Professional Documents

Culture Documents

Internal Rate of Return

Uploaded by

maha Sri0 ratings0% found this document useful (0 votes)

8 views2 pagesThe document discusses calculating internal rate of return (IRR) for investment projects and provides 4 examples of projects with initial investments, estimated lives, and annual cash flows. It asks to calculate the IRR for each project to determine which is most suitable based on this metric.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses calculating internal rate of return (IRR) for investment projects and provides 4 examples of projects with initial investments, estimated lives, and annual cash flows. It asks to calculate the IRR for each project to determine which is most suitable based on this metric.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesInternal Rate of Return

Uploaded by

maha SriThe document discusses calculating internal rate of return (IRR) for investment projects and provides 4 examples of projects with initial investments, estimated lives, and annual cash flows. It asks to calculate the IRR for each project to determine which is most suitable based on this metric.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Internal Rate of Return

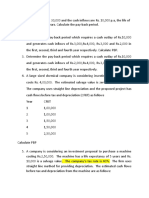

1. Calculate Internal Rate of Return

Initial Outlay Rs.50,000

Life of the Assets 5 years

Estimated Annual Cash flow Rs.12,500

2. Calculate Internal Rate of Return

Initial Investment Rs.60,000

Life of the Asset 4 Years

Estimated Net Annual Cash Flows

First Year Rs.15,000

Second Year Rs.20,000

Third Year Rs.30,000

Fourth Year Rs.20,000

3. Royal Ltd. is considering two mutually exclusive projects. Both require an

initial cash outlay of Rs.100, 000 each and have a life of five years. The company

pays tax at 50%. The projects will be depreciated on a straight line basis. The

profit before depreciation and Tax expected to be generated by the projects are as

follow:

Year 1 2 3 4 5

Project I Rs.40,000 Rs.40,000 Rs.40,000 Rs.40,000 Rs.40,000

Project II Rs.60,000 Rs.30,000 Rs.20,000 Rs.50,000 Rs.50,000

Which one is suitable under IRR method.

4.From the following information, calculate IRR of the two project and suggest which of

the two projects should be accepted.

Particulars Project X Project Y

Initial Investment Rs.20,000 Rs.30,000

Estimated Life 5 Years 5 Years

Scrap Value Nil Nil

The profits before depreciation and after taxation (cash flows) are as follows:

Projects Year 1 Year 2 Year 3 Year 4 Year 5

X 5,000 10,000 10,000 3,000 2,000

Y 20,000 10,000 5,000 3,000 2,000

You might also like

- 4.unit-4 Capital BudgetingDocument51 pages4.unit-4 Capital BudgetingGaganGabriel100% (1)

- ) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%Document4 pages) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%kfbhgikNo ratings yet

- Capital Budgeting CW FMPDocument6 pagesCapital Budgeting CW FMPSufyan Ashraf100% (1)

- Capital BudgetingDocument8 pagesCapital BudgetingArun AntonyNo ratings yet

- CAPITAL BUDGETING AssignmentDocument4 pagesCAPITAL BUDGETING Assignmentqurban baloch100% (1)

- Numericals On Capital Budgeting TechniquesDocument5 pagesNumericals On Capital Budgeting TechniquesKritikaNo ratings yet

- FM - Assignment 2 (Capital Budgeting) - 2019-2021Document3 pagesFM - Assignment 2 (Capital Budgeting) - 2019-2021dangerous saif100% (1)

- Capital Budgeting: Prepared By:-Priyanka GohilDocument44 pagesCapital Budgeting: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- Assignment - 1 (Capital Budgeting)Document3 pagesAssignment - 1 (Capital Budgeting)AnusreeNo ratings yet

- Capital Budgeting Questions - UE - FMDocument3 pagesCapital Budgeting Questions - UE - FMVimoli MehtaNo ratings yet

- Practice SheetDocument2 pagesPractice Sheetishapnil 63No ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Investment DecisionsDocument4 pagesInvestment DecisionsDevadutt M.SNo ratings yet

- Capital Budgeting ProblemsDocument2 pagesCapital Budgeting Problemsvijayadarshini vNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- Fundamentals of Financial Management All Questions Are Compulsory Students Have To Upload The Scanned Solution On TEAMSDocument3 pagesFundamentals of Financial Management All Questions Are Compulsory Students Have To Upload The Scanned Solution On TEAMSlolik soli100% (1)

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- Assignment Problems On Cap BudDocument3 pagesAssignment Problems On Cap BudSunil TripathiNo ratings yet

- Financial ManagementDocument79 pagesFinancial ManagementJobin Joseph KalapurayilNo ratings yet

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- Capital Budgeting 1Document3 pagesCapital Budgeting 1maha SriNo ratings yet

- Problems of Capital BudgetingDocument4 pagesProblems of Capital Budgetingm agarwalNo ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentRITU NANDAL 144No ratings yet

- Investment Appraisal/capital Investment: Page 1 of 20Document20 pagesInvestment Appraisal/capital Investment: Page 1 of 20parwez_0505No ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingavtaarNo ratings yet

- Capital Budgeting: Payback PeriodDocument4 pagesCapital Budgeting: Payback PeriodPooja SunkiNo ratings yet

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda0% (1)

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- 2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalDocument93 pages2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalArslanNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingAnoop SinghNo ratings yet

- NPV PDFDocument2 pagesNPV PDFMOHD AnasNo ratings yet

- FMDocument2 pagesFMsagarNo ratings yet

- Net Present Value MethodDocument3 pagesNet Present Value Methodmaha SriNo ratings yet

- CBE - Corporate Finance - SPJG - FinalDocument16 pagesCBE - Corporate Finance - SPJG - FinalNguyễn QuyênNo ratings yet

- Capital Budgeting Problems 1Document5 pagesCapital Budgeting Problems 1Juber AhamadNo ratings yet

- Docslide - Us Assignment 2 55844503ab61cDocument4 pagesDocslide - Us Assignment 2 55844503ab61cAhmedNo ratings yet

- Capital Budgeting NotesDocument3 pagesCapital Budgeting NotesSahil RupaniNo ratings yet

- CF - PWS - 5Document3 pagesCF - PWS - 5cyclo tronNo ratings yet

- Module 3 - Capital Budgeting - 3A - Questions 2022-23Document10 pagesModule 3 - Capital Budgeting - 3A - Questions 2022-23Manya GargNo ratings yet

- HW3MGT517Document3 pagesHW3MGT517Jaya PaudwalNo ratings yet

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaNo ratings yet

- IrrDocument3 pagesIrrSiva SankariNo ratings yet

- Chapter 2. An Introduction Investment Appraisal TechniquesDocument10 pagesChapter 2. An Introduction Investment Appraisal TechniquesHastings KapalaNo ratings yet

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Document5 pagesBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- Chapter 5. An Introduction Investment Appraisal TechniquesDocument10 pagesChapter 5. An Introduction Investment Appraisal TechniquesHastings KapalaNo ratings yet

- Investment Appraisal TutorialDocument6 pagesInvestment Appraisal TutorialQin Yi NgNo ratings yet

- Practice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Document3 pagesPractice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Sumit Kumar SahooNo ratings yet

- MBA-I Sem - II Subject: Financial Management (202) : Assignment Submission: 5 Nov 2016Document3 pagesMBA-I Sem - II Subject: Financial Management (202) : Assignment Submission: 5 Nov 2016ISLAMICLECTURESNo ratings yet

- Instructions To CandidatesDocument3 pagesInstructions To CandidatesSchoTestNo ratings yet

- VND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Document4 pagesVND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Rohit Singh RajputNo ratings yet

- Capital Budgeting Decisions - NON DISCOUNTING TECHNIQUESDocument2 pagesCapital Budgeting Decisions - NON DISCOUNTING TECHNIQUESPreethi VNo ratings yet

- Principles of Financial Management Practice QsDocument4 pagesPrinciples of Financial Management Practice Qs22UG1-0372 WICKRAMAARACHCHI W.A.S.M.No ratings yet

- SFM - 1Document3 pagesSFM - 1ketulNo ratings yet

- CF - PWS - 4Document2 pagesCF - PWS - 4cyclo tronNo ratings yet

- Cap BudgetingggDocument3 pagesCap BudgetingggSiva SankariNo ratings yet

- Practice CorpDocument2 pagesPractice CorpShafiquer RahmanNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- CitationsDocument2 pagesCitationsmaha SriNo ratings yet

- Problems2-Risk ManagementDocument1 pageProblems2-Risk Managementmaha SriNo ratings yet

- Net Present Value MethodDocument3 pagesNet Present Value Methodmaha SriNo ratings yet

- NPV 2Document1 pageNPV 2maha SriNo ratings yet

- Capital Budgeting 1Document3 pagesCapital Budgeting 1maha SriNo ratings yet

- Calculation of BetaDocument1 pageCalculation of Betamaha SriNo ratings yet