Professional Documents

Culture Documents

EXCLUSIONS

Uploaded by

Anthony Loveriza0 ratings0% found this document useful (0 votes)

12 views2 pagesthis is a description.

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentthis is a description.

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views2 pagesEXCLUSIONS

Uploaded by

Anthony Loverizathis is a description.

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 2

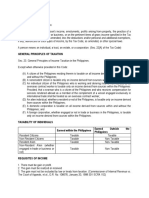

General rule

- all income subj to tax unless exempted by law

- exempt are law disfavored, construed against taxpayer

Sources of Exclusions

- Consti, Laws, and Treaties

Taxes other than Income Taxes

- exlclusions may still be subj to other type of tax

EXCLUSIONS

- earned but not included in GI

- under section 32 (b) RA 8424 are:

a) Proceeds of Life Insurance

- paid to heirs/beneficiaries upon death, whether single sum

- if under agreement to pay interest then it is INCLUDED.

EXC: if proceeds retained by insurer > interest is taxable

b) Amount received by insured as RETURN OF PREMIMUM

- amt received as return of prem paid under life insurance, endowment, annuity

contracts.

- outliving the period policy - designate the taxable and non

c) Gifts, Bequests, and Devises

- value of property acquired by gift or descent.

- if property used to earn income - INCLUDE thereon

d) Compensation for Injuries or Sickness

- amt received thru health insurance, accidents, plus AMT of any damages received

wether by suit or agreement.

e) Income exempt under Treaty

f) Retirement ben., Pensions, Gratuities & Others

- under RA 7641, whether indiv or corporate as long as:

a) there is reasonable private ben. plan by employer

b) Been in service for 10 years under same employer

c) Not less than 50 yrs of age at time of retirement

d) Benefits granted shall be availed only ONCE

e) Amt received by official/by heirs as consequence of separation from service due

to death/sickness/disability

caused BEYOND the control of the official

- Social security/ other similar ben > RC/NRC/RA

- payment of ben. due or about to - to any person residing in PH under laws of US

administed by US Vet Admin.

- Ben received under SSS in accord w/ RA 8282

- GSIS (RA 8291)

g) Prizes and Awards

-a) In recog of religious, charitable, scientific, educational, arts, literacy or

civic achievement ONLY IF

i) he was selected without any action on his part to enter the contest; and

ii) not required to render substantial future services as condition to receive the

prize

-b) Sports competition awards held by NSA

h) 13th Month pay and Other Benefits

- not exceeding P90,000

- ben. not covered by PD no. 851

- de minimis ben. (excess is added to 13th month pay)

i) unused vacation leave credits (private employee) 10 days

ii) unused vacation/sick leave of govt officials - no limit

iii) medical allowance to depndent employee - P750/250/month

iv) rice subsidy - P2,000 or 1 sack of 50kg per month

v) uniform - not exceeding P6,000 per annum

vi) Medical cash ben. - not over P10,000 per annum

vii) laundry - not over P300 per month

viii) employee achievement - in form of tangible other than cash/gift certificate

not over P10,000

ix) gifts given during christmas/anniv - not over P5,000

x) meal allowance - not over 25% of basic minimum wage

xi) travel abroad - tickets should be business/economy (1st class 30% taxable)

hotel accomodation $300 per day and inland travel

xii) Productivity bonus - not over P10,000 per employee per year given there is

collective bargain agreement.

i) Gains from sales of bonds, debentures & other cert of indebtedness

- provided it has MATURITY OF MORE THAN 5 YEARS

j) Gains from redemption of shares in mutual fund

k) Wages of MWE

l) Income derived by Foreign Govt

- from investments, loans, stocks, securities, interest on deposits in PH by

foreign govts.

m) Income derived by Govt or its Political Subdivisions

You might also like

- De Minimis Benifit AssignmentDocument9 pagesDe Minimis Benifit AssignmentJoneric RamosNo ratings yet

- Taxation: TopicsDocument128 pagesTaxation: TopicsKudryNo ratings yet

- Income Taxation Module 2Document17 pagesIncome Taxation Module 2Regelene Selda TatadNo ratings yet

- cH.8 Exclusions From Gross IncomeDocument15 pagescH.8 Exclusions From Gross IncomeJemima BukingNo ratings yet

- The Proceeds of Life Insurance Policies They Do The Heirs or Beneficiaries Upon Death of The Insured Shall Be Exempt From Income TaxDocument18 pagesThe Proceeds of Life Insurance Policies They Do The Heirs or Beneficiaries Upon Death of The Insured Shall Be Exempt From Income TaxXhien YeeNo ratings yet

- Group 2 Exclusion From Gross IncomeDocument27 pagesGroup 2 Exclusion From Gross IncomeMaryrose MalaluanNo ratings yet

- Exclusion From Gross Income & FBTDocument32 pagesExclusion From Gross Income & FBTAira Nharie MecateNo ratings yet

- CRC-ACE Income TaxationDocument127 pagesCRC-ACE Income TaxationMark Christian Cutanda VillapandoNo ratings yet

- Regular Income TaxDocument5 pagesRegular Income TaxJulyanneErikaMigriñoMeñuza100% (1)

- Tax Ii NotesDocument40 pagesTax Ii NotesMARFENo ratings yet

- Income, DefinedDocument40 pagesIncome, DefinedConcon FabricanteNo ratings yet

- Inclusions, Exclusions and Deductions of Net IncomeDocument5 pagesInclusions, Exclusions and Deductions of Net IncomeMHERITZ LYN LIM MAYOLANo ratings yet

- COMPUTATION OF GROSS INCOME As Per Tax Code Sec. 32-33Document5 pagesCOMPUTATION OF GROSS INCOME As Per Tax Code Sec. 32-332022107419No ratings yet

- GROSS INCOME Inclusions and Exclusions: Tel. Nos. (043) 980-6659Document24 pagesGROSS INCOME Inclusions and Exclusions: Tel. Nos. (043) 980-6659MaeNo ratings yet

- Gross IncomeDocument37 pagesGross IncomeAlyssa TolentinoNo ratings yet

- Computation of Income TaxDocument6 pagesComputation of Income TaxshakiraNo ratings yet

- Exclusion of Gross IncomeDocument14 pagesExclusion of Gross IncomeRnlynNo ratings yet

- Week 10 Part 3 Exclusions From The Gross IncomeDocument19 pagesWeek 10 Part 3 Exclusions From The Gross IncomeArellano Rhovic R.No ratings yet

- Section 24Document10 pagesSection 24John Rustin VillelaNo ratings yet

- Module No 7 - Exclusions From Gross IncomeDocument6 pagesModule No 7 - Exclusions From Gross IncomeLysss Epssss100% (1)

- Exclusions From Gross Income-Regular Income TaxDocument19 pagesExclusions From Gross Income-Regular Income Taxjess IcaNo ratings yet

- LECT 1 IncomeDocument4 pagesLECT 1 IncomeFredalyn Joy VelaqueNo ratings yet

- Module 7Document5 pagesModule 7Marklein DumangengNo ratings yet

- Gross Income: As A General Rules, Retirement Benefit, Pension, Gratuities, Separation Pay Are All TaxesDocument13 pagesGross Income: As A General Rules, Retirement Benefit, Pension, Gratuities, Separation Pay Are All TaxesXhien YeeNo ratings yet

- ClubbingDocument8 pagesClubbingSiddharth VaswaniNo ratings yet

- Taxation - Exclusions and ExemptionsDocument6 pagesTaxation - Exclusions and Exemptionslleiryc7No ratings yet

- Gross Income Inc Exc DedDocument9 pagesGross Income Inc Exc DedMelbert BallaraNo ratings yet

- 2nd Semester Income Taxation Module 10 CPAR Gross Income - Exclusion and InclusionsDocument21 pages2nd Semester Income Taxation Module 10 CPAR Gross Income - Exclusion and Inclusionsnicole tolaybaNo ratings yet

- Inclusion and Exclusion of Gross Income Summary Review by ValenciaDocument6 pagesInclusion and Exclusion of Gross Income Summary Review by ValenciaMichael Pelingon Severo100% (1)

- Module No 7 - Exclusions From Gross IncomeDocument5 pagesModule No 7 - Exclusions From Gross IncomeKatherine June CaoileNo ratings yet

- Exclusion of Gross IncomeDocument16 pagesExclusion of Gross IncomeAce ReytaNo ratings yet

- Group 2 Exclusion From Gross IncomeDocument32 pagesGroup 2 Exclusion From Gross IncomeMaryrose MalaluanNo ratings yet

- Acc311 02 2022Document3 pagesAcc311 02 2022Saya PascualNo ratings yet

- Exc and Inc of GIDocument6 pagesExc and Inc of GIJermaine SemañaNo ratings yet

- Gross IncomeDocument21 pagesGross IncomeKimberly ToraldeNo ratings yet

- Exc and Inc of GIDocument6 pagesExc and Inc of GIJermaine Rae Arpia DimayacyacNo ratings yet

- Exclusions Under The ConstitutionDocument4 pagesExclusions Under The ConstitutionGarri AtaydeNo ratings yet

- TAX-902 (Gross Income - Exclusions)Document5 pagesTAX-902 (Gross Income - Exclusions)Ciarie Salgado100% (1)

- Chapter-7 DeductionDocument7 pagesChapter-7 DeductionBrinda RNo ratings yet

- TAX2 3rd PartDocument8 pagesTAX2 3rd Partmitsudayo_No ratings yet

- Gross IncomeDocument54 pagesGross IncomeErneylou RanayNo ratings yet

- Gross Income (Exclusions and Inclusions From Gross Income) - REVISED 2022Document34 pagesGross Income (Exclusions and Inclusions From Gross Income) - REVISED 2022rav dano100% (2)

- Withholding TaxDocument10 pagesWithholding TaxAngelo ChiucoNo ratings yet

- Exclusions in Gross Income: BAM 127: Income Taxation For BA Module #15Document9 pagesExclusions in Gross Income: BAM 127: Income Taxation For BA Module #15Mylene SantiagoNo ratings yet

- Pure Compensation IncomeDocument2 pagesPure Compensation Incomechavezcelvia18No ratings yet

- 1601 CDocument8 pages1601 CMhyckee GuinoNo ratings yet

- Deductions: Basic Rule The Aggregate Amount of Deductions Under Sections 80C To 80U Cannot Exceed The Gross Total IncomeDocument29 pagesDeductions: Basic Rule The Aggregate Amount of Deductions Under Sections 80C To 80U Cannot Exceed The Gross Total IncomeashpakkhatikNo ratings yet

- Gifts Distinguished From ExchangeDocument7 pagesGifts Distinguished From ExchangedailydoseoflawNo ratings yet

- Inclusions in Gross IncomeDocument4 pagesInclusions in Gross IncomeNaiza Mae R. BinayaoNo ratings yet

- Exclusions From Gross IncomeDocument1 pageExclusions From Gross IncomeMargaux CornetaNo ratings yet

- C8 Exclusion From Gross IncomeDocument16 pagesC8 Exclusion From Gross IncomeSUBA, Michagail D.No ratings yet

- Tax HWDocument3 pagesTax HWMorris JulianNo ratings yet

- Exclusion On Gross Income OlDocument7 pagesExclusion On Gross Income OlJoneric RamosNo ratings yet

- Taxation Module 3 5Document57 pagesTaxation Module 3 5Ma VyNo ratings yet

- Incomes Which Do Not Form OF Total Income (Section 10) : Dr. P.Sree Sudha, Associate Professor, DsnluDocument48 pagesIncomes Which Do Not Form OF Total Income (Section 10) : Dr. P.Sree Sudha, Associate Professor, Dsnluleela naga janaki rajitha attiliNo ratings yet

- Deductions From Gross IncomeDocument75 pagesDeductions From Gross Incomealdric taclanNo ratings yet

- Exclusions From Gross IncomeDocument2 pagesExclusions From Gross IncomeKirsten Rose Boque ConconNo ratings yet

- Memory Aid TaxationDocument26 pagesMemory Aid TaxationGela Bea BarriosNo ratings yet

- Recovery of Past DeductionsDocument1 pageRecovery of Past DeductionsAnthony LoverizaNo ratings yet

- Wash SalesDocument2 pagesWash SalesAnthony LoverizaNo ratings yet

- BlsDocument4 pagesBlsAnthony LoverizaNo ratings yet

- Fraud Subs ProcedDocument1 pageFraud Subs ProcedAnthony LoverizaNo ratings yet

- Sonic Boom Comic Book Gacha ClubDocument9 pagesSonic Boom Comic Book Gacha ClubAnthony LoverizaNo ratings yet

- National Archives of The Philippines National Library of The PhilsDocument15 pagesNational Archives of The Philippines National Library of The PhilsAnthony LoverizaNo ratings yet

- Group4 Group Activity1Document9 pagesGroup4 Group Activity1Anthony LoverizaNo ratings yet

- How To Draw A Human: An Easy Guide, Step by Step For StartersDocument1 pageHow To Draw A Human: An Easy Guide, Step by Step For StartersAnthony LoverizaNo ratings yet

- History Physiotherapy CSP PD021Document10 pagesHistory Physiotherapy CSP PD021Michael Diet GrecoNo ratings yet

- A PRACTICAL Guide To Training and DevelopmentDocument25 pagesA PRACTICAL Guide To Training and DevelopmentERMIYAS TARIKUNo ratings yet

- APL Annual Report 2012Document104 pagesAPL Annual Report 2012Sumbul ZehraNo ratings yet

- Ab InitioDocument14 pagesAb InitioManish ChoudharyNo ratings yet

- TCS-Recruitment and SelectionDocument17 pagesTCS-Recruitment and SelectionChirag PatelNo ratings yet

- Mana 420 Review Slides - Week 10Document10 pagesMana 420 Review Slides - Week 10Clara GénadryNo ratings yet

- Ace HRM ReportDocument32 pagesAce HRM ReportRajkishor YadavNo ratings yet

- Ondoy v. IgnacioDocument2 pagesOndoy v. IgnacioKim LaguardiaNo ratings yet

- Resume Ana Devdariani JobseekerDocument1 pageResume Ana Devdariani JobseekerAna DevdarianiNo ratings yet

- Retail District Manager Cover Letter ExamplesDocument7 pagesRetail District Manager Cover Letter Examplesafjwdbaekycbaa100% (2)

- n362 Professional Dev PlanDocument4 pagesn362 Professional Dev Planapi-302732994No ratings yet

- Career Action PlanDocument7 pagesCareer Action PlanJane MiraNo ratings yet

- Production Planning and ControlDocument29 pagesProduction Planning and ControlShivam BansalNo ratings yet

- Final Retaliation Paul WestDocument7 pagesFinal Retaliation Paul WestFOX 61 WebstaffNo ratings yet

- The ShangDocument44 pagesThe ShangMarjorie MercadoNo ratings yet

- External CompetitivenessDocument33 pagesExternal Competitivenesssnehagpt100% (1)

- CHAPTER 6 EMPLOYEE INVOLVEMENT - CompressedDocument75 pagesCHAPTER 6 EMPLOYEE INVOLVEMENT - CompressedBeah Toni PacundoNo ratings yet

- HR DASHBOARD PPT 28Document15 pagesHR DASHBOARD PPT 28sajana sajeevanNo ratings yet

- Od Interventions: What Is An OD Intervention?Document9 pagesOd Interventions: What Is An OD Intervention?Sameer ShahNo ratings yet

- Business Management Project ProposalDocument14 pagesBusiness Management Project ProposalAlliciaNo ratings yet

- Bus Math-M6Document3 pagesBus Math-M6Caslenia IvyNo ratings yet

- Sales Force Training at Arrow ElectronicsDocument3 pagesSales Force Training at Arrow Electronicsvaibhavjss100% (2)

- CESC Dhariwal 300 MW - ChandrapurDocument10 pagesCESC Dhariwal 300 MW - Chandrapurramnadh803181No ratings yet

- Management Controll System BookDocument192 pagesManagement Controll System Bookmathrix01No ratings yet

- QuingDocument48 pagesQuinglulughoshNo ratings yet

- 2016-07-14 NYC Department of Investigation Report - Rivington House (Pr22)Document161 pages2016-07-14 NYC Department of Investigation Report - Rivington House (Pr22)Progress QueensNo ratings yet

- Practice 11CDocument3 pagesPractice 11CVadalinaNo ratings yet

- 2023-24 Course Brochure WebVersionDocument60 pages2023-24 Course Brochure WebVersionAbou_Issa_138No ratings yet

- Case Studi Organizational BehaviourDocument9 pagesCase Studi Organizational BehaviourNita YunitasariNo ratings yet

- Lecture Notes MacroeconomicsDocument3 pagesLecture Notes Macroeconomicsishtiaqlodhran100% (2)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionFrom EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNo ratings yet

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012From EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012No ratings yet

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessFrom EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthFrom EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo ratings yet

- Estrategias de Impuestos: Cómo Ser Más Inteligente Que El Sistema Y La IRS Cómo Un Inversionista: Al Incrementar Tu Ingreso Y Reduciendo Tus Impuestos Al Invertir Inteligentemente Volumen CompletoFrom EverandEstrategias de Impuestos: Cómo Ser Más Inteligente Que El Sistema Y La IRS Cómo Un Inversionista: Al Incrementar Tu Ingreso Y Reduciendo Tus Impuestos Al Invertir Inteligentemente Volumen CompletoNo ratings yet

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)

- S Corporation ESOP Traps for the UnwaryFrom EverandS Corporation ESOP Traps for the UnwaryNo ratings yet

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)