Professional Documents

Culture Documents

Practice 11 How To Stop Calculations For All Taxes On Purchase Order

Uploaded by

ERP Finance Support0 ratings0% found this document useful (0 votes)

11 views2 pagesOriginal Title

Practice_11_How_to_stop_calculations_for_all_taxes_on_Purchase_Order

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesPractice 11 How To Stop Calculations For All Taxes On Purchase Order

Uploaded by

ERP Finance SupportCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

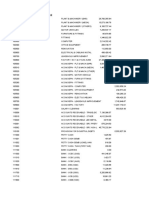

Practice 11: How to stop calculations for all taxes on Purchase Order?

Default tax setup:

1)Location: Arabia Saudita location

2)Suppliers: Tax Supplier 1, Tax Supplier 2

3)Tax Regime: Tax Regime 1

4)Tax: Tax 1

5)Tax Jurisdiction: Tax Jurisdiction 1

6)Tax Status: Tax Status 1

7) Recovery Rate: Tax Recovery 1

8)Tax Rate: Rate 1 with 5%

9)Tax Rate: Rate 0% with 0%

10) Item: Tax item 1 with category code: MISC.Misc

11) Item: Tax item 2 with category code: Computer.Software

12) Item: Tax item 3 with another category code, different than category code for Tax item 1 and Tax item 2.

We need this setup:

1) Go in Manage Configuration owner Tax Options. Click "Create" and select the configuration

owner and Event Class (ex: Purchase Order and Agreement for Enterprise Tax). Uncheck the

"Allow Tax Applicability" checkbox, Regime Determination Set: TAXREGIME and save and

close.

2) Test the setup:

Create PO: # 328 and no tax applied:

Please note that:

- If you use in Configuration Owner Tax Options Event Class: Purchase Order and Agreement for

Enterprise Tax and Allow tax applicability unchecked you will stop calculation for all taxes on

Purchase Orders and on Blanket Agreements.

- If you use in Configuration Owner Tax Options Event Class: P Purchase Requisition for Enterprise

Tax and Allow tax applicability unchecked you will stop calculation for all taxes on Purchase

Requisitions.

You might also like

- Practice 10 How To Make That Tax To Not Be Calculated For One SupplierDocument2 pagesPractice 10 How To Make That Tax To Not Be Calculated For One SupplierERP Finance SupportNo ratings yet

- Tax Setup Steps R12.1.2Document37 pagesTax Setup Steps R12.1.2Rashid Jamal97% (32)

- E-Business Tax - Setup With ExampleDocument36 pagesE-Business Tax - Setup With ExampleReddy SreeNo ratings yet

- Tax Does Not Calculate in R12 E-Business Tax (EBTAX)Document4 pagesTax Does Not Calculate in R12 E-Business Tax (EBTAX)msalahscribdNo ratings yet

- Tax Setup Steps R12.1.2Document37 pagesTax Setup Steps R12.1.2Uma Shankar MedamNo ratings yet

- Setup Condition Sets and Determining Factor Sets For Tax Rules (Doc ID 1111553.1)Document5 pagesSetup Condition Sets and Determining Factor Sets For Tax Rules (Doc ID 1111553.1)haribaskariNo ratings yet

- Taxation Practice - 1 - Default - Tax - SetupDocument13 pagesTaxation Practice - 1 - Default - Tax - SetupSyed MustafaNo ratings yet

- Practice 2: How To Override Tax Using Tax Classification? Solution 1Document6 pagesPractice 2: How To Override Tax Using Tax Classification? Solution 1Syed MustafaNo ratings yet

- Enable Tax To Calculate On Invoices Originating in Oracle R12 ProjectsDocument23 pagesEnable Tax To Calculate On Invoices Originating in Oracle R12 ProjectsRam ParepalliNo ratings yet

- 20C Financials StudentGuide 2Document717 pages20C Financials StudentGuide 2Giselle PereiraNo ratings yet

- How To Setup Expert Tax Rules On EBTaxDocument5 pagesHow To Setup Expert Tax Rules On EBTaxnaveencbe1016No ratings yet

- Document 549697.1 Ebs No Calcula Tax en APDocument6 pagesDocument 549697.1 Ebs No Calcula Tax en APMariaPaola Pacheco AraujoNo ratings yet

- How To Setup A Group Tax in R12 E-Business Tax (EBTax) (Doc ID 1604480.1)Document18 pagesHow To Setup A Group Tax in R12 E-Business Tax (EBTax) (Doc ID 1604480.1)Lo JenniferNo ratings yet

- Basic Tax Setups in E-Business Tax: Case Study - 1Document24 pagesBasic Tax Setups in E-Business Tax: Case Study - 1ved.prakash.mehtaNo ratings yet

- ID 2546502.1 HSN and SAC CodeDocument15 pagesID 2546502.1 HSN and SAC CodeJanardhanNo ratings yet

- Practice 3: How To Override Tax Using User-Defined Fiscal Classification?Document5 pagesPractice 3: How To Override Tax Using User-Defined Fiscal Classification?Syed Mustafa100% (1)

- 78 0288a GTM2019dDocument155 pages78 0288a GTM2019dfrankyboy53No ratings yet

- Offset Taxes in EBTax PDFDocument9 pagesOffset Taxes in EBTax PDFFco Jav RamNo ratings yet

- Vat Reporting For France Topical EssayDocument17 pagesVat Reporting For France Topical EssayMiguel FelicioNo ratings yet

- Basic Tax Setups in E-Business Tax: Case Study - 1Document22 pagesBasic Tax Setups in E-Business Tax: Case Study - 1jabar aliNo ratings yet

- Freight Rule in R12 E-Business Tax (EBtax) Payables To Exempt TaxDocument3 pagesFreight Rule in R12 E-Business Tax (EBtax) Payables To Exempt TaxAyman BadrNo ratings yet

- AP Integration With E TAXDocument23 pagesAP Integration With E TAXTejeshwar KumarNo ratings yet

- Cloud AP 1099 and Withholding Tax SetupDocument14 pagesCloud AP 1099 and Withholding Tax SetupSrinivasa Rao AsuruNo ratings yet

- Tax Bulletin - Issue 2Document26 pagesTax Bulletin - Issue 2Sindura KuloNo ratings yet

- Test Case Withholding Tax Classification Code Not Showing Up in Income Tax Tab However Codes Have Been Created and ActiveDocument2 pagesTest Case Withholding Tax Classification Code Not Showing Up in Income Tax Tab However Codes Have Been Created and ActiveERP Finance SupportNo ratings yet

- Israel EssayDocument30 pagesIsrael Essaysudhirpatil15No ratings yet

- Taxation Sap Explain With An ExampleDocument18 pagesTaxation Sap Explain With An Examplejitendraverma8No ratings yet

- Tax Procedures - TAXINJ - SAP FICO DocsDocument4 pagesTax Procedures - TAXINJ - SAP FICO Docschaitu121276No ratings yet

- R12 EtaxDocument66 pagesR12 Etaxsatya_raya8022No ratings yet

- Modified Type Status: Goal SolutionDocument3 pagesModified Type Status: Goal SolutionSherif Abdel MoneomNo ratings yet

- Tds NotesDocument15 pagesTds NotesnaysarNo ratings yet

- EB Tax For PakistanDocument31 pagesEB Tax For Pakistanhamzaali227004No ratings yet

- Oracle E-Business Tax: Regime To Rate Flow in Oracle R12Document14 pagesOracle E-Business Tax: Regime To Rate Flow in Oracle R12M Rajender ReddyNo ratings yet

- How To Configure Ebtax For Vat TaxDocument17 pagesHow To Configure Ebtax For Vat TaxKaushik BoseNo ratings yet

- Introducing A New VAT System: Everything You Always Wanted To Know About VAT in SAP But Were Not Aware To AskDocument7 pagesIntroducing A New VAT System: Everything You Always Wanted To Know About VAT in SAP But Were Not Aware To Askchandra_kumarbrNo ratings yet

- Tax Manager Setup With ScreenDocument46 pagesTax Manager Setup With ScreenK.c. Nayak100% (3)

- Vat Reporting For Spain Topical EssayDocument34 pagesVat Reporting For Spain Topical EssayMiguel FelicioNo ratings yet

- RequirementsDocument174 pagesRequirementsSourav KumarNo ratings yet

- Oracle - Receivables: Date - 1 MAR 2006 1 OF 5Document5 pagesOracle - Receivables: Date - 1 MAR 2006 1 OF 5AnjanNo ratings yet

- VAT in Oracle EBSDocument8 pagesVAT in Oracle EBSAbhishek IyerNo ratings yet

- Tax Calculation Process in SDDocument4 pagesTax Calculation Process in SDVinayNo ratings yet

- A Overview of Maharashtra Value Added Tax: IndexDocument10 pagesA Overview of Maharashtra Value Added Tax: IndexAdnan ParkarNo ratings yet

- Tcs DocDocument8 pagesTcs DocSelvaRajNo ratings yet

- Tax PDFDocument32 pagesTax PDFAd ElouNo ratings yet

- CIN Step by StepDocument32 pagesCIN Step by StepBalakrishna GovinduNo ratings yet

- Process Document Deferred TaxDocument6 pagesProcess Document Deferred TaxAmit ShindeNo ratings yet

- EBTAX SetupsDocument11 pagesEBTAX Setupssvennam_sssNo ratings yet

- MVAT Notes RectifiedDocument49 pagesMVAT Notes RectifiedsachindhodreNo ratings yet

- E Business Tax Flow in Oracle R12Document17 pagesE Business Tax Flow in Oracle R12murali.kasuru100% (1)

- SAPCIN FI ConfigurationDocument14 pagesSAPCIN FI ConfigurationbogasrinuNo ratings yet

- Setting Up TaxesDocument11 pagesSetting Up TaxesFco Jav RamNo ratings yet

- Tax in PurchasingDocument8 pagesTax in PurchasingRussellNo ratings yet

- TAX and Pricing Procedure Configuration For GSTDocument9 pagesTAX and Pricing Procedure Configuration For GSTmohammedNo ratings yet

- CIN (Country India Version) MM, SD, FI Module Integration: Img SettingsDocument8 pagesCIN (Country India Version) MM, SD, FI Module Integration: Img SettingsMayur KhamitkarNo ratings yet

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024From EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024No ratings yet

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchFrom EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchRating: 5 out of 5 stars5/5 (1)

- Practice 13 Incorporate Tax-Inclusive Pricing On Purchase OrderDocument3 pagesPractice 13 Incorporate Tax-Inclusive Pricing On Purchase OrderERP Finance SupportNo ratings yet

- Practice What Setup Is Needed That Tax To Be Calculated On Base Amount Not On The Amount After Discount OrderedDocument3 pagesPractice What Setup Is Needed That Tax To Be Calculated On Base Amount Not On The Amount After Discount OrderedERP Finance SupportNo ratings yet

- Test Case Withholding Tax Classification Code Not Showing Up in Income Tax Tab However Codes Have Been Created and ActiveDocument2 pagesTest Case Withholding Tax Classification Code Not Showing Up in Income Tax Tab However Codes Have Been Created and ActiveERP Finance SupportNo ratings yet

- Test Case Tax Based On Product TypeDocument5 pagesTest Case Tax Based On Product TypeERP Finance SupportNo ratings yet

- GST No Tax ApiDocument5 pagesGST No Tax ApiERP Finance SupportNo ratings yet

- How Tax Is Coming On Purchase Order Based On Purchasing CategoryDocument2 pagesHow Tax Is Coming On Purchase Order Based On Purchasing CategoryERP Finance SupportNo ratings yet

- ID 2546502.1 HSN and SAC CodeDocument15 pagesID 2546502.1 HSN and SAC CodeJanardhanNo ratings yet

- Credit Enhancement Sit EvidencesDocument4 pagesCredit Enhancement Sit EvidencesERP Finance SupportNo ratings yet

- L - 367 - ADV - 19JAN22Document25 pagesL - 367 - ADV - 19JAN22ERP Finance SupportNo ratings yet

- How To Solve Error With Tax On Requisitions The Tax Amounts Cannot Be Calculated. Contact The Procurement Application Administrator POR-2010408Document2 pagesHow To Solve Error With Tax On Requisitions The Tax Amounts Cannot Be Calculated. Contact The Procurement Application Administrator POR-2010408ERP Finance SupportNo ratings yet

- CMI Merge Order Generation LogicDocument1 pageCMI Merge Order Generation LogicERP Finance SupportNo ratings yet

- GL Format MSKEDocument30 pagesGL Format MSKEERP Finance SupportNo ratings yet

- Remarks For TestingDocument53 pagesRemarks For TestingERP Finance SupportNo ratings yet

- Sample DataDocument2 pagesSample DataERP Finance SupportNo ratings yet

- LWM - DATADocument14 pagesLWM - DATAERP Finance SupportNo ratings yet

- January 2023 Salary - Attendance WorkbookDocument5 pagesJanuary 2023 Salary - Attendance WorkbookERP Finance SupportNo ratings yet

- SOP For Transfer Order RequestDocument2 pagesSOP For Transfer Order RequestERP Finance SupportNo ratings yet

- CUX MI GST Dunning Letter Prin 211121Document3 pagesCUX MI GST Dunning Letter Prin 211121ERP Finance SupportNo ratings yet

- 36 Pcs Grouping Probelm of CMIDocument13 pages36 Pcs Grouping Probelm of CMIERP Finance SupportNo ratings yet

- SOP For Transfer Order RequestDocument2 pagesSOP For Transfer Order RequestERP Finance SupportNo ratings yet

- GST ConfigurationDocument1 pageGST ConfigurationERP Finance SupportNo ratings yet

- Oracle E-Business Suite User's GuideDocument53 pagesOracle E-Business Suite User's GuideERP Finance SupportNo ratings yet

- Oracle UpgradeDocument8 pagesOracle UpgradeERP Finance SupportNo ratings yet

- AR SetupsDocument45 pagesAR SetupsERP Finance SupportNo ratings yet

- Basic Vs Adv Pricing FundaDocument15 pagesBasic Vs Adv Pricing FundaERP Finance SupportNo ratings yet

- Xxcns BL SheetDocument1 pageXxcns BL SheetERP Finance SupportNo ratings yet