Professional Documents

Culture Documents

Activity On Adjusting Entry

Activity On Adjusting Entry

Uploaded by

Charizmae MadridOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity On Adjusting Entry

Activity On Adjusting Entry

Uploaded by

Charizmae MadridCopyright:

Available Formats

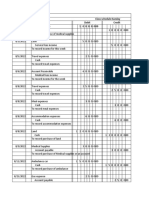

BACC 05

BASIC FINANCE

SOLVING PROBLEMS FOR ADJUSTING ENTRIES

1. A computer, printer, and a copier were purchased for a total price of P250,000 on

August 1, 2022. The company estimated that the equipment purchased will be

effectively used for 5 years and after that equipment can be sold for P20,000.

a. How much is the annual depreciation of the equipment?

b. How much depreciation will be recorded in year 2022, assuming the

company is maintaining a calendar period?

c. What percent of the cost of the equipment is the annual depreciation?

d. How much is the depreciation for year 2023?

e. Prepare the adjusting journal entry for years 2022 and 2023.

2. Office Chairs and tables were purchased from a furniture shop amounting to

P350,000 on December 1, 2022. The company estimated that the life of the pieces

of furniture will be 10 years and can be sold for a scrap of P30,000

a. What is the adjusting journal entry at the end of the period of December

31, 2022?

b. What is the book value of the pieces of furniture at the end of the calendar

year of 2024?

3. A company purchased an air conditioner at SN Appliance Center for P45,000 and

paid an installation fee of P6,000 with a delivery charge of P1,000. The air

conditioner has an estimated life span of 5 years with a residual value of P15,000.

a. What is the depreciable cost of the air conditioner?

b. How much is the annual depreciation?

You might also like

- FAR Preweek Lecture (B42)Document14 pagesFAR Preweek Lecture (B42)Ciarie Mae Salgado50% (4)

- Afar Mock Board 2022Document16 pagesAfar Mock Board 2022Reynaldo corpuz0% (1)

- Financial Accounting TestbankDocument34 pagesFinancial Accounting Testbankemilio_ii71% (14)

- Exercises. Correction of ErrorsDocument7 pagesExercises. Correction of ErrorsGia Sarah Barillo BandolaNo ratings yet

- Sample Problem AdjustingDocument17 pagesSample Problem AdjustingHanna Mae CatudayNo ratings yet

- Finacc4 Assignment 2 Property, Plant and Equipment, Part 2 Submit All Your Answers in An Excel File. Use One Worksheet (Not File) For Each ProblemDocument3 pagesFinacc4 Assignment 2 Property, Plant and Equipment, Part 2 Submit All Your Answers in An Excel File. Use One Worksheet (Not File) For Each ProblemAlrac GarciaNo ratings yet

- ACT1104-Final Period Quiz No. 6 With AnswerDocument12 pagesACT1104-Final Period Quiz No. 6 With AnswerPj Dela VegaNo ratings yet

- AP-PW 91: Review Problems-1Document9 pagesAP-PW 91: Review Problems-1Joris YapNo ratings yet

- Module 5 - PpsDocument4 pagesModule 5 - PpsMIGUEL JOSHUA VILLANUEVANo ratings yet

- Assessment TasksDocument5 pagesAssessment TasksLDB Ashley Jeremiah Magsino - ABMNo ratings yet

- FAR - Learning Assessment 2 - For PostingDocument6 pagesFAR - Learning Assessment 2 - For PostingDarlene JacaNo ratings yet

- MC9 - Hire Purchase A202 - StudentDocument3 pagesMC9 - Hire Purchase A202 - Studentlim qs0% (1)

- Homework 5 - Current Liabilities - RevisedDocument3 pagesHomework 5 - Current Liabilities - RevisedalvarezxpatriciaNo ratings yet

- IA PPE (Unit Test)Document10 pagesIA PPE (Unit Test)Nina MarieNo ratings yet

- Homework 1 - Investment PropertyDocument2 pagesHomework 1 - Investment Propertythankyoupo108No ratings yet

- PPE IllustrationsDocument3 pagesPPE Illustrationsprlu1No ratings yet

- BA 99.1 3rd LE SamplexDocument9 pagesBA 99.1 3rd LE Samplexprlu1No ratings yet

- AFARDocument17 pagesAFARChristine Mae MangahasNo ratings yet

- HW On INVESTMENT PROPERTY - 1Document2 pagesHW On INVESTMENT PROPERTY - 1Charles TuazonNo ratings yet

- Activity 5 Long Term Construction ContractsDocument4 pagesActivity 5 Long Term Construction ContractsSharon AnchetaNo ratings yet

- Activity 6 - Long-Term Construction ContractsDocument2 pagesActivity 6 - Long-Term Construction ContractsDe Chavez May Ann M.No ratings yet

- UntitledDocument3 pagesUntitledCarylChooNo ratings yet

- QuizDocument6 pagesQuizYukiNo ratings yet

- Batscpar Far3Document9 pagesBatscpar Far3Krizza MaeNo ratings yet

- AFAR Preweek Lecture Part 2Document18 pagesAFAR Preweek Lecture Part 2Joris YapNo ratings yet

- Unit 1 Pfrs 15 - Illustrative ProblemsDocument2 pagesUnit 1 Pfrs 15 - Illustrative ProblemsEmmanNo ratings yet

- Adjusting Entries ProblemsDocument5 pagesAdjusting Entries ProblemsDirck VerraNo ratings yet

- InventoriesDocument22 pagesInventoriesJane T.No ratings yet

- Prelims QuizDocument12 pagesPrelims QuizJanine TupasiNo ratings yet

- Accounting For Exploration and Evaluation Expenditures and DepletionDocument1 pageAccounting For Exploration and Evaluation Expenditures and DepletionMark Angelo BustosNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaEsse ValdezNo ratings yet

- Financial Accounting and Reporting - QUIZ 8Document5 pagesFinancial Accounting and Reporting - QUIZ 8JINGLE FULGENCIONo ratings yet

- Prelim ExamDocument6 pagesPrelim ExamJessie jorgeNo ratings yet

- LeasesDocument1 pageLeasesIm NayeonNo ratings yet

- Depreciation and DepletionDocument2 pagesDepreciation and DepletionOmbra UmabongNo ratings yet

- Ma PrelimDocument2 pagesMa PrelimLouisse Jeofferson TolentinoNo ratings yet

- ACCOUNTING 3 PPE ProblemsDocument4 pagesACCOUNTING 3 PPE ProblemsMina ChouNo ratings yet

- Quiz 2 Ncahs/ Discontinued Operation: FeedbackDocument67 pagesQuiz 2 Ncahs/ Discontinued Operation: FeedbackAngela Miles DizonNo ratings yet

- Adjusting Entries Sample ProblemsDocument2 pagesAdjusting Entries Sample ProblemsReese KimNo ratings yet

- 92 Afar PW Selftest 2Document18 pages92 Afar PW Selftest 2Benedict CasueNo ratings yet

- AFAR-03 Revenue RecognitionDocument3 pagesAFAR-03 Revenue RecognitionRamainne RonquilloNo ratings yet

- A232 MC 3 Int Assets - Questions-1Document5 pagesA232 MC 3 Int Assets - Questions-1nur amiraNo ratings yet

- On January 1Document2 pagesOn January 1UNKNOWNNNo ratings yet

- Adjusting EntriesDocument8 pagesAdjusting EntriesYusra PangandamanNo ratings yet

- Intercompany Sale of PPE ActivityDocument2 pagesIntercompany Sale of PPE Activitybea kullin0% (1)

- A231 MC 3 IA - QuestionsDocument3 pagesA231 MC 3 IA - QuestionsAmirul HaiqalNo ratings yet

- Dado BpsDocument6 pagesDado BpsmcannielNo ratings yet

- Module 2 - Assessment ActivitiesDocument3 pagesModule 2 - Assessment Activitiesaj dumpNo ratings yet

- Final Exam W MCQDocument12 pagesFinal Exam W MCQPatrick SalvadorNo ratings yet

- Adjusting EntriesDocument6 pagesAdjusting EntriesJanna PleteNo ratings yet

- Final Ac4aDocument5 pagesFinal Ac4aNexxus BaladadNo ratings yet

- May 2020 Error SHE Intangibles Liabilities LeasesDocument14 pagesMay 2020 Error SHE Intangibles Liabilities Leasesiraleigh17No ratings yet

- Auditing Problems Test Banks - PPE Part 2Document5 pagesAuditing Problems Test Banks - PPE Part 2Alliah Mae ArbastoNo ratings yet

- Current Liabilities - Exercise PremiumsDocument6 pagesCurrent Liabilities - Exercise Premiumsuser anonymousNo ratings yet

- 91 - Final Preaboard Afar (Weekends)Document18 pages91 - Final Preaboard Afar (Weekends)Joris YapNo ratings yet

- DEPRECIATIONDocument1 pageDEPRECIATIONKilljoy HeinbergNo ratings yet

- 5 6145300324501422418 PDFDocument2 pages5 6145300324501422418 PDFBeverly MindoroNo ratings yet

- Afar - First Preboard QuestionnaireDocument15 pagesAfar - First Preboard QuestionnairewithyouidkNo ratings yet

- Visual Studio 2022 In-Depth: Explore the Fantastic Features of Visual Studio 2022 - 2nd EditionFrom EverandVisual Studio 2022 In-Depth: Explore the Fantastic Features of Visual Studio 2022 - 2nd EditionNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Chariz Journal-FormatDocument2 pagesChariz Journal-FormatCharizmae MadridNo ratings yet

- Basicacctgpart1 QUIZDocument1 pageBasicacctgpart1 QUIZCharizmae MadridNo ratings yet

- Basicpart 1 AssignmentDocument1 pageBasicpart 1 AssignmentCharizmae MadridNo ratings yet

- Basic of AccountingDocument6 pagesBasic of AccountingCharizmae MadridNo ratings yet

- Aizamae 22222Document2 pagesAizamae 22222Charizmae MadridNo ratings yet