Professional Documents

Culture Documents

iCARE Consignment PDF

iCARE Consignment PDF

Uploaded by

Marjorie Pagsinuhin0 ratings0% found this document useful (0 votes)

127 views3 pagesOriginal Title

iCARE Consignment.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

127 views3 pagesiCARE Consignment PDF

iCARE Consignment PDF

Uploaded by

Marjorie PagsinuhinCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

cs

ICARE Accountancy Review wo

Innovative + Competent * Responsive =

PROBLEM SOLVING

Use the following information for the next two questions:

On November 1, 2025, Psalm Company shipped five of its appliances to the Trisha

Company on consignment. Each unit is to be sold at P50,000 payable P10,000 in the

month of purchase, and P2,000 per month thereafter. ‘The consignee is to be entitled to

Trisha Company sells three

appliances in November and one in December. Regular monthly collections are made by

20% of all amounts collected on consignment sale

the consignee and appropriate cash remittances are made to the consignor at the end of

cach month, The cost of the appliances is shipped by the consignor was P31,000 per unit.

‘The consignor paid shipping costs to the consignee totaling 10,000.

1. How much is the total collection at the end of 2025?

2. How much is the total amount remitted to the consignor for the year 2025?

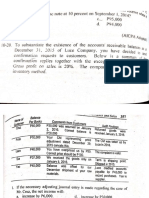

Use the following information for the next three questions

QU Inc. consigned twelve refrigerators to PRP. The refrigerators cost P 12,000 each and

the consignor paid P1,440 for freight out, The consignee subsequently rendered an

account sale for five units sold at P 15,400 each, and deducted the following items from

the selling price:

10%

commission)

Marketing expense (based on commission) 10%

Delivery and installation (on each unit sold) P60

3. How much is the commission‘

4, How much was the net profit of the consignor on the five refrigerators sold?

5, How much is the remittance?

Use the following information for the next two questions

On Jan 1, LM9 Electrical shop received from GO6 Trading 300 pieces of bread toasters.

LMO9 was to sell these on consignment at 50% above cost, for a 15% commission on the

selling price. After selling 200 pieces, LM9 had the remaining unsold units repaired for

some electrical defects for which he spent P10,000. GO6 subsequently increased the

selling price of the remaining units to P1,650 per unit.

(On Jan 31, LM9 remitted P324,900 to GO6 after deducting the 15% commission, P4,250

for delivery expenses of sold units, and P 10,000 for the repair of 100 units. The

cs

ICARE Accountancy Review oe

Innovative + Competent * Responsive =

consigned goods cost GO6 Trading P1,000 per unit, and P4,500 had been paid to ship

them to LM9 electrical shop. All expenses with the consignment were reimbursable to the

consignee.

5. How much is the profit on consignment?

6, How much is the cost of the inventory on consignment in the hands of GO6 Co?

Use the following information for the next three questions

On January 1, 2025, MMM entered into a consignment arrangement with WWW. The

consignment arrangement provides that WWW is entitled to 5% commission based on

sales. MMM manufactured 100 boxes of product at manufacturing cost of P400,000 On

July 1, 2025, MMM shipped through a common carrier 30 boxes of consigned goods to

WWW. The common carrier collected the freight amounting to P6,000 from WWW. For

the year ended December 31, 2025, WWW sold on cash 20 boxes of consigned goods to

final consumers at MMM's predetermined price of P6,000 per box.

7. What is the net income to be reported by MMM for the period ended December

31, 2025?

8. Using the same data in preceding number, what is the net remittance to be made

by WWW to MMM as of December 31, 2025?

Use the following information for the next three questions

In 2025, KKK Co. shipped 10 units of washing machine to a BIB2 Co., a retailer, on

consignment. The goods cost P30,000 each and are to be sold at 40% above cost of

merchandise excluding directly attributable costs/additional capitalizable costs. KKK Co.

paid freight of P15,000 to ship the goods to BIB2 Co. In addition, KKK Co, also paid

insurance, handling and cartage fee relating to the shipment totaling P5,000.

During the year, BIB2 Co. spent P2,000 for local advertising and was able to sell 6 units

of the consigned goods. B1B2 Co, also paid P12,000 for delivery and installation of the

goods to the customers. A unit with a minor H7Tect was retumed to KKK Co. and

P3,000 was paid by BIB2 Co. for freight to ship the returned goods,

Both parties agreed that B1B2 Co. is to receive 15% of the total sales as commission and

be reimbursed for all the payments made that are chargeable to KKK Co.

9. How much should be reported by KKK Co. as inventory out on consignment?

10. How much is the cash remittance of B1B2 Co. to KKK Co.?

11. How much is the net income related to this consignment sales?

cs

ICARE Accountancy Review oe

Innovative + Competent * Responsive =

Use the following information for the next three questions

On January 1, 2025, H7T Co. shipped 50 units of goods costing P20,000 each on

consignment basis to BIB2 Co. to be sold at P15,000 each. The agreement provides that

the consignee is to be provided 10% commission. Furthermore, it was also agreed that the

consignee will advance 50% of the cost of the oven which is to be applied to periodic

remittances in proportion to the units sold. Any expense incurred by the consignor related

to the consigned goods are also deductible from the remittance. H7T Co. incurred

P10,000 in shipping these goods to the consignee.

On March 31, 2025, the consignee reported sales with the following expenses:

advertising P3,000; delivery expenses to customers of P200 per unit; commission of

P60,000. The remittance of eash was made on the same date.

12. How much should be reported by H7T Co. as inventory out on consignment?

13, How much was the remittance received by H7T Co.?

14, How much is the net income related in the consignment sales?

Use the following information for the next three questions

555 Co. consigned 700 units of goods costing P700 each to 888 Co. to be sold to

customers at P2,000 per unit, The tenor of the contract states that 888 Co. is entitled to a

20% commission on units sold and reimbursement of any expense paid in relation to the

contract. 555 Co. paid P28, 000 worth freight and P7,000 insurance for the shipment. At

the end of the month, 88 Co. reported 195 units are still on hand. 888 Co. remitted the

available cash to 555 after deducting commission of P200, 000 and advertising cost of

P36, 000.

15. How many units were sold by 888 Co.?

16. How much was the remittance received by 555 Co.’

17, How much is the net income related to this consignment sales?

-END-

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5811)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Test Bank - Chapter13 Relevant CostingDocument43 pagesTest Bank - Chapter13 Relevant CostingAiko E. Lara93% (14)

- Audit Sampling PlanDocument2 pagesAudit Sampling PlanMarjorie PagsinuhinNo ratings yet

- Chapter 12 Testbank CapBud PDFDocument58 pagesChapter 12 Testbank CapBud PDFMarjorie PagsinuhinNo ratings yet

- IACFMAS-ASSIGN MarjDocument4 pagesIACFMAS-ASSIGN MarjMarjorie PagsinuhinNo ratings yet

- iCARE LTTContracts PDFDocument5 pagesiCARE LTTContracts PDFMarjorie PagsinuhinNo ratings yet

- Pagsinuhin, Marjorie Act. 4 AudSPIDocument2 pagesPagsinuhin, Marjorie Act. 4 AudSPIMarjorie PagsinuhinNo ratings yet

- CPAR FringeDocument6 pagesCPAR FringeMarjorie PagsinuhinNo ratings yet

- RCC PDFDocument11 pagesRCC PDFMarjorie PagsinuhinNo ratings yet

- Pagsinuhin, Marjorie Act. 3 AudSPIDocument2 pagesPagsinuhin, Marjorie Act. 3 AudSPIMarjorie PagsinuhinNo ratings yet

- Activity ReceivablesDocument6 pagesActivity ReceivablesMarjorie PagsinuhinNo ratings yet

- Dayag CH 10Document10 pagesDayag CH 10Marjorie PagsinuhinNo ratings yet

- Berk Prob AnswersDocument7 pagesBerk Prob AnswersMarjorie PagsinuhinNo ratings yet

- ONLINE CHESS TOURNAMENT GuidelinesDocument1 pageONLINE CHESS TOURNAMENT GuidelinesMarjorie PagsinuhinNo ratings yet

- Pagsinuhin Reaction Paper - Dirty Money 46234Document2 pagesPagsinuhin Reaction Paper - Dirty Money 46234Marjorie PagsinuhinNo ratings yet

- This Is The New NormalDocument2 pagesThis Is The New NormalMarjorie PagsinuhinNo ratings yet