Professional Documents

Culture Documents

Amended TRUST DEED - Latest PDF

Amended TRUST DEED - Latest PDF

Uploaded by

suresh kumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amended TRUST DEED - Latest PDF

Amended TRUST DEED - Latest PDF

Uploaded by

suresh kumarCopyright:

Available Formats

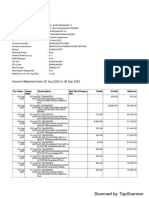

, - Managing Trastesoeany roe oray soup often bung uted? |” by the Board of Trustees. ‘ACCOUNTS; The trustees shall keep proper books of accounts of the income and expenditure of the trust, which shall be closed every year on 31* March. A reputed chartered accountant shall audit them and a certificate shall be obtained. These shall be in the custody of the Chairman-Managing Trustee. ‘The trustees shall at all times stand indemnified in respect of any act that may have been bons fide done in respect of matters relating to the trust. ‘Any decision taken by authority ofthe trastees including the managing trustee, ‘at eny trast meeting, shall be valid and binding on all the trustees and powers ‘$0 exeroised shall be valid and binding on the tcust. Arminute’s book shall be maintained atthe office by the Board of Trustoes. Minutes of all meetings, appointments and entry into the office of every new ‘trustee and other proceedings of the Board of Trustees shall be entered and recorded in such minutes book and shall be signed by the managing trustee at ‘the meeting cither at the conclusion thereof or a the subsequent meeting when they are fully confirmed. BASH ce gees ae | ig. inne a BS ee 13. ‘The Chairman-Managing trustee shell at alt times during his continuation in . the office, have the right to delegate his power to any of the remaining trusiees: “ «ro other attorneys or agent, ith pir intinaton to the Horo Tryst" cal 14, The funds nd the income ofthe Trust shall be soely uz faethe n achiovement ofits objectives and no portion of t shall be utilized for Payment. =” of the trustees by way of profit, interest, dividends etc... IN WITNESS WHEREOF, 1 HAVE SET AND SUBSCRIBE MY HAND AND SEAL THE DAY AND THE YEAR FIRST ABOVE MENTIONED. Drafted B.S Sle —ay (WEDNESSES + DEED Ww No, 3S pple SETTLOR chon GAURA CHANDRA DASA Bem, oc, Raja M9” 4 grgalere 10) messtenes | al [> 2 CORN tua e740 t Bere eee Unsyo een Tran CHAIRMAN VICE-CHAIRMAN ssicapthere Bnishas Hell chen Rood, Riga} na 7 Bauyalee “te 77 one — | / by eben sets wari pated wont « ; = Le ee Gee aye eae obatove DEED OF AMENDMENT OF TRUST DEED THIS DEED OF AMENDMENT OF TRUST DEED OF M/S THE AKSHAYA PATRA FOUNDATION is executed on the Twentieth day of February, Two Thousand and Sixteen (20/02/2016) by: 1. Sri Madhu Pandit Dasa a.k.a Sri Madhusudan Sivasankar S/o Late Sri Raman Nair Aged about 59 years Residing at Hare Krishna Hill, Chord Road Bangalore ~ 560010 | a . Sri T.V. Mohandas Pai S/o Sri T.V. Raman Pai Aged about 57 years Residing at 521, Embassy, Ali Askar Road Bangalore - 560001 ~eee » . Sri. Janardhana Reddy Thumma S/o Sti Venkateshwarlu Thumma Aged about 37 years Residing at Hare Krishna Movement-Ahmedabad Opp: Ahmedabad Dental College Bhadaj Near Science City, Ahmedabad - 380060 ore te | Wie ene, eee nnn ck Peeeeeed ~~ katv.ttes, obestosge}] — ERENT Saoetsd Gerd eters arte Roogot anced Department of Stamps ond Registration apne 33 1987 d dmpeted nage’ mohob too 10 siemabgod gatan ae, 2¢ Mis The Alshaya Patra Foundation Rep by its Trustees Sr! Madhu Pandit Dasa, $17 V ‘Mohandios Pai, Sri Janarchana Reddy Thumma, Sf Raghunath Pawar, Si V, Balaiktishnan, $11 Roj Prasanna Kondlur alt are Rep by thelr authorized PA Holder Sri Chanchalepathi Dasa, raid 1000.00 vezachrivay ring sinagoé dheyson anand, dasomeanct gp0 og (da) oe ansdtob asd arch do 1000.00 " Paidin Cash oa 1000.00 Wo: abddodgd ‘aot ; 20/02/2016 awl bene comments (oA OGO DE Designec and Developed by C- DAC ACTS Pune. Nh K( bf Wie wor ssssnnsen een BH be.vv.dat, obsisfoszie 4, Sri Raghunath Pawar S/o Late Dr G Venkat Rao Pawar Aged about 42 years Residing at No.567, 6 Main Road, 3" Stage, 3 Block, Basaveshwaranagar, Bangalore 560 079 a Sri V.Balakrishnan S/o Sri Venugopal Venkataraman Aged about 51 years Residing at # 567, 6* Main Road, 3" Stage, 3° Block Basaveshwaranagar, Bangalore ~ 560 079 » Sri Raj Prasanna Kondur S/o Sti Laksmana Kondur Raju Aged about 44 years Residing at # Nirvana Tower, One Sigma, Tech Park 7, Whitefield Main Road, Bangalore ~ 560 021, (hereinafter referred to as the “Trustees”)" The Trustees No.1 to No are represented by their duly authorized power of Attorney Holder Sri Chanchalapathi Dasa. WHEREAS the Trust Deed was executed on 16" October, 2001, registered on 17 October 2001, registered as Document bearing No. 154, stored in Book No. IV SE, Volume No. 241, pages 183-192, registered in the office of Sub-Registrar, Rajajinagar, irrevocably settling an amount of Rs.1,008/- (Rupees One Thousand Bight Only) for the sole purpose of providing relief to the poor, medical 2 RERSERBENL We piper 2 2tan sta, ea Print Octe & Time : 20-02-2016 11:52:24 AM de.10. Rat. adalsoxgso dhepileun ort, 253 obdslodaid dQds ensserodmamd oneness dats BbOohe Oxned 20-02-2016 doch 11:51193 AM roth de sond deyghaoart Bay 7 ay 1 [Bere ie, oe 7 [aaa ww er 600 4p M/s The Akshayo Patra Foundation Rep by its Trustaes Si Machu Poncit Dasa, Si TV Mohandas Pol, Jonordhone Reddy Thumme, Si Raghunath Pawar, Si V. Bolakrshnan, Sti Ral Prasanna Kondur all ere Rep by their authored PA Holder Sri Choncholopathi Dose sided amaid anced ei Gale a * BEM he AisayS Pov Foundation op by its rstoos 3h | tModhu Ponait O83, SAV aS Mohandas Pat, Si Joncrdhane Rede ee Thumme, SH Raghunath Pawar. SHV. Se en Botocisnnan. sf Ro Prosanno Kena} + = 2S at are Rep by thet authorized PA Holder $i Chanchoiapathi Dosa adeboagegn eytags z ee ics ats ayyteon 2s Wis ha Aishaya Bate Foundation Rep by its Trustees SiiMaahu Poncst Dosa, S817 Monendas Pa, St Janardhana RecksyTsttmnc. $Raghunath = Powar SV. Bolokishnon. SR : Prasonns Kondur flare Rep by theircuthorzed PA Hokser si |= “ ‘Chanchalopathi Dora (eciedocista WH anemia | Pooneton Ree by is Tstoes Si Madhu Poni OSS Set \Monandis Pat Sf Jonorchone Reddy Thumm, Si Roghunath | 9 [PaRCLSIY, Batakshnan, SH Roj| + 25: bey 2 Te we Mpendae obesovar va relief, education for the public and objects of general utility on such terms and conditions as contained therein; AND WHEREAS Clause 4 (c) of the Trust Deed permits the amendment of Trust Deed, subject however that such amendment shall be carried out subject to amendment being in consonance with Section 2 (15), 11, 12, 13 and 80G of the Income Tax Act, 1961 and that such no amendment shall be carried out “without the ptior approval of the commissioner of Income Tax or the Director of Income tax- Exemptions, as the case may be”; WHEREAS for the sake of convenience for running the activities of the Trust and since the Trust now intends to embark on certain activities in India and other parts of the world, the Trustees have agreed to adopt major amendments in the Trust Deed of the earlier Trust Deed dated 16% October, 2001 in terms of intention of ‘Trustees and in terms of such amendment the Clauses A, B, C and D of the recitals and Clause 1 and 2 continue to bind the parties and hence the Trust Deed clauses 3 onwards until the clause 14 be replaced with the amendment as set out below; WHEREAS the Commissioner of Income Tax or the Director of Income tax-Exemptions have approved the proposed amendments vide their order bearing No. CIT (E)/AmendmenYAAATT6468P/ TPO-1/2015-16 dated 29% October, 2015. WHEREAS the Board of Trustees have approved the draft and authorized Sri Chanchalapathi Dasa aka Sri Chandrashekar Srirangapatnam to be the authorized representative to sign and maak ; Wied FT Wis The Alshayo Patra Foundation Rep by its trustees ‘1 Madhu Parait Dasa. Sa TV ‘Monaneics Po, Sr Jonerahana Redey Tumma, 64 Raghunath Pawar. StV. Bolokishnan, Rey Prosonna Kondur al ore Rep by “|. their oumorzed PA Holder Si (Chonehalepathi Dasa (odbteabase) ire 2S dt execute the amendment to Trust Deed for and on behalf of the ‘Trust and the same was approved vide Resolution passed in the meeting held on 174 January, 2016. WHEREAS the Trustees as a matter of abundant caution have also executed Powers of Attorney in favour of Sri Chanchalapathi Dasa aka Sti Chandrashekar Srirangapatnam giving him the powers to sign, execute and register the amendment to Trust Deed for and on behalf of the Trustees of the trust; NOW THIS DEED OF AMENDMENT OF TRUST DEED WITNESSETH AS UNDER: 1. . ‘That the following clauses be added under Clause 3 ‘Objects he Trust’ of the Trust Deed after sub-clause d). ° “Sey “To setup community kitchens as a part of “Relief and rehabilitation” for people affected by Natural and Manmade calamities or disasters; f) To provide technical or financial or operational support to any other agency to set-up and/or run community kitchen for the benefit of poorer sections of society. g) To support children of deprived sections of society: i. By providing them potable drinking water ii, By providing and educating about health and hygiene related aspects which shall lead to better and healthy lifestyle ap | reba Fie pe Dose 7 Bb dad Som | i fo Guna 7 iho Guneaj wein.croatoos naan trosaors Vika : fk i, Chord Roce, Rejainagax, Bangalore 10 fot a a8 (eis / Yo, Mega _ | 4 & Sid rasta Lf | sows VPRA000520018 160 ie “2 4.0, sows YPRDIZ8 equa. (4 FH i08 20-02 D6 etd docomnctvivond =| |B 'e/: NG é RQ o te : aetoninl bialbreaagy elonsdiend Developed by C:OAC.ACTS Pune 80. WHITE, eat SacorseTaH HI ese (etteaTch, Sorte ee h) ifi, By running student development programs that would encompass life skill development and by providing tuitions iv. By providing financial support for school, college and professional education by way of scholarships etc, to the students from economically poorer section of society. The Trust shall carry out activities with the object of general public utility which may include rendering any activity or service for a cess or fee or any consideration, provided that such aggregate receipts from such activity or activities shall not exceed the limits as prescribed by the Income Tax Act, 1961 or any other amendments from time to time. Alll the activities in connection with the achievement of the above objects will be carried on in India or any other country in the world, for a charitable purpose which tends to promote international welfare in which India is interested. However, the activities outside India, shall be carried out only after obtaining prior permission of the statutory authorities under Income Tax Act and other relevant laws, and in strict compliance with all the applicable laws such as Income Tax Act, FEMA etc, Provided that in order to implement the objectives or undertake activities as mentioned in Clause 3(g) and 3(i) above outside India, the same be approved by a majority in a meeting of the Board of Trustees.” —= 53 ae “tie swaps Zoe ede batters That the following clause be added under Clause-4 ‘Investments’ of the Trust Deed in continuation of sub-clause °. “The Board of Trustees will also have the power to carry out any amendments/deletions/additions to the Trust Deed provided that the same is by a resolution of at least % of the total number of Trustees. Provided that no such rules and bye-laws or additions/ deletions/amendments to the Trust Deed/ rules and regulations shall in any way alter or contravene the main objects of the Trust or the provisions of sections 2(15), 11, 12, and 13 of the Income Tax Act, 1961 as amended from time to time.” ‘That the following clause be added under Clause 7 “Board of Trustees” of the Trust Deed after sub-clause v). vi) “Any of the Trustees may resign / retire after giving 30 days’ notice in writing regarding his intention to do so to the Board of Trustees and upon completion of the said 30 days he shall ipso-facto cease to be the Trustee of the Trust.” That the following clauses be added under Clause 8 “Power of the Trustees” of the Trust Deed after sub-clause xiv). CL Sy 6 |} (ga )3) 8) me “yee serps Leet tenor. chuciosss y\)// xv) “To appoint from time to time sub committees consisting of one or more trustee(s) and or one or more senior executives of the Trust to deal with such matters as they may deem fit and for this purpose may delegate any powers as they can lawfully delegate and revoke as and when felt necessary. xvi) The Board of Trustees may, by its resolutions enlarge, abridge, or alter the powers, rights, privileges, duties, functions and obligations or any of the office bearers by majority of the total number of Board of Trustees. xvii) The Board of Trustees shall have all the powers to do, any act, deed or thing in respect of which no specific provision act, deed or thing in respect of which no specific provision is made for under this deed which is found necessary for carrying out the purposes and objects of the Trust. xviii) The power duties and functions of the Trustees and other not specified herein shall be governed by provisions of Indian Trust Act 1882 as may be applicable.” That the following clauses be added under Clause 14 of the Trust Deed. “The Boatd of Trustees can also conduct the meetings by way of video conferencing provided each person taking part in the meeting is able to hear and see each other taking part and provided further that each Trustee must acknowledge TL PB880, YOY ae wpe 2am 2 A tawo.dee. cae his presence for the purpose of the meeting and also vote at such meetings as if he was physically present. Circular Resolution In addition to the above, The Board of Trustees may pass resolutions without formally convening a meeting of the Board according to the following procedure: Any member of the Board of Trustees desiring to put forward a proposal for consideration, outside of a formally convened meeting, may submit the same, in writing together with an explanation to the Secretary of the Trust, who shall circulate the same to all the Trustees. The proposal shall be considered as accepted as a formal Resolution of the Board of Trustees upon receipt by the Secretary of the written consent to the proposal by the required number of Trustees, Such resolutions(s) shall be valid and effectual just as if they have been passed at a meeting duly called and constituted and this notwithstanding that such resolution(s) may be signed at different places or times. Such resolution(s) shall be entered in the Minute Book of the Trust within thirty (80) days by the Secretary. All such resolution(s) shall be placed before the following meeting of the Board of Trustees. In any meeting of the Board of Trustees including meeting by way of video conferencing or Circular Resolution, in the event of equality of votes, the Chairman elected for the meeting shall have the casting vote.” Ce IN Tise wept Zo Bmaees 7 smoev.dint. ohstiows IN WITNESS WHEREOF the following persons have set and subscribed their hands on the day, month and year hereinabove written: CL ae ----Madhu Pandit Dasa a.k.a Madhusudan Sivasankar S/o Late Sri Raman Nair Represented by Power of Attorney Holder Sri Chanchalapathi S/o Sti T.V. Raman Pai Represented by Power of Attorney Holder Sri Chanchalapathi Dasa aka Sri om Srirangapatnam Trustee No. 2 Ch. Sed . S/o Sri Venkatéshwarlu Thumma Represented by Power of Attorney Holder Sri Chanchalapathi Dasa a.k.a Sri Chandrashekar Srirangapatnami Trustee No. 3 i “$/o Late Dr @ Venkat Rao Pawar Represented by Power of Attorney Holder Sri Chanchalapathi Dasa a.k.a Sri Chandrashekar Srirangapatnam Trustee No. 4 ‘Balakrishnan S/o Sri Venugopal Venkataraman Represented by Power of Attorney Holder Sri Chanchalapathi Dasa a.k.a Sri Chandrashekar Srirangapatnam Trustee No, 5 condur ~~ S}o Sri Laksnfana Kondur Raju Represented by Power of Attorney Holder Sri Chanchalapathi Dasa a.k.a Sri Chandrashekar Srirangapatnam Trustee No. 6 Witnesses: lhe Fisreergs” pov 1. Usha Gururaj 2, BhavinBS HK Hill, Chord Road HK Hill, Chord Road Rajajinagar, Bangalore - 10 Rejajinagar, Bangalore - 10 DRAFTED BY aul (wvctimeg i) Dwl no hbo G0 oi) Med r Chee to taorexd RET Bococked srke aaaod aensd 383,15 (78 & Bide sarin 110s Nobadaay, Lace ) Receipt No ; 8335 Bek : obddosgd Original Qap08 : 20/02/2016 3¢Mis The Akshaya Patra Foundation Rep by its Trustees Sri Madhu Pandit Daso, STV Mohandas Poi, Sti Janardhona Reddy Thumma, $i Raghunath Pawar. Sil V. Balakrishnan, S11 Raj Prasanna Kondur all are Rep by thelr authorized PA Holder Sr Choncholapathi Dasa - waioos yesodennd 2015- 16 aislew aia - gated 253 dosfob alge Aaomasidiman ao. ~ Roeodi bey at : 500,00 fee tem de, ace Lee 490.00 ua: 990.00 | Rs. 990,00 aricen Paid in Cash | riowA gedoard shoaged they: ————— 1000.00 me: 1990.00 CeRERQ) Cao, wowh made excadd decd Racers) ) i BeOS mawodoba, 20/02/2016 dadoch dedenrdaich Rer detaRD abddsosyjd ‘Designed and Developed by C- DAC ACTS Pune, OFFICE OF THE COMMISSIONER OF INCOME-TAX (EXEMPTIONS), 3° FLOOR, C.R.BUILDINGS, QUEENS Road, Bengaluru-O1. No, CIT(E)/Amendment/AAATT6468P/ITO-1/2015-16 Date:29-10-2015 PROCEEDINGS OF COMMISSIONER OF INCOMETAX (EXEMPTIONS), BENGAL JRU ‘SRI K.GNANA PRAKASH. COMMISSIONER OF INCOME TAX (EXEMPTIONS), BENGALURU. ‘Sub: Amendment to the trust deed - Akshaya Patra - reg- Ref: Applicant trust’ letter dated 30-06-2015, With regard to the above, the following amendment to the trust deed is here by permitted: Following additional clauses to be added: 2) To setup community kitchens as a part of “Relief and rehabilitation” for people affected by Natural ond Manmade calamities or disasters; : 4) To provide technical or financial or operational support to any other agency to set:up and/or run community kitchen forthe benefit of poorer sections of society To support children of deprived sections of society i. By providing them potoble drinking water ii. By providing & educating about health & hygiene related aspects which shal! lead to better@healthy lifestyle i. By running student development programs that would éncompess life skil development and by providing tultions ‘i, By providing financial support for schodl, college and professional education by way of scholarships etc, to the students from economically poorer section of society. 4) The Trust shall cary out activities with the abject of general public utlity which may include rendering ony activity or service for a cess or jee or any consideration, provided that such aggregate ceceipts from such fctivty or activities shail not exceed the limits as prescribed by the Income Tax Act, 1961 or any other amendments from time to time, 1). Provision 8 carry out activities outside India: €) All the activities in connection with the achievement of the above objects will be carried on in india or any ‘ther country in the worl, for a charitable purpose which tends to promote international welfare in which India is interested. However, the activities outside India, shall be carried out only after obtaining prior permission of the statutory authorities under Income Tax Act end other relevant laws, ond in strict compliance with all the applicable laws such as Income Tax Act, FEMA etc, Provided thot in order to implement the objectives or undertake activities as mentioned In Clause 3 (a) and 3 (i) above outside India, the same be approved by a majority in @ meeting ofthe Board of Trustees. 2) Administrative matters; Inclusion of mode and manner of resignation of Trustee. i Any of the Trustees may resign / retire after gluing 30 days’ notice in wring regarding his intention to do 0 to the Board of Trustees and upan completion of the said 30 days he shall iso-facto cease to be the Trustee of the Trust. 3) Power of trustees: Additional provisions for ease of day to day working of trust 4. To appoint from time to time sub committees consisting of one or more trustee(s) ond or one or more senior executives of the Trust to deol with such matters as they may deem fit and for this purpose may delegate any powers as they can lawfully delegate and revoke as and when felt necessary. 4 The Board of Trustees may, by its resolutions enlarge, abridge, or alter the powers, rights, privileges, duties, Functions ond obligations or any of the office bearers by majority of the total number of Board of Trustees i. The Board of Trustees sholl have all the powers to do any act, deed or thing in respect of which no specific provision act, deed or thing in respect of which no specifit provision is made for under this deed which is found necessary for carrying out the purposes and objects of the Trust. fu. The power duties and functions of the Trustees and other not specified herein shall be governed by provisions of indian Trust Act 1882 as may be applicable. 4) Meetings: Provision for Meeting through Video Conferencing and Circular Resolution The Boord of Trustees con also conduct the meetings by way of video conferencing provided each person taking art in the meeting is able to hear ond see each other toking part and provided further that each Trustee must ‘acknowledge his presence for the purpase of the meeting and aise vote at such meetings os If he was physicolly present. 4) Circular Resolution 1 addition to the above, The Board of Trustees may pass resolutions without formally convening a meeting of the Boord according to the following procedure: ‘Any member of the Board of Trustees desiring to put forword a proposal for consideration, outside of a formally convened meeting, may submit the same, in writing, together with an explanation to the Secretary of the Trust, ‘who shall circulate the same to all the Trustees. The proposal shall be considered as accepted as a formal Resolution of the Board of Trustees upon receipt by the Secretary of the written consent to the proposal by the required number of Trustees. Such resolutions(5) shall be valid and effectuol just as if they have been passed at @ meeting duly called and constituted ond this notwithstanding that such resolution(s) may be signed at different places or times. Such resolutions) shall be entered in the Minute Book of the Trust within thirty (30) days by the Secretary. All such resolution(s) shall be placed before the following meeting of the Board of Trustees. ‘in any meeting of the Board of Trustees including meeting by way of video conferencing or Circular Resolution, in the event of equelity of votes, the Chairman elected for the meeting shall have the casting vate. b) Addition to the existing amendment clause: The Board of Trustees will also have the power to carry out ary amendments/deletions/additions to the Trust Deed provided that the same is by a resolution of at least % ofthe totel number of Trustees. Provided that no such rules and bye-taws or additions/deletions/amendments to the Trust Deed/ rules and requiations shail in any way alter or contravene the main objects of the Trust or the provisions of sections 2(15), 411, 12, and 13 of the income Tax Act, 1961 as amended from time to time Further you are Informed that the amendment will have prospective effect from the date, the amended deed is registered. ‘You are requested to furnish a copy of the registered amended deed to this office immediately after registration. (K. abvewsi ) Commissioner of Income Tax (Exemption), To Bengaluru. ee Trustee, Akshaya Patra, No.72, 3 Floor, 3 Main, 1° & 2 Stage, Industrial Sub-urb, Rejajinagar, Bengluru 560 022. Copy to the Assessing Officer (P.V.NARAYANA SHARMA) Income tax Officer (Exemptions) Wd-1, For Commissioner of Income Tax (Exemptions), Bengaluru.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- வெண்ணிற இரவுகள்Document96 pagesவெண்ணிற இரவுகள்suresh kumarNo ratings yet

- September StatementDocument6 pagesSeptember Statementsuresh kumarNo ratings yet

- CH 4 DurkheimDocument6 pagesCH 4 Durkheimsuresh kumarNo ratings yet

- Varahe AgreementDocument9 pagesVarahe Agreementsuresh kumarNo ratings yet

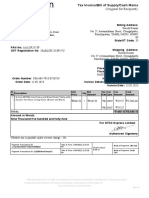

- Chennai To Tirunelveli GST InvoiceDocument1 pageChennai To Tirunelveli GST Invoicesuresh kumarNo ratings yet

- Resignation Letter ExampleDocument1 pageResignation Letter Examplesuresh kumarNo ratings yet

- Isha Vidhya - Social Audit Report - 2021 - 22 - Suresh Draft 2Document21 pagesIsha Vidhya - Social Audit Report - 2021 - 22 - Suresh Draft 2suresh kumarNo ratings yet

- Dated: 03-04-2021Document1 pageDated: 03-04-2021suresh kumarNo ratings yet

- Invoice TableDocument1 pageInvoice Tablesuresh kumarNo ratings yet

- Invoice TableDocument1 pageInvoice Tablesuresh kumarNo ratings yet

- Akshay A Patra CSR Proposal 202223Document25 pagesAkshay A Patra CSR Proposal 202223suresh kumarNo ratings yet

- Suresh Kumar OKR 2022-2023Document7 pagesSuresh Kumar OKR 2022-2023suresh kumarNo ratings yet

- Suresh Hyderabad Reimbursement (Granules)Document4 pagesSuresh Hyderabad Reimbursement (Granules)suresh kumarNo ratings yet

- 80G-Lifetime Validity PDFDocument1 page80G-Lifetime Validity PDFsuresh kumarNo ratings yet