Professional Documents

Culture Documents

Product Life Cycle Costing

Uploaded by

Deepak ChandekarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Product Life Cycle Costing

Uploaded by

Deepak ChandekarCopyright:

Available Formats

Cost Management

Study Note - 1

COST MANAGEMENT

This Study Note includes

1.1 Life Cycle Costing

1.2 Target Costing

1.3 Kaizen Costing

1.4 Value Analysis and Value Engineering

1.5 Throughput Costing

1.6 Business Process Re-engineering

1.7 Back-flush Accounting

1.8 Lean Accounting

1.9 Socio Economic Costing

1.10 Cost Control and Cost Reduction – Basics, Process, Methods and Techniques of Cost Reduction Programme

1.1 LIFE CYCLE COSTING

Meaning of Life Cycle Costing

(a) Life Cycle Costing; aims at cost ascertainment of a product, project etc. over its projected life.

(b) It is a system that tracts and accumulates the actual costs snd revenues attributable to cost object (i.e.;

product) from its inception to its abandonment.

(c) Sometimes the terms; cradle-to-grave costing and womb-to-tomb costing convey the meaning of fully

capturing all costs associated with the product from its initial to final stages.

Meaning of Product Life Cycle

(a) Product Life Cycle is a pattern of expenditure, sale level, revenue and profit over the period from new idea

generation to the deletion of product from product range.

(b) Product Life Cycle spans the time from initial R&D on a product to when customer servicing and support is no

longer offered for the product. For products like motor vehicles, this time-span may range from 5 to 7 years.

For some basic pharmaceuticals, the time-span be 7 to 10 years.

Characteristic of PLCC

(a) Involves tracing of costs and revenues of each product over several calendar periods throughout their entire

life cycle.

(b) Traces research, design and development costs and total magnitude of these costs for each individual

product and compared with product revenue.

(c) Assists report generation for costs and revenues.

Phases in Product Life Cycle:

The 4 identifiable phases in the product Life Cycle are — (a) Introduction (b) Growth (c) Maturity and (d) Decline.

A comparative analysis of these phases is given below —

THE INSTITUTE OF COST ACCOUNTANTS OF INDIA 1

Strategic Cost Management - Decision Making

Particulars Introduction Growth Maturity Decline

Phase 1 II III IV

Sales Initial stages, hence Rise in sales levels at Rise in sales levels at Sales level off and then

Volumes low. increasing rates. decreasing rates start decreasing

Prices of High levels to cover Retention of high Prices fall closer to Gap between price

products initial costs and level prices except in cost, due to effect of and cost is further

promotional exps. certain cases. competition. reduced.

Ratio of Highest, due to effort Total expenses Ratio reaches a normal Reduced sales

promotion needed to inform remain the same, level of sales. Such promotional efforts as

expenses to potential customers, while ratio of S&D OH normal level becomes the product is no longer

sales launch products, to sales is reduced the industry standard. in demand.

distribute to customers due to increase in

etc. sales.

Competiti Negligible and Entry of a large Fierce Competition Starts disappearing

on insignificant number of due to withdrawal of

competitors. products.

Profits Nil, due to heavy initial Increase at a rapid Normal rate of profits Decline profits due to

costs pace since costs and prices price competition new

are normalized. products etc.

• in the growth stage, maintain the prices at high levels, in order to realize maximum profits.

• Price reduction will not be undertaken unless (a) the low prices will lead to market penetration, (b) the Firm

has sufficient production capacity to absorb the increased sales volume, and (c) Competitors enters the

market.

Maturity

Growth

Sales

Decline

`

Introduction

Time

Benefits of PLCC

(a) Results in earlier actions to generate revenue or to lower costs than otherwise might be considered.

(b) Ensures better decision from a more accurate and realistic assessment of revenues and costs atleast within a

particular life cycle stage.

(c) Promotes long-term rewarding.

(d) Provides an overall framework for considering total incremental costs over the life span of the product.

2 THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

Cost Management

Importance of Product Life Cycle Costing:

Product Life Cycle Costing is considered important due to the following reasons —

(a) Time based analysis: Life cycle costing involves tracing of costs and revenues of each product over several

calendar periods throughout their life cycle. Costs and revenues can analysed by time periods. The total

magnitude of costs for each individual product can be reported and compared with product revenues

generated in various time periods.

(b) Overall Cost Analysis: Production Costs are accounted and recognized by the routine accounting system.

However non-production costs like R&D; design; marketing; distribution; customer service etc. are less visible

on a product — by — product basis. Product Life Cycle Costing focuses on recognizing both production and

non-production costs.

(c) Pre-production costs analysis: The development period of R&D and design is long and costly. A high

percentage of total product costs maybe incurred before commercial production begin. Hence; the

Company needs accurate information on such costs for deciding whether to continue with the R&D or not.

(d) Effective Pricing Decisions: Pricing Decisions; in order to be effective; should include market considerations

on one hand and cost considerations on the other. Product Life Cycle Costing and Target Costing help

analyze both these considerations and arrive at optimal price decisions.

(e) Better Decision Making: Based on a more accurate and realistic assessment ot revenues and costs, at least

within a particular life cycle stage, better decisions can be taken.

(f) Long Run Holistic view: Product Life Cycle Costing can promote long-term rewarding in contrast to short-term

profitability rewarding. It provides an overall framework for considering total incremental costs over the entire

life span of a product, which in turn facilitates analysis of parts of the whole where cost effectiveness might

be improved.

(g) Life Cycle Budgeting: Life Cycle Budgeting, i.e., Life Cycle Costing with Target Costing principles, facilitates

scope for cost reduction at the design stage itself. Since costs are avoided before they are committed or

locked in the Company is benefited.

(h) Review: Life Cycle Costing provides scope for analysis of long term picture of product line profitability,

feedback on the effectiveness of life cycle planning and cost data to clarify the economic impact of

alternatives chosen in the design, engineering phase etc.

Illustration 1.

Wipro is examining the profitability and pricing policies of its Software Division. The Software Division develops

Software Packages for Engineers. It has collected data on three of its more recent packages - (a) ECE Package

for Electronics and Communication Engineers, (b) CE Package for Computer Engineers, and (c) IE Package for

Industrial Engineers.

Summary details on each package over their two year cradle to grave product lives are -

Package Selling Price Number of units sold

Year 1 Year 2

ECE ` 250 2,000 8,000

CE ` 300 2,000 3,000

IE ` 200 5,000 3,000

Assume that no inventory remains on hand at the end of year 2. Wipro is deciding which product lines to emphasize

in its software division. In the past two years, the profitability of this division has been mediocre.

Wipro is particularly concerned with the increase in R & D costs in several of its divisions. An analyst at the Software

Division pointed out that for one of its most recent packages (IE) major efforts had been made to reduce R&D

costs.

THE INSTITUTE OF COST ACCOUNTANTS OF INDIA 3

Strategic Cost Management - Decision Making

Last week, Amit, the Software Division Manager, decides to use Life Cycle Costing in his own division. He collects

the following Life Cycle Revenue and Cost information for the packages - Amount (`)

Particulars Package ECE Package CE Package IE

Year 1 Year 2 Year 1 Year 2 Year 1 Year 2

Revenues 5,00,000 20,00,000 6,00,000 9,00,000 10,00,000 6,00,000

Costs

R&D 7,00,000 - 4,50,000 - 2,40,000 -

Design of Product 1,15,000 85,000 1,05,000 15,000 76,000 20,000

Manufacturing 25,000 2,75,000 1,10,000 1,00,000 1,65,000 43,000

Marketing 1,60,000 3,40,000 1,50,000 1,20,000 2,08,000 2,40,000

Distribution 15,000 60,000 24,000 36,000 60,000 36,000

Customer Service 50,000 3,25,000 45,000 1,05,000 2,20,000 3,88,000

Present a Product Life Cycle Income Statement for each Software Package. Which package is most profitable

and which is the least profitable? How do the three packages differ in their cost structure (the percentage of total

costs in each category)?

Answer:

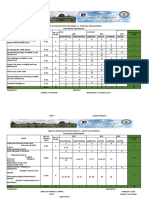

Life cycle Income Statement (in ` 000s)

Particulars Package ECE Package CE Package IE

Y1 Y2 Total % Y1 Y2 Total % Y1 Y2 Total %

Revenues 500 2,000 2,500 100% 600 900 1,500 100% 1,000 600 1,600 100%

Costs

R&D 700 - 700 28% 450 - 450 30% 240 - 240 15%

Design 115 85 200 8% 105 15 120 8% 76 20 96 6%

Manufacturing 25 275 300 12% 110 100 210 14% 165 43 208 13%

Marketing 160 340 500 20% 150 120 270 18% 208 240 448 28%

Distribution 15 60 75 3% 24 36 60 4% 60 36 96 6%

Cust. Service 50 325 375 15% 45 105 150 10% 220 388 608 38%

Total Costs 1065 1,085 2150 86% 884 376 1260 84% 969 727 1696 106%

Profit 350 14% 240 16% (96) -6%

Observation: Package ECE is most profitable, while package IE is least profitable.

Illustration 2.

A2Z p.l.c supports the concept of tero technology or life cycle costing for new investment decisions covering its

engineering activities. The financial side of this philosophy is now well established and its principles extended to all

other areas of decision making. The company is to replace a number of its machines and the Production Manager

is torn between the Exe Machine, a more expensive machine with a life of 12 years, and the Wye machine with an

estimated life of 6 years. If the Wye machine is chosen it is likely that it would be replaced at the end of 6 years by

another Wye machine. The patter of maintenance and running costs differs between the two types of machine

and relevant data are shown below:

4 THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

Cost Management

Exe Wye

` `

Purchase price 19,000 13,000

Trade-in value/brakeup/scrap 3,000 3,000

Annual repair costs 2,000 2,600

Overhaul costs (at year 8) 4,000 (at year 4) 2,000

Estimated financing costs averaged over machine life

10%p.a -Exe; 10% p.a. -Wye

You are required to: recommend with supporting figures, which machine to purchase, stating any assumptions

made.

Solution:

Computation of present value of outflows and equivalent annual

` Exe machine ` WYE machine

` `

Initial cost 19,000.00 13,000.00

Less : Scrap at the end of the life (3000x0.32) 960.00 (3000X.56) 1,680.00

18,040.00 11,320.00

Present value of total annual cost (2000x6.81) 13,620.00 (2600x4.36) 11,336.00

Overhaul cost (4000X.47) 1,880.00 (2000X.68) 1,360.00

33,540.00 24,016.00

Capital recovery factor (1/6.81) 0.15 (1/4.36) 0.23

Equivalent annual cost 4,925.00 5,508.00

As the equivalent annual cost is less for exe machine, it is better to purchase the same.

Illustration 3.

Company X is forced to choose between two machines A and B. The two machines are designed differently, but

have identical capacity and do exactly the same job. Machine A costs ` 1,50,000 and will last for 3 years. It costs

`40,000 per year to run. Machine B is an ‘economy’ model costing only ` 1,00,000, but will last only for 2 years, and

costs ` 60,000 per year to run. These are real cash flows. The costs are forecasted in rupees of constant purchasing

power. Ignore tax. Opportunity cost of capital is 10%. Which machine Company X should buy?

Answer:

Compound present value of 3 years @ 10% = 2.486

P.V. of running cost of Machine A for 3 years = ` 40,000 x 2.486 = ` 99,440

Compound present value of 2 years @ 10% = 1.735

P.V. of running cost of Machine B for 2 years = ` 60,000 x 1.735 = ` 1,04,100

Statement Showing Evaluation of Machines A and B (`)

Particulars Machine A Machine B

Cost of purchase 1,50,000 1,00,000

Add: P.V. of running cost for 3 years 99,440 1,04,100

P.V. of Cash outflow 2,49,440 2,04,100

2,49,440 2,04,100

Equivalent present value of annual cash outflow 2.486 1.735

= 1,00,338 = 1,17,637

Analysis: Since the annual cash outflow of Machine B is higher, Machine A can be purchased.

THE INSTITUTE OF COST ACCOUNTANTS OF INDIA 5

Strategic Cost Management - Decision Making

Illustration 4.

Computation of Equivalent Annual Cost and Identification of Year to Replace the Machine

A & Co. is contemplating whether to replace an existing machine or to spend money on overhauling it.

A & Co. currently pays no taxes. The replacement machine costs ` 90,000 now and requires maintenance of

` 10,000 at the end of every year for eight years. At the end of eight years it would have a salvage value of ` 20,000

and would be sold. The existing machine requires increasing amounts of maintenance each year and its salvage

value falls each year as follows:

Amount (` )

Year Maintenance Salvage

Present 0 40,000

1 10,000 25,000

2 20,000 15,000

3 30,000 10,000

4 40,000 0

The opportunity cost of capital for A & Co. is 15%.

When should the company replace the machine?

(Notes: Present value of an annuity of ` 1 per period for 8 years at interest rate of 15% : 4.4873; present value of ` 1

to be received after 8 years at interest rate of 15% : 0.3269)

Answer:

Calculation of Equivalent Annual Cost of New Machine Amount (` )

Cost of New Machine 90,000

Add: Present value of annual maintenance cost for 8 years (` 10,000 × 4.4873) 44,873

1,34,873

Less: Present value of salvage value at the end of 8th year (`20,000 × 0.3269) 6,538

Total present value of life cycle costs of new machine 1,28,335

Equivalent Annual cost = ` 1,28,335/4.4873 = ` 28,600

Calculation of Equivalent Annual cost in continuing with Existing Machine

1st Year Amount (` )

P.V. of salvage value at the beginning of 1st year 40,000

Add: P. V. of Maintenance cost (10,00/1.15) 8,696

48,696

Less: P.V. of salvage value at the end of the year (25,000/1.15) 21,739

26,957

Equivalent Annual cost at the end of 1st year (26,957 × 1.15) 31,000

2nd Year Amount (` )

P.V. of salvage value at the beginning of 2nd year 25,000

Add: P. V. of Maintenance cost (20,00/1.15) 17,391

42,391

Less: P.V. of salvage value at the end of the 2nd year (15,000/1.15) 13,043

29,348

Equivalent Annual cost at the end of 2 nd

year (29,348 × 1.15) 33,750

6 THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

Cost Management

3rd Year Amount (` )

P.V. of salvage value at the beginning of 3rd year 15,000

Add: P. V. of Maintenance cost (30,00/1.15) 26,087

41,087

Less: P.V. of salvage value at the end of the 3rd year (10,000/1.15) 8,696

32,391

Equivalent Annual cost at the end of 3rd year (32,391 × 1.15) 37,250

4th Year Amount (` )

P.V. of salvage value at the beginning of 4th year 10,000

Add: P. V. of Maintenance cost (40,00/1.15) 34,783

44,783

Less: P.V. of salvage value at the end of the 4th year Nil

44,783

Equivalent Annual cost at the end of 4 year th

(44,783 × 1.15) 51,500

Analysis: Since the equivalent annual cost of new machine is lesser than that of existing machine, it is suggested

to replace the existing machine with new machine. The equivalent annual cost of existing machine is higher in all

the four years as compared to new machine.

Illustration 5.

A company is considering the purchase of a machine for ` 3,50,000. It feels quite confident that it can sell the

goods produced by the machine as to yield an annual cash surplus of ` 1,00,000. There is however uncertainly as

to the machine working life. A recently published Trade Association Survey shows that members of the Association

have between them owned 250 of these machines and have found the lives of the machines vary as under:

No. of year of machine life 3 4 5 6 7 Total

No. of machines having given life 20 50 100 70 10 250

Assuming discount rate of 10% the net present value for each different machine life is follows:

Machine life 3 4 5 6 7

NPV (`) (1,01,000) (33,000) 29,000 86,000 1,37,000

You required to advice whether the company should purchase a machine or not.

Answer:

Computation of NPV of an asset considering the probability of life of machine.

Year Probability NPV Expected value

(a) ` (b) ` (a × b)

3 20/250 (1,01,000) (8,080)

4 50/250 (33,000) (6,600)

5 100/250 29,000 11,600

6 70/250 86,000 24,080

7 10/250 1,37,000 5,480

26,480

So, Assets should be purchased.

THE INSTITUTE OF COST ACCOUNTANTS OF INDIA 7

You might also like

- Cost INGDocument49 pagesCost INGvyavahareanant145No ratings yet

- Final Strategic Cost Management TheoryDocument74 pagesFinal Strategic Cost Management TheoryxxxcxxxNo ratings yet

- Strategic Cost Management Techniques for Maximizing ProfitsDocument74 pagesStrategic Cost Management Techniques for Maximizing ProfitsClari TyNo ratings yet

- 4.0 Life Cycle CostDocument7 pages4.0 Life Cycle CostAmirul Hafizi Mohd MidhalNo ratings yet

- B03 - Life CycleDocument11 pagesB03 - Life CycleAcca BooksNo ratings yet

- HOW TO DRIVE STRATEGIC COST MANAGEMENT TO WINNING COMPETITION - ShareDocument75 pagesHOW TO DRIVE STRATEGIC COST MANAGEMENT TO WINNING COMPETITION - ShareRisa LubisNo ratings yet

- Life Cycle CostingDocument4 pagesLife Cycle CostingpalaviyaNo ratings yet

- Strategic Cost Management Cost Planning For Product Life-Cycle: Life-Cycle Costing and Long-Term Pricing Target Costing and Theory of ConstraintsDocument12 pagesStrategic Cost Management Cost Planning For Product Life-Cycle: Life-Cycle Costing and Long-Term Pricing Target Costing and Theory of ConstraintsNune SabanalNo ratings yet

- Life Cycle CostingDocument10 pagesLife Cycle Costingvicent laurianNo ratings yet

- Mgac Theo NotesDocument17 pagesMgac Theo Notesisiah regisNo ratings yet

- Life cycle costing analysis for solar panel productDocument37 pagesLife cycle costing analysis for solar panel productanantarajkhanalNo ratings yet

- Target & LCCDocument45 pagesTarget & LCCAbhinav MadraNo ratings yet

- Ch3 LifeCycleDocument14 pagesCh3 LifeCycleadamNo ratings yet

- Target and Life Cycle Costing: Instructor: Prof. Paramjeet Ma'am by Tanvi Pathania Yashvendra Aman BhaweshDocument20 pagesTarget and Life Cycle Costing: Instructor: Prof. Paramjeet Ma'am by Tanvi Pathania Yashvendra Aman BhaweshYashvendra RawatNo ratings yet

- Capsim Simulation Team StrategyDocument9 pagesCapsim Simulation Team StrategyDhruv KumbhareNo ratings yet

- Module - Chapter 8Document21 pagesModule - Chapter 8Clarissa A. FababairNo ratings yet

- Module Cuac 413Document93 pagesModule Cuac 413Danisa NdhlovuNo ratings yet

- Bossugansnov 18 Finalp 5Document23 pagesBossugansnov 18 Finalp 5Veer ShahNo ratings yet

- Answer To Questions: Strategic Cost Management - Solutions ManualDocument8 pagesAnswer To Questions: Strategic Cost Management - Solutions ManualKyla Roxas67% (6)

- Daily Wear: Business Management and StrategyDocument7 pagesDaily Wear: Business Management and StrategyMuhammad ArslanNo ratings yet

- Cost Management For Product Life CycleDocument24 pagesCost Management For Product Life CycleAlexa Daphne M. EquisabalNo ratings yet

- Cost Management Techiniques Used in Sugar Industry: AbstractDocument8 pagesCost Management Techiniques Used in Sugar Industry: AbstractUnknown 777No ratings yet

- Product Life Cycle ManagamentDocument4 pagesProduct Life Cycle Managamentisiah regisNo ratings yet

- Product Life Cycle ManagementDocument58 pagesProduct Life Cycle Managementcaptain mkNo ratings yet

- Target Costing Presentation FinalDocument57 pagesTarget Costing Presentation FinalMr Dampha100% (1)

- Strategic Tools for Mgt AccountantsDocument15 pagesStrategic Tools for Mgt AccountantsPANDHARE SIDDHESHNo ratings yet

- Forecasting Techniques and ApproachesDocument35 pagesForecasting Techniques and ApproachesDaniel KetemawNo ratings yet

- Activity 3-Cost Volume Profit AnalysisDocument2 pagesActivity 3-Cost Volume Profit AnalysisFortunato EllenNo ratings yet

- Presented by By: Ali NadafDocument24 pagesPresented by By: Ali NadafAli NadafNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingTayyeba IrshadNo ratings yet

- Business O Level Notes - Chapter 16Document4 pagesBusiness O Level Notes - Chapter 16Heba KhattabNo ratings yet

- Business O Level Notes - Chapter 16 PDFDocument4 pagesBusiness O Level Notes - Chapter 16 PDFHeba KhattabNo ratings yet

- Maf Seminar Slide SyafDocument19 pagesMaf Seminar Slide SyafNur SyafiqahNo ratings yet

- Topic 2 - Strategi Marketing BudgetingDocument30 pagesTopic 2 - Strategi Marketing BudgetingCleo Coleen FortunadoNo ratings yet

- T-8 Management Acc TechniquesDocument35 pagesT-8 Management Acc TechniquesPOOJA GUPTANo ratings yet

- PLC BasicDocument28 pagesPLC BasicTwinkal chakradhariNo ratings yet

- Target CostingDocument21 pagesTarget CostingAli NadafNo ratings yet

- Chapter 4 Product Life Cycle Costing: 1. ObjectivesDocument13 pagesChapter 4 Product Life Cycle Costing: 1. ObjectivesVladlenaAlekseenko100% (1)

- Complete Topic 6 - Life Cycle CostingDocument6 pagesComplete Topic 6 - Life Cycle CostingchaiigasperNo ratings yet

- Forecasting (1) HHHDocument124 pagesForecasting (1) HHHMichaela WongNo ratings yet

- Cost & Pricing StrategiesDocument5 pagesCost & Pricing StrategiesMoti BekeleNo ratings yet

- Transfer Pricing: CA Final: Paper 5: Advanced Management Accounting: Chapter 7Document71 pagesTransfer Pricing: CA Final: Paper 5: Advanced Management Accounting: Chapter 7Abid Siddiq Murtazai100% (1)

- Product Life-Cycle Management: Concept and Stages: Professor in Hindi, PGGC-11 ChandigarhDocument2 pagesProduct Life-Cycle Management: Concept and Stages: Professor in Hindi, PGGC-11 ChandigarhMahesh GanchariNo ratings yet

- Lecture 7 - Managing Product Offerings - PDFDocument25 pagesLecture 7 - Managing Product Offerings - PDFMihaela PopazovaNo ratings yet

- Module 1 - Product Life Cycle ManagementDocument45 pagesModule 1 - Product Life Cycle ManagementNeha chauhanNo ratings yet

- Chapter 3 Life Cycle Costing: Answer 1 Target Costing Traditional ApproachDocument11 pagesChapter 3 Life Cycle Costing: Answer 1 Target Costing Traditional ApproachadamNo ratings yet

- LIfe Cycle CostingDocument18 pagesLIfe Cycle CostingShaikh SuhailNo ratings yet

- Life Cycle CostingDocument14 pagesLife Cycle CostingMUNAWAR ALI87% (15)

- 00 Theories Final Exam To Be PrintedDocument4 pages00 Theories Final Exam To Be PrintedPillos Jr., ElimarNo ratings yet

- Product Lifecycle Pricing - 2011Document51 pagesProduct Lifecycle Pricing - 2011Mohamadhu UsmanNo ratings yet

- Chap013 Target Costing Cost MNGTDocument49 pagesChap013 Target Costing Cost MNGTramaNo ratings yet

- Chap013 Target Costing Cost MNGTDocument49 pagesChap013 Target Costing Cost MNGTSyifaNo ratings yet

- CVP AnalysisDocument38 pagesCVP AnalysisDr. D.N.S.KUMAR100% (1)

- Target Costing Presentation FinalDocument22 pagesTarget Costing Presentation FinalvijaypandaNo ratings yet

- How to Manage Future Costs and Risks Using Costing and MethodsFrom EverandHow to Manage Future Costs and Risks Using Costing and MethodsNo ratings yet

- The Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)From EverandThe Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)No ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- The Key to Higher Profits: Pricing PowerFrom EverandThe Key to Higher Profits: Pricing PowerRating: 5 out of 5 stars5/5 (1)

- New Efficiency AuditDocument13 pagesNew Efficiency AuditDeepak ChandekarNo ratings yet

- UntitledDocument44 pagesUntitledRafay AnwarNo ratings yet

- Recent Advances in Cost Accounting and Cost SystemDocument6 pagesRecent Advances in Cost Accounting and Cost SystemDeepak ChandekarNo ratings yet

- Cas 1 24 CasbDocument145 pagesCas 1 24 CasbTirumaleswara ReddyNo ratings yet

- Sustainable Development Goals PDFDocument5 pagesSustainable Development Goals PDFsadafmirzaNo ratings yet

- Value Analysis and Value Engineering CMA Old ModuleDocument7 pagesValue Analysis and Value Engineering CMA Old ModuleDeepak ChandekarNo ratings yet

- SDG Goals Sustainable Development GoalDocument15 pagesSDG Goals Sustainable Development Goalajay dodiya100% (1)

- Capital Budgeting MethodsDocument23 pagesCapital Budgeting MethodsAbhishek SinhaNo ratings yet

- Moot Problem 2ndDocument2 pagesMoot Problem 2ndDeepak ChandekarNo ratings yet

- An Ethics Framework For Public HealthDocument19 pagesAn Ethics Framework For Public HealthLaura ZahariaNo ratings yet

- Analyzing Repairable vs. Non-Repairable SystemsDocument20 pagesAnalyzing Repairable vs. Non-Repairable SystemsAji PratamaNo ratings yet

- Abertay Coursework ExtensionDocument4 pagesAbertay Coursework Extensiondut0s0hitan3100% (2)

- Practical Research Module 6.fDocument5 pagesPractical Research Module 6.fDianne Masapol100% (1)

- Đánh giá có hệ thống về hành vi công dân của khách hàng Làm rõ lĩnh vực và chương trình nghiên cứu trong tương laiDocument15 pagesĐánh giá có hệ thống về hành vi công dân của khách hàng Làm rõ lĩnh vực và chương trình nghiên cứu trong tương laiMinh HuyềnNo ratings yet

- Marketing ProjectDocument68 pagesMarketing Projectdivya0% (1)

- AssignmentDocument30 pagesAssignmentLadymae Barneso SamalNo ratings yet

- Tittle: Convertible Emergency Shelters Ready in Paniqui General Hospital Room Facility ShortageDocument23 pagesTittle: Convertible Emergency Shelters Ready in Paniqui General Hospital Room Facility ShortageGroup4RamosNo ratings yet

- Human Resources at The AES CorpDocument3 pagesHuman Resources at The AES Corpeko.rakhmat100% (1)

- Hindsight BiasDocument4 pagesHindsight BiasGaurav TripathiNo ratings yet

- Impact of Employee Motivation on Firm PerformanceDocument3 pagesImpact of Employee Motivation on Firm Performancemuhammad usamaNo ratings yet

- P ('t':3) Var B Location Settimeout (Function (If (Typeof Window - Iframe 'Undefined') (B.href B.href ) ), 15000)Document29 pagesP ('t':3) Var B Location Settimeout (Function (If (Typeof Window - Iframe 'Undefined') (B.href B.href ) ), 15000)dhiauddinNo ratings yet

- T309 - Microbiological Quality Control Requirements in An ISO 17025 Laboratory PDFDocument26 pagesT309 - Microbiological Quality Control Requirements in An ISO 17025 Laboratory PDFПламен ЛеновNo ratings yet

- Investigating Liquidity-Profitability Relationship: Evidence From Companies Listed in Saudi Stock Exchange (Tadawul)Document15 pagesInvestigating Liquidity-Profitability Relationship: Evidence From Companies Listed in Saudi Stock Exchange (Tadawul)tjarnob13No ratings yet

- The Naked of Piping DesignDocument20 pagesThe Naked of Piping DesignAndiWSutomoNo ratings yet

- PS5 ResubmitDocument6 pagesPS5 ResubmitAshley PlemmonsNo ratings yet

- Fat Ores BahreinDocument16 pagesFat Ores BahreinAmanda MacielNo ratings yet

- Ensayo controlado aleatorio que prueba la viabilidad de una intervención de ejercicio y nutrición para pacientes con cáncer de ovario durante y después de la quimioterapia de primera línea (estudio BENITA)Document11 pagesEnsayo controlado aleatorio que prueba la viabilidad de una intervención de ejercicio y nutrición para pacientes con cáncer de ovario durante y después de la quimioterapia de primera línea (estudio BENITA)joelccmmNo ratings yet

- ATP 1: Social Psychology 1: The Nature of Social PsychologyDocument24 pagesATP 1: Social Psychology 1: The Nature of Social Psychologypallavi082100% (1)

- Statistical analysis of public sanitation survey dataDocument1 pageStatistical analysis of public sanitation survey dataLara GatbontonNo ratings yet

- 64 Ec 8 Eac 283 F 3Document13 pages64 Ec 8 Eac 283 F 3Sains Data MRendyNo ratings yet

- Distortional Buckling of CFS BeamsDocument404 pagesDistortional Buckling of CFS BeamsNazar BazaraaNo ratings yet

- Table of Specification For Grade 12 - Personal Development First Quarter ExaminationDocument17 pagesTable of Specification For Grade 12 - Personal Development First Quarter ExaminationArgie Joy Marie AmpolNo ratings yet

- Project Report at BajajDocument59 pagesProject Report at Bajajammu ps100% (2)

- Niche Tourism - Group PresentationDocument17 pagesNiche Tourism - Group Presentationlinh nguyenNo ratings yet

- Submitted As Partial Fulfillment of Systemic Functional Linguistic Class AssignmentsDocument28 pagesSubmitted As Partial Fulfillment of Systemic Functional Linguistic Class AssignmentsBhonechell GhokillNo ratings yet

- Components Research ProposalDocument3 pagesComponents Research ProposalPeter Fainsan IIINo ratings yet

- Social Media Marketing MidtermDocument3 pagesSocial Media Marketing MidtermAnassT 555No ratings yet

- Design Realization Manual Cycle1Document12 pagesDesign Realization Manual Cycle1Jeeva KeshavNo ratings yet