget and

on time, instead of driving actual business outcomes or increasing customer satisfaction

7 S TAGES TO LEAN BU DGE TIN G SUCCE SS | 3 |

Decision-Making and Approval Process Structure

The root of each of these issues is the way work is funded and who controls the

decision-making and approval power around funding. In traditional organizations,

this power resides with the PMO. In order to make informed decisions, the PMO

requires teams to gather requirements and data to create work plans that likely

won’t start for months. By the time the PMO receives the plan, it’s likely already out

of date.

Funding a project might require pulling from multiple cost center budgets, creating

a slow, complicated budgeting process that expects estimates, plans, and details

far before they are accurate. By the time a plan is approved, and the team begins

work, it likely already has to be updated to account for new information, changing

requirements, etc. But accounting for new information requires additional work,

meetings, and overhead – so teams are actually incentivized to not incorporate new

learnings into a revised project proposal.

Lack of Flexibility and Agility

Once budgets are approved and work is ready to start, new challenges emerge.

With project-based funding, budgets are fixed for the duration of the planned

project. These budget constraints reduce flexibility and agility, locking teams into

completing plans that may no longer be the best use of resources (time and money)

for the organization.

The people doing the work don’t have the ability to react to new information by

shifting focus and budget. In order for the team to adjust the budget, the PMO has

created heavily governed change management process to try to control the changes

in funding. In order to change the plan, they’d have to go back through a quarterly

or annual portfolio review to re-budget and re-allocate team members to the more

promising projects. Once again, the team is incentivized not to make this change –

and the organization suffers as a result.

7 S TAGES TO LEAN BU DGE TIN G SUCCE SS | 4 |

The Lean-Agile Approach to Funding and Delivery

As you can see, traditional cost accounting practices are misaligned and counterintuitive to Lean-Agile delivery. Fortunately, there is a way to maintain

financial and appropriate governance while also minimizing the overhead of traditional project-based funding and cost accounting: Lean budgeting.

In Lean budgeting, fiduciaries control spending by value stream, while teams within each value stream are empowered for rapid decision-making and

flexible value delivery. Enterprises can have the best of both worlds: a value delivery process that is far more dynamic and responsive to market needs,

as well as clear visibility to and accountability of spending.

Here are the key features that distinguish the Lean-Agile approach to funding and delivery.

Funding by Value Stream

A value stream is defined as an end-to-end business process and the associated steps an organization takes to deliver customer value, or it

may refer to a line of business that delivers value, typically a product or solution, to a customer. As organizations evolve, the shape of their

value streams often evolves. For some companies, a value stream begins as a few teams organized to deliver a set or grouping of capabilities

that satisfy a customer need. For others, it is truly the end-to-end value chain, from vision to value. Regardless of how an organization is

currently defining a value stream, the purpose of organizing by value stream is generally the same: to deliver products and solutions beyond

potentially disjointed project-based delivery. By aligning work and funding to delivery, value is created and managed more effectively.

Rather than trying to fund individual projects, the Lean approach allocates budgets to value streams, with guardrails to define spending

policies, guidelines, and practices for that portfolio (more on this later). This allows for flexibility, autonomy, and speed within each value

stream, while maintaining cohesion across the portfolio.

Long-Lived, Self-Organizing Teams

Shifting to a value stream-based funding structure means that employees aren’t shuffled around from project to project or team to team,

which is highly inefficient and detrimental to morale. Instead, they organize into self-sufficient, cross-functional teams who work together to

achieve a common goal.

Organizing into value streams allows team members to:

• Align around shared, defined goals for their value stream

• Optimize funding allocations for their value stream to deliver maximum value

• Have the autonomy to pivot at the epic level eliminating the heavy change management processes around funding impacts due to

changes in delivery (freeing up management’s time for more strategic work)

7 S TAGES TO LEAN BU DGE TIN G SUCCE SS | 5 |

Continuous Flow, Not Sequential Steps

Traditional (annual) budgeting and planning follows a linear structure, where plans are made

for the year and then executed, with checkpoints throughout the year to assess status. Success

within this sequential structure assumes conditions and information remain stable throughout

the year. However, in most industries, conditions are not stable: new information, competitors,

and business models can completely change the face of an industry within a matter of months.

In Lean-Agile organizations, work is planned, prioritized, and executed in a continuous flow.

Agile teams are always collecting data about the performance of their products and services,

as well as the market in which their customers operate. Teams, the value stream, and leadership

continuously monitor both internal and external conditions to evaluate whether the current

focus aligns with larger organizational goals. New proposals are discussed frequently, typically

in alignment with quarterly or mid-range planning cadences.

The continuous flow of Lean budgeting and planning includes space for incorporating new

data, feedback, and information, and pivoting plans accordingly. As plans are executed, more

data is collected about these and other ongoing initiatives to determine priorities for the near

and distant future.

Let’s dive into the seven continuous stages needed for Lean budgeting.

7 S TAGES TO LEAN BU DGE TIN G SUCCE SS | 6 |

7 Stages to Lean Budgeting Success

1 Define strategic organizational goals with measurable, desired results

The first step toward adopting Lean budgeting at any scale is to define strategic organizational goals and communicate these

across the organization. What specifically are you aiming to accomplish as an organization? What industries, markets, or customer

bases are you actively looking to tap into? Equally importantly – which industries, markets, or customer bases are you actively not

looking to move into? Defining these at the portfolio level (and communicating them throughout the organization) is critical for

maintaining alignment from the bottom to the top of the organization and between value streams.

2 Create Lean business cases

With goals established, you can begin planning the work needed to achieve them. Traditionally, teams use business cases to

justify and/or prove the value of a proposed project based on its expected benefits. The purpose of writing a business case is to

scope out the work so that a centralized team of decision makers can assess its value against that of other proposed projects.

Business cases include a risk/benefit analysis, expected cost, resources needed, cost of delay, potential roadblocks, and any other

(exhaustive) information that would be helpful to the decision makers within the organization.

Once approved, traditional business cases serve as a sort of ‘blueprint’ for the project. Since business cases are typically presented

and decided upon during annual planning periods, they often rely on estimates and predictions made well in advance that become

increasingly inaccurate during execution.

These types of detailed business cases aren’t necessary in Lean budgeting. As a first step toward more continuous planning cycles,

Lean-Agile organizations use Lean business cases to make investment decisions within value streams.

Rather than serving as a detailed blueprint for how to complete a project, Lean business cases are meant to articulate the expected

results of an initiative, as well as what it will take to achieve those results. Unlike traditional business cases, Lean business cases:

• Focus less on detailing work involved in an initiative, and more on providing only the sufficient information needed to make a

go/no-go decision

• Propose work to achieve desired results that can be accomplished in shorter time increments (3-6 months, not 6-12+ months)

7 S TAGES TO LEAN BU DGE TIN G SUCCE SS | 7 |

In Lean budgeting, Lean business cases are preferable to traditional business cases for two main reasons: Speed and accuracy. Lean business cases are

not centrally created and evaluated like traditional business cases, therefore, the value stream can make the decision on what to work on, when to start

the work, and other decisions related to the business cases. This means Lean business cases are less likely to become stale or inaccurate due to a faster

evaluation process and direct alignment to the value stream. As a result, the process of developing Lean business cases is inherently less wasteful.

Success with this system hinges on adapting governance at each organizational level to ensure it still fits the purpose and is appropriate: If you plan

to move to delegation of funding by value stream at the portfolio level, you need a governance process that’s appropriate for defining the size and

categorization of funding delegation or ‘buckets’, and how that information is communicated downward and outward.

At the value stream level, you need a process for prioritizing and sequencing on business case epics, the related funding allocated to the value stream,

and for holding people accountable for the outcomes within that Lean business case.

Typically, each Lean business case represents an initiative, called an epic. Epics can be a new feature or solution to an existing problem, or they can be

an architectural need or change to enable other epics to occur, called an enabler epic (for example: the implementation of a new technology required

to build a new feature in the product).

Within the value stream, teams will review the estimated ‘size’ of epics so that they can accurately prioritize and sequence epics against other priorities,

including ongoing maintenance work. There are several ways organizations can size their epics, but all share the goal of assessing urgency, value, cost

of delivery, and cost of delay to enable smarter, faster prioritization decisions.

3 Prioritize and sequence Lean business cases

Once Lean business cases and their represented epics are drafted and and practicality of various sequences. This allows them to consider

sized, they are ready for a different type of prioritization exercise. various tradeoffs involved in certain sequences and mitigate risks or

dependencies across epics.

Many organizations choose to follow a Weighted Shortest Job First, or

WSJF, approach, where the epics determined to have the highest cost Prioritizing epics in this way helps to ensure the right mix of investment

of delay for their size are completed first. This is a helpful starting place, across value streams consuming those epics, while also drastically

especially for groups and people new to Lean budgeting. speeding up the process from vision to value.

To truly optimize investments and resources throughout the portfolio,

organizations will run different scenarios to test the logistical feasibility

7 S TAGES TO LEAN BU DGE TIN G SUCCE SS | 8 |

4 Use Lean guardrails to define spending policies by value stream

As we mentioned earlier, the Lean budgeting approach allocates Guardrails help to ensure the mix of investments within and across each

budgets to value streams, with guardrails to define spending policies, value stream addresses both short-term opportunities and long-term

guidelines, and practices for that portfolio. strategy, that significant initiatives can be approved, that value and

solution integrity is optimized with respect to capacity allocation, and

Defined spending policies, guidelines, and practices across the portfolio that investments in technology, infrastructure, and maintenance aren’t

ensure the right investments are made within each budget. These routinely ignored.

guardrails are critical to success with Lean budgeting because they

provide the structure necessary to enable autonomy, both in funding and

planning work. Guardrails can include things like:

• Investment allocation guidance for a healthy mix of spend across

horizons

• Capacity allocation based on new features, enablers, and maintenance

• Guidance or process for the value streams when an initiative is

Within a value stream, Lean guardrails can help determine whether

“discovered” within the value stream

new opportunities that emerge based on customer feedback, market

changes, etc., can be prioritized or not. They also help to balance

• Shared understanding of business owners’ involvement and

capacity so value streams don’t begin work on features without planning

responsibilities to the team and vice versa

for the enablers and runway needed to complete them.

Lean guardrails also ensure business owners are actively engaged to

guide spending over time, and enable organizational leaders to gain a

clear understanding of how strategic, organizational goals are met, or

not, which can inform future investment decisions.

7 S TAGES TO LEAN BU DGE TIN G SUCCE SS | 9 |

5 Implement and/or expand Program Increment (PI) Planning

Stages 2-4 are repeated on a regular basis, contributing to the technical debt and maintenance. During the planning session, they’ll

continuous structure of Lean budgeting. Program Increment, or PI, collaborate with Product and Solution Management to ensure the work

Planning, is the culmination of each cycle of these steps and often when planned for the PI contains the right mix of investments for near-term

budgets are adjusted. opportunities, long-term strategy, and decommissioning solutions.

The purpose of PI Planning is to coordinate efforts within value streams, Teams should leave PI Planning with a clear understanding of the value

aligning groups of teams, sometimes called Agile Release Trains, to the stream’s top strategic objectives, and their role in helping to achieve

portfolio’s current strategic goals. It can help the teams within each value them, including:

stream match demand to capacity, assess funding allocation, and ensure

teams know the most valuable work to focus on. Since most PI Planning • Accepted features

sessions happen face-to-face, they’re also an outstanding time to align

Lean budgeting practices to a cycle or cadence. • New feature delivery targets

Leadership at the portfolio level plays a vital role in preparing for PI • Dependencies within and outside of the portfolio

Planning. Ahead of a planning session, leaders will pull metrics to

• Milestones

prioritize which epics to bring into PI Planning and determine funding

shifts. During PI Planning, they’ll work to ensure teams within the value • A plan for assessing progress

stream are allocating sufficient capacity for new features, enablers, and

7 S TAGES TO LEAN BU DGE TIN G SUCCE SS | 10 |

6 Monitor and measure progress (customer value)

Because progress is defined so differently in Lean budgeting, the measures used to assess

progress are different, as well. Whereas traditional accounting practices might look at

compliance with schedules, scope, and budgets as indicators of success, Lean budgeting

measures, first and foremost, value creation: How much customer value did we create during

this PI?

The OKR (Objectives and Key Results) process is one way mature Lean organizations

approach setting, communicating, and monitoring goals on a regular basis. Defining and

aligning around OKRs helps to link organizational and team goals in a hierarchical way to

measurable outcomes. Put simply, OKRs help to answer these two questions:

• Where do we want to go?

• How will we measure our work to get there?

Objectives should be: Ambitious, qualitative, actionable, and time bound. An example of a

portfolio-level Objective is:

• Improve online customer experience within the next 6 months.

Key Results should be: Measurable, quantitative, time-bound, and help to make the objective

actionable. Some examples of portfolio-level Key Results for the Objective above are:

• Reduce online support calls by 15 percent

• Increase conversion rate of website visitors to trial by 20 percent

• Better understand online customer pain points

Defining and aligning around OKRs helps to link organizational and team goals in a

hierarchical way to measurable outcomes, ultimately connecting spend to outcomes through

Lean budgeting.

7 S TAGES TO LEAN BU DGE TIN G SUCCE SS | 11 |

7 Reallocate Lean budgets iteratively

Finally, it’s important to periodically reassess how funds are allocated across

the portfolio. This process requires analysis at both the the portfolio and

value stream levels and is typically scheduled to coincide with PI Planning.

Establishing a regular cadence to assess portfolio performance, using

the OKRs set forth, and reallocate budgets accordingly is a critical part

of Lean budgeting. This creates a regular opportunity to, across the

portfolio, adjust investments in various value streams based on real-time

performance metrics:

• If your teams are seeing a lot of validation from a particular market, you

can invest more into exploring that market.

• If you are receiving a lot of negative feedback about a new feature or

service offering, you can make a decision about whether you want to

continue investing into that feature or service offering, or to reallocate

those resources towards ‘winners’.

In a traditional system, there wouldn’t be an opportunity for that team to

abandon the project until the next planning cycle, which means they’d not

only create waste by completing the project anyway, they’d also incur the

cost of delaying the next, more impactful change by months or even years.

7 S TAGES TO LEAN BU DGE TIN G SUCCE SS | 12 |

In order to evolve your business with Lean Portfolio Management (LPM), you have to evolve

your budgeting practices, as well. Lean budgeting is an approach that is a critical component

of Lean Portfolio Management, and the key to successfully change how your organization funds

the work that matters most.

These seven stages are designed to guide you toward a Lean budgeting organization. The

practices outlined in this guide will help to decrease funding overhead and friction while

maintaining financial governance within your portfolio, so that everyone can stay focused on

delivering strategic objectives and customer value.

About Planview’s Enterprise Agile Planning Solution

Planview’s Enterprise Agile Planning solution provides a scalable enterprise-level Lean Portfolio

Management, Agile Program Management, and Agile delivery platform that enables planning

and value delivery from the portfolio level to the Agile team. With transparency into how

portfolio initiatives and value streams are progressing across the business and key insight into

changes needed across financials, capacity, and delivery, the entire organization can more fluidly

shift to deliver better business outcomes.

To learn more visit the Enterprise Agile Planning solutions page at

Planview.info/eap-solution-page or watch the Enterprise Agile

Planning demo at Planview.info/eap-demo-on-demand

E B 1 41 LT REN © 2 0 2 1 P LANVIEW, INC ., ALL RIGH T S RES ER VED.

You might also like

- Zero Based BudgetingDocument10 pagesZero Based BudgetingYu-zap Mpesa OcampoNo ratings yet

- BUDGETINGDocument11 pagesBUDGETINGCeceil PajaronNo ratings yet

- LV5-1510-20-UL-SLR 1MW/ GFDI/6input/Insul - Monitor: Verdrahtungshinweise Wiring InstructionsDocument113 pagesLV5-1510-20-UL-SLR 1MW/ GFDI/6input/Insul - Monitor: Verdrahtungshinweise Wiring Instructionsedvaldo alves pintoNo ratings yet

- Math 9 Summative Test and Performance Task 1 1Document2 pagesMath 9 Summative Test and Performance Task 1 1Kira GandaNo ratings yet

- Internal Audit Process and ActivitiesDocument20 pagesInternal Audit Process and ActivitiesFreddy ReyesNo ratings yet

- PARTLIST-Benelli-Leoncino-500-Leoncino 500-Key69-D2021-12-06-02-06-23pmDocument74 pagesPARTLIST-Benelli-Leoncino-500-Leoncino 500-Key69-D2021-12-06-02-06-23pmCalidad AutomotrizNo ratings yet

- SAP Master Data Governance, Cloud Edition Trial Getting Started GuideDocument19 pagesSAP Master Data Governance, Cloud Edition Trial Getting Started GuidejeefmNo ratings yet

- Seminar On: Budget Estimate, Revised Budget and Performance Budget)Document12 pagesSeminar On: Budget Estimate, Revised Budget and Performance Budget)Reshma AnilkumarNo ratings yet

- Seminar On: Budget Estimate, Revised Budget and Performance Budget)Document12 pagesSeminar On: Budget Estimate, Revised Budget and Performance Budget)Reshma AnilkumarNo ratings yet

- Week Five: A Budget Is A ContractDocument25 pagesWeek Five: A Budget Is A ContractNizam JewelNo ratings yet

- Budgeting and Financial PlanningDocument11 pagesBudgeting and Financial PlanningMohamed Ali Jamesha100% (1)

- Lean Portfolio Management For The Enterprise WP940LTRENDocument5 pagesLean Portfolio Management For The Enterprise WP940LTRENhavendan100% (2)

- Phone Number ListDocument6 pagesPhone Number Listbadshasm776No ratings yet

- E4-E5 - Text - Chapter 4. CONVERGED PACKET BASED AGGREGATION NETWORK (CPAN)Document11 pagesE4-E5 - Text - Chapter 4. CONVERGED PACKET BASED AGGREGATION NETWORK (CPAN)nilesh_2014No ratings yet

- BUDGETINGDocument17 pagesBUDGETINGDana50% (4)

- Financial Management of Not-for-Profit Organizations: White PaperDocument9 pagesFinancial Management of Not-for-Profit Organizations: White PaperGaurav KushwahaNo ratings yet

- Budget & Budgetary Control - Sem-IDocument37 pagesBudget & Budgetary Control - Sem-Ishital_vyas19870% (1)

- BudgetingDocument26 pagesBudgetingShivendu GuptaNo ratings yet

- Astroloji Psikoloji Ve Dort Element PDFDocument208 pagesAstroloji Psikoloji Ve Dort Element PDFsibelNo ratings yet

- Lean BudgetsDocument6 pagesLean BudgetsAlexandru CiocovenaruNo ratings yet

- Zero Based BudgetingDocument10 pagesZero Based Budgetingmisbah mohamedNo ratings yet

- Budget As A Tool of MCSDocument11 pagesBudget As A Tool of MCSRenukaNo ratings yet

- BSM PG College Roorkee: Assignment On AuditingDocument42 pagesBSM PG College Roorkee: Assignment On AuditingNeeraj Singh RainaNo ratings yet

- Profit Planning or Budgeting: Control Is The Use of Budget To Control A Firm's ActivitiesDocument30 pagesProfit Planning or Budgeting: Control Is The Use of Budget To Control A Firm's ActivitiesRaven Dumlao OllerNo ratings yet

- Managing WithoutDocument27 pagesManaging WithoutNoman JamilNo ratings yet

- BUD 2242 Budgeting Small SchoolsDocument73 pagesBUD 2242 Budgeting Small SchoolsMaria Faye MarianoNo ratings yet

- Vipul2 PDFDocument39 pagesVipul2 PDFNeeraj Singh RainaNo ratings yet

- 2020 PDFDocument39 pages2020 PDFNeeraj Singh RainaNo ratings yet

- BSM PG College Roorkee: Assignment On AuditingDocument39 pagesBSM PG College Roorkee: Assignment On AuditingNeeraj Singh RainaNo ratings yet

- Budgets & Budgetary ControlDocument39 pagesBudgets & Budgetary ControlNeeraj Singh RainaNo ratings yet

- Budgeting and Planning: University Transylvania, Brasov Faculty of Economic Sciences and Business Administration 3 YearDocument11 pagesBudgeting and Planning: University Transylvania, Brasov Faculty of Economic Sciences and Business Administration 3 YearAndreea-Violeta DarnaNo ratings yet

- Pre-Read Material - Budgeting and VariancesDocument12 pagesPre-Read Material - Budgeting and Variancesankithar1110No ratings yet

- Zero BudgetDocument2 pagesZero BudgetAsif RajuNo ratings yet

- CFO Edge Traditional Budgeting Vs Beyond BudgetingDocument3 pagesCFO Edge Traditional Budgeting Vs Beyond BudgetingSong SongNo ratings yet

- Budget ControlDocument33 pagesBudget Controladnan arshadNo ratings yet

- Zero Based Budgeting SynopsisDocument12 pagesZero Based Budgeting Synopsisvava kuttyNo ratings yet

- Rolling BudgetDocument7 pagesRolling BudgetThảo Hương PhạmNo ratings yet

- A Lean Approach To Change Management: Framework For A Successful TransformationDocument4 pagesA Lean Approach To Change Management: Framework For A Successful TransformationKaranNo ratings yet

- 4 Behavioural Approaches BudgetingDocument16 pages4 Behavioural Approaches BudgetingSunny XuNo ratings yet

- Budgetary ControlDocument32 pagesBudgetary ControlanishaNo ratings yet

- Assingment Nasir Sir PDFDocument15 pagesAssingment Nasir Sir PDFSarwar Jahan TareqNo ratings yet

- Lesson 10 - Financial ManagementDocument8 pagesLesson 10 - Financial ManagementMyline GabinoNo ratings yet

- Kpi PDFDocument2 pagesKpi PDFmadelo2No ratings yet

- Resource AllocationDocument6 pagesResource AllocationaditiNo ratings yet

- Budget by ArmaanDocument37 pagesBudget by Armaansyed bilalNo ratings yet

- Lesson 10 - Financial ManagementDocument8 pagesLesson 10 - Financial ManagementLand DoranNo ratings yet

- Ma 13 TheoryDocument1 pageMa 13 TheorySai AmruthaNo ratings yet

- Budget and Budgetory Control System in HeritageDocument5 pagesBudget and Budgetory Control System in HeritagevarunNo ratings yet

- An Introduction To Evidence-Based Portfolio ManagementDocument9 pagesAn Introduction To Evidence-Based Portfolio ManagementPooyan SoltaniNo ratings yet

- What Consists A Project Master Plan? and What Are Its Elements?Document4 pagesWhat Consists A Project Master Plan? and What Are Its Elements?Rafael LopezNo ratings yet

- BUDGETING PresentationDocument6 pagesBUDGETING PresentationJandJ's Art BoxNo ratings yet

- Project Report On Reliance MutuaDocument8 pagesProject Report On Reliance MutuaPRADYUMNA .SNo ratings yet

- Financial Management PDFDocument63 pagesFinancial Management PDFAfifa RawalNo ratings yet

- The Importance of Defining A Project's ScopeDocument4 pagesThe Importance of Defining A Project's ScopeVijay KumarNo ratings yet

- 6 Zero Based BudgetDocument19 pages6 Zero Based BudgetangadsinghmalhanNo ratings yet

- Financial-Performance-Tools-1 Report 2020Document30 pagesFinancial-Performance-Tools-1 Report 2020Jason RecanaNo ratings yet

- Makalah Strategy and The Master BUDGETDocument32 pagesMakalah Strategy and The Master BUDGETlely2014No ratings yet

- The Budgeting Survival GuideDocument11 pagesThe Budgeting Survival GuideSara SyedNo ratings yet

- Q # 1. Explain How Budgetary Systems Fit Within The Performance Hierarchy?Document5 pagesQ # 1. Explain How Budgetary Systems Fit Within The Performance Hierarchy?Hammad AnwarNo ratings yet

- Discussion TopicsDocument2 pagesDiscussion TopicsDidie DiyanahNo ratings yet

- Budgeting StrategiesDocument4 pagesBudgeting StrategiesJaya ShankarNo ratings yet

- AC 312 Management Accounting I - Budgeting and Planning - Margaret Aeka ID 2270Document10 pagesAC 312 Management Accounting I - Budgeting and Planning - Margaret Aeka ID 227022700021maaeNo ratings yet

- Marshalling Resources To Support The Strategy Execution EffortDocument6 pagesMarshalling Resources To Support The Strategy Execution EffortCHRISCEL VALIENTENo ratings yet

- Best Practices: Developing BudgetsDocument6 pagesBest Practices: Developing Budgetsnavpreet singhNo ratings yet

- Budgeting: Advantages & LimitationsDocument8 pagesBudgeting: Advantages & LimitationsSrinivas R. KhodeNo ratings yet

- Zero BudgetingDocument3 pagesZero BudgetingPankaj2cNo ratings yet

- Capstone Mid-Term Assignment VarunDocument6 pagesCapstone Mid-Term Assignment Varunvarun khajuriaNo ratings yet

- Deed of DonationDocument2 pagesDeed of DonationMelvin John CabelinNo ratings yet

- Computers and Electronics in Agriculture: Konstantinos P. FerentinosDocument3 pagesComputers and Electronics in Agriculture: Konstantinos P. FerentinosCoffee pasteNo ratings yet

- Automotive Industry Job Description: Job Description of Ceo in 3 Different Sectors CeoDocument15 pagesAutomotive Industry Job Description: Job Description of Ceo in 3 Different Sectors CeoDương Thanh HuyềnNo ratings yet

- PIX System Configuration enDocument32 pagesPIX System Configuration ensani priadiNo ratings yet

- Indian Standard: Rules For Rounding Off Numerical ValuesDocument14 pagesIndian Standard: Rules For Rounding Off Numerical ValuesAvishek DeyNo ratings yet

- 4 Numerical DifferentiationDocument5 pages4 Numerical DifferentiationRumondor Kosmas VqNo ratings yet

- Service Guide 4800-723-743-783 - 784Document132 pagesService Guide 4800-723-743-783 - 784Jorge IbacetaNo ratings yet

- Fight Corona IDEAthon Case StudyDocument4 pagesFight Corona IDEAthon Case StudyDrive SynqNo ratings yet

- Captain Sim FMC TutorialDocument21 pagesCaptain Sim FMC TutorialcuriouspaxNo ratings yet

- UG0054-01 IMC-Panel-200 Operators Guide For IS750Document176 pagesUG0054-01 IMC-Panel-200 Operators Guide For IS750Ardian AriefNo ratings yet

- N2A19603 Parts Invoice RBR22M005906Document3 pagesN2A19603 Parts Invoice RBR22M005906RKNo ratings yet

- Aim - Smartycam 2.2 ManualDocument3 pagesAim - Smartycam 2.2 Manualteam unicorseNo ratings yet

- Fireeye HX Series: HX 4400, HX 4400D, HX 4402, HX 9402: Fips 140-2 Security Policy V0.5Document27 pagesFireeye HX Series: HX 4400, HX 4400D, HX 4402, HX 9402: Fips 140-2 Security Policy V0.5hbnjknwvnffkjrpaadttirvorgNo ratings yet

- Frameless Snubbing UnitDocument16 pagesFrameless Snubbing UnitDean ReinNo ratings yet

- The Courier Relic Runner Book 1 - Ernest DempseyDocument276 pagesThe Courier Relic Runner Book 1 - Ernest DempseyDirt Road CowboyNo ratings yet

- Service Quotation DZRV Radio Veritas Foundation Inc.: Human Resource Service CooperativeDocument2 pagesService Quotation DZRV Radio Veritas Foundation Inc.: Human Resource Service CooperativeKrystle Ann AguirreNo ratings yet

- Subaru EA 82 Service Manual Part 1Document200 pagesSubaru EA 82 Service Manual Part 1Philzip100% (2)

- Apps WVD Infographic The Virtual EnvironmentDocument1 pageApps WVD Infographic The Virtual EnvironmentElastic ITNo ratings yet

- Yealink W70B DECT IP Phone Release Notes of Version 85Document9 pagesYealink W70B DECT IP Phone Release Notes of Version 85tristan.zfrNo ratings yet

- TUV India Training Academy - Online Training Calendar - Uptill 3oth Sept 2023Document9 pagesTUV India Training Academy - Online Training Calendar - Uptill 3oth Sept 2023Janarthanan LaxmananNo ratings yet

- Fifa 2005 English Language Pack PDFDocument3 pagesFifa 2005 English Language Pack PDFJulieNo ratings yet

- e-ISSN: 2320-0847 p-ISSN: 2320-0936 Volume-02, Issue-12, pp-75-82Document8 pagese-ISSN: 2320-0847 p-ISSN: 2320-0936 Volume-02, Issue-12, pp-75-82AJER JOURNALNo ratings yet