Professional Documents

Culture Documents

Ts Grewal Solutions For Class 11 Accountancy Chapter 10 Trial

Uploaded by

MantejOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ts Grewal Solutions For Class 11 Accountancy Chapter 10 Trial

Uploaded by

MantejCopyright:

Available Formats

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

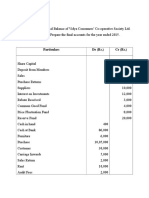

Q.1 Prepare a Trial Balance with the following information:

Balance Balance

Sl. No Name of Account Sl. No Name of Account

(₹) (₹)

(i) Capital 2,00,000 (ii) Stock 70,000

(iii) Cash 1,80,000 (iv) Debtors 3,00,000

(v) Creditors 1,00,000 (vi) Bank Loan 1,50,000

(vii) Sales 3,00,000 (viii) Purchases 2,00,000

The solution can be represented as follows

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

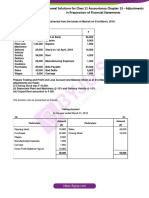

Q.2 Journalise the following transactions, post them into Ledger and prepare a Trial Balance:

2019 (₹) 2019 (₹)

April 1 Mohan commenced business with 1,00,000 April Received cash from Gopal 3,950

cash 20

April 3 Bought goods 5,000 Discount Allowed 50

April 4 Sold goods to Gopal 4,000 April Paid wages 700

25

April Bought goods from Ram 8,000 April Paid to Ram in full settlement 7,700

10 27

April Paid trade expenses 2,000 April Paid rent 1,500

15 30

The solution can be represented as follows

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

Q.3 Prepare the Trial Balance of Ankit as on 31st March, 2019. He has omitted to open a Capital

Account:

₹ ₹

Bank Overdraft 85,000 Purchases 4,45,000

Sales 8,10,000 Cash in Hand 8,500

Purchases Return 22,500 Creditors 2,15,000

Debtors 4,00,500 Sales Return 15,750

Wages 96,000 Equipment 25,000

Capital ? Opening Stock 3,00,500

The solution can be presented as follows

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

Q.4 Prepare a Trial Balance from the following items:

₹ ₹

Capital 24,000 Building 12,000

Opening Stock 8,500 Returns Inward 1,900

Furniture 2,600 Returns Outward 350

Purchases 8,950 Trade Expenses 1,000

Cash 7,300 Discount Received 970

Carriage 300 Salary 3,000

Sales 22,500 Office Rent 2,270

The solution can be presented as follows

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

Q.5 The following are the balances extracted from the books of Mr. A. Mukhopadhyay. Prepare a Trial

Balance as on 31st March, 2019:

₹ ₹

Cash 2,000 Sundry Creditors 40,000

Capital 80,000 Investment 8,000

Purchases 85,000 Plant and Machinery 15,000

Sales 1,08,400 Building 20,000

Purchases Return 6,000 Furniture 6,000

Sales Return 4,000 Electricity 700

Transportation 1,800 Postage 400

Discount Allowed 500 Drawings 8,000

Printing 5,000 Salaries 6,000

Sundry Debtors 70,000 Travelling Expenses 2,000

Input CGST A/c 2,500 Output CGST A/c 1,500

Input SGST A/c 2,500 Output SGST A/c 1,500

Input IGST A/c 4,000 Output IGST A/c 6,000

The solution can be presented as follows

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

Q.6 From the following information, prepare a Trial Balance of M/s. Prayag for the year ended 31st March,

2019:

₹ ₹

Capital Accounts 1,25,000 Sales 1,54,500

Furniture and Fittings 6,400 Bank (Cr. Balance) 28,500

Motor Car 62,500 Purchase Returns 1,250

Buildings 75,000 Commission (Cr.) 3,750

Total Debtors 38,000 Sales Return 2,000

Total Creditors 25,000 Advertisement 2,500

Bad Debts 1,250 Interest Account (Dr.) 1,180

Stock (1st April 2018) 34,600 Cash Balance 6,500

Purchases 54,750 Insurance and Taxes 12,500

Input IGST A/c 3,000 Salaries 40,820

Output CGST A/c 1,500 Output SGST A/c 1,500

The solution can be presented as follows

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

Q.7 From the following balances extracted from the Ledger of Sri Narugopal, prepare Trial Balance as on

31st March, 2019:

₹ ₹

Capital 75,00,000 Building 7,50,000

Plant 15,00,000 Stock on 1st April, 2018 12,50,000

Cash in Hand 2,500 Cash at Bank 5,75,000

Rates, Taxes and 30,000

Commission Received 1,75,000

Insurance

Discount (Dr.) 55,000 Discount (Cr.) 45,000

Purchases Return 50,000 Sundry Creditors 2,50,000

Interest Received 30,000 Sales 62,50,000

Repairing Charges 1,25,000 Book Debts 15,00,000

General Expenses 3,00,000 Rent 62,500

Wages 5,00,000 Purchases 48,00,000

Furnitures 1,20,000 Carriage and Freight 75,000

Sales Return 90,000 Delivery Van 5,00,000

Loan Advanced 6,00,000 Travelling Expenses 50,000

Office Salaries 6,25,000 Drawings 6,00,000

The solution can be presented as follows

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

Q.8 From the following Ledger account balances extracted from the books of R.J. Gupta, prepare a Trial

Balance as on 31st March, 2019:

₹ ₹

Purchases 1,04,000 Drawings 7,950

Sundry Debtors 18,550 Sundry Creditors 8,300

Premises 62,000 Returns Inward 5,360

Sales 1,49,000 Furniture 15,600

Returns Outward 8,900 Cash in Hand 390

Rates and Taxes 780 Capital 85,000

Cash at Bank 1,560 Factory wages 5,830

Carriage Inwards 650 Carriage Outwards 260

Salaries 3,900 Rent Received 2,990

Stock (1st April, 2018) 25,000 Insurance 2,100

Input IGST A/c 5,000 Bad Debts 260

Input CGST A/c 2,500 Output IGST A/c 10,000

Input SGST A/c 2,500

The solution can be presented as follows

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

Q.9 Following Trial Balance is given but it is not correct. Prepare correct Trial Balance.

Amount Amount

Debit Balances Credit Balances

(₹) (₹)

Building 3,00,000 Capital 3,68,000

Machinery 85,000 Furniture 28,000

Returns Outward 13,000 Sales 5,20,000

Bad Debts 14,000 Debtors 3,00,000

Cash 2,000 Interest Received 13,000

Discount Received 15,000

Bank Overdraft 50,000

Creditors 2,50,000

Purchases 5,00,000

12,29,000 12,29,000

The solution can be presented as follows

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

Q.10 Redraft correctly the Trial Balance given below:

Amount Amount

Debit Balances Credit Balances

(₹) (₹)

Capital 8,000 Debtors 7,580

Bad Debts Recovered 250 Bank Deposits 2,750

Discount 40

Creditors 1,250

Allowed

Returns Outward 350 Drawings 600

Bank Overdraft 1,570 Returns Inward 450

Rent 360 Sales 13,690

Salaries 850 Bills Payable 1,350

Trade Expenses 300 Grant Received 1,000

Cash in Hand 210

Opening Stock 2,450

Purchases 11,870

27,460 27,460

The solution can be presented as follows

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

Q.11 Correct the following Trial Balance:

Debit Balances ₹ Credit Balances ₹

Opening Stock 1,02,600 Debtors 45,000

Returns Outward 48,000 Carriage Outwards 15,000

Salaries 36,000 Capital 1,65,600

Creditors 84,000 Machinery 54,000

Bank 1,35,000 Returns Inward 9,000

Carriage Inwards 18,000 Insurance Claim Received 12,000

Rent Received 9,000 Trade Expenses 18,000

Discount Allowed 6,000 Sales 4,20,000

Purchases 3,00,000 Building 60,000

Bills Payable 60,000

7,98,600 7,98,600

The solution can be presented as follows

TS Grewal Solutions for Class 11 Accountancy Chapter 10 - Trial Balance

Q.12 Prepare correct Trial Balance from the following Trial Balance in which there are certain mistakes:

Heads of Accounts Dr. (₹) Cr. (₹)

Cost of Goods Sold 1,50,000 ...

Closing Stock ... 40,000

Debtors ... 60,000

Creditors ... 30,000

Fixed Assets 50,000 ...

Opening Stock 60,000 ...

Expenses ... 20,000

Sales ... 2,00,000

Capital 90,000 ...

Total 3,50,000 3,50,000

The solution can be presented as follows

You might also like

- Profit and Loss - Balance SheetDocument4 pagesProfit and Loss - Balance SheetAnklesh kumar Gupta100% (1)

- 3.1 Profit and Loss - Balance SheetDocument7 pages3.1 Profit and Loss - Balance Sheetjangirvihan2No ratings yet

- SET 1. Q.1 Explain Any Two Accounting Concepts With Example? AnsDocument9 pagesSET 1. Q.1 Explain Any Two Accounting Concepts With Example? AnsmuravbookNo ratings yet

- Set 1 MB0025 Financial and Management AccountingDocument7 pagesSet 1 MB0025 Financial and Management AccountingcaggandhiNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- MB0025 Financial and Management AccountingDocument7 pagesMB0025 Financial and Management Accountingvarsha100% (1)

- Soal UAS 2015.2016 KajianDocument4 pagesSoal UAS 2015.2016 Kajiansyafaatun munajahNo ratings yet

- Q.Prepare A Statement of P & L A/C As Per Revised Schedule III AnsDocument6 pagesQ.Prepare A Statement of P & L A/C As Per Revised Schedule III AnsTejas ChandanshiveNo ratings yet

- FABM1 11 Quarter 4 Week 6 Las 3Document4 pagesFABM1 11 Quarter 4 Week 6 Las 3Janna PleteNo ratings yet

- Accounting for business decisionsDocument96 pagesAccounting for business decisionsRahul Ghosale100% (1)

- Vidya Consumer Co-op Society AccountsDocument7 pagesVidya Consumer Co-op Society Accountsswati100% (3)

- Accounting For Sole Proprietorship Problem3-6Document3 pagesAccounting For Sole Proprietorship Problem3-6Rocel Domingo100% (1)

- Frq-Acc-Grade 11-Set 05Document3 pagesFrq-Acc-Grade 11-Set 05itzmellowteaNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- Fundamentals of Accounting 2019Document4 pagesFundamentals of Accounting 2019sreehari dineshNo ratings yet

- AFH Important questionDocument6 pagesAFH Important questionmanassadashiv013No ratings yet

- Ts Grewal Solutions For Class 11 Account Chapter 15 MinDocument36 pagesTs Grewal Solutions For Class 11 Account Chapter 15 Minrocking toxtricityNo ratings yet

- LAB QuickBooks Ver 7.0Document8 pagesLAB QuickBooks Ver 7.0gtecNo ratings yet

- Trial BalanceDocument14 pagesTrial Balanceswetha_makulaNo ratings yet

- 11-Accountancy WEEKLY-WORK 01.02.2022 Ch-22 Financial Statement - With AdjustmentDocument4 pages11-Accountancy WEEKLY-WORK 01.02.2022 Ch-22 Financial Statement - With AdjustmentSandeep NehraNo ratings yet

- 9 Fundamentals of Accounting December 2019Document5 pages9 Fundamentals of Accounting December 2019Suhail AhmedNo ratings yet

- Suggested Answer CAP I June 2018Document40 pagesSuggested Answer CAP I June 2018alchemistNo ratings yet

- 11 - Final Accounts Assessment 4 PDFDocument7 pages11 - Final Accounts Assessment 4 PDFShreyas ParekhNo ratings yet

- Final Account WorksheetDocument4 pagesFinal Account Worksheetravikumarbadass0No ratings yet

- Practical Question Accountancy MainDocument22 pagesPractical Question Accountancy MainDubai SheikhNo ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Co 2101Document3 pagesCo 2101PRIYA LAKSHMANNo ratings yet

- Question BankDocument31 pagesQuestion BankmahendrabpatelNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Trial Balance Adjustments Income Statement Balance SheetDocument3 pagesTrial Balance Adjustments Income Statement Balance SheetREEMA MATHIASNo ratings yet

- Adjustment Entry precticleDocument1 pageAdjustment Entry precticlevihanjangid223No ratings yet

- Minsupala Trading Corporation (Workbook)Document14 pagesMinsupala Trading Corporation (Workbook)Luis Melquiades P. Garcia100% (3)

- Unit IDocument10 pagesUnit IkuselvNo ratings yet

- ASSIGNMENT OF ACCOUNTING II JJJJDocument5 pagesASSIGNMENT OF ACCOUNTING II JJJJJunaid AhmedNo ratings yet

- Financial and Management Accounting MB0025Document27 pagesFinancial and Management Accounting MB0025manuunamNo ratings yet

- M.B.A. QPDocument184 pagesM.B.A. QPyogeshNo ratings yet

- Exercises - Trial Balance and Final Accounts - PracticeDocument23 pagesExercises - Trial Balance and Final Accounts - PracticeDilfaraz Kalawat79% (38)

- Journal Entries (Llandino)Document12 pagesJournal Entries (Llandino)Joy Danielle LlandinoNo ratings yet

- Acct 4Document6 pagesAcct 4Mopur NELLORENo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- FS Withoutadj QuesDocument2 pagesFS Withoutadj QuesHimank SaklechaNo ratings yet

- BCA DEGREE EXAM ACCOUNTING EXAMDocument11 pagesBCA DEGREE EXAM ACCOUNTING EXAMStudents Xerox ChidambaramNo ratings yet

- Departmenatal AccountsDocument4 pagesDepartmenatal Accountsmanjunatha TKNo ratings yet

- Income StatementDocument13 pagesIncome StatementShakir IsmailNo ratings yet

- Fundamentals of Accounting 2020Document4 pagesFundamentals of Accounting 2020sreehari dineshNo ratings yet

- TS Grewal Solutions for Class 11 Accountancy Chapter 14 - Capital and Revenue ExpenditureDocument39 pagesTS Grewal Solutions for Class 11 Accountancy Chapter 14 - Capital and Revenue ExpenditureShivant GuptaNo ratings yet

- Management Programme: MS-04: Accounting and Finance For ManagersDocument5 pagesManagement Programme: MS-04: Accounting and Finance For Managersanon_323108No ratings yet

- AFM Q-BankDocument42 pagesAFM Q-Banks BNo ratings yet

- ASPL3 Activity 3-6 DoneDocument7 pagesASPL3 Activity 3-6 DoneConcepcion Family33% (3)

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- 2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Document3 pages2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Mohammad ShahidNo ratings yet

- Jayalakshmi Institute of Technology Accounting For Management Unit - Ii QuestionsDocument2 pagesJayalakshmi Institute of Technology Accounting For Management Unit - Ii QuestionsJayalakshmi Institute of TechnologyNo ratings yet

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- Assignment Final AccountsDocument9 pagesAssignment Final Accountsjasmine chowdhary50% (2)

- Chapter-2 Profit & Loss - Balance SheetDocument2 pagesChapter-2 Profit & Loss - Balance Sheetvihanjangid223No ratings yet

- 11 - Final Accounts Assessment 2 PDFDocument6 pages11 - Final Accounts Assessment 2 PDFShreyas ParekhNo ratings yet

- P&LAC Exercises PracticeDocument5 pagesP&LAC Exercises PracticeDilfaraz KalawatNo ratings yet

- Final Accounts Problems SheetDocument2 pagesFinal Accounts Problems SheetSaransh MaheshwariNo ratings yet

- Business Startup Costs and FundingDocument9 pagesBusiness Startup Costs and Fundingنور روسلنNo ratings yet

- Investing and Compounding Interest Rates ExplainedDocument4 pagesInvesting and Compounding Interest Rates ExplainedJufel RamirezNo ratings yet

- Super Bond Adhesives Private LimitedDocument22 pagesSuper Bond Adhesives Private Limitedvikasaggarwal01No ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasMHILET BasanNo ratings yet

- Fin CH 2 ProblemsDocument9 pagesFin CH 2 Problemsshah118850% (4)

- MHF 2019 062 Boris FaysDocument53 pagesMHF 2019 062 Boris Faysnexxus hcNo ratings yet

- Analyze Financial Health with Key MetricsDocument12 pagesAnalyze Financial Health with Key Metricsayushi kapoorNo ratings yet

- Trial Balance Ud Mudah HasilDocument1 pageTrial Balance Ud Mudah HasilSani SausanNo ratings yet

- IU Student Bank StatementDocument1 pageIU Student Bank StatementHasnain AliNo ratings yet

- ch02 p14 Build A ModelDocument6 pagesch02 p14 Build A Modelapi-285101607No ratings yet

- DEPOSIT INSURANCE SCHEME CHALLENGESDocument17 pagesDEPOSIT INSURANCE SCHEME CHALLENGESDaniel AdegboyeNo ratings yet

- 1 - Kagiso Mmusi Uif - 20230711 - 0001Document8 pages1 - Kagiso Mmusi Uif - 20230711 - 0001Kagiso Kagi MmusiNo ratings yet

- Next Ias EconomyDocument41 pagesNext Ias EconomyChinmay JenaNo ratings yet

- Esop FinalDocument31 pagesEsop Finalansh384100% (2)

- Akl Resume CH.5Document3 pagesAkl Resume CH.5cindy vica azizahNo ratings yet

- LandBank - Cash Card FormDocument2 pagesLandBank - Cash Card FormPete Rahon94% (16)

- Payment Card Statement From 01.01.2023 To 31.01.2023: New TransactionsDocument2 pagesPayment Card Statement From 01.01.2023 To 31.01.2023: New TransactionsBlacky BurnNo ratings yet

- Credit Transactions Reviewer PDFDocument5 pagesCredit Transactions Reviewer PDFJustineNo ratings yet

- Structure of The Balance Sheet and Statement of Cash Flows: Revsine/Collins/Johnson/Mittelstaedt/Soffer: Chapter 4Document29 pagesStructure of The Balance Sheet and Statement of Cash Flows: Revsine/Collins/Johnson/Mittelstaedt/Soffer: Chapter 4Dylan AdrianNo ratings yet

- Maples and Calder Ireland Intellectual Property 2018Document4 pagesMaples and Calder Ireland Intellectual Property 2018Anonymous cs1zxNFTNo ratings yet

- Analysis of The BankingDocument3 pagesAnalysis of The Bankingarnav singhNo ratings yet

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- NORKA SPECIAL SCHEME FOR RETURNING EMIGRANTSDocument1 pageNORKA SPECIAL SCHEME FOR RETURNING EMIGRANTSGreatway ServicesNo ratings yet

- Project ReportDocument65 pagesProject ReportstafanaNo ratings yet

- What is Repo Rate, Reverse Repo Rate & their ImpactDocument4 pagesWhat is Repo Rate, Reverse Repo Rate & their ImpactRatnakar AletiNo ratings yet

- Balance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of AccountsDocument27 pagesBalance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of Accountsrisc1No ratings yet

- Insurance License Study GuideDocument3 pagesInsurance License Study GuideKatherine Hsu67% (3)

- Process Lockboxes 190421Document11 pagesProcess Lockboxes 190421Maria ChavezNo ratings yet

- Case 2 - Marriott CorporationDocument8 pagesCase 2 - Marriott CorporationMorten LassenNo ratings yet

- Panama Private FoundationDocument2 pagesPanama Private FoundationJil JimenezNo ratings yet