Professional Documents

Culture Documents

Notes On Company Accounts

Uploaded by

tahreemOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

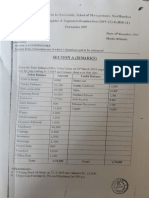

Notes On Company Accounts

Uploaded by

tahreemCopyright:

Available Formats

Introduction to Company Accounts

Company by the virtue of Law of the state is a separate legal entity.

Companies normally have limited liability

Companies issues capital in the form of Shares (Ordinary / Common and Preference)

Owners and Management may be different in which case it will be and Agent / Principal

relationship

Liability of the all shareholders will be limited to their capital, any liability which stays unpaid

due to in sufficient funds / asset by company will be a loss for creditors

Companies can distribute profit through dividend and bonus share

To issue shares company needs to get approval from the concerned authority which will

approve and allow a specific authorized capital mentioning number of shares and base price per

share

Authorized share capital can be further increased if needed

No of shares issued by a company are called issued shares

If shares are issued over and above base price the same is termed as share premium

Companies could be public or private and Profit or non profit organization

Further Share Issue

1. Right Issue : this is just like a normal share issue this is done in proportion to previous holding ratio

Entry Made:

Bank Dr (Total amount received)

Share Capital Cr (Only by face Value)

Share Premium Cr (amount over and above face value)

2. Bonus Issue: Share are distributed to existing share holders In their holding ratios

Entry Made:

Reserve (Capital / Revenue) Dr – Face Value

Share Capital (Cr) Face Value

Similarly, Shares can also be redeemed if are redeemable:

For Redemption of Shares Capital Redemption reserve is required to be made equivalent to Share Face

Value for the protection of creditors.

Shares Preference or Ordinary redeemable shares can also be redeemed at premium. In this case

premium if originally received can be adjusted from share premium account any excess amount to be

adjusted from P & L Account.

Reconstruction of Shares:

If the company has negative reserve they cannot issue dividends, so at times when company is

restructuring itself and looking forward for a new startup can go for a reconstruction where in all

negative reserves are adjusted against capital reduction in face value to clear negative reserve allowing

future profit to be distributed if available.

You might also like

- Dividend Investing for Beginners & DummiesFrom EverandDividend Investing for Beginners & DummiesRating: 5 out of 5 stars5/5 (1)

- Board Question Paper BKDocument27 pagesBoard Question Paper BK9137373282abcd100% (1)

- Chapter 12 Share CapitalDocument42 pagesChapter 12 Share CapitalOmer UddinNo ratings yet

- Shares and DividendsDocument4 pagesShares and Dividendsricha_saini1953% (17)

- Excel Formulas For Accounting and FinanceDocument7 pagesExcel Formulas For Accounting and FinanceJenina Rose SalvadorNo ratings yet

- Soal 1 (LO3 10%) : Tugas Personal Ke-2 Week 7Document16 pagesSoal 1 (LO3 10%) : Tugas Personal Ke-2 Week 7Nadilla Nur100% (2)

- Instant Download Ebook PDF Financial Accounting 9th Edition by Craig Deegan PDF ScribdDocument41 pagesInstant Download Ebook PDF Financial Accounting 9th Edition by Craig Deegan PDF Scribdrobert.gourley48695% (37)

- PPT9-Changes in Ownership InterestDocument32 pagesPPT9-Changes in Ownership InterestRifdah SaphiraNo ratings yet

- Additional Paid-In CapitalDocument5 pagesAdditional Paid-In CapitalBR Lake City LHRNo ratings yet

- Extra Reading Lecture 02Document17 pagesExtra Reading Lecture 02iragouldNo ratings yet

- Fa Unit 4Document13 pagesFa Unit 4VTNo ratings yet

- Financed by LectureDocument5 pagesFinanced by LectureEng Abdikarim WalhadNo ratings yet

- Company Share Capital 2020Document26 pagesCompany Share Capital 2020Levin makokhaNo ratings yet

- Capital Refers To The Amount Invested in The Company So That It Can Carry On Its ActivitiesDocument3 pagesCapital Refers To The Amount Invested in The Company So That It Can Carry On Its ActivitiesSheBZzSEkhNo ratings yet

- STLT Finance 3 - Equity MarketsDocument10 pagesSTLT Finance 3 - Equity MarketsHanae ElNo ratings yet

- 11 CA Foundation Accounts Introduction To Company Accounts WithoutDocument45 pages11 CA Foundation Accounts Introduction To Company Accounts Withoutbhawanar3950No ratings yet

- Final AssignmentDocument51 pagesFinal AssignmentNaveeda RiazNo ratings yet

- Share CapitalDocument8 pagesShare Capitalyash chouhanNo ratings yet

- Bonus Share and Right IssueDocument5 pagesBonus Share and Right IssueNiketa SharmaNo ratings yet

- Corporate Finance - Aaqib NazimuddinDocument10 pagesCorporate Finance - Aaqib NazimuddinAaqib ChaturbhaiNo ratings yet

- Bus 143 (1) The Need For CapitalDocument33 pagesBus 143 (1) The Need For CapitalItsme ShemNo ratings yet

- Shares:: Why Are Shares Issued?Document7 pagesShares:: Why Are Shares Issued?Muhammad TalhaNo ratings yet

- Acctng 15Document1 pageAcctng 15Franzane Daphnie QuitorianoNo ratings yet

- Advanced AccountingDocument70 pagesAdvanced AccountingNasrudin Mohamed AhmedNo ratings yet

- Stocks and Their ValuationDocument20 pagesStocks and Their ValuationRajiv LamichhaneNo ratings yet

- Common Stock and Preffered Stock1Document5 pagesCommon Stock and Preffered Stock1mengistuNo ratings yet

- Financial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120Document5 pagesFinancial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120wajid2345No ratings yet

- Company Accounts Notes - CA Anand BhangariyaDocument17 pagesCompany Accounts Notes - CA Anand BhangariyaAagam ShahNo ratings yet

- Meaning: Asset Company Call Shares Money Creditor Interest Ordinary Shares Means Share Profits ReturnsDocument10 pagesMeaning: Asset Company Call Shares Money Creditor Interest Ordinary Shares Means Share Profits ReturnskhuushbuNo ratings yet

- Unit 4 - Company Accounts Lecture NotesDocument12 pagesUnit 4 - Company Accounts Lecture NotesTan TaylorNo ratings yet

- PM AssignmentDocument22 pagesPM AssignmentEmuyeNo ratings yet

- Introduction To SHARESDocument6 pagesIntroduction To SHARESShristi thakurNo ratings yet

- Difference Between Bonus Shares and Right SharesDocument9 pagesDifference Between Bonus Shares and Right SharesFaizanNo ratings yet

- Equity Share and Its TypesDocument4 pagesEquity Share and Its TypeslakshmibabymaniNo ratings yet

- BA II Notes UCU Jan 2020 Vol 2-1Document16 pagesBA II Notes UCU Jan 2020 Vol 2-1kasumbajohndavis2No ratings yet

- Equity - The Accounting Equation For Every BusinessDocument5 pagesEquity - The Accounting Equation For Every BusinessSarah Del RosarioNo ratings yet

- Company Law Assignment: Submitted To: Miss Divya VermaDocument14 pagesCompany Law Assignment: Submitted To: Miss Divya Vermaharsh mittalNo ratings yet

- HSC SP Q.8. Answer The FollowingDocument11 pagesHSC SP Q.8. Answer The FollowingTanya SinghNo ratings yet

- Legal Aspect of Business AssignmentDocument25 pagesLegal Aspect of Business AssignmentUBSHimanshu KumarNo ratings yet

- Assignment For FmsDocument4 pagesAssignment For FmsSouvik PurkayasthaNo ratings yet

- Preference SharesDocument5 pagesPreference ShareshasnaglowNo ratings yet

- Introduction To Issue Forfeiture and Reissue of SharesDocument37 pagesIntroduction To Issue Forfeiture and Reissue of SharesRkenterpriseNo ratings yet

- Shares: Presentation BY Mahender VijaypalDocument24 pagesShares: Presentation BY Mahender VijaypalHemant AgarwalNo ratings yet

- Advantages and Disadvantages of Preferred StockDocument5 pagesAdvantages and Disadvantages of Preferred StockVaibhav Rolihan100% (2)

- Corporate Accounting Theory For First Unit-2Document9 pagesCorporate Accounting Theory For First Unit-2Rigved PrasadNo ratings yet

- AC Theory - Pref Share, Valuation, CR, AmalgamationDocument8 pagesAC Theory - Pref Share, Valuation, CR, Amalgamationjimmyadamskl69No ratings yet

- Cbi 01 MFS PPT2Document18 pagesCbi 01 MFS PPT2rishi raj modiNo ratings yet

- Chapter 7 - Sources of FinanceDocument12 pagesChapter 7 - Sources of FinanceSai SantoshNo ratings yet

- Sources of FinanceDocument6 pagesSources of FinanceNeesha NazNo ratings yet

- Share CapitalDocument4 pagesShare Capital20AH419 Talukdar DebanjanaNo ratings yet

- Chapter 3 PDFDocument24 pagesChapter 3 PDFCarlos PadillaNo ratings yet

- Share, Capital & BorrowingDocument26 pagesShare, Capital & BorrowingshahneelahmedNo ratings yet

- Chapter 2: Companies: 1. The Memorandum of AssociationDocument7 pagesChapter 2: Companies: 1. The Memorandum of AssociationZac Half-eye MehdidNo ratings yet

- SHAREHOLDERS EQUITY RevisedDocument5 pagesSHAREHOLDERS EQUITY Revisedemail i can't sendNo ratings yet

- Share CapitalDocument17 pagesShare Capitalzydeco.14No ratings yet

- Chapter 17 1Document26 pagesChapter 17 1Diệu Linh NguyễnNo ratings yet

- Vishi ProjectDocument36 pagesVishi Projectparmindersingh072No ratings yet

- Name - Shreeyash Nitin Temkar Class - Tybba ROLL NO - 8144 Topic - Equity Shares Subject - Financial ManagementDocument7 pagesName - Shreeyash Nitin Temkar Class - Tybba ROLL NO - 8144 Topic - Equity Shares Subject - Financial ManagementShreeyash TemkarNo ratings yet

- Company Accounts-Updated-1Document44 pagesCompany Accounts-Updated-1cleophacerevivalNo ratings yet

- P-2 TheoryDocument72 pagesP-2 TheoryUdayan KachchhyNo ratings yet

- Introduction To Company AccountingDocument19 pagesIntroduction To Company AccountingIsra GhousNo ratings yet

- Sourcing Money May Be Done For A Variety of ReasonsDocument24 pagesSourcing Money May Be Done For A Variety of ReasonsFelix Amirth RajNo ratings yet

- Equity and LiabilitiesDocument11 pagesEquity and LiabilitiesLaston MilanziNo ratings yet

- Chapter 10 Shareholders EquityDocument10 pagesChapter 10 Shareholders EquityMarine De CocquéauNo ratings yet

- CH 6Document91 pagesCH 6EyobedNo ratings yet

- Company Accounts Practice Questions - Nov 2, 2020Document8 pagesCompany Accounts Practice Questions - Nov 2, 2020tahreemNo ratings yet

- Partnership - Lecture Sep 23, 2020Document2 pagesPartnership - Lecture Sep 23, 2020tahreemNo ratings yet

- AA - 2023 3 Planning and MaterialityDocument19 pagesAA - 2023 3 Planning and MaterialitytahreemNo ratings yet

- AA - 2023 7.1 Professional EthicsDocument12 pagesAA - 2023 7.1 Professional EthicstahreemNo ratings yet

- Chapter 3 - Formation of The CompanyDocument12 pagesChapter 3 - Formation of The CompanytahreemNo ratings yet

- AA - 2023 11 Professional EthicsDocument13 pagesAA - 2023 11 Professional EthicstahreemNo ratings yet

- Current RatioDocument19 pagesCurrent Ratiotahreem100% (1)

- January Bank StatementDocument8 pagesJanuary Bank StatementYoel CabreraNo ratings yet

- Accounts Xerox Wala Question Paper 08-Jan-2022Document16 pagesAccounts Xerox Wala Question Paper 08-Jan-2022Aquila GodaboleNo ratings yet

- Finance FirmsDocument2 pagesFinance FirmsjyguygNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- Be 313 - Week 4-5 - Unit Learning CDocument32 pagesBe 313 - Week 4-5 - Unit Learning Cmhel cabigonNo ratings yet

- Unggul Indah Cahaya - Bilingual - 31 - Des - 2017 - Released - RevisiDocument125 pagesUnggul Indah Cahaya - Bilingual - 31 - Des - 2017 - Released - Revisiwr KheruNo ratings yet

- Abfm CH 25 Full PDF (No Video) - 19592914 - 2023 - 06 - 05 - 21 - 50Document31 pagesAbfm CH 25 Full PDF (No Video) - 19592914 - 2023 - 06 - 05 - 21 - 50gurugulab8876No ratings yet

- M Arkan Hafidz - 2602297301 - Assignment Week 2Document6 pagesM Arkan Hafidz - 2602297301 - Assignment Week 2Arkan HafidzNo ratings yet

- Temp Statement RFBX 7836 Akun DemoDocument2 pagesTemp Statement RFBX 7836 Akun DemoFebbyNo ratings yet

- Mid Term PPT - Bhavesh Rathod BMS2199Document8 pagesMid Term PPT - Bhavesh Rathod BMS2199bnrathod0902No ratings yet

- Reviewer For CpaleDocument41 pagesReviewer For Cpalehello kitty black and whiteNo ratings yet

- Solution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFDocument30 pagesSolution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFtiffany.kunst387100% (12)

- Private Equity in IndiaDocument10 pagesPrivate Equity in IndiaAmar KashyapNo ratings yet

- Verification of Assets and LiabilitiesDocument51 pagesVerification of Assets and Liabilitiessherly joiceNo ratings yet

- FR 2 New Question PaperDocument9 pagesFR 2 New Question Paperneha manglaniNo ratings yet

- Transaction History - IB Payroll3269 - 592023195937Document4 pagesTransaction History - IB Payroll3269 - 592023195937Satria NugrahaNo ratings yet

- Class Practice Question-PPEDocument3 pagesClass Practice Question-PPEAmanda KatsioNo ratings yet

- Company Law Cheat SheetDocument21 pagesCompany Law Cheat SheetAdarsh RamisettyNo ratings yet

- UNIT II PPT - Venture CapitalDocument28 pagesUNIT II PPT - Venture CapitalShivam Goel100% (1)

- 1st Activity in ACCA104Document11 pages1st Activity in ACCA104John Rey BonitNo ratings yet

- MS11 - Capital BudgetingDocument8 pagesMS11 - Capital BudgetingElsie GenovaNo ratings yet

- Financial Statement of Sole Proprietorship (Final Ac)Document16 pagesFinancial Statement of Sole Proprietorship (Final Ac)centmusic8No ratings yet

- Class-12-Accountancy-Part-2-Chapter-6 SolutionsDocument41 pagesClass-12-Accountancy-Part-2-Chapter-6 Solutionssugapratha lingamNo ratings yet

- TESTDocument3 pagesTESTjoker mcNo ratings yet

- Solutions Manual: Introducing Corporate Finance 2eDocument16 pagesSolutions Manual: Introducing Corporate Finance 2ePaul Sau HutaNo ratings yet