Professional Documents

Culture Documents

LTA Form Block Year 2022-2025 - Keysight

Uploaded by

Tarun Jain0 ratings0% found this document useful (0 votes)

35 views2 pagesOriginal Title

LTA Form Block year 2022-2025_Keysight.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

35 views2 pagesLTA Form Block Year 2022-2025 - Keysight

Uploaded by

Tarun JainCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

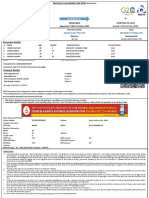

Claim for Leave Travel Allowance

4 Yrs LTA Block

For the period …26-Dec-2022… to …30-Dec-2022.… 2022 – 2025

1. Name of Employee ……………Tarun Jain………………………………Emp_Code. .……01010683.

2. Department …FBIS…………………………. Designation …………ICB Expert……………...……………..

Please mention LTA availed in

3. Period of Journey from ……26-Dec-2022………………. to ….30-Dec-2022…. Total....5 Days the current block either as Non Taxable or Taxable

Tick the BOX

4. Place/Places Visited ………………Dibrugarh………………………………………...………………...

5. Travel Started from ………Delhi……………………….. to ………………… Dibrugarh ………………

Non Taxable Taxable

6. Leave availed (Approved by HR) from …………26-Dec-2022….. to …………30-Dec-2022……..

2022 :- Y

7. Amount of L.T.A. Entitlement / Claim Rs…………………78772.54.........………….……………

8. Mode of Transport with supporting (Air/Train/Taxi) : …………Air……………………. 2023 :-

9. No of Family Members Travelled & Relations

2024 :-

Sr. No Name Relation Age

1 Tarun Jain Self 35 2025 :-

2 Sonam Jain Wife 33

3 Ayansh Jain Son 3

4 Shyam Lal Jain Father 69 As per LTA rules in a Block of 4 years.

5 Kusum Jain Mother 65

2 Yrs Non Taxable and 2 Yrs Taxable ha

It is verified that I have actually spent the above amount on journey with my family members.

(Signature of Employee) Date: ……12-03-2023……………

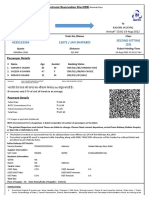

Yearly Monthly Claim-As-You-Earn for

Sl

Descriptions Maximum Maximum FBP Reimbursement Document to be submitted Rules-1 Rules-2

No.

Entitlement Entitlement Components

Only DOMESTICS Travel

allowed

Airways :- Airway ticket

along with boarding passes

are must to claim LTA Clarification regarding LTA combined

reimbursement. travelling:-

Railways :- A Travelling IF Taxi bill are submitted along with

ticket which is purchased Air/Rail tickets certain points has to be

through a railway ticketing remembered,

counter or a Eticket which is

booked through internet is > Only “source to destination” and back

required for LTA will be allowed.

reimbursement. > Local travelling, sightseeing, fooding,

lodging are NOT allowed.

Grade

Note :- Please attach any > No Multi travelling are allowed for

Based,

LTA is an exception Hotel/restaurant/toll bill to example (travelled to hometown ie

which can be paid to an support your travelling to Bangalore to Delhi and then travelling

Leave Travel Minimum 2

1 0 to 250000 employee in advance the destination you have from Delhi to Jammu and back to Delhi,

Assistance days Annual

for entitlement upto travelled.. and again travelling from Delhi to Shimla

leave to

Financial Year end. and back to Delhi..

avail LTA

> Only one trip is allowed to the last

reimb. Roadways :- Any hired

destination ie Bangalore to

Car/Taxi bill with clearly A/C First class

Jammu/Shimla and back to Bangalore

mentioning the date of fare to be

with break-journey in it..

Travel, Travelled from and calculated

> No pick-up and drop taxi bill are

to place, KM's travelled. based on the

allowed ie (home to railway

KM's

station/airport and vice-sa-versa)

Note :- Please attach any travelled, no

> To support your travelling any

Hotel/restaurant/toll bill to Flat amount

Hotel/Restaurant/toll bill has to be

support your travelling to will be

submitted along with the taxi bill

the destination you have approved.

submitted.

travelled..

You might also like

- Adobe Scan 06-Mar-2024Document14 pagesAdobe Scan 06-Mar-2024abhineshNo ratings yet

- Brajesh Kumar TA - 05 - 08 - 22Document3 pagesBrajesh Kumar TA - 05 - 08 - 22Sandeep BoraNo ratings yet

- Leave Travel Concession Bill Part-A: Form T.R.25C (LTC)Document3 pagesLeave Travel Concession Bill Part-A: Form T.R.25C (LTC)Kishor Kumar JhaNo ratings yet

- Dli PTK Exp Second Sitting (2S)Document2 pagesDli PTK Exp Second Sitting (2S)Akshay KumarNo ratings yet

- Rail NR7516473467434884Document2 pagesRail NR7516473467434884PREET SINGH KUNDLASNo ratings yet

- Gmail - Booking Confirmation On IRCTC, Train - 13186, 19-Dec-2021, 2S, MBI - SDAHDocument1 pageGmail - Booking Confirmation On IRCTC, Train - 13186, 19-Dec-2021, 2S, MBI - SDAHMukesh MistriNo ratings yet

- Irctcs E-Ticketing Service Electronic Cancellation Slip (Personal User)Document2 pagesIrctcs E-Ticketing Service Electronic Cancellation Slip (Personal User)Mr. RAJASEKHARNo ratings yet

- Train Tickrt Sreen ShotDocument2 pagesTrain Tickrt Sreen ShotBibinNo ratings yet

- TA Form With InstructionsDocument5 pagesTA Form With InstructionsJal AgrawalNo ratings yet

- Shane Punjab Second Sitting (2S)Document2 pagesShane Punjab Second Sitting (2S)Akshay KumarNo ratings yet

- GOFLDSTMOB5D1PEH7035 ETicketDocument4 pagesGOFLDSTMOB5D1PEH7035 ETicketTarunay DayalNo ratings yet

- TicketDocument2 pagesTicketshubham agarwalNo ratings yet

- IRCTC E-Ticketing ServiceDocument3 pagesIRCTC E-Ticketing ServiceAman AliNo ratings yet

- Fshbro: Eticket Itinerary / ReceiptDocument3 pagesFshbro: Eticket Itinerary / ReceiptAnkit KanojiaNo ratings yet

- FWD: Booking Confirmation On IRCTC, Train: 22534, 16-Dec-2021, 3A, SC - ASHDocument1 pageFWD: Booking Confirmation On IRCTC, Train: 22534, 16-Dec-2021, 3A, SC - ASHbatticaloa bdeNo ratings yet

- LTA Guidelines and FAQ DocumentDocument3 pagesLTA Guidelines and FAQ DocumentdsdsNo ratings yet

- Office Copy: GAR-14C TR-25C Leave Travel Concession Bill For The Block of Year . To .Document3 pagesOffice Copy: GAR-14C TR-25C Leave Travel Concession Bill For The Block of Year . To .SouravNo ratings yet

- TA Bill FormatDocument4 pagesTA Bill FormatBikee Yadav100% (1)

- Irctcs E-Ticketing Service Electronic Cancellation Slip (Personal User)Document2 pagesIrctcs E-Ticketing Service Electronic Cancellation Slip (Personal User)Kanishka MandalNo ratings yet

- Refund 2Document2 pagesRefund 2Kanishka MandalNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document2 pagesIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Indra MishraNo ratings yet

- Confirmed: Booking Type Defence FareDocument2 pagesConfirmed: Booking Type Defence Faremanoj salameNo ratings yet

- Babu Prem Itinerary DetailsDocument4 pagesBabu Prem Itinerary DetailsGiri BabuNo ratings yet

- VR6CMKDocument2 pagesVR6CMKrahulthakur290496No ratings yet

- Air Ticket Booking - Book Flight Tickets - Cheap Air Fare - LTC Fare - IRCTC AIRDocument1 pageAir Ticket Booking - Book Flight Tickets - Cheap Air Fare - LTC Fare - IRCTC AIRchakri278No ratings yet

- Irctcs Ticketing Service Electronic Slip (Personal) : e Reservation UserDocument2 pagesIrctcs Ticketing Service Electronic Slip (Personal) : e Reservation Userjeet.ghosh07No ratings yet

- Https Book - Spicejet.com ItineraryPrint - AspxDocument4 pagesHttps Book - Spicejet.com ItineraryPrint - AspxSohrab ChoudharyNo ratings yet

- Inclusive of GST - # Convenience Fee Per E-Ticket Irrespective of Number of Passengers On The TicketDocument2 pagesInclusive of GST - # Convenience Fee Per E-Ticket Irrespective of Number of Passengers On The TicketJagjiv VermaNo ratings yet

- Transaction Id: Booking Date & Time:: Please See Section Below For IRCTC Terms and ConditionDocument2 pagesTransaction Id: Booking Date & Time:: Please See Section Below For IRCTC Terms and ConditionTravellers SoulNo ratings yet

- Trips Flight DownloadETicketDocument2 pagesTrips Flight DownloadETicketAnkit RathiNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Abhishek MishraNo ratings yet

- COK-SHJ Air-Arabia Sony SebastianDocument2 pagesCOK-SHJ Air-Arabia Sony SebastianArshad100% (1)

- Ticket 4 49186002 28085206Document2 pagesTicket 4 49186002 28085206RohitNo ratings yet

- GZB To DDNDocument2 pagesGZB To DDNAryan AsijaNo ratings yet

- Bui To NdlsDocument2 pagesBui To NdlsGolu BhaiNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document2 pagesIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)SAHELI TOUR & TRAVELSNo ratings yet

- Uttarakhand Transport Corporation E-Ticket: Fare DetailDocument1 pageUttarakhand Transport Corporation E-Ticket: Fare DetailTarun KumarNo ratings yet

- Subject: Booking Confirmation On IRCTC, Train: 02617, 23-Dec-2021, SL, Majn - NKDocument1 pageSubject: Booking Confirmation On IRCTC, Train: 02617, 23-Dec-2021, SL, Majn - NKPrabhav ShenoyNo ratings yet

- Zubair Bhai TicketDocument3 pagesZubair Bhai TicketshakeelahmadjsrNo ratings yet

- TA Bill From 040320 To 070320Document2 pagesTA Bill From 040320 To 070320Ankit KhuranaNo ratings yet

- Bam-Hwh D TiwariDocument3 pagesBam-Hwh D TiwariBiswjit DeyNo ratings yet

- Untitled DocumentDocument3 pagesUntitled DocumentDaksh mathurNo ratings yet

- List of AssociationDocument3 pagesList of AssociationRakesh JainNo ratings yet

- Awb To Kyn 2Document2 pagesAwb To Kyn 2salim shaikhNo ratings yet

- Delhi To MotihariDocument1 pageDelhi To MotihariAryan PrabhakarNo ratings yet

- Jasidh PanbeDocument2 pagesJasidh PanbeSANDEEP SINGHNo ratings yet

- Ndls CoimbtoreDocument3 pagesNdls CoimbtorePawan MadhesiyaNo ratings yet

- Rahul 24 12 Pryj STDocument1 pageRahul 24 12 Pryj STMohit LahotiNo ratings yet

- NDLS HWDocument2 pagesNDLS HWAnkit KanojiyaNo ratings yet

- Gar 14a LegalDocument4 pagesGar 14a LegalpumkhawpauvaNo ratings yet

- Gmail - FWD - Booking Confirmation On IRCTC, Train - 19037, 20-Jun-2022, SL, AF - BMKIDocument2 pagesGmail - FWD - Booking Confirmation On IRCTC, Train - 19037, 20-Jun-2022, SL, AF - BMKIkumarsuraj04122004No ratings yet

- Train CancellationDocument3 pagesTrain CancellationVaibhav NarulaNo ratings yet

- Uttarakhand Transport Corporation E-Ticket: Fare DetailDocument1 pageUttarakhand Transport Corporation E-Ticket: Fare DetailTarun KumarNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Nk SinghNo ratings yet

- GoAir - YAShDocument2 pagesGoAir - YAShakash agarwalNo ratings yet

- Shi0838126 - Ramasamy KarthiDocument9 pagesShi0838126 - Ramasamy Karthisyahmi.ramzi09No ratings yet

- Trips FlightDocument3 pagesTrips FlightSouvik DasNo ratings yet

- Modify ItineraryDocument4 pagesModify ItinerarySarvesh GulguliaNo ratings yet

- Gmail - Booking Confirmation On IRCTC, Train - 15009, 11-Sep-2022, SL, TLR - SDDocument1 pageGmail - Booking Confirmation On IRCTC, Train - 15009, 11-Sep-2022, SL, TLR - SDAttɩtʋɗe Boƴ YʌɗʌvNo ratings yet

- Booking Invoice - M06AI22I03013031 PDFDocument2 pagesBooking Invoice - M06AI22I03013031 PDFTarun JainNo ratings yet

- Oracle India LocalizationDocument77 pagesOracle India Localizationanitlin_jinish50% (2)

- Booking Invoice - M06AI22I03013031Document2 pagesBooking Invoice - M06AI22I03013031Tarun JainNo ratings yet

- Oracle India LocalizationDocument77 pagesOracle India Localizationanitlin_jinish50% (2)

- Service Tax 1211454372Document25 pagesService Tax 1211454372tirumalr_1No ratings yet

- EBT Implementation ConsiderationsDocument45 pagesEBT Implementation ConsiderationsTarun JainNo ratings yet

- Chapter 15 - CCS Pension Rules 1972Document13 pagesChapter 15 - CCS Pension Rules 1972palfootNo ratings yet

- Chapter 15 - CCS Pension Rules 1972Document13 pagesChapter 15 - CCS Pension Rules 1972palfootNo ratings yet

- Thoughts For Every DayDocument367 pagesThoughts For Every DayTapan Maru100% (6)

- Chapter 15 - CCS Pension Rules 1972Document13 pagesChapter 15 - CCS Pension Rules 1972palfootNo ratings yet

- How To Create A Manual Transaction and Pay Commission in Oracle Incentive Compensation Release 12 (ID 1248974.1)Document6 pagesHow To Create A Manual Transaction and Pay Commission in Oracle Incentive Compensation Release 12 (ID 1248974.1)Tarun JainNo ratings yet

- AR Reconciliation ReportDocument2 pagesAR Reconciliation ReportTarun JainNo ratings yet

- XMLWP12Document10 pagesXMLWP12Tarun JainNo ratings yet

- Tips and Techniques: O A U GDocument9 pagesTips and Techniques: O A U GTarun JainNo ratings yet

- Asean Quiz 2Document10 pagesAsean Quiz 2Jandej PookwangNo ratings yet

- Analysis On Philippine TaxationDocument4 pagesAnalysis On Philippine TaxationAngelica ElboNo ratings yet

- Economic Drain PRCDocument48 pagesEconomic Drain PRCSubhadip Saha ChowdhuryNo ratings yet

- Shipping OrderDocument7 pagesShipping OrdersentyNo ratings yet

- Blockchain Explained What It Is and IsntDocument13 pagesBlockchain Explained What It Is and IsntJulia Magnolia MicaelaNo ratings yet

- 15.05.2023 Cause List C - IiDocument6 pages15.05.2023 Cause List C - IiPranay ChauguleNo ratings yet

- Building Brand ArchitectureDocument4 pagesBuilding Brand ArchitectureArkabh Mitra0% (1)

- British Pound SterlingDocument2 pagesBritish Pound SterlingAsir Awsaf AliNo ratings yet

- MPSC State Service Preliminary Exam 2018 Paper 1@govnokri - in PDFDocument44 pagesMPSC State Service Preliminary Exam 2018 Paper 1@govnokri - in PDFShwetaNo ratings yet

- Canara Bank Reported A Robust Jump in Net Profit at Rs 899 Crore For The QuarterDocument6 pagesCanara Bank Reported A Robust Jump in Net Profit at Rs 899 Crore For The QuarterRahul RajNo ratings yet

- Pilipinas Shell Petroleum Corpo RationDocument12 pagesPilipinas Shell Petroleum Corpo RationCario Mary Cris DaanoyNo ratings yet

- Chandigarh University Department of CommerceDocument12 pagesChandigarh University Department of CommerceMs TNo ratings yet

- CTM WheatDocument10 pagesCTM WheatVini GoelNo ratings yet

- Sole Trader A4 FDocument81 pagesSole Trader A4 FalizaNo ratings yet

- Feeder Pillar EnclosureDocument16 pagesFeeder Pillar EnclosureAndrei Horhoianu0% (1)

- Warren Buffet Powerpoint Presentation PDF FreeDocument7 pagesWarren Buffet Powerpoint Presentation PDF FreeHeeba jeeNo ratings yet

- JSW Steel - WikipediaDocument28 pagesJSW Steel - WikipediaPawan SrivastavaNo ratings yet

- Solicitation Letter For Fiesta 2014Document1 pageSolicitation Letter For Fiesta 2014MJ Villamor Aquillo93% (30)

- 1.2 Types of OrganziationDocument7 pages1.2 Types of OrganziationSovannNo ratings yet

- Elements of Mineral Resource Engineering: Dr. Muhammad NadeemDocument27 pagesElements of Mineral Resource Engineering: Dr. Muhammad NadeemHaseeb AhmedNo ratings yet

- Lecture 5: Inflation: Engineering EconomyDocument37 pagesLecture 5: Inflation: Engineering EconomyQed VioNo ratings yet

- Market Leader Test 2Document2 pagesMarket Leader Test 2Deniss De AnissNo ratings yet

- Buku Energi Outlook 2022 Versi Bhs InggrisDocument132 pagesBuku Energi Outlook 2022 Versi Bhs InggrisHaryo Pandu WinotoNo ratings yet

- MAKIBEEDocument12 pagesMAKIBEEIndra J MerkuriusNo ratings yet

- Approved List of Securities at Zerodha.Document204 pagesApproved List of Securities at Zerodha.Hemanth ReddyNo ratings yet

- Price Action Simplified by EmzetDocument25 pagesPrice Action Simplified by EmzetEmzet PremiseNo ratings yet

- Political IdeologiesDocument135 pagesPolitical IdeologiesJohn Lawrence PeñalbaNo ratings yet

- THE European Union: HistoryDocument4 pagesTHE European Union: HistoryGoussot LylouNo ratings yet

- Course Title: College of CommerceDocument6 pagesCourse Title: College of CommerceCJ GranadaNo ratings yet

- Open Economy Macroeconomics (PDFDrive)Document399 pagesOpen Economy Macroeconomics (PDFDrive)Karya BangunanNo ratings yet