Professional Documents

Culture Documents

090 PDF

Uploaded by

AMIT SYSTEMOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

090 PDF

Uploaded by

AMIT SYSTEMCopyright:

Available Formats

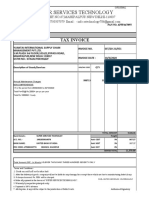

Tax Invoice

SHREE SALES & SERVICES Invoice No. Dated

HOUSE NO-845 BLOCK-J 090 20-Feb-2023

JAHANGIRPURI DELHI-110033 Delivery Note Mode/Terms of Payment

GSTIN/UIN: 07GGKPS1000L1ZA

State Name : Delhi, Code : 07 Supplier's Ref. Other Reference(s)

E-Mail : AMITSYSTEM2021@GMAIL.COM

Buyer Buyer's Order No. Dated

KRISHNA HIRING CO

C-196/II, 1ST FLOOR, MAYA PURI, PHASE-II Despatch Document No. Delivery Note Date

DELHI-110064

GSTIN/UIN : 07ACFPS6900E1ZP Despatched through Destination

State Name : Delhi, Code : 07

Terms of Delivery

Sl Description of HSN/SAC GST Quantity Rate per Amount

No. Services Rate

1 REPAIR SERVICES 9985 18 % 10,000.00

DEMAGE AC-543

SITE:- muzaffarnagar

SERVICES DAYS-1

CGST OUTPUT 9 % 9 % 900.00

SGST OUTPUT 9 % 9 % 900.00

Total ₹ 11,800.00

Amount Chargeable (in words) E. & O.E

INR Eleven Thousand Eight Hundred Only

HSN/SAC Taxable Central Tax State Tax Total

Value Rate Amount Rate Amount Tax Amount

9985 10,000.00 9% 900.00 9% 900.00 1,800.00

Total 10,000.00 900.00 900.00 1,800.00

Tax Amount (in words) : INR One Thousand Eight Hundred Only

Company's Bank Details

Bank Name : UNION BANK OF INDIA

A/c No. : 053121010000028

Branch & IFS Code: New Delhi & UBIN0905313

Declaration for SHREE SALES & SERVICES

We declare that this invoice shows the actual price of the

goods described and that all particulars are true and

correct. Authorised Signatory

This is a Computer Generated Invoice

You might also like

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- Screenshot 2021-07-05 at 6.40.56 PMDocument1 pageScreenshot 2021-07-05 at 6.40.56 PMChandu HiremathNo ratings yet

- Municipal Corporation of Greater Mumbai: License Department Projection&Stallboard Renewal ReceiptDocument1 pageMunicipal Corporation of Greater Mumbai: License Department Projection&Stallboard Renewal ReceiptSandeep ShahNo ratings yet

- RI22507945 - Dec 28 2022 - 183245Document2 pagesRI22507945 - Dec 28 2022 - 183245vijayNo ratings yet

- Transcom Worldwide Philippines, Inc.: Taxable Income DetailsDocument1 pageTranscom Worldwide Philippines, Inc.: Taxable Income DetailsarbyjamesNo ratings yet

- TGT403Document7 pagesTGT403vikasNo ratings yet

- TLC Nov22Document1 pageTLC Nov22ABhshekNo ratings yet

- Paywithtaxslip 102324 PDFDocument1 pagePaywithtaxslip 102324 PDFamitshrivastava154218No ratings yet

- Activa InsuranceDocument1 pageActiva Insuranceyash shahNo ratings yet

- Bill Sample of CementDocument2 pagesBill Sample of Cementshadanjamia96No ratings yet

- Yuantai Amc Invoice No.51Document6 pagesYuantai Amc Invoice No.51Saurabh K MishraNo ratings yet

- Lenovo A6000 PlusDocument1 pageLenovo A6000 PlusKishore ReddyNo ratings yet

- Carabinz Tourism RZ31CG1461: Numeric PNRDocument1 pageCarabinz Tourism RZ31CG1461: Numeric PNRRidhwanNo ratings yet

- Ramesh Verma PDFDocument2 pagesRamesh Verma PDFPankajNo ratings yet

- Answer Key TaxDocument12 pagesAnswer Key TaxLocklaim Cardinoza100% (1)

- Morph Ser202324027 31102023 277Document6 pagesMorph Ser202324027 31102023 277gokulpics1No ratings yet

- Tax Invoice: Name Address State State Code Description AmountDocument1 pageTax Invoice: Name Address State State Code Description AmountArun UpadhyeNo ratings yet

- Invoice INV318Document2 pagesInvoice INV318shecamazicaNo ratings yet

- Nitesh Pad PDFDocument1 pageNitesh Pad PDFdeep kumarNo ratings yet

- NDTL JLN STADIUM - Sept'23Document1 pageNDTL JLN STADIUM - Sept'23vineet.tpsNo ratings yet

- D-524 BiomeriuxDocument4 pagesD-524 BiomeriuxVinay KatochNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnkur RatheeNo ratings yet

- PaymentReceipt - 6A - 61 - R - 00000137 - 1687318827937Document2 pagesPaymentReceipt - 6A - 61 - R - 00000137 - 1687318827937Ishini NadeeshaNo ratings yet

- Shahzad Haider: Declaration Acknowledgement SlipDocument2 pagesShahzad Haider: Declaration Acknowledgement SlipShehzad HaiderNo ratings yet

- TASL Export Commercial Invoice (ZHEX)Document1 pageTASL Export Commercial Invoice (ZHEX)Vinod KumarNo ratings yet

- Telephone BillDocument1 pageTelephone BillPulkit GargNo ratings yet

- KentDocument1 pageKentSunil PatelNo ratings yet

- LK InvoiceDocument1 pageLK InvoicekanggadeviNo ratings yet

- TC Tours Invoice 8th JuneDocument2 pagesTC Tours Invoice 8th JuneDeepak SharmaNo ratings yet

- Istilah Pajak Dalam Bahasa InggrisDocument6 pagesIstilah Pajak Dalam Bahasa InggrisGraha BeenovaNo ratings yet

- HQ04 - Final Income TaxationDocument5 pagesHQ04 - Final Income TaxationJimmyChaoNo ratings yet

- Public Fiscal Report ScriptDocument8 pagesPublic Fiscal Report ScriptMIS Informal Settler FamiliesNo ratings yet

- Grand Total 100.00: District-Jhajjar, FC - Farrukhnagar, Jhajjar, Haryana, India - 124103, IN-HRDocument4 pagesGrand Total 100.00: District-Jhajjar, FC - Farrukhnagar, Jhajjar, Haryana, India - 124103, IN-HRrishovNo ratings yet

- Invoice (1377 52902)Document2 pagesInvoice (1377 52902)JonaNo ratings yet

- SmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceDocument2 pagesSmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceJitender NarulaNo ratings yet

- Invoice SocleanDocument1 pageInvoice SocleanDavid ThomasNo ratings yet

- GoodDocument1 pageGoodEntertain with musicNo ratings yet

- Sterling N ComputingDocument2 pagesSterling N ComputingSwagBeast SKJJNo ratings yet

- In Voice 23023Document3 pagesIn Voice 23023drogonNo ratings yet

- Kurnia Insurans (Malaysia) Berhad (44191-P) : E-Policy / Endorsement Submission Sheet (Motor)Document1 pageKurnia Insurans (Malaysia) Berhad (44191-P) : E-Policy / Endorsement Submission Sheet (Motor)Yuen ThouNo ratings yet

- III InvoiceDocument1 pageIII InvoiceAshu SinghNo ratings yet

- Renewal of Your Easy Health Individual Standard Insurance PolicyDocument5 pagesRenewal of Your Easy Health Individual Standard Insurance PolicyHeena BhatNo ratings yet

- 150 Massar Al-Ingaz 3M Cat6 CablesDocument1 page150 Massar Al-Ingaz 3M Cat6 CablesIbrahim AljunaidiNo ratings yet

- WIFIDocument1 pageWIFINurul HasanNo ratings yet

- Solid Q 50 KW InvoiceDocument1 pageSolid Q 50 KW InvoiceTrisha RawatNo ratings yet

- Tax - Invoice: Burckhardt Compression (India) Pvt. LTDDocument1 pageTax - Invoice: Burckhardt Compression (India) Pvt. LTDYOGESHNo ratings yet

- C3TW4F: Date Flight From / Terminal To / Terminal Stops Departs Arrives Baggage Allowance ClassDocument1 pageC3TW4F: Date Flight From / Terminal To / Terminal Stops Departs Arrives Baggage Allowance ClassMadhuram SharmaNo ratings yet

- Tax Invoice: Charge DetailsDocument3 pagesTax Invoice: Charge DetailssrinivasNo ratings yet

- Bhiwandi Lrno.Document1 pageBhiwandi Lrno.MD Amir SohailNo ratings yet

- Info Edge (India) LTD: Tax InvoiceDocument1 pageInfo Edge (India) LTD: Tax Invoicephani raja kumarNo ratings yet

- Invoice - Dhanraj1992 APRIL-23 PDDocument1 pageInvoice - Dhanraj1992 APRIL-23 PDAinta GaurNo ratings yet

- Tax Invoice: Advance Receipt Voucher NoDocument2 pagesTax Invoice: Advance Receipt Voucher NoRajeev PuppalaNo ratings yet

- I CRMDocument2 pagesI CRMAnupesh PachoriNo ratings yet

- Joister 3Document1 pageJoister 3priyank31No ratings yet

- T1 DC YC70 W FHZUPzw PSCUu ADocument2 pagesT1 DC YC70 W FHZUPzw PSCUu Ashreya arunNo ratings yet

- Print 2Document2 pagesPrint 2SwagBeast SKJJNo ratings yet

- Faulty Adopters InvoiceDocument1 pageFaulty Adopters InvoicesumitsharmaNo ratings yet

- Receipt 1Document2 pagesReceipt 1SehrishNo ratings yet

- Tally Bill The Perfect 1Document1 pageTally Bill The Perfect 1Unnat aggarwalNo ratings yet

- SeminarDocument1 pageSeminarSafalsha BabuNo ratings yet

- Sewa bill-AED 559Document1 pageSewa bill-AED 559muhdazarNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerPramod Kumar GuptaNo ratings yet

- Sold To: Tax InvoiceDocument1 pageSold To: Tax Invoiceমধু্স্মিতা ৰায়No ratings yet

- Hotel BillDocument2 pagesHotel BillDEVI SUNDARNo ratings yet

- INV#23002073 Tejas Networks LTD (DTA Unit) (PO-1122201371)Document1 pageINV#23002073 Tejas Networks LTD (DTA Unit) (PO-1122201371)Venkatesan ANo ratings yet

- D Block Audi CompreserDocument1 pageD Block Audi Compreserrajesh.vNo ratings yet

- Spaze TowerDocument1 pageSpaze TowerShubhamvnsNo ratings yet

- Public Finance and TaxationDocument134 pagesPublic Finance and TaxationyebegashetNo ratings yet

- Don't Use Any Special Characters Like (') 2. Don't Leave Any Row Blank Between. 3. Don't Move ColumnsDocument13 pagesDon't Use Any Special Characters Like (') 2. Don't Leave Any Row Blank Between. 3. Don't Move ColumnsUtkarsh SrivastavaNo ratings yet

- Payslip For March 2023 - TORM ARAWA (Closed Payroll) : Torm A/S Torm A/SDocument1 pagePayslip For March 2023 - TORM ARAWA (Closed Payroll) : Torm A/S Torm A/SRodelio TomasNo ratings yet

- Income Tax Notes Income Tax Notes: Income Tax Law (University of Sindh) Income Tax Law (University of Sindh)Document44 pagesIncome Tax Notes Income Tax Notes: Income Tax Law (University of Sindh) Income Tax Law (University of Sindh)Farhan Khan MarwatNo ratings yet

- 75% RuleDocument2 pages75% RuleKAM JIA LINGNo ratings yet

- Taxation Law Bar Review Lecture NotesDocument3 pagesTaxation Law Bar Review Lecture NotesIra AgtingNo ratings yet

- HDMFDocument12 pagesHDMFAlvin HallarsisNo ratings yet

- RR 04-08 (Sale of RP)Document7 pagesRR 04-08 (Sale of RP)joefieNo ratings yet

- Study Guide 6.3.1Document2 pagesStudy Guide 6.3.1nhloniphointelligenceNo ratings yet

- MYVI 1.3: Automatic ManualDocument2 pagesMYVI 1.3: Automatic ManualMuhammad NazwanNo ratings yet

- Business Math Report On TaxDocument23 pagesBusiness Math Report On TaxJustine Kaye PorcadillaNo ratings yet

- Chapter 10 Compensation IncomeDocument4 pagesChapter 10 Compensation IncomeJason MablesNo ratings yet

- 2021 IK Return WDocument6 pages2021 IK Return Wali razaNo ratings yet

- A Study On Systematic Investment Plan in Mutual FundDocument43 pagesA Study On Systematic Investment Plan in Mutual FundParag JagtapNo ratings yet

- 611 1Document1 page611 1Santhiya RNo ratings yet

- Driver Salary Reimb Voucher - October 2014Document1 pageDriver Salary Reimb Voucher - October 2014KarthikSureshNo ratings yet

- Ae211 Finals QuizDocument20 pagesAe211 Finals QuizDJAN IHIAZEL DELA CUADRANo ratings yet

- Md. Jehad Uddin Deputy Secretary Financial Institutions Division Ministry of FinanceDocument75 pagesMd. Jehad Uddin Deputy Secretary Financial Institutions Division Ministry of FinanceKhadeeza ShammeeNo ratings yet

- Chapter 3 PayrollDocument16 pagesChapter 3 PayrollAbdi Mucee TubeNo ratings yet

- Invoice 92Document1 pageInvoice 92Propriter:Gaurav KesharwaniNo ratings yet

- March 11 Pay Slip NewDocument2 pagesMarch 11 Pay Slip NewManish ShrivastavaNo ratings yet

- Buckwold12e Solutions Ch11Document40 pagesBuckwold12e Solutions Ch11Fang YanNo ratings yet

- Tax-1-Solutions Bsa Quiz - Theories W AnsDocument6 pagesTax-1-Solutions Bsa Quiz - Theories W AnsCyrss BaldemosNo ratings yet