Professional Documents

Culture Documents

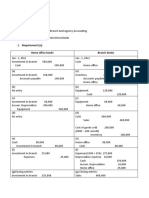

HO and Branch Exercises - Solution

Uploaded by

Trisha Mae Alburo0 ratings0% found this document useful (0 votes)

11 views2 pagesHO

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHO

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesHO and Branch Exercises - Solution

Uploaded by

Trisha Mae AlburoHO

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

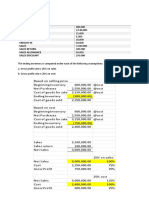

Problem 1

Answers

a. 255,000

b. 243,200

c. 538,700

d. 12,000

e. 187,700

Billed Price Cost Allowance for Overvaluation

130% 100% 30%

Beginning Inventory xx xx xx

Shipments from Home Office xx xx xx

Goods Available for Sale xx xx xx

Ending Inventory (xx) (xx) (xx)

Cost of Sales xx xx xx

Billed Price Cost Allowance for Overvaluation

130% 100% 30%

Beginning Inventory

Shipments from Home Office 188,500

Goods Available for Sale 52,500

Ending Inventory (52,000)

Cost of Sales

Billed Price Cost Allowance for Overvaluation

130% 100% 30%

Beginning Inventory 39,000 30,000 9,000

Shipments from Home Office 188,500 145,000 43,500

Goods Available for Sale 227,500 175,000 52,500

Ending Inventory (52,000) (40,000) (12,000)

Cost of Sales 175,500 135,000 40,500

Ending Inventory billed price (79,700 – 27,700 = 52,000)

Allowance for overvaluation of 52,500 is allowance on GAS or the unadjusted balance of allowance

Branch Computation – Outside Suppliers

Beginning Inventory 19,000 (58,000 – 39,000)

Purchases 200,000

Ending Inventory (27,700)

Cost of Sales 191,300

Home Office Computation – Net Income

Sales 1,200,000

Cost of Sales

Beginning Inventory 20,000

Purchases 900,000

Shipments to Branch (145,000)

Ending Inventory (120,000) (655,000)

Operating Expenses (290,000)

Net Income 255,000

Branch Computation – Net Income

Sales 720,000

Cost of Sales

Home Office 175,500

Outsiders 191,300 (366,800)

Operating Expenses (110,000)

Net Income 243,200

Branch Income 243,500

Income from Allowance 40,500

True Income of Branch 283,700

Home Office Income 255,000

Combined Income 538,700

Home Office – ending inventory 120,000

Branch – ending inventory from HO at cost 40,000

Branch – ending inventory from outsiders 27,700

Total 187,700

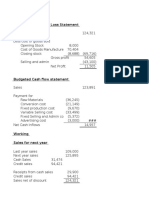

Problem 2

Question 1 b

Question 2 c

Question 3 c

Question 4 b

Billed Price Cost Allowance for Overvaluation

Beginning Inventory

Shipments from Home Office 10,000 8,000

Goods Available for Sale 3,600

Ending Inventory (7,500)

Cost of Sales

Billed Price Cost Allowance for Overvaluation

125% 100% 25%

Beginning Inventory 8,000 6,400 1,600

Shipments from Home Office 10,000 8,000 2,000

Goods Available for Sale 18,000 14,400 3,600

Ending Inventory (7,500) (6,000) (1,500)

Cost of Sales 10,500 8,400 2,100

Branch Computation – Outside Suppliers

Beginning Inventory 7,000 (15,000 – 8,000)

Purchases 5,500

Ending Inventory (2,500)

Cost of Sales 10,000

Home Office Computation – Net Income

Sales 60,000

Cost of Sales

Beginning Inventory 20,000

Purchases 35,000

Shipments to branch (8,000)

Ending Inventory (20,000) (27,000)

Operating Expenses (14,000)

Net Income 19,000

Branch Computation – Net Income

Sales 30,000

Cost of Sales

Home Office 10,500

Outsiders 10,000 (20,500)

Operating Expenses (6,000)

Net Income 3,500

Combined Net Income

Home Office Net Income 19,000

Branch Home Office 3,500

Realized Profit from COS 2,100

Total 24,600

You might also like

- Quiz On Fraud and Error and Audit EvidenceDocument5 pagesQuiz On Fraud and Error and Audit EvidenceTrisha Mae Alburo100% (1)

- Cost Accounting AssignmentDocument6 pagesCost Accounting AssignmentCharles BarcelaNo ratings yet

- Manufacturing Account Worked Example Question 13Document6 pagesManufacturing Account Worked Example Question 13Roshan Ramkhalawon100% (1)

- CVP Analysis - Straight Problems - With SolutionsDocument3 pagesCVP Analysis - Straight Problems - With SolutionsTrisha Mae Alburo100% (4)

- Final - Home Office Branch of AccountingDocument13 pagesFinal - Home Office Branch of AccountingHazel Jane Esclamada100% (1)

- ISCC EU PLUS Procedure Chain-of-CustodyDocument54 pagesISCC EU PLUS Procedure Chain-of-CustodySartika MutiarasaniNo ratings yet

- Home Office and Branch HandoutsDocument4 pagesHome Office and Branch HandoutsbangtansonyeondaNo ratings yet

- The Pearl Rating System For Estidama Villa Rating System Design & Construction. Version 1.0Document141 pagesThe Pearl Rating System For Estidama Villa Rating System Design & Construction. Version 1.0ANo ratings yet

- Sawyers - Introduction To Managerial AccountingDocument29 pagesSawyers - Introduction To Managerial AccountingTrisha Mae AlburoNo ratings yet

- Roque - Managerial AccountingDocument17 pagesRoque - Managerial AccountingTrisha Mae AlburoNo ratings yet

- Discontinued Operation: Intermediate Accounting 3Document21 pagesDiscontinued Operation: Intermediate Accounting 3Trisha Mae AlburoNo ratings yet

- Non-Current Asset Held For SaleDocument28 pagesNon-Current Asset Held For SaleTrisha Mae AlburoNo ratings yet

- Home Office and Branch AccountingDocument12 pagesHome Office and Branch AccountingKrizia Mae FloresNo ratings yet

- Business Enhancement 2nd Summative TextDocument16 pagesBusiness Enhancement 2nd Summative TextCams DlunaNo ratings yet

- Sol. Man. - Chapter 7 - Inventories - Ia Part 1a - P 2,3,5,6 PDFDocument18 pagesSol. Man. - Chapter 7 - Inventories - Ia Part 1a - P 2,3,5,6 PDFLalaland Acads100% (2)

- CVP and Break-Even Analysis - RoqueDocument33 pagesCVP and Break-Even Analysis - RoqueTrisha Mae AlburoNo ratings yet

- Home Office, Branch and Agency Accounting: Problem 11-1: True or FalseDocument13 pagesHome Office, Branch and Agency Accounting: Problem 11-1: True or FalseVenz Lacre100% (1)

- Unrealized Mark-Up: Best CoDocument4 pagesUnrealized Mark-Up: Best CoPalos DoseNo ratings yet

- Business Combination Problem 1 Upto 9Document8 pagesBusiness Combination Problem 1 Upto 9jhun nhixNo ratings yet

- ASsignemts SCIDocument25 pagesASsignemts SCIPedro PelaezNo ratings yet

- HOBA Special ProbDocument14 pagesHOBA Special ProbRujean Salar AltejarNo ratings yet

- Tugas 4 Lambertus HelliDocument6 pagesTugas 4 Lambertus HelliLambertus ZoNo ratings yet

- Manufacturing Account Worked Example Question 12Document6 pagesManufacturing Account Worked Example Question 12Roshan RamkhalawonNo ratings yet

- Jawaban Perhitungan Dan Akumulasi BiayaDocument7 pagesJawaban Perhitungan Dan Akumulasi BiayaEka OematanNo ratings yet

- Case A Case B Case CDocument2 pagesCase A Case B Case Ckhiladi883No ratings yet

- Manufacturing Account Worked Example Question 17Document6 pagesManufacturing Account Worked Example Question 17Roshan RamkhalawonNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingRajibNo ratings yet

- HOBA Special ProbDocument19 pagesHOBA Special ProbRujean Salar AltejarNo ratings yet

- MCMCDocument6 pagesMCMCIT GAMINGNo ratings yet

- Cost Sheet ProblemsDocument5 pagesCost Sheet ProblemsshamilaNo ratings yet

- ho.br.docxDocument16 pagesho.br.docxjuennaguecoNo ratings yet

- Tugas Managerial AccountinDocument3 pagesTugas Managerial Accountinlaurentinus fikaNo ratings yet

- CHEER UP Chapter 13 Gross Profit MethodDocument7 pagesCHEER UP Chapter 13 Gross Profit MethodaprilNo ratings yet

- Home Office Branch AgencyyyDocument9 pagesHome Office Branch AgencyyyIyah AmranNo ratings yet

- Cost Accounting (Tooba)Document6 pagesCost Accounting (Tooba)Ali AbbasNo ratings yet

- Karen Company Statement of Cost of Goods Manufactured For The Year Ended Dec. 31, 2020Document8 pagesKaren Company Statement of Cost of Goods Manufactured For The Year Ended Dec. 31, 2020Althea Gabrielle PinedaNo ratings yet

- Mô HìnhDocument7 pagesMô HìnhThanh Tâm Lê ThịNo ratings yet

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- Afar 2 LQ T2Document14 pagesAfar 2 LQ T2Alexandria EvangelistaNo ratings yet

- Activity 4 Cost Accounting Answer KeyDocument6 pagesActivity 4 Cost Accounting Answer KeyJamesNo ratings yet

- Assignment On Cost SheetDocument3 pagesAssignment On Cost SheetRashmi KumariNo ratings yet

- Shipments From Home Office 29,000 Accounts Receivable 7,000 Freight-In 4,000 Home Office 40,000Document13 pagesShipments From Home Office 29,000 Accounts Receivable 7,000 Freight-In 4,000 Home Office 40,000Julie Mae Caling MalitNo ratings yet

- Bacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesDocument7 pagesBacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesQueenie Rose BacolodNo ratings yet

- Preparation of Individual Income Tax Return For Mixed Income EarnerDocument3 pagesPreparation of Individual Income Tax Return For Mixed Income Earnercarl patNo ratings yet

- CMA Vol 1-1Document211 pagesCMA Vol 1-1Shahaer MumtazNo ratings yet

- LCNRV - SolutionDocument3 pagesLCNRV - SolutionMagadia Mark JeffNo ratings yet

- Perpetual System Periodic System: InventoryDocument2 pagesPerpetual System Periodic System: InventoryPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Cost Accounting AnswersDocument10 pagesCost Accounting AnswersHaris KhanNo ratings yet

- At Billed Price Shipments in TransitDocument3 pagesAt Billed Price Shipments in TransitALIX V. LIMNo ratings yet

- Solution Prelim ExamDocument30 pagesSolution Prelim ExamMedalla NikkoNo ratings yet

- Problem 2-29Document6 pagesProblem 2-29Love IslamNo ratings yet

- Chapter 04Document4 pagesChapter 04Nouman BaigNo ratings yet

- UntitledDocument4 pagesUntitledJomar PenaNo ratings yet

- Solution CostingDocument21 pagesSolution CostingANo ratings yet

- Hoba Problem 1Document2 pagesHoba Problem 1njsrzaNo ratings yet

- Manufacturing Account Worked Example Question 7Document4 pagesManufacturing Account Worked Example Question 7Roshan Ramkhalawon100% (1)

- Karen Company Statement of Cost of Goods Manufactured For The Year Ended Dec. 31, 2020Document5 pagesKaren Company Statement of Cost of Goods Manufactured For The Year Ended Dec. 31, 2020Althea Gabrielle PinedaNo ratings yet

- P 5 - Assigned Tasks Afar302aDocument7 pagesP 5 - Assigned Tasks Afar302aLyn CosNo ratings yet

- Manufacturing Account Worked Example Question 3Document3 pagesManufacturing Account Worked Example Question 3Roshan RamkhalawonNo ratings yet

- Job Order CostingDocument6 pagesJob Order CostingTrixie DacanayNo ratings yet

- Inventory EstimationDocument11 pagesInventory EstimationTrace ReyesNo ratings yet

- Cash FlowsDocument7 pagesCash FlowsJasmine ActaNo ratings yet

- Cost Accounting Chapter 5 AnswersDocument11 pagesCost Accounting Chapter 5 AnswersJolina MostalesNo ratings yet

- 2 Manufacturing ProblemsDocument18 pages2 Manufacturing Problemsone dev onliNo ratings yet

- Answer To Exercises To AnswerDocument9 pagesAnswer To Exercises To AnswerLEONNA BEATRIZ LOPEZNo ratings yet

- Akuntansi ManufakturDocument7 pagesAkuntansi ManufakturZEN AMALIANo ratings yet

- Cost Accounting Chapter 5 AnswersDocument11 pagesCost Accounting Chapter 5 AnswersMark Angelo AlvarezNo ratings yet

- Partnership DissolutionDocument24 pagesPartnership DissolutionTrisha Mae AlburoNo ratings yet

- Partnership OperationsDocument21 pagesPartnership OperationsTrisha Mae AlburoNo ratings yet

- Quiz On Partnership LiquidationDocument4 pagesQuiz On Partnership LiquidationTrisha Mae AlburoNo ratings yet

- Audit Theory Comprehensive Test - Set BDocument8 pagesAudit Theory Comprehensive Test - Set BTrisha Mae AlburoNo ratings yet

- Quiz On Audit Report and DocumentationDocument6 pagesQuiz On Audit Report and DocumentationTrisha Mae AlburoNo ratings yet

- Quiz On Entity's Environment and Internal ControlDocument5 pagesQuiz On Entity's Environment and Internal ControlTrisha Mae AlburoNo ratings yet

- Quiz On Audit SamplingDocument5 pagesQuiz On Audit SamplingTrisha Mae AlburoNo ratings yet

- Semi-Finals Exam On Audit TheoryDocument6 pagesSemi-Finals Exam On Audit TheoryTrisha Mae AlburoNo ratings yet

- Cash and Accrual Basis - Exercises - AnswersDocument2 pagesCash and Accrual Basis - Exercises - AnswersTrisha Mae AlburoNo ratings yet

- Single Entry - Exercises - SolutionDocument1 pageSingle Entry - Exercises - SolutionTrisha Mae AlburoNo ratings yet

- Cash and Accrual Basis - ExercisesDocument2 pagesCash and Accrual Basis - ExercisesTrisha Mae AlburoNo ratings yet

- Operating Segment: Intermediate Accounting 3Document51 pagesOperating Segment: Intermediate Accounting 3Trisha Mae AlburoNo ratings yet

- Liabilities by Valix: Intermediate Accounting 2Document34 pagesLiabilities by Valix: Intermediate Accounting 2Trisha Mae AlburoNo ratings yet

- Accrued Liabilities and Deferred RevenueDocument21 pagesAccrued Liabilities and Deferred RevenueTrisha Mae AlburoNo ratings yet

- Interim Financial Reporting: Intermediate Accounting 3Document45 pagesInterim Financial Reporting: Intermediate Accounting 3Trisha Mae AlburoNo ratings yet

- Sawyers - CVP AnalysisDocument47 pagesSawyers - CVP AnalysisTrisha Mae AlburoNo ratings yet

- Roque - Basic Condiderations in MASDocument7 pagesRoque - Basic Condiderations in MASTrisha Mae AlburoNo ratings yet

- Sawyers - Cost BehaviorDocument30 pagesSawyers - Cost BehaviorTrisha Mae AlburoNo ratings yet

- Financial Accounting Problems: Problem I (Current Assets)Document21 pagesFinancial Accounting Problems: Problem I (Current Assets)Fery AnnNo ratings yet

- Mandatory Registration Information: TransactionDocument2 pagesMandatory Registration Information: TransactionRalphNo ratings yet

- Plug Power GenDrive™ Fuel Cells Support Green OperationsDocument1 pagePlug Power GenDrive™ Fuel Cells Support Green OperationsI. SANCHEZNo ratings yet

- Background: Bangladesh Bank'S Supervision On Banking SectorDocument11 pagesBackground: Bangladesh Bank'S Supervision On Banking Sectorrajin_rammsteinNo ratings yet

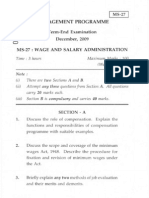

- MS 27dec09Document6 pagesMS 27dec09Richa ShrivasravaNo ratings yet

- A Medium For Male Escort Jobs in MumbaiDocument5 pagesA Medium For Male Escort Jobs in MumbaiBombay HotboysNo ratings yet

- PPG - Vigor ZN 302 SR - EnglishDocument5 pagesPPG - Vigor ZN 302 SR - EnglisherwinvillarNo ratings yet

- Investment Ass#6 - Daniyal Ali 18u00265Document3 pagesInvestment Ass#6 - Daniyal Ali 18u00265Daniyal Ali100% (1)

- Annexure ADocument28 pagesAnnexure Ajob.cndNo ratings yet

- Sample Business CaseDocument19 pagesSample Business CasepreetigopalNo ratings yet

- Characteristics of TQMDocument5 pagesCharacteristics of TQMJasmin AsinasNo ratings yet

- Federal Resume SampleDocument5 pagesFederal Resume Samplef5dq3ch5100% (2)

- Solid Pin Conversion Kits: Equipment: Cat Loaders To Suit Machines: 990, 992C, 992G, 992K, 994C, 994D & 994FDocument2 pagesSolid Pin Conversion Kits: Equipment: Cat Loaders To Suit Machines: 990, 992C, 992G, 992K, 994C, 994D & 994FMax SashikhinNo ratings yet

- How To Gain Clients and Keep Them Coming Back - FinalDocument50 pagesHow To Gain Clients and Keep Them Coming Back - Finalrmonyk1No ratings yet

- Long-Run Economic Growth: Intermediate MacroeconomicsDocument23 pagesLong-Run Economic Growth: Intermediate MacroeconomicsDinda AmeliaNo ratings yet

- 1330 Sarevsh Shinde Pptx. HRM IIDocument9 pages1330 Sarevsh Shinde Pptx. HRM IIsarvesh shindeNo ratings yet

- Applied Economics (Banking and Financial Markets) Online MSCDocument2 pagesApplied Economics (Banking and Financial Markets) Online MSCSami GulemaNo ratings yet

- Law of Corporate Finance - TATA CONSULTANCY SERVICES LIMITED V. CYRUS INVESTMENTS PVT. LTD. AND ORS.Document18 pagesLaw of Corporate Finance - TATA CONSULTANCY SERVICES LIMITED V. CYRUS INVESTMENTS PVT. LTD. AND ORS.Jinal ShahNo ratings yet

- Mahalwari Abd Ryotwari SystemDocument10 pagesMahalwari Abd Ryotwari SystemHarper companyNo ratings yet

- Tunnel Advertising Business ProposalDocument28 pagesTunnel Advertising Business ProposalNavpreetthettiNo ratings yet

- VP Institutional Asset Management in Washington DC Resume Lisa DrazinDocument3 pagesVP Institutional Asset Management in Washington DC Resume Lisa DrazinLisaDrazinNo ratings yet

- Meaning of Unpaid SellerDocument6 pagesMeaning of Unpaid Sellerr.k.sir7856No ratings yet

- T.D. Williamson, Inc.: Piping SolutionsDocument59 pagesT.D. Williamson, Inc.: Piping SolutionsMelele MuNo ratings yet

- Ch02 Recording Business Transactions SVDocument28 pagesCh02 Recording Business Transactions SVBảo DươngNo ratings yet

- Consumer Behavior On Tata MotorsDocument78 pagesConsumer Behavior On Tata MotorsAkshitha MadishettyNo ratings yet

- April 202 FdA Business Environment Assignment 2 L4 AmendedDocument5 pagesApril 202 FdA Business Environment Assignment 2 L4 AmendedHussein MubasshirNo ratings yet

- Management Information SytemDocument7 pagesManagement Information SytemHrishikesh Maheswaran100% (1)

- CFA Level 3 - Formula Sheet (NO PRINT)Document35 pagesCFA Level 3 - Formula Sheet (NO PRINT)Denis DikarevNo ratings yet