Professional Documents

Culture Documents

Info Mail

Uploaded by

Srikanth ReddyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Info Mail

Uploaded by

Srikanth ReddyCopyright:

Available Formats

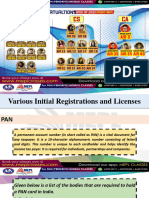

Online PAN application

As per ITD guidelines,'Request for New PAN Card or/and Changes or Correction in PAN Data'

application is presently to be used only for update/correction in PAN database. For procedure to link

Aadhaar with PAN, please click here.

As per provisions of Section 272B of the Income Tax Act., 1961, a penalty of ₹ 10,000 can be levied on

possession of more than one PAN.

Apply Online

Continue With Application

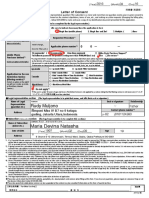

Application Type* ----Please Select------ New PAN - Indian Citizen (Form 49A)New PAN - Foreign

Citizen (Form 49AA)Changes or Correction in existing PAN Data / Reprint of PAN Card (No changes in

existing PAN Data)

----Please Select------

Category* ----Please Select------ INDIVIDUALASSOCIATION OF PERSONSBODY OF

INDIVIDUALSCOMPANYTRUSTLIMITED LIABILITY PARTNERSHIPFIRMGOVERNMENTHINDU

UNDIVIDED FAMILYARTIFICIAL JURIDICAL PERSONLOCAL AUTHORITY

----Please Select------

Applicant information

Title* ----Please Select------

----Please Select------

Last Name / Surname*

First Name

Middle Name

Date of Birth / Incorporation / Formation (DD/MM/YYYY)*

Email ID*

Mobile Number*

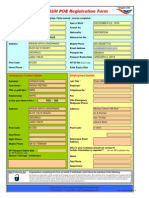

By submitting data to us and/or using our Protean e-Gov TIN web

site https://www.onlineservices.Protean.com/paam/endUserRegisterContact.html you give your

consent that all personal data/information that you submit to avail tax related services from Protean

eGov Technologies Limited may be received, stored, processed, transmitted and or made available for

view /use as mandated by law or otherwise, shall be dealt with by us in the manner and for the

purposes specified / as described in the privacy policy or as mandated by law.

Captcha Code *

You might also like

- E ServicesDocument52 pagesE ServicesRheneir MoraNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Letter of Intent BIR-eFPSDocument1 pageLetter of Intent BIR-eFPSsheNo ratings yet

- Letter of IntentDocument2 pagesLetter of IntentMariam SalongaNo ratings yet

- Pre-Emloyment KitDocument2 pagesPre-Emloyment KitBarangay SalongNo ratings yet

- Permanent Account Number (Pan)Document11 pagesPermanent Account Number (Pan)KrishanuNayakNo ratings yet

- REGISTRATION On GST NotesDocument6 pagesREGISTRATION On GST NotesRohan SinhaNo ratings yet

- PCDA-Rev Advisory For Pensioners SPARSHDocument5 pagesPCDA-Rev Advisory For Pensioners SPARSHSandeep KumarNo ratings yet

- Facility For Download of ePAN CardDocument1 pageFacility For Download of ePAN Cardprasan bhandariNo ratings yet

- Offline Payment ConfirmationDocument2 pagesOffline Payment ConfirmationSharad GuptaNo ratings yet

- EPOnlineSvcAccessApplnForm CompileDocument11 pagesEPOnlineSvcAccessApplnForm CompileRia ArguellesNo ratings yet

- GST Registration Procedure and FAQsDocument21 pagesGST Registration Procedure and FAQsSahil KumarNo ratings yet

- Transaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Document3 pagesTransaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Mahtab KhanNo ratings yet

- Various Initial Registrations and LicensesDocument34 pagesVarious Initial Registrations and LicensesshrividhulaaNo ratings yet

- Protean - Confirmation of Contribution Request Under National Pension System - NDocument1 pageProtean - Confirmation of Contribution Request Under National Pension System - NMitali GargNo ratings yet

- TTH3G9SDocument77 pagesTTH3G9SRobert SmithNo ratings yet

- Annex 882039274666970Document1 pageAnnex 882039274666970sandeep.soniNo ratings yet

- Unit 3Document41 pagesUnit 3bhagyashripande321No ratings yet

- Pan Card Application - Pan Card Status Information of Pan Card ApplicationDocument5 pagesPan Card Application - Pan Card Status Information of Pan Card ApplicationShankar JhaNo ratings yet

- Doisho English CopyeditDocument1 pageDoisho English CopyeditDevinaMuljonoNo ratings yet

- Cyber Cafe Application FormDocument4 pagesCyber Cafe Application Formkrul786100% (2)

- 1.permanent Account Number (Pan)Document10 pages1.permanent Account Number (Pan)akashNo ratings yet

- National Pension System (NPS) : First Name Middle Name Last NameDocument1 pageNational Pension System (NPS) : First Name Middle Name Last NameJayanti Prasad GautamNo ratings yet

- eNPSForm PDFDocument5 pageseNPSForm PDFPradnyaNo ratings yet

- Provident Fund Steps - UANDocument38 pagesProvident Fund Steps - UANSandip ChaudhuriNo ratings yet

- 20150707+Application+for+Opening+of+Securities+Account+ (Individual) Ver3.20Document2 pages20150707+Application+for+Opening+of+Securities+Account+ (Individual) Ver3.20Alvin TanNo ratings yet

- ApplyCertRegistrationPharmacy 29 Sep 08Document3 pagesApplyCertRegistrationPharmacy 29 Sep 08William ChandraNo ratings yet

- Filing Itr HbookDocument26 pagesFiling Itr HbookRaveendran PmNo ratings yet

- Biznet Order Form - MetroNET Promo 070110Document2 pagesBiznet Order Form - MetroNET Promo 070110Rana WahyudiNo ratings yet

- FW WP Appln FormDocument22 pagesFW WP Appln Formsanjayak_3No ratings yet

- SECP Digital Certificate Request Form: (Only For Non-Incorporated Companies)Document3 pagesSECP Digital Certificate Request Form: (Only For Non-Incorporated Companies)M. Zubair AlamNo ratings yet

- Transaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Document3 pagesTransaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)RnnrohitNo ratings yet

- Entrepass Application Form (Form 8) : Work Pass DivisionDocument11 pagesEntrepass Application Form (Form 8) : Work Pass DivisionBanyar AungNo ratings yet

- Checklist For Enrolment With GST Portal 09012017Document8 pagesChecklist For Enrolment With GST Portal 09012017Mahaveer P UpadhyeNo ratings yet

- Tax. 23Document18 pagesTax. 23RahulNo ratings yet

- Rajesh Annex-259579700022090Document1 pageRajesh Annex-259579700022090sona singhNo ratings yet

- Step by Step Guide For CTA RegistrationDocument4 pagesStep by Step Guide For CTA Registrationbarbara3721No ratings yet

- Permanent Order 5-12-2011Document16 pagesPermanent Order 5-12-2011RajNo ratings yet

- User Registration Guide 10052017 (F)Document19 pagesUser Registration Guide 10052017 (F)Syed Muhammad Zubair TariqNo ratings yet

- (A Govt. of India Undertaking) Network Systems Unit F-100, Dooravani Nagar BENGALURU - 560016Document4 pages(A Govt. of India Undertaking) Network Systems Unit F-100, Dooravani Nagar BENGALURU - 560016penaticNo ratings yet

- Annex 603869700012681Document1 pageAnnex 603869700012681ULTIMA SERVICESNo ratings yet

- Steps For Online PF Transfer-Out From M&M PF TrustDocument3 pagesSteps For Online PF Transfer-Out From M&M PF TrustKunal AroraNo ratings yet

- National Fertilizers Limited: (A Govt of India Undertaking) Panipat Unit:Gohana Road, Haryana-132 106Document5 pagesNational Fertilizers Limited: (A Govt of India Undertaking) Panipat Unit:Gohana Road, Haryana-132 106Sunil GiriNo ratings yet

- RR 8 - 2022wwwDocument10 pagesRR 8 - 2022wwwKC AtinonNo ratings yet

- CRF SECP ExistingCompanyDocument4 pagesCRF SECP ExistingCompanyریحان اشرفNo ratings yet

- Stepwise Procedure For Company IncorporationDocument6 pagesStepwise Procedure For Company IncorporationMalik Mohsin IshtiaqNo ratings yet

- Registration Using PAN354Document2 pagesRegistration Using PAN354mitesh.mightyboyNo ratings yet

- What Is Pan?: Frequently Asked Questions and Answers (Faqs)Document7 pagesWhat Is Pan?: Frequently Asked Questions and Answers (Faqs)deepak_itsmeNo ratings yet

- NPSSDocument2 pagesNPSSN InbasagaranNo ratings yet

- EP SPass Form8Document15 pagesEP SPass Form8Harold PanesNo ratings yet

- SECP Form FillingDocument22 pagesSECP Form FillingKhuram Shehzad JafriNo ratings yet

- Vendor Registration - GuideDocument13 pagesVendor Registration - GuideTejash NayakNo ratings yet

- CorrectFillingOfe MRODocument1 pageCorrectFillingOfe MROPratyush ThakurNo ratings yet

- Activity 02Document3 pagesActivity 02HaruNo ratings yet

- Application For PAN Through Online Services: Tax Information NetworkDocument6 pagesApplication For PAN Through Online Services: Tax Information NetworkGaurav GuptaNo ratings yet

- Vantage Syst Form1Document7 pagesVantage Syst Form1GunawanArpulNo ratings yet

- Efiling Home Page, Income Tax Department, Government ofDocument1 pageEfiling Home Page, Income Tax Department, Government ofbhattpiyush93No ratings yet

- Annex 882038275424342Document1 pageAnnex 882038275424342Shree Nath Transport Co.No ratings yet

- Info MailDocument1 pageInfo MailSrikanth ReddyNo ratings yet

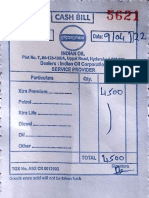

- InvoiceDocument1 pageInvoiceSrikanth ReddyNo ratings yet

- Petrol BillDocument14 pagesPetrol BillSrikanth ReddyNo ratings yet

- Book BillDocument1 pageBook BillSrikanth ReddyNo ratings yet