Professional Documents

Culture Documents

Dghhu

Uploaded by

LOUIEVIE MAY SAJULGAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dghhu

Uploaded by

LOUIEVIE MAY SAJULGACopyright:

Available Formats

lOMoAR cPSD| 22592286

Others WALK IN Norsu MAS Finals 14 x11 Financial Management B Working Capital Management

Bachelor of sscience in Civil Engineering (Negros Oriental State University)

Studocu is not sponsored or endorsed by any college or university

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

Financial Management

(B. Working Capital

B. WORKING CAPITAL MANAGEMENT Management)

THEORIES:

Working capital management

1. Working capital management involves investment and financing decisions related to:

A. plant and equipment and current liabilities.

B. current assets and capital structure.

C. current assets and current liabilities.

D. sales and credit.

17. The goal of managing working capital, such as inventory, should be to minimize the:

A. costs of carrying inventory

B. opportunity cost of capital

C. aggregate of carrying and shortage costs

D. amount of spoilage or pilferage

Working capital financing policy

Aggressive

5. Zap Company follows an aggressive financing policy in its working capital management while Zing Corporation follows a conservative financing policy.

Which one of the following statements is correct?

A. Zap has low ratio of short-term debt to total debt while Zing has a high ratio of short-term debt to total debt.

B. Zap has a low current ratio while Zing has a high current ratio.

C. Zap has less liquidity risk while Zing has more liquidity risk.

D. Zap finances short-term assets with long-term debt while Zing finances short-term assets with short-term debt.

6. Which of the following would increase risk?

A. Raise the level of working capital.

B. Decrease the amount of inventory by formulating an effective inventory policy.

C. Increase the amount of short-term borrowing.

D. Increase the amount of equity financing.

Conservative

2. As a company becomes more conservative with respect to working capital policy, it would tend to have a(n)

A. Increase in the ratio of current liabilities to noncurrent liabilities.

B. Increase in the operating cycle.

C. Decrease in the operating cycle.

D. Increase in the ratio of current assets to current liabilities.

Moderate

3. Short-term financing plans with high liquidity have:

A. high return and high risk

B. moderate return and moderate risk

C. low profit and low risk

D. none of the above

Temporary & Permanent working capital

4. Temporary working capital supports

A. the cash needs of the company. C. acquisition of capital equipment.

B. payment of long term debt. D. seasonal peaks.

Cash Management

Motives for holding cash

7. The transaction motive for holding cash is for:

A. a safety cushion C. compensating balance requirements

B. daily operating requirements D. none of the above

Float

8. The difference between the cash balance on the firm's books and the balance shown o

636

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

Financial Management

(B. Working Capital

Management)

the bank statement is called:

A, the compensating balance C. a safety cushion

B. float D. none of the above

Cash conversion cycle

9. The length of time between payment for inventory and the collection of cash is referred to as:

A. payables deferral period C. operating cycle

B. receivables conversion period D. cash conversion cycle

10.As a firm's cash conversion cycle increases, the firm:

A. becomes less profitable

B. increases its investment in working capital

C. reduces its accounts payable period

D. incurs more shortage costs

11.The longer the firm's accounts payable period, the:

A. longer the firm's cash conversion cycle is.

B. shorter the firm's inventory period is.

C. more the delay in the accounts receivable period.

D. less the firm must invest in working capital.

12.The average length of time a peso is tied up in current asset is called the:

A. net working capital. C. receivables conversion period.

B. inventory conversion period. D. cash conversion period.

Receivables management

13.All of these factors are used in credit policy administration except:

A. credit standards C. peso amount of receivables

B. terms of trade D. collection policy

14.Which of the following statements is most correct? If a company lowers its DSO, but no changes occur in sales or operating costs, then:

A. the company might well end up with a higher debt ratio.

B. the company might well end up with a lower debt ratio.

C. the company would probably end up with a higher ROE.

D. the company's total asset turnover ratio would probably decline.

15.All but which of the following is considered in determining credit policy?

A. Credit standards C. Accounts payable deferral period

B. Credit limits D. Collection efforts

Inventory management

16.The use of safety stock by a firm will:

A. reduce inventory costs C. have no effect on inventory costs

B. increase inventory costs D. none of the above

18. When a specified level of safety stock is carried for an item in inventory, the average inventory level for that item

A. decreases by the amount of the safety stock.

B. is one-half the level of the safety stock.

C. Increases by one-half the amount of the safety stock.

D. Increases by the number of units of the safety stock.

19. Which of the following statements is correct for a firm that currently has total costs of carrying and ordering inventory that are 50% higher than total

carrying costs?

A. Current order size is greater than optimal

B. Current order size is less than optimal

C. Per unit carrying costs are too high

D. The optimal order size is currently being used

Trade credit

20. With credit terms of 3/8, n/30, what is the customer’s payment decision date?

637

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

Financial Management

(B. Working Capital

Management)

A. Three days after the invoice is received.

B. The 8th day is the customer’s decision date.

C. Anytime during the period, 8th to the 30th.

D. The 30th day is the primary decision date.

PROBLEMS

Working capital financing

i

. Casie Company turns out 200 calculators a day at a cost of P250 per calculator for materials and variable conversion cost. It take s the firm 18 days to

convert raw materials into calculator. Casie’s usual credit terms extended to its customers is 30 days, and the firm generally pays its suppliers in 20

days.

If the foregoing cycles are constant, what amount of working capital must Casie Company finance?

A. P1,400,000 C. P 900,000

B. P2,400,000 D. P1,800,000

Cash conversion cycle

ii

. Luke Company has an inventory conversion period of 60 days, a receivables conversion period of 45 days, and a payments cycle of 30 days. What is the

length of the firm’s cash conversion cycle?

A. 90 days C. 54 days

B. 75 days D. 105 days

iii

. The Spades Company has an inventory conversion period of 75 days, a receivables conversion period of 38 days, and a payable payment period of 30

days. What is the length of the firm’s cash conversion cycle?

A. 83 days C. 67 days

B. 113 days D. 45 days

iv

. Samaritan Supplies, Inc. has P5 million in inventory and P2 million in accounts receivable. Its average daily sales are P100,000. The company has P1.5

million in accounts payable. Its average daily purchases are P50,000. What is the length of the company’s cash conversion period?

A. 50 days C. 30 days

B. 20 days D. 40 days

Days inventory

v

. What is the inventory period for a firm with an annual cost of goods sold of P8 million, P1.5 million in average inventory, and a cash conversion cycle

of 75 days?

A. 6.56 days C. 52.60 days

B. 18.75 days D. 67.50 days

vi

. Samaritan Supplies, Inc. has P5 million in inventory and P2 million in accounts receivable. Its average daily sales are P100,000. The company has P1.5

million in accounts payable. Its average daily purchases are P50,000. What is the length of the company’s inventory conversion period?

A. 50 days C. 120 days

B. 90 days D. 40 days

Cash management

Economic conversion quantity (ECQ)

vii

. Simile Inc. has a total annual cash requirement of P9,075,000 which are to be paid uniformly. Simile has the opportunity to invest the money at 24%

per annum. The company spends, on the average, P40 for every cash conversion to marketable securities.

What is the optimal cash conversion size?

A. P60,000 C. P45,000

B. P55,000 D. P72,500

Opportunity cost

viii

. Hyperbole Corporation estimates its total annual cash disbursements of P3,251,250 which are to be paid uniformly. Hyperbole has the opportunity to

invest the money at 9% per annum. The company spends, on the average, P25 for every cash conversion

638

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

Financial Management

(B. Working Capital

Management)

to marketable securities and vice versa.

What is the opportunity cost of keeping cash in the bank account? A. P3,825.00 C. P4,190.00

B. P1,912.50 D. P 188.55

Annual savings

ix

. What are the expected annual savings from a lock-box system that collects 150 checks per day averaging P500 each, and reduces mailing and processing

times by 2.5 and 1.5 days respectively, if the annual interest rate is 7%?

A. P 5,250 C. P 21,000

B. P 13,125 D. P300,000

Receivables management

Carrying cost

x

. The Camp Company has an inventory conversion period of 60 days, a receivable conversion period of 30 days, and a payable payment period of 45 days.

The Camp’s variable cost ratio is 60 percent and annual fixed costs of P600,000. The current cost of capital for Camp is 12%.

If Camp’s annual sales are P3,375,000 and all sales are on credit, what is the firm’s carrying cost on accounts receivable, using 360 days year?

A. P281,250 C. P 20,250

B. P168,750 D. P 56,250

Average receivables

xi

. Caja Company sells on terms 3/10, net 30. Total sales for the year are P900,000. Forty percent of the customers pay on the tenth day and take

discounts; the other 60 percent pay, on average, 45 days after their purchases.

What is the average amount of receivables? A. P70,000 C. P77,200

B. P77,500 D. P67,500

xii

. Palm Company’s budgeted sales for the coming year are P40,500,000 of which 80% are expected to be credit sales at terms of n/30. Palm estimates

that a proposed relaxation of credit standards will increase credit sales by 20% and increase the average collection period from 30 days to 40 days.

Based on a 360-day year, the proposed relaxation of credit to standards will result in an expected increase in the average accounts receivable balance

of

A. P 540,000 C. P2,700,000

B. P 900,000 D. P1,620,000

Investment in receivables

xiii

. Currently, La Carlota Company has annual sales of P2,500,000. Its average collection period is 45 days, and bad debts are 3 percent of sales. The credit

and collection manager is considering instituting a stricter collection policy, whereby bad debts would be reduced to 1.5 percent of total sales, and the

average collection period would fall to 30 days. However, sales would also fall by an estimated P300,000 annually. Variable costs are 75 percent of

sales and the cost of carrying receivables is 10 percent. Assume a tax rate of 40 percent and 360 days per year.

What would be the decrease in investment in receivables if the change were made? A. P 9,688 C. P 96,875

B. P 12,988 D. P129,975

Comprehensive

Question Nos. 14 through 16 are based on the following data:

Sonata Company is considering changing its credit terms from 2/15, net 30 to 3/10, net

30 in order to speed collections. At present, 40 percent of Sonata Company‘s customers take the 2 percent discount. Und er the new term, discount

customers are expected to rise to 50 percent. Regardless of the credit terms, half of the customers who do not take the discount are expected to pay on

time, whereas the remainder will pay 10 days late. The change does not involve a relaxation of credit standards; therefore bad debt losses are not

expected to rise above their present 2 percent level. However, the more generous cash discount terms are expected to increase sales from P2 million to

P2.6 million per year. Sonata Company’s variable cost ratio is 75 percent, the interest rate on

639

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

Financial Management

(B. Working Capital

Management)

funds invested in accounts receivable is 9 percent, and the firm’s income tax rate is 40 percent.

xiv

. What are the days sales outstanding (DSO) before and after the change of credit policy?

A. 27.0 days and 22.5 days, respectively C. 22.5 days and 21.5 days, respectively

B. 22.5 days and 27.0 days, respectively D. 21.5 days and 22.5 days respectively

xv

. The incremental carrying cost on receivable is A. P 843.75 C. P 643.75

B. P8,889.00 D. P6,667.00

xvi

. The incremental after tax profit from the change in credit terms isA. P68,493 C. P60,615

B. P65,640 D. P57,615

Inventory management

EOQ

xvii

. What is the economic order quantity for the following inventory policy: A firm sells 32,000 bags of premium sugar per year. The cost per order is P200

and the firm experiences a carrying cost of P0.80 per bag.

A. 2,000 bags C. 8,000 bags

B. 4,000 bags D. 16,000 bags

Annual demand

xviii

. Marsman Co. has determined the following for a given year: Economic order quantity (standard order size)

5,000 units Total cost to place

purchase orders for the year P40,000 Cost to place one

purchase order P 100

Cost to carry one unit for one year P 4

What is Marsman’s estimated annual usage in units? A. 1,000,000 C. 500,000

B. 2,000,000 D. 1,500,000

Required annual return on investment

xix

. BIBO Company is a distributor of videotapes. Pirate Mart is a local retail outlet which sells blank and recorded videos. Pirate Mart purchases tapes from

BIBO Company at P300.00 per tape; tapes are shipped in packages of 20. BIBO Company pays all incoming freight, and Pirate Mart does not inspect

the tapes due to BIBO Company's reputation for high quality. Annual demand is 104,000 tapes at a rate of 4,000 tapes per week. Pirate Mart earns

20% on its cash investments. The purchase-order lead time is two weeks.

The following cost data are available:

Relevant ordering costs per purchase order P80 P90.50 Carrying costs per

package per year 3

Relevant insurance, materials handling, breakage, etc., per year 2 P 4.50 What is the

required annual return on investment per package?

A. P6,000 C. P1,200

B. P 250 D. P 600

Order quantity

xx

. For Raw Material L12, a company maintains a safety stock of 5,000 pounds. Its average inventory (taking into account the safety stock) is 12,000

pounds. What is the apparent order quantity?

A. 18,000 lbs. C. 14,000 lbs.

B. 6,000 lbs. D. 24,000 lbs

Optimal safety stock level

xxi

. Each stockout of a product sold by Arnis Co. costs P1,750 per occurrence. The company’s carrying cost per unit of inventory is P5 per year, and the

company orders 1,500 units of product 20 times a year at a cost of P100 per order. The probabilities of a stockout at various levels of safety stock

are:

640

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

Financial Management

(B. Working Capital

Units of Safety Stock Probability of Stockout 0.

Management)

0.50

100. 0.30

200. 0.14

300. 0.05

400. 0.01

The optimal safety stock level for the company based on the units of safety stock level above is

A. 200 units C. 100 units

B. 300 units D. 400 units

xxii

. Paeng Company uses the EOQ model for inventory control. The company has an annual demand of 50,000 units for part number 6702 and has

computed an optimal lot size of 6,250 units. Per-unit carrying costs and stockout costs are P9 and P4, respectively. The following data have been gathered

in an attempt to determine an appropriate safety stock level:

Units Short Because of Excess Demand during the Lead Time Period

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

Number of Times Short in the last 40 Reorder Cycles Financial Management

100 8 (B. Working Capital

200 10

300 14 Management)

400 8

What is the optimal safety stock level?

A. 100 units C. 200 units

B. 300 units D. 400 units

Annual inventory costs

xxiii

. Durable Furniture Company uses about 200,000 yards of a particular fabric each year. The fabric costs P25 per yard. The current policy is to order the

fabric four times a year. Incremental ordering costs are about P200 per order, and incremental carrying costs are about P0.75 per yard, much of

which represents the opportunity cost of the funds tied up in inventory.

How much total annual costs are associated with the current inventory policy? A. P19,550 C. P38,300

B. P18,750 D. P62,500

Maximum interest rate

xxiv

. Narra Company is considering a switch to level production. Cost efficiencies will occur under level production and after tax cost would decline by

P70,000 but inventory would increase from P1,000,000 to P1,800,000. Narra would have to finance the extra inventory at a cost of 10.5 percent.

What is the maximum interest rate that makes level production feasible?

A. 7.00 percent C. 8.75 percent

B. 5.83 percent D. 10.00 percent

Opportunity cost

xxv

. Diesel Fashion estimates that 90,000 zippers will be needed in the manufacture of high selling products for the coming year. Its supplier quoted a price

of P25 per zipper. Diesel planned to purchase 7,500 units per month but its supplier could not guarantee this delivery schedule. In order to ensure

availability of these zippers, Diesel is considering the purchase of all these 90,000 units on January 1. Assuming Diesel can invest cash at 12%, the

company’s opportunity cost of purchasing the 90,000 units at the beginning of the year is

A. P127,500 C. P123,750

B. P135,000 D. P264,000

Trade credit

xxvi

. If a firm is given a trade credit terms of 2/10, net 30, then the cost to the firm failing to take the discount is:

A. 2.0%. C. 36.7%

B. 30.0%. D. 10.0%.

641

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

Financial Management

(B. Working Capital

Management)

xxvii

. The cost of discounts missed on credit terms of 2/10, n/60 is

A. 2.0 percent C. 12.4 percent

B. 14.9 percent D. 21.2 percent

Bank loans

Discount loan

xxviii

. You plan to borrow P10,000 from your bank, which offers to lend you the money at a10 percent nominal, or stated, rate on a one-year loan. What is

the effective interest rate if the loan is a discount loan?

A. 10.00% C. 12.45%

B. 11.11% D. 14.56%

Discount loan with compensating balance

xxix

. What is the effective rate of a 15% discounted loan for 90 days, P200,000, with 10% compensating balance? Assume 360 days per year.

A. 20.0% C. 17.4%

B. 15.0% D. 22.2%

Compensating balance with interest

xxx

. The Premiere Company obtained a short-term bank loan for P1,000,000 at an annual interest rate 12%. As a condition of the loan, Premiere is required

to maintain a compensating balance of P300,000 in its checking account. The checking account earns interest at an annual rate of 3%. Premiere would

otherwise maintain only P100,000 in its checking account for transactional purposes. Premiere’s effective interest costs of the loan is

A. 12.00% C. 16.30%

B. 14.25% D. 15.86%

Add-on

xxxi

. Perlas Company borrowed from a bank an amount of P1,000,000. The bank charged a12% stated rate in an add-on arrangement, payable in 12 equal

monthly installments. A. 22.15% C. 25.05%

B. 24.00% D. 12.70%

Financing alternative

xxxii

. A company has accounts payable of P5 million with terms of 2% discount within 15days, net 30 days (2/15 net 30). It can borrow funds from a bank at

an annual rate of 12%, or it can wait until the 30th day when it will receive revenues to cover the payme nt. If it borrows funds on the last day of the

discount period in order to obtain the discount, its total cost will be

A. P 51,000 less C. P 75,500 less

B. P100,000 less D. P 24,500 more

xxxiii

. Every 15 days a company receives P10,000 worth of raw materials from its suppliers. The credit terms for these purchases are 2/10, net 30, and

payment is made on the 30th day after each delivery. Thus, the company is considering a 1-year bank loan for P9,800 (98% of the invoice amount).

If the effective annual interest rate on this loan is 12%, what will be the net peso savings over the year by borrowing and then taking the discount on

the materials?

A. P3,624 C. P4,800

B. P1,176 D. P1,224

xxxiv

. An invoice of a P100,000 purchase has credit terms of 1/10, n/40. A bank loan for 8 percent can be arranged at any time. When should the customer

pay the invoice?

A. Pay on the 1st. C. Pay on the 40th

B. Pay on the 10th D. Pay on the 60th

xxxv

. The Peninsula Commercial Bank and Island Corporation agreed to the following loan proposal:

Stated interest rate of 10% on a one-year discounted loan; and

15% of the loan as compensating balance on zero-interest current account to be

642

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

Financial Management

(B. Working Capital

Management)

maintained by Island Corporation with Peninsula Commercial Bank.

The loan requires a net proceeds of P1.5 million. What is the principal amount of loan applied for as part of the loan agreement?

A. P1,666,667 C. P1,764,706

B. P2,000,000 D. P1,125,000

643

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

i

. Answer: A

Daily working capital required: 200 x 250 50,000

Total working capital needed: 28 days x 50,000 1,400,000

CCC = 18 + 30 – 20 28 days

. Answer: B

ii

Cash Conversion Cycle = Ave. collection period + Inventory cycle days – Ave. Accounts Payable payment days

Inventory cycle in days 60 days

Average collection period 45 days

Operating cycle 105 days

Deduct Accounts payable payment days 30 days Cash conversion

cycle 75 days

iii

. Answer: A

Inventory cycle in days 75 days

Average collection period 38 days

Operating cycle 113 days

Deduct Accounts payable payment days 30 days Cash conversion

cycle 83 days

iv

. Answer: D

Inventory conversion period (See #4) 50.0 days

Average collection period (2M/0.1M) 20.0 days

Operating cycle 70.0 days

Less: Ave. Accounts Payable payment days (1.5M/0.5M)30.0 days Cash conversion period 40.0 days

v

. Answer: D

Inventory turnover:

Cost of goods sold/Ave. Inventory (8M/1.5M) 5.33x Inventory

conversion period (360 days/5.33) 67.5 days

vi

. Answer: A

Annual sales 360 days x 100,000 36.0M

Inventory turnover 36M/5M 7.2x Inventory

conversion period 360/7.2 50.0 days

vii

. Answer: B

Optimal cash conversion size = (9,075,000 x 40 / 0.24)^1/2 = 55,000

. Answer: B

viii

OTS: (2 x P3,251,250 x P25 ÷ = P42,500

0.09)^1/2

ix

Opportunity cost: P42,500 ÷ 2 x 0.09 P 1,912.50

x

. Answer: C

Reduction in cash float (2.5 + 1.5) 4.0 days

xi

Additional free cash (4 days x 150 x P500) P300,000

xii

Annual savings (P300,000 x 0.07) P 21,000

. Answer: C

Average AR 3,375,000/360 x 30 days 281,250

xiii Average investment: 281,250 x 0.60 168,750

Carrying cost: 168,750 x 0.12 20,250

. Answer: B

DSO = (.4 x 10) + (.60 x 45) 31 days

Average AR: 900,000/360x31 days P77,500

. Answer: D

Credit sale = 40,500,000 x 80% = 32,400,000

Increased credit sales: 32,400,000 x 1.2 = 38,880,000

New Average AR 38,880,000/360 x 40 = 4,320,000

Old Average AR 32,400,000/360 x 30 = 2,700,000

Increase in Average AR 1,620,000

. Answer: C

Change in average accounts receivables:

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

Planned: 2,200,000/360x30 183,333

Present: 2,500,000/360x45 312,500

Decrease in AR balance 129,667

Variable cost ratio 75%

Decrease in investment in AR 96,875

. Answer: A

xiv

Days’ sales outstanding

xv Old policy: (.4 x 15) + (.3 x 30) + (.3 x 40) 27.0 days

New policy (.5 x 10) + (.25 x 30) + (.25 x 40) 22.5 days

. Answer: A

xvi

Average receivable

New policy: 2.6M/360 x 22.5 162,500

Old policy: 2.0M/360 x 27 150,000

Incremental Accounts Receivable 12,500

Incremental carrying cost on receivable 12,500 x 0.75 x 0.09

xvii

. Answer: A

xviii

Incremental sales 600,000

Variable cost (.75 x 600,000) ( 450,000)

xix

Additional bad debts (600,000 x 2%) ( 12,000)

Additional carrying cost ( 844)

xx

Additional discounts (2,600,000 x .5 x 03) –(2,000,000 x .4 .02)

x

23,000)

xxi Before tax increase in income 114,156

Less tax 45,663

Incremental income 68,493

. Answer: B

EOQ = (2 x 32,000 x 20 0.8)^1/2 = 4,000 bags

. Answer: B

Number of orders made 40,000/100 400

Annual requirement 400 x 5,000 2,000,000

. Answer: C

Investment in 1 package (20 x P300) P6,000

Required annual return: P6,000 x 0.2 P1,200

. Answer: C

Average inventory units 12,000

Less safety units 5,000

Average inventory based on EOQ 7,000

Order size 7,000 x 2 14,000

. Answer: D

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

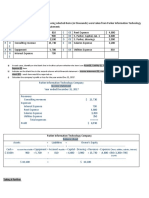

Safety stockStock out Costs (1)Carrying Costs @

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

843.75

(

P5Total10010,500500P11,0002004,9001,0005,9003001,7501,5003,2504003502,0002,3 50

Stockout Costs

100 1750 x .30 x 20 orders = 10,500

200 1750 x .05 x 20 = 4,900

300 1750 x .05 x 20 = 1750

400 1750 x .01 x 20 = 350

Optimal safety stock is 400-unit level with a cost of only P2,350 cost.

xxii

. Answer: B

The optimal safety stock level represents the level that gives the lowest sum of stock out costs and additional carrying costs. Based on the

computation below, the lowest combined costs is P3,340, corresponding to 300-unit level

First compute the stockout costs based on given probability of demand. Starting with 100-unit level as safety stock, if the additional demand is

200, the company has stockout of 100 units.

100: (100 x 32* x 0.25) + (200 x 32 x 0.35) + (300 x 32 x 0.20) + (100 x 9)

4,960

200: (100 x 32 x 0.35) + (200 x 32 x 0.20) + (200 x 9)4,200

300: (100 x 31 x 0.20) + (300 x 9) 3,340

400: (400 x 9) 3,600

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

stockout per unit x 8 orders per year.

.Answer: A

xxiii

Ordering costs 4 x P200 800

Carrying costs (50,000 ÷ 2 x 0.75 18,750

. Answer: C Total 19,550

xxiv

Savings in Expenses/additional Investment in Inventory = Maximum Interest Rate 70,000 / (1,800,000 – 1,000,000) = 8.75%

xxv

. Answer: C

Number of units to be purchased in advance: 90,000 – 7,500 82,500 Average investments in

working capital: 82,500 x 0.5* x P25 1,031,250 Opportunity cost 1,031,250 x 0.12

123,750

*The average investment is one-half (82,500 + 0) ÷ 2

xxvi

. Answer: C

k = (2 98) x (360 20 = 36.7%

The solution assumes that the company foregoes the discount only once during the year.

xxvii

. Answer: B

With credit terms of 2/10, n/60 one must pay on the 10th day choosing to finance the net payment (invoice price minus the cash discount) at the

rate of 2 percent for 50 days, paying the loan on the 60th day. The annualized rate of foregoing the discount is

14.9 percent.

k = 2/98 x 365/50 = 14.9%

xxviii

. Answer: B

k = 10 ÷ (100 – 10) = 11.11%

. Answer: C

xxix

Principal 200,000

Less: Discount 200,000 x 0.15 x 90/360 ( 7,500)

Compensating balance ( 20,000)

Net proceeds 172,500

xxx

Less interest income on additional CA balance (200,000 x 0.03) 6,000 Net interest cost

Effective rate: 114,000/(1,000,000

Effective interest rate

(7,500/172,500) x 360/90

– 200,000)14.25%

17.4%114,000

xxxi

. Answer: . A Answer: B

Interest for 1 year 1M x 12% 120,000

Interest

Average Principal: expense

[1M + (1M/12)] ÷ 2 1M x 0.12 120,000

541,667 Estimated

effective rate 120,000/541,667 22.15%

Alternative solution for approximate effective rate:

(2 x No. of payments x Interest) ÷ [(1 + No. of payments) x Principal] (2 x 12 x P120,000) ÷ (13 x P1M) = 22.15%

xxxii

. Answer: C

Discount 5M x 0.02 100,000

Interest (5M x 0.98 x 0.12) x 15/360 = 24,500 Savings = 75,500

xxxiii

. Answer: A

Purchase discount 10,000 x 0.02 x 200 purchases 4,800

Interest on borrowed money 9,800 x 0.12 1,176

Savings 3,624

Number of purchases: 360 days/15-day interval 200

xxxiv

. Answer: B

The cost of discounts missed is 12.3% which is more than the 8 percent that the bank charges. The company should borrow on th e 10th, pay the

invoice, and finance at 8% for the next 30 days (pay off the bank on the 40th).

Cost of foregoing discount: (1 99) x (360 30) = 12.31%

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

lOMoAR cPSD| 22592286

xxxv

. Answer; B

Net proceeds in pesos P1,500,000 Divided by net proceeds

percentage 1.00 – 0.1 – 0.15 0.75 Principal amount

P2,000,000

Downloaded by Queenie Osorio (kwini.queenieosorio@gmail.com)

You might also like

- 14 x11 Financial Management BDocument10 pages14 x11 Financial Management BChristine Elaine Laman100% (3)

- PDF 34Document4 pagesPDF 34Michaela QuimsonNo ratings yet

- Short-Term Financing - Extra CreditDocument7 pagesShort-Term Financing - Extra CreditEnola HolmesNo ratings yet

- WC QUIZ Theory and ProblemDocument5 pagesWC QUIZ Theory and ProblemRachelle Anne M PardeñoNo ratings yet

- 14 x11 Financial Management BDocument10 pages14 x11 Financial Management Balexandro_novora639671% (14)

- Quiz 1 - Period 3 Working Capital Mansgement Wioth AnswersDocument4 pagesQuiz 1 - Period 3 Working Capital Mansgement Wioth AnswersLieza Jane AngelitudNo ratings yet

- Ilovepdf MergedDocument33 pagesIlovepdf Mergedyor7724No ratings yet

- M - Working Capital ManagementDocument8 pagesM - Working Capital ManagementJewel Mae MercadoNo ratings yet

- Cost of CapitalDocument41 pagesCost of CapitalMCDABCNo ratings yet

- Exam 44Document5 pagesExam 44Karlo D. Recla100% (1)

- Examination - 2020 Subject: Financial ManagementDocument5 pagesExamination - 2020 Subject: Financial ManagementhareshNo ratings yet

- X Working Capital Finance StudentDocument5 pagesX Working Capital Finance StudentAsnor RandyNo ratings yet

- 14 x11 Financial Management B-1Document9 pages14 x11 Financial Management B-1amirNo ratings yet

- MS Quiz 3Document4 pagesMS Quiz 3Harold Dan AcebedoNo ratings yet

- TheoriesDocument9 pagesTheoriesShella Marie PaladNo ratings yet

- FM - Working Capital MGMTDocument6 pagesFM - Working Capital MGMTSam Sasuman100% (1)

- Working Capital ManagementDocument7 pagesWorking Capital ManagementMay RamosNo ratings yet

- CMA Part1EDocument27 pagesCMA Part1EMaria100% (1)

- Working Capital Policy and ManagementDocument64 pagesWorking Capital Policy and ManagementUy SamuelNo ratings yet

- Fin ManDocument7 pagesFin ManRyan Malanum AbrioNo ratings yet

- Use Capital Letters Only Label Answers Properly Answers Must Be Handwritten Present Solutions. Submit Answers Through Messenger or EmailDocument6 pagesUse Capital Letters Only Label Answers Properly Answers Must Be Handwritten Present Solutions. Submit Answers Through Messenger or EmailJungie Mablay WalacNo ratings yet

- 14 x11 Financial Management B PDFDocument10 pages14 x11 Financial Management B PDFChristine FerrerasNo ratings yet

- 2022 FinManDocument4 pages2022 FinManAngela SolanaNo ratings yet

- 14 x11 Financial Management B Working Capital ManagementDocument9 pages14 x11 Financial Management B Working Capital ManagementAbegail Ara Loren33% (3)

- Finman Bobadilla PDFDocument49 pagesFinman Bobadilla PDFChristopher Vicente100% (1)

- MSQ-03 - Working Capital FinanceDocument11 pagesMSQ-03 - Working Capital FinanceJade RamosNo ratings yet

- T03 - Working Capital FinanceDocument39 pagesT03 - Working Capital FinanceJesha Jotojot100% (1)

- Working Capital Practice SetDocument12 pagesWorking Capital Practice SetRyan Malanum AbrioNo ratings yet

- FM-II - Work Sheet and Assignment PDFDocument10 pagesFM-II - Work Sheet and Assignment PDFnatnaelbtamu haNo ratings yet

- Working CapitalDocument2 pagesWorking CapitalLycka Bernadette MarceloNo ratings yet

- T03 - Working Capital FinanceDocument40 pagesT03 - Working Capital FinanceJesha JotojotNo ratings yet

- Instructions. Choose The BEST Answer For Each of The Following ItemsDocument4 pagesInstructions. Choose The BEST Answer For Each of The Following ItemsDiomela BionganNo ratings yet

- FinMan 1 - Prelim Reviewer 2017Document17 pagesFinMan 1 - Prelim Reviewer 2017Rachel Dela CruzNo ratings yet

- Unit 6 Business FinanceDocument33 pagesUnit 6 Business FinanceSalvacion CalimpayNo ratings yet

- Working Capital Management StudentDocument48 pagesWorking Capital Management StudentCezanne Pi-ay EckmanNo ratings yet

- DocxDocument32 pagesDocxDaniella Zapata Montemayor100% (1)

- MAS HO 013 v2.0 Working Capital MangementDocument7 pagesMAS HO 013 v2.0 Working Capital MangementCarlo C. Cariaso III0% (1)

- Financial Management QuestionsDocument9 pagesFinancial Management QuestionsNiyati JainNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementCyril EstandarteNo ratings yet

- Diagnostic Test FAR (No Answers)Document4 pagesDiagnostic Test FAR (No Answers)David GonzalesNo ratings yet

- Working Capital Management Multiple ChoiceDocument2 pagesWorking Capital Management Multiple ChoiceluardwinlyNo ratings yet

- MCQ Working Capital Management CPAR 1 84 PDFDocument18 pagesMCQ Working Capital Management CPAR 1 84 PDFAnnaNo ratings yet

- Theory: Financial Management - Midterm Exam AGPDocument26 pagesTheory: Financial Management - Midterm Exam AGPJULES RINGGO AGUILARNo ratings yet

- Moldez INT03 QUIZDocument3 pagesMoldez INT03 QUIZVincent Larrie MoldezNo ratings yet

- Question For Manager Test in Ksfe PDFDocument11 pagesQuestion For Manager Test in Ksfe PDFRajimol RNo ratings yet

- CWKARLDocument9 pagesCWKARLKarlo D. ReclaNo ratings yet

- MCFM131 133Document9 pagesMCFM131 133Nicole Allyson AguantaNo ratings yet

- MSQ-09 - Working Capital FinanceDocument11 pagesMSQ-09 - Working Capital FinanceMark Edward G. NganNo ratings yet

- Genwcmgmt Cosajka (Complete)Document10 pagesGenwcmgmt Cosajka (Complete)Ken CosaNo ratings yet

- Finance Can Be Defined AsDocument6 pagesFinance Can Be Defined AsPrankyJellyNo ratings yet

- Model Answers Subject - Working Capital Management Paper code-AS-2377Document8 pagesModel Answers Subject - Working Capital Management Paper code-AS-2377avni shrmaNo ratings yet

- Xtra CreditDocument4 pagesXtra CreditKristine Lirose BordeosNo ratings yet

- Af101 S1 2018 MSTDocument9 pagesAf101 S1 2018 MSTMalia i Lutu Leonia Kueva LosaluNo ratings yet

- Optimal Cash Balance Financial Management AccountingDocument2 pagesOptimal Cash Balance Financial Management AccountingRandy ManzanoNo ratings yet

- Management Advisory ServicesDocument5 pagesManagement Advisory ServicesTk KimNo ratings yet

- Working Capital Management Test BankDocument10 pagesWorking Capital Management Test BankLawrence Guzman83% (6)

- Stream Theory: An Employee-Centered Hybrid Management System for Achieving a Cultural Shift through Prioritizing Problems, Illustrating Solutions, and Enabling EngagementFrom EverandStream Theory: An Employee-Centered Hybrid Management System for Achieving a Cultural Shift through Prioritizing Problems, Illustrating Solutions, and Enabling EngagementNo ratings yet

- Declaration by Applicant For Overseas LE Form - July 2018Document1 pageDeclaration by Applicant For Overseas LE Form - July 2018Ravan RaNo ratings yet

- Handout 3.0 ACP 313 Derivatives and Hedging Accounting - v2Document5 pagesHandout 3.0 ACP 313 Derivatives and Hedging Accounting - v2LOUIEVIE MAY SAJULGANo ratings yet

- Sim Sim For Ge15 UmDocument104 pagesSim Sim For Ge15 UmLOUIEVIE MAY SAJULGANo ratings yet

- Financial Statement Analysis - CPARDocument13 pagesFinancial Statement Analysis - CPARxxxxxxxxx100% (2)

- 10-X08-Budgeting (1) ZSDDocument46 pages10-X08-Budgeting (1) ZSDLOUIEVIE MAY SAJULGANo ratings yet

- Printing Press Survey Questionnair CompetitorsDocument11 pagesPrinting Press Survey Questionnair CompetitorsLOUIEVIE MAY SAJULGANo ratings yet

- Araling Panlipunan: Quarter 3 - Module 2 Paglawak NG Kapangyarihan NG EuropeDocument23 pagesAraling Panlipunan: Quarter 3 - Module 2 Paglawak NG Kapangyarihan NG EuropeLOUIEVIE MAY SAJULGANo ratings yet

- Act Module4 Cashflow Fabm 2 5.Document11 pagesAct Module4 Cashflow Fabm 2 5.DOMDOM, NORIEL O.No ratings yet

- LK SMART 30 Jun 2021Document111 pagesLK SMART 30 Jun 2021Annisa Nur FadhilahNo ratings yet

- Module in Cash To Accrual and Vice VersaDocument12 pagesModule in Cash To Accrual and Vice Versayugyeom rojasNo ratings yet

- Accounting EquationDocument5 pagesAccounting EquationLucky Mark Abitong75% (12)

- Operating Segments PDFDocument12 pagesOperating Segments PDFZahidNo ratings yet

- FULL DISCLOSURE Test BankDocument11 pagesFULL DISCLOSURE Test Bankzee abadillaNo ratings yet

- The Statement of Financial Position or (SFP)Document4 pagesThe Statement of Financial Position or (SFP)UnkownamousNo ratings yet

- Chapter 46 Cash Flow ComprehensiveDocument8 pagesChapter 46 Cash Flow ComprehensiveCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Bai Tap CMQT clc59Document20 pagesBai Tap CMQT clc59Hải AnhNo ratings yet

- Lecture 3Document14 pagesLecture 3Lol 123No ratings yet

- ACCA Paper F7: Financial ManagementDocument11 pagesACCA Paper F7: Financial ManagementLai AndrewNo ratings yet

- Dwi Suci Indah S - 472026 - W5 Easy ProblemDocument5 pagesDwi Suci Indah S - 472026 - W5 Easy ProblemucyNo ratings yet

- Understanding Business 12th Edition Nickels Test BankDocument11 pagesUnderstanding Business 12th Edition Nickels Test BankSeanMorrisonsipn100% (34)

- Bharat Hotels Valuation Case StudyDocument3 pagesBharat Hotels Valuation Case StudyRohitNo ratings yet

- CH 5 Test BankDocument15 pagesCH 5 Test Bankhaidy gabrNo ratings yet

- Reynaldo Gulane CleanersDocument3 pagesReynaldo Gulane CleanersshaneemacasiNo ratings yet

- Financial Statement AnalysisDocument82 pagesFinancial Statement AnalysisHeisen LukeNo ratings yet

- Financial Statement Analysis of Cherat Cement Company Limited Nowshera PakistanDocument37 pagesFinancial Statement Analysis of Cherat Cement Company Limited Nowshera Pakistansaeedktg33% (3)

- FarmFresh - Annual Report 20221Document118 pagesFarmFresh - Annual Report 20221qNo ratings yet

- ACCT 2211 Assignment 1Document12 pagesACCT 2211 Assignment 1Tannaz SNo ratings yet

- Ratio Analysis of Coca-ColaDocument26 pagesRatio Analysis of Coca-ColaWajid Ali71% (7)

- CMA II 2016 Study Materials CMA Part 2 MDocument37 pagesCMA II 2016 Study Materials CMA Part 2 Mkopy brayntNo ratings yet

- Wilmington HA - Audit March 2018Document92 pagesWilmington HA - Audit March 2018Ben SchachtmanNo ratings yet

- Tugas Tutorial Ke-2 Analisis Informasi KeuanganDocument5 pagesTugas Tutorial Ke-2 Analisis Informasi KeuanganputridewitawinantiNo ratings yet

- Sample Auditing Problems Proof of Cash Sample Auditing Problems Proof of CashDocument17 pagesSample Auditing Problems Proof of Cash Sample Auditing Problems Proof of Cashmariyha PalangganaNo ratings yet

- LSBF SBR+Class+Notes+September+2018+-+June+2019FINAL PDFDocument229 pagesLSBF SBR+Class+Notes+September+2018+-+June+2019FINAL PDFGunva TonkNo ratings yet

- FABM2 Module 06 (Q1-W7)Document8 pagesFABM2 Module 06 (Q1-W7)Christian Zebua75% (4)

- Chapter 05 Consolidation of Less Than WHDocument93 pagesChapter 05 Consolidation of Less Than WH05 - Trần Mai AnhNo ratings yet

- Chapter 1: Session 1 Introduction To Financial AccountingDocument161 pagesChapter 1: Session 1 Introduction To Financial AccountingHarshini Akilandan100% (1)

- RECEIVABLESDocument23 pagesRECEIVABLESSaghielyn BicomongNo ratings yet