Professional Documents

Culture Documents

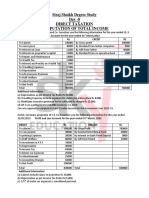

Introduction To Taxation

Uploaded by

Ehsan Khan0 ratings0% found this document useful (0 votes)

4 views4 pagesThe document discusses different types of taxes including income tax, corporation tax, capital gains tax, inheritance tax, and VAT. It also mentions tax-exempt savings accounts like ISAs with an annual maximum investment of £20,000 and tax avoidance through gratuitous gifts to spouses or children. The tax year ranges from April 6th to April 5th. Interest earned on overpaid taxes is paid back to the taxpayer.

Original Description:

Original Title

1. Introduction to Taxation.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses different types of taxes including income tax, corporation tax, capital gains tax, inheritance tax, and VAT. It also mentions tax-exempt savings accounts like ISAs with an annual maximum investment of £20,000 and tax avoidance through gratuitous gifts to spouses or children. The tax year ranges from April 6th to April 5th. Interest earned on overpaid taxes is paid back to the taxpayer.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views4 pagesIntroduction To Taxation

Uploaded by

Ehsan KhanThe document discusses different types of taxes including income tax, corporation tax, capital gains tax, inheritance tax, and VAT. It also mentions tax-exempt savings accounts like ISAs with an annual maximum investment of £20,000 and tax avoidance through gratuitous gifts to spouses or children. The tax year ranges from April 6th to April 5th. Interest earned on overpaid taxes is paid back to the taxpayer.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 4

GRATITIOUS GIFT TRANSFER OF PROPERTY, FREELY GIVEN

TYPES OF TAXES

NIC 1 INCOME TAX PAYABLE BY INDIVIDUALS

2 CORPORATION TAX PAYABLE BY COMPANIES

3 CAPITAL GAIN TAX (CGT) PAYABLE BY INDIVIDUALS UPON THE GAIN GENERATED OVER TH

4 INHERITANCE TAX (IHT) PAYABLE BY INDIVIDUALS

5 VAT PAYABLE BY CUSTOMERS & IMPOSED BY SELLER ON THE SELLING

ISA==> INDIVIDUAL SAVINGS ACCOUNT TAX EXEMPT INTEREST FROM ISA

MAX INVESTMENT OF £20000/YEAR

GIFT PARENT > ON THE OCCASION OF MARRIAGE

TAX AVOIDANCE

MR.A MRS.A FIRST 5000 EXEMPT

10000 0 SPOUSE > EXEMPT

SON

FOR TAX AVOIDANCE

MR.A MRS.A

5000 5000

SON

O OBJECTIVITY

P PROFESSIONAL COMPETENCE & DUE CARE

P PROFESSIONAL BEHAVIOUR

I INTEGRITY

C CONFIDENTIALITY

TAX EXEMPT INCOME

10000 NATIONAL SAVINGS CERTIFICATES

PERIOD - 8 YEARS

INTEREST ON OVERPAID TAXES 15000==>18000

OVERPAYMENT--> 3000 PLUS INTEREST

ISA -- INTEREST (EXEMPT)

20000/YR (CASH/SHARES) MAX INVESTMENT

TAX YEAR

19/20 6 APRIL 2019 TO 5 APRIL 2020

20/21 6 APRIL 2020 TO 5 APRIL 2021

21/22 6 APRIL 2021 TO 5 APRIL 2022

N THE GAIN GENERATED OVER THE DISPOSAL OF NCA

POSED BY SELLER ON THE SELLING PRICE OF THE PRODUCT

ST FROM ISA

F £20000/YEAR

OF MARRIAGE

& DUE CARE

X INVESTMENT

You might also like

- IT 2 Income From BusinessDocument19 pagesIT 2 Income From BusinessAmith AlphaNo ratings yet

- Trading ProfitDocument9 pagesTrading ProfitEhsan KhanNo ratings yet

- Chapter 2 Capsule SessionDocument40 pagesChapter 2 Capsule SessionKshitishNo ratings yet

- Date Transactions Dr. CRDocument16 pagesDate Transactions Dr. CRClyde Ian Brett PeñaNo ratings yet

- Annual Individual Income Tax Return: Attachment - IDocument5 pagesAnnual Individual Income Tax Return: Attachment - IellenruntunuwuNo ratings yet

- BES172 P3 GST Goods Services TaxDocument97 pagesBES172 P3 GST Goods Services TaxVibhore Kumar SainiNo ratings yet

- 01the Economic Times WealthDocument5 pages01the Economic Times WealthvivoposNo ratings yet

- Problems On Profits and Gains of Business and ProfessionDocument11 pagesProblems On Profits and Gains of Business and ProfessionNikithaNo ratings yet

- 0456Document4 pages0456Usman Shaukat Khan100% (1)

- Income Tax Calculator FY 2014 15Document2 pagesIncome Tax Calculator FY 2014 15atul bansalNo ratings yet

- Income From Business-ProblemsDocument20 pagesIncome From Business-Problems24.7upskill Lakshmi V100% (1)

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument4 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internaszairah jean baquilarNo ratings yet

- Admissible and Inadmissible ExpensesDocument2 pagesAdmissible and Inadmissible Expensesjhansiaj06No ratings yet

- Income Tax Compliance, Schemes of Income Taxation and Final Income TaxationDocument45 pagesIncome Tax Compliance, Schemes of Income Taxation and Final Income TaxationMonica MonicaNo ratings yet

- Train Law: Saliant Topics inDocument4 pagesTrain Law: Saliant Topics incrookshanksNo ratings yet

- ProfitabilityDocument17 pagesProfitabilityJenina Augusta EstanislaoNo ratings yet

- Profitability RatiosDocument17 pagesProfitability RatiosJenina Augusta EstanislaoNo ratings yet

- Strategic Tax Management (Final Period Assignment Quiz)Document4 pagesStrategic Tax Management (Final Period Assignment Quiz)Nelia AbellanoNo ratings yet

- Types of Business Organization: Sole ProprietorshipDocument13 pagesTypes of Business Organization: Sole Proprietorshipmani_hashmiNo ratings yet

- 9 - The Following Is The Trading and Profit and Loss A/c of Sankar For The Previous YearDocument1 page9 - The Following Is The Trading and Profit and Loss A/c of Sankar For The Previous YearSiva SankariNo ratings yet

- Day 1 Cash Flow Ias 7Document2 pagesDay 1 Cash Flow Ias 7Laiba AslamNo ratings yet

- PC Square2307Document3 pagesPC Square2307SirManny ReyesNo ratings yet

- TX - SuccessDocument112 pagesTX - SuccesssakhiahmadyarNo ratings yet

- Exh. 1 - Percentage Expense Allocation Template: Gross Annual Income Segment Expense RateDocument1 pageExh. 1 - Percentage Expense Allocation Template: Gross Annual Income Segment Expense RateJayNo ratings yet

- Income Tax Calculator FY 2020 2021Document8 pagesIncome Tax Calculator FY 2020 2021LalitNo ratings yet

- TX - SUCCESS by Ajith AntonyDocument110 pagesTX - SUCCESS by Ajith AntonyPhebin PhilipNo ratings yet

- 01-Uptown ServicesDocument2 pages01-Uptown ServicesMarina ButlayNo ratings yet

- Form-1770-Attachment I Page 1Document1 pageForm-1770-Attachment I Page 1rover2010No ratings yet

- 9Document2 pages9Le Lhiin CariñoNo ratings yet

- Management 2Document7 pagesManagement 2elena rossiNo ratings yet

- Class Demos Week 111Document22 pagesClass Demos Week 111SanjayNo ratings yet

- One and Done 2307Document2 pagesOne and Done 2307Maricris LegaspiNo ratings yet

- Activity 3 Gross IncomeDocument16 pagesActivity 3 Gross IncomeAnne OlitoquitNo ratings yet

- Income Taxation ExamDocument2 pagesIncome Taxation ExamyezaqueraNo ratings yet

- Module 1 - Cherry Alfuerte - Train LawDocument41 pagesModule 1 - Cherry Alfuerte - Train Lawgerry dacerNo ratings yet

- Direct Tax Laws Sample MCQ PPT Full Part 1Document62 pagesDirect Tax Laws Sample MCQ PPT Full Part 1Pooja MaruNo ratings yet

- Final Tax On Passive Income2Document7 pagesFinal Tax On Passive Income2Ivy Rica AyapanaNo ratings yet

- Income Tax Calculator FY 2014 15Document2 pagesIncome Tax Calculator FY 2014 15Pardeep KumarNo ratings yet

- Chapter 5 Solutions To Assigned HomeworkDocument9 pagesChapter 5 Solutions To Assigned HomeworkLiyue QiNo ratings yet

- Problems Problem 10.1: © John Wiley and Sons Australia, LTD 2010 10.21Document5 pagesProblems Problem 10.1: © John Wiley and Sons Australia, LTD 2010 10.21alfaressNo ratings yet

- Franchise AccountingDocument4 pagesFranchise AccountingJeric IsraelNo ratings yet

- Train 2 or Trabaho Bill: (Tax Reform For Attracting Better and High-Quality Opportunities) House Bill No. 8083Document30 pagesTrain 2 or Trabaho Bill: (Tax Reform For Attracting Better and High-Quality Opportunities) House Bill No. 8083Azaria MatiasNo ratings yet

- RC ColaDocument2 pagesRC ColaMi MiNo ratings yet

- Form 2307Document2 pagesForm 2307Dino Garzon OcinoNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Marfrancisco, Pinamalayan, Oriental MindoroDocument5 pagesCertificate of Creditable Tax Withheld at Source: Marfrancisco, Pinamalayan, Oriental MindoroChristcelda lozadaNo ratings yet

- TX - SUCCESSDocument113 pagesTX - SUCCESSBiKâSH JhâNo ratings yet

- Basic Example Fa-Class 4-Feb 3 2024-Solution With Class NotesDocument14 pagesBasic Example Fa-Class 4-Feb 3 2024-Solution With Class Notesdharmendra_kanthariaNo ratings yet

- Day 8 TaxationDocument2 pagesDay 8 TaxationKhan Shadab -27No ratings yet

- 2) NM SDN BHD Chargeable Income For The Year Assessment 2019 Note RM'000 (-) RM'000 (+)Document4 pages2) NM SDN BHD Chargeable Income For The Year Assessment 2019 Note RM'000 (-) RM'000 (+)Chiayi NgNo ratings yet

- Value Added Tax Lecture Summary 2020Document72 pagesValue Added Tax Lecture Summary 2020Tatenda RamsNo ratings yet

- Accounting For Proportional TreatiesDocument35 pagesAccounting For Proportional TreatiesGashawNo ratings yet

- ACCT Sample WorksheetDocument3 pagesACCT Sample WorksheetMa. Kelly Cassandra RiveraNo ratings yet

- BES172 P3 GST Goods Services TaxDocument97 pagesBES172 P3 GST Goods Services Taxroy lexterNo ratings yet

- Bir Form 2307 SampleDocument3 pagesBir Form 2307 SampleErick Echual75% (4)

- Sample 2307Document4 pagesSample 2307kaysNo ratings yet

- Insurance Accounting Entries and TypeDocument4 pagesInsurance Accounting Entries and TypeimranNo ratings yet

- Smart Platina Plus - Hand Bill 1Document1 pageSmart Platina Plus - Hand Bill 1Ashish RanjanNo ratings yet

- CorporateAccounting Costing March2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 28A260DADocument3 pagesCorporateAccounting Costing March2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 28A260DAMubin Shaikh NooruNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet