100% found this document useful (2 votes)

29K views15 pagesAccounting Equation

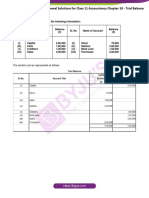

The document provides information to prepare the accounting equation from a series of transactions.

1) Sandeep started a business with Rs. 100,000 cash. Various assets like furniture, goods, and credits were recorded in the accounting equation along with capital.

2) Goods costing Rs. 40,000 were sold for a profit of 20% resulting in an increase in assets and capital in the accounting equation.

3) The accounting equation is balanced at each step to show equality between total assets and the sum of liabilities and capital.

Uploaded by

Arkaprava ChakrabortyCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

100% found this document useful (2 votes)

29K views15 pagesAccounting Equation

The document provides information to prepare the accounting equation from a series of transactions.

1) Sandeep started a business with Rs. 100,000 cash. Various assets like furniture, goods, and credits were recorded in the accounting equation along with capital.

2) Goods costing Rs. 40,000 were sold for a profit of 20% resulting in an increase in assets and capital in the accounting equation.

3) The accounting equation is balanced at each step to show equality between total assets and the sum of liabilities and capital.

Uploaded by

Arkaprava ChakrabortyCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

- Accounting Equation Examples - Part 1

- Accounting Equation Practice - Part 1

- Balance Sheet Exercises

- Transactions and Balances - Examples

- Complex Accounting Scenarios

- Working Notes and Calculations

- Problem Set: Accounting Equations

- Solution Steps and Examples

- Advanced Accounting Questions

- Exercise Solutions - Detailed Review

- Transactional Analysis and Solutions

- Transaction Correction Drill - Part 2

- Working Calculations and Solutions Guide

- Balance Sheet and Profit Calculations

- Final Thoughts and Recap