Professional Documents

Culture Documents

Indian Income Tax Return Acknowledgement 2021-22: Assessment Year

Uploaded by

Suresh PrasadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Income Tax Return Acknowledgement 2021-22: Assessment Year

Uploaded by

Suresh PrasadCopyright:

Available Formats

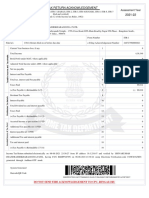

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT

[Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-6, ITR-7

Assessment Year

filed and verified] 2021-22

(Please see Rule 12 of the Income-tax Rules, 1962)

PAN ASSSSSSSS

Name JAI CHAND SHAW

Address 1/113 , MIRPARA ROAD , Bhattanagar S.O , Bhattanagar , HOWRAH , 32-West Bengal , 91-India , 711203

Status Individual Form Number ITR-4

Filed u/s 139(1) Return filed on or before due date e-Filing Acknowledgement Number 692509440311221

Current Year business loss, if any 1 0

Total Income 4,20,000

Book Profit under MAT, where applicable 2 0

Adjusted Total Income under AMT, where applicable 3 0

Net tax payable 4 0

Interest and Fee Payable 5 0

Total tax, interest and Fee payable 6 0

Taxes Paid 7 0

(+)Tax Payable /(-)Refundable (6-7) 8 0

Dividend Tax Payable 9 0

Interest Payable 10 0

Total Dividend tax and interest payable 11 0

Taxes Paid 12 0

(+)Tax Payable /(-)Refundable (11-12) 13 0

Accreted Income as per section 115TD 14 0

Additional Tax payable u/s 115TD 15 0

Interest payable u/s 115TE 16 0

Additional Tax and interest payable 17 0

Tax and interest paid 18 0

(+)Tax Payable /(-)Refundable (17-18) 19 0

Income Tax Return submitted electronically on 31-12-2021 07:46:46 from IP address 10.1.213.135 and verified by JAI CHAND SHAW

having PAN FASPS1599K on 28-02-2022 05:30:00 using Paper ITR-verification form generated through mode

System Generated

Barcode/QR Code

FASPS1599K04692509440311221A5A76A38E66E019AE46DD64F1F458C36019CA4CE

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

You might also like

- Jean Keating and Jack SmithDocument10 pagesJean Keating and Jack SmithStephen Monaghan100% (2)

- Week 1 MSTA Notes PDFDocument93 pagesWeek 1 MSTA Notes PDFMohd Najmi HuzaiNo ratings yet

- Law Firm Profile FormatDocument11 pagesLaw Firm Profile Formatsher afzal khan babar100% (1)

- Wells Fargo Bank N.A. V Erobobo wNEW YORK 5 2013Document13 pagesWells Fargo Bank N.A. V Erobobo wNEW YORK 5 2013MackLawfirmNo ratings yet

- T Vijaya Kumar - Accounting For Management-Tata McGraw Hill Education Private Limited (2010)Document842 pagesT Vijaya Kumar - Accounting For Management-Tata McGraw Hill Education Private Limited (2010)2073 - Ajay Pratap Singh Bhati100% (1)

- Trading Webinar Workbook PDFDocument115 pagesTrading Webinar Workbook PDFManoj Kumar100% (3)

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearDirector GGINo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAditya Adi SinghNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- PDF 882266220231121Document1 pagePDF 882266220231121EmperorNo ratings yet

- 2122 ItrDocument1 page2122 ItrAjay PratapNo ratings yet

- PDF 990850220061221Document1 pagePDF 990850220061221Olympia FitnessNo ratings yet

- Fabm ExamDocument3 pagesFabm ExamRonald AlmagroNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAryan KulhariNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAmiya Ranjan PaniNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearsumitNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearBrajesh kumar sharmaNo ratings yet

- Re InsuranceDocument18 pagesRe InsuranceRahul MaratheNo ratings yet

- Itr - 21-22Document1 pageItr - 21-22Ruloans VaishaliNo ratings yet

- PDF 590366920301221Document1 pagePDF 590366920301221Kishan UnadkatNo ratings yet

- PDF 240303030171221Document1 pagePDF 240303030171221Hasan KhanNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: PDF Created With Pdffactory Trial VersionDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: PDF Created With Pdffactory Trial VersionRenu KhetanNo ratings yet

- Krina Ashokkumar PatelDocument1 pageKrina Ashokkumar PatelFMG PATELNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearRahul RoyNo ratings yet

- PDF 411173710251221Document1 pagePDF 411173710251221Raghav SharmaNo ratings yet

- Kanuji Jivaji ThakorDocument1 pageKanuji Jivaji ThakorFMG PATELNo ratings yet

- SAHIL SAMIM KHAN - 29-Dec-2021 - 572667530Document1 pageSAHIL SAMIM KHAN - 29-Dec-2021 - 572667530Anil kadamNo ratings yet

- PDF 507970650300322Document1 pagePDF 507970650300322Kishan UnadkatNo ratings yet

- PDF 440143000261221Document1 pagePDF 440143000261221Atinderpal SinghNo ratings yet

- J Itr 2021-22Document1 pageJ Itr 2021-22prabhjeet singh antalNo ratings yet

- PDF 678141790131021Document1 pagePDF 678141790131021bodana vijayNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearRia SinghalNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearRakesh AgrawalNo ratings yet

- Itr Ay 2021-22Document1 pageItr Ay 2021-22Ubfinancial ServicesNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAditya SharmaNo ratings yet

- PDF 492974040281221Document1 pagePDF 492974040281221Sumit MurumkarNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearneerajNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSumal kumarNo ratings yet

- PDF 330427890221221Document1 pagePDF 330427890221221Asfa rehmanNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearIshan DhodyNo ratings yet

- PDF 196540320141221Document1 pagePDF 196540320141221ANIKET ROYNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearMinakshmi KarformaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearpawaryogeshNo ratings yet

- Itr Ack Ay 21-22Document1 pageItr Ack Ay 21-22Paswan LokeshNo ratings yet

- PDF 113926490081221Document1 pagePDF 113926490081221Saravana SaruNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSwapna BahaddurNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSaurya KumarNo ratings yet

- PDF 763168470311221Document1 pagePDF 763168470311221jasjeetNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSanket DeolNo ratings yet

- PDF 317138280100322Document1 pagePDF 317138280100322anjana19780316No ratings yet

- PDF 206900810151221Document1 pagePDF 206900810151221SandhyaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNirav TailorNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearninja gamerNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearMeharchand ChoudharyNo ratings yet

- Lovepreet Itr 21-22Document1 pageLovepreet Itr 21-22joginder2002kNo ratings yet

- Tarun Naib 21-22Document1 pageTarun Naib 21-22Shaheen SobtiNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearPawan SharmaNo ratings yet

- AcknowledgmentDocument1 pageAcknowledgmentKanchan AgrawalNo ratings yet

- PDF 716981210221021Document1 pagePDF 716981210221021kmco dhnNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearsafiNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearJeeva BharathiNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNayab Rasool SKNo ratings yet

- PDF 812625500111121 PDFDocument1 pagePDF 812625500111121 PDFPranav NegiNo ratings yet

- PDF 651256400071021Document1 pagePDF 651256400071021Raju Kumar SharmaNo ratings yet

- PDF 711946690211021 220524 140905Document1 pagePDF 711946690211021 220524 140905Sudhanshu PandeyNo ratings yet

- PDF 135304110091221Document1 pagePDF 135304110091221soutan chakrabortyNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearImtiaz SkNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearshivu patilNo ratings yet

- To Whom It May Concern: 328, Sodepur Road KOLKATA-700082 LP.157/17/15Document1 pageTo Whom It May Concern: 328, Sodepur Road KOLKATA-700082 LP.157/17/15Suresh PrasadNo ratings yet

- To Whom It May Concern: Zaba Mukhtar Block-A, 37 Topsia Road Kolkata-700039Document1 pageTo Whom It May Concern: Zaba Mukhtar Block-A, 37 Topsia Road Kolkata-700039Suresh PrasadNo ratings yet

- Rent Agreement This Rent Agreement Is Executed at Kolkata, West Bengal On This 01 Day of JUNE, 2022 BetweenDocument4 pagesRent Agreement This Rent Agreement Is Executed at Kolkata, West Bengal On This 01 Day of JUNE, 2022 BetweenSuresh PrasadNo ratings yet

- Pas 5Document1 pagePas 5Suresh PrasadNo ratings yet

- MAA AMBE TRADING CO PricingDocument2 pagesMAA AMBE TRADING CO PricingSuresh PrasadNo ratings yet

- Section 44ae of Income Tax ActDocument2 pagesSection 44ae of Income Tax ActSuresh PrasadNo ratings yet

- CompReg 9MARCH2023Document457 pagesCompReg 9MARCH2023Suresh PrasadNo ratings yet

- SPICeMoA INC0000536612Document4 pagesSPICeMoA INC0000536612Suresh PrasadNo ratings yet

- Tutorial - Chapter 11 - Monetary Policy - QuestionsDocument4 pagesTutorial - Chapter 11 - Monetary Policy - QuestionsNandiieNo ratings yet

- NEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsDocument168 pagesNEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsAkash MalikNo ratings yet

- Tax Avoidance and Coporate Capital Structure (Cristine Harrington)Document20 pagesTax Avoidance and Coporate Capital Structure (Cristine Harrington)Risa Nadya SafrizalNo ratings yet

- Rangkuman TaDocument19 pagesRangkuman Tamutia rasyaNo ratings yet

- Ra 6977Document12 pagesRa 6977Kobe MambaNo ratings yet

- Chronicle of World Financial Crisis 2007-2008Document4 pagesChronicle of World Financial Crisis 2007-2008Md. Azim Ferdous100% (1)

- List of Groups and Topic For Practical Assignment 1Document5 pagesList of Groups and Topic For Practical Assignment 1pareek gopalNo ratings yet

- Eduardo Tabrilla Business Plan AssignmentDocument4 pagesEduardo Tabrilla Business Plan AssignmentJed Jt TabrillaNo ratings yet

- PG - M.com - Commerce (English) - 31031 Investment Analysis and Portfolio ManagementDocument166 pagesPG - M.com - Commerce (English) - 31031 Investment Analysis and Portfolio ManagementDeeNo ratings yet

- Islami Bank Bangladesh Limited: Dhanmondi BranchDocument1 pageIslami Bank Bangladesh Limited: Dhanmondi BranchMonirul IslamNo ratings yet

- Commerzbank AG: Issuer Rating ReportDocument12 pagesCommerzbank AG: Issuer Rating ReportvaishnaviNo ratings yet

- Annuity DueDocument2 pagesAnnuity DueJsbebe jskdbsj50% (2)

- Swift MT RulesDocument2 pagesSwift MT RulesJit JackNo ratings yet

- BobredDocument430 pagesBobredNikunj OlpadwalaNo ratings yet

- Finance Master Thesis PDFDocument7 pagesFinance Master Thesis PDFafkojbvmz100% (2)

- Annexure - 1: S.Vasudevan CPS Index NumberDocument8 pagesAnnexure - 1: S.Vasudevan CPS Index NumbertnadehkjpdNo ratings yet

- Problems of Merchant BankersDocument2 pagesProblems of Merchant BankersMohith Sharma75% (12)

- Beauhurst Crowdfunding Index Q1 2017Document5 pagesBeauhurst Crowdfunding Index Q1 2017CrowdfundInsiderNo ratings yet

- Bhavesh Jadav BB 1Document7 pagesBhavesh Jadav BB 1bhaveshjadavNo ratings yet

- 15 Account Fo Partenership UDDocument35 pages15 Account Fo Partenership UDERICK MLINGWA60% (5)

- Ms8-Set A Midterm - With AnswersDocument5 pagesMs8-Set A Midterm - With AnswersOscar Bocayes Jr.No ratings yet

- Characteristics of The Islamic EconomyDocument3 pagesCharacteristics of The Islamic EconomyJuliyana Jamal100% (3)