0% found this document useful (0 votes)

1K views4 pagesMotor Insurance for Royal Enfield

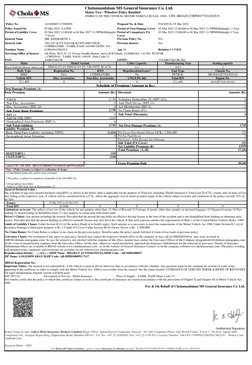

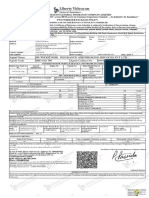

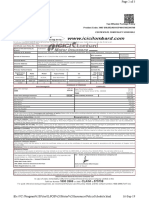

This document is a motor insurance policy document for Mr. Siddharth L issued by Aditya Birla Insurance Brokers Limited, a subsidiary of Aditya Birla Capital Limited. The key details include insuring a Royal Enfield Himalayan motorcycle registered in Coimbatore, Tamil Nadu for a sum insured of Rs. 211,400 with own damage and third party liability coverage for one year from March 5, 2022 to March 4, 2023. The policy also provides additional benefits like cashless claim settlement at Royal Enfield dealerships under the Royal Enfield Secure program.

Uploaded by

Bala SubramaniyamCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

1K views4 pagesMotor Insurance for Royal Enfield

This document is a motor insurance policy document for Mr. Siddharth L issued by Aditya Birla Insurance Brokers Limited, a subsidiary of Aditya Birla Capital Limited. The key details include insuring a Royal Enfield Himalayan motorcycle registered in Coimbatore, Tamil Nadu for a sum insured of Rs. 211,400 with own damage and third party liability coverage for one year from March 5, 2022 to March 4, 2023. The policy also provides additional benefits like cashless claim settlement at Royal Enfield dealerships under the Royal Enfield Secure program.

Uploaded by

Bala SubramaniyamCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd